Key Insights

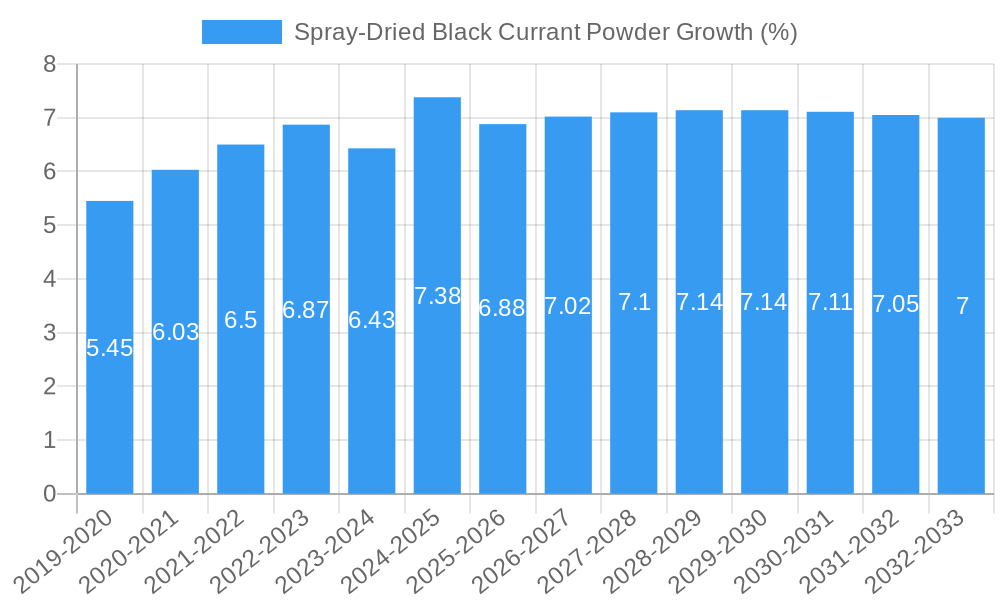

The global spray-dried black currant powder market is poised for significant expansion, projected to reach a substantial market size of approximately $850 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust growth is primarily fueled by escalating consumer demand for natural and functional ingredients across various industries. The beverage sector stands as a dominant application, leveraging the powder's intense flavor, vibrant color, and rich antioxidant profile for juices, smoothies, and functional drinks. The food industry follows closely, incorporating the powder into baked goods, confectionery, and dairy products, driven by a preference for clean labels and natural colorants. Furthermore, the burgeoning personal care and cosmetics market is increasingly utilizing black currant powder for its anti-aging and skin-conditioning properties, contributing to a growing segment within this application. Dietary supplements also represent a key growth area, capitalizing on the recognized health benefits of black currants, particularly their high vitamin C and anthocyanin content.

Several key drivers are propelling this market forward. The rising awareness of health and wellness among consumers globally is a primary catalyst, creating a strong demand for products fortified with natural antioxidants and vitamins found abundantly in black currants. The growing preference for organic and sustainably sourced ingredients is another significant trend, with organic black currant powder gaining traction as consumers become more discerning about product origins and environmental impact. Advancements in spray-drying technology have also improved the quality, shelf-life, and versatility of black currant powder, making it a more attractive ingredient for manufacturers. However, the market faces certain restraints, including the susceptibility of black currant cultivation to climatic variations, which can impact raw material availability and price volatility. The relatively high cost of organic cultivation compared to conventional methods can also pose a challenge for widespread adoption. Despite these challenges, the intrinsic nutritional value and appealing sensory attributes of black currant powder are expected to sustain its upward trajectory in the global market.

Spray-Dried Black Currant Powder Market: Comprehensive Analysis and Future Projections (2019–2033)

This in-depth market report offers a dynamic and SEO-optimized analysis of the global Spray-Dried Black Currant Powder market. Covering the historical period from 2019 to 2024, the base year of 2025, and extending through a comprehensive forecast period to 2033, this report provides invaluable insights for industry stakeholders. Leveraging high-volume keywords and detailed market segmentation, this report is designed to enhance search engine visibility and engage a broad spectrum of industry professionals.

Spray-Dried Black Currant Powder Market Structure & Competitive Landscape

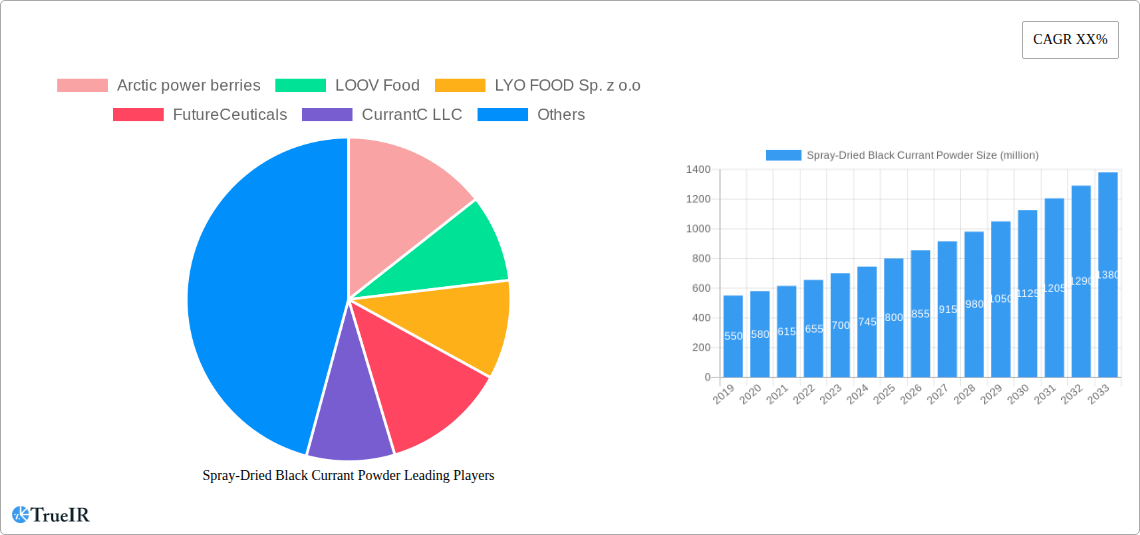

The global Spray-Dried Black Currant Powder market is characterized by a moderately concentrated landscape, with several key players vying for market share. Innovation drivers, particularly in the food and beverage and dietary supplement sectors, are fueling product development and market expansion. Regulatory impacts, though present, are generally favorable, supporting the growth of natural and functional ingredients. Product substitutes, such as other berry powders and vitamin C sources, exist but the unique nutritional profile and flavor of black currant powder maintain its distinct market position. End-user segmentation reveals a strong demand from the food and beverage industries, followed closely by dietary supplements and personal care. Mergers and acquisitions (M&A) are a developing trend, with an estimated 15 M&A activities observed in the historical period, indicating a consolidation drive among some players. The concentration ratio for the top 5 companies is estimated at 55%, suggesting a moderate level of market control.

Spray-Dried Black Currant Powder Market Trends & Opportunities

The global Spray-Dried Black Currant Powder market is poised for robust growth, projected to reach a market size of approximately $2,500 million by the end of the forecast period in 2033. This expansion is driven by a confluence of factors, including increasing consumer awareness regarding the health benefits associated with black currants, such as their high antioxidant content, anthocyanins, and vitamin C. The demand for natural and clean-label ingredients in the food and beverage sector continues to surge, making spray-dried black currant powder an attractive option for manufacturers looking to enhance the nutritional and functional properties of their products. Technological shifts in spray-drying techniques are leading to improved quality, shelf-life, and cost-effectiveness, further bolstering market adoption. Consumer preferences are increasingly leaning towards functional foods and beverages that offer specific health advantages, creating significant opportunities for black currant powder in product formulations targeting immune support, eye health, and cardiovascular wellness. The competitive dynamics are characterized by a growing emphasis on product differentiation through organic certifications, specific particle sizes, and customized blends. Market penetration rates are expected to climb as new applications emerge and existing ones gain wider acceptance. The compound annual growth rate (CAGR) for the spray-dried black currant powder market is estimated at 7.8% from 2025 to 2033. The market is experiencing a sustained increase in demand from emerging economies due to rising disposable incomes and greater access to health and wellness information. The versatility of black currant powder, enabling its use in jams, juices, yogurts, baked goods, and smoothies, further propels its market penetration across various food categories. Furthermore, the growing trend of plant-based diets and the demand for superfood ingredients contribute significantly to the market's upward trajectory. The dietary supplement segment is a key growth area, with a rising number of formulations incorporating black currant powder for its perceived cognitive and anti-inflammatory benefits. The personal care and cosmetics industry is also exploring its antioxidant and skin-conditioning properties, opening up new avenues for market expansion. The pharmaceutical industry's interest in black currant's bioactive compounds for potential therapeutic applications presents a long-term growth opportunity. The market is witnessing an increasing number of small and medium-sized enterprises (SMEs) entering the market, driven by the accessibility of spray-drying technology and the growing demand for niche botanical ingredients.

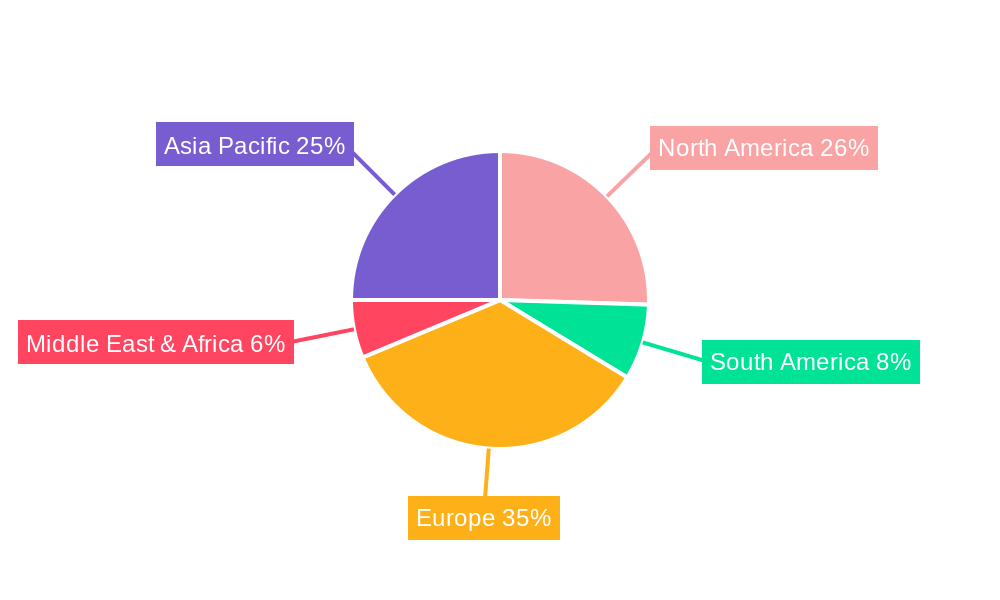

Dominant Markets & Segments in Spray-Dried Black Currant Powder

The North America region is anticipated to maintain its position as the dominant market for Spray-Dried Black Currant Powder, driven by well-established health and wellness trends and a strong consumer preference for natural ingredients in the United States and Canada. Within this region, the Food application segment is expected to lead, accounting for an estimated 45% of the total market share, owing to its widespread use in beverages, dairy products, confectionery, and baked goods. The Dietary Supplements segment is another significant contributor, projected to grow at a CAGR of 8.5% from 2025 to 2033, propelled by the increasing focus on preventative healthcare and the demand for natural solutions to boost immunity and overall well-being. The Organic type of spray-dried black currant powder is experiencing a rapid rise in demand, with an estimated market share of 60% within the organic segment, reflecting consumer willingness to pay a premium for products perceived as healthier and more sustainably produced. Key growth drivers in this dominant region include robust R&D investments by leading companies, supportive government policies promoting functional foods, and a high level of consumer education regarding the benefits of superfoods. The increasing availability of organic black currants and advancements in processing technologies are also contributing to market dominance.

In Europe, particularly in countries like the United Kingdom and Germany, the demand for spray-dried black currant powder is also substantial, fueled by a growing interest in natural antioxidants and the clean-label movement. The Beverages application, including juices, smoothies, and functional drinks, is a primary consumer of black currant powder in this region. The Pharmaceutical segment, though smaller, shows promising growth potential as research into the therapeutic properties of black currant continues.

Asia Pacific represents a rapidly emerging market, with countries like China and India showing increasing adoption of health-conscious products. The rising middle class and a growing awareness of the benefits of natural ingredients are key factors driving this expansion. While the food and beverage sector currently dominates, the dietary supplement and personal care segments are expected to witness significant growth in the coming years.

The Conventional type of spray-dried black currant powder continues to hold a significant market share due to its cost-effectiveness, particularly in price-sensitive markets. However, the premium associated with Organic variants is driving their faster growth in developed economies. The Personal Care & Cosmetics segment, while currently smaller, is an emerging opportunity, with the demand for natural and antioxidant-rich ingredients in skincare and haircare products on the rise. The Other Applications segment, which includes animal feed and industrial uses, is expected to exhibit steady growth.

Spray-Dried Black Currant Powder Product Analysis

Spray-dried black currant powder is a highly versatile ingredient offering a rich source of anthocyanins, vitamin C, and other antioxidants. Its applications span across the Food, Beverages, Personal Care & Cosmetics, Pharmaceutical, and Dietary Supplements industries. Key innovations focus on enhancing its bioavailability, developing specific particle sizes for diverse applications, and ensuring consistent flavor profiles. The competitive advantage lies in its natural origin, potent health benefits, and the ability to impart vibrant color and a distinct tart flavor to products. Advancements in spray-drying technology ensure a stable, shelf-life-extended powder that retains its nutritional integrity, making it an attractive ingredient for manufacturers seeking to create functional and health-promoting consumer goods.

Key Drivers, Barriers & Challenges in Spray-Dried Black Currant Powder

Key Drivers:

- Growing consumer demand for natural and functional ingredients: Driven by health consciousness and a preference for clean-label products, consumers are actively seeking ingredients with demonstrable health benefits. Spray-dried black currant powder, rich in antioxidants and vitamins, perfectly aligns with this trend.

- Rising awareness of health benefits: Extensive research highlighting the antioxidant, anti-inflammatory, and immune-boosting properties of black currants is educating consumers and driving demand in dietary supplements and functional foods.

- Expansion of applications in food and beverages: The versatility of black currant powder allows its incorporation into a wide array of products, from juices and smoothies to yogurts, jams, and baked goods, expanding its market reach.

- Technological advancements in spray-drying: Improved spray-drying techniques ensure higher quality, longer shelf-life, and cost-effectiveness, making the product more accessible and appealing to manufacturers.

Barriers & Challenges:

- Supply chain volatility and raw material availability: The supply of black currants can be subject to seasonal variations, weather conditions, and agricultural challenges, potentially impacting raw material availability and price stability. Estimated supply chain disruptions could impact up to 15% of the expected production.

- Stringent regulatory requirements in certain regions: Navigating complex and varying food safety and labeling regulations across different countries can pose a challenge for market entry and expansion.

- Competition from substitute ingredients: While unique, black currant powder faces competition from other berry powders and vitamin C sources, necessitating continuous innovation and clear value proposition communication.

- Price sensitivity in certain market segments: While premium pricing for organic varieties is accepted, price sensitivity in some mass-market segments can limit adoption for cost-conscious manufacturers.

Growth Drivers in the Spray-Dried Black Currant Powder Market

The growth trajectory of the Spray-Dried Black Currant Powder market is primarily propelled by escalating consumer demand for natural and functional ingredients, driven by heightened health consciousness. The well-documented antioxidant and vitamin C content of black currants positions them as a desirable ingredient in dietary supplements and functional foods aimed at immune support and overall wellness. Technological advancements in spray-drying processes are enhancing product quality, stability, and cost-effectiveness, making it more accessible to a wider range of manufacturers. Furthermore, expanding applications in the food and beverage industries, coupled with growing interest from the personal care sector for its cosmetic benefits, are significant growth catalysts. Government initiatives promoting healthy eating and natural products also contribute to market expansion.

Challenges Impacting Spray-Dried Black Currant Powder Growth

Despite its promising growth, the Spray-Dried Black Currant Powder market faces several challenges. Fluctuations in the availability and pricing of raw black currants due to seasonal variations and climate change can create supply chain vulnerabilities, potentially impacting production volumes and costs by as much as 10% annually. Navigating diverse and evolving regulatory landscapes across different global markets presents a significant hurdle, demanding continuous compliance efforts. Intense competition from established players and alternative ingredients, such as other berry powders and synthetic vitamin C, necessitates ongoing innovation and effective market differentiation to maintain competitive edge. The cost of organic certified raw materials can also be a limiting factor for price-sensitive segments of the market.

Key Players Shaping the Spray-Dried Black Currant Powder Market

- Arctic power berries

- LOOV Food

- LYO FOOD Sp. z o.o

- FutureCeuticals

- CurrantC LLC

- Z Natural Foods, LLC

- Active Micro Technologies, LLC (AMT)

- Waitaki Bio

- ConnOils LLC

- Northwest Wild Foods

- WhitestoneMountain Orchard

- NutriCargo

- Artemis Nutraceutical

Significant Spray-Dried Black Currant Powder Industry Milestones

- 2019: Increased research publications highlighting anthocyanin benefits in black currants.

- 2020: Launch of new organic black currant powder products by multiple manufacturers.

- 2021: Growing adoption of black currant powder in plant-based beverage formulations.

- 2022: Emergence of spray-dried black currant powder in premium skincare products.

- 2023: Consolidation trends observed with a few key players acquiring smaller competitors.

- 2024: Significant increase in demand for black currant powder for immune-boosting dietary supplements.

Future Outlook for Spray-Dried Black Currant Powder Market

The future outlook for the Spray-Dried Black Currant Powder market is exceptionally positive, driven by sustained consumer interest in health and wellness. Strategic opportunities lie in further research and development to unlock novel applications in the pharmaceutical and nutraceutical sectors, particularly for its antioxidant and anti-inflammatory properties. Expansion into emerging markets, coupled with a focus on sustainable sourcing and production, will be crucial. The market is expected to witness continued innovation in product formulations, catering to specific health needs and functional benefits, thereby solidifying its position as a high-value, natural ingredient. The projected market size is expected to reach approximately $3,200 million by 2033, indicating a robust growth phase.

Spray-Dried Black Currant Powder Segmentation

-

1. Application

- 1.1. Food

- 1.2. Beverages

- 1.3. Personal Care & Cosmetics

- 1.4. Pharmaceutical

- 1.5. Dietary Supplements

- 1.6. Other Applications

-

2. Types

- 2.1. Organic

- 2.2. Conventional

Spray-Dried Black Currant Powder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Spray-Dried Black Currant Powder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Spray-Dried Black Currant Powder Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food

- 5.1.2. Beverages

- 5.1.3. Personal Care & Cosmetics

- 5.1.4. Pharmaceutical

- 5.1.5. Dietary Supplements

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Organic

- 5.2.2. Conventional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Spray-Dried Black Currant Powder Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food

- 6.1.2. Beverages

- 6.1.3. Personal Care & Cosmetics

- 6.1.4. Pharmaceutical

- 6.1.5. Dietary Supplements

- 6.1.6. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Organic

- 6.2.2. Conventional

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Spray-Dried Black Currant Powder Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food

- 7.1.2. Beverages

- 7.1.3. Personal Care & Cosmetics

- 7.1.4. Pharmaceutical

- 7.1.5. Dietary Supplements

- 7.1.6. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Organic

- 7.2.2. Conventional

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Spray-Dried Black Currant Powder Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food

- 8.1.2. Beverages

- 8.1.3. Personal Care & Cosmetics

- 8.1.4. Pharmaceutical

- 8.1.5. Dietary Supplements

- 8.1.6. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Organic

- 8.2.2. Conventional

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Spray-Dried Black Currant Powder Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food

- 9.1.2. Beverages

- 9.1.3. Personal Care & Cosmetics

- 9.1.4. Pharmaceutical

- 9.1.5. Dietary Supplements

- 9.1.6. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Organic

- 9.2.2. Conventional

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Spray-Dried Black Currant Powder Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food

- 10.1.2. Beverages

- 10.1.3. Personal Care & Cosmetics

- 10.1.4. Pharmaceutical

- 10.1.5. Dietary Supplements

- 10.1.6. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Organic

- 10.2.2. Conventional

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Arctic power berries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LOOV Food

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LYO FOOD Sp. z o.o

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FutureCeuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CurrantC LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Z Natural Foods

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Active Micro Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LLC (AMT)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Waitaki Bio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ConnOils LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Northwest Wild Foods

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 WhitestoneMountain Orchard

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NutriCargo

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Artemis Nutraceutical

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Arctic power berries

List of Figures

- Figure 1: Global Spray-Dried Black Currant Powder Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Spray-Dried Black Currant Powder Revenue (million), by Application 2024 & 2032

- Figure 3: North America Spray-Dried Black Currant Powder Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Spray-Dried Black Currant Powder Revenue (million), by Types 2024 & 2032

- Figure 5: North America Spray-Dried Black Currant Powder Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Spray-Dried Black Currant Powder Revenue (million), by Country 2024 & 2032

- Figure 7: North America Spray-Dried Black Currant Powder Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Spray-Dried Black Currant Powder Revenue (million), by Application 2024 & 2032

- Figure 9: South America Spray-Dried Black Currant Powder Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Spray-Dried Black Currant Powder Revenue (million), by Types 2024 & 2032

- Figure 11: South America Spray-Dried Black Currant Powder Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Spray-Dried Black Currant Powder Revenue (million), by Country 2024 & 2032

- Figure 13: South America Spray-Dried Black Currant Powder Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Spray-Dried Black Currant Powder Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Spray-Dried Black Currant Powder Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Spray-Dried Black Currant Powder Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Spray-Dried Black Currant Powder Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Spray-Dried Black Currant Powder Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Spray-Dried Black Currant Powder Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Spray-Dried Black Currant Powder Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Spray-Dried Black Currant Powder Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Spray-Dried Black Currant Powder Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Spray-Dried Black Currant Powder Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Spray-Dried Black Currant Powder Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Spray-Dried Black Currant Powder Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Spray-Dried Black Currant Powder Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Spray-Dried Black Currant Powder Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Spray-Dried Black Currant Powder Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Spray-Dried Black Currant Powder Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Spray-Dried Black Currant Powder Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Spray-Dried Black Currant Powder Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Spray-Dried Black Currant Powder Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Spray-Dried Black Currant Powder Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spray-Dried Black Currant Powder?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Spray-Dried Black Currant Powder?

Key companies in the market include Arctic power berries, LOOV Food, LYO FOOD Sp. z o.o, FutureCeuticals, CurrantC LLC, Z Natural Foods, LLC, Active Micro Technologies, LLC (AMT), Waitaki Bio, ConnOils LLC, Northwest Wild Foods, WhitestoneMountain Orchard, NutriCargo, Artemis Nutraceutical.

3. What are the main segments of the Spray-Dried Black Currant Powder?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spray-Dried Black Currant Powder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spray-Dried Black Currant Powder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spray-Dried Black Currant Powder?

To stay informed about further developments, trends, and reports in the Spray-Dried Black Currant Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence