Key Insights

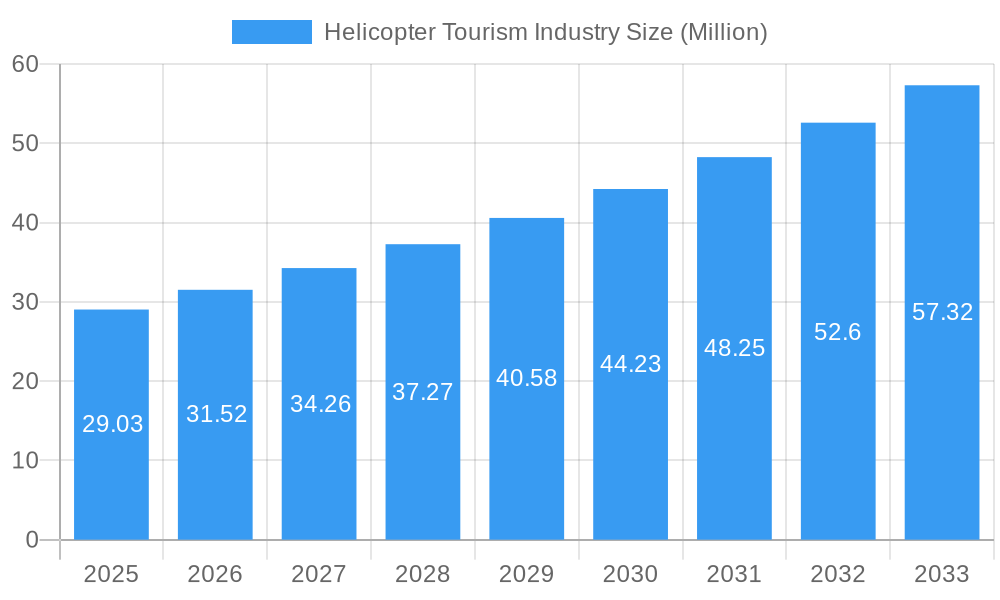

The global helicopter tourism market, valued at $29.03 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 8.82% from 2025 to 2033. This expansion is fueled by several key factors. Increasing disposable incomes in developing economies, coupled with a rising demand for unique and luxurious travel experiences, are significantly boosting the sector. The allure of breathtaking scenic views and inaccessible locations accessible only by helicopter is attracting a growing number of affluent tourists. Furthermore, technological advancements in helicopter design and safety features are enhancing passenger comfort and confidence, further driving market growth. The industry is also witnessing the emergence of innovative tourism packages, integrating helicopter rides with other luxury services like gourmet dining and exclusive accommodation, adding to its appeal. The segment showing the highest growth potential is leisure charter, followed closely by business and corporate travel, fueled by the need for efficient and time-saving transportation solutions for executives.

Helicopter Tourism Industry Market Size (In Million)

However, the market faces certain challenges. Stringent safety regulations and licensing requirements, coupled with the relatively high operational costs associated with helicopter maintenance and pilot training, can act as restraints. Fluctuations in fuel prices also pose a considerable risk to profitability. Despite these challenges, the market's growth trajectory remains positive, with ongoing efforts to enhance safety protocols and technological innovations expected to mitigate these risks. The geographical distribution of market share will likely see strong growth in Asia-Pacific and Latin America, driven by rapid economic expansion and burgeoning tourism sectors in these regions. North America and Europe, while already established markets, will continue to contribute significantly, driven by high-end tourism trends.

Helicopter Tourism Industry Company Market Share

Helicopter Tourism Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global helicopter tourism industry, projecting a market size exceeding $XX Million by 2033. It examines market structure, competitive dynamics, key trends, and growth opportunities across various segments, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The report covers the period from 2019 to 2033, using 2025 as the base and estimated year.

Helicopter Tourism Industry Market Structure & Competitive Landscape

The helicopter tourism industry exhibits a moderately concentrated market structure, with key players like CHC Group LL, Heli-union, and Air Methods Corporation holding significant market share. The 2025 Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Innovation in areas such as electric propulsion and autonomous flight systems is driving significant change, while regulatory frameworks regarding airspace management and safety standards exert considerable influence. Product substitutes, such as fixed-wing aircraft for certain applications, pose a competitive challenge. The industry is witnessing a rise in mergers and acquisitions (M&A) activity, with an estimated volume of xx deals exceeding $xx Million in the historical period (2019-2024). End-user segments, such as leisure charters, business travel, and air ambulance services are exhibiting varied growth trajectories, shaped by unique demand factors.

- Market Concentration: Moderately concentrated, with an estimated 2025 HHI of xx.

- Innovation Drivers: Electric propulsion, autonomous flight systems, advanced avionics.

- Regulatory Impacts: Stringent safety regulations, airspace management policies.

- Product Substitutes: Fixed-wing aircraft, alternative transportation modes.

- End-User Segmentation: Leisure charter, business travel, air ambulance, search and rescue, media and entertainment, surveying, offshore.

- M&A Trends: Significant M&A activity with xx deals exceeding $xx Million (2019-2024).

Helicopter Tourism Industry Market Trends & Opportunities

The global helicopter tourism market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by increasing disposable incomes, particularly in emerging economies, coupled with a rising demand for unique and luxury travel experiences. Technological advancements are enabling enhanced safety features, improved efficiency, and more comfortable passenger experiences, further driving market penetration. The market is also seeing a shift towards sustainable practices, with operators increasingly adopting eco-friendly technologies and practices. Competitive dynamics are characterized by a mix of established players and new entrants, leading to heightened innovation and improved service offerings. Market penetration rates vary across segments, with leisure charter and business travel witnessing the most significant growth.

Dominant Markets & Segments in Helicopter Tourism Industry

The North American region dominates the global helicopter tourism market, followed by Europe and Asia-Pacific. Within the application segments, Air Ambulance and Business and Corporate Travel are the most dominant, fueled by high demand and a robust economic outlook in many developed markets.

- Leading Regions: North America, Europe, Asia-Pacific.

- Dominant Segments: Air Ambulance, Business and Corporate Travel.

Key Growth Drivers:

- Air Ambulance: Increasing healthcare expenditure, improving emergency response infrastructure, and rising geriatric populations.

- Business and Corporate Travel: Growing business activities in key regions, the need for efficient transportation of high-value personnel, and the preference for private travel options.

- Search and Rescue: Growing government spending on safety and security, rising awareness of the need for rapid emergency response.

- Leisure Charter: Increase in affluence and a demand for exclusive tourism experiences.

- Transport: Demand from remote or challenging terrain locations.

- Media and Entertainment: A demand for unique filming and photography opportunities.

- Surveying: Use of aerial photography to create high-resolution images, GIS data collection, and geological surveys.

- Offshore: Demand from offshore oil and gas industry activities for worker transportation.

The dominance of these segments is largely attributable to robust infrastructure, favorable regulatory environments, and high disposable incomes in key markets.

Helicopter Tourism Industry Product Analysis

The helicopter tourism industry is characterized by a range of aircraft tailored to specific applications, ranging from lightweight single-engine helicopters for leisure activities to larger, more powerful models for air ambulance and offshore operations. Recent innovations focus on enhancing safety and efficiency, with developments in noise reduction technologies, improved fuel efficiency, and advanced avionics systems gaining traction. Manufacturers are increasingly integrating advanced materials and manufacturing processes to reduce weight and improve performance, thereby enhancing market competitiveness.

Key Drivers, Barriers & Challenges in Helicopter Tourism Industry

Key Drivers:

Rising disposable incomes, increasing demand for luxury travel, technological advancements (e.g., autonomous flight, electric propulsion), favorable government policies supporting tourism in several regions.

Key Barriers & Challenges:

High operating costs, stringent safety regulations, fluctuating fuel prices, competition from alternative transportation modes, airspace congestion in certain regions, and geopolitical instability impacting some regional markets. These challenges collectively constrain market growth and profitability.

Growth Drivers in the Helicopter Tourism Industry Market

Several factors fuel market growth: increasing tourism, technological progress (e.g., autonomous flight), supportive government policies, rising demand for efficient transportation, and expanding applications into new sectors.

Challenges Impacting Helicopter Tourism Industry Growth

The sector faces hurdles: high operational costs, stringent safety regulations, fuel price volatility, and competition from other transportation options. These create significant barriers to entry and can limit profitability.

Key Players Shaping the Helicopter Tourism Industry Market

- CHC Group LL

- Heli-union

- Air Methods Corporation

- Acadian Air Med Services (Acadian Companies)

- LUXEMBOURG AIR RESCUE ASBL

- PHI Group Inc

- Babcock Scandinavian Air Ambulance (Babcock International Group)

- Bristow Group Inc

- Emsos Medical Pvt Ltd

- Abu Dhabi Aviation

Significant Helicopter Tourism Industry Industry Milestones

- 2020: Introduction of the first commercially viable electric helicopter prototype.

- 2022: Several major mergers and acquisitions in the air ambulance sector.

- 2023: Significant investment in advanced air mobility (AAM) infrastructure.

Future Outlook for Helicopter Tourism Industry Market

The helicopter tourism market is poised for continued expansion, driven by technological advancements, burgeoning tourism, and increasing demand across various segments. Strategic partnerships, expansion into new markets, and the adoption of sustainable practices will be crucial for achieving sustained growth and profitability in the coming years. The market is expected to witness a considerable increase in the adoption of autonomous and electric helicopters.

Helicopter Tourism Industry Segmentation

-

1. Application

- 1.1. Air Ambulance

- 1.2. Business and Corporate Travel

- 1.3. Search and Rescue

- 1.4. Leisure Charter

- 1.5. Transport

- 1.6. Media and Entertainment

- 1.7. Surveying

- 1.8. Offshore

- 1.9. Other Applications

Helicopter Tourism Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Indonesia

- 3.6. Malaysia

- 3.7. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Turkey

- 5.5. Rest of Middle East and Africa

Helicopter Tourism Industry Regional Market Share

Geographic Coverage of Helicopter Tourism Industry

Helicopter Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Air Ambulance Segment is Projected to Show the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Air Ambulance

- 5.1.2. Business and Corporate Travel

- 5.1.3. Search and Rescue

- 5.1.4. Leisure Charter

- 5.1.5. Transport

- 5.1.6. Media and Entertainment

- 5.1.7. Surveying

- 5.1.8. Offshore

- 5.1.9. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Air Ambulance

- 6.1.2. Business and Corporate Travel

- 6.1.3. Search and Rescue

- 6.1.4. Leisure Charter

- 6.1.5. Transport

- 6.1.6. Media and Entertainment

- 6.1.7. Surveying

- 6.1.8. Offshore

- 6.1.9. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Air Ambulance

- 7.1.2. Business and Corporate Travel

- 7.1.3. Search and Rescue

- 7.1.4. Leisure Charter

- 7.1.5. Transport

- 7.1.6. Media and Entertainment

- 7.1.7. Surveying

- 7.1.8. Offshore

- 7.1.9. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Air Ambulance

- 8.1.2. Business and Corporate Travel

- 8.1.3. Search and Rescue

- 8.1.4. Leisure Charter

- 8.1.5. Transport

- 8.1.6. Media and Entertainment

- 8.1.7. Surveying

- 8.1.8. Offshore

- 8.1.9. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Air Ambulance

- 9.1.2. Business and Corporate Travel

- 9.1.3. Search and Rescue

- 9.1.4. Leisure Charter

- 9.1.5. Transport

- 9.1.6. Media and Entertainment

- 9.1.7. Surveying

- 9.1.8. Offshore

- 9.1.9. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Air Ambulance

- 10.1.2. Business and Corporate Travel

- 10.1.3. Search and Rescue

- 10.1.4. Leisure Charter

- 10.1.5. Transport

- 10.1.6. Media and Entertainment

- 10.1.7. Surveying

- 10.1.8. Offshore

- 10.1.9. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Indonesia

- 13.1.6 Malaysia

- 13.1.7 Rest of Asia Pacific

- 14. Latin America Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Mexico

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 South Africa

- 15.1.4 Turkey

- 15.1.5 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 CHC Group LL

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Heli-union

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Air Methods Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Acadian Air Med Services (Acadian Companies)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 LUXEMBOURG AIR RESCUE ASBL

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PHI Group Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Babcock Scandinavian Air Ambulance (Babcock International Group)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Bristow Group Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Emsos Medical Pvt Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Abu Dhabi Aviation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 CHC Group LL

List of Figures

- Figure 1: Global Helicopter Tourism Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Latin America Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East and Africa Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: Middle East and Africa Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Helicopter Tourism Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: North America Helicopter Tourism Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 15: North America Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 16: Europe Helicopter Tourism Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Helicopter Tourism Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific Helicopter Tourism Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Helicopter Tourism Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 23: Asia Pacific Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 24: Latin America Helicopter Tourism Industry Revenue (Million), by Application 2025 & 2033

- Figure 25: Latin America Helicopter Tourism Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Latin America Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 27: Latin America Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

- Figure 28: Middle East and Africa Helicopter Tourism Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Helicopter Tourism Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Helicopter Tourism Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Helicopter Tourism Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Helicopter Tourism Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Helicopter Tourism Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Helicopter Tourism Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Germany Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Russia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: India Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: China Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: South Korea Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Indonesia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Malaysia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Mexico Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Latin America Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Saudi Arabia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: United Arab Emirates Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Turkey Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Middle East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Helicopter Tourism Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United States Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Canada Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Helicopter Tourism Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Germany Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: France Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Russia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Helicopter Tourism Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: India Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: China Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: South Korea Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Indonesia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Malaysia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Asia Pacific Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Global Helicopter Tourism Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 53: Brazil Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Mexico Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Rest of Latin America Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Global Helicopter Tourism Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 57: Global Helicopter Tourism Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Saudi Arabia Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: United Arab Emirates Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Turkey Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Helicopter Tourism Industry?

The projected CAGR is approximately 8.82%.

2. Which companies are prominent players in the Helicopter Tourism Industry?

Key companies in the market include CHC Group LL, Heli-union, Air Methods Corporation, Acadian Air Med Services (Acadian Companies), LUXEMBOURG AIR RESCUE ASBL, PHI Group Inc, Babcock Scandinavian Air Ambulance (Babcock International Group), Bristow Group Inc, Emsos Medical Pvt Ltd, Abu Dhabi Aviation.

3. What are the main segments of the Helicopter Tourism Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Air Ambulance Segment is Projected to Show the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Helicopter Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Helicopter Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Helicopter Tourism Industry?

To stay informed about further developments, trends, and reports in the Helicopter Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence