Key Insights

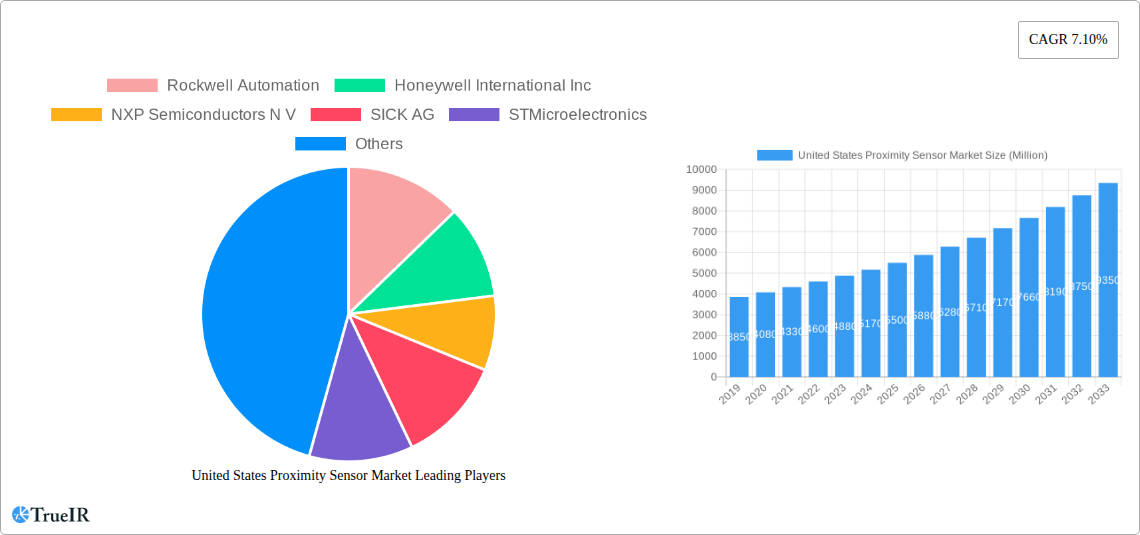

The United States proximity sensor market is poised for robust expansion, driven by increasing adoption across diverse industries like industrial automation, automotive, and aerospace and defense. With an estimated market size of approximately $5,500 million in the base year of 2025 and a projected Compound Annual Growth Rate (CAGR) of 7.10%, the market is expected to reach significant valuations by 2033. Key technological advancements, particularly in inductive and photoelectric sensors, are fueling this growth, enabling more precise object detection and enhanced automation capabilities. The automotive sector is a major contributor, with the integration of proximity sensors for advanced driver-assistance systems (ADAS) and parking assistance becoming standard. Similarly, industrial automation is witnessing a surge in demand for these sensors to improve efficiency, safety, and process control in manufacturing environments. The "Other Technology" segment, encompassing emerging sensor types like LiDAR and advanced vision sensors, also presents considerable growth opportunities as these technologies mature and become more cost-effective.

United States Proximity Sensor Market Market Size (In Billion)

Several factors underpin the market's positive trajectory. The continuous push for smart manufacturing and Industry 4.0 initiatives necessitates sophisticated sensor technologies for real-time data collection and automated decision-making. In the aerospace and defense sector, proximity sensors are crucial for navigation, object avoidance, and sophisticated guidance systems. Consumer electronics are also increasingly incorporating these sensors for touchless interfaces and proximity detection. However, certain challenges, such as the high initial cost of some advanced sensor technologies and the need for specialized technical expertise for installation and maintenance, could present temporary headwinds. Despite these, the inherent benefits of proximity sensors – their non-contact operation, durability, and ability to function in harsh environments – ensure their continued relevance and demand, particularly in multi-channel applications requiring simultaneous detection from multiple points.

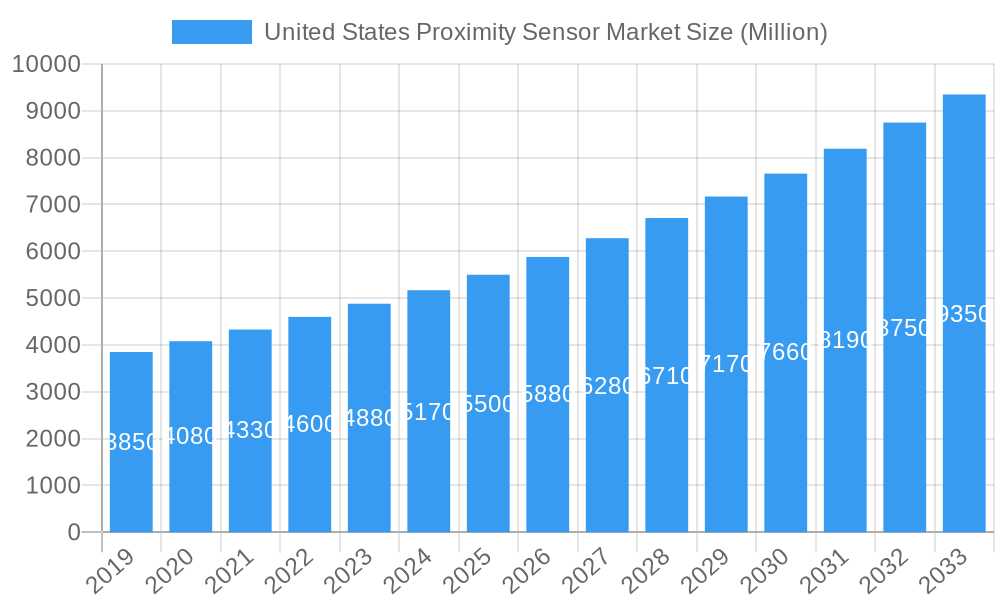

United States Proximity Sensor Market Company Market Share

This in-depth market report offers a dynamic, SEO-optimized analysis of the United States Proximity Sensor Market, leveraging high-volume keywords to enhance search rankings and engage industry professionals. We provide a comprehensive overview, from historical trends to future projections, covering market structure, trends, dominant segments, product analysis, key drivers, challenges, and a detailed competitive landscape.

United States Proximity Sensor Market Market Structure & Competitive Landscape

The United States Proximity Sensor Market exhibits a moderately concentrated structure, with several established players holding significant market share, alongside a growing number of specialized and emerging companies. Innovation drivers are primarily centered around miniaturization, enhanced sensing capabilities, increased accuracy, and improved integration with IoT platforms. Regulatory impacts, particularly concerning safety standards in industrial automation and automotive applications, play a crucial role in shaping product development and market entry strategies. Product substitutes, such as vision systems and advanced mechanical switches, are present but often cater to niche applications or offer different cost-benefit propositions.

Key aspects of the market structure include:

- Market Concentration: Dominated by a mix of large multinational corporations and specialized sensor manufacturers. The top 5 companies are estimated to hold approximately 55% of the market share.

- Innovation Drivers:

- Advancements in sensing technologies (e.g., AI-powered anomaly detection).

- Miniaturization for compact device integration.

- Increased ruggedization for harsh environments.

- Enhanced connectivity and data output for Industry 4.0.

- Regulatory Impacts: Strict adherence to safety certifications (e.g., UL, CE) and environmental regulations.

- Product Substitutes: Vision systems, limit switches, and advanced mechanical switches.

- End-User Segmentation: Industrial Automation and Automotive are the largest end-user segments, representing an estimated combined market share of over 60%.

- Mergers & Acquisitions (M&A) Trends: Sporadic M&A activity focused on acquiring specialized technology or expanding market reach. Over the historical period (2019-2024), approximately 15-20 significant M&A deals were recorded, with an estimated total transaction value in the hundreds of millions of dollars.

United States Proximity Sensor Market Market Trends & Opportunities

The United States Proximity Sensor Market is projected to experience robust growth, driven by the relentless march of technological innovation and the increasing adoption of automation across diverse industries. The market size is estimated to reach an impressive figure of over $4,000 million by the end of 2025, demonstrating a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is fueled by several interconnected trends.

Technological shifts are at the forefront, with a growing demand for proximity sensors that offer enhanced precision, faster response times, and greater reliability. The rise of the Industrial Internet of Things (IIoT) is a significant catalyst, as proximity sensors are integral components in smart factories, enabling real-time monitoring, predictive maintenance, and optimized production processes. The transition towards Industry 4.0 is creating a surge in demand for sensors that can communicate wirelessly and integrate seamlessly with cloud-based analytics platforms.

Consumer preferences are also indirectly influencing the market. The demand for sophisticated consumer electronics, smart home devices, and advanced automotive features necessitates the inclusion of highly functional and compact proximity sensors. In the automotive sector, the proliferation of Advanced Driver-Assistance Systems (ADAS), autonomous driving technologies, and sophisticated in-car interfaces are directly reliant on accurate and reliable proximity sensing. This trend is expected to drive a substantial portion of market growth.

Competitive dynamics are intensifying, with key players investing heavily in research and development to introduce next-generation sensors. Differentiation is occurring through specialized features such as multi-sensing capabilities, improved environmental resilience (e.g., dust, water, temperature resistance), and the integration of AI for smarter decision-making at the edge. The market penetration rate for proximity sensors in advanced manufacturing and automotive applications is already high, but there remains significant untapped potential in emerging sectors like renewable energy infrastructure and sophisticated agricultural automation.

Opportunities lie in developing solutions tailored for specific industry challenges, such as highly specialized sensors for pharmaceutical manufacturing that meet stringent hygiene standards, or robust sensors for the demanding conditions of the oil and gas industry. The increasing emphasis on energy efficiency also presents an opportunity for proximity sensors that can optimize machinery operation and reduce energy consumption. Furthermore, the growing need for enhanced security and surveillance systems in both commercial and public spaces is creating a demand for advanced proximity detection technologies. The estimated market size for 2025 is $4,050 million, with a projected CAGR of 7.5% through 2033.

Dominant Markets & Segments in United States Proximity Sensor Market

The United States Proximity Sensor Market is characterized by distinct dominant segments, driven by specific technological advancements, application requirements, and end-user demands. Among the various technologies, Photoelectric sensors are currently leading, driven by their versatility, non-contact operation, and ability to detect a wide range of objects at various distances. Their dominance is further amplified by their widespread adoption in industrial automation, packaging, and material handling. Following closely, Inductive sensors remain a cornerstone for detecting metallic objects, essential in manufacturing and robotics where precision and durability are paramount.

- Technology Dominance:

- Photoelectric Sensors: Dominant due to their versatility in industrial automation, packaging, and logistics. Key growth drivers include increasing automation in the food & beverage and pharmaceutical industries, requiring precise object detection.

- Inductive Sensors: Strong presence in automotive manufacturing, robotics, and machine tools for metallic object detection. Growth is spurred by the automotive industry's demand for high-precision assembly line components and the continued expansion of industrial robotics.

- Ultrasonic Sensors: Gaining traction in applications requiring detection in challenging environments (e.g., dusty, humid) and for fill-level monitoring in the food & beverage and chemical industries.

- Capacitive Sensors: Niche applications in detecting non-metallic materials and liquids, particularly in consumer electronics and food processing.

- Magnetic Sensors: Crucial for position sensing in automotive and industrial applications, with growth tied to the increasing complexity of vehicle systems and automated machinery.

In terms of Channel Type, Single-Channel sensors represent the largest segment due to their widespread use in basic detection and control applications. However, Multi-Channel sensors are witnessing rapid growth, especially in complex automation systems where multiple detection points or simultaneous sensing is required.

- Channel Type Dominance:

- Single-Channel: Historically dominant due to simplicity and cost-effectiveness in basic automation tasks.

- Multi-Channel: Experiencing higher growth rates due to the increasing complexity of automated systems and the need for simultaneous data acquisition from multiple sensing points.

The End-User landscape reveals Industrial Automation as the undisputed leader, accounting for a significant portion of the market share. This is a direct consequence of the ongoing automation revolution across manufacturing sectors, where proximity sensors are indispensable for machine control, safety interlocks, and material flow management. The Automotive sector is another major contributor, with proximity sensors playing a vital role in everything from assembly lines to ADAS and in-cabin features.

- End-User Dominance:

- Industrial Automation: The largest and fastest-growing segment, driven by Industry 4.0 initiatives, smart manufacturing, and robotics adoption. Infrastructure development in manufacturing facilities is a key growth driver.

- Automotive: Significant demand from vehicle manufacturing for assembly processes and the integration of ADAS, autonomous driving, and infotainment systems. Government policies promoting advanced vehicle technologies further bolster this segment.

- Consumer Electronics: Steady demand for proximity sensors in smartphones, wearables, and smart home devices, driven by miniaturization and advanced functionality.

- Aerospace and Defense: Niche but high-value applications, requiring ruggedized and highly reliable sensors for critical systems.

- Food & Beverage and Pharmaceutical: Growing adoption of automation for safety, hygiene, and process control, demanding specialized sensors.

- Construction and Energy: Emerging segments for proximity sensors in heavy machinery, infrastructure monitoring, and renewable energy installations.

The estimated market size for Industrial Automation in 2025 is projected to be over $1,500 million, while the Automotive segment is expected to exceed $1,200 million.

United States Proximity Sensor Market Product Analysis

The United States Proximity Sensor Market is characterized by continuous product innovation focused on enhancing performance, reducing size, and expanding functionality. Key product advancements include the development of solid-state sensors with no moving parts, leading to increased reliability and lifespan. Photoelectric sensors are evolving with advanced features like background suppression for greater accuracy and time-of-flight (ToF) technology for precise distance measurement. Inductive sensors are becoming more robust, capable of operating in extreme temperatures and harsh chemical environments. Capacitive sensors are being miniaturized for integration into compact electronic devices, while magnetic sensors are increasingly incorporating digital outputs for seamless data integration. The competitive advantage for manufacturers lies in their ability to offer tailored solutions that meet the specific requirements of diverse end-user applications, from the stringent demands of aerospace to the high-volume needs of consumer electronics.

Key Drivers, Barriers & Challenges in United States Proximity Sensor Market

Key Drivers: The United States Proximity Sensor Market is propelled by the overarching trend of Industrial Automation and Digital Transformation. The integration of IoT and Industry 4.0 principles necessitates sophisticated sensing capabilities for real-time data collection and control. The Automotive industry's rapid adoption of ADAS and autonomous driving technologies is a significant driver, demanding advanced proximity sensing for safety and functionality. Furthermore, miniaturization trends in consumer electronics and the increasing demand for smart devices are creating a need for smaller, more integrated proximity sensors. Government initiatives promoting advanced manufacturing and technological innovation also play a supportive role.

Barriers & Challenges: Despite the growth, the market faces challenges. Supply chain disruptions, particularly for critical components, can impact production and lead times, leading to increased costs. Intense competition among established players and emerging niche providers puts pressure on pricing and margins. Regulatory complexities, especially concerning safety standards and emerging cybersecurity requirements for connected sensors, can pose hurdles to market entry and product development. The need for high initial investment for advanced R&D and manufacturing capabilities can also be a barrier for smaller companies. Furthermore, the shortage of skilled labor capable of designing, implementing, and maintaining advanced sensor systems can impede adoption in certain sectors.

Growth Drivers in the United States Proximity Sensor Market Market

The United States Proximity Sensor Market is significantly influenced by several key growth drivers. Technological advancements remain paramount, with ongoing innovation in sensor materials, signal processing, and connectivity solutions fueling demand for more accurate and reliable proximity detection. The widespread adoption of Industry 4.0 and IIoT across manufacturing sectors is a major catalyst, as proximity sensors are fundamental components for smart factories, enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency. The automotive sector's increasing focus on safety features, ADAS, and autonomous driving technologies directly translates to a surge in demand for various types of proximity sensors. Economic factors, such as increased manufacturing output and investment in infrastructure development, also contribute to market expansion. Moreover, government policies that encourage technological innovation and domestic manufacturing further support market growth.

Challenges Impacting United States Proximity Sensor Market Growth

Several challenges can impact the growth trajectory of the United States Proximity Sensor Market. Supply chain vulnerabilities, exacerbated by global events, can lead to material shortages and increased lead times, affecting production schedules and ultimately, market availability. The highly competitive landscape intensifies pressure on pricing and profit margins, making it difficult for smaller players to compete. Regulatory hurdles, including evolving safety standards and environmental compliance requirements, necessitate significant investment in product development and testing, potentially slowing down innovation cycles. Furthermore, the increasing complexity of sensor integration with existing systems and the need for advanced data analytics require specialized expertise, leading to a potential shortage of skilled personnel for implementation and maintenance. The high cost of advanced sensor technologies can also be a barrier for adoption in price-sensitive applications.

Key Players Shaping the United States Proximity Sensor Market Market

- Rockwell Automation

- Honeywell International Inc

- NXP Semiconductors N V

- SICK AG

- STMicroelectronics

- Schneider Electric

- OMRON Corporation

- Panasonic Corporation

- General Electric

Significant United States Proximity Sensor Market Industry Milestones

- 2019: Increased investment in AI-powered sensor analytics for predictive maintenance in industrial settings.

- 2020: Rise in demand for contact-less sensing solutions due to public health concerns, boosting photoelectric and ultrasonic sensor adoption.

- 2021: Significant product launches focusing on miniaturization and enhanced power efficiency for consumer electronics and IoT devices.

- 2022: Growing integration of machine learning algorithms within proximity sensors for edge computing applications.

- 2023: Expansion of supply chains to mitigate risks and ensure availability of critical sensor components.

- 2024: Increased focus on cybersecurity features for networked proximity sensors in industrial and automotive applications.

Future Outlook for United States Proximity Sensor Market Market

The future outlook for the United States Proximity Sensor Market is exceptionally bright, driven by sustained technological advancements and the pervasive integration of automation and connectivity across industries. The continued evolution of Industry 4.0, the expansion of electric and autonomous vehicle technologies, and the increasing sophistication of consumer electronics will serve as powerful growth catalysts. Opportunities abound in developing highly specialized sensors for niche applications, such as advanced medical devices and sustainable energy infrastructure. The market will likely see a greater emphasis on smart sensors with embedded intelligence, enabling real-time data processing and decision-making at the edge. Strategic collaborations and acquisitions will continue to shape the competitive landscape, as companies seek to expand their technological capabilities and market reach. The projected market size in 2033 is estimated to exceed $7,000 million, underscoring the significant growth potential.

United States Proximity Sensor Market Segmentation

-

1. Technology

- 1.1. Inductive

- 1.2. Capacitive

- 1.3. Photoelectric

- 1.4. Magnetic

- 1.5. Ultrasonic

- 1.6. Other Technology

-

2. Channel Type

- 2.1. Single Channel

- 2.2. Multi-Channel

-

3. End-User

- 3.1. Aerospace and Defense

- 3.2. Automotive

- 3.3. Industrial Automation

- 3.4. Consumer Electronics

- 3.5. Food & Beverage

- 3.6. Pharmaceutical

- 3.7. Construction

- 3.8. Energy

- 3.9. Other End-users

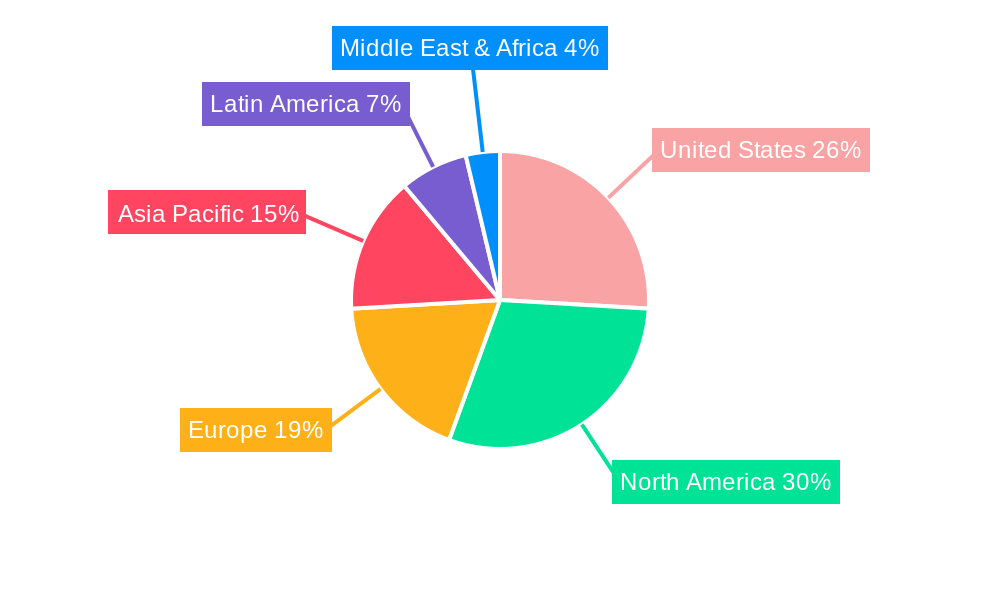

United States Proximity Sensor Market Segmentation By Geography

- 1. United States

United States Proximity Sensor Market Regional Market Share

Geographic Coverage of United States Proximity Sensor Market

United States Proximity Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Industrial Automation; Increase in the Demand for Inductive Sensing Technology; Expansion of Automotive Sensing Applications

- 3.3. Market Restrains

- 3.3.1. Design Comlexity & Reliability

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Proximity Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Inductive

- 5.1.2. Capacitive

- 5.1.3. Photoelectric

- 5.1.4. Magnetic

- 5.1.5. Ultrasonic

- 5.1.6. Other Technology

- 5.2. Market Analysis, Insights and Forecast - by Channel Type

- 5.2.1. Single Channel

- 5.2.2. Multi-Channel

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Aerospace and Defense

- 5.3.2. Automotive

- 5.3.3. Industrial Automation

- 5.3.4. Consumer Electronics

- 5.3.5. Food & Beverage

- 5.3.6. Pharmaceutical

- 5.3.7. Construction

- 5.3.8. Energy

- 5.3.9. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America United States Proximity Sensor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Proximity Sensor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Proximity Sensor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America United States Proximity Sensor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa United States Proximity Sensor Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rockwell Automation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductors N V

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SICK AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 STMicroelectronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schneider Electric

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OMRON Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Panasonic Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Rockwell Automation

List of Figures

- Figure 1: United States Proximity Sensor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Proximity Sensor Market Share (%) by Company 2025

List of Tables

- Table 1: United States Proximity Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: United States Proximity Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: United States Proximity Sensor Market Revenue Million Forecast, by Channel Type 2020 & 2033

- Table 4: United States Proximity Sensor Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: United States Proximity Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United States Proximity Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Proximity Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United States Proximity Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Proximity Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Proximity Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Proximity Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United States Proximity Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Proximity Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Proximity Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Proximity Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United States Proximity Sensor Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: United States Proximity Sensor Market Revenue Million Forecast, by Channel Type 2020 & 2033

- Table 18: United States Proximity Sensor Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 19: United States Proximity Sensor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Proximity Sensor Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the United States Proximity Sensor Market?

Key companies in the market include Rockwell Automation, Honeywell International Inc, NXP Semiconductors N V, SICK AG, STMicroelectronics, Schneider Electric, OMRON Corporation, Panasonic Corporation, General Electric*List Not Exhaustive.

3. What are the main segments of the United States Proximity Sensor Market?

The market segments include Technology, Channel Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Industrial Automation; Increase in the Demand for Inductive Sensing Technology; Expansion of Automotive Sensing Applications.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Design Comlexity & Reliability.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Proximity Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Proximity Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Proximity Sensor Market?

To stay informed about further developments, trends, and reports in the United States Proximity Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence