Key Insights

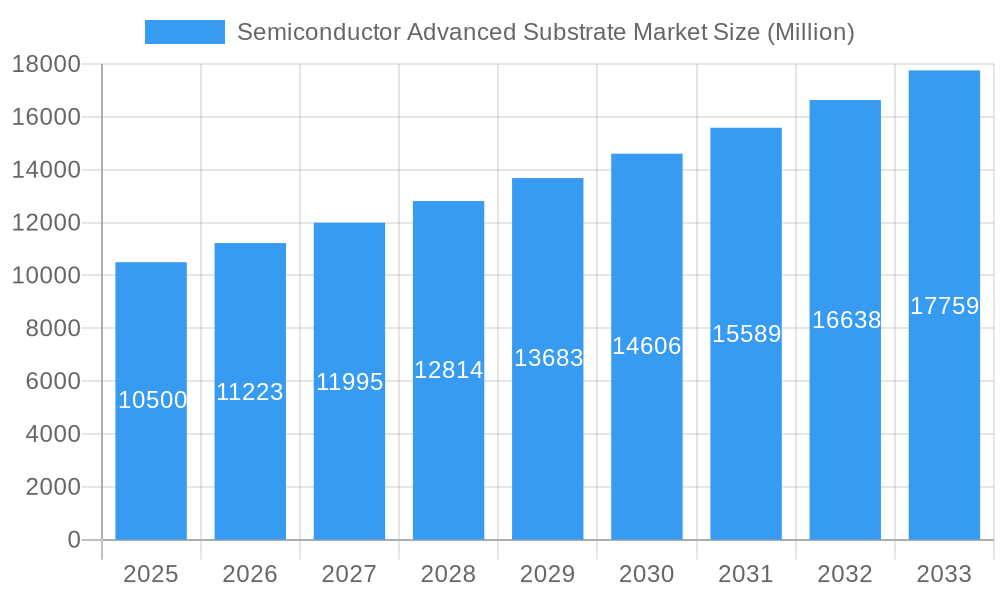

The global Semiconductor Advanced Substrate Market is projected to expand significantly, reaching USD 702.44 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.25% from the base year 2025 through 2033. This growth is driven by the escalating demand for high-performance computing, artificial intelligence (AI), and 5G technology, which require advanced and compact semiconductor packaging. Key technologies like Flip-Chip Ball Grid Array (FC BGA) and Flip-Chip Chip Scale Package (FC CSP) are vital for superior electrical performance, thermal management, and signal integrity. Substrate-Like PCBs (SLPs) are increasingly adopted in premium smartphones and wearables for ultra-thin designs and enhanced functionality, while embedded die solutions are gaining traction in mobile and automotive electronics for space optimization and improved performance.

Semiconductor Advanced Substrate Market Market Size (In Billion)

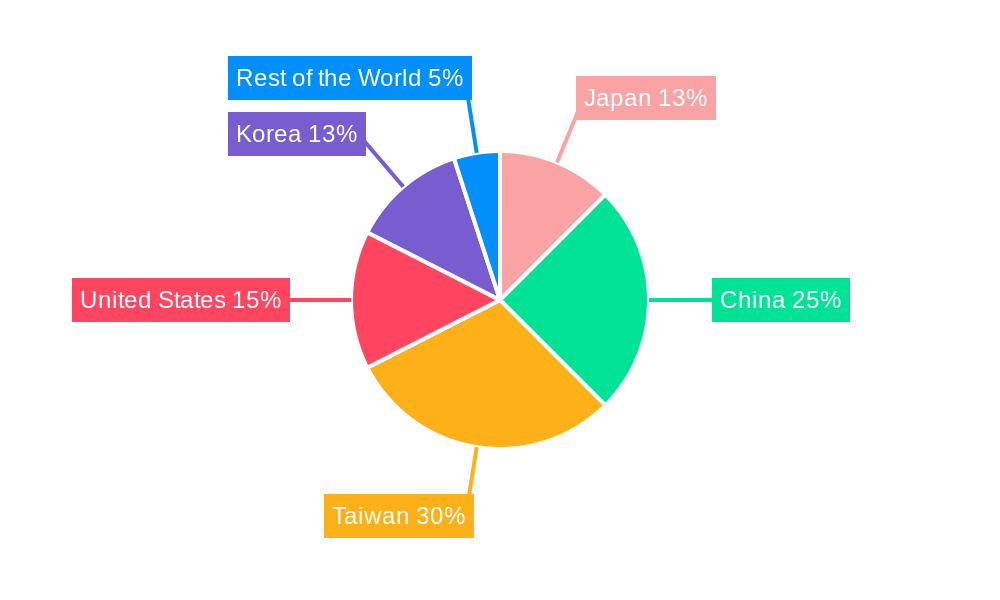

Asia-Pacific, led by Taiwan, China, and Korea, is anticipated to lead the market due to its robust semiconductor manufacturing infrastructure and the presence of major industry players. The United States also holds a significant position, supported by strong research and development capabilities and domestic industry growth in AI and high-performance computing. Emerging trends include thinner, flexible substrates, novel materials for enhanced conductivity and thermal dissipation, and sustainable manufacturing. Market challenges involve high capital investment for advanced facilities, stringent quality control, and global supply chain complexities. Leading companies such as Unimicron, Zhen Ding Tech, Samsung Electro-Mechanics, and AT&S are investing in R&D to meet industry demands.

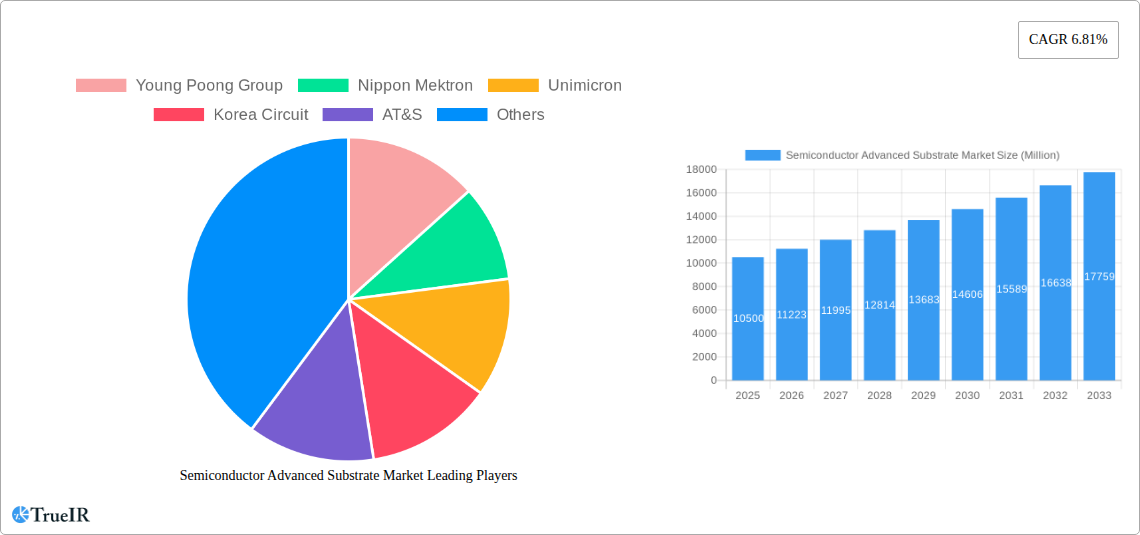

Semiconductor Advanced Substrate Market Company Market Share

This comprehensive report offers strategic insights into the Semiconductor Advanced Substrate Market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It analyzes key segments including Advanced IC Substrates (FC BGA, FC CSP), Substrate-like PCBs (SLP) for mobile and other devices, and Embedded Die solutions for mobile and automotive applications. The report covers market dynamics, competitive landscapes, and growth opportunities across Japan, China, Taiwan, the United States, Korea, and the Rest of the World, focusing on innovation drivers, market trends, and key player strategies within the semiconductor advanced substrate ecosystem.

Semiconductor Advanced Substrate Market Market Structure & Competitive Landscape

The Semiconductor Advanced Substrate Market is characterized by a moderately concentrated structure, with a handful of key players dominating innovation and market share. This concentration is driven by the substantial capital investment required for research and development, advanced manufacturing facilities, and the stringent quality control necessary for high-performance semiconductor substrates. Innovation drivers are primarily fueled by the relentless demand for miniaturization, increased processing power, and enhanced energy efficiency in electronic devices. Leading companies are continuously investing in next-generation materials and manufacturing processes to meet the evolving needs of the semiconductor industry. Regulatory impacts, while generally supportive of semiconductor manufacturing through various national initiatives, can also introduce complexities related to environmental standards and trade policies. Product substitutes, though evolving, are currently limited due to the specialized nature and performance requirements of advanced substrates. End-user segmentation is crucial, with smartphones, data centers, and automotive electronics representing the most significant demand drivers. Mergers and acquisitions (M&A) trends are observable as companies seek to consolidate market positions, acquire critical technologies, or expand their geographical reach. For instance, the acquisition of smaller specialized firms by larger players is a recurring theme aimed at bolstering technological capabilities and market access. The market's competitive intensity is high, necessitating continuous innovation and strategic partnerships to maintain a leading edge. Concentration ratios in specific product categories like FC BGA are estimated to be around 70% among the top five players. M&A volumes have seen a steady increase over the historical period, reflecting the strategic importance of this sector.

Semiconductor Advanced Substrate Market Market Trends & Opportunities

The Semiconductor Advanced Substrate Market is poised for significant expansion driven by an insatiable global demand for more powerful, compact, and energy-efficient electronic devices. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period of 2025–2033. This growth is underpinned by several profound technological shifts. The ongoing proliferation of Artificial Intelligence (AI), machine learning, and high-performance computing (HPC) necessitates advanced substrates capable of handling higher power densities and superior signal integrity. This is particularly evident in the demand for Flip-Chip Ball Grid Array (FC BGA) substrates, which are essential for high-end processors and GPUs. Furthermore, the ubiquitous expansion of 5G networks and the burgeoning Internet of Things (IoT) ecosystem are creating a surge in demand for sophisticated semiconductor packaging solutions. Substrate-like PCBs (SLP), offering thinner form factors and improved electrical performance compared to traditional PCBs, are becoming indispensable in the design of next-generation smartphones and other mobile devices. Consumer preferences are increasingly shifting towards sleeker, more powerful gadgets, pushing manufacturers to adopt advanced packaging technologies that enable further miniaturization without compromising performance. The automotive sector is another significant growth area, with the increasing electrification and autonomy of vehicles requiring advanced semiconductors and, consequently, advanced substrates for infotainment systems, advanced driver-assistance systems (ADAS), and electric vehicle powertrains. Opportunities abound for companies that can innovate in materials science, manufacturing processes, and vertical integration. The development of novel materials with superior thermal management properties and enhanced electrical conductivity will be critical. Advanced lithography techniques and wafer-level packaging technologies also present significant avenues for market penetration and differentiation. The competitive dynamics are intensifying, with established players investing heavily in R&D and emerging players vying for niche markets. Strategic collaborations between substrate manufacturers and semiconductor foundries are becoming more prevalent to co-develop solutions tailored to specific advanced packaging needs. The market penetration rate for advanced IC substrates in high-performance computing applications is already substantial and is expected to grow further as the demand for AI accelerators and data center infrastructure intensifies.

Dominant Markets & Segments in Semiconductor Advanced Substrate Market

The global Semiconductor Advanced Substrate Market exhibits distinct geographical and segmental dominance, driven by a confluence of technological innovation, manufacturing capabilities, and end-user demand. China stands out as a dominant geographical market, propelled by its massive electronics manufacturing ecosystem, significant government support for the semiconductor industry, and a rapidly growing domestic demand for advanced electronic products. The country's burgeoning fabless semiconductor sector and its role as a global hub for electronics assembly create a substantial pull for advanced substrates. Taiwan remains a critical player, leveraging its unparalleled expertise in semiconductor manufacturing and its established leadership in advanced packaging technologies. The presence of leading foundries and outsourced semiconductor assembly and test (OSAT) companies makes Taiwan a vital center for the development and production of advanced substrates, particularly for high-density interconnects.

Within the Platform segment, Advanced IC Substrate is a dominant category, with FC BGA (Flip-Chip Ball Grid Array) substrates leading the charge. This dominance is attributed to their critical role in supporting high-performance processors, GPUs, and AI accelerators that power data centers, high-end gaming, and scientific computing. The increasing complexity and power requirements of these chips necessitate the superior electrical performance and thermal management offered by FC BGA.

In terms of End-User Application, Smartphones continue to be a massive driver, fueling the demand for Substrate-like PCBs (SLP). The relentless pursuit of thinner, lighter, and more feature-rich smartphones by global brands necessitates SLPs that offer higher density interconnects and reduced thickness compared to conventional PCBs. The market for Tablets and Smartwatches also contributes significantly to SLP demand, albeit to a lesser extent than smartphones.

The Embedded Die segment, particularly within the Mobile and Automotive sectors, presents a significant growth opportunity. As devices become more integrated and complex, embedding bare dies directly into the substrate offers advantages in terms of size, performance, and power consumption. The automotive industry's drive towards autonomous driving, advanced infotainment, and electrification is a key catalyst for the adoption of embedded die technologies in various automotive modules.

Key growth drivers across these dominant markets include:

- Infrastructure Development: Massive investments in semiconductor manufacturing facilities and R&D centers in China and Taiwan.

- Government Policies: Favorable policies, subsidies, and tax incentives aimed at promoting domestic semiconductor production and innovation in key regions.

- Demand from High-Growth End Markets: The insatiable demand for AI, 5G, IoT, and advanced automotive technologies.

- Technological Advancements: Continuous innovation in materials science, lithography, and packaging techniques enabling smaller, faster, and more efficient substrates.

Korea also plays a pivotal role, especially in the development and production of high-end FC BGA substrates, driven by the presence of global semiconductor giants like Samsung Electronics and SK Hynix. The United States, while having a smaller manufacturing base for substrates, is a crucial market for design and innovation, particularly in advanced computing and defense applications. The Rest of the World comprises emerging markets and specialized applications, contributing to the overall diversification of the global semiconductor advanced substrate landscape.

Semiconductor Advanced Substrate Market Product Analysis

Product innovations in the Semiconductor Advanced Substrate Market are sharply focused on enabling higher performance, increased integration, and improved thermal management for advanced semiconductor devices. Key advancements include the development of thinner and lighter substrates for mobile applications, such as Substrate-like PCBs (SLP), which offer superior routing density and reduced form factors. For high-performance computing and AI applications, Flip-Chip Ball Grid Array (FC BGA) substrates are continually evolving with finer line widths and spaces, increased layer counts, and improved dielectric materials to handle higher signal frequencies and power densities. Embedded Die technologies, where the semiconductor die is integrated directly into the substrate, offer significant advantages in terms of miniaturization and performance for mobile and automotive applications. The competitive advantage lies in the ability to provide customized solutions that meet the stringent electrical, thermal, and mechanical requirements of cutting-edge semiconductor chips, thereby driving market adoption and expansion.

Key Drivers, Barriers & Challenges in Semiconductor Advanced Substrate Market

Key Drivers:

The Semiconductor Advanced Substrate Market is propelled by several critical factors. Technologically, the relentless demand for enhanced processing power, miniaturization, and energy efficiency in devices across mobile, computing, and automotive sectors is a primary driver. The rapid expansion of 5G infrastructure, Artificial Intelligence (AI), and the Internet of Things (IoT) ecosystems necessitates more sophisticated semiconductor packaging solutions, directly boosting demand for advanced substrates. Economically, global digitalization trends and the increasing adoption of high-performance computing in data centers and enterprise applications create significant market pull. Policy-driven factors, such as government initiatives promoting domestic semiconductor manufacturing and R&D investments in key regions like China and the United States, also provide substantial impetus.

Key Barriers & Challenges:

Despite the strong growth trajectory, the market faces several barriers and challenges. Supply chain disruptions, exacerbated by geopolitical tensions and global events, pose a significant risk to raw material availability and production continuity, with potential impacts on lead times and costs. Regulatory hurdles, including increasingly stringent environmental regulations concerning material usage and manufacturing processes, can add complexity and investment requirements for compliance. Competitive pressures are intense, with a high level of R&D investment required to stay at the forefront of technology, leading to potential margin erosion for less innovative players. The high capital expenditure needed for advanced manufacturing facilities creates a significant barrier to entry for new market participants. The cost of advanced materials and complex manufacturing processes can also limit adoption in cost-sensitive applications.

Growth Drivers in the Semiconductor Advanced Substrate Market Market

The Semiconductor Advanced Substrate Market is experiencing robust growth fueled by several key drivers. Technologically, the insatiable demand for higher processing speeds, increased memory capacity, and greater energy efficiency in consumer electronics, enterprise solutions, and automotive systems is paramount. The proliferation of Artificial Intelligence (AI) and Machine Learning (ML) applications, requiring powerful and compact semiconductor chips, is a significant catalyst. Economic factors, such as the global digitalization trend and the continuous expansion of data centers to support cloud computing and big data analytics, are creating sustained demand. Regulatory drivers, including government incentives and strategic investments in domestic semiconductor manufacturing capabilities in various countries, are further accelerating market growth and innovation.

Challenges Impacting Semiconductor Advanced Substrate Market Growth

Despite strong market potential, the Semiconductor Advanced Substrate Market faces significant challenges. Regulatory complexities, including evolving environmental standards and international trade policies, can create uncertainty and impact manufacturing costs. Persistent supply chain issues, ranging from raw material shortages to logistics bottlenecks, continue to disrupt production and extend lead times, impacting overall market efficiency. Intense competitive pressures necessitate substantial and continuous R&D investment to maintain technological leadership, which can strain profitability for smaller players. The high capital expenditure required for establishing and maintaining advanced substrate manufacturing facilities presents a considerable barrier to entry and expansion.

Key Players Shaping the Semiconductor Advanced Substrate Market Market

- Young Poong Group

- Nippon Mektron

- Unimicron

- Korea Circuit

- AT&S

- Hannstar

- Zhen Ding Tech

- Samsung Electro-Mechanics

- IBIDEN

- Daeduck Electronics

- TTM Technologies

- Compeg

- LG Innotek

Significant Semiconductor Advanced Substrate Market Industry Milestones

- February 2023: TTM Technologies announced its participation in the 2023 International Electronics Circuit Exhibition in Shenzhen, China. The company planned to host technical seminars to showcase its cutting-edge engineering and product solutions designed to address customer challenges across various end markets and applications.

- November 2023: AT&S revealed that it is supplying IC substrates to the global semiconductor company AMD. These substrates are integral components of AMD's high-performance, energy-efficient data center processors, powering advanced digital experiences, including AI and VR applications.

Future Outlook for Semiconductor Advanced Substrate Market Market

The future outlook for the Semiconductor Advanced Substrate Market is exceptionally promising, driven by accelerating technological advancements and expanding market applications. Key growth catalysts include the continued proliferation of AI and machine learning, the widespread deployment of 5G and future wireless technologies, and the increasing electrification and autonomy of the automotive sector. Strategic opportunities lie in developing ultra-high-density interconnect substrates, advanced thermal management solutions, and novel materials that enable further miniaturization and performance gains. The market potential is vast, with emerging applications in augmented reality, virtual reality, and the metaverse poised to create new demand streams for sophisticated semiconductor packaging. Companies that focus on innovation, strategic partnerships, and sustainable manufacturing practices will be best positioned to capitalize on this robust growth.

Semiconductor Advanced Substrate Market Segmentation

-

1. Platform

-

1.1. Advanced IC Substrate

-

1.1.1. Product Category

- 1.1.1.1. FC BGA

- 1.1.1.2. FC CSP

-

1.1.1. Product Category

-

1.2. Substrate-like-PCB (SLP)

-

1.2.1. End-User Application

- 1.2.1.1. Smartphone

- 1.2.1.2. Others (Tablets and Smartwatches)

-

1.2.1. End-User Application

-

1.3. Embedded Die

- 1.3.1. Mobile

- 1.3.2. Automotive

-

1.1. Advanced IC Substrate

-

2. Geography

- 2.1. Japan

- 2.2. China

- 2.3. Taiwan

- 2.4. United States

- 2.5. Korea

- 2.6. Rest of the World

Semiconductor Advanced Substrate Market Segmentation By Geography

- 1. Japan

- 2. China

- 3. Taiwan

- 4. United States

- 5. Korea

- 6. Rest of the World

Semiconductor Advanced Substrate Market Regional Market Share

Geographic Coverage of Semiconductor Advanced Substrate Market

Semiconductor Advanced Substrate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Applications of Advanced Substrates in Manufacturing IoT Equipment; Increasing Trend of Miniaturization in Semiconductor Devices

- 3.3. Market Restrains

- 3.3.1. Complexity in the Manufacturing Process

- 3.4. Market Trends

- 3.4.1. FC BGA to Hold the Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Advanced IC Substrate

- 5.1.1.1. Product Category

- 5.1.1.1.1. FC BGA

- 5.1.1.1.2. FC CSP

- 5.1.1.1. Product Category

- 5.1.2. Substrate-like-PCB (SLP)

- 5.1.2.1. End-User Application

- 5.1.2.1.1. Smartphone

- 5.1.2.1.2. Others (Tablets and Smartwatches)

- 5.1.2.1. End-User Application

- 5.1.3. Embedded Die

- 5.1.3.1. Mobile

- 5.1.3.2. Automotive

- 5.1.1. Advanced IC Substrate

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Japan

- 5.2.2. China

- 5.2.3. Taiwan

- 5.2.4. United States

- 5.2.5. Korea

- 5.2.6. Rest of the World

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. Taiwan

- 5.3.4. United States

- 5.3.5. Korea

- 5.3.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Japan Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Advanced IC Substrate

- 6.1.1.1. Product Category

- 6.1.1.1.1. FC BGA

- 6.1.1.1.2. FC CSP

- 6.1.1.1. Product Category

- 6.1.2. Substrate-like-PCB (SLP)

- 6.1.2.1. End-User Application

- 6.1.2.1.1. Smartphone

- 6.1.2.1.2. Others (Tablets and Smartwatches)

- 6.1.2.1. End-User Application

- 6.1.3. Embedded Die

- 6.1.3.1. Mobile

- 6.1.3.2. Automotive

- 6.1.1. Advanced IC Substrate

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Japan

- 6.2.2. China

- 6.2.3. Taiwan

- 6.2.4. United States

- 6.2.5. Korea

- 6.2.6. Rest of the World

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. China Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Advanced IC Substrate

- 7.1.1.1. Product Category

- 7.1.1.1.1. FC BGA

- 7.1.1.1.2. FC CSP

- 7.1.1.1. Product Category

- 7.1.2. Substrate-like-PCB (SLP)

- 7.1.2.1. End-User Application

- 7.1.2.1.1. Smartphone

- 7.1.2.1.2. Others (Tablets and Smartwatches)

- 7.1.2.1. End-User Application

- 7.1.3. Embedded Die

- 7.1.3.1. Mobile

- 7.1.3.2. Automotive

- 7.1.1. Advanced IC Substrate

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Japan

- 7.2.2. China

- 7.2.3. Taiwan

- 7.2.4. United States

- 7.2.5. Korea

- 7.2.6. Rest of the World

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Taiwan Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Advanced IC Substrate

- 8.1.1.1. Product Category

- 8.1.1.1.1. FC BGA

- 8.1.1.1.2. FC CSP

- 8.1.1.1. Product Category

- 8.1.2. Substrate-like-PCB (SLP)

- 8.1.2.1. End-User Application

- 8.1.2.1.1. Smartphone

- 8.1.2.1.2. Others (Tablets and Smartwatches)

- 8.1.2.1. End-User Application

- 8.1.3. Embedded Die

- 8.1.3.1. Mobile

- 8.1.3.2. Automotive

- 8.1.1. Advanced IC Substrate

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Japan

- 8.2.2. China

- 8.2.3. Taiwan

- 8.2.4. United States

- 8.2.5. Korea

- 8.2.6. Rest of the World

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. United States Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Advanced IC Substrate

- 9.1.1.1. Product Category

- 9.1.1.1.1. FC BGA

- 9.1.1.1.2. FC CSP

- 9.1.1.1. Product Category

- 9.1.2. Substrate-like-PCB (SLP)

- 9.1.2.1. End-User Application

- 9.1.2.1.1. Smartphone

- 9.1.2.1.2. Others (Tablets and Smartwatches)

- 9.1.2.1. End-User Application

- 9.1.3. Embedded Die

- 9.1.3.1. Mobile

- 9.1.3.2. Automotive

- 9.1.1. Advanced IC Substrate

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Japan

- 9.2.2. China

- 9.2.3. Taiwan

- 9.2.4. United States

- 9.2.5. Korea

- 9.2.6. Rest of the World

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Korea Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Advanced IC Substrate

- 10.1.1.1. Product Category

- 10.1.1.1.1. FC BGA

- 10.1.1.1.2. FC CSP

- 10.1.1.1. Product Category

- 10.1.2. Substrate-like-PCB (SLP)

- 10.1.2.1. End-User Application

- 10.1.2.1.1. Smartphone

- 10.1.2.1.2. Others (Tablets and Smartwatches)

- 10.1.2.1. End-User Application

- 10.1.3. Embedded Die

- 10.1.3.1. Mobile

- 10.1.3.2. Automotive

- 10.1.1. Advanced IC Substrate

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Japan

- 10.2.2. China

- 10.2.3. Taiwan

- 10.2.4. United States

- 10.2.5. Korea

- 10.2.6. Rest of the World

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Rest of the World Semiconductor Advanced Substrate Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 11.1.1. Advanced IC Substrate

- 11.1.1.1. Product Category

- 11.1.1.1.1. FC BGA

- 11.1.1.1.2. FC CSP

- 11.1.1.1. Product Category

- 11.1.2. Substrate-like-PCB (SLP)

- 11.1.2.1. End-User Application

- 11.1.2.1.1. Smartphone

- 11.1.2.1.2. Others (Tablets and Smartwatches)

- 11.1.2.1. End-User Application

- 11.1.3. Embedded Die

- 11.1.3.1. Mobile

- 11.1.3.2. Automotive

- 11.1.1. Advanced IC Substrate

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Japan

- 11.2.2. China

- 11.2.3. Taiwan

- 11.2.4. United States

- 11.2.5. Korea

- 11.2.6. Rest of the World

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Young Poong Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nippon Mektron

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Unimicron

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Korea Circuit

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AT&S

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Hannstar

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zhen Ding Tech

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Samsung Electro-Mechanics

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 IBIDEN

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Daeduck Electronics*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 TTM Technologies

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Compeg

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 LG Innotek

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Young Poong Group

List of Figures

- Figure 1: Global Semiconductor Advanced Substrate Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Japan Semiconductor Advanced Substrate Market Revenue (billion), by Platform 2025 & 2033

- Figure 3: Japan Semiconductor Advanced Substrate Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: Japan Semiconductor Advanced Substrate Market Revenue (billion), by Geography 2025 & 2033

- Figure 5: Japan Semiconductor Advanced Substrate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Japan Semiconductor Advanced Substrate Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Japan Semiconductor Advanced Substrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: China Semiconductor Advanced Substrate Market Revenue (billion), by Platform 2025 & 2033

- Figure 9: China Semiconductor Advanced Substrate Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: China Semiconductor Advanced Substrate Market Revenue (billion), by Geography 2025 & 2033

- Figure 11: China Semiconductor Advanced Substrate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: China Semiconductor Advanced Substrate Market Revenue (billion), by Country 2025 & 2033

- Figure 13: China Semiconductor Advanced Substrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Taiwan Semiconductor Advanced Substrate Market Revenue (billion), by Platform 2025 & 2033

- Figure 15: Taiwan Semiconductor Advanced Substrate Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Taiwan Semiconductor Advanced Substrate Market Revenue (billion), by Geography 2025 & 2033

- Figure 17: Taiwan Semiconductor Advanced Substrate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Taiwan Semiconductor Advanced Substrate Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Taiwan Semiconductor Advanced Substrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: United States Semiconductor Advanced Substrate Market Revenue (billion), by Platform 2025 & 2033

- Figure 21: United States Semiconductor Advanced Substrate Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: United States Semiconductor Advanced Substrate Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: United States Semiconductor Advanced Substrate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: United States Semiconductor Advanced Substrate Market Revenue (billion), by Country 2025 & 2033

- Figure 25: United States Semiconductor Advanced Substrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Korea Semiconductor Advanced Substrate Market Revenue (billion), by Platform 2025 & 2033

- Figure 27: Korea Semiconductor Advanced Substrate Market Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Korea Semiconductor Advanced Substrate Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Korea Semiconductor Advanced Substrate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Korea Semiconductor Advanced Substrate Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Korea Semiconductor Advanced Substrate Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Semiconductor Advanced Substrate Market Revenue (billion), by Platform 2025 & 2033

- Figure 33: Rest of the World Semiconductor Advanced Substrate Market Revenue Share (%), by Platform 2025 & 2033

- Figure 34: Rest of the World Semiconductor Advanced Substrate Market Revenue (billion), by Geography 2025 & 2033

- Figure 35: Rest of the World Semiconductor Advanced Substrate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Rest of the World Semiconductor Advanced Substrate Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Rest of the World Semiconductor Advanced Substrate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 2: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 5: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 8: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 11: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 14: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 17: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 20: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 21: Global Semiconductor Advanced Substrate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Advanced Substrate Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Semiconductor Advanced Substrate Market?

Key companies in the market include Young Poong Group, Nippon Mektron, Unimicron, Korea Circuit, AT&S, Hannstar, Zhen Ding Tech, Samsung Electro-Mechanics, IBIDEN, Daeduck Electronics*List Not Exhaustive, TTM Technologies, Compeg, LG Innotek.

3. What are the main segments of the Semiconductor Advanced Substrate Market?

The market segments include Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 702.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Applications of Advanced Substrates in Manufacturing IoT Equipment; Increasing Trend of Miniaturization in Semiconductor Devices.

6. What are the notable trends driving market growth?

FC BGA to Hold the Major Market Share.

7. Are there any restraints impacting market growth?

Complexity in the Manufacturing Process.

8. Can you provide examples of recent developments in the market?

February 2023 - TTM Technologies announces exhibit at the 2023 International Electronics Circuit Exhibition (Shenzhen), at Booth in the Shenzhen World Exhibition & Convention Center (Bao'an), in China, Where TTM will be hosting a series of technical seminars to present its cutting edge engineering and product solutions aimed at dealing with customer problems across different end markets and applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Advanced Substrate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Advanced Substrate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Advanced Substrate Market?

To stay informed about further developments, trends, and reports in the Semiconductor Advanced Substrate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence