Key Insights

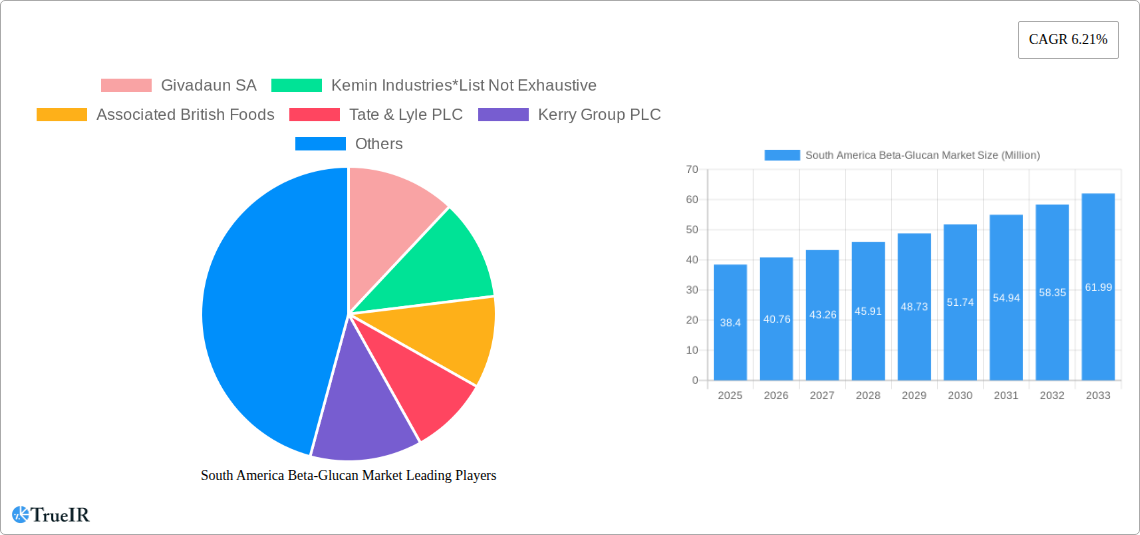

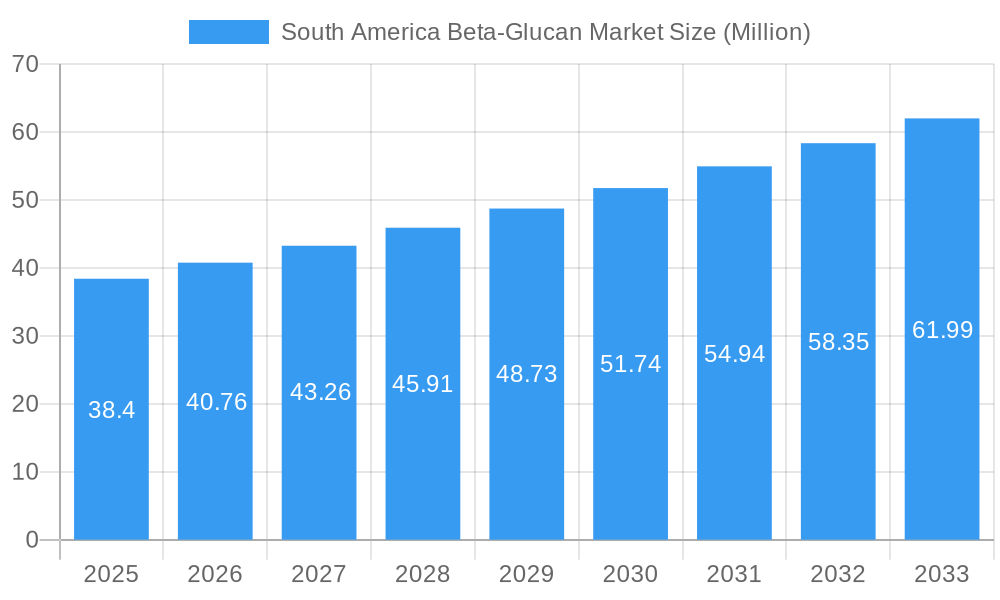

The South American Beta-Glucan market is poised for significant expansion, currently valued at approximately USD 38.40 million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.21% through 2033. This upward trajectory is propelled by increasing consumer awareness regarding the health benefits of beta-glucan, particularly its immunomodulatory and cholesterol-lowering properties. The growing demand for functional foods and beverages, enriched with ingredients that offer tangible health advantages, is a primary driver. In the Food and Beverages sector, dairy products, snacks, and confectionery are emerging as key application areas, leveraging beta-glucan for its texture-enhancing and health-boosting attributes. Similarly, the Healthcare and Dietary Supplements segment, especially infant nutrition, is witnessing a surge in demand as parents seek to bolster their children’s immune systems. Innovations in processing technologies and the development of novel beta-glucan sources are further fueling market growth, making it more accessible and versatile for various applications.

South America Beta-Glucan Market Market Size (In Million)

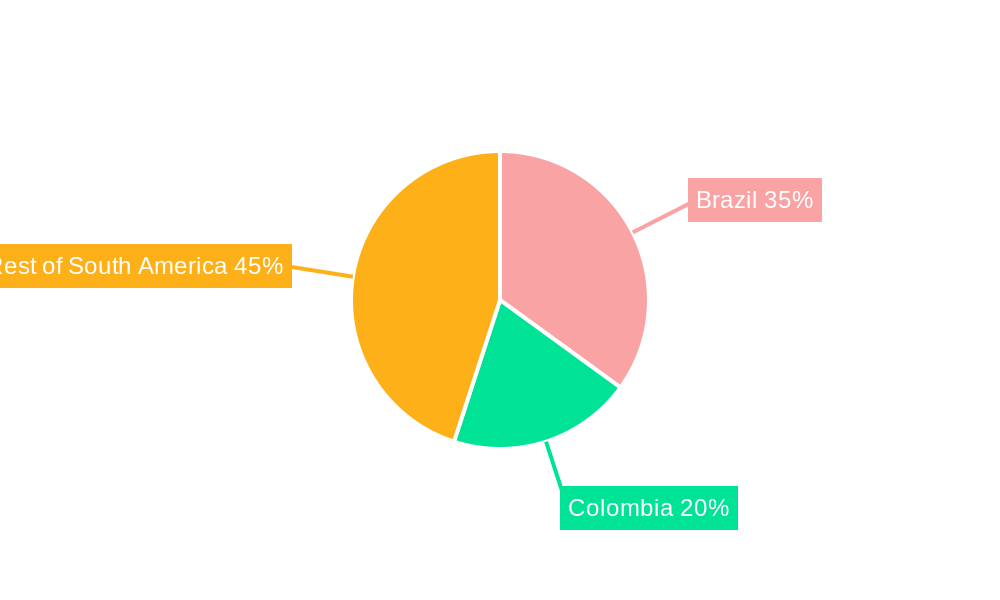

Despite the promising outlook, certain factors could influence the market’s pace. High production costs associated with certain beta-glucan sources and the need for consumer education to fully appreciate its benefits present potential restraints. However, the inherent versatility of beta-glucan, spanning from its soluble and insoluble forms, caters to a wide array of product development needs across both food and healthcare industries. Geographically, Brazil is anticipated to lead market expansion, driven by its large consumer base and growing health consciousness, followed by Colombia and the rest of South America. Companies like Associated British Foods, Tate & Lyle PLC, and Kerry Group PLC are actively investing in research and development, aiming to introduce innovative beta-glucan-based products and capitalize on the escalating demand for healthier food and supplement options. The strategic focus on these key regions and product segments underscores the dynamic evolution of the South American Beta-Glucan market.

South America Beta-Glucan Market Company Market Share

South America Beta-Glucan Market: Comprehensive Analysis 2019-2033

This in-depth market report provides a definitive analysis of the South America Beta-Glucan Market, encompassing a detailed historical review, current market dynamics, and a robust forecast for the period 2019–2033. With the base year set as 2025, the report offers unparalleled insights into market size, growth trajectory, key trends, and the competitive landscape. Leveraging high-volume SEO keywords such as "South America Beta-Glucan," "Beta-Glucan Market Brazil," "Functional Ingredients Latin America," and "Health Supplements South America," this report is meticulously crafted to attract and inform industry stakeholders, including ingredient manufacturers, food and beverage companies, pharmaceutical firms, and investment analysts.

Key Report Features:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Market Size: Predicted to reach xx Million by 2033.

- CAGR: Estimated at xx% during the forecast period.

South America Beta-Glucan Market Market Structure & Competitive Landscape

The South America Beta-Glucan Market exhibits a moderately concentrated structure, with a few key players holding significant market share, alongside a growing number of emerging players focusing on niche applications and regional expansion. Innovation drivers are primarily centered around product development for enhanced health benefits, such as improved cholesterol management and immune support, as well as the development of novel delivery systems and extraction technologies for greater purity and efficacy. Regulatory impacts, while still evolving in some regions, are increasingly influenced by global food safety and health claims standards, necessitating strict adherence to quality control and ingredient transparency. Product substitutes, such as other soluble fibers like psyllium or inulin, and alternative functional ingredients, present a constant competitive challenge, requiring beta-glucan providers to emphasize superior functional properties and scientifically validated health claims. End-user segmentation is robust, with the Food and Beverages sector dominating, followed by Healthcare and Dietary Supplements. Mergers and acquisitions (M&A) trends are expected to gain momentum as larger corporations seek to expand their portfolios and gain access to specialized beta-glucan technologies and regional market footholds, further shaping the competitive landscape. The market is poised for consolidation and strategic partnerships to drive growth.

South America Beta-Glucan Market Market Trends & Opportunities

The South America Beta-Glucan Market is experiencing robust growth, driven by a confluence of factors including rising health consciousness, increasing demand for functional foods and beverages, and growing awareness of beta-glucan's diverse health benefits. The market size is projected to witness significant expansion, fueled by a Compound Annual Growth Rate (CAGR) of xx% over the forecast period. Technological shifts are crucial, with advancements in extraction and purification methods enhancing the quality and cost-effectiveness of beta-glucan production, making it more accessible for a wider range of applications. Consumer preferences are increasingly leaning towards natural, clean-label ingredients with proven health claims, positioning beta-glucans as a highly desirable component in various consumer products. The growing prevalence of lifestyle diseases and a proactive approach to wellness are further accelerating the adoption of beta-glucan-rich products. The competitive dynamics are characterized by innovation in product formulation and application development. Opportunities abound in catering to the burgeoning demand for fortified food and beverages, particularly within the dairy, snack, and baked goods segments, where beta-glucan can be seamlessly integrated to offer nutritional enhancements. The healthcare and dietary supplement sector also presents substantial growth potential, with a rising consumer base seeking natural solutions for cardiovascular health, immune system support, and gut health. Furthermore, the "Rest of South America" region, beyond Brazil and Colombia, offers untapped potential for market penetration as economies develop and consumer purchasing power increases. The increasing focus on plant-based diets and sustainable sourcing will also create new avenues for market expansion for oat and barley-derived beta-glucans.

Dominant Markets & Segments in South America Beta-Glucan Market

The South America Beta-Glucan Market is significantly dominated by the Food and Beverages segment, which accounts for the largest share of market revenue and consumption. Within this broad category, specific sub-segments like Dairy products, including yogurts and milk-based beverages fortified with beta-glucans for their cholesterol-lowering properties, are experiencing accelerated demand. Snacks and Baked Goods are also key growth areas, where beta-glucan is incorporated to enhance fiber content and offer added nutritional value, aligning with consumer trends towards healthier snacking options and improved baked product formulations. Other Products within the Food and Beverages umbrella, such as breakfast cereals and nutritional bars, further contribute to the segment's dominance.

Geographically, Brazil stands out as the leading market for beta-glucans in South America. This dominance is attributed to its large population, a growing middle class with increased disposable income, a well-established food processing industry, and rising consumer awareness regarding health and wellness. Government initiatives promoting healthy eating and fortified foods also play a crucial role in Brazil's market leadership. Colombia emerges as another significant market, showing promising growth due to similar drivers of increasing health consciousness and a dynamic food industry. The Rest of South America, encompassing countries like Argentina, Chile, Peru, and Ecuador, represents a substantial and rapidly expanding market. As these economies continue to develop, and consumer awareness of functional ingredients like beta-glucans grows, the region presents considerable untapped potential and opportunities for market players.

In terms of beta-glucan categories, Soluble beta-glucans are far more prevalent due to their well-documented health benefits, particularly their impact on cholesterol reduction and blood sugar control, and their ease of incorporation into liquid and semi-solid food matrices. Insoluble beta-glucans, while having specific applications in areas like dietary fiber enrichment and potentially in certain industrial uses, currently hold a smaller market share. The Healthcare and Dietary Supplements segment is a strong secondary driver, with Infant Nutrition showing particular promise as parents seek to provide immune-boosting and gut-health-supporting ingredients for their children. The "Other Applications" segment, which may include animal feed or industrial applications, is nascent but holds potential for future diversification.

South America Beta-Glucan Market Product Analysis

Product innovation in the South America Beta-Glucan Market is characterized by a focus on purity, functionality, and application-specific formulations. Manufacturers are developing beta-glucan ingredients with enhanced solubility and bioavailability, ensuring optimal absorption and efficacy in consumer products. Technological advancements in extraction methods, particularly from sources like oats and barley, are yielding higher concentrations of beta-glucans with specific molecular weights, allowing for tailored functionalities. Competitive advantages are being built around scientifically validated health claims, clean-label certifications, and cost-effective production processes. The application spectrum is broadening beyond traditional functional foods to include innovative uses in beverages, dairy alternatives, and specialized dietary supplements, catering to a growing demand for targeted health solutions.

Key Drivers, Barriers & Challenges in South America Beta-Glucan Market

Key Drivers:

- Rising Health Consciousness: Growing consumer awareness of beta-glucan's cholesterol-lowering, immune-boosting, and gut-health benefits is a primary growth propeller.

- Demand for Functional Foods: The increasing popularity of foods and beverages that offer added health benefits beyond basic nutrition fuels demand for ingredients like beta-glucans.

- Technological Advancements: Improvements in extraction and purification technologies are making beta-glucan more accessible and cost-effective.

- Favorable Regulatory Environment: Evolving regulations supporting health claims for functional ingredients encourage product development and market expansion.

Barriers & Challenges:

- Price Volatility: Fluctuations in the price of raw materials, such as oats and barley, can impact the cost-effectiveness of beta-glucan production.

- Supply Chain Disruptions: Dependence on agricultural inputs makes the market susceptible to weather patterns, crop yields, and logistical challenges.

- Consumer Education: A need for greater consumer education regarding the specific benefits and sources of beta-glucan remains a challenge.

- Competition from Substitutes: Other dietary fibers and functional ingredients present ongoing competitive pressure.

- Regulatory Hurdles: Navigating varying national regulations for food additives and health claims across different South American countries can be complex.

Growth Drivers in the South America Beta-Glucan Market Market

The South America Beta-Glucan Market is propelled by several significant growth drivers. Technologically, advancements in enzymatic extraction and purification processes are leading to higher yields and purer beta-glucan products, making them more competitive. Economically, the rising disposable incomes in key South American nations are enabling consumers to invest more in health and wellness products, including functional foods and dietary supplements. Regulatory support, with an increasing number of countries recognizing and approving health claims associated with beta-glucan consumption, is further stimulating market growth by providing a clearer framework for product development and marketing. The growing global trend towards plant-based diets also presents a substantial opportunity, as beta-glucans are predominantly derived from plant sources like oats and barley.

Challenges Impacting South America Beta-Glucan Market Growth

Several challenges can impact the growth of the South America Beta-Glucan Market. Regulatory complexities across different countries within the region can pose barriers to entry and market penetration, with varying standards for ingredient approval and health claims. Supply chain issues, including the availability and cost of key raw materials like oats and barley, can be influenced by agricultural yields, weather patterns, and geopolitical factors, leading to price volatility. Competitive pressures from other functional ingredients and established food additives also require continuous innovation and differentiation from beta-glucan manufacturers. Furthermore, ensuring consistent quality and efficacy across diverse geographical markets and production scales remains a critical operational challenge for many players.

Key Players Shaping the South America Beta-Glucan Market Market

- Givadaun SA

- Kemin Industries

- Associated British Foods

- Tate & Lyle PLC

- Kerry Group PLC

- Koninklijke DSM NV

- Lantmannen

- Lesaffre International

- Angel Yeast Co Ltd

- Biotec Pharmacon

Significant South America Beta-Glucan Market Industry Milestones

- February 2024: Kemin Industries, a global ingredient manufacturer, opened an Innovation Center and second spray-drying facility at its regional headquarters in Vargeão, Santa Catarina, Brazil, making the Kemin Nutrisurance location the largest pet food manufacturing plant in Latin America by volume capacity for producing dry and liquid palatants.

- March 2024: Bio-Thera Solutions, a commercial-stage biopharmaceutical company developing innovative therapies and biosimilars, and SteinCares, one of Latin America's leading specialty healthcare companies, announced a new licensing agreement to distribute and market Bio-Thera's pharmaceuticals in Brazil and the rest of the region.

- July 2023: BENEO launched its first barley beta-glucans ingredient, Orafti β-Fit. It is a natural and clean-label wholegrain barley flour with 20% beta-glucans and is an extension of the functional fiber range. The launch was effective globally, including in South America.

Future Outlook for South America Beta-Glucan Market Market

The future outlook for the South America Beta-Glucan Market is exceptionally positive, driven by sustained demand for health-focused ingredients and growing consumer awareness. Strategic opportunities lie in expanding product portfolios to cater to emerging health trends, such as immune system support and gut microbiome enhancement. The increasing focus on natural and sustainable ingredients will further bolster the market for plant-derived beta-glucans. Key growth catalysts include potential collaborations between ingredient suppliers and food manufacturers for product innovation, alongside increased investment in research and development to uncover new applications and health benefits. The developing economies within South America present significant untapped market potential, offering substantial opportunities for market penetration and expansion for both established and emerging players in the beta-glucan industry.

South America Beta-Glucan Market Segmentation

-

1. Category

- 1.1. Soluble

- 1.2. Insoluble

-

2. Application

-

2.1. Food and Beverages

- 2.1.1. Dairy

- 2.1.2. Snacks

- 2.1.3. Confectionery

- 2.1.4. Baked Goods

- 2.1.5. Other Products

-

2.2. Healthcare and Dietary Supplements

- 2.2.1. Infant Nutrition

- 2.3. Other Applications

-

2.1. Food and Beverages

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Rest of South America

South America Beta-Glucan Market Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Rest of South America

South America Beta-Glucan Market Regional Market Share

Geographic Coverage of South America Beta-Glucan Market

South America Beta-Glucan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Application in Dietary Supplements

- 3.3. Market Restrains

- 3.3.1. Increasing prevalence of hydroglycemia

- 3.4. Market Trends

- 3.4.1. Increased Demand for Algae derived Beta Glucan in Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Soluble

- 5.1.2. Insoluble

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.1.1. Dairy

- 5.2.1.2. Snacks

- 5.2.1.3. Confectionery

- 5.2.1.4. Baked Goods

- 5.2.1.5. Other Products

- 5.2.2. Healthcare and Dietary Supplements

- 5.2.2.1. Infant Nutrition

- 5.2.3. Other Applications

- 5.2.1. Food and Beverages

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Soluble

- 6.1.2. Insoluble

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.1.1. Dairy

- 6.2.1.2. Snacks

- 6.2.1.3. Confectionery

- 6.2.1.4. Baked Goods

- 6.2.1.5. Other Products

- 6.2.2. Healthcare and Dietary Supplements

- 6.2.2.1. Infant Nutrition

- 6.2.3. Other Applications

- 6.2.1. Food and Beverages

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Colombia South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Soluble

- 7.1.2. Insoluble

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.1.1. Dairy

- 7.2.1.2. Snacks

- 7.2.1.3. Confectionery

- 7.2.1.4. Baked Goods

- 7.2.1.5. Other Products

- 7.2.2. Healthcare and Dietary Supplements

- 7.2.2.1. Infant Nutrition

- 7.2.3. Other Applications

- 7.2.1. Food and Beverages

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Rest of South America South America Beta-Glucan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Soluble

- 8.1.2. Insoluble

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.1.1. Dairy

- 8.2.1.2. Snacks

- 8.2.1.3. Confectionery

- 8.2.1.4. Baked Goods

- 8.2.1.5. Other Products

- 8.2.2. Healthcare and Dietary Supplements

- 8.2.2.1. Infant Nutrition

- 8.2.3. Other Applications

- 8.2.1. Food and Beverages

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Givadaun SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Kemin Industries*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Associated British Foods

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Tate & Lyle PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kerry Group PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Koninklijke DSM NV

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Lantmannen

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Lesaffre International

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Angel Yeast Co Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Biotec Pharmacon

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Givadaun SA

List of Figures

- Figure 1: South America Beta-Glucan Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Beta-Glucan Market Share (%) by Company 2025

List of Tables

- Table 1: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 2: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: South America Beta-Glucan Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 6: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: South America Beta-Glucan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 10: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Beta-Glucan Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Beta-Glucan Market Revenue Million Forecast, by Category 2020 & 2033

- Table 14: South America Beta-Glucan Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: South America Beta-Glucan Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: South America Beta-Glucan Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Beta-Glucan Market?

The projected CAGR is approximately 6.21%.

2. Which companies are prominent players in the South America Beta-Glucan Market?

Key companies in the market include Givadaun SA, Kemin Industries*List Not Exhaustive, Associated British Foods, Tate & Lyle PLC, Kerry Group PLC, Koninklijke DSM NV, Lantmannen, Lesaffre International, Angel Yeast Co Ltd, Biotec Pharmacon.

3. What are the main segments of the South America Beta-Glucan Market?

The market segments include Category, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Application in Dietary Supplements.

6. What are the notable trends driving market growth?

Increased Demand for Algae derived Beta Glucan in Dietary Supplements.

7. Are there any restraints impacting market growth?

Increasing prevalence of hydroglycemia.

8. Can you provide examples of recent developments in the market?

February 2024: Kemin Industries, a global ingredient manufacturer, opened an Innovation Center and second spray-drying facility at its regional headquarters in Vargeão, Santa Catarina, Brazil, making the Kemin Nutrisurance location the largest pet food manufacturing plant in Latin America by volume capacity for producing dry and liquid palatants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Beta-Glucan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Beta-Glucan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Beta-Glucan Market?

To stay informed about further developments, trends, and reports in the South America Beta-Glucan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence