Key Insights

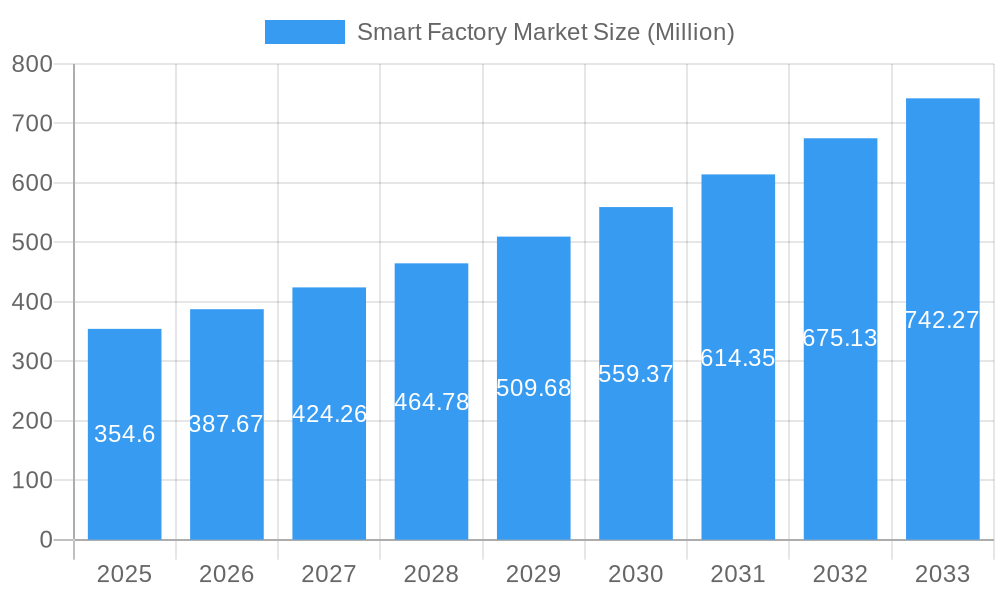

The global Smart Factory market is poised for robust growth, projected to reach approximately USD 354.60 million in value by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 9.74% through 2033. This significant expansion is fueled by a confluence of technological advancements and industrial imperatives. Key drivers include the relentless pursuit of enhanced operational efficiency, the escalating demand for personalized and high-quality production, and the critical need for improved safety standards in manufacturing environments. The integration of advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and Big Data analytics is fundamentally transforming traditional manufacturing paradigms into intelligent, interconnected, and self-optimizing ecosystems. Machine vision systems, industrial robotics, and sophisticated control devices are at the forefront of this transformation, enabling greater automation, precision, and data-driven decision-making across all stages of the production lifecycle. The market's trajectory is further bolstered by the growing adoption of Industry 4.0 principles, emphasizing digital transformation and the creation of smart, adaptable production lines capable of responding dynamically to market fluctuations and evolving customer needs.

Smart Factory Market Market Size (In Million)

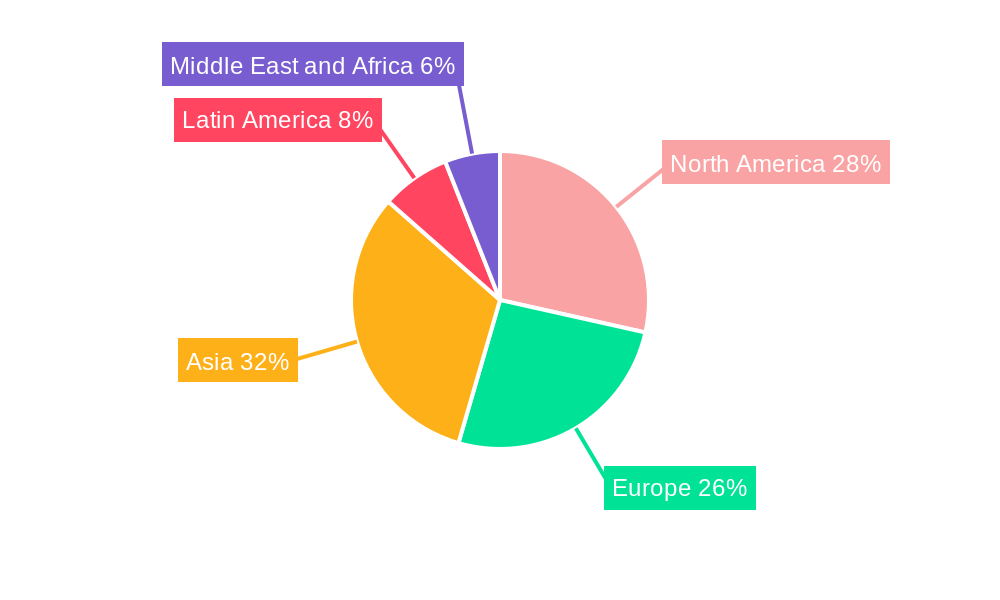

The market's segmentation reveals a diverse landscape of growth opportunities. Machine Vision Systems, encompassing cameras, processors, and software, are pivotal in providing real-time data for quality control and process optimization. Industrial Robotics, from traditional articulated arms to advanced collaborative robots, are instrumental in automating complex tasks, increasing throughput, and addressing labor shortages. Control Devices, including relays, switches, and servo motors, alongside sensors and advanced communication technologies, form the backbone of these smart systems, facilitating seamless data flow and operational control. The end-user industry analysis highlights the Automotive sector as a primary beneficiary and adopter of smart factory solutions, driven by the need for high-volume, precision manufacturing. Semiconductors, Pharmaceuticals, and Aerospace & Defense also represent significant growth areas, demanding stringent quality control and complex production processes that smart factories are uniquely positioned to deliver. Geographically, North America and Europe are leading the adoption, with Asia, particularly China and India, demonstrating rapid growth due to expanding manufacturing bases and government initiatives promoting industrial digitalization.

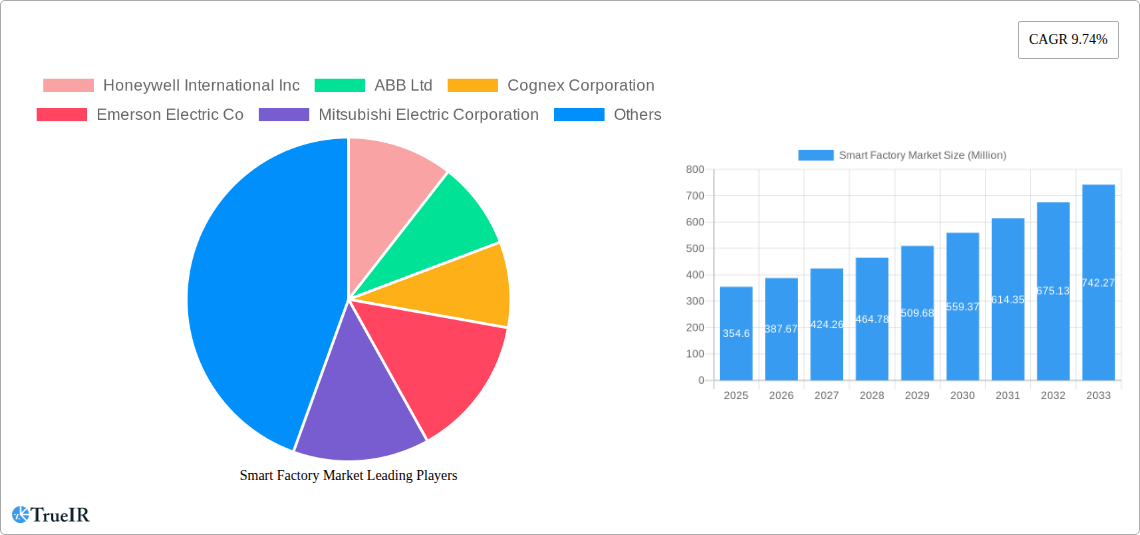

Smart Factory Market Company Market Share

Unlocking the Future of Manufacturing: Comprehensive Smart Factory Market Analysis (2019–2033)

This in-depth report provides an indispensable analysis of the global Smart Factory Market, forecasting significant growth and detailing key trends, opportunities, and competitive dynamics. Covering the period from 2019 to 2033, with a base year of 2025, this report is crucial for manufacturers, technology providers, investors, and policymakers seeking to navigate the evolving landscape of intelligent manufacturing. Explore how advancements in Industrial IoT (IIoT), AI, robotics, and automation are revolutionizing production processes, driving efficiency, and creating new revenue streams.

Smart Factory Market Market Structure & Competitive Landscape

The Smart Factory Market is characterized by a moderately consolidated structure, with a few major players holding significant market share, alongside a dynamic ecosystem of specialized technology providers. Innovation drivers include the relentless pursuit of operational efficiency, cost reduction, enhanced product quality, and increased production flexibility. Regulatory impacts, while varying by region, are increasingly focusing on cybersecurity, data privacy, and environmental sustainability within smart manufacturing environments. Product substitutes are emerging as integrated solutions become more sophisticated, blurring the lines between traditional automation components and advanced smart factory platforms. End-user segmentation reveals distinct adoption rates and specific needs across various industries, from high-volume automotive manufacturing to precision-driven semiconductor production. Mergers and acquisitions (M&A) activity is a significant trend, with larger companies acquiring innovative startups to expand their technology portfolios and market reach, thereby shaping the competitive landscape. The market concentration is estimated to be around 60% by the top 10 players. M&A volumes have seen a steady increase, with an estimated 50+ deals annually over the past three years.

Smart Factory Market Market Trends & Opportunities

The global Smart Factory Market is poised for robust expansion, driven by the pervasive integration of digital technologies across manufacturing operations. The market size is projected to reach approximately USD 200 billion by 2028, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Key technological shifts are centered around the widespread adoption of Industrial Internet of Things (IIoT) for real-time data collection and analysis, Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and process optimization, and advanced robotics for enhanced automation and human-robot collaboration. Consumer preferences are increasingly demanding customized products produced with greater speed and efficiency, compelling manufacturers to embrace smart factory solutions. The competitive dynamics are intensifying, with a focus on offering end-to-end integrated solutions rather than isolated products. Opportunities abound in developing cybersecurity solutions tailored for OT environments, creating AI-powered analytics platforms for operational intelligence, and offering specialized robotics for niche applications. The increasing demand for sustainable manufacturing practices also presents a significant opportunity for smart factories to reduce energy consumption and waste. Market penetration rates for IIoT devices in manufacturing are expected to exceed 75% by 2030, highlighting the transformative potential.

Dominant Markets & Segments in Smart Factory Market

North America currently holds a dominant position in the Smart Factory Market, driven by substantial investments in Industry 4.0 initiatives, a well-established manufacturing base, and a strong emphasis on technological innovation. Within North America, the United States leads due to its advanced semiconductor and automotive industries, both of which are early adopters of smart factory technologies.

Product Type Dominance:

- Industrial Robotics: This segment is a significant growth driver, with articulated and collaborative robots leading adoption due to their versatility and increasing affordability. The automotive sector's demand for efficient assembly lines fuels this segment.

- Machine Vision Systems: Essential for quality control and automation, these systems, encompassing cameras, processors, and software, are critical for industries like semiconductors and pharmaceuticals where precision is paramount.

- Sensors: The proliferation of smart sensors is fundamental to the IIoT infrastructure of smart factories, enabling the collection of vast amounts of real-time data.

Technology Dominance:

- Manufacturing Execution System (MES): MES platforms are crucial for managing and monitoring work-in-progress on the factory floor, providing real-time visibility into production operations.

- Programmable Logic Controller (PLC): PLCs remain the backbone of industrial automation, controlling individual machines and processes, and are continuously evolving with enhanced connectivity and processing power.

- Human Machine Interface (HMI): Intuitive HMIs are vital for operators to interact with complex machinery and systems, improving usability and reducing errors.

End-user Industry Dominance:

- Automotive: This industry is a primary driver of smart factory adoption, seeking to enhance production efficiency, reduce lead times, and improve vehicle quality through automation, robotics, and data analytics.

- Semiconductors: The high-precision and complex nature of semiconductor manufacturing make it a prime candidate for smart factory solutions, particularly in areas like machine vision for defect detection and automation for wafer handling.

- Aerospace and Defense: This sector is increasingly investing in smart factory technologies to improve manufacturing precision, reduce costs, and enhance the reliability of complex components.

Key growth drivers across these dominant segments include government initiatives promoting digital transformation, the need for greater supply chain resilience, and the competitive pressure to adopt advanced manufacturing techniques. Infrastructure development, particularly in terms of robust network connectivity and cloud computing capabilities, further supports the expansion of these dominant markets and segments.

Smart Factory Market Product Analysis

Innovations in smart factory products are increasingly focused on interoperability, AI integration, and enhanced user experience. Machine vision systems are becoming more sophisticated with advanced algorithms for real-time defect detection and predictive quality analysis. Industrial robots are evolving towards greater dexterity and collaborative capabilities, enabling seamless integration with human workers. Control devices and sensors are leveraging AI to enable predictive maintenance and optimize energy consumption. Communication technologies are prioritizing secure and high-bandwidth wireless solutions to support the vast data flows inherent in smart factories. The competitive advantage lies in offering integrated solutions that provide end-to-end visibility and control across the entire manufacturing value chain.

Key Drivers, Barriers & Challenges in Smart Factory Market

Key Drivers: The Smart Factory Market is propelled by several key drivers. Technologically, the maturation of AI, IIoT, and advanced robotics is enabling unprecedented levels of automation and efficiency. Economically, the need for cost reduction, increased productivity, and enhanced competitiveness in a global market is a significant motivator. Policy-driven factors, such as government initiatives promoting digital transformation and Industry 4.0 adoption, are also crucial. For example, the German "Industrie 4.0" initiative has spurred widespread adoption and innovation.

Challenges: However, the market faces significant challenges and restraints. Supply chain issues, particularly the availability of critical components and semiconductors, can disrupt production and deployment timelines. Regulatory hurdles related to data security and privacy, especially in cross-border operations, can create complexities. Competitive pressures are intensifying, requiring continuous innovation and investment to maintain market position. The initial high cost of implementation and the need for a skilled workforce capable of managing complex smart factory systems also pose substantial barriers to adoption for small and medium-sized enterprises.

Growth Drivers in the Smart Factory Market Market

The growth of the Smart Factory Market is primarily fueled by technological advancements such as the widespread adoption of Industrial Internet of Things (IIoT) for real-time data acquisition, Artificial Intelligence (AI) for predictive analytics and optimization, and advanced robotics for enhanced automation and flexibility. Economic imperatives, including the relentless pursuit of operational efficiency, cost reduction, and improved product quality, are compelling manufacturers to invest in smart solutions. Policy-driven factors, such as government incentives for digital transformation and smart manufacturing initiatives, further accelerate market penetration. The increasing demand for customized products and faster time-to-market also necessitates the agility and responsiveness offered by smart factory environments.

Challenges Impacting Smart Factory Market Growth

Several challenges are impacting the growth of the Smart Factory Market. Regulatory complexities, particularly concerning data security, privacy, and interoperability standards, can create barriers to widespread adoption. Supply chain issues, including the availability of critical hardware components and the potential for disruptions, pose a significant concern for manufacturers reliant on these technologies. Competitive pressures are intensifying, requiring substantial investment in research and development to stay ahead. The high initial investment costs for implementing smart factory solutions, coupled with the need for a skilled workforce proficient in managing these advanced systems, can also hinder growth, especially for small and medium-sized enterprises.

Key Players Shaping the Smart Factory Market Market

Honeywell International Inc ABB Ltd Cognex Corporation Emerson Electric Co Mitsubishi Electric Corporation Siemens AG Schneider Electric SE Fanuc Corporation KUKA AG Robert Bosch GmbH FLIR Systems Inc (Teledyne Technologies Incorporated) Rockwell Automation Inc Yokogawa Electric Corporation

Significant Smart Factory Market Industry Milestones

- February 2023: Emerson combined its extensive power expertise and renewable energy capabilities into the OvationTM Green portfolio to help power generation companies meet the needs of their customers as they transition to green energy generation and storage. Emerson has broadened its power-based control architecture by integrating newly acquired Mita-Teknik software and technology with its industry-leading Ovation automation platform, extensive renewable energy knowledge base, cybersecurity solutions, and remote management capabilities.

- January 2023: Siemens Digital Industries Software announced the launch of eXplore live at Wichita's The Smart Factory. The smart factory contains a fully experiential lab and an active product line for developing and exploring innovative smart manufacturing capabilities. The Siemens Xcelerator portfolio is used in eXplore Live at Deloitte's The Smart Factory in Wichita to help companies experience the power of digitalization and the future of smart manufacturing.

- October 2022: ABB entered into a strategic collaboration with U.S.-based startup Scalable Robotics to improve its portfolio of user-friendly robotic welding techniques. Through 3D vision and implanted process understanding, the Scalable Robotics technology enables users to quickly program welding robots without coding.

Future Outlook for Smart Factory Market Market

The future outlook for the Smart Factory Market is exceptionally bright, driven by continued advancements in AI, IIoT, and edge computing. The increasing demand for hyper-personalization and sustainable manufacturing practices will further accelerate the adoption of smart technologies. Strategic opportunities lie in developing more integrated and intuitive platforms, enhancing cybersecurity solutions, and creating accessible smart factory solutions for SMEs. The market's potential for transformation extends across all manufacturing sectors, promising significant improvements in efficiency, flexibility, and overall competitiveness in the global industrial landscape.

Smart Factory Market Segmentation

-

1. Product Type

-

1.1. Machine Vision Systems

- 1.1.1. Cameras

- 1.1.2. Processors

- 1.1.3. Software

- 1.1.4. Enclosures

- 1.1.5. Frame Grabbers

- 1.1.6. Integration Services

- 1.1.7. Lighting

-

1.2. Industrial Robotics

- 1.2.1. Articulated Robots

- 1.2.2. Cartesian Robots

- 1.2.3. Cylindrical Robots

- 1.2.4. SCARA Robots

- 1.2.5. Parallel Robots

- 1.2.6. Collaborative Industry Robots

-

1.3. Control Devices

- 1.3.1. Relays and Switches

- 1.3.2. Servo Motors and Drives

- 1.4. Sensors

-

1.5. Communication Technologies

- 1.5.1. Wired

- 1.5.2. Wireless

- 1.6. Other Product Types

-

1.1. Machine Vision Systems

-

2. Technology

- 2.1. Product Lifecycle Management (PLM)

- 2.2. Human Machine Interface (HMI)

- 2.3. Enterprise Resource and Planning (ERP)

- 2.4. Manufacturing Execution System (MES)

- 2.5. Distributed Control System (DCS)

- 2.6. Supervis

- 2.7. Programmable Logic Controller (PLC)

- 2.8. Other Technologies

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Semiconductors

- 3.3. Oil and Gas

- 3.4. Chemical and Petrochemical

- 3.5. Pharmaceutical

- 3.6. Aerospace and Defense

- 3.7. Food and Beverage

- 3.8. Mining

- 3.9. Other End-user Industries

Smart Factory Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Smart Factory Market Regional Market Share

Geographic Coverage of Smart Factory Market

Smart Factory Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain; Rising Demand for Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Huge Capital Investments for Transformations; Vulnerable to Cyberattacks

- 3.4. Market Trends

- 3.4.1. Semiconductor Sector is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Machine Vision Systems

- 5.1.1.1. Cameras

- 5.1.1.2. Processors

- 5.1.1.3. Software

- 5.1.1.4. Enclosures

- 5.1.1.5. Frame Grabbers

- 5.1.1.6. Integration Services

- 5.1.1.7. Lighting

- 5.1.2. Industrial Robotics

- 5.1.2.1. Articulated Robots

- 5.1.2.2. Cartesian Robots

- 5.1.2.3. Cylindrical Robots

- 5.1.2.4. SCARA Robots

- 5.1.2.5. Parallel Robots

- 5.1.2.6. Collaborative Industry Robots

- 5.1.3. Control Devices

- 5.1.3.1. Relays and Switches

- 5.1.3.2. Servo Motors and Drives

- 5.1.4. Sensors

- 5.1.5. Communication Technologies

- 5.1.5.1. Wired

- 5.1.5.2. Wireless

- 5.1.6. Other Product Types

- 5.1.1. Machine Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Product Lifecycle Management (PLM)

- 5.2.2. Human Machine Interface (HMI)

- 5.2.3. Enterprise Resource and Planning (ERP)

- 5.2.4. Manufacturing Execution System (MES)

- 5.2.5. Distributed Control System (DCS)

- 5.2.6. Supervis

- 5.2.7. Programmable Logic Controller (PLC)

- 5.2.8. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Semiconductors

- 5.3.3. Oil and Gas

- 5.3.4. Chemical and Petrochemical

- 5.3.5. Pharmaceutical

- 5.3.6. Aerospace and Defense

- 5.3.7. Food and Beverage

- 5.3.8. Mining

- 5.3.9. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Machine Vision Systems

- 6.1.1.1. Cameras

- 6.1.1.2. Processors

- 6.1.1.3. Software

- 6.1.1.4. Enclosures

- 6.1.1.5. Frame Grabbers

- 6.1.1.6. Integration Services

- 6.1.1.7. Lighting

- 6.1.2. Industrial Robotics

- 6.1.2.1. Articulated Robots

- 6.1.2.2. Cartesian Robots

- 6.1.2.3. Cylindrical Robots

- 6.1.2.4. SCARA Robots

- 6.1.2.5. Parallel Robots

- 6.1.2.6. Collaborative Industry Robots

- 6.1.3. Control Devices

- 6.1.3.1. Relays and Switches

- 6.1.3.2. Servo Motors and Drives

- 6.1.4. Sensors

- 6.1.5. Communication Technologies

- 6.1.5.1. Wired

- 6.1.5.2. Wireless

- 6.1.6. Other Product Types

- 6.1.1. Machine Vision Systems

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Product Lifecycle Management (PLM)

- 6.2.2. Human Machine Interface (HMI)

- 6.2.3. Enterprise Resource and Planning (ERP)

- 6.2.4. Manufacturing Execution System (MES)

- 6.2.5. Distributed Control System (DCS)

- 6.2.6. Supervis

- 6.2.7. Programmable Logic Controller (PLC)

- 6.2.8. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Semiconductors

- 6.3.3. Oil and Gas

- 6.3.4. Chemical and Petrochemical

- 6.3.5. Pharmaceutical

- 6.3.6. Aerospace and Defense

- 6.3.7. Food and Beverage

- 6.3.8. Mining

- 6.3.9. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Machine Vision Systems

- 7.1.1.1. Cameras

- 7.1.1.2. Processors

- 7.1.1.3. Software

- 7.1.1.4. Enclosures

- 7.1.1.5. Frame Grabbers

- 7.1.1.6. Integration Services

- 7.1.1.7. Lighting

- 7.1.2. Industrial Robotics

- 7.1.2.1. Articulated Robots

- 7.1.2.2. Cartesian Robots

- 7.1.2.3. Cylindrical Robots

- 7.1.2.4. SCARA Robots

- 7.1.2.5. Parallel Robots

- 7.1.2.6. Collaborative Industry Robots

- 7.1.3. Control Devices

- 7.1.3.1. Relays and Switches

- 7.1.3.2. Servo Motors and Drives

- 7.1.4. Sensors

- 7.1.5. Communication Technologies

- 7.1.5.1. Wired

- 7.1.5.2. Wireless

- 7.1.6. Other Product Types

- 7.1.1. Machine Vision Systems

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Product Lifecycle Management (PLM)

- 7.2.2. Human Machine Interface (HMI)

- 7.2.3. Enterprise Resource and Planning (ERP)

- 7.2.4. Manufacturing Execution System (MES)

- 7.2.5. Distributed Control System (DCS)

- 7.2.6. Supervis

- 7.2.7. Programmable Logic Controller (PLC)

- 7.2.8. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Semiconductors

- 7.3.3. Oil and Gas

- 7.3.4. Chemical and Petrochemical

- 7.3.5. Pharmaceutical

- 7.3.6. Aerospace and Defense

- 7.3.7. Food and Beverage

- 7.3.8. Mining

- 7.3.9. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Machine Vision Systems

- 8.1.1.1. Cameras

- 8.1.1.2. Processors

- 8.1.1.3. Software

- 8.1.1.4. Enclosures

- 8.1.1.5. Frame Grabbers

- 8.1.1.6. Integration Services

- 8.1.1.7. Lighting

- 8.1.2. Industrial Robotics

- 8.1.2.1. Articulated Robots

- 8.1.2.2. Cartesian Robots

- 8.1.2.3. Cylindrical Robots

- 8.1.2.4. SCARA Robots

- 8.1.2.5. Parallel Robots

- 8.1.2.6. Collaborative Industry Robots

- 8.1.3. Control Devices

- 8.1.3.1. Relays and Switches

- 8.1.3.2. Servo Motors and Drives

- 8.1.4. Sensors

- 8.1.5. Communication Technologies

- 8.1.5.1. Wired

- 8.1.5.2. Wireless

- 8.1.6. Other Product Types

- 8.1.1. Machine Vision Systems

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Product Lifecycle Management (PLM)

- 8.2.2. Human Machine Interface (HMI)

- 8.2.3. Enterprise Resource and Planning (ERP)

- 8.2.4. Manufacturing Execution System (MES)

- 8.2.5. Distributed Control System (DCS)

- 8.2.6. Supervis

- 8.2.7. Programmable Logic Controller (PLC)

- 8.2.8. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Semiconductors

- 8.3.3. Oil and Gas

- 8.3.4. Chemical and Petrochemical

- 8.3.5. Pharmaceutical

- 8.3.6. Aerospace and Defense

- 8.3.7. Food and Beverage

- 8.3.8. Mining

- 8.3.9. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Machine Vision Systems

- 9.1.1.1. Cameras

- 9.1.1.2. Processors

- 9.1.1.3. Software

- 9.1.1.4. Enclosures

- 9.1.1.5. Frame Grabbers

- 9.1.1.6. Integration Services

- 9.1.1.7. Lighting

- 9.1.2. Industrial Robotics

- 9.1.2.1. Articulated Robots

- 9.1.2.2. Cartesian Robots

- 9.1.2.3. Cylindrical Robots

- 9.1.2.4. SCARA Robots

- 9.1.2.5. Parallel Robots

- 9.1.2.6. Collaborative Industry Robots

- 9.1.3. Control Devices

- 9.1.3.1. Relays and Switches

- 9.1.3.2. Servo Motors and Drives

- 9.1.4. Sensors

- 9.1.5. Communication Technologies

- 9.1.5.1. Wired

- 9.1.5.2. Wireless

- 9.1.6. Other Product Types

- 9.1.1. Machine Vision Systems

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Product Lifecycle Management (PLM)

- 9.2.2. Human Machine Interface (HMI)

- 9.2.3. Enterprise Resource and Planning (ERP)

- 9.2.4. Manufacturing Execution System (MES)

- 9.2.5. Distributed Control System (DCS)

- 9.2.6. Supervis

- 9.2.7. Programmable Logic Controller (PLC)

- 9.2.8. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Semiconductors

- 9.3.3. Oil and Gas

- 9.3.4. Chemical and Petrochemical

- 9.3.5. Pharmaceutical

- 9.3.6. Aerospace and Defense

- 9.3.7. Food and Beverage

- 9.3.8. Mining

- 9.3.9. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Machine Vision Systems

- 10.1.1.1. Cameras

- 10.1.1.2. Processors

- 10.1.1.3. Software

- 10.1.1.4. Enclosures

- 10.1.1.5. Frame Grabbers

- 10.1.1.6. Integration Services

- 10.1.1.7. Lighting

- 10.1.2. Industrial Robotics

- 10.1.2.1. Articulated Robots

- 10.1.2.2. Cartesian Robots

- 10.1.2.3. Cylindrical Robots

- 10.1.2.4. SCARA Robots

- 10.1.2.5. Parallel Robots

- 10.1.2.6. Collaborative Industry Robots

- 10.1.3. Control Devices

- 10.1.3.1. Relays and Switches

- 10.1.3.2. Servo Motors and Drives

- 10.1.4. Sensors

- 10.1.5. Communication Technologies

- 10.1.5.1. Wired

- 10.1.5.2. Wireless

- 10.1.6. Other Product Types

- 10.1.1. Machine Vision Systems

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Product Lifecycle Management (PLM)

- 10.2.2. Human Machine Interface (HMI)

- 10.2.3. Enterprise Resource and Planning (ERP)

- 10.2.4. Manufacturing Execution System (MES)

- 10.2.5. Distributed Control System (DCS)

- 10.2.6. Supervis

- 10.2.7. Programmable Logic Controller (PLC)

- 10.2.8. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Semiconductors

- 10.3.3. Oil and Gas

- 10.3.4. Chemical and Petrochemical

- 10.3.5. Pharmaceutical

- 10.3.6. Aerospace and Defense

- 10.3.7. Food and Beverage

- 10.3.8. Mining

- 10.3.9. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Smart Factory Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 Honeywell International Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 ABB Ltd

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Cognex Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Emerson Electric Co

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Mitsubishi Electric Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Siemens AG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Schneider Electric SE

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Fanuc Corporation

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 KUKA AG

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Robert Bosch GmbH

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 FLIR Systems Inc (Teledyne Technologies Incorporated)*List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Rockwell Automation Inc

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Yokogawa Electric Corporation

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Smart Factory Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: MEA Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 13: MEA Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Smart Factory Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: North America Smart Factory Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: North America Smart Factory Market Revenue (Million), by Technology 2025 & 2033

- Figure 17: North America Smart Factory Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: North America Smart Factory Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: North America Smart Factory Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: North America Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 21: North America Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Smart Factory Market Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Europe Smart Factory Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Europe Smart Factory Market Revenue (Million), by Technology 2025 & 2033

- Figure 25: Europe Smart Factory Market Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Europe Smart Factory Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 27: Europe Smart Factory Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 28: Europe Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 29: Europe Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 30: Asia Smart Factory Market Revenue (Million), by Product Type 2025 & 2033

- Figure 31: Asia Smart Factory Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 32: Asia Smart Factory Market Revenue (Million), by Technology 2025 & 2033

- Figure 33: Asia Smart Factory Market Revenue Share (%), by Technology 2025 & 2033

- Figure 34: Asia Smart Factory Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Asia Smart Factory Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Asia Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Latin America Smart Factory Market Revenue (Million), by Product Type 2025 & 2033

- Figure 39: Latin America Smart Factory Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 40: Latin America Smart Factory Market Revenue (Million), by Technology 2025 & 2033

- Figure 41: Latin America Smart Factory Market Revenue Share (%), by Technology 2025 & 2033

- Figure 42: Latin America Smart Factory Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 43: Latin America Smart Factory Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 44: Latin America Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 45: Latin America Smart Factory Market Revenue Share (%), by Country 2025 & 2033

- Figure 46: Middle East and Africa Smart Factory Market Revenue (Million), by Product Type 2025 & 2033

- Figure 47: Middle East and Africa Smart Factory Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 48: Middle East and Africa Smart Factory Market Revenue (Million), by Technology 2025 & 2033

- Figure 49: Middle East and Africa Smart Factory Market Revenue Share (%), by Technology 2025 & 2033

- Figure 50: Middle East and Africa Smart Factory Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 51: Middle East and Africa Smart Factory Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 52: Middle East and Africa Smart Factory Market Revenue (Million), by Country 2025 & 2033

- Figure 53: Middle East and Africa Smart Factory Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Factory Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Smart Factory Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Smart Factory Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Smart Factory Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Smart Factory Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Germany Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherland Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Nordics Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Korea Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Southeast Asia Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Indonesia Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Phillipes Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Thailandc Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Peru Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Chile Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Colombia Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Ecuador Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Venezuela Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: United States Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Canada Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Mexico Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 47: United Arab Emirates Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Saudi Arabia Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Africa Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Global Smart Factory Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 52: Global Smart Factory Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 53: Global Smart Factory Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 55: United States Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Canada Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global Smart Factory Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 58: Global Smart Factory Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 59: Global Smart Factory Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 60: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 61: United Kingdom Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Germany Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: France Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Global Smart Factory Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 65: Global Smart Factory Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 66: Global Smart Factory Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: China Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 69: India Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Japan Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 71: Australia and New Zealand Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Global Smart Factory Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 73: Global Smart Factory Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 74: Global Smart Factory Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 75: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 76: Brazil Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 77: Argentina Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Mexico Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 79: Global Smart Factory Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 80: Global Smart Factory Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 81: Global Smart Factory Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 82: Global Smart Factory Market Revenue Million Forecast, by Country 2020 & 2033

- Table 83: United Arab Emirates Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Saudi Arabia Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 85: South Africa Smart Factory Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Factory Market?

The projected CAGR is approximately 9.74%.

2. Which companies are prominent players in the Smart Factory Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Cognex Corporation, Emerson Electric Co, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, KUKA AG, Robert Bosch GmbH, FLIR Systems Inc (Teledyne Technologies Incorporated)*List Not Exhaustive, Rockwell Automation Inc, Yokogawa Electric Corporation.

3. What are the main segments of the Smart Factory Market?

The market segments include Product Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 354.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Internet of Things (IoT) Technologies Across the Value Chain; Rising Demand for Energy Efficiency.

6. What are the notable trends driving market growth?

Semiconductor Sector is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Huge Capital Investments for Transformations; Vulnerable to Cyberattacks.

8. Can you provide examples of recent developments in the market?

February 2023: Emerson combined its extensive power expertise and renewable energy capabilities into the OvationTM Green portfolio to help power generation companies meet the needs of their customers as they transition to green energy generation and storage. Emerson has broadened its power-based control architecture by integrating newly acquired Mita-Teknik software and technology with its industry-leading Ovation automation platform, extensive renewable energy knowledge base, cybersecurity solutions, and remote management capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Factory Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Factory Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Factory Market?

To stay informed about further developments, trends, and reports in the Smart Factory Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence