Key Insights

The United States starch derivatives market is projected for significant expansion, driven by robust demand across various industrial sectors and a projected Compound Annual Growth Rate (CAGR) of 5.8%. The market is estimated to reach $17.62 billion by 2025. Key growth catalysts include the increasing utilization of starch derivatives as functional ingredients in the food and beverage industry for texture enhancement, stabilization, and shelf-life extension. Growing demand from the paper industry for improved strength and coating properties, alongside expanding applications in pharmaceuticals as excipients and binders, further supports this positive market trend. Innovations in modified starches offering customized functionalities are also vital in stimulating market growth.

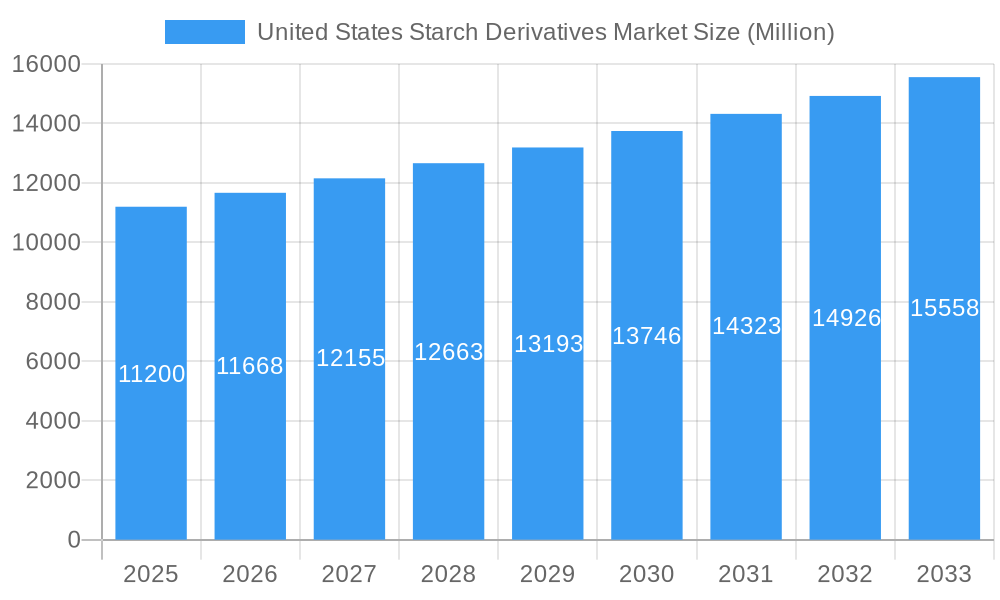

United States Starch Derivatives Market Market Size (In Billion)

Several trends are shaping the United States starch derivatives market. A rising consumer preference for clean-label ingredients is driving demand for naturally derived starch derivatives and encouraging innovation in processing techniques. The feed industry's increasing reliance on starch derivatives for animal nutrition and feed efficiency represents another significant growth factor. However, market restraints include price volatility of raw materials, such as corn and wheat, which can impact production costs. Stringent regulatory frameworks for food additives and processing aids also require continuous compliance. Nonetheless, with a strong presence in the food and beverage sector and expanding applications in paper, feed, and pharmaceuticals, the United States starch derivatives market is expected to sustain its growth trajectory.

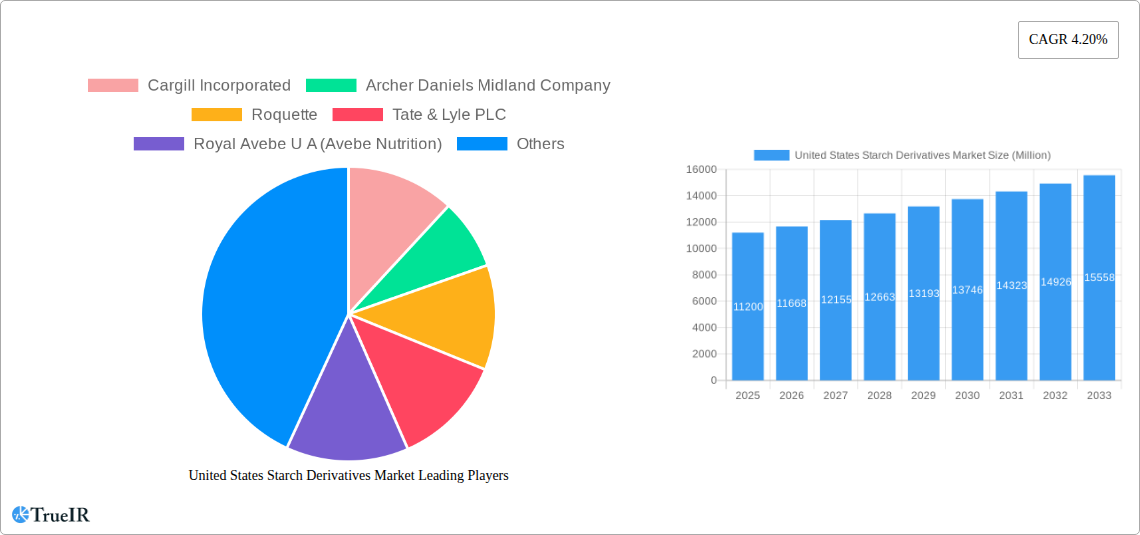

United States Starch Derivatives Market Company Market Share

This comprehensive report offers an in-depth analysis of the United States starch derivatives market, providing critical insights into its structure, competitive landscape, prevailing trends, dominant segments, and future outlook. Optimized for search engines with high-volume keywords such as "United States starch derivatives market," "food ingredients," "modified starch," "glucose syrup," "maltodextrin," and "pharmaceutical excipients," this analysis is essential for industry stakeholders, manufacturers, suppliers, and investors.

Base Year: 2025 | Forecast Period: 2025–2033

United States Starch Derivatives Market Market Structure & Competitive Landscape

The United States starch derivatives market exhibits a moderately concentrated market structure, with key players like Cargill Incorporated, Archer Daniels Midland Company, and Ingredion Incorporated holding significant market share. Innovation serves as a primary driver, with companies continually investing in research and development to introduce novel starch derivatives with enhanced functionalities and improved sustainability profiles. Regulatory impacts, particularly concerning food safety standards and environmental regulations, play a crucial role in shaping market dynamics. The availability of plant-based alternatives and competing ingredients influences product substitutability. End-user segmentation across the food and beverage, paper, pharmaceutical, and cosmetic industries dictates demand patterns. Merger and acquisition (M&A) activity, with an estimated volume of 15-20 M&A deals per year over the historical period, has been instrumental in consolidating market share and expanding product portfolios. The average concentration ratio for the top 3 players is estimated to be around 50-60%, reflecting the competitive intensity.

United States Starch Derivatives Market Market Trends & Opportunities

The United States starch derivatives market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. This expansion is fueled by increasing consumer demand for clean-label ingredients, the growing popularity of processed foods, and the rising adoption of starch derivatives in pharmaceutical formulations. Technological advancements, including enzymatic modifications and advanced processing techniques, are leading to the development of starch derivatives with tailored functionalities for specific applications, such as improved texture in food products and enhanced drug delivery systems in pharmaceuticals. Consumer preferences are shifting towards natural and sustainable ingredients, presenting a significant opportunity for starch producers to highlight the eco-friendly aspects of their products. Competitive dynamics are characterized by intense product development, strategic partnerships, and a focus on cost optimization. The market penetration rate for modified starch in the US food and beverage industry is estimated to be over 70%. Opportunities lie in capitalizing on the growing demand for specialty starch derivatives in niche applications, expanding into emerging end-use industries, and developing bio-based and biodegradable starch derivatives to meet sustainability demands. The market size is projected to reach $18,500 Million by 2033.

Dominant Markets & Segments in United States Starch Derivatives Market

Within the United States starch derivatives market, the Food and Beverage application segment dominates, driven by its extensive use as thickeners, stabilizers, sweeteners, and emulsifiers. Maltodextrin is a particularly high-volume type, finding widespread application in confectionery, beverages, and infant nutrition due to its versatility and cost-effectiveness. The Modified Starch segment also holds substantial market share, offering tailored properties for diverse food processing needs.

- Food and Beverage Application: This segment is propelled by the burgeoning processed food industry, increasing disposable incomes, and evolving consumer tastes. Key growth drivers include the demand for convenience foods, reduced-fat products requiring texture enhancement, and sugar-free alternatives utilizing maltodextrin. The market size for this segment alone is estimated to exceed $10,000 Million by 2033.

- Pharmaceutical Industry Application: The pharmaceutical sector is a significant and growing consumer of starch derivatives, primarily as excipients in tablet manufacturing, binders, and disintegrants. The increasing global demand for pharmaceuticals and the development of novel drug delivery systems are key growth catalysts. The market size for this segment is projected to reach $2,000 Million by 2033.

- Paper Industry Application: Modified starches are crucial in the paper industry for improving paper strength, surface properties, and printability. Growth in this segment is linked to packaging demand and the need for enhanced paper quality.

- Feed Application: Starch derivatives are used as binders and energy sources in animal feed formulations. The expanding livestock industry and focus on animal nutrition contribute to this segment's growth.

- Cosmetics Application: Starch derivatives offer functionalities like absorbency and thickening in cosmetic products, supporting the growth of the personal care industry.

United States Starch Derivatives Market Product Analysis

The United States starch derivatives market is characterized by continuous product innovation, with manufacturers focusing on developing starch derivatives with improved functionalities, higher purity, and enhanced sustainability. Modified starches, offering tailored rheological properties, solubility, and thermal stability, are at the forefront of innovation. Glucose syrups are being developed with lower glycemic index properties, catering to health-conscious consumers. Maltodextrin continues to see applications expand into sports nutrition and functional foods. The competitive advantage lies in companies' ability to customize starch derivatives to meet precise end-user requirements, drive down production costs through efficient processing, and secure reliable sourcing of raw materials.

Key Drivers, Barriers & Challenges in United States Starch Derivatives Market

Key Drivers:

- Growing Demand for Processed Foods: An increasing preference for convenient and ready-to-eat food products drives the demand for starch derivatives as essential ingredients for texture, stabilization, and sweetness.

- Health and Wellness Trends: The rising consumer interest in healthier food options, including low-fat and sugar-free products, fuels the demand for maltodextrin and modified starches with specific nutritional profiles.

- Technological Advancements: Innovations in starch modification techniques allow for the creation of specialized derivatives with enhanced functionalities, catering to niche applications in pharmaceuticals and personal care.

- Expansion of Pharmaceutical and Personal Care Industries: The growing pharmaceutical sector's need for excipients and the expanding cosmetics market's demand for functional ingredients are significant growth propellers.

Barriers and Challenges:

- Volatile Raw Material Prices: Fluctuations in the prices of corn, wheat, and potatoes, the primary sources of starch, can impact production costs and market profitability.

- Regulatory Scrutiny: Stringent food safety regulations and evolving labeling requirements can pose compliance challenges for manufacturers.

- Competition from Alternative Ingredients: The availability of other hydrocolloids and sweeteners presents competitive pressure, requiring continuous innovation and cost-effectiveness from starch derivative producers.

- Supply Chain Disruptions: Geopolitical factors, climate change, and transportation challenges can disrupt the supply of raw materials and finished products, impacting market stability. The estimated impact of these disruptions can lead to 5-10% price increases for raw materials.

Growth Drivers in the United States Starch Derivatives Market Market

Key growth drivers in the United States starch derivatives market are the increasing demand for processed and convenience foods, driven by urbanization and busy lifestyles. Technological advancements in starch modification are enabling the creation of specialized derivatives with improved functionalities, such as enhanced emulsification, better freeze-thaw stability, and targeted controlled release in pharmaceutical applications. The burgeoning health and wellness trend is also a significant factor, with consumers actively seeking out products with reduced sugar, fat, and calories, leading to increased use of maltodextrin and other starch derivatives as clean-label alternatives. Furthermore, the expanding pharmaceutical industry's requirement for high-quality excipients for drug formulation and delivery systems is a consistent growth catalyst. The overall market is expected to grow at a CAGR of 5.5% in the forecast period.

Challenges Impacting United States Starch Derivatives Market Growth

Challenges impacting the United States starch derivatives market include the inherent volatility of agricultural commodity prices, which directly influences raw material costs for starch production. Stringent regulatory frameworks, particularly concerning food additives and processing aids, can necessitate significant investment in compliance and product reformulation. Supply chain vulnerabilities, exposed by recent global events, pose a continuous risk of material shortages and increased logistics expenses. Moreover, intense competition from other food ingredients, such as gums, pectins, and alternative sweeteners, requires continuous innovation and a competitive pricing strategy to maintain market share. The paper industry's adoption of sustainable practices may also influence the demand for certain starch-based coatings.

Key Players Shaping the United States Starch Derivatives Market Market

- Cargill Incorporated

- Archer Daniels Midland Company

- Roquette

- Tate & Lyle PLC

- Royal Avebe U A (Avebe Nutrition)

- Tereos S A

- Ingredion Incorporated

- Beneo

- Bunge Limited

- Cumberland Packing Corp

Significant United States Starch Derivatives Market Industry Milestones

- 2023: Launch of novel, sustainably sourced modified starch for plant-based dairy alternatives by a leading manufacturer.

- 2022: Significant investment by Archer Daniels Midland Company in expanding its specialty starch production capacity.

- 2021: Introduction of a new line of high-purity maltodextrins for pharmaceutical applications by Roquette.

- 2020: Tate & Lyle PLC announces strategic partnerships to enhance its ingredient portfolio in the functional foods segment.

- 2019: Ingredion Incorporated completes acquisition of a specialized starch derivatives company to strengthen its market position in Latin America.

Future Outlook for United States Starch Derivatives Market Market

The future outlook for the United States starch derivatives market is exceptionally positive, driven by sustained demand from the food and beverage sector and increasing adoption in high-value applications like pharmaceuticals and cosmetics. The emphasis on clean-label ingredients and sustainable sourcing will continue to shape product development, favoring bio-based and biodegradable starch derivatives. Opportunities for growth lie in developing specialized starch derivatives for functional foods, expanding applications in nutraceuticals, and catering to the evolving needs of the bioplastics industry. Strategic partnerships and technological innovation will be paramount for players to maintain a competitive edge and capitalize on the burgeoning market potential, which is estimated to reach $18,500 Million by 2033.

United States Starch Derivatives Market Segmentation

-

1. Type

- 1.1. Maltodextrin

- 1.2. Cyclodextrin

- 1.3. Glucose Syrups

- 1.4. Modified Starch

- 1.5. Others

-

2. Application

- 2.1. Food and Beverage

- 2.2. Paper Industry

- 2.3. Feed

- 2.4. Pharmaceutical Industry

- 2.5. Cosmetics

- 2.6. Others

United States Starch Derivatives Market Segmentation By Geography

- 1. United States

United States Starch Derivatives Market Regional Market Share

Geographic Coverage of United States Starch Derivatives Market

United States Starch Derivatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Fitness and Increasing Intake of Plant-based Protein; Increase in Consumer Inclination Towards Meat Substitutes

- 3.3. Market Restrains

- 3.3.1. Gluten-Intolerance Among the Population Hindering the Market

- 3.4. Market Trends

- 3.4.1. Rising Demand for Functional Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Starch Derivatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Maltodextrin

- 5.1.2. Cyclodextrin

- 5.1.3. Glucose Syrups

- 5.1.4. Modified Starch

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverage

- 5.2.2. Paper Industry

- 5.2.3. Feed

- 5.2.4. Pharmaceutical Industry

- 5.2.5. Cosmetics

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Archer Daniels Midland Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roquette

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tate & Lyle PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal Avebe U A (Avebe Nutrition)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tereos S A*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beneo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bunge Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cumberland Packing Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: United States Starch Derivatives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Starch Derivatives Market Share (%) by Company 2025

List of Tables

- Table 1: United States Starch Derivatives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United States Starch Derivatives Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: United States Starch Derivatives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: United States Starch Derivatives Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: United States Starch Derivatives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United States Starch Derivatives Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: United States Starch Derivatives Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United States Starch Derivatives Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: United States Starch Derivatives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: United States Starch Derivatives Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: United States Starch Derivatives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Starch Derivatives Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Starch Derivatives Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the United States Starch Derivatives Market?

Key companies in the market include Cargill Incorporated, Archer Daniels Midland Company, Roquette, Tate & Lyle PLC, Royal Avebe U A (Avebe Nutrition), Tereos S A*List Not Exhaustive, Ingredion Incorporated, Beneo, Bunge Limited , Cumberland Packing Corp.

3. What are the main segments of the United States Starch Derivatives Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Fitness and Increasing Intake of Plant-based Protein; Increase in Consumer Inclination Towards Meat Substitutes.

6. What are the notable trends driving market growth?

Rising Demand for Functional Ingredients.

7. Are there any restraints impacting market growth?

Gluten-Intolerance Among the Population Hindering the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Starch Derivatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Starch Derivatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Starch Derivatives Market?

To stay informed about further developments, trends, and reports in the United States Starch Derivatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence