Key Insights

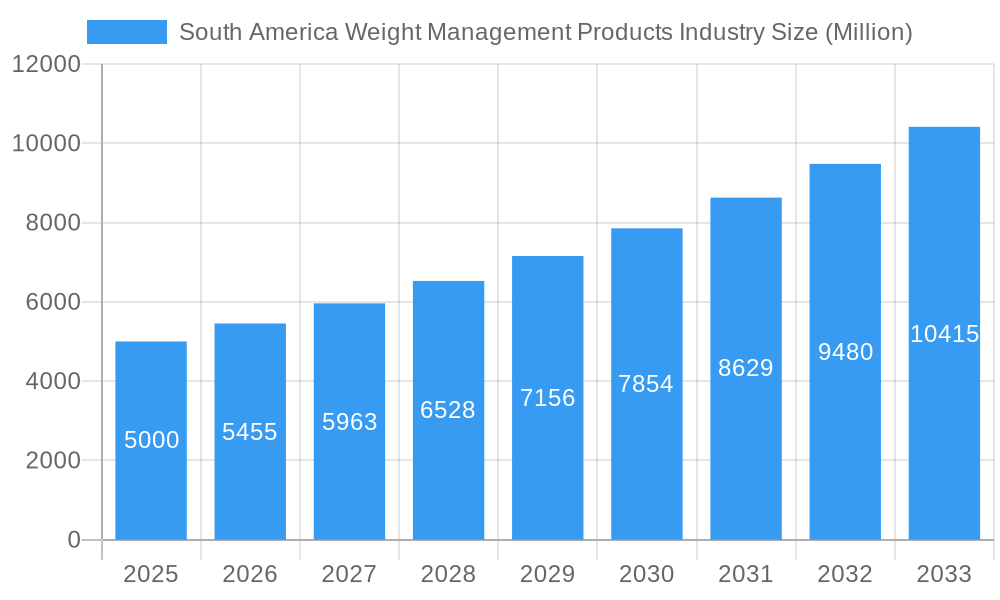

The South American weight management products market, encompassing meal replacements, beverages, and supplements, is poised for substantial expansion. Driven by heightened health consciousness, rising obesity rates, and increased awareness of weight management's importance, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 8.3%. This growth is supported by diverse distribution channels, including hypermarkets, convenience stores, and the burgeoning online retail sector. Brazil and Argentina currently lead market share, with significant growth potential in other South American nations. Supplements are a key product segment due to their convenience and targeted benefits. Despite economic volatility and varying regulatory frameworks, robust growth drivers are expected to propel the market forward. The competitive landscape features both international and regional brands, indicating opportunities for new and established companies. Strategic partnerships, product innovation, and targeted marketing will be crucial for success. Future growth will be influenced by rising disposable incomes, evolving consumer preferences, and advancements in product formulations.

South America Weight Management Products Industry Market Size (In Billion)

Key factors accelerating growth in the South American weight management market include the expanding reach of digital marketing and e-commerce, enabling wider product accessibility and targeted advertising. The increasing adoption of healthy lifestyles, such as regular exercise and balanced diets, synergistically drives demand for weight management solutions. The proliferation of fitness centers and wellness initiatives further bolsters this trend. While regulatory and pricing challenges exist, ongoing investment in research and development, particularly in natural and organic products, is expected to foster innovation and sustain future growth. Increased competition will necessitate innovative product strategies and effective branding to secure consumer loyalty.

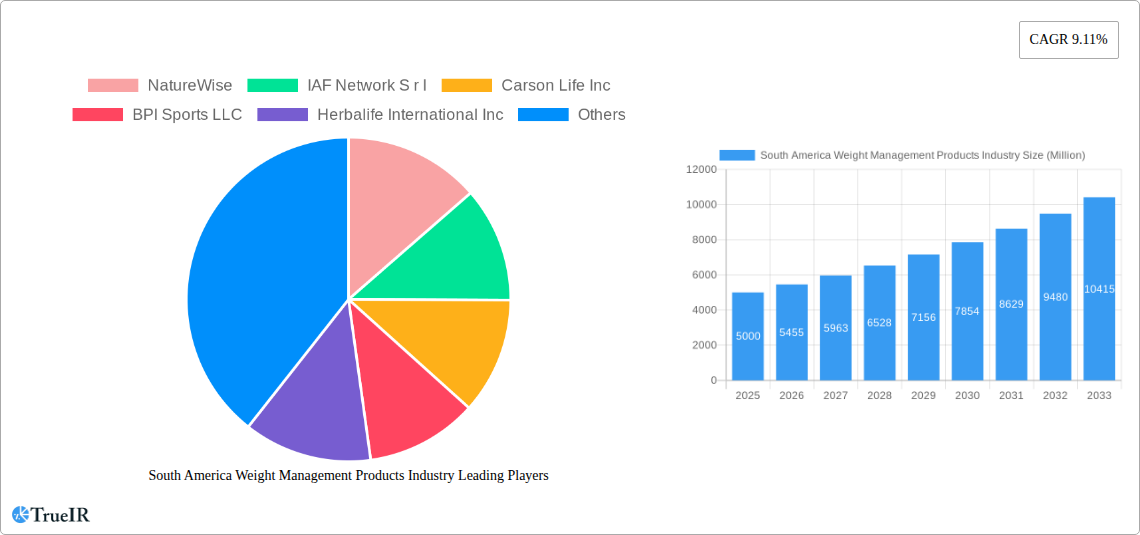

South America Weight Management Products Industry Company Market Share

South America Weight Management Products Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the South America Weight Management Products industry, offering invaluable insights for businesses, investors, and stakeholders seeking to understand this dynamic market. With a focus on market size, growth trends, competitive dynamics, and future projections, this report covers the period from 2019 to 2033, with a base year of 2025. The report leverages extensive data analysis and expert insights to provide a clear and actionable understanding of this rapidly evolving sector. Expect in-depth coverage of key players like Herbalife International Inc, Nestle SA, and many more.

South America Weight Management Products Industry Market Structure & Competitive Landscape

The South America weight management products market exhibits a moderately concentrated structure, with a few large multinational corporations and numerous smaller regional players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, suggesting a competitive yet not fully fragmented landscape. Innovation is a key driver, with companies continually introducing new products and formulations to cater to evolving consumer preferences and health trends. Regulatory oversight, particularly concerning labeling and ingredient claims, significantly impacts market dynamics. Substitute products, such as dietary changes and exercise programs, represent a significant competitive challenge. End-user segmentation is primarily driven by demographics (age, income, lifestyle), with distinct product offerings tailored to specific segments. Mergers and acquisitions (M&A) activity is relatively moderate, driven by strategies to expand product portfolios and geographic reach. In the last five years, the total value of M&A deals in the region is estimated at $xx Million.

- Market Concentration: HHI (2024): xx

- Innovation Drivers: New product formulations, technological advancements in delivery systems (e.g., smart supplements).

- Regulatory Impacts: Stricter labeling regulations, ingredient approvals, and advertising restrictions.

- Product Substitutes: Dietary changes, exercise, alternative weight-loss therapies.

- End-User Segmentation: Age groups (young adults, middle-aged adults), income levels, lifestyle choices.

- M&A Trends: Strategic acquisitions to expand market reach and product portfolios; total M&A value (2019-2024): $xx Million

South America Weight Management Products Industry Market Trends & Opportunities

The South America weight management products market is experiencing robust growth, driven by increasing health consciousness, rising disposable incomes, and changing lifestyle patterns. The market size in 2024 was approximately $xx Million and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements are significantly impacting the market, with the emergence of personalized nutrition solutions and digital health platforms. Consumer preferences are shifting towards natural, organic, and scientifically validated products. The competitive landscape is characterized by intense rivalry, with established players facing challenges from innovative startups and new product introductions. Market penetration rates for key product categories are as follows: Supplements (xx%), Beverages (xx%), Meals (xx%). The highest market penetration is witnessed in the urban areas of major cities like Sao Paulo and Buenos Aires.

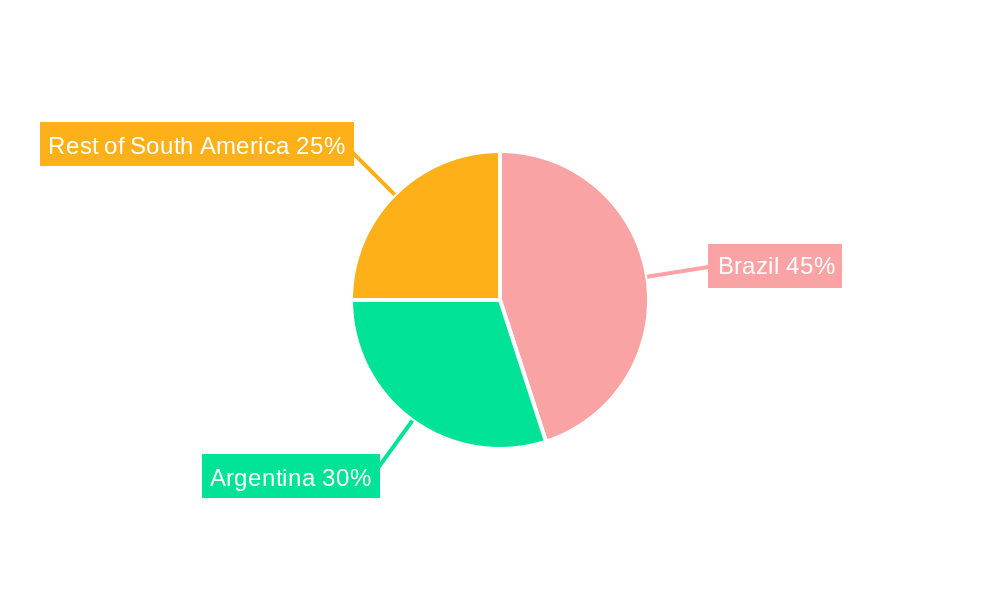

Dominant Markets & Segments in South America Weight Management Products Industry

Brazil stands as the dominant market in South America for weight management products, driven by a large population, rising health awareness, and expanding retail infrastructure. Other significant markets include Argentina, Colombia, and Mexico.

- By Type: Supplements represent the largest segment, followed by beverages and meal replacements. Growth is driven by consumer preference for convenience, efficacy, and perceived health benefits.

- By Distribution Channel: Hypermarkets/supermarkets dominate distribution, followed by online retail stores, reflecting changing consumer shopping habits. Convenience stores play a smaller role.

Key Growth Drivers (Brazil):

- Strong economic growth and rising disposable incomes.

- Increasing health awareness and adoption of health and wellness lifestyles.

- Growing urban population and retail infrastructure expansion.

- Favorable government policies promoting healthy eating habits.

South America Weight Management Products Industry Product Analysis

The South American weight management products market showcases a diverse range of offerings, encompassing meal replacements, beverages, and supplements. Technological advancements are evident in the development of personalized nutrition plans and the use of innovative ingredients with scientifically proven efficacy. Competitive advantages are driven by product differentiation, brand recognition, and effective marketing strategies that emphasize health benefits and efficacy. The market shows a growing trend towards products with natural ingredients and sustainable sourcing.

Key Drivers, Barriers & Challenges in South America Weight Management Products Industry

Key Drivers:

- Rising health consciousness among consumers, leading to increased demand for weight management products.

- Growing prevalence of obesity and related health issues.

- Increased disposable incomes and improved living standards, creating greater affordability for health and wellness products.

- Technological advancements leading to more effective and convenient products.

Key Challenges:

- Stringent regulatory requirements, including labeling and ingredient approvals, can hinder market entry and product innovation. The estimated cost of regulatory compliance per product launch is $xx Million.

- Supply chain disruptions caused by geopolitical factors, impacting product availability and pricing.

- Intense competition among numerous players, leading to price wars and decreased profit margins.

Growth Drivers in the South America Weight Management Products Industry Market

The market is fueled by rising health consciousness, increasing obesity rates, improving economic conditions, and the development of innovative, convenient products. Government initiatives promoting healthy lifestyles also contribute to market expansion.

Challenges Impacting South America Weight Management Products Industry Growth

Regulatory hurdles, economic instability in certain regions, fluctuating raw material costs, and stiff competition impede growth. Supply chain vulnerabilities also pose a significant risk.

Key Players Shaping the South America Weight Management Products Industry Market

- NatureWise

- IAF Network S r l

- Carson Life Inc

- BPI Sports LLC

- Herbalife International Inc

- Nestle SA

- The Hut com Limited (Myprotein)

- Ultimate Nutrition inc

- N V Perricone LLC

- California Medical Weight Management LLC

Significant South America Weight Management Products Industry Industry Milestones

- May 2022: Nestlé Health Science acquired Puravida in Brazil, significantly expanding its market share.

- July 2022: Herbalife launched a new weight management product featuring prickly pear cactus fiber, backed by clinical trials.

- April 2023: Herbalife unveiled 106 new wellness products globally, including in Brazil, covering various health segments.

Future Outlook for South America Weight Management Products Industry Market

The South America weight management products market is poised for continued growth, driven by increasing health awareness, expanding middle class, and the adoption of innovative product offerings. Opportunities lie in the development of personalized nutrition solutions, leveraging digital health platforms, and tapping into the growing demand for natural and organic products. The market is expected to see a sustained increase in the adoption of dietary supplements, and the projected growth rate for the next decade remains optimistic.

South America Weight Management Products Industry Segmentation

-

1. Type

- 1.1. Meal

- 1.2. Beverage

- 1.3. Supplements

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of the South America

South America Weight Management Products Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of the South America

South America Weight Management Products Industry Regional Market Share

Geographic Coverage of South America Weight Management Products Industry

South America Weight Management Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Obesity Incidence and Weight Consciousness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meal

- 5.1.2. Beverage

- 5.1.3. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of the South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of the South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Meal

- 6.1.2. Beverage

- 6.1.3. Supplements

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of the South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Meal

- 7.1.2. Beverage

- 7.1.3. Supplements

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of the South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the South America South America Weight Management Products Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Meal

- 8.1.2. Beverage

- 8.1.3. Supplements

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of the South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 NatureWise

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 IAF Network S r l

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Carson Life Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 BPI Sports LLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Herbalife International Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Nestle SA*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 The Hut com Limited (Myprotein)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ultimate Nutrition inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 N V Perricone LLC

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 California Medical Weight Management LLC

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 NatureWise

List of Figures

- Figure 1: South America Weight Management Products Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Weight Management Products Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Weight Management Products Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: South America Weight Management Products Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Weight Management Products Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: South America Weight Management Products Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Weight Management Products Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Weight Management Products Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the South America Weight Management Products Industry?

Key companies in the market include NatureWise, IAF Network S r l, Carson Life Inc, BPI Sports LLC, Herbalife International Inc, Nestle SA*List Not Exhaustive, The Hut com Limited (Myprotein), Ultimate Nutrition inc, N V Perricone LLC, California Medical Weight Management LLC.

3. What are the main segments of the South America Weight Management Products Industry?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 163.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Rising Obesity Incidence and Weight Consciousness.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Herbalife unveiled 106 innovative Wellness Products on a global scale, catering to a diverse audience spanning 95 markets where the company maintains a strong presence, including Brazil. These new product additions are strategically designed to address various facets of well-being, including nutrient supplementation, weight management, digestion, and other essential segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Weight Management Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Weight Management Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Weight Management Products Industry?

To stay informed about further developments, trends, and reports in the South America Weight Management Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence