Key Insights

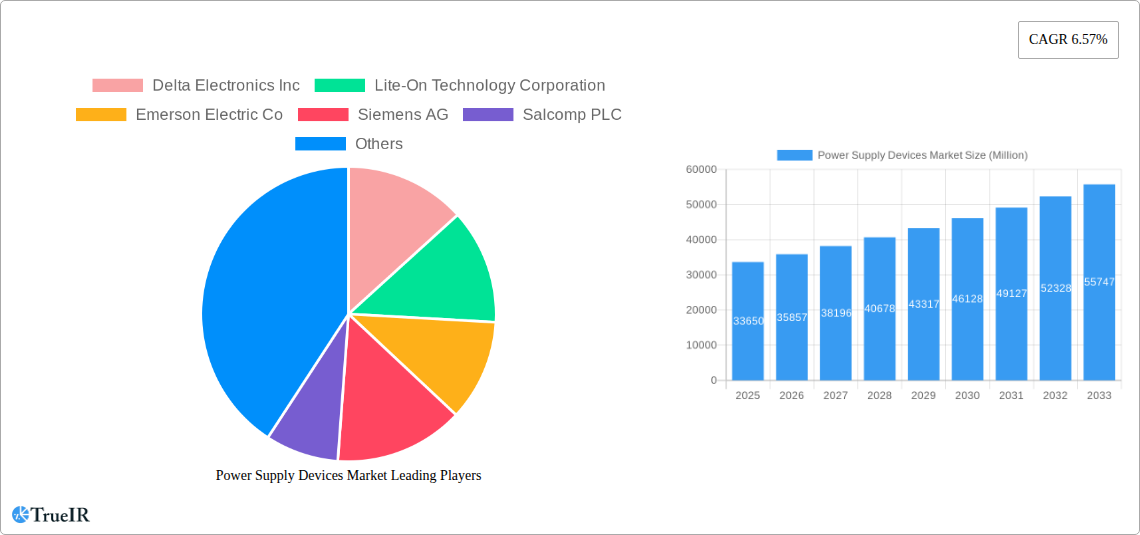

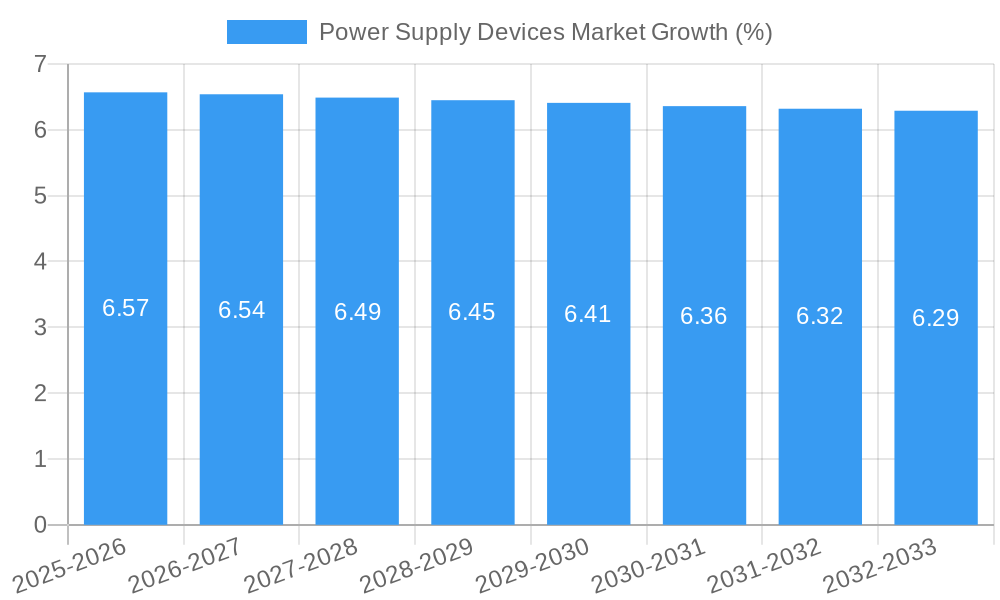

The global Power Supply Devices Market is poised for significant expansion, projected to reach an estimated USD 33.65 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.57% anticipated throughout the forecast period of 2025-2033. This growth is fueled by an increasing demand for efficient and reliable power solutions across a multitude of rapidly evolving sectors. Key drivers include the relentless expansion of the communication industry, driven by 5G deployment and the burgeoning IoT ecosystem, which necessitates advanced power management for connected devices. The industrial sector is also a major contributor, as automation and smart manufacturing initiatives demand sophisticated and stable power supplies for machinery and control systems. Furthermore, the pervasive adoption of consumer electronics and mobile devices, alongside the transformative electrification of the automotive and transportation sectors, are substantial growth catalysts. Emerging trends such as the integration of AI and machine learning in power management systems for enhanced efficiency and the growing emphasis on sustainable and energy-efficient power solutions are shaping the market landscape.

While the market demonstrates strong upward momentum, certain restraints could influence its trajectory. These may include the increasing complexity and cost associated with developing highly efficient and miniaturized power supply units, potential supply chain disruptions for critical components, and evolving regulatory landscapes concerning power efficiency standards and environmental compliance. The market is segmented into AC-DC Power Supplies and DC-DC Converters, with both segments expected to witness steady growth. In terms of end-user industries, Communication, Industrial, Consumer and Mobile, Automotive, and Transportation are anticipated to be the dominant segments, followed by Lighting and other niche applications. Key players like Delta Electronics Inc., Lite-On Technology Corporation, Emerson Electric Co., Siemens AG, and TDK-Lambda Corporation are actively innovating to capture market share through product development and strategic expansions, particularly in regions like Asia, which is expected to lead in market size and growth due to its manufacturing prowess and rapidly expanding end-user industries.

Dynamic SEO-Optimized Report Description: Power Supply Devices Market (2019–2033)

Unlock critical insights into the Power Supply Devices Market, a rapidly evolving sector projected to reach a valuation of $xx Billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of x.x% from 2025 to 2033. This comprehensive report delves deep into the market's structure, trends, opportunities, and competitive landscape, providing actionable intelligence for stakeholders. Leveraging high-volume keywords such as "power supply market," "AC-DC power supplies," "DC-DC converters," "industrial power supplies," "automotive power solutions," and "communication power systems," this analysis is meticulously crafted to enhance search visibility and engage industry professionals. Our study period spans from 2019 to 2033, with the base year at 2025, offering a robust historical context and forward-looking projections. Discover the latest industry developments, dominant market segments, and key players driving innovation.

Power Supply Devices Market Market Structure & Competitive Landscape

The Power Supply Devices Market is characterized by a moderate to high level of concentration, with a few dominant players accounting for a significant portion of the market share. Innovation drivers are primarily fueled by the relentless demand for higher efficiency, miniaturization, and intelligent power management solutions across various end-user industries. Regulatory impacts, such as energy efficiency standards and safety certifications, play a crucial role in shaping product development and market entry. Product substitutes, while present in the form of alternative energy storage or conversion technologies, have not significantly eroded the core demand for power supply devices.

Key aspects of the market structure include:

- Market Concentration: Dominated by a mix of large, established multinational corporations and specialized niche manufacturers. Concentration ratios are expected to remain moderately high due to the capital-intensive nature of production and R&D.

- Innovation Drivers:

- Demand for increased power density and reduced form factors.

- Advancements in Wide Bandgap (WBG) semiconductors (SiC, GaN) for improved efficiency and performance.

- Integration of IoT and AI for smart power management and predictive maintenance.

- Growing adoption of renewable energy sources requiring robust grid-tie and off-grid power solutions.

- Regulatory Impacts: Stringent energy efficiency mandates (e.g., DOE, EuP) and safety standards (e.g., IEC, UL) necessitate continuous product upgrades and compliance efforts.

- Product Substitutes: While direct substitutes are limited, emerging energy harvesting technologies and advanced battery chemistries could influence specific application segments in the long term.

- End-user Segmentation: The market is highly diversified, with Communication, Industrial, and Automotive sectors exhibiting the highest demand.

- Mergers & Acquisitions (M&A) Trends: M&A activities are expected to continue as companies seek to expand their product portfolios, gain market access, and acquire technological capabilities. In recent years, M&A volumes have been substantial, indicating consolidation and strategic realignment within the industry.

Power Supply Devices Market Market Trends & Opportunities

The Power Supply Devices Market is experiencing robust growth, driven by a confluence of technological advancements, increasing end-user demand, and expanding application areas. The global market size is projected to witness significant expansion, fueled by a projected CAGR of x.x% during the forecast period of 2025–2033. This growth trajectory is underpinned by several key trends. Firstly, the escalating demand for energy efficiency is a primary catalyst, compelling manufacturers to develop more advanced AC-DC power supplies and DC-DC converters that minimize energy loss. This trend is further amplified by stringent government regulations and corporate sustainability initiatives across the globe.

Technological shifts are profoundly reshaping the market. The widespread adoption of Wide Bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), is enabling the development of smaller, lighter, and more efficient power supplies. These materials facilitate higher switching frequencies and operating temperatures, leading to substantial improvements in power density and reduced cooling requirements. Furthermore, the integration of digital control and communication features within power supply devices is becoming increasingly prevalent. This allows for intelligent power management, remote monitoring, and seamless integration into complex systems, particularly within the Industrial Internet of Things (IIoT) and smart grid applications.

Consumer preferences are also evolving, with a growing emphasis on reliable, long-lasting, and safe power solutions. In the consumer electronics and mobile segments, there is a continuous drive for compact and fast-charging power adapters. For automotive applications, the shift towards electric vehicles (EVs) has created immense opportunities for high-voltage DC-DC converters and onboard charging solutions. The transportation sector, including railways and aerospace, also presents significant growth potential due to the need for ruggedized and highly reliable power systems.

The competitive dynamics within the Power Supply Devices Market are intensifying. Key players are investing heavily in research and development to stay ahead of the innovation curve and capture market share. Strategic partnerships, collaborations, and acquisitions are common strategies employed by companies to broaden their technological capabilities and market reach. The increasing complexity of power management in modern electronic devices and systems creates a fertile ground for specialized power supply solutions, offering opportunities for companies to differentiate themselves through niche expertise and customized offerings.

Moreover, the burgeoning demand for renewable energy integration, such as solar and wind power, requires sophisticated power conversion and management systems. This opens up new avenues for power supply manufacturers to develop grid-tie inverters, energy storage solutions, and microgrid power management systems. The expansion of data centers, driven by the growth of cloud computing and big data, also necessitates high-efficiency, high-density power supplies to meet their immense energy demands.

In summary, the Power Supply Devices Market is poised for substantial growth, driven by energy efficiency mandates, technological breakthroughs, evolving consumer needs, and the increasing electrification across multiple industries. Opportunities abound for companies that can deliver innovative, reliable, and sustainable power solutions.

Dominant Markets & Segments in Power Supply Devices Market

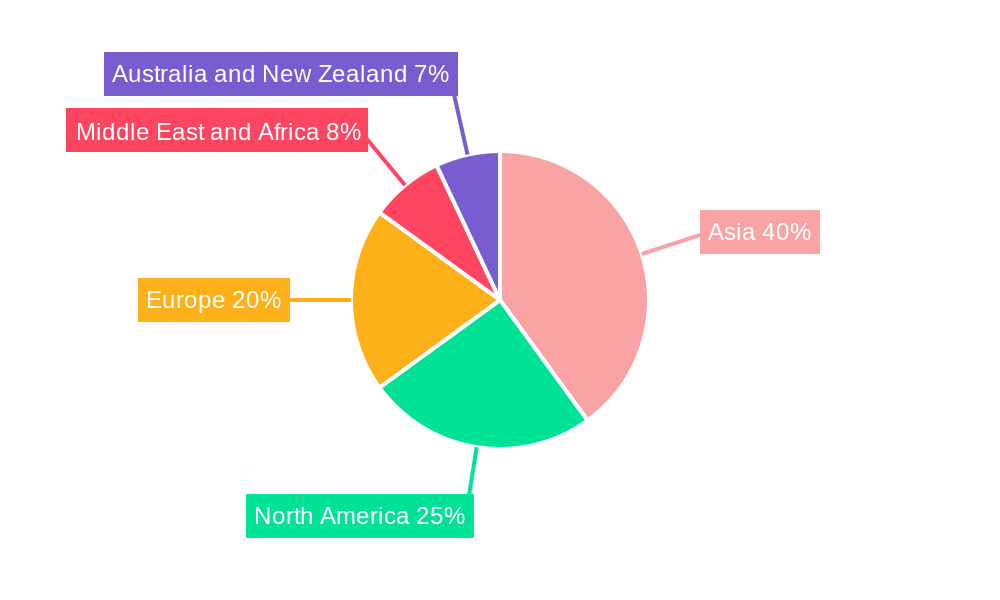

The Power Supply Devices Market exhibits significant dominance across various regions and end-user industries, driven by distinct growth catalysts.

Dominant Regions and Countries:

- Asia Pacific: This region stands out as the largest and fastest-growing market for power supply devices. Key growth drivers include:

- Robust Manufacturing Hub: The concentration of electronics manufacturing in countries like China, South Korea, and Taiwan fuels substantial demand for power supplies across diverse industries.

- Infrastructure Development: Significant investments in telecommunications, industrial automation, and renewable energy projects, particularly in China and India, are major contributors.

- Growing Consumer Electronics Market: Rising disposable incomes and a large consumer base in countries like India and Southeast Asian nations drive demand for consumer power solutions.

- North America: A mature yet significant market, driven by:

- Technological Innovation: The presence of leading technology companies in the US fosters demand for advanced power solutions in data centers, communications, and automotive sectors.

- Government Initiatives: Policies supporting renewable energy and grid modernization contribute to market growth.

- Automotive Sector: The increasing adoption of electric vehicles and advanced driver-assistance systems (ADAS) boosts demand for specialized automotive power supplies.

- Europe: This region demonstrates consistent growth due to:

- Stringent Energy Efficiency Regulations: High energy efficiency standards imposed by the European Union (EU) drive the adoption of advanced power supply technologies.

- Industrial Automation and Smart Manufacturing: The widespread implementation of Industry 4.0 initiatives fuels demand for industrial power supplies.

- Automotive Industry: A strong automotive manufacturing base and a push towards electrification are key growth factors.

Dominant Segments by Device Type:

- AC-DC Power Supplies: This segment holds the largest market share and is expected to continue its dominance.

- Key Growth Drivers:

- Ubiquitous use in virtually all electronic devices, from consumer gadgets to industrial machinery.

- Demand for higher efficiency and compact designs in an era of increasing power consumption.

- Evolution of charging technologies for consumer electronics and electric vehicles.

- Key Growth Drivers:

- DC-DC Converters: This segment is experiencing rapid growth, particularly driven by:

- Increased Complexity in Electronic Systems: Multi-voltage requirements within single devices necessitate efficient DC-DC conversion.

- Automotive Electrification: Critical for managing power distribution in EVs and hybrid vehicles.

- Renewable Energy Systems: Essential for voltage regulation and power conditioning in solar and wind installations.

Dominant Segments by End-user Industry:

- Communication: This sector is a major consumer of power supply devices, driven by:

- 5G Network Deployment: The rollout of 5G infrastructure requires a vast number of high-reliability power supplies for base stations and network equipment.

- Data Centers: The exponential growth of data centers necessitates massive power infrastructure, including AC-DC power supplies and DC-DC converters.

- Telecommunications Equipment: Continuous innovation in networking hardware fuels demand for advanced power solutions.

- Industrial: This segment is a consistent and significant contributor to market growth due to:

- Automation and Robotics: The increasing adoption of automation in manufacturing processes requires robust and efficient industrial power supplies.

- Factory Modernization (Industry 4.0): Smart factories and interconnected systems demand reliable power for sensors, control units, and machinery.

- Renewable Energy Integration: Power supplies are critical for grid-tie inverters and energy storage systems in industrial settings.

- Automotive: This segment is experiencing the most dynamic growth due to:

- Electric Vehicle (EV) Revolution: On-board chargers, battery management systems, and powertrain control units all rely on specialized DC-DC converters and AC-DC power supplies.

- Advanced Driver-Assistance Systems (ADAS): The increasing complexity of ADAS features requires sophisticated power management for numerous sensors and processors.

- Infotainment Systems: Growing demand for advanced in-car entertainment and connectivity features.

The interplay of these regional and segmental dynamics, coupled with continuous technological innovation, shapes the overall trajectory and opportunities within the global Power Supply Devices Market.

Power Supply Devices Market Product Analysis

The Power Supply Devices Market is defined by a continuous stream of product innovations aimed at enhancing efficiency, miniaturization, and intelligent functionality. Key advancements include the integration of Wide Bandgap (WBG) semiconductors like GaN and SiC, enabling smaller form factors and higher power densities, crucial for applications in consumer electronics and electric vehicles. The development of conduction-cooled power modules, such as Vox Power's VCCR300 Series, caters to rugged environments like railways by offering silent, reliable power delivery. Furthermore, ultra-wide input voltage DC-DC converters, exemplified by Mean Well's RQB60W12 series, are crucial for ensuring stable operation across variable input conditions, especially in transportation sectors. These innovations translate into competitive advantages by offering improved performance, reliability, and reduced operational costs for end-users across diverse industries.

Key Drivers, Barriers & Challenges in Power Supply Devices Market

Key Drivers:

The Power Supply Devices Market is propelled by several powerful forces. Technologically, the widespread adoption of Wide Bandgap (WBG) semiconductors (SiC and GaN) is enabling higher efficiency and power density. Economically, the burgeoning demand for electric vehicles, the expansion of data centers, and the push for industrial automation are creating substantial market opportunities. Policy-driven factors, such as stringent energy efficiency regulations and government incentives for renewable energy, further stimulate the demand for advanced power solutions.

Barriers & Challenges:

Despite the strong growth trajectory, the market faces significant challenges. Supply chain issues, including the availability of critical components and geopolitical disruptions, can lead to increased lead times and costs. Regulatory hurdles, such as evolving safety standards and import/export complexities across different regions, require constant adaptation. Competitive pressures are intense, with numerous players vying for market share, leading to price sensitivity in certain segments. The high cost of R&D for cutting-edge technologies like WBG semiconductors can also act as a barrier for smaller companies.

Growth Drivers in the Power Supply Devices Market Market

The Power Supply Devices Market is experiencing significant growth due to a combination of technological advancements, economic trends, and policy initiatives. Technologically, the increasing integration of Wide Bandgap (WBG) semiconductors (SiC and GaN) is a major driver, enabling the development of more efficient, compact, and higher-performance power supplies. Economically, the global surge in electric vehicle (EV) adoption is creating a massive demand for specialized automotive power solutions, including onboard chargers and DC-DC converters. The relentless expansion of data centers and the increasing adoption of industrial automation further fuel the need for reliable and efficient power infrastructure. Policy-driven factors, such as stringent energy efficiency standards and government support for renewable energy deployment, are also critical growth catalysts, compelling manufacturers to innovate and meet evolving regulatory requirements.

Challenges Impacting Power Supply Devices Market Growth

The Power Supply Devices Market is not without its obstacles. Regulatory complexities, including ever-evolving energy efficiency standards and safety certifications across diverse global markets, pose a continuous challenge for manufacturers requiring significant compliance efforts. Supply chain issues, exacerbated by geopolitical tensions and the scarcity of key components, can lead to extended lead times, increased costs, and production delays. Competitive pressures are immense, with a fragmented market landscape and intense price competition in certain segments, particularly for commoditized products. Furthermore, the substantial investment required for research and development of advanced technologies like Wide Bandgap (WBG) semiconductors can present a barrier to entry and growth for smaller players.

Key Players Shaping the Power Supply Devices Market Market

- Delta Electronics Inc

- Lite-On Technology Corporation

- Emerson Electric Co

- Siemens AG

- Salcomp PLC

- Acbel Polytech Inc

- Mean Well Enterprises Co Ltd

- Murata Manufacturing Co Ltd

- TDK-Lambda Corporation (TDK Corporation)

Significant Power Supply Devices Market Industry Milestones

- November 2023: Vox Power announced the introduction of the VCCR300 Conduction Cooled Power Series, a robust, rugged, and highly reliable DC/DC power supply capable of silently delivering 300 Watts of power. The VCCR300 Series provides a wider DC input voltage range, including the standard 48V, 72V, 96V, and 110V railway battery requirements as outlined in EN50155. This development underscores the increasing demand for specialized power solutions in the transportation sector.

- October 2023: Mean Well Enterprises Co. Ltd introduced the RQB60W12 series in ultra-wide input railway DC-DC converter. The main features include 14~160Vdc ultra-wide voltage input that can cover the mainstream nominal voltages of global railway systems (24/36/48/72/96/110Vdc), operate under extreme environments of -40~+90℃, an external capacitor can be added to ensure the hold-up time would last for 10~30 ms. In contrast, the DC input is temporarily unstable, 2KVac/3KVdc high isolation withstand voltage, complete protections, etc. This launch highlights the industry's focus on ruggedized and versatile power solutions for harsh operating conditions.

Future Outlook for Power Supply Devices Market Market

The future outlook for the Power Supply Devices Market is exceptionally bright, fueled by sustained innovation and expanding applications. Strategic opportunities lie in the continued development and adoption of Wide Bandgap (WBG) semiconductor technologies, promising even higher efficiencies and power densities. The escalating global shift towards electric vehicles presents a significant growth catalyst, demanding advanced and specialized power management solutions. Furthermore, the expansion of 5G networks and the continuous growth of data centers will require an ongoing supply of high-performance and reliable power infrastructure. The increasing emphasis on sustainability and energy efficiency globally will continue to drive demand for greener power supply solutions. Market potential remains high for companies that can offer intelligent, compact, and cost-effective power conversion and management technologies across all key end-user segments.

Power Supply Devices Market Segmentation

-

1. Device Type

- 1.1. AC-DC Power Supplies

- 1.2. DC-DC Converters

-

2. End-user Industry

- 2.1. Communication

- 2.2. Industrial

- 2.3. Consumer and Mobile

- 2.4. Automotive

- 2.5. Transportation

- 2.6. Lighting

- 2.7. Other End-user Industries

Power Supply Devices Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

Power Supply Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Home and Building Automation Systems; Increasing Demand for Energy-efficient Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Compliance and Safety Standards

- 3.4. Market Trends

- 3.4.1. Consumer and Mobile Segment to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. AC-DC Power Supplies

- 5.1.2. DC-DC Converters

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Communication

- 5.2.2. Industrial

- 5.2.3. Consumer and Mobile

- 5.2.4. Automotive

- 5.2.5. Transportation

- 5.2.6. Lighting

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Americas Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. AC-DC Power Supplies

- 6.1.2. DC-DC Converters

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Communication

- 6.2.2. Industrial

- 6.2.3. Consumer and Mobile

- 6.2.4. Automotive

- 6.2.5. Transportation

- 6.2.6. Lighting

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. AC-DC Power Supplies

- 7.1.2. DC-DC Converters

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Communication

- 7.2.2. Industrial

- 7.2.3. Consumer and Mobile

- 7.2.4. Automotive

- 7.2.5. Transportation

- 7.2.6. Lighting

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. AC-DC Power Supplies

- 8.1.2. DC-DC Converters

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Communication

- 8.2.2. Industrial

- 8.2.3. Consumer and Mobile

- 8.2.4. Automotive

- 8.2.5. Transportation

- 8.2.6. Lighting

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Australia and New Zealand Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. AC-DC Power Supplies

- 9.1.2. DC-DC Converters

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Communication

- 9.2.2. Industrial

- 9.2.3. Consumer and Mobile

- 9.2.4. Automotive

- 9.2.5. Transportation

- 9.2.6. Lighting

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Middle East and Africa Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. AC-DC Power Supplies

- 10.1.2. DC-DC Converters

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Communication

- 10.2.2. Industrial

- 10.2.3. Consumer and Mobile

- 10.2.4. Automotive

- 10.2.5. Transportation

- 10.2.6. Lighting

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Americas Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Australia and New Zealand Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Delta Electronics Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lite-On Technology Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Emerson Electric Co

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Siemens AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Salcomp PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Acbel Polytech Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Mean Well Enterprises Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Murata Manufacturing Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 TDK-Lambda Corporation (TDK Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Delta Electronics Inc

List of Figures

- Figure 1: Global Power Supply Devices Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Power Supply Devices Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: Americas Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 4: Americas Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: Americas Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Americas Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Australia and New Zealand Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Australia and New Zealand Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Middle East and Africa Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 20: Middle East and Africa Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: Middle East and Africa Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East and Africa Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Americas Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 24: Americas Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 25: Americas Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 26: Americas Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 27: Americas Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 28: Americas Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 29: Americas Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Americas Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 31: Americas Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Americas Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 33: Americas Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Americas Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 36: Europe Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 37: Europe Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 38: Europe Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 39: Europe Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 40: Europe Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 41: Europe Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Europe Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 43: Europe Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 48: Asia Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 49: Asia Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 50: Asia Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 51: Asia Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 52: Asia Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 53: Asia Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 54: Asia Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 55: Asia Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 59: Australia and New Zealand Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 60: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 61: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 62: Australia and New Zealand Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 63: Australia and New Zealand Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 64: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 65: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 66: Australia and New Zealand Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 67: Australia and New Zealand Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 68: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 69: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: Australia and New Zealand Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 72: Middle East and Africa Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 73: Middle East and Africa Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 74: Middle East and Africa Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 75: Middle East and Africa Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 76: Middle East and Africa Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 77: Middle East and Africa Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 78: Middle East and Africa Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 79: Middle East and Africa Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Middle East and Africa Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 81: Middle East and Africa Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Middle East and Africa Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Power Supply Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Power Supply Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 5: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: Global Power Supply Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Power Supply Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 30: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 31: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 33: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 36: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 37: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 39: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 42: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 43: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 44: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 45: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 48: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 49: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 50: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 51: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 54: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 55: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 56: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 57: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Supply Devices Market?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Power Supply Devices Market?

Key companies in the market include Delta Electronics Inc, Lite-On Technology Corporation, Emerson Electric Co, Siemens AG, Salcomp PLC, Acbel Polytech Inc, Mean Well Enterprises Co Ltd, Murata Manufacturing Co Ltd, TDK-Lambda Corporation (TDK Corporation.

3. What are the main segments of the Power Supply Devices Market?

The market segments include Device Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Home and Building Automation Systems; Increasing Demand for Energy-efficient Devices.

6. What are the notable trends driving market growth?

Consumer and Mobile Segment to Witness Major Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Compliance and Safety Standards.

8. Can you provide examples of recent developments in the market?

November 2023: Vox Power announced the introduction of the VCCR300 Conduction Cooled Power Series, a robust, rugged, and highly reliable DC/DC power supply capable of silently delivering 300 Watts of power. The VCCR300 Series provides a wider DC input voltage range, including the standard 48V, 72V, 96V, and 110V railway battery requirements as outlined in EN50155.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Supply Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Supply Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Supply Devices Market?

To stay informed about further developments, trends, and reports in the Power Supply Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence