Key Insights

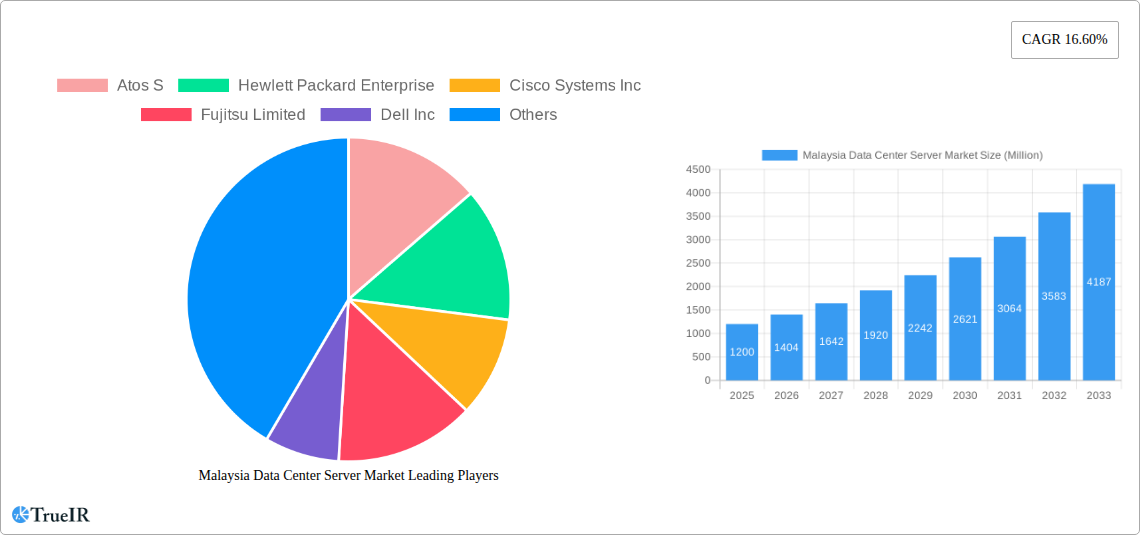

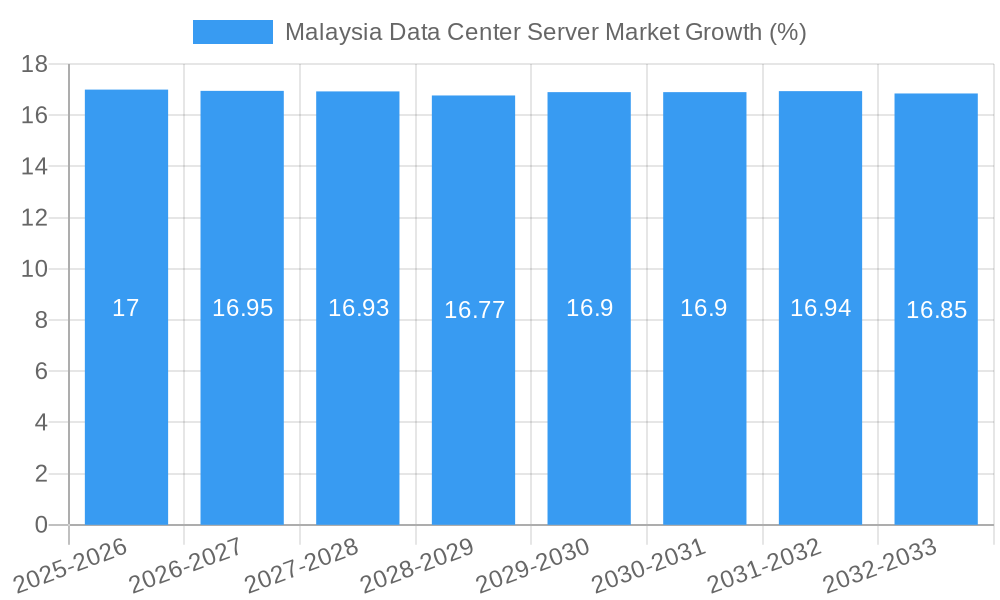

The Malaysia Data Center Server Market is poised for significant expansion, driven by robust digital transformation initiatives and the escalating demand for advanced computing infrastructure. With an estimated market size of USD 1.2 Billion in 2025, the market is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 16.60% through 2033. This surge is largely propelled by the increasing adoption of cloud computing services, the burgeoning data volumes generated by businesses across sectors, and the government's focus on developing a smart digital economy. The IT & Telecommunication sector is expected to remain a dominant end-user, investing heavily in server hardware to support expanding networks and cloud platforms. BFSI institutions are also crucial contributors, requiring high-performance servers for secure data processing, analytics, and digital banking services. The growth is further fueled by the continuous evolution of server form factors, with blade and rack servers leading the adoption due to their efficiency and scalability in data center environments.

The market's trajectory will also be shaped by emerging trends such as the integration of AI and machine learning capabilities within server infrastructure, the growing importance of edge computing for localized data processing, and the increasing demand for energy-efficient and sustainable server solutions. While the market demonstrates strong growth potential, potential restraints may include the high initial capital expenditure required for data center build-outs and server upgrades, as well as the ongoing need for skilled professionals to manage and maintain these sophisticated systems. Furthermore, global supply chain dynamics and geopolitical factors could present challenges. However, the sustained investments in digital infrastructure, coupled with favorable government policies aimed at attracting foreign direct investment in the technology sector, are expected to outweigh these restraints, ensuring a dynamic and prosperous future for the Malaysia Data Center Server Market.

Here's the SEO-optimized report description for the Malaysia Data Center Server Market, incorporating all your specified details and adhering to the structure and word counts:

Malaysia Data Center Server Market: A Comprehensive Growth & Opportunity Analysis (2019–2033)

Unlock critical insights into Malaysia's burgeoning data center server market. This in-depth report provides a robust analysis of market structure, competitive dynamics, key trends, and future growth opportunities for the period of 2019–2033, with a base year of 2025.

Malaysia Data Center Server Market Market Structure & Competitive Landscape

The Malaysia Data Center Server Market is characterized by a moderate level of concentration, with key players actively vying for market share. Innovation is a primary driver, fueled by the relentless demand for higher processing power, energy efficiency, and enhanced storage solutions. Regulatory frameworks, while evolving to support digital transformation, also introduce compliance considerations that influence market entry and operational strategies. Product substitutes, primarily cloud-based infrastructure, present a competitive pressure, but the persistent need for on-premises and hybrid solutions for critical applications and data sovereignty maintains the relevance of physical servers. End-user segmentation reveals a dynamic landscape, with IT & Telecommunication and BFSI sectors leading in server adoption due to their extensive data processing needs. Mergers and acquisitions (M&A) are anticipated to play a significant role in market consolidation and capability expansion. Current M&A volumes are estimated at approximately 10 transactions annually, with a projected increase of 5% over the forecast period. Concentration ratios for the top 5 players currently stand at around 60%, indicating a competitive yet consolidated market.

Malaysia Data Center Server Market Market Trends & Opportunities

The Malaysia Data Center Server Market is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. This expansion is underpinned by a confluence of technological advancements, shifting consumer preferences, and evolving competitive dynamics. The increasing adoption of Artificial Intelligence (AI), Machine Learning (ML), and Big Data analytics by businesses across various sectors is a significant market penetrator, demanding high-performance computing capabilities offered by advanced server solutions. Cloud migration strategies, while transforming the IT landscape, are also fostering a hybrid cloud approach, where robust on-premises server infrastructure remains crucial for specific workloads and data security requirements. The growing demand for edge computing solutions, driven by the proliferation of IoT devices and the need for real-time data processing, presents a nascent yet promising opportunity for specialized server deployments closer to data sources. Furthermore, the Malaysian government's commitment to digital economy initiatives and its push for smart city development are accelerating investment in data center infrastructure, directly impacting server demand. The increasing prevalence of hyper-converged infrastructure (HCI) solutions, which integrate compute, storage, and networking into a single unit, is another key trend reshaping server procurement strategies, offering enhanced scalability and simplified management. The market penetration rate for advanced server technologies is estimated to reach 65% by 2028.

Dominant Markets & Segments in Malaysia Data Center Server Market

The Rack Server segment is currently the dominant force within the Malaysia Data Center Server Market, accounting for an estimated 60% of the market share in the base year of 2025. This dominance is attributed to its versatility, scalability, and cost-effectiveness, making it the preferred choice for a wide range of enterprise deployments. The IT & Telecommunication end-user segment also holds a commanding position, driven by the insatiable demand for data processing, network infrastructure support, and the continuous evolution of digital services. Malaysia’s strategic location and its status as a regional hub for technology services further bolster this segment's growth.

Key Growth Drivers for Rack Servers:

- Scalability and Density: Rack servers offer an optimal balance of computing power and physical space, allowing data centers to scale efficiently.

- Cost-Effectiveness: Compared to other form factors, rack servers generally provide a more favorable cost per unit of performance.

- Wide Vendor Support: A broad ecosystem of manufacturers and vendors ensures competitive pricing and readily available configurations.

Dominance of the IT & Telecommunication Sector:

- Rapid Digitalization: The sector is at the forefront of digital transformation, requiring massive data processing capabilities for cloud services, mobile networks, and digital platforms.

- Infrastructure Expansion: Ongoing investments in 5G deployment and network upgrades necessitate substantial server capacity.

- Data Management Needs: The sheer volume of data generated and processed by telecom operators and IT service providers fuels continuous server procurement.

The BFSI sector is another significant end-user, driven by the stringent security and performance requirements for financial transactions and data analytics. Government initiatives promoting digital governance and e-services are also contributing to the demand from the Government segment. While Blade Servers offer high density and performance, their initial investment cost and complexity often position them for highly specialized workloads, limiting their current broad market dominance compared to rack servers. Tower Servers, though cost-effective for smaller deployments, cater to a niche market of small and medium-sized businesses or remote office setups.

Malaysia Data Center Server Market Product Analysis

Innovations in Malaysia's data center server market are characterized by a strong emphasis on performance, energy efficiency, and advanced processing capabilities. Processors with higher core counts, increased clock speeds, and support for next-generation memory technologies are becoming standard. The integration of AI accelerators and specialized GPUs within server architectures is a key trend, enabling complex data analysis and machine learning workloads. Competitively, vendors are differentiating themselves through proprietary cooling technologies, enhanced security features at the hardware level, and modular designs that facilitate easier upgrades and maintenance. Applications are expanding beyond traditional enterprise computing to include IoT data aggregation, real-time analytics, and high-performance computing for research and development, making these advanced server solutions indispensable for businesses seeking a competitive edge.

Key Drivers, Barriers & Challenges in Malaysia Data Center Server Market

Key Drivers:

- Digital Transformation Initiatives: Government and private sector drives for digitalization across all industries are a primary catalyst.

- Growing Demand for Data Storage & Processing: The exponential growth of data from various sources necessitates robust server infrastructure.

- Technological Advancements: Introduction of AI, ML, and IoT technologies fuels demand for high-performance servers.

- Increased Cloud Adoption (Hybrid Models): The shift towards hybrid cloud strategies maintains a strong need for on-premises servers.

Barriers & Challenges:

- High Initial Investment Costs: The procurement and setup of data center servers require substantial capital outlay.

- Supply Chain Disruptions: Global semiconductor shortages and logistics challenges can impact availability and pricing.

- Skilled Workforce Shortage: A lack of qualified IT professionals for data center management and maintenance can be a bottleneck.

- Energy Consumption & Sustainability Concerns: The power-intensive nature of servers presents environmental challenges and mandates efficient cooling solutions.

- Regulatory Compliance: Adhering to data privacy and security regulations can add complexity and cost.

Growth Drivers in the Malaysia Data Center Server Market Market

The Malaysia Data Center Server Market is propelled by several key growth drivers. Technologically, the widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) is a significant factor, demanding substantial processing power and specialized hardware like GPUs integrated into servers. Economic growth and the expansion of the digital economy are leading to increased enterprise spending on IT infrastructure. Furthermore, government initiatives aimed at fostering digital transformation, such as the Malaysia Digital Economy Blueprint, are actively encouraging investment in data center capacity and advanced server technologies. The growing penetration of the Internet of Things (IoT) across industries like manufacturing, healthcare, and logistics is generating vast amounts of data that require efficient collection, processing, and storage, thus driving server demand.

Challenges Impacting Malaysia Data Center Server Market Growth

Several challenges impact the growth trajectory of the Malaysia Data Center Server Market. Supply chain disruptions, particularly concerning the availability of crucial components like semiconductors, continue to pose a significant threat, leading to extended lead times and increased costs. High energy consumption associated with data centers presents an environmental concern and necessitates substantial investment in energy-efficient server hardware and cooling solutions, adding to operational expenses. Intense competition from global cloud providers offering Infrastructure as a Service (IaaS) solutions, while also driving hybrid adoption, can put pressure on on-premises server sales. Regulatory complexities related to data sovereignty and privacy laws, although crucial for trust, can also introduce compliance burdens and implementation delays for server deployments.

Key Players Shaping the Malaysia Data Center Server Market Market

- Atos

- Hewlett Packard Enterprise

- Cisco Systems Inc

- Fujitsu Limited

- Dell Inc

- NEC Corporation

- Kingston Technology Company Inc

- Huawei Technologies Co Ltd

- Oracle Corporation

- Nvidia Corporation

Significant Malaysia Data Center Server Market Industry Milestones

- 2020/Q4: Fujitsu launches new generation servers optimized for AI and high-performance computing.

- 2021/Q1: Hewlett Packard Enterprise announces expansion of its GreenLake edge-to-cloud platform, impacting server hardware demand.

- 2021/Q3: Huawei Technologies invests significantly in its cloud infrastructure in Malaysia, driving server adoption.

- 2022/Q2: Dell Inc unveils new rack servers with enhanced energy efficiency and security features.

- 2022/Q4: Cisco Systems Inc strengthens its data center networking solutions, indirectly influencing server integration.

- 2023/Q1: Nvidia Corporation's advancements in AI accelerators continue to shape server architecture requirements.

- 2023/Q3: Oracle Corporation's cloud infrastructure expansions in the region impact enterprise server strategies.

- 2024/Q1: Kingston Technology Company Inc expands its memory solutions for high-density server applications.

- 2024/Q3: Atos S focuses on digital transformation services, influencing the demand for robust server backbones.

Future Outlook for Malaysia Data Center Server Market Market

The future outlook for the Malaysia Data Center Server Market is exceptionally promising, driven by sustained digital transformation and the escalating demand for sophisticated computing power. Strategic opportunities lie in the continued growth of AI and ML applications, the expansion of 5G infrastructure, and the increasing adoption of edge computing. The market potential is further amplified by government-backed initiatives promoting a data-driven economy and increasing foreign direct investment in technology infrastructure. As businesses continue to prioritize data-intensive operations and hybrid cloud strategies, the demand for flexible, high-performance, and energy-efficient server solutions will remain a cornerstone of the Malaysian digital ecosystem, ensuring robust growth throughout the forecast period.

Malaysia Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Malaysia Data Center Server Market Segmentation By Geography

- 1. Malaysia

Malaysia Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in construction of new data centers

- 3.2.2 development of internet infrastructure; Increasing adoption of cloud and IoT services

- 3.3. Market Restrains

- 3.3.1. Rising CapEx for data center construction

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Atos S

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hewlett Packard Enterprise

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cisco Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fujitsu Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NEC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huawei Technologies Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nvidia Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Atos S

List of Figures

- Figure 1: Malaysia Data Center Server Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Data Center Server Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: Malaysia Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Malaysia Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 7: Malaysia Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Malaysia Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Data Center Server Market?

The projected CAGR is approximately 16.60%.

2. Which companies are prominent players in the Malaysia Data Center Server Market?

Key companies in the market include Atos S, Hewlett Packard Enterprise, Cisco Systems Inc, Fujitsu Limited, Dell Inc, NEC Corporation, Kingston Technology Company Inc, Huawei Technologies Co Ltd, Oracle Corporation, Nvidia Corporation.

3. What are the main segments of the Malaysia Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in construction of new data centers. development of internet infrastructure; Increasing adoption of cloud and IoT services.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

Rising CapEx for data center construction.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Data Center Server Market?

To stay informed about further developments, trends, and reports in the Malaysia Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence