Key Insights

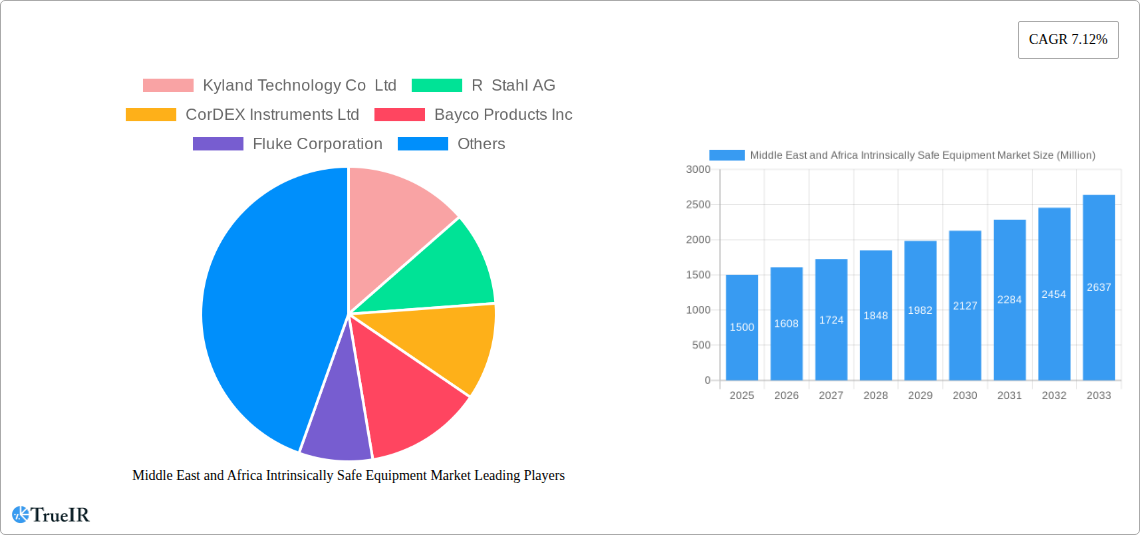

The Middle East and Africa (MEA) Intrinsically Safe Equipment Market is projected to experience significant growth, reaching an estimated market size of $3.88 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 7.12% from the 2025 base year. This expansion is primarily fueled by the increasing adoption of rigorous safety regulations in hazardous industrial settings, especially within the thriving oil and gas sector. The heightened emphasis on operational safety and the critical need to prevent ignitions in explosive environments are driving demand for intrinsically safe devices like sensors, detectors, and transmitters. The mining and chemical industries are also key contributors, where the implementation of intrinsically safe equipment is essential for operational safety and regulatory compliance. The market is observing a growing demand for advanced, connected intrinsically safe solutions, mirroring the broader digital transformation in industrial automation.

Middle East and Africa Intrinsically Safe Equipment Market Market Size (In Billion)

Key growth drivers include demand from Zone 1 and Zone 20 classified areas, characterized by the highest explosion risks, necessitating certified equipment. The MEA region, with substantial investments in oil and gas infrastructure and ongoing developments in the power and petrochemical sectors, is a vital market. Nations like Saudi Arabia and the United Arab Emirates are spearheading the adoption of these safety technologies, supported by government initiatives to elevate industrial safety standards. While significant opportunities exist, potential market restraints involve the high initial investment for intrinsically safe equipment and the requirement for specialized installation and maintenance expertise. Nevertheless, the long-term advantages, including reduced accident risks, minimized operational downtime, and adherence to international safety standards, are expected to ensure sustained market growth for MEA Intrinsically Safe Equipment.

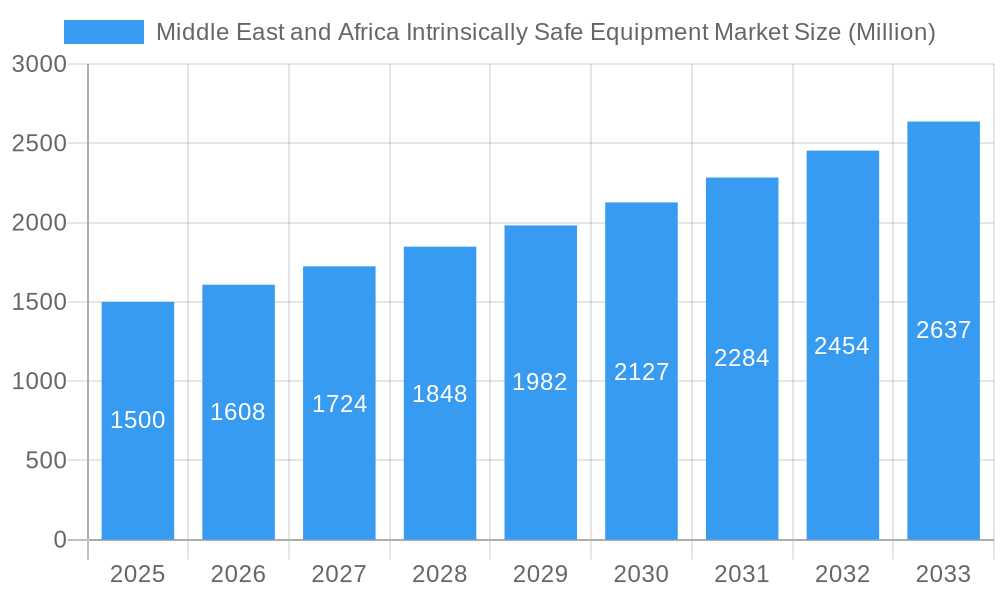

Middle East and Africa Intrinsically Safe Equipment Market Company Market Share

This comprehensive report provides an in-depth analysis of the Middle East and Africa Intrinsically Safe Equipment Market, offering crucial insights for industry stakeholders. The study encompasses the historical period from 2019 to 2024, using 2025 as the base year and extending the forecast to 2033. We strategically incorporate high-volume SEO keywords such as "intrinsically safe equipment MEA," "Middle East hazardous area solutions," "Africa explosion proof equipment," "oil and gas safety MEA," and "chemical plant safety compliance" to enhance search engine visibility and reach relevant industry professionals.

Middle East and Africa Intrinsically Safe Equipment Market Market Structure & Competitive Landscape

The Middle East and Africa intrinsically safe equipment market is characterized by moderate concentration, with a few key global players dominating, alongside a growing number of regional manufacturers. Innovation drivers are primarily fueled by stringent safety regulations and the increasing demand for enhanced worker safety in hazardous environments, particularly within the oil and gas sector. Regulatory impacts are significant, with bodies like IEC and ATEX dictating product standards and certification requirements, influencing market entry and product development. Product substitutes, while present in less demanding applications, offer limited alternatives for high-risk zones. End-user segmentation reveals a strong reliance on the oil and gas industry, followed by mining and chemical sectors. Mergers and acquisitions (M&A) trends are moderate, with larger entities acquiring smaller innovators to expand their product portfolios and geographical reach. For instance, M&A volumes in the broader hazardous area equipment market have averaged around USD 1,000 Million annually over the historical period. Key companies shaping this landscape include Kyland Technology Co Ltd, R Stahl AG, CorDEX Instruments Ltd, Bayco Products Inc, Fluke Corporation, Pepperl + Fuchs, OMEGA Engineering (Spectris PLC), and Eaton Corporation.

Middle East and Africa Intrinsically Safe Equipment Market Market Trends & Opportunities

The Middle East and Africa intrinsically safe equipment market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This robust growth is underpinned by increasing investments in oil and gas exploration and production in regions like Saudi Arabia, the UAE, and Nigeria, necessitating advanced safety solutions. Technological shifts are evident with the growing adoption of smart intrinsically safe devices that offer remote monitoring capabilities and predictive maintenance, enhancing operational efficiency and safety. Consumer preferences are increasingly leaning towards certified, reliable, and durable equipment that minimizes downtime and ensures compliance with international safety standards. Competitive dynamics are intensifying as both established global players and emerging regional manufacturers vie for market share. Opportunities abound for manufacturers focusing on customized solutions for specific hazardous environments and end-user industries. The market penetration rate for advanced intrinsically safe equipment is expected to rise from an estimated 45% in 2025 to over 65% by 2033. The rising trend towards digitalization and the Industrial Internet of Things (IIoT) in hazardous industrial settings presents a substantial opportunity for the integration of smart intrinsically safe sensors and communication devices. Furthermore, governmental initiatives promoting industrial safety and environmental protection in countries such as South Africa and Egypt are creating a more conducive environment for market growth. The increasing complexity of offshore oil and gas operations and the expansion of petrochemical facilities across the region will further propel the demand for high-performance, explosion-proof equipment. The evolving regulatory landscape, while posing challenges, also acts as a significant driver for innovation and adoption of certified solutions. The demand for intrinsically safe equipment extends beyond traditional sectors, with growing applications in renewable energy installations, particularly in solar and wind farms located in remote or potentially hazardous areas.

Dominant Markets & Segments in Middle East and Africa Intrinsically Safe Equipment Market

The Oil and Gas end-user industry stands as the dominant market for intrinsically safe equipment across the Middle East and Africa, accounting for an estimated 60% of the market share. This dominance is driven by the extensive presence of upstream, midstream, and downstream operations in regions with inherent explosion risks.

- Zone Dominance: Zone 0 and Zone 1 areas within oil and gas facilities are critical for the demand of intrinsically safe equipment due to the presence of flammable gases and vapors at all times or for extended periods. Zone 20 and Zone 21 are also significant in mining and certain processing industries.

- Class Dominance: Class 1 (gases, vapors, and liquids) is the most prevalent class, directly correlating with the needs of the oil and gas and chemical sectors. Class 2 is important in mining and grain processing.

- Product Dominance: Sensors and Transmitters are the leading product categories, essential for continuous monitoring and control in hazardous environments. LED Indicators also see significant demand for visual alerts.

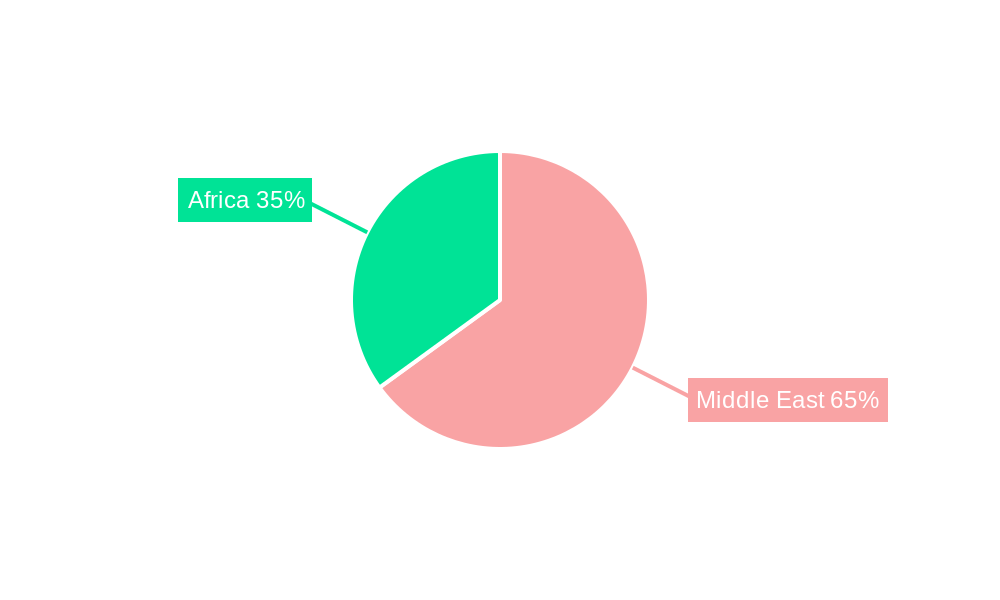

- Geographical Dominance: The Middle East, particularly countries like Saudi Arabia, the UAE, and Qatar, represents the largest market due to substantial investments in oil and gas infrastructure and a strong emphasis on safety compliance. Africa's significant oil-producing nations like Nigeria and Angola are also key contributors.

Key growth drivers include:

- Infrastructure Development: Ongoing and planned expansion of oil refineries, petrochemical plants, and gas processing facilities.

- Stringent Safety Regulations: Enforcement of international safety standards and increasing awareness of workplace hazards.

- Technological Advancements: Introduction of smarter, more robust, and energy-efficient intrinsically safe equipment.

- Mining Sector Growth: Expansion of mining operations in countries like South Africa, Botswana, and Zambia, requiring explosion-proof solutions.

Middle East and Africa Intrinsically Safe Equipment Market Product Analysis

Product innovation in the Middle East and Africa intrinsically safe equipment market is largely focused on enhancing reliability, connectivity, and energy efficiency. Advancements in sensor technology are leading to more precise detection of hazardous gases and conditions, while smart transmitters offer real-time data transmission for improved operational oversight. The development of durable LED indicators and explosion-proof lighting solutions addresses critical visibility needs in dark or hazardous operational areas. Isolators are also seeing improvements in surge protection and signal integrity. These product advancements are crucial for meeting the evolving demands of the oil and gas, mining, and chemical industries, providing competitive advantages through improved safety performance and operational uptime.

Key Drivers, Barriers & Challenges in Middle East and Africa Intrinsically Safe Equipment Market

Key Drivers:

- Growing Oil & Gas Exploration and Production: Significant investments in the upstream and downstream sectors across the Middle East and Africa are a primary growth catalyst.

- Stringent Safety Regulations: Increasing adoption and enforcement of international safety standards like IECEx and ATEX are mandating the use of certified intrinsically safe equipment.

- Industrial Automation & Digitalization: The drive towards smart factories and IIoT in hazardous environments is boosting the demand for connected intrinsically safe devices.

Barriers & Challenges:

- High Initial Investment Cost: Intrinsically safe equipment is often more expensive than standard equipment, posing a barrier for smaller enterprises.

- Complex Certification Processes: Navigating the diverse and often stringent certification requirements in different countries can be a significant hurdle.

- Skilled Workforce Shortage: A lack of adequately trained personnel for the installation, maintenance, and operation of specialized intrinsically safe equipment.

- Economic Volatility: Fluctuations in commodity prices, particularly oil and gas, can impact capital expenditure and investment in safety equipment.

Growth Drivers in the Middle East and Africa Intrinsically Safe Equipment Market Market

The Middle East and Africa intrinsically safe equipment market is propelled by several key growth drivers. Economically, substantial ongoing investments in oil and gas infrastructure, particularly in major producing nations, directly translate to increased demand for explosion-proof solutions. Technologically, the integration of Industry 4.0 principles and the Industrial Internet of Things (IIoT) is driving the adoption of smart, connected intrinsically safe devices for enhanced monitoring and control. Regulatory factors are also critical, with a growing emphasis on worker safety and environmental protection leading to stricter compliance mandates for hazardous areas. For instance, new projects in the petrochemical sector in countries like Saudi Arabia often have explicit requirements for ATEX or IECEx certified equipment.

Challenges Impacting Middle East and Africa Intrinsically Safe Equipment Market Growth

Several challenges are impacting the growth of the Middle East and Africa intrinsically safe equipment market. Regulatory complexities and the varied certification standards across different countries can create significant hurdles for manufacturers and end-users, increasing lead times and costs. Supply chain disruptions, exacerbated by geopolitical factors and logistical challenges in remote regions, can affect the availability of critical components and finished products. Competitive pressures from both established global players and emerging local manufacturers can lead to price wars, potentially impacting profit margins. Furthermore, economic downturns or volatility in key end-user industries like oil and gas can lead to reduced capital expenditure and delayed procurement of safety equipment.

Key Players Shaping the Middle East and Africa Intrinsically Safe Equipment Market Market

- Kyland Technology Co Ltd

- R Stahl AG

- CorDEX Instruments Ltd

- Bayco Products Inc

- Fluke Corporation

- Pepperl + Fuchs

- OMEGA Engineering (Spectris PLC)

- Eaton Corporation

Significant Middle East and Africa Intrinsically Safe Equipment Market Industry Milestones

- Jan 2021: Teledyne Technologies Incorporated and FLIR Systems, Inc announced a definitive agreement for Teledyne to acquire FLIR in a cash and stock transaction valued at approximately USD 8.0 billion, aiming to expand its sensor business and potentially integrate advanced sensing technologies into intrinsically safe equipment.

- Feb 2021: Banner Engineering launched the Industry's Powerful Safety Scanner, SX5 Series, featuring advanced capabilities for increased personnel and equipment protection, including master and remote variants with multiple safety outputs and customizable zone sets, enhancing safety solutions for hazardous areas.

Future Outlook for Middle East and Africa Intrinsically Safe Equipment Market Market

The future outlook for the Middle East and Africa intrinsically safe equipment market is exceptionally promising, driven by sustained investments in critical industries and an unwavering commitment to enhanced safety standards. The growing demand for digitalization and IIoT integration will spur innovation in smart, connected intrinsically safe devices, offering advanced monitoring and predictive maintenance capabilities. Opportunities will continue to emerge from the expansion of oil and gas infrastructure, the burgeoning mining sector, and the increasing adoption of stricter safety regulations across the region. Strategic collaborations and technological advancements will be key to navigating the evolving market landscape and capitalizing on the significant growth potential.

Middle East and Africa Intrinsically Safe Equipment Market Segmentation

-

1. Zone

- 1.1. Zone 0

- 1.2. Zone 20

- 1.3. Zone 22

- 1.4. Zone 1

- 1.5. Zone 21

-

2. Class

- 2.1. Class 1

- 2.2. Class 2

- 2.3. Class 3

-

3. Products

- 3.1. Sensors

- 3.2. Detectors

- 3.3. Transmitters

- 3.4. Isolators

- 3.5. LED Indicators

- 3.6. Others

-

4. End-user Industry

- 4.1. Oil and Gas

- 4.2. Mining

- 4.3. Power

- 4.4. Chemical and Petrochemical

- 4.5. Processing

- 4.6. Others

Middle East and Africa Intrinsically Safe Equipment Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Intrinsically Safe Equipment Market Regional Market Share

Geographic Coverage of Middle East and Africa Intrinsically Safe Equipment Market

Middle East and Africa Intrinsically Safe Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Government Regulations; Growing Energy Requirements driving the Demand for Exploration of New Mines and Oil and Gas Resources

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Intrinsically Safe Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Zone

- 5.1.1. Zone 0

- 5.1.2. Zone 20

- 5.1.3. Zone 22

- 5.1.4. Zone 1

- 5.1.5. Zone 21

- 5.2. Market Analysis, Insights and Forecast - by Class

- 5.2.1. Class 1

- 5.2.2. Class 2

- 5.2.3. Class 3

- 5.3. Market Analysis, Insights and Forecast - by Products

- 5.3.1. Sensors

- 5.3.2. Detectors

- 5.3.3. Transmitters

- 5.3.4. Isolators

- 5.3.5. LED Indicators

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Oil and Gas

- 5.4.2. Mining

- 5.4.3. Power

- 5.4.4. Chemical and Petrochemical

- 5.4.5. Processing

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Zone

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kyland Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 R Stahl AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CorDEX Instruments Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayco Products Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fluke Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pepperl + Fuchs

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OMEGA Engineering (Spectris PLC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eaton Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kyland Technology Co Ltd

List of Figures

- Figure 1: Middle East and Africa Intrinsically Safe Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Intrinsically Safe Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Zone 2020 & 2033

- Table 2: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Zone 2020 & 2033

- Table 3: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Class 2020 & 2033

- Table 4: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Class 2020 & 2033

- Table 5: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Products 2020 & 2033

- Table 6: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Products 2020 & 2033

- Table 7: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 9: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Zone 2020 & 2033

- Table 12: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Zone 2020 & 2033

- Table 13: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Class 2020 & 2033

- Table 14: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Class 2020 & 2033

- Table 15: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Products 2020 & 2033

- Table 16: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Products 2020 & 2033

- Table 17: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 19: Middle East and Africa Intrinsically Safe Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Middle East and Africa Intrinsically Safe Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Saudi Arabia Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Saudi Arabia Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: United Arab Emirates Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: United Arab Emirates Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Israel Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Israel Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Qatar Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Qatar Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Kuwait Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Kuwait Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Oman Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Oman Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Bahrain Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Bahrain Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Jordan Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Jordan Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Lebanon Middle East and Africa Intrinsically Safe Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Lebanon Middle East and Africa Intrinsically Safe Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Intrinsically Safe Equipment Market?

The projected CAGR is approximately 7.12%.

2. Which companies are prominent players in the Middle East and Africa Intrinsically Safe Equipment Market?

Key companies in the market include Kyland Technology Co Ltd, R Stahl AG, CorDEX Instruments Ltd, Bayco Products Inc, Fluke Corporation, Pepperl + Fuchs, OMEGA Engineering (Spectris PLC), Eaton Corporation.

3. What are the main segments of the Middle East and Africa Intrinsically Safe Equipment Market?

The market segments include Zone, Class, Products, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Government Regulations; Growing Energy Requirements driving the Demand for Exploration of New Mines and Oil and Gas Resources.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

High Maintenance Cost.

8. Can you provide examples of recent developments in the market?

Jan 2021: Teledyne Technologies Incorporated and FLIR Systems, Inc announced that they had reached a definitive agreement under which Teledyne would acquire FLIR in a cash and stock transaction valued at approximately USD 8.0 billion in order to expand its sensor business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Intrinsically Safe Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Intrinsically Safe Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Intrinsically Safe Equipment Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Intrinsically Safe Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence