Key Insights

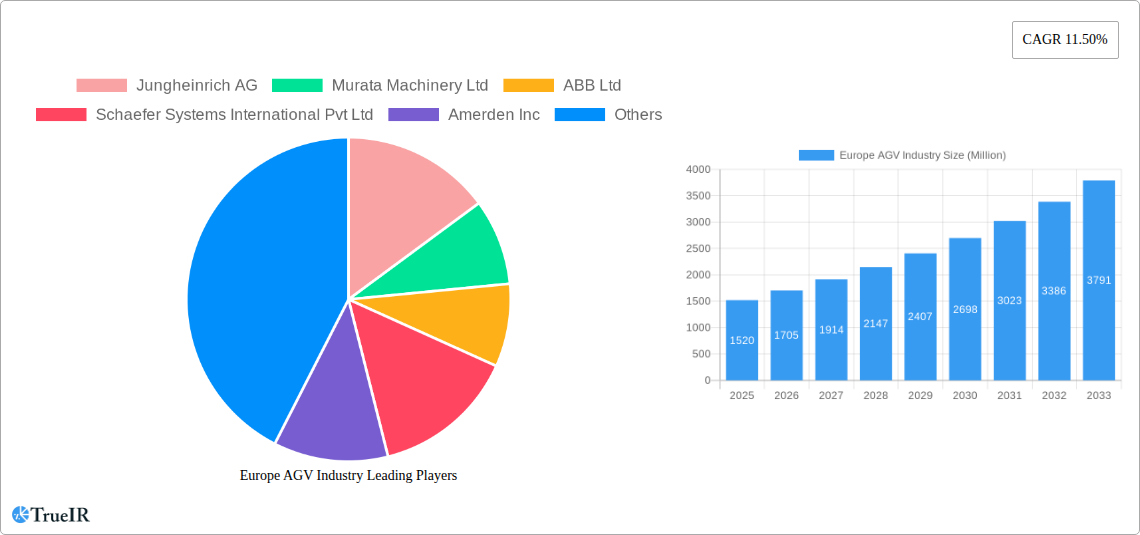

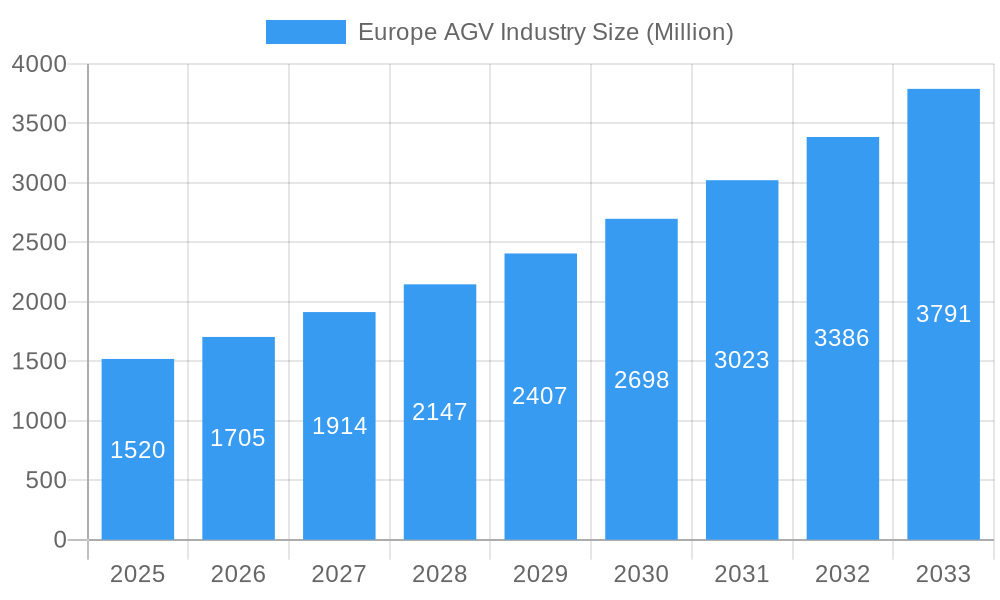

The European Automated Guided Vehicle (AGV) market is poised for significant expansion, driven by a confluence of factors that are reshaping industrial operations across the continent. With a current market size of an estimated USD 1.52 billion in 2025 and a robust Compound Annual Growth Rate (CAGR) of 11.50%, the industry is projected to witness substantial value creation, reaching approximately USD 3.45 billion by 2033. This impressive growth trajectory is primarily fueled by the escalating demand for enhanced operational efficiency, reduced labor costs, and improved workplace safety within key sectors such as automotive, food and beverage, and retail. The increasing adoption of Industry 4.0 technologies, including IoT, AI, and machine learning, is further accelerating the integration of AGVs, enabling more sophisticated automation and data-driven decision-making. Furthermore, governmental initiatives promoting advanced manufacturing and smart logistics infrastructure are acting as significant catalysts for market penetration, encouraging businesses to invest in cutting-edge AGV solutions. The competitive landscape features prominent players like Jungheinrich AG, Murata Machinery Ltd., and ABB Ltd., who are continuously innovating to offer advanced AGV systems, including automated forklifts, unit load carriers, and specialized assembly line solutions.

Europe AGV Industry Market Size (In Billion)

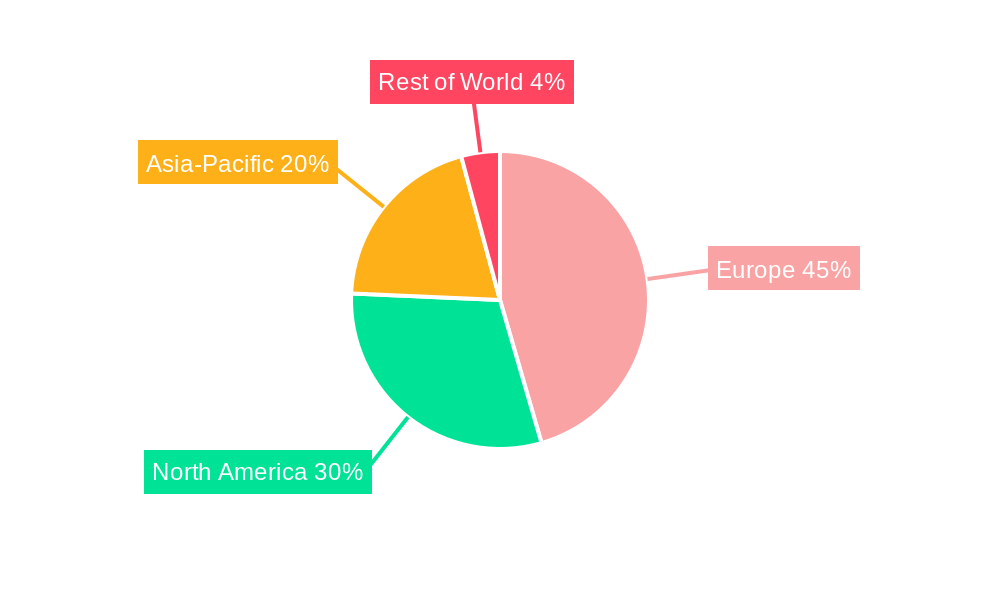

The market is segmented into various product types, with Automated Forklifts and Unit Load AGVs expected to dominate due to their widespread application in warehousing and material handling. The end-user industry landscape is diverse, with Food & Beverage and Automotive sectors leading in AGV adoption, followed closely by Retail and Electronics & Electrical. Challenges such as the high initial investment cost for sophisticated AGV systems and the need for substantial infrastructure modifications in older facilities may temper rapid widespread adoption in some segments. However, the long-term benefits in terms of productivity, accuracy, and reduced operational overhead are compelling. Europe, with its strong industrial base and commitment to technological advancement, represents a critical region for AGV market growth. Key countries like Germany, the United Kingdom, and France are at the forefront, investing heavily in smart factory solutions and automated logistics. As the study period (2019-2033) progresses, continued innovation in AGV technology, including enhanced navigation, collaborative capabilities, and cloud-based fleet management, will be instrumental in overcoming these restraints and unlocking the full potential of this dynamic market.

Europe AGV Industry Company Market Share

Europe AGV Industry Market Structure & Competitive Landscape

The European Automated Guided Vehicle (AGV) industry is characterized by a highly competitive and dynamic market structure. While dominated by a few key industry players, the market also fosters innovation and niche specialization. Market concentration is moderate, with leading companies like Jungheinrich AG, Murata Machinery Ltd, ABB Ltd, and KUKA AG holding significant market share. However, the presence of agile players and emerging technologies prevents complete dominance. Innovation drivers are primarily fueled by the increasing demand for automation in logistics and manufacturing, driven by labor shortages, efficiency imperatives, and the pursuit of Industry 4.0 objectives. Regulatory impacts, while still evolving, are leaning towards promoting safety standards and environmental sustainability, influencing the adoption of AGVs with features like advanced navigation and energy efficiency. Product substitutes, though present in traditional material handling equipment, are increasingly being outpaced by the flexibility and scalability of AGVs. End-user segmentation reveals a strong reliance on industries like Automotive, Food & Beverage, and Retail for AGV deployment. Mergers & Acquisitions (M&A) trends are evident, with established players acquiring smaller, innovative companies to expand their technological capabilities and market reach. For instance, M&A volumes in the past year are estimated to be in the hundreds of millions of Euros, indicating consolidation and strategic growth.

Europe AGV Industry Market Trends & Opportunities

The Europe AGV industry is on a robust growth trajectory, projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period of 2025–2033. This expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and intensifying competitive dynamics across various end-user industries. The market size is anticipated to surge from an estimated XX million Euros in 2025 to over XX billion Euros by 2033. Technological shifts are a primary catalyst, with a pronounced move towards intelligent AGVs equipped with AI, machine learning, and advanced sensor technologies. This enables enhanced navigation, real-time decision-making, and seamless integration into complex warehouse and production environments. The increasing adoption of the Internet of Things (IoT) and cloud computing further facilitates remote monitoring, predictive maintenance, and fleet management, boosting operational efficiency. Consumer preferences are increasingly leaning towards solutions that offer flexibility, scalability, and reduced operational costs. Companies are demanding material handling systems that can adapt to fluctuating production volumes and product diversity, a niche that AGVs are exceptionally well-suited to fill. This preference is driving the demand for customizable and modular AGV solutions. Competitive dynamics are intensifying, with established manufacturers continuously investing in research and development to introduce next-generation AGVs. The market penetration rate for AGVs, currently estimated at around 12% in key industrial sectors, is expected to climb steadily as more businesses recognize the tangible benefits of automation. Opportunities abound for providers offering integrated solutions that encompass not just the AGVs themselves but also the necessary software, infrastructure, and support services. The growing e-commerce sector, particularly in regions like the UK and Germany, is a significant opportunity, creating a sustained demand for efficient warehouse automation. Furthermore, the push for sustainable logistics is opening doors for AGVs powered by renewable energy sources, such as hydrogen fuel cells, as demonstrated by GAUSSIN's innovative launch. The development of more sophisticated and user-friendly AGV systems is also broadening their applicability to smaller and medium-sized enterprises (SMEs), further expanding the market's reach.

Dominant Markets & Segments in Europe AGV Industry

The Automotive industry stands as a dominant force within the Europe AGV industry, exhibiting substantial growth and widespread adoption. This dominance is attributed to the sector's relentless pursuit of manufacturing efficiency, lean production methodologies, and the need for precise, on-time material delivery within complex assembly lines. The adoption of AGVs in automotive manufacturing significantly streamlines the movement of components, sub-assemblies, and finished vehicles, reducing human error and enhancing safety.

- Key Growth Drivers in Automotive:

- Just-In-Time (JIT) Manufacturing: AGVs are crucial for supporting JIT delivery systems, ensuring parts arrive at assembly stations precisely when needed.

- Robot Integration: Seamless integration with robotic arms for assembly tasks further amplifies the efficiency gains.

- Customization and Flexibility: The ability of AGVs to adapt to changing production layouts and vehicle models is invaluable in the automotive sector.

- Safety Enhancements: Reducing manual handling of heavy components leads to a safer working environment.

Beyond the Automotive sector, the Food & Beverage industry also presents significant growth potential. AGVs in this sector are critical for maintaining hygiene standards, ensuring efficient cold chain logistics, and handling high volumes of goods in processing and distribution centers. The ability of AGVs to operate in controlled environments and reduce human touchpoints makes them ideal for food safety compliance.

- Key Growth Drivers in Food & Beverage:

- Hygiene and Sanitation: AGVs minimize contamination risks in sensitive production environments.

- Cold Chain Integrity: Efficient and consistent material movement in refrigerated and frozen environments.

- High Throughput Demands: Managing large volumes of packaged goods from production to dispatch.

- Traceability and Compliance: Integration with inventory management systems enhances product traceability.

Within product types, Automated Forklifts are experiencing widespread adoption across various industries, particularly in warehousing and distribution. Their ability to handle palletized goods with precision and efficiency makes them a cornerstone of modern logistics. Unit Load AGVs, designed for transporting larger loads, are also crucial for inter-facility transport and heavy-duty applications.

- Market Dominance Analysis:

- Germany leads the European market in AGV adoption, driven by its strong manufacturing base, particularly in automotive and general manufacturing, and its early embrace of Industry 4.0 principles.

- The United Kingdom is also a significant market, fueled by the booming e-commerce sector and increasing investments in automated warehousing.

- France shows growing interest, with initiatives to boost industrial automation and reduce logistical costs.

- The adoption of Special Purpose AGVs is on the rise, catering to unique industrial needs within sectors like aerospace and pharmaceuticals, where specialized handling requirements are paramount.

Europe AGV Industry Product Analysis

The Europe AGV industry is witnessing rapid product innovation, with manufacturers focusing on enhanced intelligence, safety, and integration capabilities. Automated Forklifts are evolving with advanced vision systems for precise pallet handling, while Automated Tow/Tractor/Tugs are being optimized for efficient towing of multiple carts in large manufacturing facilities. Unit Load AGVs are gaining modularity, allowing for diverse load configurations. Key competitive advantages lie in the development of AGVs with superior navigation systems (e.g., SLAM technology), robust obstacle detection, and seamless integration with existing Warehouse Management Systems (WMS). The trend towards flatter, more flexible control architectures and predictive maintenance capabilities further enhances their market appeal, offering clients reduced downtime and optimized operational workflows.

Key Drivers, Barriers & Challenges in Europe AGV Industry

Key Drivers, Barriers & Challenges in Europe AGV Industry

Growth Drivers: The Europe AGV industry is propelled by the persistent demand for increased operational efficiency and productivity, driven by labor shortages and rising wage costs. Technological advancements in AI, IoT, and robotics are enabling more sophisticated and versatile AGV solutions. The global push towards Industry 4.0 and smart manufacturing mandates further fuel adoption. Furthermore, supportive government initiatives and incentives for automation and digitalization across member states are playing a crucial role. The burgeoning e-commerce sector's requirement for rapid order fulfillment also acts as a significant growth catalyst.

Barriers & Challenges: Despite the robust growth, the Europe AGV market faces several challenges. The initial high capital investment for AGV systems can be a significant barrier for small and medium-sized enterprises (SMEs). Regulatory complexities and the need for standardization across different European countries can slow down widespread adoption. Integrating AGVs into existing, often legacy, infrastructure and workflows requires substantial planning and potential disruption. Supply chain disruptions for key components can also impact production timelines and costs. Lastly, the competitive pressure from alternative automation solutions and the need for skilled personnel for installation, maintenance, and operation present ongoing hurdles.

Growth Drivers in the Europe AGV Industry Market

Key growth drivers in the Europe AGV Industry Market are rooted in the relentless pursuit of operational excellence and cost optimization within businesses. The increasing scarcity of skilled labor and rising labor costs across Europe are compelling companies to seek automated solutions for material handling. Technological advancements are central to this growth, with the integration of Artificial Intelligence (AI), Machine Learning (ML), and sophisticated sensor technologies leading to smarter, more adaptable AGVs. The global shift towards Industry 4.0 principles, emphasizing interconnectedness, data analytics, and automation, provides a strong policy-driven impetus. Furthermore, favorable government policies and grants aimed at promoting industrial automation and digital transformation across European nations are actively encouraging investment in AGV technology.

Challenges Impacting Europe AGV Industry Growth

Challenges impacting Europe AGV Industry growth include the significant upfront capital expenditure required for implementing AGV systems, which can be a deterrent for smaller businesses. Regulatory complexities and the lack of uniform standards across different European countries can create integration hurdles. The integration of AGVs into existing, often outdated, manufacturing and warehouse infrastructure demands extensive planning and can lead to operational disruptions during the transition phase. Additionally, disruptions in the global supply chain for critical components can lead to production delays and increased costs. The ongoing need for a skilled workforce capable of operating, maintaining, and troubleshooting these advanced systems also presents a continuous challenge.

Key Players Shaping the Europe AGV Industry Market

- Jungheinrich AG

- Murata Machinery Ltd

- ABB Ltd

- Schaefer Systems International Pvt Ltd

- Amerden Inc

- KUKA AG

- Dematic Corp

- Transbotics Corporation

- Toyota Material Handling International AB

- John Bean Technologies (JBT) Corporation

- Swisslog Holding AG

- Seegrid Corporation

Significant Europe AGV Industry Industry Milestones

- June 2022: ek robotics entered into a partnership with BMW to provide a complete turnkey automated guided vehicle (AGV) solution. The ek robotics' massive custom-move AVG solution would enable BMW to optimize its manufacturing and warehouse activities. The equipment includes the Custom Move, Vario Move, and Very Narrow Aisle (VNA) AGVs. The AGV solution was delivered and implemented at BMW's PGA Press Plant in Swindon, England.

- March 2022: GAUSSIN launched the world's first hydrogen-powered fuel cell Automated Guided Vehicles (AGV H2) for seaports. The new vehicles would complement GAUSSIN's range of hydrogen-powered vehicles. The newly launched AGV could be autonomously driven in mixed traffic and an infra-structureless environment. It would help port operators switch to zero-emission immediately, shorter and less frequent refueling, provide longer operating hours, and quiet and efficient transportation.

Future Outlook for Europe AGV Industry Market

The future outlook for the Europe AGV Industry Market is exceptionally positive, driven by accelerating trends in automation and digitalization. Strategic opportunities lie in the increasing demand for flexible and scalable logistics solutions, particularly in the e-commerce and retail sectors. The growing emphasis on sustainability will further boost the adoption of energy-efficient AGVs and those powered by alternative energy sources. The continuous evolution of AI and robotics will enable AGVs to perform more complex tasks, expanding their application scope into new industries such as healthcare and pharmaceuticals. Investments in research and development focused on collaborative AGVs that can work alongside human operators safely and efficiently will be critical. The market potential is substantial, with projections indicating continued strong growth as more businesses recognize the transformative benefits of AGVs in optimizing operations, reducing costs, and enhancing overall competitiveness.

Europe AGV Industry Segmentation

-

1. Product Type

- 1.1. Automated Fork Lift

- 1.2. Automated Tow/Tractor/Tugs

- 1.3. Unit Load

- 1.4. Assembly Line

- 1.5. Special Purpose

-

2. End-User Industry

- 2.1. Food & Beverage

- 2.2. Automotive

- 2.3. Retail

- 2.4. Electronics & Electrical

- 2.5. General Manufacturing

- 2.6. Pharmaceuticals

- 2.7. Other End-user Industries

Europe AGV Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe AGV Industry Regional Market Share

Geographic Coverage of Europe AGV Industry

Europe AGV Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth of the E-commerce Industry; Need for Automation in Maritime Applications for Improvement in Terminal Efficiency

- 3.3. Market Restrains

- 3.3.1. Limitation of Real-time Wireless Control Due to Communication Delays

- 3.4. Market Trends

- 3.4.1. Food and Beverages is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automated Fork Lift

- 5.1.2. Automated Tow/Tractor/Tugs

- 5.1.3. Unit Load

- 5.1.4. Assembly Line

- 5.1.5. Special Purpose

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food & Beverage

- 5.2.2. Automotive

- 5.2.3. Retail

- 5.2.4. Electronics & Electrical

- 5.2.5. General Manufacturing

- 5.2.6. Pharmaceuticals

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 7. France Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe AGV Industry Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Jungheinrich AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Murata Machinery Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 ABB Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Schaefer Systems International Pvt Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Amerden Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 KUKA AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Dematic Corp

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Transbotics Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Toyota Material Handling International AB

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 John Bean Technologies (JBT) Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Swisslog Holding AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Seegrid Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Jungheinrich AG

List of Figures

- Figure 1: Europe AGV Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe AGV Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe AGV Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Europe AGV Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: Europe AGV Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Europe AGV Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 5: Europe AGV Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Europe AGV Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 7: Europe AGV Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe AGV Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe AGV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe AGV Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 11: Germany Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: France Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Italy Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Netherlands Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Netherlands Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Sweden Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Sweden Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Europe AGV Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Europe AGV Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Europe AGV Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 28: Europe AGV Industry Volume K Unit Forecast, by End-User Industry 2020 & 2033

- Table 29: Europe AGV Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe AGV Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United Kingdom Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Germany Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Germany Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Netherlands Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Netherlands Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Belgium Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Belgium Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Sweden Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Sweden Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Norway Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Norway Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Poland Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Poland Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Denmark Europe AGV Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Denmark Europe AGV Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe AGV Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Europe AGV Industry?

Key companies in the market include Jungheinrich AG, Murata Machinery Ltd, ABB Ltd, Schaefer Systems International Pvt Ltd, Amerden Inc, KUKA AG, Dematic Corp, Transbotics Corporation, Toyota Material Handling International AB, John Bean Technologies (JBT) Corporation, Swisslog Holding AG, Seegrid Corporation.

3. What are the main segments of the Europe AGV Industry?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth of the E-commerce Industry; Need for Automation in Maritime Applications for Improvement in Terminal Efficiency.

6. What are the notable trends driving market growth?

Food and Beverages is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Limitation of Real-time Wireless Control Due to Communication Delays.

8. Can you provide examples of recent developments in the market?

June 2022 - ek robotics entered in a partnership with BMW to provide a complete turnkey automated guided vehicle (AGV) solution. The ek robotics' massive custom-move AVG solution would enable BMW to optimize its manufacturing and warehouse activities. The equipment includes the Custom Move, Vario Move, and Very Narrow Aisle (VNA) AGVs. The AGV solution was delivered and implemented at BMW's PGA Press Plant in Swindon, England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe AGV Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe AGV Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe AGV Industry?

To stay informed about further developments, trends, and reports in the Europe AGV Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence