Key Insights

The global Bio-MEMS market is projected for significant expansion, expected to reach approximately $12.22 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 16.92%. This growth is driven by increasing demand for advanced diagnostics, personalized medicine, and sophisticated patient monitoring. Key applications like In-Vitro Diagnostics (IVD) and patient monitoring benefit from miniaturization, enhanced sensitivity, and cost reductions offered by Bio-MEMS. The development of lab-on-a-chip and microfluidic systems for rapid disease detection, alongside wearable health trackers and implantable sensors for continuous health monitoring, are key market drivers. The rising prevalence of chronic diseases and an aging global population further emphasize the need for efficient and accessible healthcare solutions, a domain where Bio-MEMS technology excels.

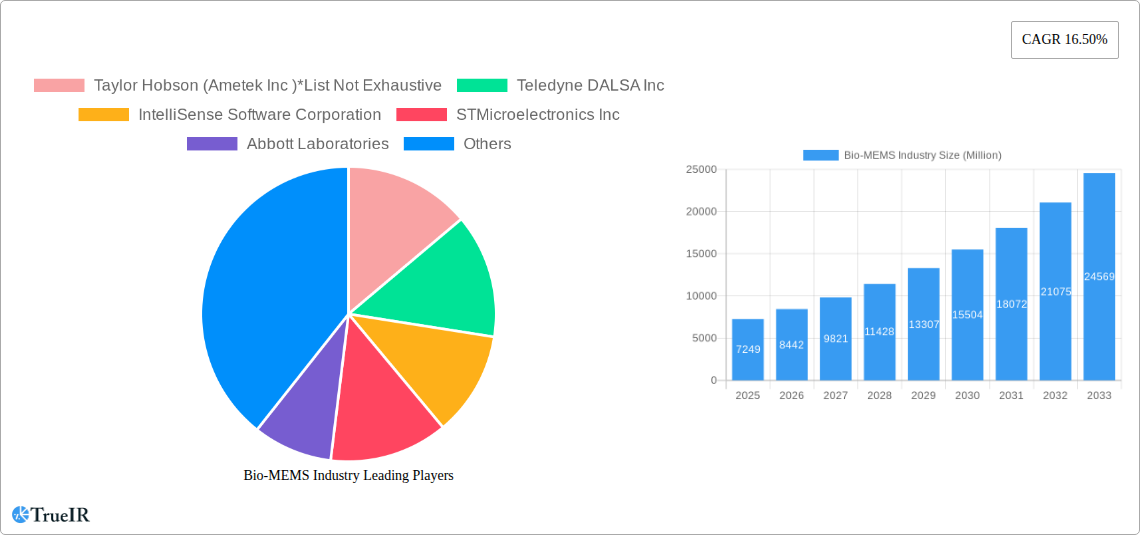

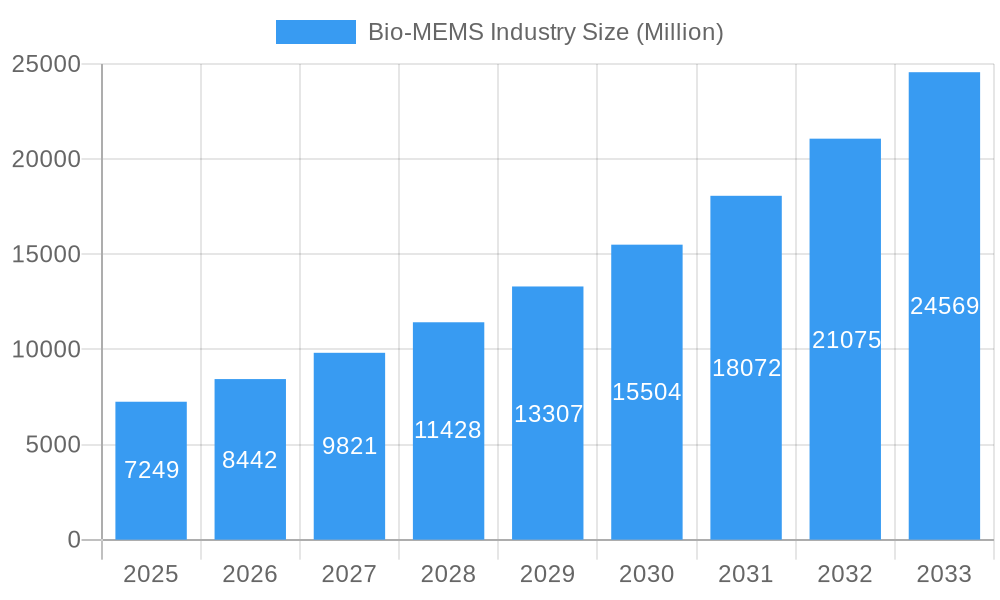

Bio-MEMS Industry Market Size (In Billion)

Emerging trends, including the integration of AI and machine learning with Bio-MEMS devices for advanced data analysis and predictive healthcare, are opening new opportunities. Increased R&D investment from established companies and startups is accelerating technological advancements and product launches. Challenges such as high initial development costs, stringent regulatory approvals, and standardization needs persist. However, advancements in microfabrication, alongside growing awareness of minimally invasive procedures and point-of-care diagnostics, are expected to mitigate these restraints. Leading players are actively contributing to market growth through strategic collaborations and product innovations, reinforcing the industry's robust upward trajectory.

Bio-MEMS Industry Company Market Share

Bio-MEMS Industry Report Description: Unlocking Innovation in Healthcare Technology

This comprehensive Bio-MEMS industry report provides an in-depth analysis of the microelectromechanical systems market for biological and medical applications. Delving into a study period spanning from 2019 to 2033, with a base and estimated year of 2025, and a robust forecast period of 2025–2033, this report offers critical insights for stakeholders navigating this rapidly evolving sector. With a historical period review from 2019–2024, the report establishes a solid foundation for understanding past performance and future trajectories. The global Bio-MEMS market is projected to witness significant expansion, driven by escalating demand for advanced diagnostics, personalized medicine, and minimally invasive medical procedures. Key applications such as Patient Monitoring and IVD Testing are expected to lead this growth, fueled by technological advancements and an increasing healthcare expenditure worldwide.

Bio-MEMS Industry Market Structure & Competitive Landscape

The Bio-MEMS industry is characterized by a dynamic and moderately concentrated market structure. Key innovation drivers include breakthroughs in miniaturization, enhanced sensitivity, and increased biocompatibility of microdevices. Regulatory impacts from bodies like the FDA and EMA play a crucial role in product development and market access, often demanding rigorous testing and validation. Product substitutes, such as traditional laboratory equipment and less integrated diagnostic tools, are present but are increasingly being challenged by the efficiency and portability of Bio-MEMS solutions. End-user segmentation reveals a strong reliance on healthcare providers, research institutions, and pharmaceutical companies. Mergers and acquisitions (M&A) are a significant trend, with larger entities acquiring innovative startups to expand their technology portfolios and market reach. For instance, the acquisition volume in the past three years has averaged approximately 5-8 significant deals per annum, with estimated deal values ranging from tens of millions to several hundred million dollars. Concentration ratios for top players are estimated to be in the range of 40-50%, indicating a competitive yet consolidated landscape.

Bio-MEMS Industry Market Trends & Opportunities

The Bio-MEMS industry is on a trajectory of substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and significant investment. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 15-18% during the forecast period, reaching an estimated market value of over $50 Million by 2033. This expansion is fueled by the increasing adoption of point-of-care diagnostics, enabling faster and more accurate disease detection and management. Technological shifts are leaning towards the development of more sophisticated and integrated Bio-MEMS devices, such as lab-on-a-chip platforms that can perform complex biological analyses on a single microfluidic chip. Consumer preferences are increasingly gravitating towards personalized medicine, wearable health monitors, and non-invasive diagnostic tools, all areas where Bio-MEMS technology plays a pivotal role. The competitive dynamics are intensifying, with a push towards miniaturization, enhanced sensitivity, and cost-effectiveness. Opportunities abound in the development of novel biosensors for early disease detection, microfluidic devices for drug screening and development, and implantable Bio-MEMS for chronic disease management. The market penetration rate for advanced Bio-MEMS in niche applications is expected to rise significantly, from an estimated 25% in the base year of 2025 to over 50% by 2033. The rising prevalence of chronic diseases, coupled with an aging global population, further amplifies the demand for sophisticated healthcare solutions that Bio-MEMS can provide. The increasing focus on preventative healthcare and remote patient monitoring is also a significant growth catalyst, creating a fertile ground for innovation and market expansion. Furthermore, advancements in materials science and fabrication techniques are enabling the creation of more robust, biocompatible, and cost-effective Bio-MEMS devices, making them accessible to a broader range of healthcare settings. The integration of artificial intelligence (AI) and machine learning (ML) with Bio-MEMS platforms is poised to revolutionize data analysis and predictive diagnostics, unlocking unprecedented opportunities for precision medicine and personalized treatment strategies.

Dominant Markets & Segments in Bio-MEMS Industry

The IVD Testing segment is poised to dominate the Bio-MEMS industry due to its critical role in disease diagnosis and management. The market dominance in this segment is driven by several key growth factors, including the escalating global burden of infectious diseases and chronic conditions, necessitating rapid and accurate diagnostic solutions. Government initiatives and increasing healthcare expenditure worldwide are further bolstering the demand for advanced IVD testing technologies. The Patient Monitoring segment is also exhibiting significant growth, propelled by the rising demand for wearable health devices, remote patient monitoring solutions, and the increasing prevalence of chronic diseases requiring continuous health surveillance.

Key Growth Drivers for IVD Testing Dominance:

- Technological Advancements: Development of highly sensitive and specific biosensors, miniaturized analyzers, and lab-on-a-chip platforms.

- Cost-Effectiveness: Bio-MEMS-based IVD tests offer a more cost-effective alternative to traditional laboratory testing, especially for point-of-care applications.

- Early Disease Detection: The ability of Bio-MEMS to detect biomarkers at very low concentrations enables earlier and more accurate diagnosis, improving patient outcomes.

- Point-of-Care Applications: The demand for rapid diagnostic results at the point of care, such as in clinics, pharmacies, and even at home, is a major growth driver.

- Regulatory Support: Favorable regulatory pathways for diagnostic devices in various regions are accelerating market entry.

Key Growth Drivers for Patient Monitoring Growth:

- Aging Population: The increasing global geriatric population necessitates continuous monitoring for age-related health issues.

- Rise of Chronic Diseases: Growing prevalence of diabetes, cardiovascular diseases, and respiratory disorders requires ongoing health tracking.

- Wearable Technology Adoption: Consumer interest in wearable fitness trackers and health monitors, increasingly incorporating Bio-MEMS sensors, is driving innovation.

- Remote Healthcare Trends: Telemedicine and remote patient monitoring frameworks are heavily reliant on Bio-MEMS for data collection.

- Minimally Invasive Monitoring: Preference for non-invasive or minimally invasive monitoring techniques aligns perfectly with Bio-MEMS capabilities.

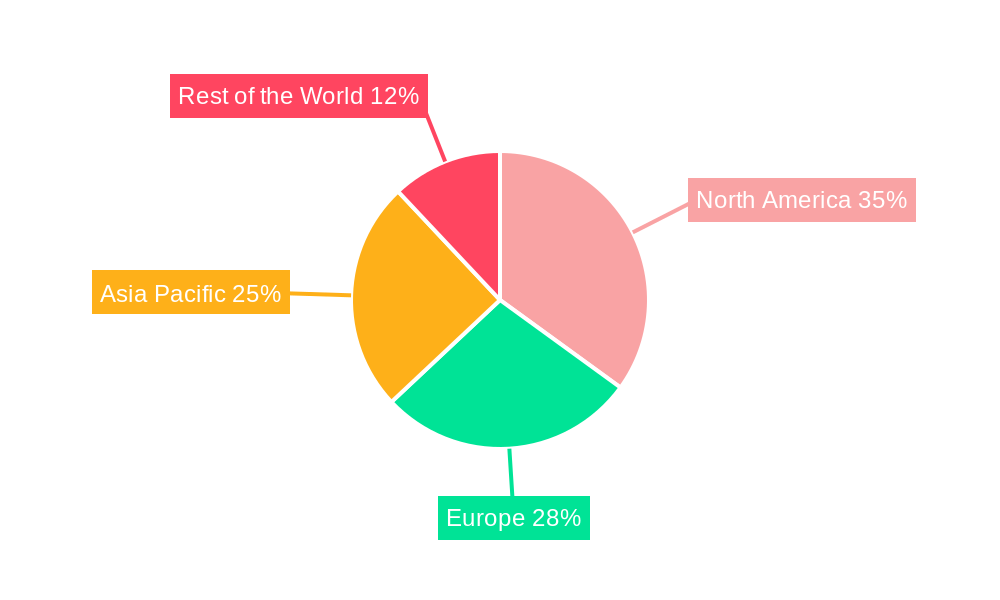

Regionally, North America is expected to maintain its leadership position in the Bio-MEMS market, driven by substantial investments in R&D, a well-established healthcare infrastructure, and high adoption rates of advanced medical technologies. The United States, in particular, accounts for a significant share due to its robust pharmaceutical and biotechnology sectors.

Bio-MEMS Industry Product Analysis

Bio-MEMS product innovations are revolutionizing healthcare by enabling miniaturized, highly sensitive, and cost-effective solutions. Innovations span microfluidic devices for precise sample manipulation, advanced biosensors for biomarker detection, and integrated systems for point-of-care diagnostics. These products offer significant competitive advantages through enhanced portability, reduced reagent consumption, faster analysis times, and the ability to perform complex assays with minimal sample volumes. Technological advancements are focusing on improving biocompatibility, increasing sensor sensitivity, and integrating multiple functionalities onto single chips, paving the way for personalized medicine and ubiquitous health monitoring.

Key Drivers, Barriers & Challenges in Bio-MEMS Industry

Growth Drivers in the Bio-MEMS Industry Market

Key drivers propelling the Bio-MEMS industry include the escalating global demand for advanced diagnostics and therapeutics, particularly for chronic diseases. Technological advancements in microfabrication, materials science, and biosensor technology are enabling the development of smaller, more sensitive, and cost-effective devices. The increasing emphasis on personalized medicine and the growing adoption of wearable health monitors are also significant growth catalysts. Favorable government initiatives and rising healthcare expenditures in emerging economies are further expanding market opportunities. The pursuit of minimally invasive medical procedures and the need for rapid point-of-care diagnostics are also fundamental drivers.

Challenges Impacting Bio-MEMS Industry Growth

Despite its immense potential, the Bio-MEMS industry faces several challenges. Regulatory complexities and lengthy approval processes for novel medical devices can hinder market entry and increase development costs. High manufacturing costs associated with specialized fabrication techniques and the need for sterile environments can impact the affordability of some Bio-MEMS products. Supply chain issues, particularly for specialized components and materials, can lead to production delays and cost fluctuations. Intense competition from established diagnostic companies and the emergence of alternative technologies also present competitive pressures. Furthermore, the need for extensive validation and clinical trials to ensure accuracy and reliability is a significant barrier.

Key Players Shaping the Bio-MEMS Industry Market

- Taylor Hobson (Ametek Inc)

- Teledyne DALSA Inc

- IntelliSense Software Corporation

- STMicroelectronics Inc

- Abbott Laboratories

- uFluidix

- Koninklijke Philips N V

- Micronit Micro Technologies BV

- Redbud Labs Inc

- Sensera Limited

Significant Bio-MEMS Industry Industry Milestones

- 2019: Launch of advanced microfluidic devices for DNA sequencing, reducing analysis time and cost.

- 2020: Introduction of novel biosensors for early detection of viral pathogens, aiding in pandemic response.

- 2021: Significant advancements in implantable Bio-MEMS for continuous glucose monitoring, enhancing diabetes management.

- 2022: Approval of a new generation of Bio-MEMS-based lab-on-a-chip systems for complex IVD testing.

- 2023: Increased investment in research for Bio-MEMS integration with AI for predictive diagnostics and personalized treatment.

- 2024: Emergence of highly miniaturized Bio-MEMS sensors for widespread adoption in wearable health technology.

Future Outlook for Bio-MEMS Industry Market

The future outlook for the Bio-MEMS industry is exceptionally bright, driven by continuous innovation and increasing demand for advanced healthcare solutions. Strategic opportunities lie in the development of integrated Bio-MEMS platforms for comprehensive health monitoring and early disease intervention. The market potential is further amplified by the growing focus on preventative healthcare, personalized medicine, and the expansion of telehealth services. Continued advancements in miniaturization, sensitivity, and biocompatibility, coupled with decreasing manufacturing costs, will accelerate the adoption of Bio-MEMS across a wider spectrum of medical applications, promising a future of more accessible, efficient, and effective healthcare globally. The convergence of Bio-MEMS with artificial intelligence and big data analytics will unlock unprecedented insights into human health, paving the way for truly revolutionary medical breakthroughs.

Bio-MEMS Industry Segmentation

-

1. Application

- 1.1. Patient Monitoring

- 1.2. IVD Testing

- 1.3. Medical Imaging

- 1.4. Drug Delivery

- 1.5. Other Applications

Bio-MEMS Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Bio-MEMS Industry Regional Market Share

Geographic Coverage of Bio-MEMS Industry

Bio-MEMS Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Application of Mobile Care Along with Incorporation of Advanced Technologies; Growing Ratio of Population Suffering from Chronic Diseases with Global Population Ageing.

- 3.3. Market Restrains

- 3.3.1. ; Long Development Cycle with High R&D Cost

- 3.4. Market Trends

- 3.4.1. Microfluidic Chips to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio-MEMS Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Patient Monitoring

- 5.1.2. IVD Testing

- 5.1.3. Medical Imaging

- 5.1.4. Drug Delivery

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bio-MEMS Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Patient Monitoring

- 6.1.2. IVD Testing

- 6.1.3. Medical Imaging

- 6.1.4. Drug Delivery

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Bio-MEMS Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Patient Monitoring

- 7.1.2. IVD Testing

- 7.1.3. Medical Imaging

- 7.1.4. Drug Delivery

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Bio-MEMS Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Patient Monitoring

- 8.1.2. IVD Testing

- 8.1.3. Medical Imaging

- 8.1.4. Drug Delivery

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Bio-MEMS Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Patient Monitoring

- 9.1.2. IVD Testing

- 9.1.3. Medical Imaging

- 9.1.4. Drug Delivery

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Taylor Hobson (Ametek Inc )*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Teledyne DALSA Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IntelliSense Software Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 STMicroelectronics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abbott Laboratories

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 uFluidix

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke Philips N V

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Micronit Micro Technologies BV

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Redbud Labs Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sensera Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Taylor Hobson (Ametek Inc )*List Not Exhaustive

List of Figures

- Figure 1: Global Bio-MEMS Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bio-MEMS Industry Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Bio-MEMS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Bio-MEMS Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Bio-MEMS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Bio-MEMS Industry Revenue (billion), by Application 2025 & 2033

- Figure 7: Europe Bio-MEMS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Bio-MEMS Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Bio-MEMS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Bio-MEMS Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Asia Pacific Bio-MEMS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Bio-MEMS Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Bio-MEMS Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Bio-MEMS Industry Revenue (billion), by Application 2025 & 2033

- Figure 15: Rest of the World Bio-MEMS Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Rest of the World Bio-MEMS Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Bio-MEMS Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bio-MEMS Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Bio-MEMS Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Bio-MEMS Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Bio-MEMS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Bio-MEMS Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Bio-MEMS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Bio-MEMS Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Bio-MEMS Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Bio-MEMS Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Bio-MEMS Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio-MEMS Industry?

The projected CAGR is approximately 16.92%.

2. Which companies are prominent players in the Bio-MEMS Industry?

Key companies in the market include Taylor Hobson (Ametek Inc )*List Not Exhaustive, Teledyne DALSA Inc, IntelliSense Software Corporation, STMicroelectronics Inc, Abbott Laboratories, uFluidix, Koninklijke Philips N V, Micronit Micro Technologies BV, Redbud Labs Inc, Sensera Limited.

3. What are the main segments of the Bio-MEMS Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.22 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Application of Mobile Care Along with Incorporation of Advanced Technologies; Growing Ratio of Population Suffering from Chronic Diseases with Global Population Ageing..

6. What are the notable trends driving market growth?

Microfluidic Chips to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

; Long Development Cycle with High R&D Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio-MEMS Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio-MEMS Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio-MEMS Industry?

To stay informed about further developments, trends, and reports in the Bio-MEMS Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence