Key Insights

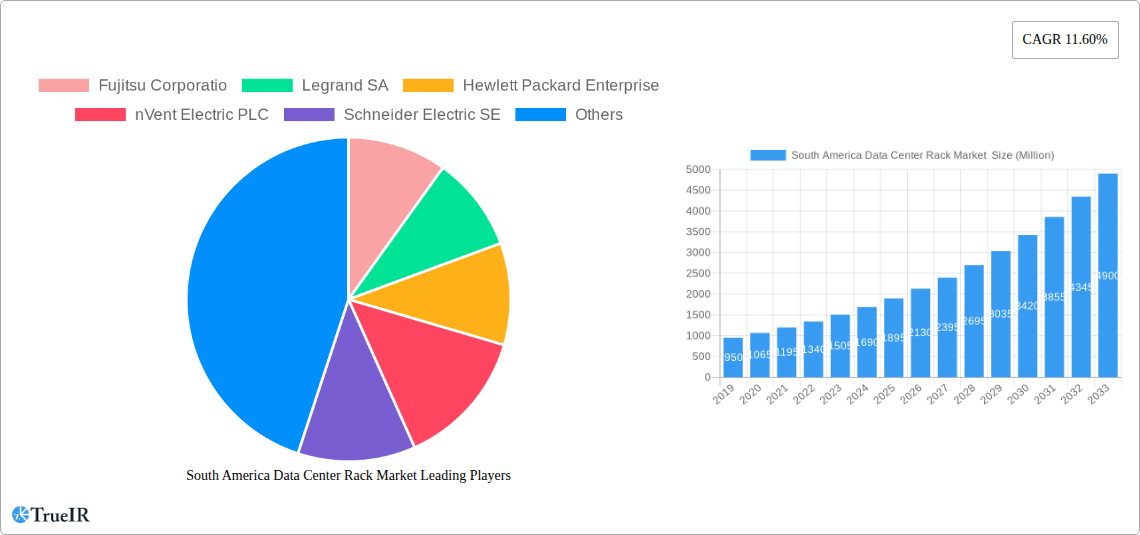

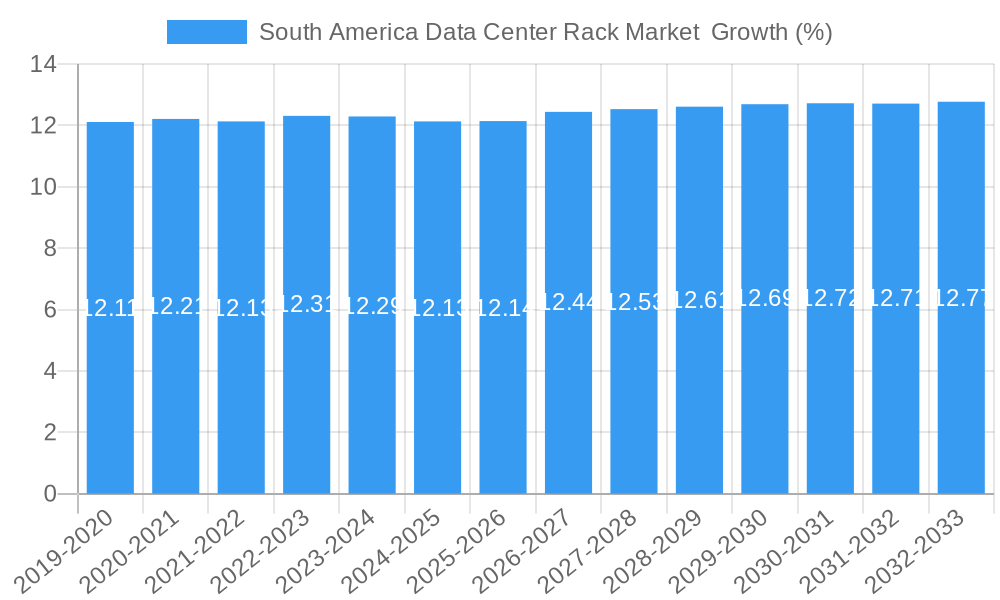

The South America Data Center Rack Market is poised for substantial expansion, projected to reach a market size of approximately $2,450 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 11.60%. This impressive growth trajectory is fueled by several critical factors, including the burgeoning demand for data processing and storage across key end-user industries such as IT & Telecommunication, BFSI, Government, and Media & Entertainment. The increasing adoption of cloud computing services, the proliferation of IoT devices, and the ongoing digital transformation initiatives across the region are significantly escalating the need for advanced and scalable data center infrastructure. Furthermore, government investments in digital infrastructure and the growing enterprise focus on data localization and compliance are acting as powerful catalysts for market expansion. The market will see a dynamic shift towards more sophisticated rack solutions, with a notable emphasis on Half and Full Rack configurations to accommodate growing server densities and complex IT environments.

The market's growth is also being shaped by evolving trends such as the increasing demand for high-density racks to optimize space utilization and improve cooling efficiency, alongside a growing interest in smart and connected racks that offer enhanced monitoring and remote management capabilities. The increasing complexity of IT deployments necessitates adaptable and efficient rack solutions, pushing innovation in areas like modular designs and integrated power and cooling systems. However, the market also faces certain restraints. High initial capital expenditure for advanced data center infrastructure, coupled with the availability of relatively less developed digital ecosystems in some parts of South America, could pose challenges. Despite these hurdles, the sustained digital transformation, coupled with strategic investments from leading companies like Fujitsu Corporation, Legrand SA, Hewlett Packard Enterprise, and Schneider Electric SE, is expected to propel the South America Data Center Rack Market forward, making it a dynamic and attractive landscape for both existing players and new entrants.

South America Data Center Rack Market: Comprehensive Analysis and Future Outlook (2025-2033)

This in-depth report provides a detailed analysis of the South America Data Center Rack Market, offering critical insights for stakeholders from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study covers historical trends, current market dynamics, and future projections. Leveraging high-volume keywords such as "South America data center racks," "colocation market growth," "hyperscale data center infrastructure," and "IT infrastructure South America," this report is meticulously crafted for optimal SEO performance and maximum engagement with industry professionals. It explores market segmentation by rack size and end-user, identifies dominant markets, analyzes key players, and outlines significant industry developments.

South America Data Center Rack Market Market Structure & Competitive Landscape

The South America Data Center Rack Market exhibits a moderately concentrated structure, with a few prominent players holding significant market share. Innovation in rack design, cooling technologies, and power distribution remains a key differentiator, driven by increasing demand for high-density computing and energy efficiency. Regulatory frameworks, particularly concerning data sovereignty and environmental standards, are increasingly influencing market entry and operational strategies. Product substitutes, such as modular data centers and edge computing solutions, present emerging challenges and opportunities. End-user segmentation reveals a strong demand from the IT & Telecommunication and BFSI sectors, with growing contributions from Government and Media & Entertainment. Mergers & Acquisitions (M&A) trends indicate consolidation efforts aimed at expanding geographical reach and technological capabilities. For instance, in the last 24 months, an estimated 5-7 significant M&A deals have been observed, focusing on bolstering colocation capacity and enhancing service portfolios. Concentration ratios for the top 5 players are estimated to be around 55-65%, highlighting a degree of market dominance.

South America Data Center Rack Market Market Trends & Opportunities

The South America Data Center Rack Market is poised for substantial growth, projected to expand from an estimated USD 2,500 Million in 2025 to USD 5,500 Million by 2033, registering a Compound Annual Growth Rate (CAGR) of approximately 8.5%. This robust expansion is fueled by the escalating adoption of cloud computing, the proliferation of IoT devices, and the increasing demand for high-performance computing. Technological shifts are pivotal, with a growing emphasis on liquid cooling solutions for high-density racks, advanced cable management systems, and smart rack monitoring capabilities to enhance operational efficiency and reduce downtime. Consumer preferences are leaning towards scalable, flexible, and energy-efficient data center rack solutions that can accommodate evolving IT workloads. Competitive dynamics are intensifying, with established players investing heavily in expanding their infrastructure and service offerings to meet the burgeoning demand. The market penetration rate for advanced data center rack solutions is expected to rise significantly as businesses recognize the critical role of robust physical infrastructure in their digital transformation journeys. The increasing digitalization across various industries, coupled with the need for localized data processing and reduced latency, presents a significant opportunity for the deployment of more data centers and, consequently, a higher demand for data center racks. The ongoing investments in digital infrastructure across the region, driven by both private sector initiatives and government support for digital economies, are foundational to this growth trajectory. Emerging trends like edge computing, while potentially decentralizing some aspects of data storage, will also necessitate specialized rack solutions at numerous distributed locations. The competitive landscape is characterized by a race for capacity expansion, technological innovation, and the development of sustainable data center practices.

Dominant Markets & Segments in South America Data Center Rack Market

Brazil currently stands as the dominant market within the South America Data Center Rack sector, driven by its large economy, extensive digital infrastructure, and significant investments in hyperscale data centers. Chile and Colombia are emerging as key growth regions, actively attracting foreign investment and expanding their data center footprints.

Rack Size:

- Full Rack: This segment commands the largest market share, catering to the substantial space and power requirements of large enterprises, cloud providers, and hyperscale data centers. The demand for full racks is driven by the need for centralized, high-capacity IT infrastructure.

- Half Rack: This segment offers a flexible and cost-effective solution for medium-sized businesses and specific departmental deployments, providing a balance between capacity and space utilization.

- Quarter Rack: This segment is witnessing steady growth due to the increasing adoption of edge computing and specialized server deployments where space and power are at a premium.

End User:

- IT & Telecommunication: This sector remains the primary consumer of data center racks, fueled by the continuous expansion of network infrastructure, cloud services, and mobile data consumption. Investments in 5G deployment further escalate demand.

- BFSI: The banking, financial services, and insurance sector exhibits robust demand due to the critical need for secure, reliable, and high-performance data storage and processing for transactions and compliance.

- Government: Government entities are increasingly investing in digital transformation initiatives, requiring secure and scalable data center infrastructure for public services, defense, and smart city projects.

- Media & Entertainment: The growing demand for streaming services, content creation, and digital distribution drives significant investments in data center capacity, thus boosting the demand for racks.

- Other End Users: This includes sectors like healthcare, retail, and manufacturing, all of which are undergoing digital transformation and increasing their reliance on data center infrastructure.

The growth in these segments is underpinned by ongoing infrastructure development, favorable government policies promoting digital adoption, and the strategic expansion of data center operators across the region. For instance, the increasing number of new data center builds, as highlighted in the industry developments, directly translates into a heightened demand for racks across all sizes and end-user categories. The expansion of cloud services and the increasing adoption of hybrid cloud models are further strengthening the demand for flexible and scalable rack solutions.

South America Data Center Rack Market Product Analysis

The South America Data Center Rack Market is characterized by continuous product innovation focused on enhanced thermal management, power distribution efficiency, and physical security. Innovations include advanced airflow management systems, integrated power distribution units (PDUs), and modular rack designs that allow for scalability and rapid deployment. Applications range from housing high-density servers and networking equipment to supporting specialized IT infrastructure for AI and IoT. Competitive advantages are being carved out through superior build quality, customizable configurations, and integrated smart monitoring features that provide real-time performance data and predictive maintenance capabilities.

Key Drivers, Barriers & Challenges in South America Data Center Rack Market

Key Drivers:

- Digital Transformation: The widespread adoption of digital technologies across industries is a primary driver, necessitating robust data center infrastructure.

- Cloud Computing Growth: The expansion of cloud services and the demand for colocation facilities are directly increasing the need for data center racks.

- Data Sovereignty & Localization: Increasing emphasis on data localization laws is encouraging the development of local data centers, thereby boosting rack demand.

- Technological Advancements: Innovations in IT hardware requiring higher power densities and improved cooling solutions are driving demand for advanced rack designs.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of raw materials and manufactured components for racks, potentially leading to delays and increased expenses.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different South American countries can pose challenges for market entry and operational compliance.

- Economic Volatility: Fluctuations in regional economies and currency exchange rates can affect investment decisions and the overall market growth trajectory.

- Skilled Labor Shortage: A lack of specialized skilled labor for data center design, installation, and maintenance can hinder rapid expansion.

Growth Drivers in the South America Data Center Rack Market Market

The South America Data Center Rack Market is propelled by several key growth drivers. Technologically, the burgeoning demand for high-density computing, driven by AI, big data analytics, and IoT, necessitates sophisticated rack solutions capable of supporting advanced hardware. Economically, significant foreign and domestic investments in digital infrastructure, including the expansion of hyperscale data centers and edge facilities, are directly translating into increased rack procurement. Policy-wise, governments across the region are increasingly recognizing the importance of digital infrastructure for economic development, leading to initiatives that support data center growth and connectivity. The ongoing expansion of fiber optic networks and the increasing penetration of broadband services further fuel the need for consolidated and efficient data storage and processing capabilities, all of which rely heavily on a robust data center rack ecosystem.

Challenges Impacting South America Data Center Rack Market Growth

Several challenges can impede the growth of the South America Data Center Rack Market. Regulatory complexities, particularly concerning permits, environmental compliance, and cross-border data flow, can create significant hurdles. Supply chain issues, exacerbated by global logistical challenges, can lead to increased lead times and material costs for rack manufacturing. Competitive pressures from both established global players and emerging local manufacturers can lead to price sensitivity and necessitate continuous innovation to maintain market share. Furthermore, the significant capital investment required for large-scale data center deployments and the associated rack infrastructure can be a barrier in certain sub-regions with less developed financial markets.

Key Players Shaping the South America Data Center Rack Market Market

- Fujitsu Corporation

- Legrand SA

- Hewlett Packard Enterprise

- nVent Electric PLC

- Schneider Electric SE

- Dell Inc

- Black Box Corporation

- Rittal GMBH & Co KG

- Vertic Group Corp

- Eaton Corporation

Significant South America Data Center Rack Market Industry Milestones

- November 2022: Ascenty, a leading data center operator in Latin America, announced plans to construct five new facilities across Brazil, Chile, Mexico, and Colombia, adding 33 operational infrastructures to its portfolio. This initiative includes Santiago 3 (21,000 m², 16 MW), Bogota 1 and 2 (9,000 m² each, 12 MW each), and Sao Paulo 5 and 6 (7,000 m² each, 19 MW each), significantly expanding the region's data center capacity.

- August 2022: Scala Data Centers launched SGRUTB04, the largest vertical data center in Latin America, with an 18MW capacity, situated in the Tamboré Campus in Greater Sao Paulo, Brazil. This facility, dedicated to a single hyperscale client, spans over 140,000 square feet and can accommodate more than 1,500 racks, emphasizing the trend towards high-density, hyperscale deployments.

Future Outlook for South America Data Center Rack Market Market

The future outlook for the South America Data Center Rack Market is exceptionally promising, driven by the accelerating pace of digitalization and the sustained demand for cloud services. Strategic opportunities lie in catering to the growing needs of hyperscale cloud providers, expanding edge computing deployments, and developing sustainable and energy-efficient rack solutions. The increasing investments in technological infrastructure across countries like Brazil, Mexico, and Colombia will continue to fuel market growth. The trend towards higher rack densities and advanced cooling technologies will shape product development, while government initiatives promoting digital transformation will provide a stable foundation for market expansion, projecting continued robust growth through 2033.

South America Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

South America Data Center Rack Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share

- 3.3. Market Restrains

- 3.3.1. Increasing Utilization of Blade Servers

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Brazil South America Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Fujitsu Corporatio

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Legrand SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hewlett Packard Enterprise

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 nVent Electric PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Schneider Electric SE

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dell Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Black Box Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Rittal GMBH & Co KG

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Vertic Group Corp

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Eaton Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Fujitsu Corporatio

List of Figures

- Figure 1: South America Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: South America Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: South America Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: South America Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South America Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of South America South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South America Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 10: South America Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 11: South America Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Colombia South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Peru South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Venezuela South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Ecuador South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bolivia South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Paraguay South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Uruguay South America Data Center Rack Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Data Center Rack Market ?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the South America Data Center Rack Market ?

Key companies in the market include Fujitsu Corporatio, Legrand SA, Hewlett Packard Enterprise, nVent Electric PLC, Schneider Electric SE, Dell Inc, Black Box Corporation, Rittal GMBH & Co KG, Vertic Group Corp, Eaton Corporation.

3. What are the main segments of the South America Data Center Rack Market ?

The market segments include Rack Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Deployment of Data Center Facilities; Growing Cloud Computing Adoption Leading to Investment in Hyperscale Data Centers; BFSI Sector Expected to Hold a Significant Share.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

Increasing Utilization of Blade Servers.

8. Can you provide examples of recent developments in the market?

November 2022: Ascenty, the prevailing market leader in Latin America's data center domain, unveiled its groundbreaking initiative to construct five novel facilities, further cementing its position of preeminence with an aggregate of 33 infrastructures spanning Brazil, Chile, Mexico, and now Colombia. The novel data centers were strategically situated, including Santiago 3, encompassing 21,000 m² with a power capacity of 16 MW; Bogota 1 and 2, each spanning 9,000 m² and equipped with a 12 MW capacity; and finally, So Paulo 5 and 6, boasting an expansive area of 7,000 m² and a commanding capacity of 19 MW each.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Data Center Rack Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Data Center Rack Market ?

To stay informed about further developments, trends, and reports in the South America Data Center Rack Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence