Key Insights

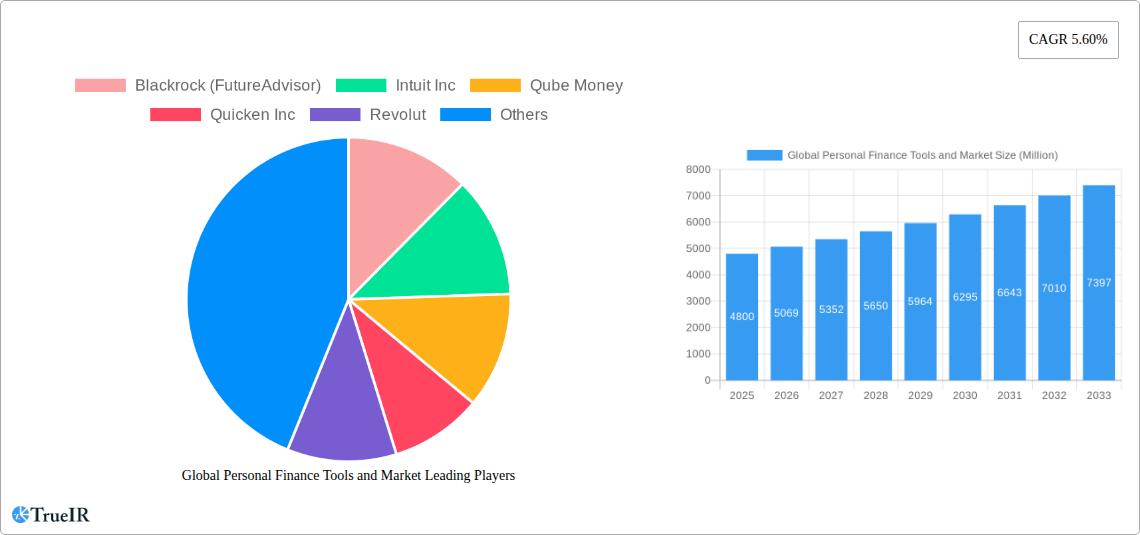

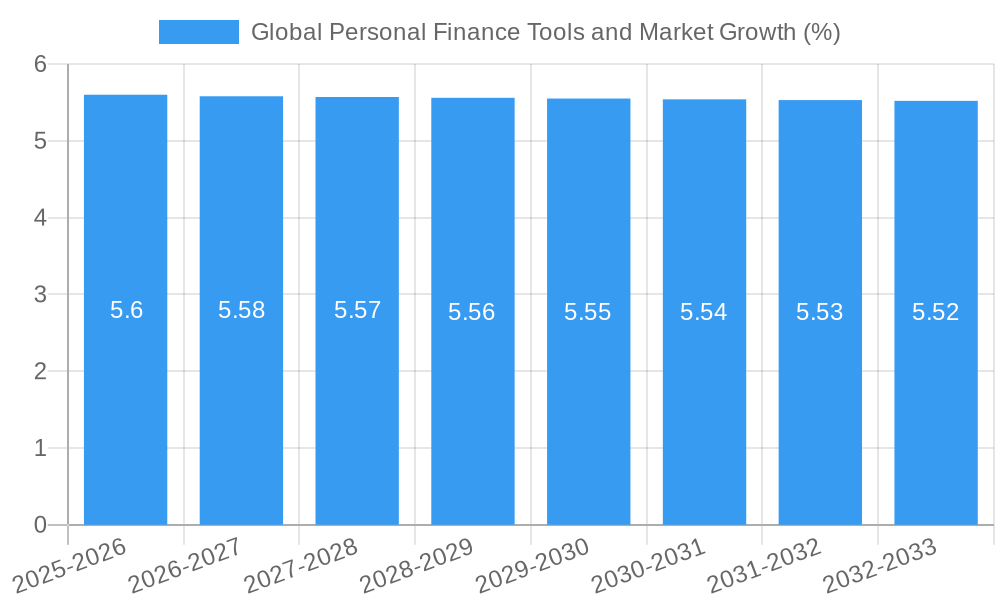

The global personal finance tools market is poised for substantial growth, with an estimated market size of USD 4,800 million in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 5.60% through 2033. This robust expansion is fueled by an increasing awareness among individuals regarding financial management, a growing demand for digital solutions to track spending, manage budgets, and optimize investments, and the proliferation of user-friendly web-based and mobile-based software applications. The ease of access and convenience offered by these digital platforms, coupled with the desire for greater financial control and long-term wealth building, are significant drivers. Key players like Blackrock (FutureAdvisor), Intuit Inc., Revolut, and PayPal are innovating with advanced features, personalized insights, and seamless integration with banking and investment accounts, further accelerating market adoption.

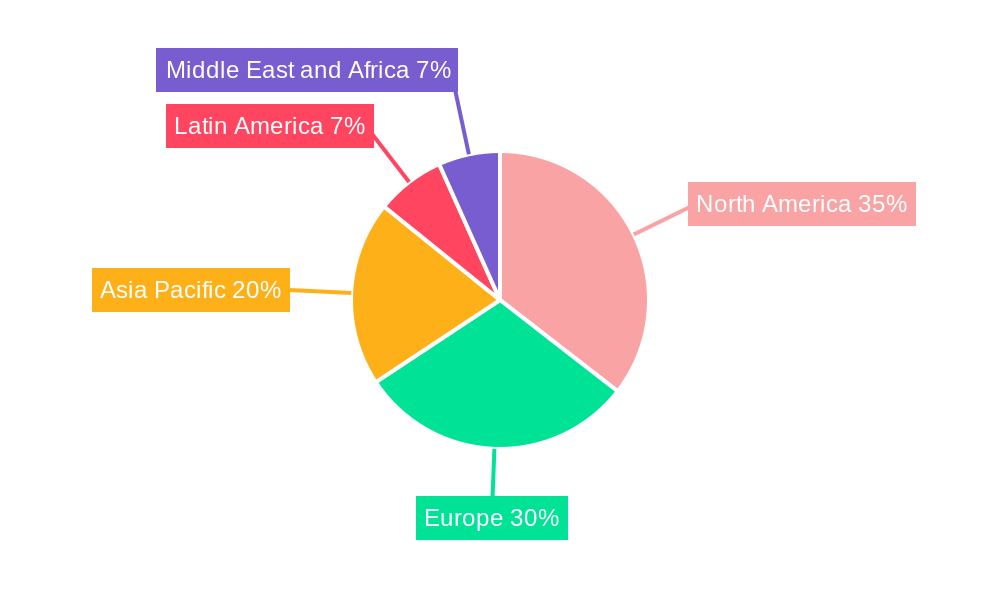

The market's dynamism is also shaped by emerging trends such as the integration of Artificial Intelligence (AI) for personalized financial advice and automated savings, the rise of open banking initiatives facilitating data sharing for comprehensive financial overviews, and the growing popularity of gamified financial management features to encourage user engagement. While these factors propel growth, certain restraints, including data privacy concerns and the initial learning curve for some advanced features, could temper the pace of adoption in specific segments. Nevertheless, the overarching shift towards digital financial literacy and the continuous innovation in user experience are expected to drive significant market penetration across individual consumers worldwide, with North America and Europe likely to remain dominant regions in the near term, followed by promising growth in the Asia Pacific.

Global Personal Finance Tools and Market: Comprehensive Industry Analysis & Forecast (2019-2033)

Gain unparalleled insights into the global personal finance tools and market with this in-depth report. Covering the historical period of 2019–2024 and extending to a robust forecast until 2033, with a base and estimated year of 2025, this study delves into market dynamics, competitive landscapes, and emerging opportunities. Leverage high-volume keywords such as personal finance software, money management app, budgeting tools, investment tracking, financial planning, and wealth management solutions to stay ahead in this rapidly evolving sector. This report is meticulously structured for clarity, featuring detailed analysis, quantitative data, and strategic recommendations for industry stakeholders.

Global Personal Finance Tools and Market Market Structure & Competitive Landscape

The global personal finance tools and market exhibits a dynamic structure influenced by technological innovation, evolving consumer demands, and a growing regulatory landscape. Market concentration varies, with some highly competitive segments dominated by established players and others featuring emerging innovators. Key drivers of innovation include the demand for user-friendly interfaces, advanced analytics, AI-powered insights, and seamless integration across multiple financial platforms. Regulatory impacts, while not overtly restrictive, focus on data privacy and security, influencing product development and user trust. Product substitutes range from traditional spreadsheet methods to a proliferation of specialized mobile applications. End-user segmentation is primarily focused on individual consumers seeking better control over their finances. Mergers & Acquisitions (M&A) trends indicate strategic consolidation as companies aim to expand their service offerings and market reach. For instance, the acquisition of Finicity Corporation (Mvelopes) by Mastercard signifies a significant move to integrate financial data aggregation capabilities into broader payment ecosystems. Estimated M&A volumes in the past five years are in the range of $500 Million to $1 Billion, reflecting a healthy appetite for strategic partnerships and acquisitions.

Global Personal Finance Tools and Market Market Trends & Opportunities

The global personal finance tools and market is poised for substantial growth, projected to reach over $5,000 Million by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 12%. This expansion is fueled by several interconnected trends. Firstly, the increasing digital adoption and smartphone penetration worldwide have created a fertile ground for mobile-based personal finance solutions, making them more accessible than ever. Consumers are actively seeking digital tools to manage their income, expenses, savings, and investments more effectively. Secondly, a growing awareness of financial literacy and the desire for better financial well-being are driving demand for comprehensive money management apps. This includes tools that offer budgeting functionalities, expense tracking, debt management, and investment portfolio monitoring. The post-pandemic economic landscape has further amplified this need, as individuals become more cautious about their financial futures. Technological advancements are continuously reshaping the market, with a notable shift towards AI-driven insights, personalized financial advice, and predictive analytics. For example, features like automated savings, intelligent bill payment reminders, and customized investment recommendations are becoming standard offerings. The competitive landscape is intensifying, with both established software providers and nimble fintech startups vying for market share. This competition breeds innovation, leading to the development of more sophisticated and feature-rich platforms. Opportunities abound for companies that can effectively address the evolving needs of individual consumers, offering a consolidated, intuitive, and secure platform for all their financial activities. The rise of open banking and the increasing availability of financial data through APIs also present significant opportunities for developers to create innovative solutions that provide a holistic view of a user's financial life. The market penetration rate for personal finance apps, while still growing, is estimated to be around 40% globally in the base year of 2025, with significant room for expansion across diverse demographics and income levels. The focus on providing value beyond simple transaction tracking, such as financial education and long-term planning tools, will be crucial for sustained growth.

Dominant Markets & Segments in Global Personal Finance Tools and Market

The global personal finance tools and market is significantly influenced by regional adoption rates, technological infrastructure, and prevailing economic policies. North America currently dominates the market, driven by high disposable incomes, widespread digital literacy, and a mature financial services ecosystem. The United States, in particular, is a key growth engine, with a high concentration of users adopting advanced money management apps and investment tracking tools. The robust financial technology (FinTech) sector in the US, coupled with strong consumer demand for personalized financial solutions, underpins this dominance. In terms of segmentation, Mobile-based Software is emerging as the dominant type, reflecting the global shift towards mobile-first digital experiences. Users prefer the convenience of managing their finances on-the-go, accessing real-time information and executing transactions from their smartphones. The End User segment of Individual Consumers represents the entirety of the market's focus, with a clear trend towards catering to diverse needs, from basic budgeting for young adults to comprehensive wealth management for high-net-worth individuals.

Key growth drivers for mobile-based software include:

- Increasing Smartphone Penetration: Ubiquitous smartphone ownership provides the foundational infrastructure for widespread adoption.

- User-Friendly Interfaces: Intuitive app designs appeal to a broad range of users, regardless of their technical expertise.

- Real-time Data Access: Mobile apps offer instant access to account balances, transaction histories, and market data, empowering users with timely financial awareness.

- Personalized Financial Management: Features like customizable budgets, spending alerts, and investment goal tracking resonate strongly with individual consumers seeking tailored solutions.

Europe is rapidly catching up, propelled by initiatives like PSD2 (Payment Services Directive 2) which promotes open banking and enhances data sharing, fostering innovation in financial management applications. Asia-Pacific presents immense untapped potential, with a rapidly growing middle class and increasing digital adoption, indicating significant future growth opportunities. The continuous development of localized budgeting tools and payment integrations will be critical for capturing market share in these emerging regions.

Global Personal Finance Tools and Market Product Analysis

The global personal finance tools and market is characterized by relentless product innovation aimed at enhancing user experience and providing deeper financial insights. Key advancements include the integration of AI for predictive budgeting and personalized investment recommendations, sophisticated expense categorization with machine learning algorithms, and seamless aggregation of all financial accounts (bank accounts, credit cards, investment portfolios) into a single dashboard. Companies are focusing on developing ad-free, intuitive interfaces like Quicken Inc.'s 'Simplifi', which offers a consolidated view of finances coupled with powerful expense tracking. Competitive advantages are being built on robust security features, customizable reporting, and the ability to offer financial planning beyond mere tracking, such as retirement planning and debt reduction strategies. The market fit is being optimized by catering to specific user needs, from basic personal finance management to advanced wealth management.

Key Drivers, Barriers & Challenges in Global Personal Finance Tools and Market

Key Drivers:

- Technological Advancements: AI, machine learning, and mobile technology are enabling more sophisticated and user-friendly financial tools.

- Growing Financial Literacy: Increased awareness of the importance of personal financial management drives demand for budgeting and planning solutions.

- Digital Transformation: The widespread adoption of smartphones and online banking services creates a fertile ground for digital personal finance tools.

- Government Initiatives: Open banking policies and regulations promoting financial inclusion are fostering innovation.

Barriers & Challenges:

- Data Security and Privacy Concerns: Users are hesitant to share sensitive financial data, requiring robust security measures and transparent data policies.

- Regulatory Complexities: Navigating varying financial regulations across different regions can be challenging for global service providers.

- Intense Competition: The market is crowded with established players and new entrants, making it difficult to gain significant market share without differentiation.

- User Inertia and Trust: Convincing users to switch from existing methods or adopt new tools requires significant effort and demonstrated value. Estimated churn rates can be as high as 25% annually without continuous engagement.

Growth Drivers in the Global Personal Finance Tools and Market Market

The global personal finance tools and market is propelled by several interconnected growth drivers. Technologically, the widespread adoption of smartphones and the increasing sophistication of mobile apps have made financial management more accessible and convenient than ever. AI and machine learning are enabling hyper-personalized financial advice and automated budgeting, appealing to a generation seeking proactive financial guidance. Economically, rising disposable incomes in emerging markets and a general global trend towards financial prudence are increasing the demand for effective money management tools. Government initiatives promoting financial literacy and open banking frameworks further stimulate the market by creating a more conducive environment for innovation and data sharing.

Challenges Impacting Global Personal Finance Tools and Market Growth

Despite robust growth potential, the global personal finance tools and market faces significant challenges. Regulatory complexities, including varying data privacy laws and compliance requirements across different jurisdictions, can hinder global expansion and increase operational costs. Supply chain issues are less direct for software, but can impact hardware integrations if bundled with devices or services. Competitive pressures are immense, with a crowded marketplace forcing companies to invest heavily in customer acquisition and retention. Overcoming user inertia and building trust are critical; a significant portion of the population remains hesitant to fully embrace digital financial tools due to security concerns or a preference for traditional methods. The estimated cost of customer acquisition in this sector can range from $50 to $150 per user.

Key Players Shaping the Global Personal Finance Tools and Market Market

- Blackrock (FutureAdvisor)

- Intuit Inc.

- Qube Money

- Quicken Inc.

- Revolut

- PayU Money

- Finicity Corporation (Mvelopes)

- Personal Capital

- Paypal

- YNAB

- Bettermen

Significant Global Personal Finance Tools and Market Industry Milestones

- January 2020: Quicken Inc. launched 'Simplifi,' a next-generation finance management tool offering a consolidated view of all accounts and an integrated expense tracker. This ad-free app was designed as a comprehensive yet intuitive solution for managing monetary inflows and outflows efficiently.

- June 2020: Personal Capital Corporation introduced its 'Recession Simulator' feature. In response to market volatility caused by the COVID-19 pandemic, this tool provided users with insights into the impact of historical market recessions, becoming the first free tool of its kind for all Personal Capital users and wealth management clients in the Americas.

Future Outlook for Global Personal Finance Tools and Market Market

The global personal finance tools and market is set for continued expansion, driven by emerging technologies and evolving consumer expectations. Strategic opportunities lie in enhancing personalized financial planning, offering more sophisticated wealth management solutions, and expanding into underserved markets. The growing emphasis on financial wellness and the desire for simplified financial lives will fuel demand for intuitive, integrated platforms. Companies that can effectively leverage AI for predictive insights, ensure robust data security, and adapt to changing regulatory landscapes are best positioned for long-term success. The market is expected to witness further innovation in areas like cryptocurrency tracking, ESG investing tools, and hyper-personalized budgeting, catering to a diverse and increasingly financially engaged global population.

Global Personal Finance Tools and Market Segmentation

-

1. Type

- 1.1. Web-based

- 1.2. Mobile-based Software

-

2. End User

- 2.1. Individual Consumers

Global Personal Finance Tools and Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global Personal Finance Tools and Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of the Digitalization in Developing Region; Rise of Personal Financial Apps

- 3.3. Market Restrains

- 3.3.1. Lack of Knowledge to Operate the Tool

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Smartphone has Significant Growth Potential on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Web-based

- 5.1.2. Mobile-based Software

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Individual Consumers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Web-based

- 6.1.2. Mobile-based Software

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Individual Consumers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Web-based

- 7.1.2. Mobile-based Software

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Individual Consumers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Web-based

- 8.1.2. Mobile-based Software

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Individual Consumers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Web-based

- 9.1.2. Mobile-based Software

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Individual Consumers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Web-based

- 10.1.2. Mobile-based Software

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Individual Consumers

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Global Personal Finance Tools and Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Blackrock (FutureAdvisor)

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Intuit Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Qube Money

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Quicken Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Revolut

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 PayU Money

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Finicity Corporation (Mvelopes)

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Personal Capital

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Paypal

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 YNAB

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Bettermen

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Blackrock (FutureAdvisor)

List of Figures

- Figure 1: Global Global Personal Finance Tools and Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Global Personal Finance Tools and Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Global Personal Finance Tools and Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Global Personal Finance Tools and Market Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Global Personal Finance Tools and Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Global Personal Finance Tools and Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Global Personal Finance Tools and Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Global Personal Finance Tools and Market Revenue (Million), by End User 2024 & 2032

- Figure 23: Europe Global Personal Finance Tools and Market Revenue Share (%), by End User 2024 & 2032

- Figure 24: Europe Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Global Personal Finance Tools and Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Global Personal Finance Tools and Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Global Personal Finance Tools and Market Revenue (Million), by End User 2024 & 2032

- Figure 29: Asia Pacific Global Personal Finance Tools and Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: Asia Pacific Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Global Personal Finance Tools and Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Latin America Global Personal Finance Tools and Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Global Personal Finance Tools and Market Revenue (Million), by End User 2024 & 2032

- Figure 35: Latin America Global Personal Finance Tools and Market Revenue Share (%), by End User 2024 & 2032

- Figure 36: Latin America Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Global Personal Finance Tools and Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East and Africa Global Personal Finance Tools and Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Global Personal Finance Tools and Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Middle East and Africa Global Personal Finance Tools and Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Middle East and Africa Global Personal Finance Tools and Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Global Personal Finance Tools and Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Personal Finance Tools and Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Personal Finance Tools and Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Personal Finance Tools and Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Personal Finance Tools and Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Global Personal Finance Tools and Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Personal Finance Tools and Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Personal Finance Tools and Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Personal Finance Tools and Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Personal Finance Tools and Market Revenue Million Forecast, by End User 2019 & 2032

- Table 55: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Personal Finance Tools and Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Personal Finance Tools and Market Revenue Million Forecast, by End User 2019 & 2032

- Table 58: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Personal Finance Tools and Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Personal Finance Tools and Market Revenue Million Forecast, by End User 2019 & 2032

- Table 61: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Personal Finance Tools and Market Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Personal Finance Tools and Market Revenue Million Forecast, by End User 2019 & 2032

- Table 64: Global Personal Finance Tools and Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Personal Finance Tools and Market?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Global Personal Finance Tools and Market?

Key companies in the market include Blackrock (FutureAdvisor), Intuit Inc, Qube Money, Quicken Inc, Revolut, PayU Money, Finicity Corporation (Mvelopes), Personal Capital, Paypal, YNAB, Bettermen.

3. What are the main segments of the Global Personal Finance Tools and Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of the Digitalization in Developing Region; Rise of Personal Financial Apps.

6. What are the notable trends driving market growth?

The Increasing Adoption of Smartphone has Significant Growth Potential on the Market.

7. Are there any restraints impacting market growth?

Lack of Knowledge to Operate the Tool.

8. Can you provide examples of recent developments in the market?

January 2020-Quicken Inc., a major personal finance software market, announced the release of 'Simplifi,' a next-generation unique finance management tool designed to provide consumers with a consolidated view of all accounts synchronized with the expense tracker. The new ad-free app is the most comprehensive and powerful solution. Yet, it is also a simple and intuitive smart tool for managing monetary inflows and outflows with great efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Personal Finance Tools and Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Personal Finance Tools and Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Personal Finance Tools and Market?

To stay informed about further developments, trends, and reports in the Global Personal Finance Tools and Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence