Key Insights

The South American alcoholic beverage market, valued at $38.04 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.46% from 2025 to 2033. This expansion is driven by increasing disposable incomes, especially among the growing middle class in Brazil and Argentina, leading to higher consumption of premium alcoholic drinks. Evolving consumer preferences are favoring craft beers, premium spirits, and imported wines, presenting opportunities for both established and new market participants. While the on-trade sector (bars, restaurants, hotels) remains vital, the off-trade channel (supermarkets, liquor stores) is experiencing substantial growth due to shifting consumption patterns and convenience. However, market expansion faces challenges from regulatory complexities, including alcohol taxation and marketing restrictions, alongside economic instability in select South American regions. The market is segmented by product type (beer, wine, spirits) and distribution channel (on-trade, off-trade). Beer currently holds the largest market share, followed by wine and spirits. Leading companies such as Grupo Penaflor, Anheuser-Busch InBev, and Diageo are capitalizing on growth by leveraging their established brands and robust distribution networks within a dynamic competitive environment featuring both domestic and international players.

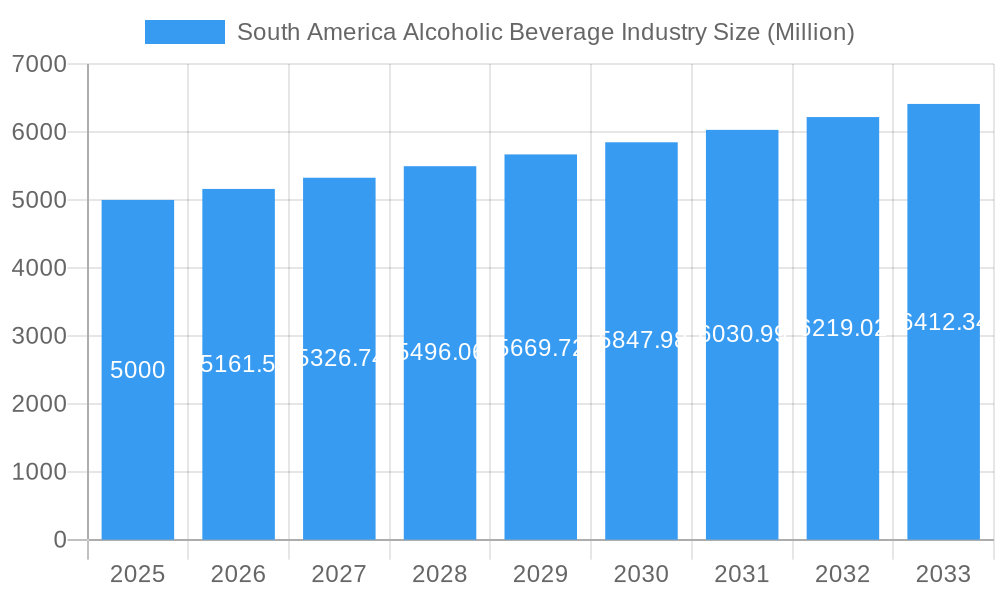

South America Alcoholic Beverage Industry Market Size (In Billion)

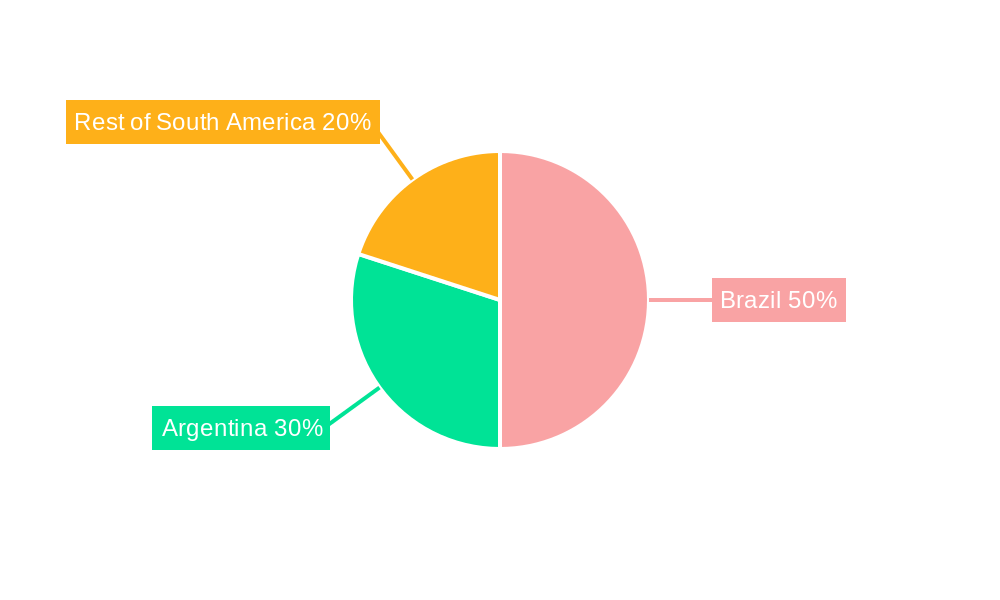

The forecast period of 2025-2033 anticipates sustained market growth with regional variations. Brazil is expected to maintain its position as the largest market due to its substantial population and consumer spending. Argentina is also a significant market, recognized for its established wine culture and production. The "Rest of South America" segment is projected for moderate growth, influenced by increasing tourism and rising disposable incomes. The market is likely to witness further industry consolidation through mergers, acquisitions, and strategic alliances, reshaping the competitive landscape. Product innovations, including low-alcohol and organic options, are anticipated to gain traction, aligning with health-conscious consumer trends.

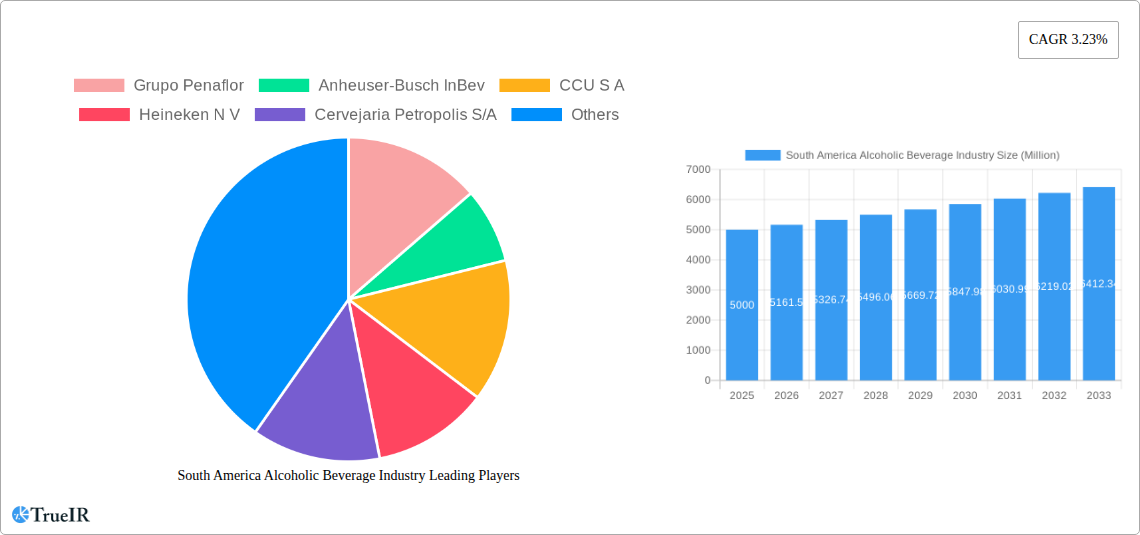

South America Alcoholic Beverage Industry Company Market Share

South America Alcoholic Beverage Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the South American alcoholic beverage market, offering invaluable insights for businesses, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report unveils the market's structure, competitive landscape, trends, and future outlook. Expect in-depth analysis of key segments, including beer, wine, and spirits, across both on-trade and off-trade distribution channels. Uncover the impact of significant M&A activities and emerging product innovations, shaping this dynamic market.

South America Alcoholic Beverage Industry Market Structure & Competitive Landscape

This section analyzes the South American alcoholic beverage market's competitive landscape, examining market concentration, innovation, regulatory influences, and M&A activity. The market is characterized by a mix of multinational corporations and regional players. Concentration ratios are estimated at xx% for the beer segment, xx% for wine, and xx% for spirits in 2025.

- Market Concentration: The market exhibits varying degrees of concentration across different segments, with beer demonstrating a higher level of consolidation compared to the wine and spirits sectors.

- Innovation Drivers: Consumer demand for premiumization, health-conscious options (e.g., low-calorie beers, hard seltzers), and craft beverages fuels innovation.

- Regulatory Impacts: Government regulations regarding alcohol production, distribution, and advertising significantly influence market dynamics. Tax policies, labeling requirements, and restrictions on alcohol advertising vary across countries, impacting market access and pricing strategies.

- Product Substitutes: Non-alcoholic beverages, including flavored waters, juices, and functional drinks, pose competition, particularly among younger demographics. The rise of hard seltzers also represents an internal substitute within the alcoholic beverage category.

- End-User Segmentation: Market segmentation involves demographics (age, income), geographic location (urban vs. rural), and lifestyle preferences.

- M&A Trends: The industry has witnessed a significant number of mergers and acquisitions, totaling an estimated $xx Million in deals in the period 2019-2024. These activities reflect strategies for market consolidation, brand expansion, and access to new product categories.

South America Alcoholic Beverage Industry Market Trends & Opportunities

The South American alcoholic beverage market is experiencing substantial growth, driven by rising disposable incomes, changing consumer preferences, and the increasing popularity of premium and craft beverages. The market size is projected to reach $xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033).

This growth is influenced by several factors including:

- Market Size Growth: The market is expected to reach $xx Million by 2033, driven by factors such as increasing disposable incomes, urbanization, and changing consumer preferences.

- Technological Shifts: E-commerce, digital marketing, and improved supply chain management are impacting market reach and efficiency. Technological advancements in brewing and distillation also contribute to product innovation.

- Consumer Preferences: A rising preference for premium and craft beverages, health-conscious options, and ready-to-drink (RTD) formats is reshaping the market. The popularity of hard seltzers and other low-calorie alternatives is significantly impacting growth.

- Competitive Dynamics: Intense competition among established players and emerging craft breweries and distilleries are increasing. The competitive landscape is marked by continuous product innovation, marketing campaigns, and distribution expansion strategies.

Dominant Markets & Segments in South America Alcoholic Beverage Industry

Brazil consistently holds the largest market share within the South American alcoholic beverage sector, followed by Argentina, Mexico, and Colombia. Beer remains the dominant product segment, followed by spirits and wine.

- Leading Region/Country: Brazil leads in market size and consumption across all segments.

- Leading Product Segment: Beer holds the largest market share due to its wide appeal and affordability, with xx Million in revenue in 2025.

- Leading Distribution Channel: The off-trade channel (retail stores, supermarkets) holds a larger share than the on-trade channel (restaurants, bars) because of broader reach and convenience.

Growth Drivers:

- Brazil: Strong economic growth, rising middle class, and a large population drive consumption.

- Argentina: A well-established wine industry and a growing preference for premium beverages support market growth.

- Mexico: High tourism and tequila exports boost the overall market.

South America Alcoholic Beverage Industry Product Analysis

The South American alcoholic beverage market showcases a range of products, from traditional beers and wines to innovative craft brews, premium spirits, and ready-to-drink (RTD) options. Recent product innovations focus on healthier options (low-calorie, low-carb), unique flavor profiles, and convenient packaging formats. Technological advancements in brewing and distillation processes lead to superior quality and consistent product offerings. The market fit is driven by consumer demand for variety, premiumization, and convenience.

Key Drivers, Barriers & Challenges in South America Alcoholic Beverage Industry

Key Drivers:

- Rising disposable incomes and urbanization increase alcohol consumption.

- Growing preference for premium and craft beverages creates opportunities.

- Tourism boosts demand, especially in regions with significant tourist activity.

Challenges:

- Regulatory Hurdles: Complex regulations related to alcohol production, distribution, and advertising pose significant barriers. This results in xx Million dollars lost due to compliance and licensing fees annually.

- Supply Chain Issues: Infrastructure limitations and logistical challenges lead to increased costs and potential delays. This has led to xx% increase in production costs in the past year.

- Competitive Pressures: Intense competition among multinational corporations and local players creates pricing pressure and necessitates continuous product innovation.

Growth Drivers in the South America Alcoholic Beverage Industry Market

The South American alcoholic beverage industry is propelled by increasing disposable incomes, especially within the rising middle class. Urbanization leads to higher alcohol consumption rates. The growing preference for premium and craft beverages fuels market expansion, while tourism boosts demand. Furthermore, innovative marketing and distribution strategies contribute to market growth.

Challenges Impacting South America Alcoholic Beverage Industry Growth

Significant barriers to growth include complex and evolving regulations across various South American countries, often resulting in differing compliance costs and market access issues. Supply chain inefficiencies and infrastructure limitations add to the costs of production and distribution. Furthermore, intense competition among established multinational corporations and local producers creates pricing pressure, and necessitates consistent product innovation.

Key Players Shaping the South America Alcoholic Beverage Industry Market

- Grupo Penaflor

- Anheuser-Busch InBev

- CCU S.A

- Heineken N.V

- Cervejaria Petropolis S/A

- Diageo

- Brown-Forman

- Molson Coors Beverage Company

- Companhia Muller de Bebidas

- Pernod Ricard

Significant South America Alcoholic Beverage Industry Industry Milestones

- November 2022: Diageo Plc's acquisition of Balcones Distilling expands its premium spirits portfolio.

- February 2022: Grupo Peñaflor's launch of Mingo Hard Seltzer signifies expansion into a growing RTD segment.

- November 2021: Grupo Petrópolis's launch of a new Itaipava 100% malt beer strengthens its premium offering.

Future Outlook for South America Alcoholic Beverage Industry Market

The South American alcoholic beverage market anticipates continued growth, driven by increasing consumer spending power, changing preferences towards premium and healthier options, and the ongoing expansion of the RTD sector. Strategic opportunities exist for companies that can innovate and adapt to evolving consumer demands, optimize supply chains, and effectively navigate the regulatory landscape. The market's potential is significant, with substantial room for further growth in both established and emerging segments.

South America Alcoholic Beverage Industry Segmentation

-

1. Product Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-trade

- 2.2. Off-trade

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Alcoholic Beverage Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Alcoholic Beverage Industry Regional Market Share

Geographic Coverage of South America Alcoholic Beverage Industry

South America Alcoholic Beverage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Brazil Dominates the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beer

- 6.1.2. Wine

- 6.1.3. Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beer

- 7.1.2. Wine

- 7.1.3. Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Alcoholic Beverage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beer

- 8.1.2. Wine

- 8.1.3. Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Grupo Penaflor

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Anheuser-Busch InBev

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 CCU S A

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Heineken N V

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cervejaria Petropolis S/A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Diageo

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Brown-Forman

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Molson Coors Beverage Company*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Companhia Muller de Bebidas

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Pernod Ricard

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Grupo Penaflor

List of Figures

- Figure 1: South America Alcoholic Beverage Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Alcoholic Beverage Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 5: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 7: South America Alcoholic Beverage Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Alcoholic Beverage Industry Volume liter Forecast, by Region 2020 & 2033

- Table 9: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 11: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 13: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 15: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

- Table 17: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 19: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 21: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 23: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

- Table 25: South America Alcoholic Beverage Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: South America Alcoholic Beverage Industry Volume liter Forecast, by Product Type 2020 & 2033

- Table 27: South America Alcoholic Beverage Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: South America Alcoholic Beverage Industry Volume liter Forecast, by Distribution Channel 2020 & 2033

- Table 29: South America Alcoholic Beverage Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: South America Alcoholic Beverage Industry Volume liter Forecast, by Geography 2020 & 2033

- Table 31: South America Alcoholic Beverage Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: South America Alcoholic Beverage Industry Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Alcoholic Beverage Industry?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the South America Alcoholic Beverage Industry?

Key companies in the market include Grupo Penaflor, Anheuser-Busch InBev, CCU S A, Heineken N V, Cervejaria Petropolis S/A, Diageo, Brown-Forman, Molson Coors Beverage Company*List Not Exhaustive, Companhia Muller de Bebidas, Pernod Ricard.

3. What are the main segments of the South America Alcoholic Beverage Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Brazil Dominates the Region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

November 2022: Diageo Plc announced the acquisition of Balcones Distilling ('Balcones'), a Texas Craft Distiller. Balcones is one of the leading producers of American Single Malt Whisky.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Alcoholic Beverage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Alcoholic Beverage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Alcoholic Beverage Industry?

To stay informed about further developments, trends, and reports in the South America Alcoholic Beverage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence