Key Insights

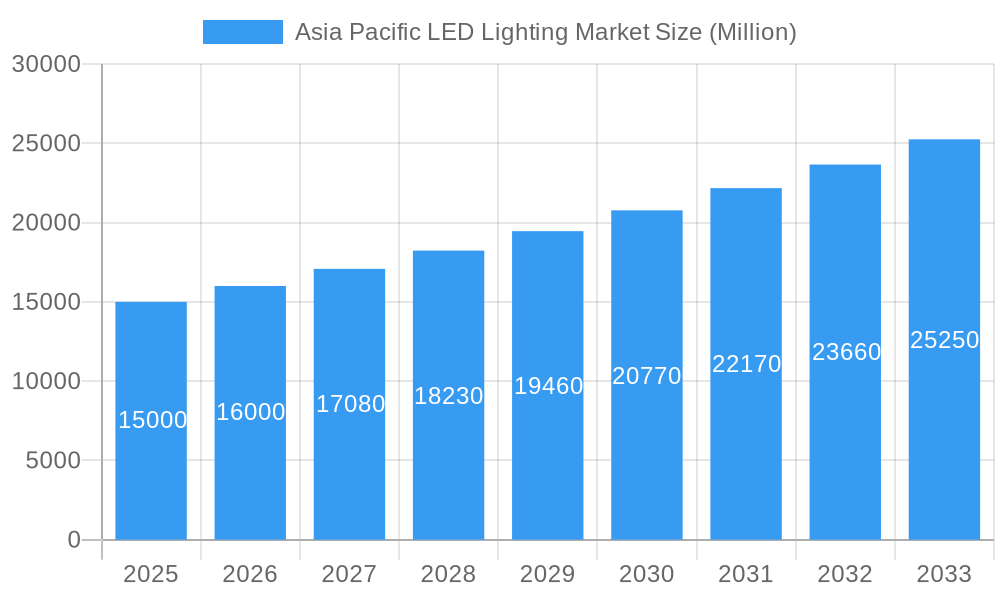

The Asia-Pacific LED lighting market is poised for significant expansion, propelled by supportive government policies promoting energy efficiency, escalating urbanization driving infrastructure development, and a growing consumer preference for sustainable, long-lasting lighting solutions. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.72%, reaching a market size of 44.34 billion by the base year 2025. Key growth drivers include automotive lighting, particularly in emerging economies like India and China, alongside robust demand for indoor commercial and industrial applications, and extensive outdoor public lighting projects in rapidly developing urban centers. While China and India lead the regional market, Japan and South Korea also represent substantial contributions, reflecting diverse economic and technological landscapes. The competitive environment features key players such as Nichia, OSRAM, Koito, and Signify, who are actively pursuing market share through innovation, strategic alliances, and cost-effective solutions. The increasing integration of smart lighting technologies and the demand for eco-friendly alternatives further reinforce market momentum.

Asia Pacific LED Lighting Market Market Size (In Billion)

Stringent environmental regulations targeting carbon emission reduction are a primary catalyst for widespread LED adoption in the Asia-Pacific region. Ongoing technological advancements, including enhanced light output, extended lifespans, and decreasing costs, are solidifying LEDs as the superior alternative to conventional lighting. Despite potential challenges such as initial investment costs and the presence of lower-cost alternatives in specific segments, the long-term economic and environmental advantages of LED technology are expected to prevail. Continued growth in the automotive and construction sectors, coupled with rising disposable incomes across Asia, will further accelerate market expansion throughout the forecast period.

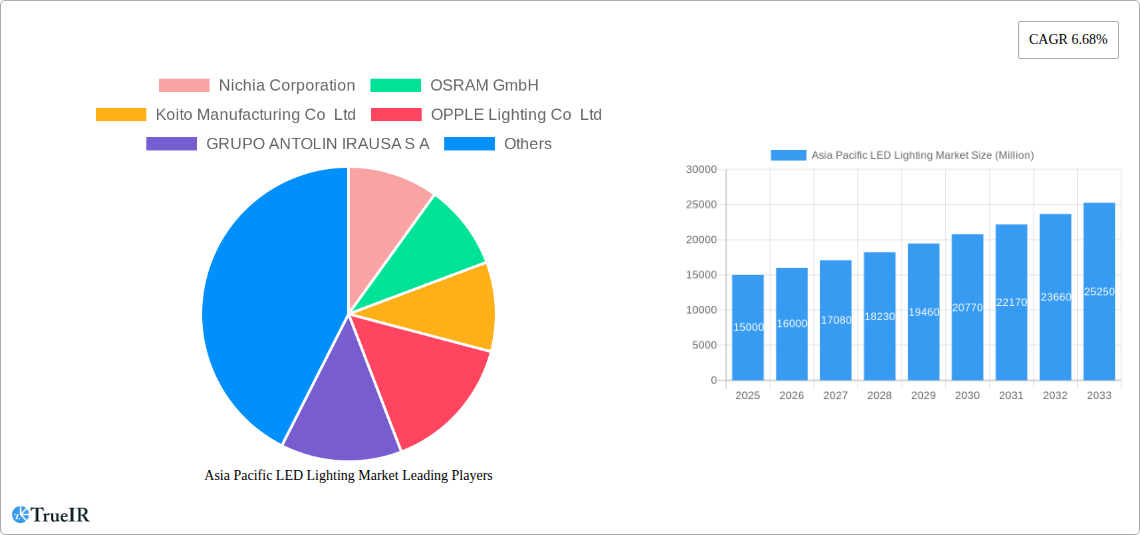

Asia Pacific LED Lighting Market Company Market Share

Asia Pacific LED Lighting Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific LED lighting market, covering the period from 2019 to 2033. With a focus on key market trends, competitive dynamics, and growth opportunities, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data and insights to offer a clear and actionable understanding of this rapidly evolving market, encompassing a market size exceeding xx Million by 2033.

Asia Pacific LED Lighting Market Market Structure & Competitive Landscape

The Asia Pacific LED lighting market is characterized by a moderately concentrated landscape, with several multinational corporations and regional players vying for market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive market. Innovation is a significant driver, with companies continuously developing energy-efficient, smart, and specialized LED lighting solutions. Stringent environmental regulations across the region, pushing for energy efficiency and reduced carbon emissions, are also major influencers. The market experiences substantial substitution from traditional lighting technologies to LED, driven by cost savings and performance improvements.

End-user segmentation is diverse, with significant contributions from residential, commercial, industrial, automotive, and outdoor lighting segments. The automotive sector exhibits particularly rapid growth due to increased adoption of LED lighting in vehicles. Mergers and acquisitions (M&A) activity within the LED lighting sector has been moderate in recent years, with approximately xx M&A transactions recorded between 2019 and 2024, largely driven by the consolidation of smaller players and expansion into new markets.

- Market Concentration: Moderately concentrated, HHI estimated at xx.

- Innovation Drivers: Energy efficiency, smart lighting functionalities, specialized applications.

- Regulatory Impacts: Stringent environmental regulations promoting energy efficiency.

- Product Substitutes: Gradual substitution of traditional lighting technologies (incandescent, fluorescent) by LEDs.

- End-User Segmentation: Residential, Commercial, Industrial, Automotive, Outdoor.

- M&A Trends: Moderate activity, focused on consolidation and market expansion (xx transactions between 2019-2024).

Asia Pacific LED Lighting Market Market Trends & Opportunities

The Asia Pacific LED lighting market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size is expected to reach xx Million by 2033, driven by increasing urbanization, infrastructure development, rising consumer awareness of energy efficiency, and favorable government policies promoting LED adoption. Technological advancements, such as the development of miniaturized LEDs, smart lighting systems, and improved color rendering capabilities, are also contributing to market expansion. Consumer preferences are shifting towards aesthetically pleasing, energy-efficient, and smart LED lighting solutions. The competitive landscape is dynamic, with both established players and emerging companies continuously innovating and expanding their product portfolios. Market penetration rates of LED lighting are expected to reach xx% in key markets such as China and India by 2033. The growing adoption of LED lighting in automotive applications, particularly in Daytime Running Lights (DRLs) and headlights, presents significant market opportunities. Furthermore, the increasing use of LED lighting in smart homes and smart cities is expected to fuel market growth.

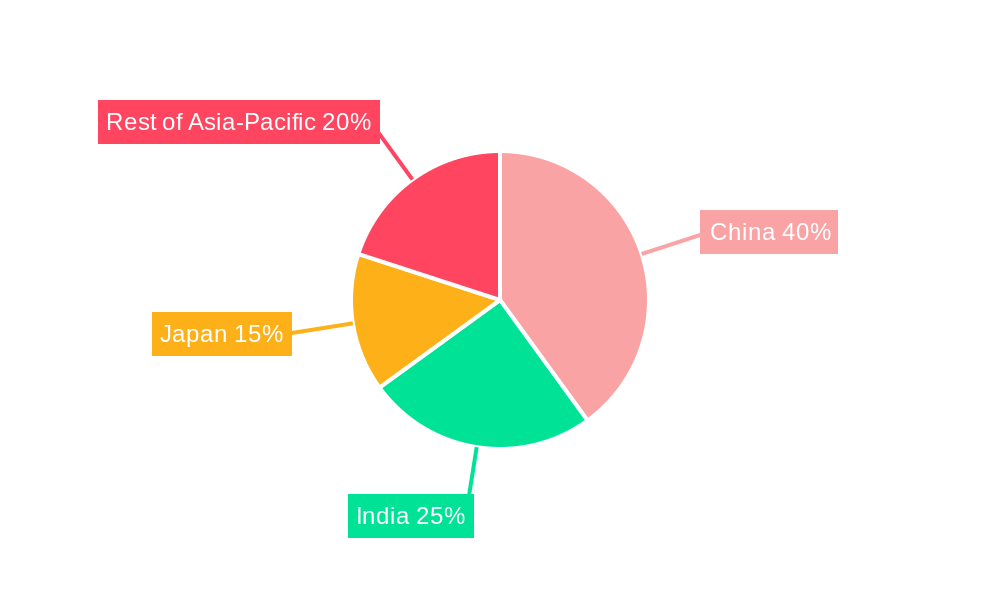

Dominant Markets & Segments in Asia Pacific LED Lighting Market

China and India are the dominant markets within the Asia Pacific region, together accounting for approximately xx% of the total market. This is primarily due to their large populations, rapid urbanization, and substantial infrastructure development projects. Japan remains a significant market with a high level of technological advancement and adoption of high-quality LED lighting solutions. The rest of Asia-Pacific is also exhibiting considerable growth potential.

Key Growth Drivers (China & India):

- Extensive infrastructure development projects.

- Rapid urbanization and increasing disposable incomes.

- Government initiatives promoting energy efficiency and renewable energy.

- Favorable regulatory policies.

Key Growth Drivers (Japan):

- Technological leadership in LED technology and manufacturing.

- High consumer adoption of premium LED lighting solutions.

- Stringent environmental regulations driving energy-efficient lighting choices.

Within the segments, the indoor lighting (commercial and residential) segments are currently largest, while automotive utility and outdoor lighting applications are growing rapidly and hold significant future potential.

Asia Pacific LED Lighting Market Product Analysis

The Asia Pacific LED lighting market showcases a continuous stream of product innovations, encompassing improved energy efficiency, enhanced color rendering, smart lighting functionalities, and diverse applications across residential, commercial, and automotive sectors. Technological advancements such as miniaturization, integration with smart home systems, and the development of LED lighting with optimized spectral output for specific applications, like horticulture, significantly enhance market competitiveness and product differentiation. The successful market fit of LED products is driven by cost effectiveness, durability, energy savings, and positive environmental impact.

Key Drivers, Barriers & Challenges in Asia Pacific LED Lighting Market

Key Drivers: The Asia Pacific LED lighting market is driven by the increasing demand for energy-efficient lighting solutions, coupled with government support through various incentive programs and regulations. Economic growth, particularly in developing economies, fuels the demand for improved infrastructure and lighting solutions. Technological advancements lead to enhanced performance and reduced costs of LED lighting products.

Key Challenges: Supply chain disruptions due to geopolitical factors can negatively affect production and pricing. Regulatory complexities and stringent standards in some markets can increase compliance costs for manufacturers. Intense competition from both established and emerging players is a challenge, requiring innovation and competitive pricing strategies. The presence of counterfeit products undermines market confidence and impacts revenue streams.

Growth Drivers in the Asia Pacific LED Lighting Market Market

Stringent environmental regulations, along with government incentives promoting energy efficiency, are strong drivers. Rapid urbanization and infrastructure development significantly increase demand. Technological advancements in LED technology, including smart lighting and IoT integration, lead to increased consumer adoption.

Challenges Impacting Asia Pacific LED Lighting Market Growth

Supply chain disruptions caused by global events could affect production and costs. Intense competition and the presence of counterfeit products may reduce market profitability. Regulatory compliance requirements could impose increased costs for manufacturers.

Key Players Shaping the Asia Pacific LED Lighting Market Market

- Nichia Corporation

- OSRAM GmbH

- Koito Manufacturing Co Ltd

- OPPLE Lighting Co Ltd

- GRUPO ANTOLIN IRAUSA S A

- EGLO Leuchten GmbH

- Marelli Holdings Co Ltd

- Stanley Electric Co Ltd

- Signify Holding (Philips)

- Panasonic Holdings Corporation

Significant Asia Pacific LED Lighting Market Industry Milestones

- March 2017: 300 LED floodlights installed in the Tokyo Dome infield.

- June 2023: Around 400 Panasonic LED floodlights (2KW equivalent) illuminated the Tokyo Dome.

- March 2023: Signify and Perfect Plants expanded their collaboration on grow lights for medicinal cannabis cultivation.

- March 2023: Nichia and OSRAM expanded their IP license collaboration for nitride-based semiconductor products (LEDs and lasers).

Future Outlook for Asia Pacific LED Lighting Market Market

The Asia Pacific LED lighting market is poised for continued robust growth, driven by ongoing technological advancements, expanding infrastructure, and supportive government policies. Strategic partnerships, product diversification, and market expansion into high-growth segments, such as smart lighting and automotive applications, will be key factors in shaping future market dynamics. The market presents significant opportunities for companies that can effectively navigate the complexities of the supply chain, regulatory environment, and competitive landscape. The market is poised for significant expansion and innovation in the coming years.

Asia Pacific LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

-

2. Outdoor Lighting

- 2.1. Public Places

- 2.2. Streets and Roadways

- 2.3. Others

-

3. Automotive Utility Lighting

- 3.1. Daytime Running Lights (DRL)

- 3.2. Directional Signal Lights

- 3.3. Headlights

- 3.4. Reverse Light

- 3.5. Stop Light

- 3.6. Tail Light

- 3.7. Others

-

4. Automotive Vehicle Lighting

- 4.1. 2 Wheelers

- 4.2. Commercial Vehicles

- 4.3. Passenger Cars

Asia Pacific LED Lighting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific LED Lighting Market Regional Market Share

Geographic Coverage of Asia Pacific LED Lighting Market

Asia Pacific LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Construction Boom Owing to the Growing Clout of Multinational Conglomerates; Increasing Emphasis on Green Building Practices; Growing Demand for Soft FM Practices

- 3.3. Market Restrains

- 3.3.1. Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Outdoor Lighting

- 5.2.1. Public Places

- 5.2.2. Streets and Roadways

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.3.1. Daytime Running Lights (DRL)

- 5.3.2. Directional Signal Lights

- 5.3.3. Headlights

- 5.3.4. Reverse Light

- 5.3.5. Stop Light

- 5.3.6. Tail Light

- 5.3.7. Others

- 5.4. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.4.1. 2 Wheelers

- 5.4.2. Commercial Vehicles

- 5.4.3. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. China Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7. Japan Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8. India Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9. South Korea Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10. Taiwan Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 11. Australia Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Asia-Pacific Asia Pacific LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nichia Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OSRAM GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Koito Manufacturing Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 OPPLE Lighting Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 GRUPO ANTOLIN IRAUSA S A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 EGLO Leuchten GmbH

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Marelli Holdings Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Stanley Electric Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Signify Holding (Philips)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nichia Corporation

List of Figures

- Figure 1: Asia Pacific LED Lighting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific LED Lighting Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Asia Pacific LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 3: Asia Pacific LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 4: Asia Pacific LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 5: Asia Pacific LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 6: Asia Pacific LED Lighting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: China Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Taiwan Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia-Pacific Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Asia Pacific LED Lighting Market Revenue billion Forecast, by Indoor Lighting 2020 & 2033

- Table 16: Asia Pacific LED Lighting Market Revenue billion Forecast, by Outdoor Lighting 2020 & 2033

- Table 17: Asia Pacific LED Lighting Market Revenue billion Forecast, by Automotive Utility Lighting 2020 & 2033

- Table 18: Asia Pacific LED Lighting Market Revenue billion Forecast, by Automotive Vehicle Lighting 2020 & 2033

- Table 19: Asia Pacific LED Lighting Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: China Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Japan Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: New Zealand Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Singapore Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Thailand Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Vietnam Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Philippines Asia Pacific LED Lighting Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific LED Lighting Market?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the Asia Pacific LED Lighting Market?

Key companies in the market include Nichia Corporation, OSRAM GmbH, Koito Manufacturing Co Ltd, OPPLE Lighting Co Ltd, GRUPO ANTOLIN IRAUSA S A, EGLO Leuchten GmbH, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, Signify Holding (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Asia Pacific LED Lighting Market?

The market segments include Indoor Lighting, Outdoor Lighting, Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Construction Boom Owing to the Growing Clout of Multinational Conglomerates; Increasing Emphasis on Green Building Practices; Growing Demand for Soft FM Practices.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulator and Legal Challenges; Growing Concentration of FM Vendors to Impact Margins.

8. Can you provide examples of recent developments in the market?

June 2023: The company light up the Tokyo Dome with around 400 Panasonic LED floodlights, 2KW equivalent. In March 2017, 300 LED floodlights installed in the infield.March 2023: Signify, and Perfect Plants has expanded their collaboration on grow lights. Driving this partnership is Perfect Plant’s ambition to become a prominent manufacturer of starting materials for medicinal cannabis cultivation. Perfect Plants has branches in the Netherlands, Canada, and South Africa.March 2023: Nichia(HQ in japan) and OSRAM emphasize the importance of intellectual property (IP) in their respective business domains and announce plans to expand their license collaboration. As a result, each company is permitted to use the patents licensed under the relevant agreement in its nitride-based semiconductor products, such as blue, green, and white LED and laser components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific LED Lighting Market?

To stay informed about further developments, trends, and reports in the Asia Pacific LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence