Key Insights

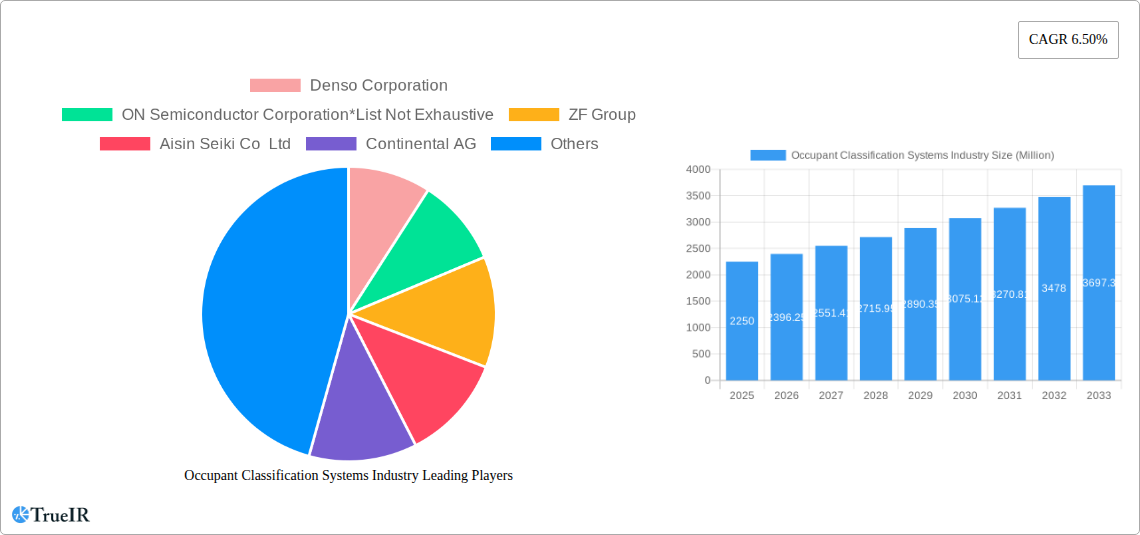

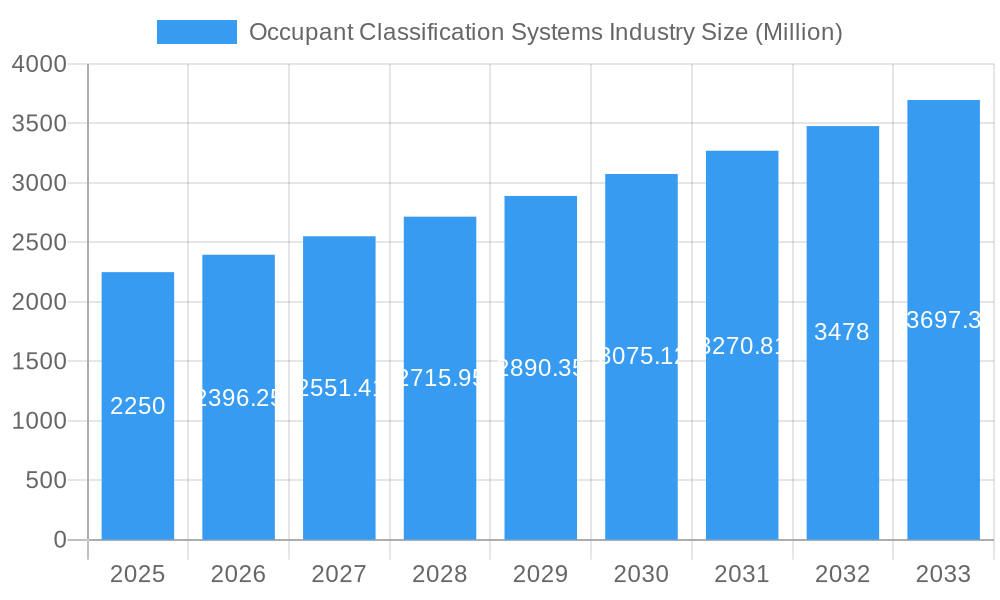

The Occupant Classification Systems (OCS) market is poised for robust growth, driven by an escalating focus on automotive safety and evolving regulatory mandates. With a projected market size of approximately $2,250 million and a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033, the industry is set to expand significantly. This expansion is fueled by the increasing sophistication of vehicle safety features, particularly the need for precise occupant detection and classification to optimize airbag deployment and other restraint systems. The rising adoption of electric vehicles (EVs), which often incorporate advanced sensor technologies, and the continued dominance of light vehicles in global sales further contribute to market momentum. Key components such as Airbag Control Units (ACUs) and various sensors, including pressure and seat belt tension sensors, are witnessing increased demand as automotive manufacturers invest heavily in enhancing occupant protection systems. This creates a fertile ground for innovation and market penetration for established and emerging players alike.

Occupant Classification Systems Industry Market Size (In Billion)

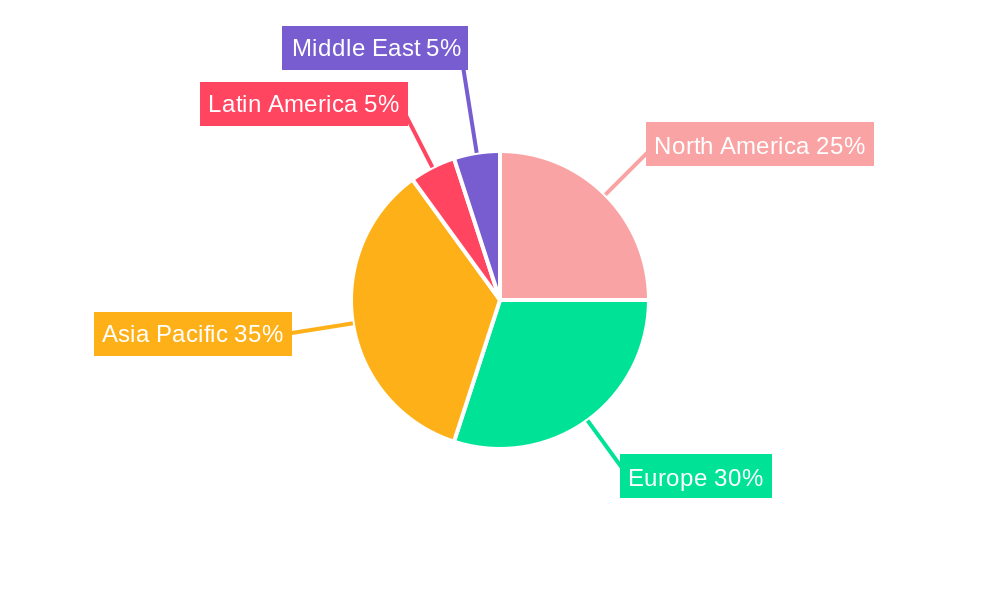

The market's trajectory is also shaped by a dynamic interplay of trends and restraints. Growing consumer awareness regarding vehicle safety and a preference for technologically advanced features are significant drivers. Furthermore, stringent safety standards implemented by governments worldwide, such as those from NHTSA in the US and Euro NCAP in Europe, mandate the inclusion and effective performance of OCS, thereby stimulating demand. However, challenges such as the high cost of advanced sensor integration and potential complexities in system calibration and maintenance could pose restraints to rapid market adoption. Despite these hurdles, the market is expected to witness strategic collaborations, mergers, and acquisitions among key players like Denso Corporation, ZF Group, Continental AG, and Autoliv Inc. to leverage expertise and expand their market reach. The Asia Pacific region is anticipated to emerge as a dominant force, owing to its large automotive manufacturing base and increasing disposable incomes, leading to higher vehicle sales and demand for safety-enhancing technologies.

Occupant Classification Systems Industry Company Market Share

This comprehensive report delves into the global Occupant Classification Systems (OCS) industry, providing in-depth analysis of market structure, trends, opportunities, and competitive dynamics. Spanning the historical period of 2019–2024 and extending to a robust forecast period of 2025–2033, with a base year of 2025, this study offers crucial insights for stakeholders navigating this rapidly evolving sector. The market is segmented by components such as Airbag Control Units (ACU) and Sensors (Pressure Sensor, Seat Belt Tension Sensor), and by vehicle types including Light Vehicles and Electric Vehicles.

Occupant Classification Systems Industry Market Structure & Competitive Landscape

The global Occupant Classification Systems (OCS) industry exhibits a moderately consolidated market structure, characterized by the presence of both established automotive giants and specialized sensor manufacturers. Leading companies like Denso Corporation, ON Semiconductor Corporation, ZF Group, Continental AG, and Aptiv Corporation hold significant market share, driving innovation and shaping competitive strategies. The concentration ratio is estimated to be around 60% among the top 5 players, reflecting a mature yet dynamic competitive environment. Innovation is a key differentiator, with a constant push towards more accurate, lightweight, and cost-effective OCS solutions. Regulatory impacts, particularly stringent safety standards mandated by global automotive safety bodies, significantly influence product development and market entry. Product substitutes, while limited in core OCS functionality, emerge from advancements in integrated sensing technologies and novel airbag deployment mechanisms. End-user segmentation primarily revolves around automotive manufacturers who are increasingly prioritizing advanced safety features. Mergers and acquisitions (M&A) have been a notable trend, with approximately $800 Million in OCS-related M&A activity observed between 2020 and 2024, aimed at acquiring technological expertise or expanding market reach.

Occupant Classification Systems Industry Market Trends & Opportunities

The Occupant Classification Systems (OCS) industry is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of 8.5% from 2025 to 2033. This expansion is primarily fueled by a global surge in demand for enhanced automotive safety, driven by increasingly stringent governmental regulations and growing consumer awareness of passive safety systems. The market size is projected to reach an impressive $7,500 Million by 2033, up from an estimated $4,000 Million in 2025. Technological shifts are central to this growth, with a strong emphasis on developing AI-powered OCS that can precisely identify occupant size, position, and type, leading to optimized airbag deployment and improved occupant protection. This includes the integration of advanced sensors like radar and cameras alongside traditional pressure sensors. Consumer preferences are increasingly leaning towards vehicles equipped with sophisticated safety features, making OCS a critical component in vehicle purchasing decisions. The competitive landscape is intensifying, with established players investing heavily in research and development to gain a competitive edge. Opportunities abound in the development of OCS for Electric Vehicles (EVs), which present unique challenges and requirements due to their lightweight construction and battery pack integration. Furthermore, the aftermarket segment for OCS upgrades and retrofits, while nascent, represents a potential growth avenue as older vehicles are equipped with enhanced safety technologies. The penetration rate of advanced OCS in new vehicle production is expected to climb to over 90% by 2033, underscoring the technology's essential role in modern automotive design.

Dominant Markets & Segments in Occupant Classification Systems Industry

The Occupant Classification Systems (OCS) industry demonstrates significant market dominance in key regions and vehicle segments. North America and Europe currently lead, driven by robust automotive manufacturing bases and stringent safety regulations like FMVSS 208 and ECE R94. The forecast period anticipates continued dominance in these regions, with Asia-Pacific expected to witness the highest growth rate due to the expanding automotive market in countries like China and India. Within the component segment, the Airbag Control Unit (ACU) remains a critical and dominant component, representing an estimated 45% of the total OCS market value. However, the Sensors segment, encompassing Pressure Sensors and Seat Belt Tension Sensors, is experiencing rapid growth, projected at a CAGR of 9.2%, due to advancements in their accuracy and reliability. The market for Pressure Sensors alone is expected to reach $2,200 Million by 2033. In terms of vehicle type, Light Vehicles, including passenger cars, SUVs, and light trucks, currently dominate the OCS market, accounting for approximately 85% of global demand. The increasing adoption of OCS in Electric Vehicles (EVs) is a significant growth driver, with this segment projected to expand at a CAGR of 12% over the forecast period, driven by the growing EV market and the unique safety considerations for EV occupants. Key growth drivers for OCS adoption in EVs include government incentives for EV sales and the development of specialized safety systems tailored to battery-electric architectures.

Occupant Classification Systems Industry Product Analysis

Product innovations in the Occupant Classification Systems (OCS) industry are primarily focused on enhancing accuracy, reducing size and weight, and improving cost-effectiveness. Advanced OCS solutions now incorporate sophisticated algorithms to differentiate between adult occupants, children, and even child seats, enabling tailored airbag responses. Competitive advantages are being gained through the integration of multiple sensor types, such as capacitive, infrared, and ultrasonic sensors, alongside traditional pressure sensors, to create a more comprehensive and reliable OCS. Applications extend beyond basic occupant detection to include features like seat belt reminders, child seat recognition for airbag deactivation, and even posture detection for personalized comfort and safety settings. These technological advancements are crucial for meeting evolving automotive safety standards and consumer expectations.

Key Drivers, Barriers & Challenges in Occupant Classification Systems Industry

The Occupant Classification Systems (OCS) industry is propelled by several key drivers. Foremost among these is the escalating global demand for automotive safety, reinforced by increasingly stringent regulatory mandates from authorities worldwide. Technological advancements, including the integration of artificial intelligence and more sophisticated sensor technologies, are enabling more precise and adaptive occupant protection. Consumer awareness and preference for vehicles equipped with advanced safety features also play a significant role. Economically, rising disposable incomes in emerging markets are contributing to the demand for vehicles with advanced safety systems.

However, the industry faces significant barriers and challenges. Supply chain complexities and the reliance on specialized semiconductor components can lead to production delays and increased costs, as witnessed during recent global chip shortages. Regulatory hurdles, while driving innovation, also impose strict testing and certification requirements that can be time-consuming and expensive. Competitive pressures from established players and new entrants alike necessitate continuous investment in R&D, potentially impacting profit margins. The cost of integrating advanced OCS into vehicle platforms remains a consideration for some automotive manufacturers, particularly in the entry-level vehicle segment.

Growth Drivers in the Occupant Classification Systems Industry Market

The Occupant Classification Systems (OCS) market is significantly driven by tightening global automotive safety regulations, such as evolving FMVSS and UNECE standards, which mandate advanced occupant detection and protection capabilities. Technological advancements, including the development of AI-driven algorithms for enhanced occupant recognition and the miniaturization of sensor components, are critical growth catalysts. The increasing consumer demand for premium safety features in vehicles, coupled with the rising adoption of Electric Vehicles (EVs) which often incorporate advanced safety systems as standard, further fuels market expansion.

Challenges Impacting Occupant Classification Systems Industry Growth

Despite robust growth prospects, the Occupant Classification Systems (OCS) industry faces several challenges. Global supply chain disruptions, particularly the shortage of critical electronic components, have impacted production volumes and timelines. The complex and evolving regulatory landscape across different regions can create hurdles for product compliance and market entry. Intense competitive pressure among established automotive suppliers and sensor manufacturers necessitates substantial R&D investment, potentially impacting profitability. Furthermore, the cost-effectiveness of integrating advanced OCS into lower-cost vehicle segments remains a key consideration for widespread adoption.

Key Players Shaping the Occupant Classification Systems Industry Market

- Denso Corporation

- ON Semiconductor Corporation

- ZF Group

- Aisin Seiki Co Ltd

- Continental AG

- Autoliv Inc

- Aptiv Corporation

- Robert Bosch GmbH

- TE Connectivity Limited

- IEE SENSING

Significant Occupant Classification Systems Industry Industry Milestones

- 2020: Introduction of advanced AI-powered OCS algorithms by major suppliers, improving occupant classification accuracy.

- 2021: Increased investment in sensor fusion technologies for enhanced OCS reliability.

- 2022: Growing demand for OCS solutions tailored for Electric Vehicles (EVs) due to their unique safety considerations.

- 2023: Several key players announced strategic partnerships to accelerate OCS development for autonomous driving integration.

- 2024: Launch of next-generation OCS with enhanced passenger detection capabilities and smaller form factors.

Future Outlook for Occupant Classification Systems Industry Market

The future outlook for the Occupant Classification Systems (OCS) industry is exceptionally promising, driven by an unwavering commitment to automotive safety and continuous technological innovation. The market is expected to witness sustained growth, fueled by the proliferation of advanced safety features in all vehicle segments and the increasing integration of OCS with other intelligent vehicle systems, such as advanced driver-assistance systems (ADAS) and autonomous driving technologies. Strategic opportunities lie in developing highly integrated and cost-effective OCS solutions for emerging markets and specialized vehicle categories, ensuring enhanced occupant protection for a broader range of consumers.

Occupant Classification Systems Industry Segmentation

-

1. Component

- 1.1. Airbag Control Unit (ACU)

-

1.2. Sensors

- 1.2.1. Pressure Sensor

- 1.2.2. Seat Belt Tension Sensor

-

2. Vehicle Type

- 2.1. Light Vehicles

- 2.2. Electric Vehicles

Occupant Classification Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Occupant Classification Systems Industry Regional Market Share

Geographic Coverage of Occupant Classification Systems Industry

Occupant Classification Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Emergence of MEMS Technology; Passenger Safety and Security Regulations and Increased Focus on compliance

- 3.3. Market Restrains

- 3.3.1. ; Integration Drift Error

- 3.4. Market Trends

- 3.4.1. Passenger Safety and security Regulations and Increased Focus on Compliances to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Airbag Control Unit (ACU)

- 5.1.2. Sensors

- 5.1.2.1. Pressure Sensor

- 5.1.2.2. Seat Belt Tension Sensor

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Light Vehicles

- 5.2.2. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Airbag Control Unit (ACU)

- 6.1.2. Sensors

- 6.1.2.1. Pressure Sensor

- 6.1.2.2. Seat Belt Tension Sensor

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Light Vehicles

- 6.2.2. Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Airbag Control Unit (ACU)

- 7.1.2. Sensors

- 7.1.2.1. Pressure Sensor

- 7.1.2.2. Seat Belt Tension Sensor

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Light Vehicles

- 7.2.2. Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Airbag Control Unit (ACU)

- 8.1.2. Sensors

- 8.1.2.1. Pressure Sensor

- 8.1.2.2. Seat Belt Tension Sensor

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Light Vehicles

- 8.2.2. Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Airbag Control Unit (ACU)

- 9.1.2. Sensors

- 9.1.2.1. Pressure Sensor

- 9.1.2.2. Seat Belt Tension Sensor

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Light Vehicles

- 9.2.2. Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Airbag Control Unit (ACU)

- 10.1.2. Sensors

- 10.1.2.1. Pressure Sensor

- 10.1.2.2. Seat Belt Tension Sensor

- 10.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.2.1. Light Vehicles

- 10.2.2. Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Occupant Classification Systems Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Denso Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ON Semiconductor Corporation*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ZF Group

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Aisin Seiki Co Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Continental AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Autoliv Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Aptiv Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Robert Bosch GmbH

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 TE Connectivity Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 IEE SENSING

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Denso Corporation

List of Figures

- Figure 1: Global Occupant Classification Systems Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Latin America Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: Middle East Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Occupant Classification Systems Industry Revenue (Million), by Component 2025 & 2033

- Figure 13: North America Occupant Classification Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 14: North America Occupant Classification Systems Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: North America Occupant Classification Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: North America Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Occupant Classification Systems Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Europe Occupant Classification Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Europe Occupant Classification Systems Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Europe Occupant Classification Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Europe Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 23: Europe Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 24: Asia Pacific Occupant Classification Systems Industry Revenue (Million), by Component 2025 & 2033

- Figure 25: Asia Pacific Occupant Classification Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 26: Asia Pacific Occupant Classification Systems Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Asia Pacific Occupant Classification Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Asia Pacific Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Asia Pacific Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: Latin America Occupant Classification Systems Industry Revenue (Million), by Component 2025 & 2033

- Figure 31: Latin America Occupant Classification Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 32: Latin America Occupant Classification Systems Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 33: Latin America Occupant Classification Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 34: Latin America Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 35: Latin America Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 36: Middle East Occupant Classification Systems Industry Revenue (Million), by Component 2025 & 2033

- Figure 37: Middle East Occupant Classification Systems Industry Revenue Share (%), by Component 2025 & 2033

- Figure 38: Middle East Occupant Classification Systems Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 39: Middle East Occupant Classification Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Middle East Occupant Classification Systems Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Occupant Classification Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Occupant Classification Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Occupant Classification Systems Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Occupant Classification Systems Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Occupant Classification Systems Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Occupant Classification Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Occupant Classification Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Occupant Classification Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Occupant Classification Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Occupant Classification Systems Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Occupant Classification Systems Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 16: Global Occupant Classification Systems Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 17: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Occupant Classification Systems Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global Occupant Classification Systems Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Occupant Classification Systems Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 22: Global Occupant Classification Systems Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Occupant Classification Systems Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 25: Global Occupant Classification Systems Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Global Occupant Classification Systems Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 28: Global Occupant Classification Systems Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Global Occupant Classification Systems Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Occupant Classification Systems Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Occupant Classification Systems Industry?

Key companies in the market include Denso Corporation, ON Semiconductor Corporation*List Not Exhaustive, ZF Group, Aisin Seiki Co Ltd, Continental AG, Autoliv Inc, Aptiv Corporation, Robert Bosch GmbH, TE Connectivity Limited, IEE SENSING.

3. What are the main segments of the Occupant Classification Systems Industry?

The market segments include Component, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Emergence of MEMS Technology; Passenger Safety and Security Regulations and Increased Focus on compliance.

6. What are the notable trends driving market growth?

Passenger Safety and security Regulations and Increased Focus on Compliances to Drive the Market.

7. Are there any restraints impacting market growth?

; Integration Drift Error.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Occupant Classification Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Occupant Classification Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Occupant Classification Systems Industry?

To stay informed about further developments, trends, and reports in the Occupant Classification Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence