Key Insights

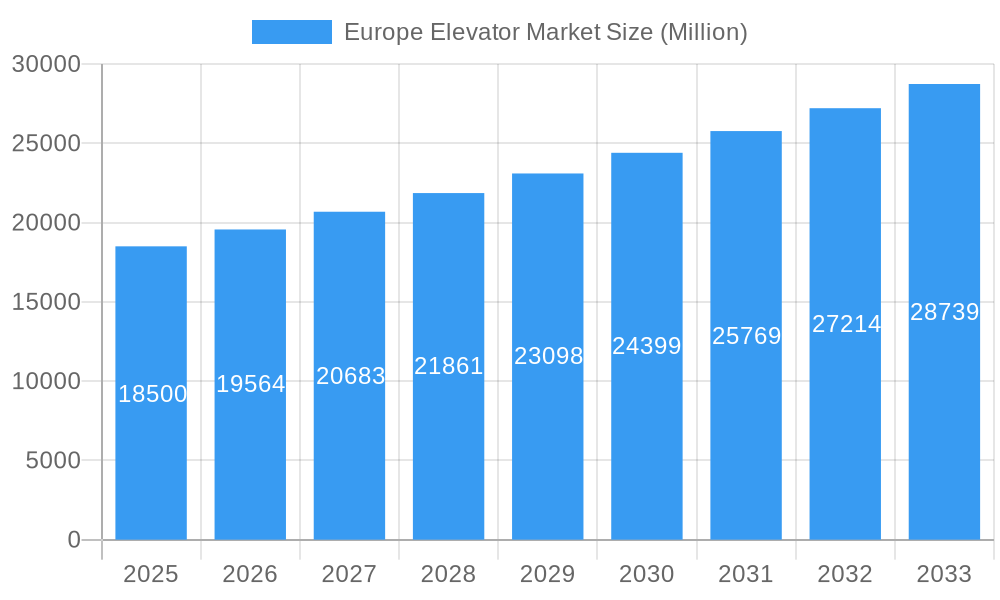

The European elevator market is projected for substantial growth, with an estimated market size of $25,188.3 million by 2024, driven by a Compound Annual Growth Rate (CAGR) of 6.4%. Key growth catalysts include the increasing demand for accessibility solutions due to an aging population, growing adoption of vertical transportation in multi-story buildings, and significant investments in infrastructure and urban regeneration across Europe. The residential sector is a primary driver, with a rising trend in installing elevators and stairlifts for enhanced home accessibility. The healthcare sector's need for efficient patient and staff movement, coupled with modernization initiatives for existing buildings, also underpins this positive market outlook.

Europe Elevator Market Market Size (In Billion)

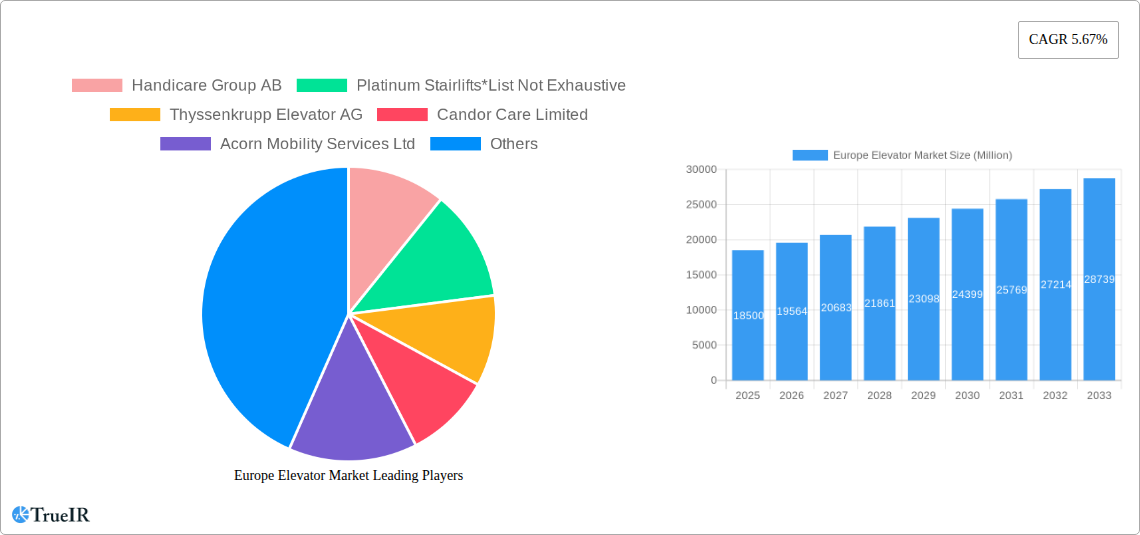

Market segmentation highlights diverse applications and user-centric designs. Straight and curved rail options accommodate various architectural requirements, while seated, standing, and integrated user orientations prioritize comfort and diverse mobility needs. Indoor and outdoor installation capabilities demonstrate system versatility. Beyond residential and healthcare, "Other Applications" likely include commercial spaces, public transport hubs, and industrial settings. Leading companies such as Thyssenkrupp Elevator AG and Handicare Group AB are at the forefront of innovation. Europe, particularly the UK, Germany, and France, represents a mature yet opportunity-rich market for elevators and stairlifts.

Europe Elevator Market Company Market Share

Europe Elevator Market Analysis: Size, Trends, and Future Projections

This comprehensive report offers a dynamic and SEO-optimized analysis of the Europe Elevator Market. It covers the historical period from 2019 to 2024 and forecasts growth from 2025 to 2033, with 2024 as the base year. The analysis includes market structure, competitive landscape, evolving trends, dominant segments, product innovations, key drivers, barriers, challenges, and a detailed future outlook.

Europe Elevator Market Market Structure & Competitive Landscape

The Europe Elevator Market exhibits a moderately consolidated structure, with key players actively engaged in innovation and strategic expansions. Concentration ratios are influenced by the presence of global giants and specialized regional manufacturers. Innovation drivers include advancements in smart technology integration, energy efficiency, and enhanced safety features, pushing the market towards sophisticated elevator solutions. Regulatory impacts, such as stringent building codes and accessibility mandates across European nations, are shaping product development and installation practices, ensuring compliance and driving demand for compliant vertical transportation systems. Product substitutes, while limited in core functionality, include alternative mobility solutions like ramps and personal elevators for very specific niche applications. End-user segmentation is diverse, with residential, healthcare, and commercial sectors representing significant demand drivers. Merger and acquisition (M&A) trends indicate a strategic consolidation by larger entities to expand their market reach, technological capabilities, and service portfolios. For instance, the past few years have seen strategic acquisitions aimed at bolstering offerings in stairlift segments, contributing to a market value estimated to reach xx Million by 2025. The competitive landscape is characterized by a blend of established multinational corporations and agile, specialized providers catering to distinct market needs, with an estimated xx Million in M&A activities observed in the historical period.

Europe Elevator Market Market Trends & Opportunities

The Europe Elevator Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated market size of xx Million by the end of the forecast period. This upward trajectory is fueled by a confluence of significant market trends and emerging opportunities. An increasing emphasis on accessible infrastructure across residential and public spaces, driven by aging demographics and evolving accessibility legislation, is a primary catalyst. This trend is particularly pronounced in urban centers and healthcare facilities, where the demand for reliable and user-friendly vertical transportation solutions is paramount.

Technological shifts are revolutionizing the elevator landscape. The integration of the Internet of Things (IoT) is leading to the development of "smart elevators" that offer predictive maintenance, remote monitoring, and enhanced passenger experience through personalized controls and connectivity. Artificial intelligence (AI) is further optimizing elevator operations, improving energy efficiency, and reducing wait times. The rise of the "smart building" concept, where elevators are seamlessly integrated into broader building management systems, presents a significant opportunity for manufacturers to offer comprehensive solutions.

Consumer preferences are increasingly leaning towards elevators that are not only functional but also aesthetically pleasing, energy-efficient, and customizable to match interior designs. There is a growing demand for compact and adaptable elevator solutions, particularly in older buildings undergoing refurbishment where space is a constraint. The "new-build" residential sector is also a strong contributor, with developers incorporating modern elevator systems as standard features.

Competitive dynamics are intensifying, with companies focusing on differentiated product offerings, superior customer service, and strategic partnerships. The aftermarket services segment, including maintenance, repair, and modernization, represents a substantial and growing revenue stream, offering recurring business opportunities. Furthermore, the increasing focus on sustainability is driving demand for energy-efficient elevators that minimize environmental impact. Opportunities also lie in developing specialized elevator solutions for niche applications, such as material handling in industrial settings or high-speed elevators for skyscrapers, as the urban landscape continues to evolve and vertical expansion becomes more prevalent. The estimated market penetration rate for modern elevator systems in new constructions is expected to reach xx% by 2025, indicating a strong underlying demand.

Dominant Markets & Segments in Europe Elevator Market

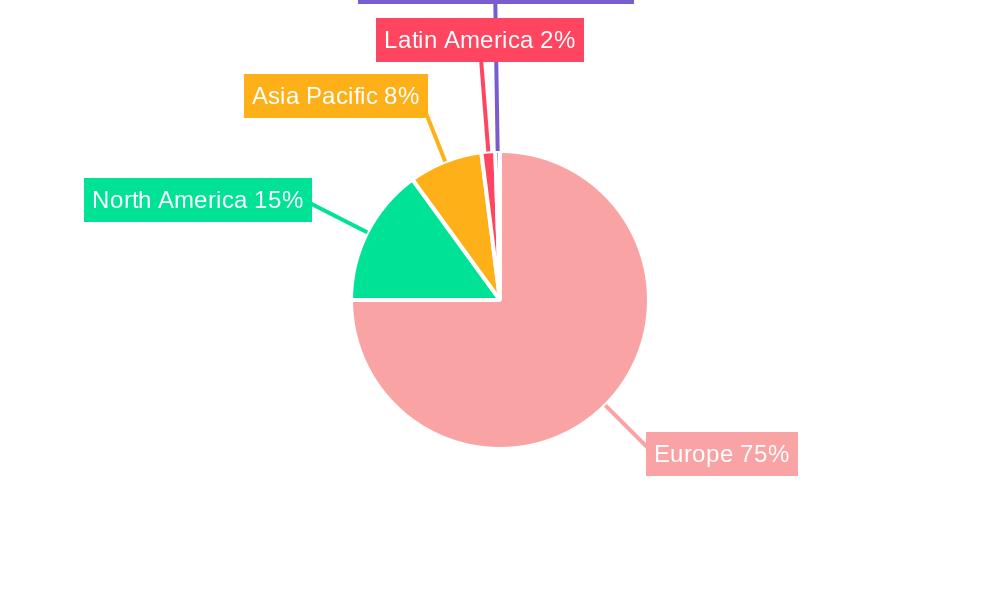

The Europe Elevator Market is characterized by significant dominance within specific regions and segments, driven by a combination of demographic, economic, and regulatory factors. Geographically, Germany consistently emerges as a leading market due to its robust industrial base, high density of aging infrastructure, and stringent building regulations that mandate accessibility upgrades. The United Kingdom follows closely, driven by a growing demand for residential elevators and stairlifts, particularly in the private sector, coupled with active government initiatives promoting independent living for the elderly. Other significant markets include France, Italy, and Spain, each contributing to the overall market value through their respective construction activities and accessibility improvement programs.

Within the Rail Orientation segment, Straight rails dominate the market, primarily due to their widespread application in standard residential and commercial buildings. However, the demand for Curved elevators is steadily increasing, particularly in historical buildings and complex architectural designs where straight installations are not feasible. This segment is expected to witness a higher CAGR.

In terms of User Orientation, Seated elevators, commonly known as stairlifts, represent a substantial and rapidly growing segment, driven by the aging population and the need for enhanced mobility and independent living. Standing elevators are prevalent in commercial and high-rise residential buildings, while Integrated solutions, often found in luxury residences and specialized applications, cater to specific design and functional requirements.

The Installation segment sees Indoor installations comprising the larger share of the market, owing to the majority of elevator systems being integrated within buildings. However, the Outdoor installation segment is experiencing significant growth, fueled by demand for external elevators in public spaces, multi-story car parks, and for improved access to existing buildings.

The Application segment is led by Residential use, driven by new construction, home renovations, and an increasing focus on aging-in-place solutions. The Healthcare sector represents another critical and expanding application, with a constant need for reliable and accessible elevators in hospitals, clinics, and care homes to facilitate patient and staff movement. Other Applications, including commercial buildings, public transportation hubs, and industrial facilities, also contribute significantly to market demand. Key growth drivers across these segments include government investments in infrastructure development, policies promoting universal design and accessibility, and a rising disposable income enabling individuals to invest in mobility solutions. The forecast period is expected to see a substantial increase in the adoption of smart and energy-efficient elevator technologies within all application segments, with an estimated xx Million in new installations projected for the residential sector alone by 2028.

Europe Elevator Market Product Analysis

The Europe Elevator Market is characterized by continuous product innovation aimed at enhancing safety, efficiency, and user experience. Key product developments include the integration of advanced sensor technologies for predictive maintenance, reducing downtime and operational costs. Smart elevators, equipped with IoT capabilities, offer remote monitoring and diagnostics, enabling manufacturers and service providers to offer proactive support. Energy-efficient designs, such as regenerative drives and LED lighting, are becoming standard, aligning with growing environmental consciousness and regulatory mandates for sustainable building practices. Furthermore, the market is witnessing a rise in modular and customizable elevator solutions, catering to diverse architectural requirements and aesthetic preferences. Competitive advantages are increasingly derived from a blend of technological sophistication, reliable performance, adherence to stringent safety standards, and comprehensive after-sales service. This focus on innovation ensures that elevator products are not only functional but also contribute to the overall value and sustainability of the buildings they serve.

Key Drivers, Barriers & Challenges in Europe Elevator Market

The Europe Elevator Market is propelled by several key drivers. Technologically, the integration of IoT and AI is leading to smarter, more efficient, and safer elevator systems. Economically, growing urbanization, infrastructure development projects, and an increasing focus on accessible housing for the aging population are significant demand boosters. Policy-driven factors, such as stringent building codes mandating accessibility and energy efficiency, further fuel market growth. For instance, EU directives on accessibility and the push for sustainable construction are directly impacting elevator specifications and installation rates.

However, the market faces notable barriers and challenges. Supply chain disruptions, exacerbated by global events, can lead to delays in component procurement and increased manufacturing costs. Regulatory complexities and differing standards across European countries can pose hurdles for manufacturers aiming for pan-European market penetration. Competitive pressures from established players and new entrants, particularly in specialized segments like stairlifts, necessitate continuous innovation and competitive pricing strategies. The cost of advanced technology, while offering long-term benefits, can be a barrier for some end-users, particularly in budget-constrained segments. The estimated impact of these challenges could lead to a temporary slowdown in growth, potentially affecting market expansion by xx% in specific sub-segments if not effectively mitigated.

Growth Drivers in the Europe Elevator Market Market

Several key drivers are shaping the growth of the Europe Elevator Market. Technological advancements are at the forefront, with the widespread adoption of IoT for remote monitoring and predictive maintenance, and AI for optimizing elevator performance and energy consumption. Economic factors, including continued urban development and the construction of new residential and commercial buildings, provide a steady demand base. Government initiatives and regulations promoting accessibility for an aging population and enforcing energy-efficient building standards are also significant growth catalysts. For example, national accessibility frameworks in countries like Germany and Sweden are directly stimulating demand for modern elevator and stairlift solutions, estimated to contribute xx Million to market revenue annually.

Challenges Impacting Europe Elevator Market Growth

The Europe Elevator Market faces several challenges that could impact its growth trajectory. Regulatory complexities and the varying enforcement of standards across different European nations can create operational and compliance hurdles for manufacturers and installers. Supply chain vulnerabilities, including the availability and cost of critical components, pose a constant risk of production delays and increased expenses. Intense competitive pressures, especially in the residential elevator and stairlift segments, can lead to price wars and reduced profit margins. Furthermore, the significant upfront investment required for high-end, technologically advanced elevator systems can be a restraint for some potential customers, particularly in economically sensitive regions. The impact of these challenges could lead to a xx% increase in lead times for certain specialized elevator models if not proactively addressed.

Key Players Shaping the Europe Elevator Market Market

- Handicare Group AB

- Thyssenkrupp Elevator AG

- Candor Care Limited

- Acorn Mobility Services Ltd

- Stannah Lifts Holdings Ltd

- Anglian Lifts Ltd

- Bespoke Stairlifts Limited

- Ableworld (UK) Ltd

- Mobility Stairlift Ltd

- Dolphin Mobility

- Weigl Liftsysteme DE GmbH

- StayHome Stairlift Ltd

- Platinum Stairlifts

Significant Europe Elevator Market Industry Milestones

- February 2023: Ableworld gathered its stairlift engineers and senior management in the United Kingdom to host its annual Stairlift Conference and announce its new stairlift warehouse. The company is now preparing for its busy spring promotional period and the upcoming Ableworld Thatcham store opening and 1,500 square-foot stairlift warehouse, both of which are scheduled to open within the next three months.

- March 2022: UK Mobility Stairlifts London announced the availability of stairlift removal services throughout the United Kingdom. Expert technicians can remove stairlifts from Stannah, Thyssen Krupp, Acorn, and Brooks if they are under five years old. Professional and experienced engineers arrive at the site with great care and attention to remove straight and curved stairlift models.

Future Outlook for Europe Elevator Market Market

The future outlook for the Europe Elevator Market is exceptionally positive, driven by sustained demographic trends and ongoing technological advancements. The increasing demand for accessible living solutions, propelled by an aging population and supportive government policies, will continue to be a primary growth catalyst. The ongoing digitalization of buildings and the integration of smart technologies will further boost the adoption of connected and intelligent elevator systems, offering enhanced convenience, safety, and efficiency. Opportunities for market expansion lie in emerging economies within Europe and in the development of specialized, high-capacity elevators for increasingly dense urban environments. Strategic collaborations between technology providers and elevator manufacturers, along with a continued focus on sustainable and energy-efficient solutions, will be crucial for capturing future market share. The market is anticipated to witness steady growth, with new installations and modernization projects contributing significantly to its overall value, projected to reach xx Million by 2033.

Europe Elevator Market Segmentation

-

1. Rail Orientation

- 1.1. Straight

- 1.2. Curved

-

2. User Orientation

- 2.1. Seated

- 2.2. Standing

- 2.3. Integrated

-

3. Installation

- 3.1. Indoor

- 3.2. Outdoor

-

4. Application

- 4.1. Residential

- 4.2. Healthcare

- 4.3. Other Applications

Europe Elevator Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Elevator Market Regional Market Share

Geographic Coverage of Europe Elevator Market

Europe Elevator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising proportion of aged people and growing disability among individuals

- 3.3. Market Restrains

- 3.3.1. High installation cost and post installation services

- 3.4. Market Trends

- 3.4.1. Residential Segment to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 5.1.1. Straight

- 5.1.2. Curved

- 5.2. Market Analysis, Insights and Forecast - by User Orientation

- 5.2.1. Seated

- 5.2.2. Standing

- 5.2.3. Integrated

- 5.3. Market Analysis, Insights and Forecast - by Installation

- 5.3.1. Indoor

- 5.3.2. Outdoor

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Residential

- 5.4.2. Healthcare

- 5.4.3. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Rail Orientation

- 6. Germany Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Elevator Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Handicare Group AB

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Platinum Stairlifts*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Thyssenkrupp Elevator AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Candor Care Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Acorn Mobility Services Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Stannah Lifts Holdings Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Anglian Lifts Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bespoke Stairlifts Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ableworld (UK) Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mobility Stairlift Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Dolphin Mobility

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Weigl Liftsysteme DE GmbH

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 StayHome Stairlift Ltd

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Handicare Group AB

List of Figures

- Figure 1: Europe Elevator Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Elevator Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Elevator Market Revenue million Forecast, by Region 2020 & 2033

- Table 2: Europe Elevator Market Revenue million Forecast, by Rail Orientation 2020 & 2033

- Table 3: Europe Elevator Market Revenue million Forecast, by User Orientation 2020 & 2033

- Table 4: Europe Elevator Market Revenue million Forecast, by Installation 2020 & 2033

- Table 5: Europe Elevator Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Elevator Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Europe Elevator Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Germany Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Sweden Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Europe Elevator Market Revenue million Forecast, by Rail Orientation 2020 & 2033

- Table 16: Europe Elevator Market Revenue million Forecast, by User Orientation 2020 & 2033

- Table 17: Europe Elevator Market Revenue million Forecast, by Installation 2020 & 2033

- Table 18: Europe Elevator Market Revenue million Forecast, by Application 2020 & 2033

- Table 19: Europe Elevator Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Germany Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: France Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Spain Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Netherlands Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Norway Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Poland Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Denmark Europe Elevator Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Elevator Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Europe Elevator Market?

Key companies in the market include Handicare Group AB, Platinum Stairlifts*List Not Exhaustive, Thyssenkrupp Elevator AG, Candor Care Limited, Acorn Mobility Services Ltd, Stannah Lifts Holdings Ltd, Anglian Lifts Ltd, Bespoke Stairlifts Limited, Ableworld (UK) Ltd, Mobility Stairlift Ltd, Dolphin Mobility, Weigl Liftsysteme DE GmbH, StayHome Stairlift Ltd.

3. What are the main segments of the Europe Elevator Market?

The market segments include Rail Orientation, User Orientation, Installation, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 25188.3 million as of 2022.

5. What are some drivers contributing to market growth?

Rising proportion of aged people and growing disability among individuals.

6. What are the notable trends driving market growth?

Residential Segment to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

High installation cost and post installation services.

8. Can you provide examples of recent developments in the market?

February 2023: Ableworld gathered its stairlift engineers and senior management in the United Kingdom to host its annual Stairlift Conference and announce its new stairlift warehouse. The company is now preparing for its busy spring promotional period and the upcoming Ableworld Thatcham store opening and 1,500 square-foot stairlift warehouse, both of which are scheduled to open within the next three months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Elevator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Elevator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Elevator Market?

To stay informed about further developments, trends, and reports in the Europe Elevator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence