Key Insights

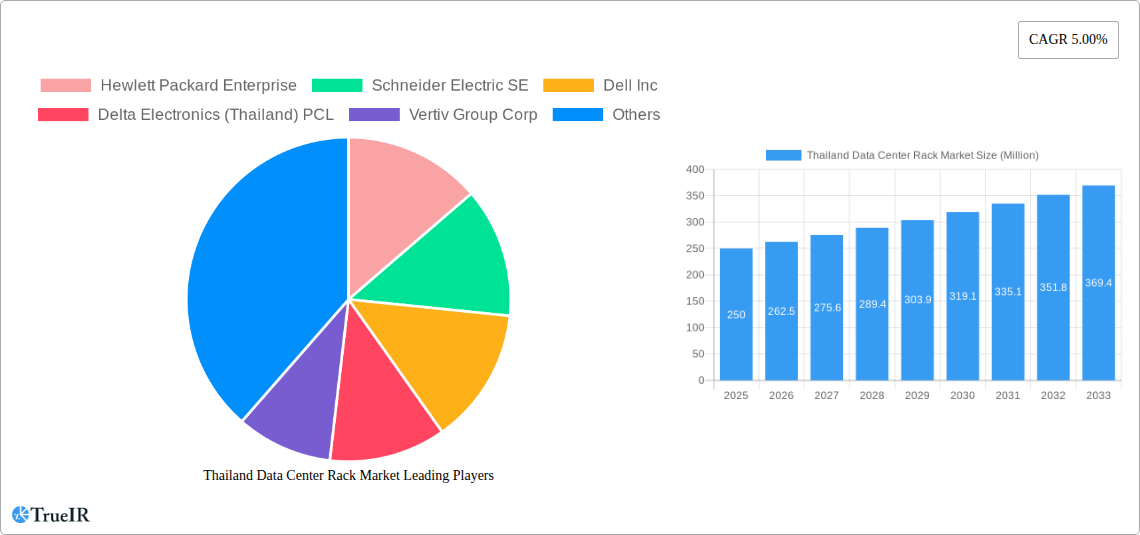

The Thailand Data Center Rack Market is poised for robust growth, projected to reach a significant market size of approximately $250 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5.00% anticipated throughout the forecast period of 2025-2033. This expansion is primarily fueled by the escalating demand for digital services and infrastructure across various sectors, notably IT & Telecommunication and BFSI. The increasing adoption of cloud computing, big data analytics, and the burgeoning internet of things (IoT) ecosystem are creating an insatiable need for advanced data center solutions, including efficient rack systems. Furthermore, the Thai government's strong push towards digitalization and smart city initiatives, coupled with significant investments in infrastructure development, are acting as powerful catalysts for market expansion. The media and entertainment industry's shift towards digital content delivery and streaming services also contributes to the rising demand for robust data center capacities, thereby driving the need for more sophisticated and scalable rack solutions.

While the market exhibits strong growth drivers, certain restraints need to be considered. The high initial capital expenditure required for setting up and upgrading data center infrastructure, including sophisticated rack systems, can pose a challenge for smaller enterprises. Additionally, the evolving technological landscape necessitates continuous investment in cutting-edge rack technologies to ensure compatibility with new hardware and cooling solutions. However, the ongoing trend of hybrid and multi-cloud deployments is mitigating some of these concerns by offering greater flexibility. Key players such as Hewlett Packard Enterprise, Schneider Electric SE, Dell Inc, Vertiv Group Corp, and Eaton Corporation are actively innovating and expanding their product portfolios to cater to the diverse needs of the Thai market, offering solutions ranging from quarter racks to full racks. The market is also witnessing a surge in demand for intelligent rack solutions that offer enhanced monitoring, power distribution, and cooling capabilities to optimize data center operations and energy efficiency.

Thailand Data Center Rack Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Thailand Data Center Rack Market. Leveraging high-volume keywords such as "Thailand data center," "data center infrastructure," "rack solutions," "colocation," and "enterprise data center," this report is designed to enhance search rankings and deliver crucial insights to industry stakeholders. The study spans from 2019 to 2033, with a base year of 2025 and a comprehensive forecast period of 2025–2033, building upon historical data from 2019–2024.

Thailand Data Center Rack Market Market Structure & Competitive Landscape

The Thailand Data Center Rack Market exhibits a moderately concentrated structure, with a blend of established global players and emerging local providers vying for market share. Innovation drivers are primarily fueled by the escalating demand for high-density computing, edge computing deployments, and the increasing adoption of cloud services across various industries. Regulatory impacts, while evolving, are largely focused on ensuring data security and compliance, potentially creating both opportunities and challenges for market participants. Product substitutes, such as integrated data center solutions and modular data centers, are present but are not expected to significantly disrupt the core rack market in the near to medium term.

End-user segmentation plays a critical role in shaping market dynamics, with the IT & Telecommunication sector leading in adoption, followed closely by BFSI and Government. Merger and acquisition (M&A) trends are anticipated to intensify as larger players seek to consolidate their market presence and gain access to new technologies or customer bases. For instance, based on market trends, an estimated 3-5 significant M&A activities are projected within the forecast period. The competitive landscape is characterized by a strategic focus on product differentiation, cost-effectiveness, and the provision of comprehensive data center infrastructure solutions.

Thailand Data Center Rack Market Market Trends & Opportunities

The Thailand Data Center Rack Market is poised for robust growth, driven by an insatiable demand for digital infrastructure and advanced computing capabilities. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 10-12% during the forecast period of 2025–2033. This significant expansion is underpinned by several key trends. Firstly, the continuous digital transformation across all sectors, particularly in IT & Telecommunication, BFSI, and Government, necessitates a substantial increase in data storage and processing power. This directly translates into a higher demand for reliable and efficient data center racks.

Technological shifts are also playing a pivotal role. The proliferation of AI, machine learning, IoT, and Big Data analytics requires more sophisticated rack solutions capable of handling higher power densities and advanced cooling mechanisms. Edge computing, a burgeoning trend, further contributes to this demand by pushing compute resources closer to data sources, leading to the development of smaller, more distributed data centers that still rely on rack infrastructure. Consumer preferences are evolving towards hyperscale and colocation facilities, which offer scalability, cost-efficiency, and advanced security features. This trend is accelerating the adoption of standardized and high-performance rack solutions.

Furthermore, government initiatives aimed at promoting Thailand as a digital hub in Southeast Asia, coupled with significant foreign and domestic investments in data center development, are creating immense opportunities. The increasing focus on cybersecurity and data sovereignty is also driving investments in on-premises and secure colocation data centers, further bolstering the demand for robust rack systems. Competitive dynamics are intensifying, with companies focusing on offering integrated solutions, smart rack technologies, and enhanced support services to capture market share. The market penetration rate for advanced rack solutions is expected to rise from an estimated 45% in the base year 2025 to over 70% by 2033.

Dominant Markets & Segments in Thailand Data Center Rack Market

The IT & Telecommunication segment stands as the dominant force within the Thailand Data Center Rack Market. This leadership is attributed to the inherent and continuous need for massive data processing, storage, and network infrastructure to support expanding mobile networks, cloud services, and digital content delivery. The sheer volume of data generated and consumed by telecommunication companies and their associated IT departments fuels an unparalleled demand for racks.

Within the Rack Size segmentation, Full Rack solutions are currently the most prevalent, catering to the substantial infrastructure needs of large enterprises and colocation providers. However, the growing trend of edge computing and specialized deployments is gradually increasing the market share of Half Rack and Quarter Rack solutions, offering flexibility and optimized space utilization for specific applications.

The BFSI (Banking, Financial Services, and Insurance) sector is another significant contributor to the market's dominance. Stringent regulatory requirements regarding data security, compliance, and business continuity necessitate robust and highly available data center infrastructure, directly translating into a strong demand for data center racks. The increasing adoption of digital banking, online trading platforms, and fintech innovations further amplifies this demand.

The Government segment, driven by initiatives such as e-government services, smart city projects, and national security mandates, also presents a substantial market. Investments in building secure and resilient data center facilities to house sensitive data are a key growth driver. While Media & Entertainment and Other End Users represent smaller but growing segments, their collective demand contributes to the overall market expansion, particularly with the rise of streaming services and digital content creation.

Key growth drivers across these dominant segments include:

- Infrastructure Expansion: Continuous investment in expanding data center capacity to meet the growing digital economy.

- Technological Advancements: Adoption of high-density computing, AI, and IoT requires more advanced rack capabilities.

- Government Support: Policies and incentives promoting digital infrastructure development.

- Data Security & Compliance: Increasing focus on robust and secure data storage solutions.

Thailand Data Center Rack Market Product Analysis

Product innovation in the Thailand Data Center Rack Market is increasingly focused on addressing the growing demands for higher power densities, advanced cooling capabilities, and enhanced physical security. Manufacturers are developing smart racks equipped with integrated power distribution units (PDUs), environmental monitoring sensors, and remote management features, enabling greater operational efficiency and proactive maintenance. The competitive advantage lies in offering modular and scalable rack solutions that can adapt to evolving IT infrastructure needs, from traditional server deployments to high-performance computing and edge deployments. Applications span across housing servers, networking equipment, storage devices, and other critical IT hardware within data centers.

Key Drivers, Barriers & Challenges in Thailand Data Center Rack Market

Key Drivers:

- Digital Transformation: The rapid adoption of digital technologies across all industries, including cloud computing, AI, IoT, and Big Data.

- Government Initiatives: Thailand's commitment to becoming a digital hub, fostering investment in data center infrastructure.

- Increasing Data Generation: Exponential growth in data creation and the need for robust storage and processing capabilities.

- Foreign Investment: Significant investments from international players in developing hyperscale and colocation data centers.

Barriers & Challenges:

- Supply Chain Disruptions: Potential for global supply chain volatility impacting the availability and cost of components.

- Skilled Workforce Shortage: A need for a skilled workforce to design, build, and manage advanced data center facilities.

- Regulatory Evolution: Navigating evolving data privacy and security regulations can pose compliance challenges.

- High Initial Investment: The significant capital required for establishing new data center facilities and upgrading existing ones.

Growth Drivers in the Thailand Data Center Rack Market Market

Growth drivers for the Thailand Data Center Rack Market are primarily technological, economic, and regulatory. The relentless pace of digital transformation, fueled by widespread adoption of cloud computing, AI, and IoT, necessitates substantial expansion of data center capacity. This directly translates into increased demand for rack infrastructure to house the growing number of servers and networking equipment. Economically, Thailand's strategic position in Southeast Asia, coupled with government initiatives to foster digital connectivity and attract foreign investment, creates a fertile ground for data center development. Policies promoting digital infrastructure and data localization further propel market growth.

Challenges Impacting Thailand Data Center Rack Market Growth

Challenges impacting Thailand Data Center Rack Market growth include potential supply chain vulnerabilities that could affect the timely delivery and cost of essential components, impacting project timelines and budgets. The scarcity of a highly skilled workforce proficient in advanced data center operations and management presents a significant operational hurdle. Furthermore, the evolving landscape of data privacy and cybersecurity regulations necessitates constant adaptation and investment to ensure compliance, which can add complexity and cost. The substantial initial capital investment required for building and upgrading data centers also acts as a barrier, particularly for smaller players, while intense competitive pressures from established global providers can make market entry challenging.

Key Players Shaping the Thailand Data Center Rack Market Market

- Hewlett Packard Enterprise

- Schneider Electric SE

- Dell Inc

- Delta Electronics (Thailand) PCL

- Vertiv Group Corp

- Rittal GMBH & Co KG

- nVent Electric PL

- Eaton Corporation

Significant Thailand Data Center Rack Market Industry Milestones

- May 2023: Thai telco Interlink Telecom (Itel) announced plans to invest USD 20 million in its data center joint venture with Etix Everywhere in Bangkok.

- March 2023: NTT Global Data Centers announced plans to invest USD 90 million to develop a 12MW, 4,000 sqm facility in Bangkok.

Future Outlook for Thailand Data Center Rack Market Market

The future outlook for the Thailand Data Center Rack Market is exceptionally bright, driven by sustained digital transformation and strategic government support. The increasing adoption of hyperscale and edge computing will continue to fuel demand for advanced, high-density rack solutions. Opportunities abound for providers offering integrated services, smart technologies, and environmentally sustainable infrastructure. Continued foreign investment and the growth of domestic cloud providers will further solidify Thailand's position as a key data center hub in the region, presenting significant growth catalysts and market potential for stakeholders.

Thailand Data Center Rack Market Segmentation

-

1. Rack Size

- 1.1. Quarter Rack

- 1.2. Half Rack

- 1.3. Full Rack

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

Thailand Data Center Rack Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Rack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

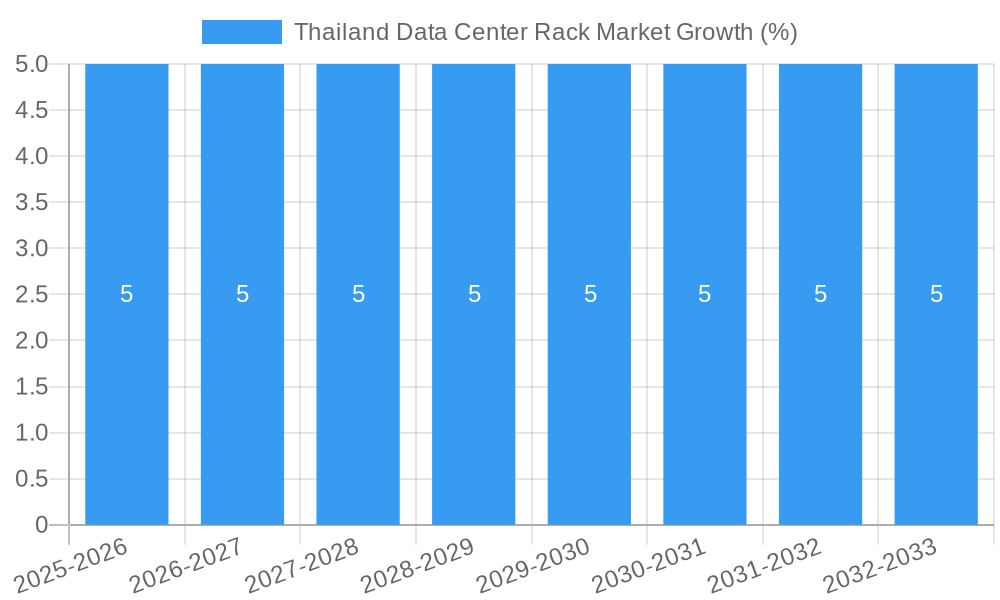

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Smartpone Users; Fiber Connectivity Network Expansion in the Country

- 3.3. Market Restrains

- 3.3.1. Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment holds the major share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Rack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 5.1.1. Quarter Rack

- 5.1.2. Half Rack

- 5.1.3. Full Rack

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Rack Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hewlett Packard Enterprise

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schneider Electric SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dell Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Delta Electronics (Thailand) PCL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vertiv Group Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rittal GMBH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 nVent Electric PL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eaton Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Hewlett Packard Enterprise

List of Figures

- Figure 1: Thailand Data Center Rack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Data Center Rack Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 3: Thailand Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Thailand Data Center Rack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Data Center Rack Market Revenue Million Forecast, by Rack Size 2019 & 2032

- Table 7: Thailand Data Center Rack Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Thailand Data Center Rack Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Rack Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Thailand Data Center Rack Market?

Key companies in the market include Hewlett Packard Enterprise, Schneider Electric SE, Dell Inc, Delta Electronics (Thailand) PCL, Vertiv Group Corp, Rittal GMBH & Co KG, nVent Electric PL, Eaton Corporation.

3. What are the main segments of the Thailand Data Center Rack Market?

The market segments include Rack Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Smartpone Users; Fiber Connectivity Network Expansion in the Country.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment holds the major share..

7. Are there any restraints impacting market growth?

Increasing Cybersecurity Threats and Ransomware Attacks; Low Availability of Resources.

8. Can you provide examples of recent developments in the market?

May 2023: Thai telco Interlink Telecom (Itel) announced plans to invest USD 20 million in its data center joint venture with Etix Everywhere in Bangkok.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Rack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Rack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Rack Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Rack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence