Key Insights

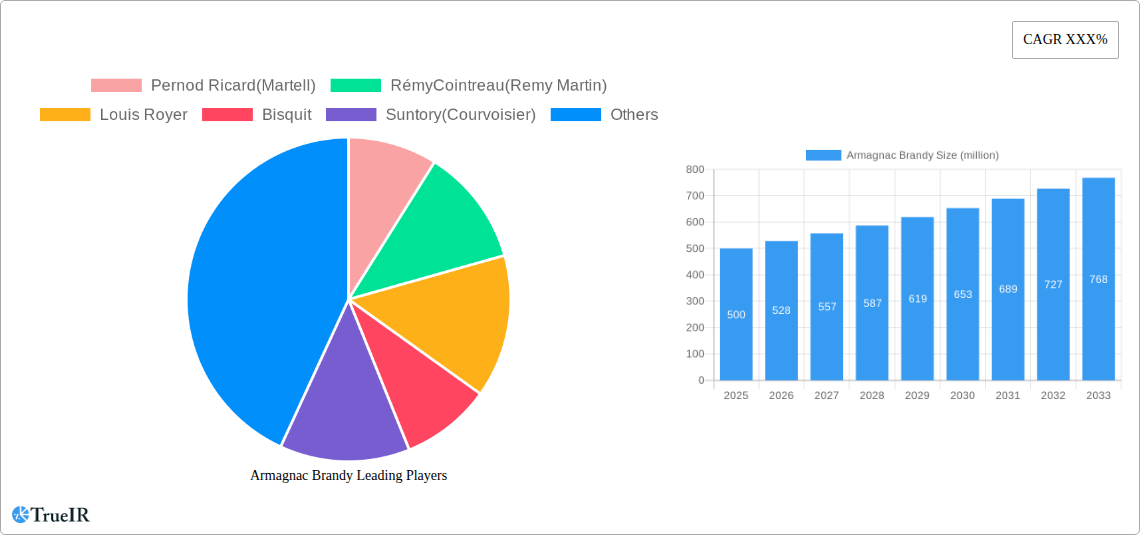

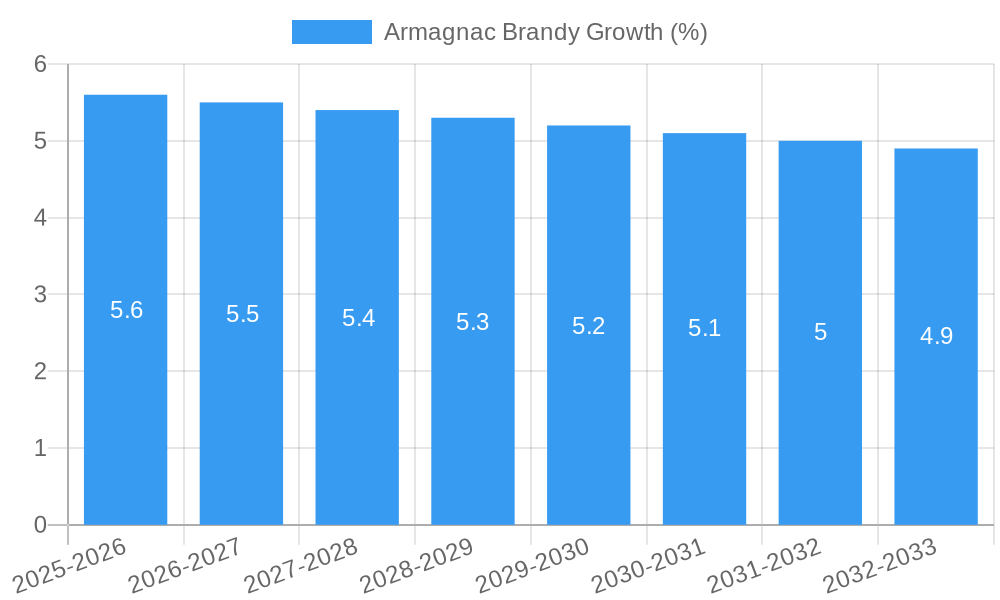

The Armagnac brandy market is poised for substantial growth, projected to reach approximately \$500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.5% expected to drive its expansion through 2033. This upward trajectory is significantly fueled by increasing consumer appreciation for artisanal spirits and the rising demand for premium and super-premium beverage options globally. Key growth drivers include the growing popularity of brandy as a sophisticated cocktail ingredient and a standalone sipping spirit, particularly among younger, affluent demographics in emerging economies. Furthermore, the historical significance and unique production methods associated with Armagnac, distinguishing it from other brandies, are creating a niche but expanding appeal among connoisseurs seeking authenticity and heritage in their libations. E-commerce platforms and direct-to-consumer sales are also playing a crucial role in expanding market reach and accessibility for these high-value spirits.

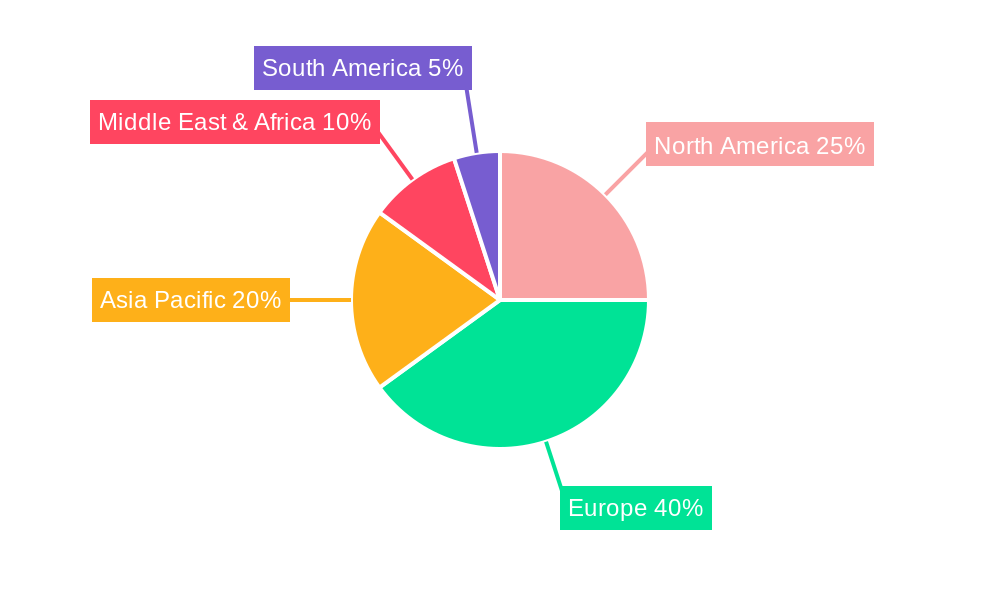

Despite the promising outlook, the Armagnac market faces certain restraints, primarily related to its relatively high price point, which can limit widespread adoption, and the perceived complexity of its different classifications (VS, VSOP, XO) compared to more mainstream spirits. Intense competition from other established brandy regions and other premium spirits also presents a challenge. However, strategic marketing efforts focusing on the heritage, craftsmanship, and unique terroir of Armagnac, coupled with innovation in packaging and distribution, are expected to mitigate these challenges. The market is segmented by application, with restaurants, bars, and exclusive stores anticipated to be dominant channels, while segments like VSOP and XO are expected to see the most robust growth within the type classification, reflecting the premiumization trend. Asia Pacific, particularly China and India, is emerging as a significant growth region, alongside continued strength in established markets like Europe and North America.

Armagnac Brandy Market Structure & Competitive Landscape

The global Armagnac Brandy market, valued at approximately 3,500 million in the base year of 2025, is characterized by a moderately concentrated competitive landscape. Key industry players such as Pernod Ricard (Martell), Rémy Cointreau (Remy Martin), Louis Royer, Bisquit, Suntory (Courvoisier), Maison Ryst Dupeyron, Janneau Grand Armagnac, and Queensway Wine actively shape market dynamics. Innovation drivers are primarily focused on premiumization, heritage marketing, and exploring unique aging techniques to differentiate products. Regulatory impacts, while generally supportive of the Appellation d'Origine Contrôlée (AOC) status, necessitate adherence to stringent production standards. Product substitutes, including other premium brandies, single malt Scotch whiskies, and high-end rums, present a constant competitive challenge, driving a need for distinct brand positioning. End-user segmentation is increasingly sophisticated, with distinct preferences emerging across segments like exclusive stores and high-end restaurants. Mergers and acquisitions (M&A) activity, while not extensive, has seen strategic consolidations aimed at portfolio enhancement and market reach, with an estimated 400 million in M&A volumes during the historical period. Concentration ratios remain moderate, reflecting the presence of both established global brands and niche artisanal producers.

Armagnac Brandy Market Trends & Opportunities

The Armagnac Brandy market is poised for significant expansion, driven by evolving consumer preferences and a burgeoning appreciation for premium spirits. The global market size is projected to reach an impressive 7,800 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.2% from the base year of 2025 through the forecast period. This robust growth trajectory is fueled by several interconnected trends.

A primary driver is the increasing consumer demand for authenticity and heritage in their beverage choices. Armagnac, with its deep-rooted history and traditional production methods dating back centuries, resonates strongly with this trend. Consumers are moving away from mass-produced spirits towards those that offer a compelling narrative and a sense of origin. This is particularly evident in developed markets where disposable incomes are high and there is a greater willingness to invest in artisanal and premium products.

Technological shifts, while not as disruptive as in other industries, are subtly influencing Armagnac production and marketing. Innovations in barrel management, distillation techniques that enhance flavor profiles, and sophisticated aging processes are contributing to the development of more complex and nuanced Armagnacs. Furthermore, advancements in digital marketing and e-commerce platforms are providing producers with new avenues to reach a global audience, bypassing traditional distribution bottlenecks and connecting directly with connoisseurs. The market penetration rate of premium Armagnac varietals is steadily increasing as awareness grows.

Consumer preferences are increasingly leaning towards higher quality, aged expressions such as VSOP and XO. The desire for a more sophisticated drinking experience, characterized by complex aromas and flavors, is driving demand for these premium categories. This shift is also being supported by a growing interest in cocktails that utilize high-quality spirits, where Armagnac can offer a unique and elevated profile. The rise of the "sipping spirit" culture further bolsters demand for aged Armagnacs.

Competitive dynamics are intensifying as established players invest in brand building and market expansion, while smaller producers focus on niche offerings and unique selling propositions. The industry is witnessing a trend towards greater transparency regarding origin and production methods, which is welcomed by discerning consumers. Opportunities lie in tapping into emerging markets, developing innovative packaging and branding strategies, and cultivating strong relationships with the hospitality sector to increase visibility and trial. The overall market penetration for Armagnac is expected to rise by approximately 25% by 2033 as these trends gain further momentum.

Dominant Markets & Segments in Armagnac Brandy

The Armagnac Brandy market exhibits distinct regional dominance and segment preference, with Western Europe, particularly France, serving as the historical heartland and a major consumer base. The Restaurant and Bar and Club segments are pivotal in driving demand, accounting for a significant share of consumption. These channels offer consumers the opportunity to experience Armagnac in a curated setting, often through expertly crafted cocktails or as a premium digestif. The Exclusive Store segment also plays a crucial role, catering to a niche clientele seeking rare and vintage bottlings, further contributing to the premium perception of Armagnac.

- Dominant Region: Western Europe, led by France, remains the largest market for Armagnac. High disposable incomes, a deeply ingrained appreciation for fine spirits, and a well-established hospitality industry create a fertile ground for Armagnac consumption.

- Key Growth Drivers in Western Europe:

- Strong Gastronomic Culture: Armagnac is often paired with regional cuisine, fostering its integration into dining experiences.

- Established Distribution Networks: Well-developed import and distribution channels facilitate market access.

- Premiumization Trend: Consumers are increasingly willing to spend on high-quality, authentic spirits.

- Dominant Application Segments:

- Restaurant: Offers a controlled environment for premium spirit trial and consumption.

- Bar and Club: Enables Armagnac's inclusion in sophisticated cocktail menus and as a high-end pour.

- Exclusive Store: Caters to collectors and connoisseurs seeking rare and aged expressions.

- Dominant Type Segments:

- VSOP (Very Superior Old Pale): This category often represents a sweet spot for consumers, offering a good balance of age, quality, and price.

- XO (Extra Old): Highly sought after for its complexity and depth of flavor, appealing to experienced spirit drinkers.

- Growth Drivers in Dominant Segments:

- Increased Disposable Income: Allowing consumers to trade up to premium beverage options.

- Rise of Craft Cocktails: Armagnac's unique flavor profile makes it an attractive ingredient for innovative mixed drinks.

- Tourism and Experiential Consumption: Tourists often seek authentic local spirits, boosting sales in hospitality venues.

- Online Retail Expansion: While not a primary segment, the growth of e-commerce is expanding reach for exclusive stores and direct-to-consumer sales.

The Others application segment, which includes direct-to-consumer sales and niche online retailers, is experiencing a substantial growth rate, indicating an increasing preference for purchasing directly from producers or specialized online platforms. This segment benefits from targeted marketing efforts and the ability to reach consumers beyond traditional retail channels. The shift towards online purchasing is a notable trend, particularly among younger demographics interested in exploring new spirits.

Armagnac Brandy Product Analysis

Armagnac Brandy is characterized by its commitment to traditional distillation and aging processes, resulting in a diverse range of products. Innovations often focus on enhancing the inherent qualities of the spirit through extended aging in local Gascon oak barrels, which impart unique tannic structures and flavor profiles. Product differentiation is achieved through meticulous blending of different grape varietals (e.g., Ugni Blanc, Baco Blanc, Folle Blanche, and Colombard) and specific vineyard plots. Competitive advantages stem from the rich heritage, the AOC appellation's strict quality control, and the production of distinct terroir-driven expressions. Technological advancements in cellar management and barrel selection contribute to consistency and the development of complex, nuanced flavor profiles that appeal to discerning palates.

Key Drivers, Barriers & Challenges in Armagnac Brandy

Key Drivers:

- Growing Appreciation for Premium Spirits: A global trend towards higher-quality, artisanal beverages.

- Authenticity and Heritage: Armagnac's long history and traditional production resonate with consumers seeking genuine experiences.

- Premiumization in Hospitality: Restaurants and bars are increasingly featuring premium spirits like Armagnac on their menus.

- Emerging Market Growth: Increasing disposable incomes in developing economies are creating new consumer bases.

- Product Innovation: Development of new expressions and cask finishes to attract a wider audience.

Barriers & Challenges:

- Competition from Other Premium Spirits: Significant competition from Scotch whisky, Cognac, and other aged spirits.

- Production Costs and Yields: Traditional production methods can be labor-intensive and subject to climatic variations impacting yields.

- Brand Awareness in Global Markets: Limited global brand recognition compared to some other premium spirits.

- Regulatory Compliance: Adherence to strict AOC regulations can be complex and costly.

- Supply Chain Disruptions: Potential impacts from climate change and logistical challenges.

Growth Drivers in the Armagnac Brandy Market

The Armagnac Brandy market's growth is propelled by several key factors. Technologically, advancements in barrel aging techniques, particularly the use of specific local oak varieties, allow for the development of richer, more complex flavor profiles that appeal to a discerning clientele. Economically, rising disposable incomes in both developed and emerging economies are enabling a larger segment of the population to explore and invest in premium spirits, with Armagnac benefiting from this trend. Regulatory factors, while maintaining strict quality standards, also provide a framework that reassures consumers of the product's authenticity and origin, thus fostering trust and demand. The increasing global interest in artisanal and heritage products further fuels Armagnac's appeal.

Challenges Impacting Armagnac Brandy Growth

Several challenges can impede the growth of the Armagnac Brandy market. Regulatory complexities, while ensuring quality, can also pose hurdles for new entrants and small producers in terms of compliance costs and adherence to stringent production protocols. Supply chain issues, including the availability of aging oak and the impact of climate change on grape harvests, can affect production volumes and consistency, potentially leading to price volatility. Competitive pressures from established international spirits like Cognac and Scotch whisky are significant, requiring continuous marketing efforts and product differentiation to maintain market share. Furthermore, raising global brand awareness beyond traditional markets remains a persistent challenge.

Key Players Shaping the Armagnac Brandy Market

- Pernod Ricard

- Rémy Cointreau

- Louis Royer

- Bisquit

- Suntory

- Maison Ryst Dupeyron

- Janneau Grand Armagnac

- Queensway Wine

Significant Armagnac Brandy Industry Milestones

- 2019: Launch of new marketing campaigns focusing on the heritage and unique terroir of specific Armagnac sub-regions.

- 2020: Increased focus on direct-to-consumer sales and online retail presence due to global events.

- 2021: Introduction of innovative cask finishing techniques by several producers to offer unique flavor profiles.

- 2022: Rise in demand for older, rarer vintages, indicating a growing collector market.

- 2023: Implementation of new sustainability initiatives within the Armagnac production process.

- 2024: Growing popularity of Armagnac in premium cocktail recipes globally.

Future Outlook for Armagnac Brandy Market

The future outlook for the Armagnac Brandy market is exceptionally promising, driven by a confluence of positive market forces. Strategic opportunities lie in leveraging the growing consumer demand for authentic, heritage-driven spirits, a trend that Armagnac is ideally positioned to capitalize on. The market potential is significant in both established and emerging economies, with a particular focus on expanding reach in North America and Asia. Continued investment in premiumization, innovative marketing that highlights the unique story and craftsmanship of Armagnac, and fostering strong partnerships with the global hospitality industry will be crucial catalysts for sustained growth. The market is expected to witness a steady increase in the demand for aged expressions like VSOP and XO, further solidifying Armagnac's position as a luxury spirit.

Armagnac Brandy Segmentation

-

1. Application

- 1.1. Shop and Supermarket

- 1.2. Restaurant, Bar and Club

- 1.3. Exclusive Store

- 1.4. Others

-

2. Type

- 2.1. VS

- 2.2. VSOP

- 2.3. XO

- 2.4. Others

Armagnac Brandy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Armagnac Brandy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Armagnac Brandy Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Shop and Supermarket

- 5.1.2. Restaurant, Bar and Club

- 5.1.3. Exclusive Store

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. VS

- 5.2.2. VSOP

- 5.2.3. XO

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Armagnac Brandy Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Shop and Supermarket

- 6.1.2. Restaurant, Bar and Club

- 6.1.3. Exclusive Store

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. VS

- 6.2.2. VSOP

- 6.2.3. XO

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Armagnac Brandy Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Shop and Supermarket

- 7.1.2. Restaurant, Bar and Club

- 7.1.3. Exclusive Store

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. VS

- 7.2.2. VSOP

- 7.2.3. XO

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Armagnac Brandy Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Shop and Supermarket

- 8.1.2. Restaurant, Bar and Club

- 8.1.3. Exclusive Store

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. VS

- 8.2.2. VSOP

- 8.2.3. XO

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Armagnac Brandy Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Shop and Supermarket

- 9.1.2. Restaurant, Bar and Club

- 9.1.3. Exclusive Store

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. VS

- 9.2.2. VSOP

- 9.2.3. XO

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Armagnac Brandy Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Shop and Supermarket

- 10.1.2. Restaurant, Bar and Club

- 10.1.3. Exclusive Store

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. VS

- 10.2.2. VSOP

- 10.2.3. XO

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pernod Ricard(Martell)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RémyCointreau(Remy Martin)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Louis Royer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bisquit

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Suntory(Courvoisier)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Maison Ryst Dupeyron

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Janneau Grand Armagnac

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Queensway Wine

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Pernod Ricard(Martell)

List of Figures

- Figure 1: Global Armagnac Brandy Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Armagnac Brandy Revenue (million), by Application 2024 & 2032

- Figure 3: North America Armagnac Brandy Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Armagnac Brandy Revenue (million), by Type 2024 & 2032

- Figure 5: North America Armagnac Brandy Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Armagnac Brandy Revenue (million), by Country 2024 & 2032

- Figure 7: North America Armagnac Brandy Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Armagnac Brandy Revenue (million), by Application 2024 & 2032

- Figure 9: South America Armagnac Brandy Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Armagnac Brandy Revenue (million), by Type 2024 & 2032

- Figure 11: South America Armagnac Brandy Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Armagnac Brandy Revenue (million), by Country 2024 & 2032

- Figure 13: South America Armagnac Brandy Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Armagnac Brandy Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Armagnac Brandy Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Armagnac Brandy Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Armagnac Brandy Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Armagnac Brandy Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Armagnac Brandy Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Armagnac Brandy Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Armagnac Brandy Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Armagnac Brandy Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Armagnac Brandy Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Armagnac Brandy Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Armagnac Brandy Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Armagnac Brandy Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Armagnac Brandy Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Armagnac Brandy Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Armagnac Brandy Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Armagnac Brandy Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Armagnac Brandy Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Armagnac Brandy Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Armagnac Brandy Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Armagnac Brandy Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Armagnac Brandy Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Armagnac Brandy Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Armagnac Brandy Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Armagnac Brandy Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Armagnac Brandy Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Armagnac Brandy Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Armagnac Brandy Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Armagnac Brandy Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Armagnac Brandy Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Armagnac Brandy Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Armagnac Brandy Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Armagnac Brandy Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Armagnac Brandy Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Armagnac Brandy Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Armagnac Brandy Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Armagnac Brandy Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Armagnac Brandy Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Armagnac Brandy?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Armagnac Brandy?

Key companies in the market include Pernod Ricard(Martell), RémyCointreau(Remy Martin), Louis Royer, Bisquit, Suntory(Courvoisier), Maison Ryst Dupeyron, Janneau Grand Armagnac, Queensway Wine.

3. What are the main segments of the Armagnac Brandy?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Armagnac Brandy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Armagnac Brandy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Armagnac Brandy?

To stay informed about further developments, trends, and reports in the Armagnac Brandy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence