Key Insights

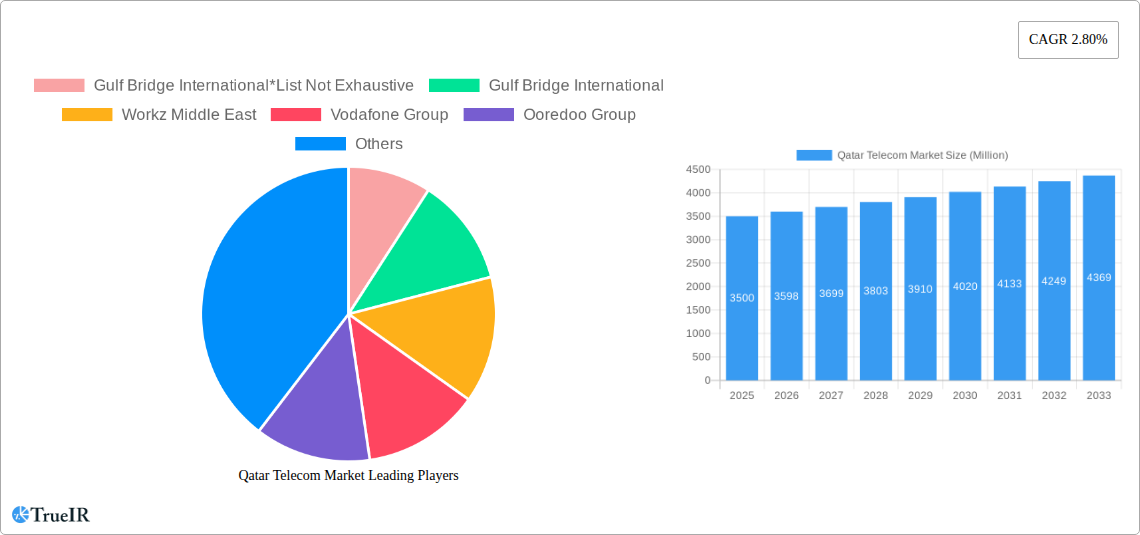

The Qatar telecommunications market is projected for substantial growth, featuring a Compound Annual Growth Rate (CAGR) of 5.7%. The market is expected to expand from an estimated size of $4.3 billion in the base year 2025. This expansion is fueled by escalating demand for advanced data services, the widespread adoption of Over-The-Top (OTT) and Pay-TV services, and sustained investment in both wired and wireless voice infrastructure. Key catalysts for this growth include Qatar's national digital transformation agenda, such as Qatar National Vision 2030, which prioritizes technological innovation and enhanced connectivity. The ongoing development of smart city initiatives, a predominantly mobile-first demographic, and a growing consumer appetite for high-speed internet and immersive digital content further bolster market expansion.

Qatar Telecom Market Market Size (In Billion)

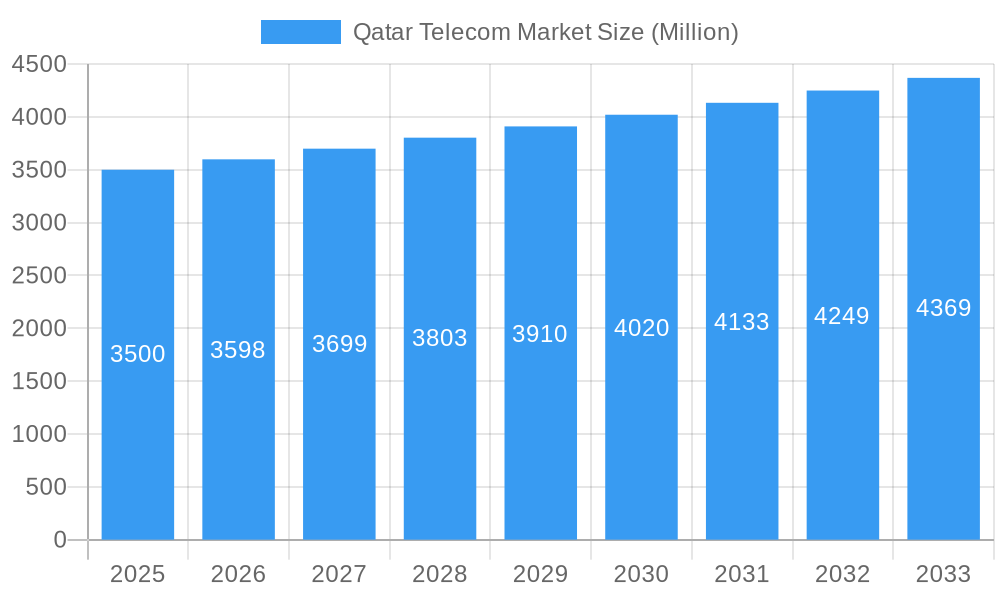

Despite significant growth drivers, several factors present challenges. The highly competitive telecommunications landscape, dominated by major entities such as Vodafone Group and Ooredoo Group, alongside the influence of technology providers like Huawei and ZTE Corporation, creates intense price competition and demands continuous service innovation. Furthermore, the considerable capital investment required for network modernization and the deployment of new technologies, including 5G and fiber optics, can pose financial hurdles for some operators. However, the telecommunications sector's critical role in Qatar's economic diversification and international standing, supported by strong government backing, positions the market for resilience and adaptability. The market is segmented into Voice Services (Wired and Wireless), Data Services, and OTT & Pay-TV Services, each contributing to the sector's overall vitality.

Qatar Telecom Market Company Market Share

Qatar Telecom Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the Qatar telecom market, leveraging high-volume keywords to capture industry interest and enhance search visibility. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this report delves into market structure, trends, dominant segments, product innovations, growth drivers, challenges, key players, and significant industry milestones. With a focus on quantitative data and qualitative insights, this report offers a complete understanding of the evolving Qatari telecommunications landscape.

Qatar Telecom Market Market Structure & Competitive Landscape

The Qatar telecom market exhibits a dynamic and evolving structure characterized by intense competition and strategic innovation. Market concentration, while present, is influenced by robust regulatory frameworks and the strategic investments of major players. Innovation drivers are predominantly fueled by the rapid adoption of advanced technologies, including 5G deployment and the expansion of fiber optic networks. The regulatory environment, overseen by the Communications Regulatory Authority (CRA), plays a pivotal role in shaping competitive dynamics, ensuring fair practices, and promoting service quality. Product substitutes are increasingly sophisticated, ranging from over-the-top (OTT) communication platforms to enhanced data services, forcing traditional service providers to adapt their offerings. End-user segmentation reveals distinct demands across residential, enterprise, and government sectors, each with unique connectivity and service requirements. Merger and acquisition (M&A) trends, though currently at a moderate volume, indicate potential consolidation and strategic partnerships aimed at expanding market reach and technological capabilities. Quantitative data suggests a moderate concentration ratio, with the top two operators holding approximately 70% of the mobile subscriber base. M&A activity has primarily focused on infrastructure development and service diversification.

- Market Concentration: Moderate, with key players dominating subscriber numbers.

- Innovation Drivers: 5G rollout, fiber optic expansion, IoT adoption.

- Regulatory Impact: CRA actively shapes competition and service quality.

- Product Substitutes: OTT services, cloud-based communication platforms.

- End-User Segmentation: Residential, enterprise, government sectors with varied needs.

- M&A Trends: Focus on infrastructure, service diversification, and strategic alliances.

Qatar Telecom Market Market Trends & Opportunities

The Qatar telecom market is poised for substantial growth and transformation over the forecast period (2025-2033), driven by a confluence of technological advancements, shifting consumer preferences, and evolving competitive dynamics. Market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This growth is underpinned by the pervasive adoption of high-speed internet services, the burgeoning demand for mobile data, and the increasing integration of telecommunications into everyday life and business operations. Technological shifts are at the forefront of this evolution, with the accelerated deployment of 5G infrastructure unlocking new opportunities for enhanced mobile broadband, massive machine-type communications for IoT applications, and ultra-reliable low-latency communications for critical services. The nation's commitment to digital transformation and its strategic vision for a knowledge-based economy are further fueling investments in cutting-edge telecommunications solutions. Consumer preferences are increasingly skewed towards seamless connectivity, personalized digital experiences, and value-added services that extend beyond basic voice and data. This includes a growing appetite for immersive content, cloud-based solutions, and smart home technologies. Competitive dynamics are characterized by a proactive approach from incumbent operators and the emergence of new service providers, all vying to capture market share through differentiated offerings and superior customer service. The drive towards a fully digital society presents immense opportunities for telecommunication providers to innovate and offer integrated solutions that cater to the diverse needs of both individuals and businesses. Market penetration rates for mobile broadband are already high, exceeding 95%, and are expected to continue their upward trajectory with the introduction of more affordable data plans and diverse device accessibility. The fixed broadband penetration is also seeing steady growth, driven by government initiatives and the demand for reliable home and office internet access. The proliferation of smart devices and the ongoing digital transformation across various industries, including healthcare, education, and transportation, will create sustained demand for robust and ubiquitous telecommunications infrastructure. Furthermore, the upcoming major sporting events and the continuous development of smart city initiatives will necessitate enhanced network capabilities and a focus on delivering high-quality, reliable connectivity solutions. The diversification of revenue streams through the offering of bundled services, content, and cloud solutions will be crucial for operators to maintain their competitive edge and capitalize on emerging market trends. The continuous expansion of the fiber optic network across Qatar is a critical enabler for delivering higher bandwidth and lower latency services, which are essential for the adoption of advanced applications such as virtual reality, augmented reality, and advanced AI-driven services. This infrastructure development will also support the growth of IoT deployments across various sectors, from smart grids and intelligent transportation systems to smart healthcare solutions.

Dominant Markets & Segments in Qatar Telecom Market

The Qatar telecom market's dominance is clearly illustrated by its leading segments, particularly in Data and OTT and Pay-TV Services. While Voice Services (Wired and Wireless) remain fundamental, the most significant growth and future potential lie in the burgeoning data consumption and the convergence of entertainment and communication through OTT and Pay-TV offerings. The extensive rollout of high-speed broadband, including fiber optic networks and advanced 5G capabilities, has created an unparalleled ecosystem for data-intensive applications. This infrastructure development is a key growth driver, enabling seamless streaming, cloud computing, and the expansion of the Internet of Things (IoT). Government policies and strategic initiatives focused on digital transformation and smart city development further bolster the growth of data services.

The Data and OTT and Pay-TV Services segment has witnessed exponential growth, fueled by:

- Increased Smartphone Penetration and Data Usage: As more users rely on mobile devices for a multitude of tasks, from communication and entertainment to work and education, the demand for high-speed mobile data continues to soar.

- Growth of Streaming Services: The popularity of Over-The-Top (OTT) platforms for video, music, and gaming has created a substantial demand for reliable and high-bandwidth internet connections.

- Development of Smart City Initiatives: Qatar's commitment to building smart cities necessitates robust data infrastructure for managing connected devices, intelligent transportation systems, and smart utilities, all of which contribute to data consumption.

- Enterprise Digitalization: Businesses across various sectors are increasingly adopting cloud-based solutions, remote work capabilities, and digital transformation strategies, driving the demand for enterprise-grade data services.

- Fiber Optic Network Expansion: The continuous expansion of Qatar's fiber optic network ensures high-speed and reliable internet access for households and businesses, facilitating the uptake of data-intensive services and advanced applications.

- Content Diversification: The availability of diverse and high-quality content on Pay-TV and OTT platforms further encourages consumers to subscribe to higher bandwidth plans, driving growth in this segment.

While Voice Services still hold a significant market share, their growth rate is comparatively slower than that of data services. Wired voice services are gradually being integrated into broader broadband packages, and wireless voice is facing competition from app-based communication services. However, the transition to 5G also presents opportunities for enhanced voice services, such as high-definition voice (HD Voice) and voice-over-LTE (VoLTE). The overarching trend indicates a clear shift towards data-centric services, with operators focusing on enhancing their data offerings and leveraging the growth potential of OTT and Pay-TV to drive revenue and customer engagement in the Qatar telecom market.

Qatar Telecom Market Product Analysis

The Qatar telecom market is witnessing a surge in innovative products and services, driven by technological advancements and a focus on user experience. Key product innovations include the widespread deployment of 5G-enabled devices and infrastructure, offering unprecedented speeds and lower latency for mobile broadband, IoT applications, and enhanced mobile experiences. Fiber optic broadband packages continue to be refined, providing higher speeds and more reliable home and business internet connectivity. Furthermore, the convergence of telecommunications with entertainment has led to a proliferation of bundled offerings combining internet, mobile, and Pay-TV services. Competitive advantages are being carved out through superior network performance, personalized digital solutions, and integrated service platforms, meeting the evolving demands of a digitally connected population.

Key Drivers, Barriers & Challenges in Qatar Telecom Market

Key Drivers, Barriers & Challenges in Qatar Telecom Market

The Qatar telecom market is propelled by several key drivers. Technologically, the rapid expansion of 5G infrastructure and fiber optic networks is a significant catalyst, enabling faster speeds and new service possibilities. Economically, the nation's strong economic growth and substantial investments in digital transformation initiatives fuel demand for advanced telecommunications. Policy-driven factors, such as the government's vision for a digital economy and support for ICT development, create a favorable environment for growth. For instance, the government's commitment to smart city development directly stimulates demand for advanced connectivity solutions.

Challenges Impacting Qatar Telecom Market Growth

Despite the positive trajectory, the market faces certain challenges. Regulatory complexities, while aimed at ensuring fair competition, can sometimes lead to extended approval processes. Supply chain issues, particularly for specialized equipment, can pose intermittent disruptions. Competitive pressures are intense, forcing operators to continually innovate and offer competitive pricing. Quantifiable impacts are seen in the pressure on ARPU (Average Revenue Per User) due to market saturation in certain segments, necessitating a focus on value-added services to maintain profitability.

Growth Drivers in the Qatar Telecom Market Market

Key growth drivers in the Qatar telecom market are multifaceted, encompassing technological, economic, and regulatory factors. Technologically, the ongoing rollout and enhancement of 5G networks are central, paving the way for advanced applications like IoT and enhanced mobile broadband. Economically, Qatar's robust GDP and significant government investment in diversifying its economy towards a digital future create substantial demand for high-quality telecommunications services. Regulatory frameworks, overseen by the CRA, promote fair competition and encourage infrastructure development, further stimulating market expansion. The continuous expansion of fiber optic networks nationwide also plays a crucial role, ensuring widespread access to high-speed internet.

Challenges Impacting Qatar Telecom Market Growth

The Qatar telecom market, while experiencing robust growth, also navigates several barriers. Regulatory complexities, although designed to foster a healthy market, can sometimes translate into longer lead times for new technology deployments. Supply chain vulnerabilities, particularly concerning specialized telecommunications equipment, can lead to project delays and increased costs. Intense competitive pressures among key players necessitate continuous investment in network upgrades and service innovation, potentially impacting profit margins and requiring strategic differentiation. The rising cost of infrastructure development and spectrum acquisition also presents a financial challenge for market participants.

Key Players Shaping the Qatar Telecom Market Market

- Gulf Bridge International

- Workz Middle East

- Vodafone Group

- Ooredoo Group

- Starlink

- Huawei

- ZTE Corporation

- Thales - Qatar

- Etisalat

- Qatar National Broadband Network Company QSC

Significant Qatar Telecom Market Industry Milestones

- August 2022: The Lusail Super Cup Local Organising Committee announced Ooredoo as their official Telecommunications partner, highlighting the company's role in providing essential Wi-Fi infrastructure for fans.

- May 2022: Qatar's Minister of Communications & Information Technology approved amendments by the CRA to enable Ooredoo and Vodafone Qatar to enhance mobile network performance and service quality, facilitating the nationwide availability of 5G technology.

Future Outlook for Qatar Telecom Market Market

The future outlook for the Qatar telecom market is exceptionally bright, characterized by sustained growth and innovation. The continued expansion of 5G and fiber optic networks will serve as the bedrock for emerging technologies such as AI, IoT, and advanced cloud services. Strategic opportunities lie in monetizing these advancements through value-added services, enterprise solutions, and the development of smart city ecosystems. With a proactive regulatory environment and a strong economic impetus for digital transformation, Qatar is well-positioned to be a regional leader in telecommunications innovation, offering lucrative prospects for market participants.

Qatar Telecom Market Segmentation

-

1. Segmenta

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and Pay-TV Services

-

1.1. Voice Services

Qatar Telecom Market Segmentation By Geography

- 1. Qatar

Qatar Telecom Market Regional Market Share

Geographic Coverage of Qatar Telecom Market

Qatar Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Mobile Internet Connections; Deployment of 5G Network

- 3.3. Market Restrains

- 3.3.1 ; Alternative Protocols

- 3.3.2 such as Bluetooth

- 3.3.3 Wi-Fi

- 3.3.4 and Z-Wave

- 3.3.5 Among Others

- 3.4. Market Trends

- 3.4.1. Deployment of 5G Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and Pay-TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Segmenta

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gulf Bridge International*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gulf Bridge International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Workz Middle East

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vodafone Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ooredoo Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Starlink

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huawei

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ZTE Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Thales - Qatar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Etisalat

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qatar National Broadband Network Company QSC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Gulf Bridge International*List Not Exhaustive

List of Figures

- Figure 1: Qatar Telecom Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Qatar Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Qatar Telecom Market Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 2: Qatar Telecom Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Qatar Telecom Market Revenue billion Forecast, by Segmenta 2020 & 2033

- Table 4: Qatar Telecom Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Telecom Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Qatar Telecom Market?

Key companies in the market include Gulf Bridge International*List Not Exhaustive, Gulf Bridge International, Workz Middle East, Vodafone Group, Ooredoo Group, Starlink, Huawei, ZTE Corporation, Thales - Qatar, Etisalat, Qatar National Broadband Network Company QSC.

3. What are the main segments of the Qatar Telecom Market?

The market segments include Segmenta.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Mobile Internet Connections; Deployment of 5G Network.

6. What are the notable trends driving market growth?

Deployment of 5G Technology.

7. Are there any restraints impacting market growth?

; Alternative Protocols. such as Bluetooth. Wi-Fi. and Z-Wave. Among Others.

8. Can you provide examples of recent developments in the market?

August 2022 - The Lusail Super Cup Local Organising Committee announced their official Telecommunications partner, Ooredoo. The company would offer Wi-Fi infrastructure during the event, allowing fans to stay connected.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Telecom Market?

To stay informed about further developments, trends, and reports in the Qatar Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence