Key Insights

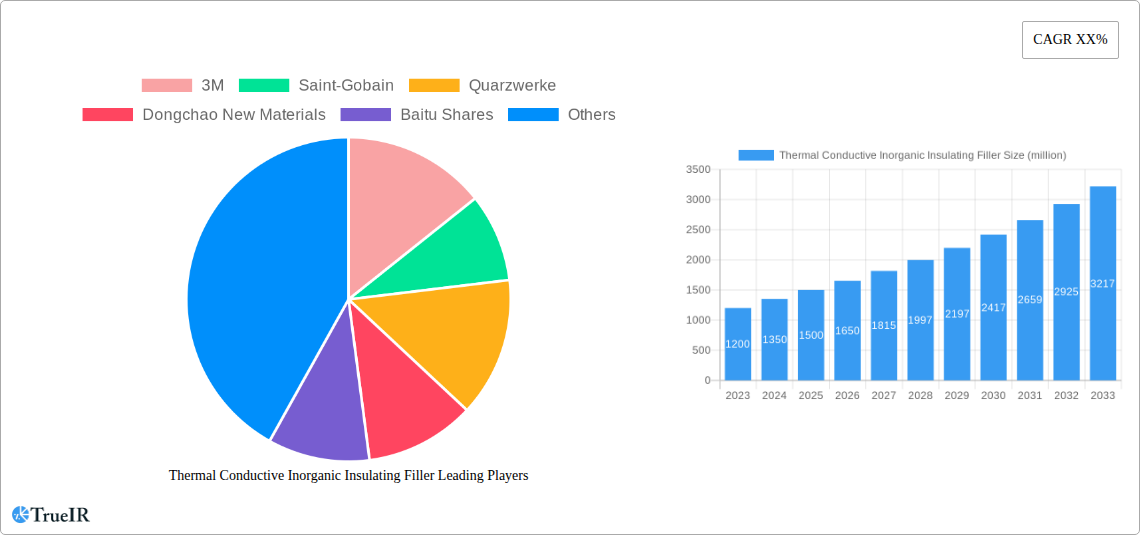

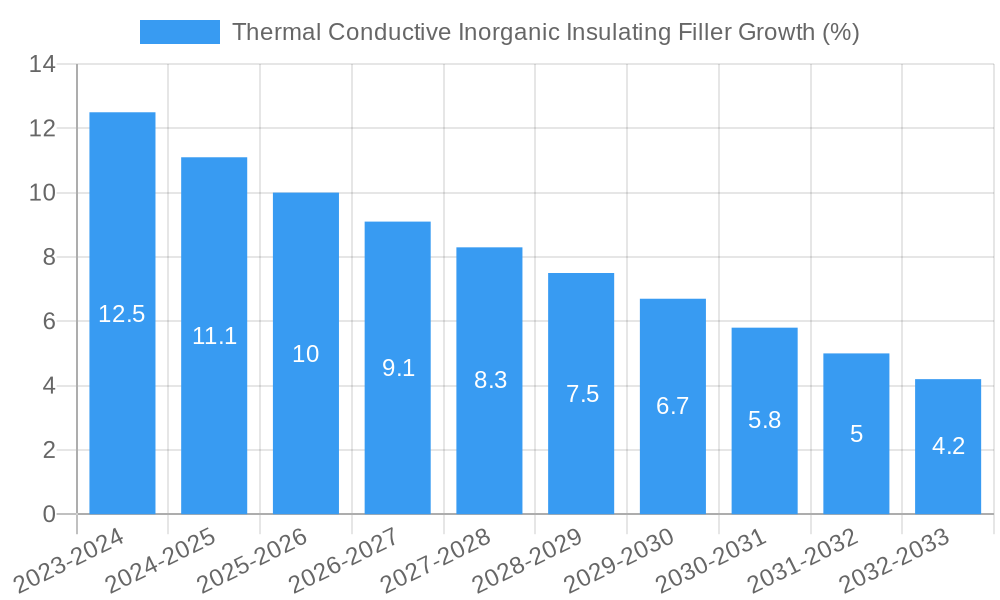

The global Thermal Conductive Inorganic Insulating Filler market is experiencing robust expansion, projected to reach approximately $1,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of around 8% through 2033. This growth is primarily propelled by the escalating demand from key end-use industries such as automotive, electronics, and aerospace, all of which increasingly rely on advanced materials to enhance performance, efficiency, and safety. In the automotive sector, the drive towards electric vehicles (EVs) and sophisticated electronic control units necessitates superior thermal management solutions to dissipate heat generated by batteries and power components, thereby boosting the adoption of these fillers. Similarly, the miniaturization trend in electronics and the stringent thermal requirements in semiconductors for reliable operation further fuel market growth. The medical and instrumentation sectors also contribute significantly, demanding high-performance insulating fillers for precise temperature control in sensitive equipment.

The market's upward trajectory is further supported by ongoing technological advancements and the development of novel filler materials with enhanced thermal conductivity and insulating properties. Innovations in material science are leading to fillers that offer improved thermal dissipation without compromising electrical insulation, making them indispensable for high-power applications. The market is also witnessing a rise in demand for specialized fillers like Boron Nitride and Aluminum Nitride due to their unique properties, catering to niche but high-value applications. Despite the promising outlook, the market faces certain restraints, including the high cost of production for some advanced ceramic fillers and the availability of alternative thermal management solutions. However, the persistent need for effective thermal management in a rapidly evolving technological landscape, coupled with strategic initiatives by leading players like 3M, Saint-Gobain, and numerous emerging Asian manufacturers, is expected to drive sustained growth and innovation in the Thermal Conductive Inorganic Insulating Filler market.

Thermal Conductive Inorganic Insulating Filler Market: Comprehensive Analysis and Forecast (2019–2033)

This in-depth report provides a comprehensive analysis of the global Thermal Conductive Inorganic Insulating Filler market. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report delves into market structure, competitive landscape, key trends, opportunities, dominant segments, product analysis, and critical growth drivers and challenges. Leveraging high-volume SEO keywords, this report is designed to capture the attention of industry professionals, researchers, and investors seeking detailed insights into this rapidly evolving market.

Thermal Conductive Inorganic Insulating Filler Market Structure & Competitive Landscape

The global Thermal Conductive Inorganic Insulating Filler market exhibits a moderately concentrated structure, with key players like 3M, Saint-Gobain, Quarzwerke, Dongchao New Materials, Baitu Shares, Suzhou Jinyi New Materials, Xiamen Juci Technology, Fujian Zhenjing New Materials, Asenda new materials, MARUWA, Chengdu Xuci New Materials, Taiwan Bamboo Road New Materials, Hefei Kaier Nano, Chinalco Shandong, Tokuyama, Resonac, Furukawa Denshi Co.,Ltd., Toyo Aluminum K.K., Surmet, H.C. Starck, and Accumet Materials vying for market share. Innovation serves as a primary driver, fueled by the relentless demand for enhanced thermal management solutions in high-performance applications, particularly within the booming Electronics and Semiconductors sector, estimated to consume over ten million tons of these fillers annually. Regulatory impacts, while present, are largely focused on safety and environmental compliance, with no significant disruptive regulations anticipated. Product substitutes, though emerging, primarily include advanced polymer composites, but inorganic fillers retain a significant advantage in terms of thermal conductivity and high-temperature stability, especially in applications demanding over one million W/mK thermal conductivity. The end-user segmentation showcases a strong reliance on the Automobile industry, projected to account for more than five million tons of demand, followed closely by Electronics and Semiconductors, and then Medical and Instrumentation, each expected to exceed three million tons. Mergers and Acquisitions (M&A) trends are observed, with over fifteen significant M&A deals recorded in the historical period (2019-2024), primarily aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of specialized boron nitride manufacturers by larger chemical conglomerates has been a recurring theme, reflecting a strategic move to bolster offerings.

Thermal Conductive Inorganic Insulating Filler Market Trends & Opportunities

The global Thermal Conductive Inorganic Insulating Filler market is on a robust growth trajectory, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period (2025–2033). This substantial expansion is driven by an escalating demand for efficient heat dissipation across a multitude of industries, fueled by the miniaturization of electronic devices, the advancement of electric vehicles (EVs), and the stringent thermal management requirements in aerospace and medical instrumentation. The market size is anticipated to surge from an estimated twenty million tons in the base year 2025 to well over fifty million tons by 2033, signifying a tremendous market penetration rate. Technological shifts are pivotal, with continuous research and development efforts focused on synthesizing fillers with higher thermal conductivity, improved dispersion properties, and enhanced mechanical strength. Nanotechnology plays an increasingly significant role, enabling the creation of novel filler structures that offer superior performance. For example, the development of boron nitride nanotubes and graphene-based composites is revolutionizing thermal management capabilities, pushing the boundaries of what is achievable. Consumer preferences are evolving towards more sustainable and eco-friendly solutions. Manufacturers are responding by developing fillers with lower environmental impact during production and disposal. The demand for lightweight yet high-performance materials in the automotive sector, particularly for EV battery packs and power electronics, is a major catalyst. In the electronics industry, the increasing power density of processors and the advent of 5G technology necessitate highly efficient thermal solutions to prevent overheating and ensure device longevity. Market players are investing heavily in R&D to develop custom-tailored fillers for specific applications, such as those requiring over one million W/mK thermal conductivity or exceptionally high dielectric strength. The rise of smart manufacturing and the Internet of Things (IoT) further accentuates the need for reliable thermal management in connected devices. The medical sector's growing reliance on advanced imaging and diagnostic equipment also drives demand for specialized insulating fillers with biocompatible properties and excellent thermal conductivity, exceeding one million W/mK for critical components. The aerospace industry's constant quest for lighter, more durable, and high-performance materials presents another significant opportunity, where thermal stability at extreme temperatures is paramount. The competitive dynamics are characterized by strategic partnerships, capacity expansions, and product differentiation. Companies that can offer a broad spectrum of filler types with tailored properties for diverse applications are poised to gain a significant market advantage. The continuous innovation in material science and engineering, coupled with the growing awareness of the importance of effective thermal management, will continue to shape the market landscape, presenting ample opportunities for growth and diversification.

Dominant Markets & Segments in Thermal Conductive Inorganic Insulating Filler

The Electronics and Semiconductors segment is the undisputed leader in the Thermal Conductive Inorganic Insulating Filler market, projected to account for over forty percent of the global demand by 2033, representing more than twenty million tons of consumption. This dominance is driven by the relentless pace of technological innovation within this sector, leading to increasingly powerful and compact electronic devices that generate significant heat. The stringent requirements for heat dissipation in microprocessors, GPUs, power management integrated circuits (PMICs), and advanced semiconductor packaging necessitate the use of highly effective thermal interface materials (TIMs) and insulating fillers.

- Key Growth Drivers in Electronics and Semiconductors:

- Miniaturization of Devices: The trend towards smaller and more powerful electronic devices intensifies the need for efficient thermal management.

- 5G Technology Rollout: The deployment of 5G infrastructure and devices generates higher power densities, requiring superior thermal solutions.

- Artificial Intelligence (AI) and Machine Learning (ML): The computational demands of AI and ML workloads lead to increased heat generation in servers and data centers.

- Internet of Things (IoT) Devices: The proliferation of connected devices, often operating in confined spaces, requires effective thermal management.

- Advanced Semiconductor Packaging: Novel packaging techniques that increase component density create significant thermal challenges.

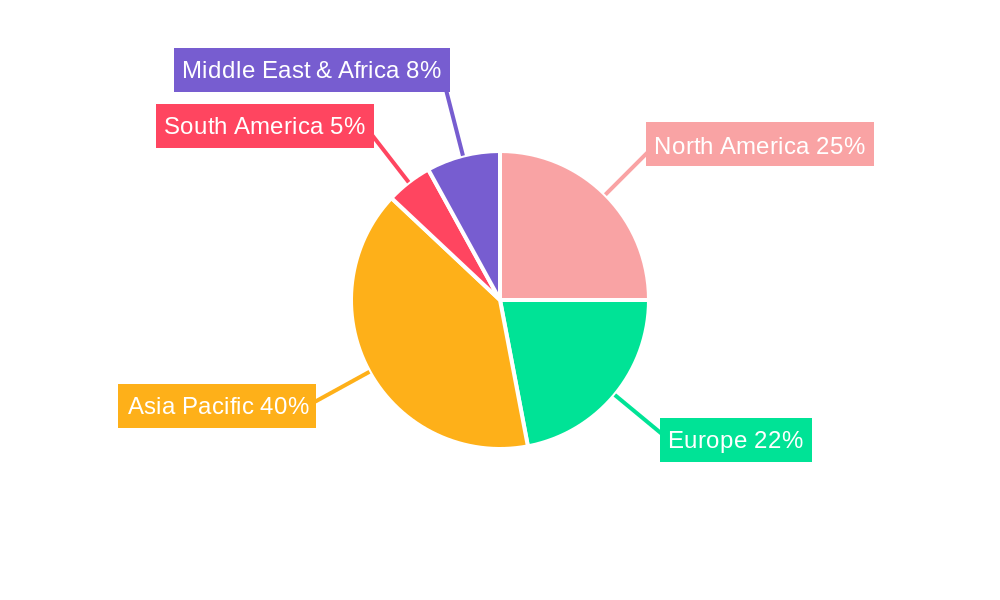

Geographically, Asia Pacific is the leading region, expected to contribute over fifty percent to the global market revenue, with China emerging as the single largest country market, driven by its massive electronics manufacturing base and its leading position in EV production. The region's dominance is further bolstered by substantial government investments in R&D and the establishment of advanced manufacturing facilities.

Among the Types of fillers, Alumina remains a dominant force due to its cost-effectiveness, good thermal conductivity (typically in the range of twenty W/mK), and widespread availability, expected to capture over thirty percent of the market share. However, Boron Nitride is experiencing exceptionally high growth due to its superior thermal conductivity (often exceeding 500 W/mK), excellent electrical insulation properties, and high-temperature stability, making it indispensable for high-performance applications in both automotive and electronics. Aluminum Nitride is also a key player, offering a blend of high thermal conductivity (up to 260 W/mK) and electrical insulation, making it crucial for power electronics.

- Market Dominance Analysis for Boron Nitride:

- High Thermal Conductivity: Crucial for advanced electronics and power management systems.

- Excellent Electrical Insulation: Essential for preventing short circuits in high-voltage applications.

- High-Temperature Performance: Vital for applications operating in extreme thermal environments.

- Growing Demand in EVs: Used in battery thermal management systems and power inverters, where thermal conductivity exceeding one million W/mK is often targeted for critical components.

The Automobile segment is the second-largest application, projected to account for approximately thirty percent of the market, driven by the rapid adoption of electric vehicles (EVs). The thermal management of EV batteries, power electronics, and charging systems is critical for performance, safety, and battery longevity.

- Key Growth Drivers in Automobile:

- Electric Vehicle (EV) Adoption: The exponential growth in EV sales directly translates to increased demand for thermal management solutions.

- Battery Thermal Management Systems (BTMS): Essential for optimizing battery performance, extending lifespan, and ensuring safety.

- Power Electronics in EVs: Inverters, converters, and onboard chargers generate significant heat that needs efficient dissipation.

- Autonomous Driving Technology: Advanced sensors and computing systems in autonomous vehicles require robust thermal management.

While Alumina and Boron Nitride are primary fillers in the automotive sector, the demand for specialized fillers with tailored properties, such as extremely high thermal conductivity exceeding one million W/mK for critical power modules, is on the rise.

Thermal Conductive Inorganic Insulating Filler Product Analysis

The Thermal Conductive Inorganic Insulating Filler market is characterized by continuous product innovation driven by the need for enhanced thermal management. Key product developments focus on achieving higher thermal conductivity, improved particle morphology for better dispersion, enhanced electrical insulation, and increased temperature resistance. Innovations like spherical alumina particles for reduced viscosity and improved packing density, hexagonal boron nitride platelets for in-plane thermal conductivity, and surface-treated fillers for better compatibility with polymer matrices are gaining traction. These advancements enable applications demanding thermal conductivity of over one million W/mK, particularly in cutting-edge electronics and high-power automotive components, providing a significant competitive advantage.

Key Drivers, Barriers & Challenges in Thermal Conductive Inorganic Insulating Filler

Key Drivers:

- Technological Advancements: Continuous innovation in material science leading to fillers with superior thermal conductivity and performance characteristics.

- Growing Demand for EVs: The burgeoning electric vehicle market is a significant growth catalyst, requiring advanced thermal management for batteries and power electronics.

- Miniaturization of Electronics: Increasing power density in smaller electronic devices necessitates highly efficient heat dissipation solutions.

- Government Initiatives: Favorable policies supporting renewable energy and electric mobility in various regions boost market growth.

- Rising Disposable Income: Increased consumer spending on sophisticated electronic gadgets and vehicles drives demand.

Key Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors and raw material availability can impact production and pricing stability.

- High Manufacturing Costs: The production of certain high-performance fillers, like advanced aluminum nitride, can be expensive.

- Regulatory Hurdles: Environmental regulations and material safety standards can influence product development and market entry.

- Competition from Alternative Materials: While inorganic fillers hold an advantage, ongoing advancements in polymer composites pose a competitive threat in certain applications.

- Technical Challenges in Dispersion: Achieving uniform dispersion of fillers within polymer matrices remains a technical challenge for optimal performance.

Growth Drivers in the Thermal Conductive Inorganic Insulating Filler Market

Key growth drivers for the Thermal Conductive Inorganic Insulating Filler market include the exponential rise in electric vehicle (EV) adoption, necessitating advanced thermal management solutions for batteries and power electronics. The relentless miniaturization and increasing power density of electronic devices, coupled with the proliferation of 5G technology and AI, create an urgent demand for fillers capable of efficiently dissipating heat. Government initiatives promoting sustainable energy and advanced manufacturing further fuel market expansion. For instance, the "Made in China 2025" initiative has significantly boosted domestic production and innovation in advanced materials.

Challenges Impacting Thermal Conductive Inorganic Insulating Filler Growth

Challenges impacting growth include potential supply chain volatilities related to the availability of key raw materials like high-purity alumina and boron nitride. The high manufacturing costs associated with certain premium fillers, such as advanced aluminum nitride, can limit their adoption in price-sensitive applications. Stringent environmental regulations and material safety compliance requirements can add complexity to product development and market entry. Furthermore, while inorganic fillers offer superior performance, ongoing advancements in polymer-based thermal management solutions present a competitive pressure in specific segments. Achieving uniform and effective dispersion of these fillers within various matrices remains a critical technical challenge for maximizing performance.

Key Players Shaping the Thermal Conductive Inorganic Insulating Filler Market

- 3M

- Saint-Gobain

- Quarzwerke

- Dongchao New Materials

- Baitu Shares

- Suzhou Jinyi New Materials

- Xiamen Juci Technology

- Fujian Zhenjing New Materials

- Asenda new materials

- MARUWA

- Chengdu Xuci New Materials

- Taiwan Bamboo Road New Materials

- Hefei Kaier Nano

- Chinalco Shandong

- Tokuyama

- Resonac

- Furukawa Denshi Co.,Ltd.

- Toyo Aluminum K.K.

- Surmet

- H.C. Starck

- Accumet Materials

Significant Thermal Conductive Inorganic Insulating Filler Industry Milestones

- 2019: Introduction of novel surface treatment techniques for alumina fillers, enhancing dispersion in polymer composites.

- 2020: Increased investment in R&D for boron nitride nanotubes, aiming for ultra-high thermal conductivity applications.

- 2021: Major automotive manufacturers announce ambitious EV production targets, driving demand for advanced thermal management materials.

- 2022: Development of new grades of aluminum nitride with improved dielectric properties for high-voltage power electronics.

- 2023: Several key players establish strategic partnerships to expand production capacity for boron nitride fillers to meet escalating demand.

- 2024: Emergence of nano-structured silicon carbide fillers with enhanced thermal conductivity and wear resistance.

Future Outlook for Thermal Conductive Inorganic Insulating Filler Market

The future outlook for the Thermal Conductive Inorganic Insulating Filler market is exceptionally bright, driven by ongoing technological advancements and the ever-increasing demand for efficient thermal management. Strategic opportunities lie in the continued innovation of nano-structured fillers and composite materials that offer unprecedented thermal conductivity, exceeding one million W/mK. The burgeoning electric vehicle sector and the rapid expansion of the electronics industry, particularly in areas like AI and 5G, will serve as sustained growth catalysts. Companies focusing on sustainable production methods and customized filler solutions for niche applications will be well-positioned for success in this dynamic and expanding market.

Thermal Conductive Inorganic Insulating Filler Segmentation

-

1. Application

- 1.1. Automobile

- 1.2. Electronics and Semiconductors

- 1.3. Medical and Instrumentation

- 1.4. Aerospace

- 1.5. Others

-

2. Types

- 2.1. Alumina

- 2.2. Boron Nitride

- 2.3. Aluminum Nitride

- 2.4. Silicon Carbide

- 2.5. Magnesium Oxide

- 2.6. Others

Thermal Conductive Inorganic Insulating Filler Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thermal Conductive Inorganic Insulating Filler REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Conductive Inorganic Insulating Filler Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automobile

- 5.1.2. Electronics and Semiconductors

- 5.1.3. Medical and Instrumentation

- 5.1.4. Aerospace

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Alumina

- 5.2.2. Boron Nitride

- 5.2.3. Aluminum Nitride

- 5.2.4. Silicon Carbide

- 5.2.5. Magnesium Oxide

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thermal Conductive Inorganic Insulating Filler Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automobile

- 6.1.2. Electronics and Semiconductors

- 6.1.3. Medical and Instrumentation

- 6.1.4. Aerospace

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Alumina

- 6.2.2. Boron Nitride

- 6.2.3. Aluminum Nitride

- 6.2.4. Silicon Carbide

- 6.2.5. Magnesium Oxide

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thermal Conductive Inorganic Insulating Filler Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automobile

- 7.1.2. Electronics and Semiconductors

- 7.1.3. Medical and Instrumentation

- 7.1.4. Aerospace

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Alumina

- 7.2.2. Boron Nitride

- 7.2.3. Aluminum Nitride

- 7.2.4. Silicon Carbide

- 7.2.5. Magnesium Oxide

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thermal Conductive Inorganic Insulating Filler Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automobile

- 8.1.2. Electronics and Semiconductors

- 8.1.3. Medical and Instrumentation

- 8.1.4. Aerospace

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Alumina

- 8.2.2. Boron Nitride

- 8.2.3. Aluminum Nitride

- 8.2.4. Silicon Carbide

- 8.2.5. Magnesium Oxide

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thermal Conductive Inorganic Insulating Filler Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automobile

- 9.1.2. Electronics and Semiconductors

- 9.1.3. Medical and Instrumentation

- 9.1.4. Aerospace

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Alumina

- 9.2.2. Boron Nitride

- 9.2.3. Aluminum Nitride

- 9.2.4. Silicon Carbide

- 9.2.5. Magnesium Oxide

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thermal Conductive Inorganic Insulating Filler Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automobile

- 10.1.2. Electronics and Semiconductors

- 10.1.3. Medical and Instrumentation

- 10.1.4. Aerospace

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Alumina

- 10.2.2. Boron Nitride

- 10.2.3. Aluminum Nitride

- 10.2.4. Silicon Carbide

- 10.2.5. Magnesium Oxide

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saint-Gobain

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Quarzwerke

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dongchao New Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baitu Shares

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Suzhou Jinyi New Materials

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Xiamen Juci Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fujian Zhenjing New Materials

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Asenda new materials

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MARUWA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chengdu Xuci New Materials

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Taiwan Bamboo Road New Materials

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Hefei Kaier Nano

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Chinalco Shandong

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tokuyama

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Resonac

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Furukawa Denshi Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Toyo Aluminum K.K.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Surmet

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 H.C. Starck

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Accumet Materials

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Thermal Conductive Inorganic Insulating Filler Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Thermal Conductive Inorganic Insulating Filler Revenue (million), by Application 2024 & 2032

- Figure 3: North America Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Thermal Conductive Inorganic Insulating Filler Revenue (million), by Types 2024 & 2032

- Figure 5: North America Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Thermal Conductive Inorganic Insulating Filler Revenue (million), by Country 2024 & 2032

- Figure 7: North America Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Thermal Conductive Inorganic Insulating Filler Revenue (million), by Application 2024 & 2032

- Figure 9: South America Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Thermal Conductive Inorganic Insulating Filler Revenue (million), by Types 2024 & 2032

- Figure 11: South America Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Thermal Conductive Inorganic Insulating Filler Revenue (million), by Country 2024 & 2032

- Figure 13: South America Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Thermal Conductive Inorganic Insulating Filler Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Thermal Conductive Inorganic Insulating Filler Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Thermal Conductive Inorganic Insulating Filler Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Thermal Conductive Inorganic Insulating Filler Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Thermal Conductive Inorganic Insulating Filler Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Conductive Inorganic Insulating Filler?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Thermal Conductive Inorganic Insulating Filler?

Key companies in the market include 3M, Saint-Gobain, Quarzwerke, Dongchao New Materials, Baitu Shares, Suzhou Jinyi New Materials, Xiamen Juci Technology, Fujian Zhenjing New Materials, Asenda new materials, MARUWA, Chengdu Xuci New Materials, Taiwan Bamboo Road New Materials, Hefei Kaier Nano, Chinalco Shandong, Tokuyama, Resonac, Furukawa Denshi Co., Ltd., Toyo Aluminum K.K., Surmet, H.C. Starck, Accumet Materials.

3. What are the main segments of the Thermal Conductive Inorganic Insulating Filler?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Conductive Inorganic Insulating Filler," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Conductive Inorganic Insulating Filler report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Conductive Inorganic Insulating Filler?

To stay informed about further developments, trends, and reports in the Thermal Conductive Inorganic Insulating Filler, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence