Key Insights

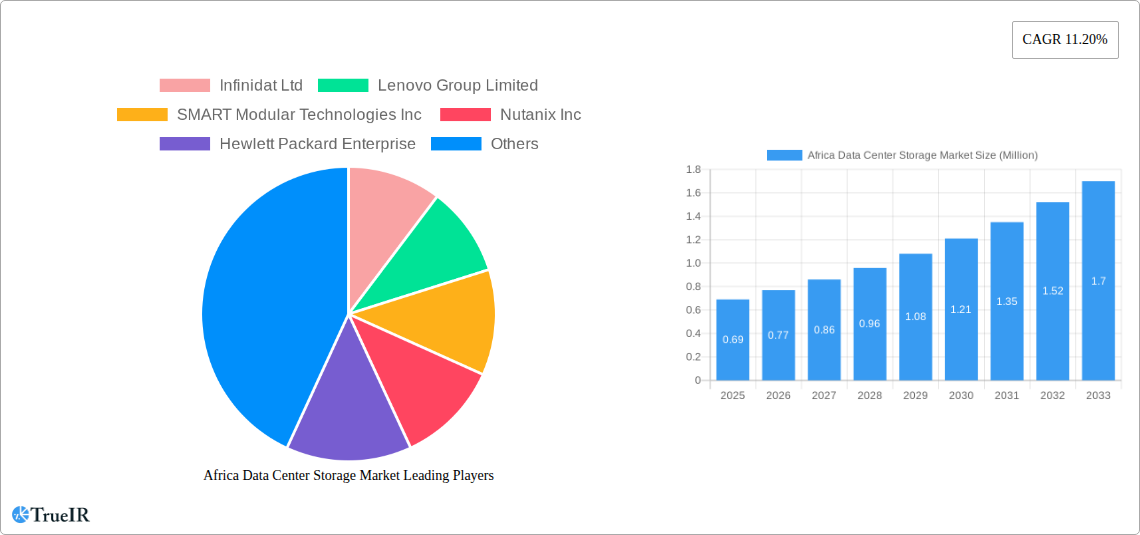

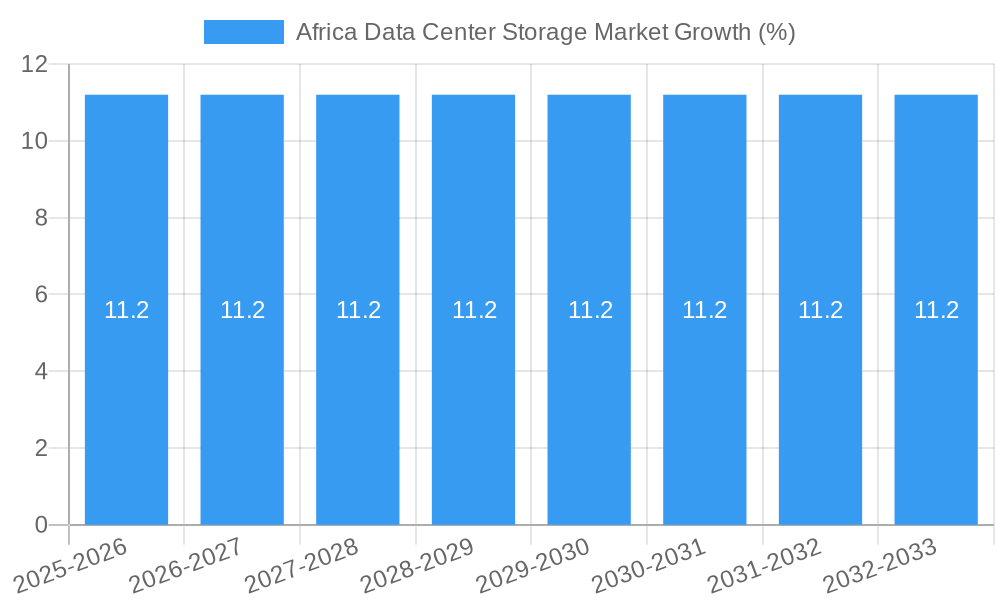

The Africa Data Center Storage Market is poised for substantial expansion, projected to reach an estimated market size of approximately USD 0.69 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 11.20% anticipated between 2025 and 2033. This surge is predominantly driven by the escalating demand for digital transformation across various sectors, including IT & Telecommunication, BFSI, Government, and Media & Entertainment. As these industries increasingly rely on data-intensive applications, the need for reliable, high-performance, and scalable storage solutions becomes paramount. The adoption of advanced technologies such as Network Attached Storage (NAS) and Storage Area Network (SAN) is expected to lead the market, offering centralized and efficient data management capabilities. Furthermore, the migration from traditional storage to All-Flash and Hybrid Storage solutions is gaining momentum, promising enhanced speed, reduced latency, and improved operational efficiency for data centers.

The African continent, with key markets like South Africa, Nigeria, and Egypt leading the charge, presents a fertile ground for data center storage investments. However, the market also faces certain restraints, including the high initial cost of implementing advanced storage infrastructure and the ongoing challenge of ensuring consistent power supply and robust cybersecurity measures across diverse regions. Despite these hurdles, the long-term outlook remains exceptionally positive. Emerging trends such as the proliferation of cloud computing services, the increasing adoption of Big Data analytics, and the burgeoning Internet of Things (IoT) ecosystem are creating an insatiable appetite for data storage capacity. Companies like Infinidat Ltd, Lenovo Group Limited, Hewlett Packard Enterprise, Dell Inc, and Pure Storage Inc are key players actively shaping this evolving landscape through innovation and strategic market penetration. The forecast period of 2025-2033 is expected to witness significant technological advancements and market consolidation, further solidifying Africa's position as a rapidly growing hub for data center storage.

Africa Data Center Storage Market: Unlocking Digital Infrastructure Growth (2019-2033)

This comprehensive report delves into the dynamic Africa Data Center Storage Market, offering an in-depth analysis of its structure, trends, opportunities, and key players. With a study period spanning from 2019 to 2033, and a base year of 2025, this report provides critical insights into the market's evolution, driven by increasing data generation, cloud adoption, and digital transformation across the continent. We leverage high-volume keywords like "data center storage Africa," "enterprise storage solutions," "cloud storage Africa," and "data infrastructure growth" to ensure maximum SEO visibility and industry engagement.

Africa Data Center Storage Market Market Structure & Competitive Landscape

The Africa Data Center Storage Market is characterized by a moderate to high level of concentration, with key global vendors dominating the enterprise segment, while local and regional players increasingly compete in specific niches. Innovation drivers are primarily centered around cost-efficiency, scalability, and enhanced data protection in the face of burgeoning data volumes. Regulatory impacts are evolving, with governments increasingly focusing on data localization policies and cybersecurity frameworks, influencing purchasing decisions and infrastructure development. Product substitutes are becoming more sophisticated, with advancements in software-defined storage and cloud-based solutions challenging traditional hardware-centric approaches.

The end-user segmentation reveals a strong demand from the IT & Telecommunication sector, driven by the rapid expansion of mobile networks and internet penetration. BFSI (Banking, Financial Services, and Insurance) institutions are significant adopters, prioritizing robust data security and compliance. Government initiatives to digitize public services and enhance national security further contribute to market growth.

Mergers & Acquisitions (M&A) trends are emerging as companies seek to expand their geographic reach and product portfolios. While specific M&A volumes for the African market are still nascent, the global trend indicates consolidation, with larger players acquiring smaller innovators to gain a competitive edge. Examples include:

- Concentration: Leading vendors like Dell Inc., Hewlett Packard Enterprise, and Huawei Technologies Co Ltd collectively hold a significant market share.

- Innovation Focus: Emphasis on all-flash storage, hybrid cloud solutions, and scalable architectures to meet growing data demands.

- Regulatory Influence: Increasing adoption of data localization mandates across various African nations.

- M&A Potential: Opportunities for strategic partnerships and acquisitions to bolster market presence.

Africa Data Center Storage Market Market Trends & Opportunities

The Africa Data Center Storage Market is poised for substantial growth, projected to expand from an estimated XX Million in 2025 to XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This remarkable trajectory is fueled by a confluence of technological advancements, shifting consumer preferences towards digital services, and an evolving competitive landscape. The increasing penetration of smartphones and internet access across the continent has led to an exponential surge in data generation, creating an insatiable demand for robust and scalable storage solutions. Organizations are migrating their IT infrastructure to data centers, both on-premises and colocation facilities, to manage this growing data footprint efficiently.

Technological shifts are playing a pivotal role. The advent and widespread adoption of All-Flash Storage arrays are revolutionizing data center performance, offering significantly faster data access and processing speeds compared to traditional mechanical drives. Hybrid Storage solutions, which combine the performance benefits of flash storage with the cost-effectiveness of traditional hard drives, are also gaining traction, providing a balanced approach for diverse workloads. Furthermore, the growing interest in hyperconverged infrastructure (HCI) is influencing storage strategies, as it integrates compute, storage, and networking into a single system, simplifying management and reducing operational costs. The increasing adoption of Network Attached Storage (NAS) for file sharing and collaboration, and Storage Area Networks (SAN) for high-performance block-level access, underscores the diverse storage needs across different industry verticals.

Consumer preferences are increasingly leaning towards digital platforms, from e-commerce and digital payments to streaming services and online education. This surge in digital engagement translates directly into higher data creation and consumption, necessitating greater storage capacity and accessibility within African data centers. The competitive dynamics are intensifying, with established global players vying for market share alongside emerging local providers who are adapting to specific regional needs and regulatory environments. The rise of cloud computing services is also a significant trend, offering scalable and flexible storage options that are particularly attractive to small and medium-sized enterprises (SMEs) across Africa. Opportunities abound for vendors offering cost-effective, scalable, and secure data center storage solutions tailored to the unique challenges and growth potential of the African market.

Dominant Markets & Segments in Africa Data Center Storage Market

The Africa Data Center Storage Market showcases distinct patterns of dominance across its various segments, driven by infrastructure development, policy frameworks, and specific industry demands.

Dominant Region: South Africa continues to be a leading market within the African continent for data center storage solutions, owing to its relatively mature digital infrastructure, significant foreign investment, and a well-established enterprise ecosystem. Nigeria and Kenya are emerging as rapidly growing markets, fueled by a burgeoning tech scene, increasing internet penetration, and government initiatives to foster digital economies.

Dominant Segments:

Storage Technology:

- Network Attached Storage (NAS): Experiencing robust growth, particularly among SMEs for centralized file storage, collaboration, and backup solutions. Its ease of deployment and cost-effectiveness make it highly attractive.

- Storage Area Network (SAN): Continues to hold a strong position, especially within large enterprises and mission-critical applications requiring high-performance block-level access, such as BFSI and IT & Telecommunication.

- Direct Attached Storage (DAS): While still relevant for specific use cases like high-performance computing or entry-level solutions, its dominance is gradually being challenged by network-based storage technologies.

Storage Type:

- All-Flash Storage: Witnessing the most rapid growth. The demand for unparalleled performance, reduced latency, and enhanced application responsiveness is driving its adoption across various sectors. This is crucial for real-time analytics, AI/ML workloads, and high-frequency trading in BFSI.

- Hybrid Storage: Remains a significant segment, offering a cost-optimized solution by blending the speed of SSDs with the capacity of HDDs. It caters to a broad range of workloads where a balance between performance and cost is essential.

- Traditional Storage: Though declining in its share, traditional HDDs still represent a substantial portion of the market, especially for bulk storage, archiving, and less performance-intensive applications due to their lower cost per terabyte.

End User:

- IT & Telecommunication: This sector is the largest consumer of data center storage in Africa. The constant need for network infrastructure upgrades, cloud service expansion, and data management for millions of users drives substantial demand for all types of storage solutions.

- BFSI: A critical segment that prioritizes security, compliance, and high availability. The digital transformation within the banking sector, including mobile banking and fintech, necessitates advanced storage capabilities for transactional data, analytics, and regulatory reporting.

- Government: As African governments increasingly focus on e-governance, smart city initiatives, and digital public services, their demand for secure and scalable data center storage is on the rise.

- Media & Entertainment: The proliferation of digital content, streaming services, and high-definition media production is creating a significant demand for high-capacity and high-performance storage solutions.

Key Growth Drivers:

- Infrastructure Development: Expansion of data center capacity, both colocation and hyperscale, across key African cities.

- Digital Transformation Initiatives: Government and private sector focus on digitization across various industries.

- Cloud Adoption: Growing adoption of cloud services by businesses of all sizes.

- Data Growth: Exponential increase in data generation from mobile devices, IoT, and digital services.

- Regulatory Landscape: Evolving data protection and localization laws driving demand for localized storage solutions.

Africa Data Center Storage Market Product Analysis

The Africa Data Center Storage Market is witnessing a wave of product innovation driven by the imperative for higher performance, increased capacity, and enhanced efficiency. Vendors are focusing on developing advanced All-Flash Storage solutions that offer superior IOPS and reduced latency, catering to demanding enterprise workloads. Hybrid Storage solutions continue to evolve, integrating more intelligent tiering capabilities to optimize cost and performance dynamically. Network Attached Storage (NAS) products are becoming more sophisticated, offering enhanced scalability, robust data protection features, and simplified management for businesses of all sizes. The competitive advantage lies in offering solutions that are not only technologically advanced but also cost-effective and tailored to the specific infrastructure constraints and connectivity challenges prevalent in many African regions. Companies like Infinidat Ltd, Pure Storage Inc., and Dell Inc. are at the forefront of these advancements, providing solutions that empower businesses to leverage their data more effectively.

Key Drivers, Barriers & Challenges in Africa Data Center Storage Market

Key Drivers:

- Digital Transformation: The widespread adoption of digital technologies across industries, from e-commerce to fintech, is a primary catalyst.

- Cloud Computing Growth: Increasing reliance on cloud services for scalability and flexibility drives demand for underlying storage infrastructure.

- Data Volume Explosion: Exponential growth in data generation from mobile usage, IoT devices, and digital services necessitates increased storage capacity.

- Government Initiatives: Digitization efforts by governments to improve public services and foster digital economies.

Barriers & Challenges:

- Infrastructure Deficiencies: Limited access to reliable power and high-speed internet connectivity in some regions can hinder data center development and storage solution deployment.

- Affordability and Cost Sensitivity: High initial investment costs for advanced storage solutions can be a barrier for SMEs.

- Skills Gap: A shortage of skilled IT professionals to manage and maintain sophisticated data center storage systems.

- Regulatory Complexity: Navigating diverse and evolving data privacy and localization regulations across different African countries.

- Supply Chain Logistics: Challenges in efficient distribution and maintenance of hardware across vast geographical areas.

Growth Drivers in the Africa Data Center Storage Market Market

The Africa Data Center Storage Market is propelled by several interconnected growth drivers. Technologically, the increasing adoption of All-Flash Storage and Hybrid Storage solutions offers significant performance improvements, making data accessible and actionable in real-time. Economically, the burgeoning digital economy, fueled by mobile penetration and the rise of e-commerce and fintech, is creating an unprecedented demand for data management and storage infrastructure. Policy-driven factors, such as government initiatives to promote local data centers and digital transformation, are also playing a crucial role. For instance, countries investing in digital infrastructure and encouraging foreign direct investment in tech hubs are witnessing accelerated market growth. The expansion of hyperscale cloud providers into Africa also creates a ripple effect, driving demand for robust storage solutions to support their expanding operations.

Challenges Impacting Africa Data Center Storage Market Growth

Despite the promising growth trajectory, the Africa Data Center Storage Market faces significant challenges. Regulatory complexities, including varying data privacy laws and localization mandates across different nations, can create compliance hurdles for vendors and customers. Supply chain issues, such as import duties, logistics, and the availability of spare parts, can lead to delays and increased operational costs. Competitive pressures are also mounting, with both global giants and emerging local players vying for market share, often leading to price sensitivity, particularly among smaller businesses. Furthermore, a persistent skills gap in IT infrastructure management and cybersecurity can hinder the effective deployment and utilization of advanced storage technologies. Addressing these challenges is crucial for unlocking the full potential of the African data center storage market.

Key Players Shaping the Africa Data Center Storage Market Market

- Infinidat Ltd

- Lenovo Group Limited

- SMART Modular Technologies Inc

- Nutanix Inc

- Hewlett Packard Enterprise

- ADATA Technology Co Ltd

- Fujitsu Limited

- Dell Inc

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Pure Storage Inc

- QSAN Technology Inc

Significant Africa Data Center Storage Market Industry Milestones

- March 2024: Western Digital expanded its product lineup with the introduction of a 24 TB WD Red Pro mechanical hard drive designed specifically for NAS (network attached storage) applications. The company launched a 24 TB model earlier, targeted at enterprise and data center use.

- March 2024: Pure Storage launched advanced data storage technologies and services. The company announced new self-service capabilities across its Pure1 storage management platform and Evergreen portfolio, offering software-based solutions, all via a single platform experience, to global customers.

Future Outlook for Africa Data Center Storage Market Market

The future outlook for the Africa Data Center Storage Market is exceptionally bright, driven by sustained digital transformation and increasing data consumption. Key growth catalysts include the continued expansion of hyperscale cloud providers, the proliferation of 5G networks enabling new use cases, and the ongoing development of smart city initiatives. Strategic opportunities lie in providing scalable, cost-effective, and highly available storage solutions that cater to the unique needs of African businesses, including robust data protection and disaster recovery capabilities. As the continent embraces digital innovation, the demand for advanced data center storage will only intensify, offering significant market potential for vendors who can adapt and deliver.

Africa Data Center Storage Market Segmentation

-

1. Storage Technology

- 1.1. Network Attached Storage (NAS)

- 1.2. Storage Area Network (SAN)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Other Technologies

-

2. Storage Type

- 2.1. Traditional Storage

- 2.2. All-Flash Storage

- 2.3. Hybrid Storage

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Media & Entertainment

- 3.5. Other End Users

Africa Data Center Storage Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Data Center Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Digitalization and Emergence of Data-centric Applications; Demand of Flash Arrays in End Users

- 3.3. Market Restrains

- 3.3.1. Compatibility and Optimum Storage Performance Issues

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 5.1.1. Network Attached Storage (NAS)

- 5.1.2. Storage Area Network (SAN)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Storage Type

- 5.2.1. Traditional Storage

- 5.2.2. All-Flash Storage

- 5.2.3. Hybrid Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Media & Entertainment

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Storage Technology

- 6. South Africa Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Data Center Storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Infinidat Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lenovo Group Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SMART Modular Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nutanix Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hewlett Packard Enterprise

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ADATA Technology Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujitsu Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Dell Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kingston Technology Company Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Huawei Technologies Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Oracle Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Pure Storage Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 QSAN Technology Inc

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Infinidat Ltd

List of Figures

- Figure 1: Africa Data Center Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Data Center Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 3: Africa Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 4: Africa Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Africa Data Center Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Data Center Storage Market Revenue Million Forecast, by Storage Technology 2019 & 2032

- Table 14: Africa Data Center Storage Market Revenue Million Forecast, by Storage Type 2019 & 2032

- Table 15: Africa Data Center Storage Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Africa Data Center Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Data Center Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Storage Market?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the Africa Data Center Storage Market?

Key companies in the market include Infinidat Ltd, Lenovo Group Limited, SMART Modular Technologies Inc , Nutanix Inc, Hewlett Packard Enterprise, ADATA Technology Co Ltd, Fujitsu Limited, Dell Inc, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Pure Storage Inc, QSAN Technology Inc.

3. What are the main segments of the Africa Data Center Storage Market?

The market segments include Storage Technology, Storage Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Digitalization and Emergence of Data-centric Applications; Demand of Flash Arrays in End Users.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility and Optimum Storage Performance Issues.

8. Can you provide examples of recent developments in the market?

March 2024: Western Digital expanded its product lineup with the introduction of a 24 TB WD Red Pro mechanical hard drive designed specifically for NAS (network attached storage) applications. The company launched a 24 TB model earlier, targeted at enterprise and data center use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Storage Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence