Key Insights

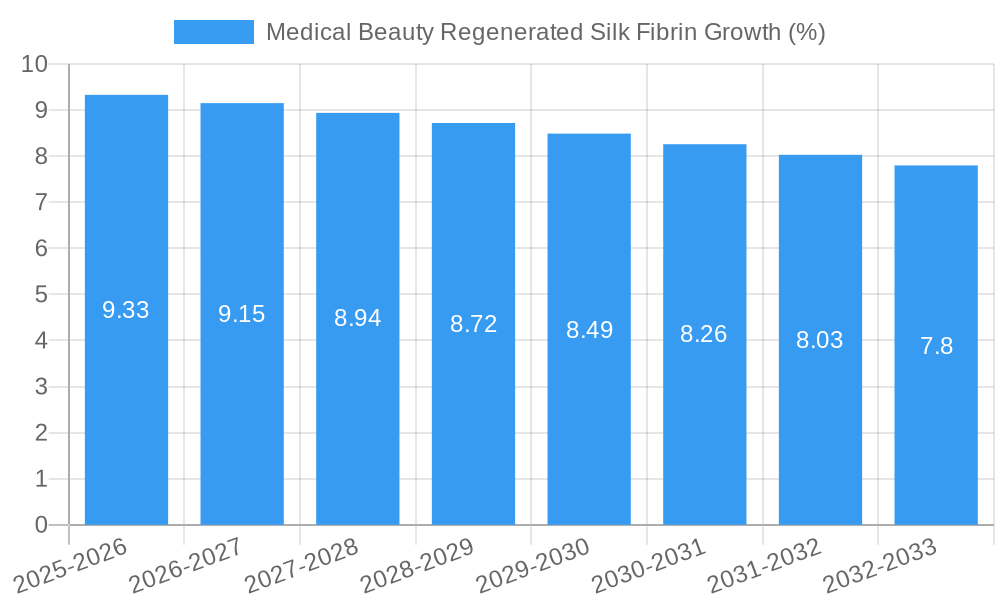

The Medical Beauty Regenerated Silk Fibrin market is poised for significant expansion, driven by an estimated market size of $XXX million and a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This robust growth trajectory is fueled by increasing consumer demand for advanced, natural, and biocompatible aesthetic treatments. Regenerated silk fibrin, a revolutionary biomaterial derived from silk protein, offers exceptional properties for wound healing, tissue regeneration, and advanced skincare formulations. Its superior biocompatibility, biodegradability, and ability to promote cell proliferation and collagen synthesis make it a highly sought-after ingredient in medical beauty applications, including advanced wound dressings and tissue engineering scaffolds for aesthetic reconstructive procedures. The rising awareness of the benefits of silk-based biomaterials, coupled with advancements in biotechnology for efficient and sustainable production, are key drivers propelling market adoption. Furthermore, a growing global preference for minimally invasive and regenerative aesthetic solutions is creating substantial opportunities for this innovative market segment.

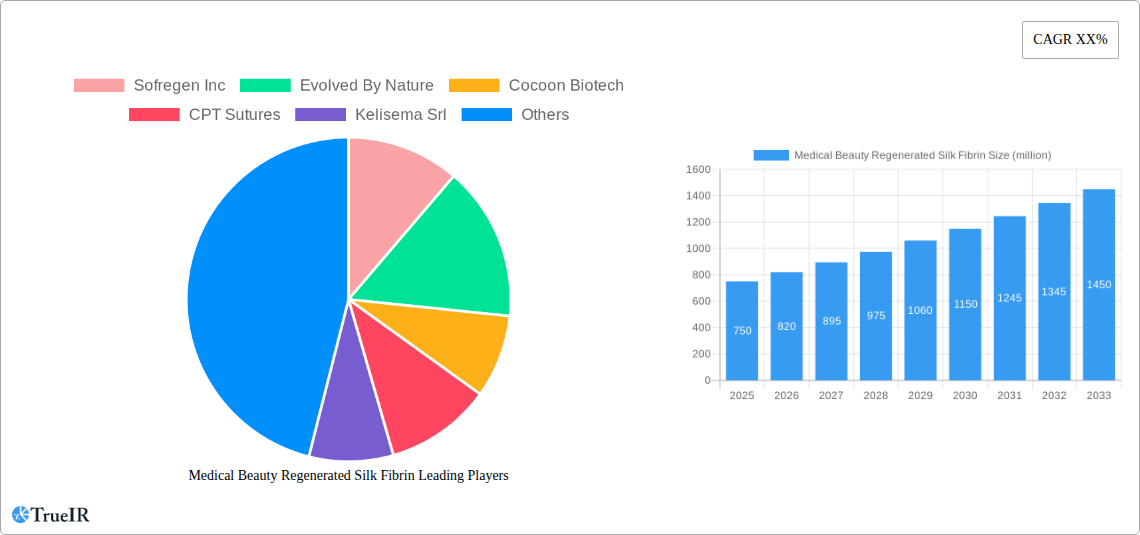

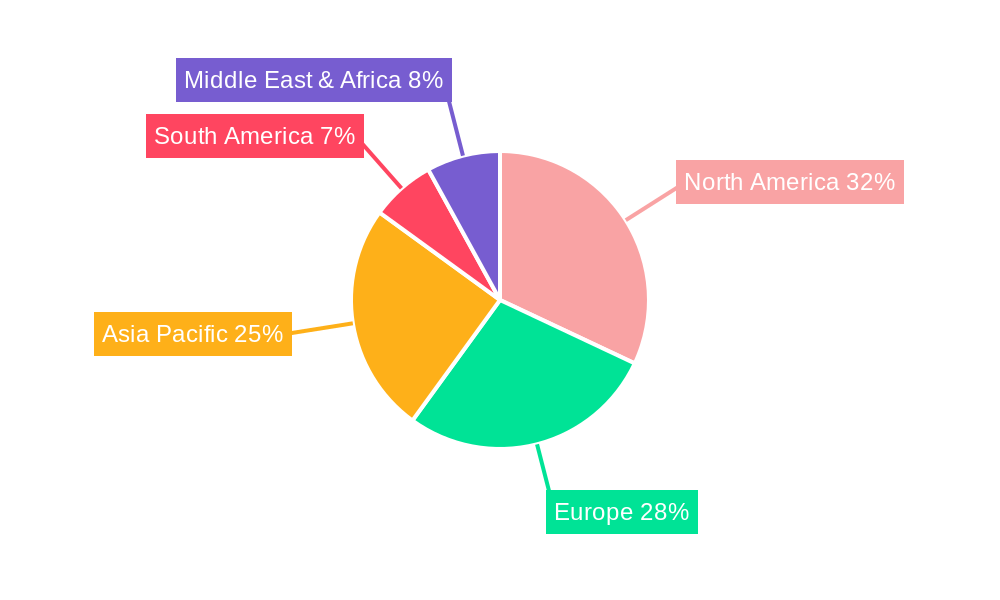

The market is segmented into various applications, with "Dressing" and "Tissue Engineering" anticipated to be dominant segments due to their direct impact on healing and regenerative aesthetics. The "Powder" and "Solution" forms cater to diverse formulation needs, allowing for versatile product development. Geographically, North America and Europe are expected to lead the market in the near term, owing to high disposable incomes, a well-established medical aesthetic infrastructure, and a strong emphasis on research and development. However, the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth, driven by a burgeoning middle class, increasing adoption of aesthetic procedures, and growing investments in biomaterial research. Key industry players like Sofregen Inc., Evolved By Nature, and DSM are actively investing in R&D and strategic collaborations to capitalize on these growth avenues and address the increasing demand for innovative and effective medical beauty solutions. Challenges such as production costs and regulatory hurdles may influence the pace of adoption in certain regions, but the overall outlook remains highly optimistic.

Here is a dynamic, SEO-optimized report description for Medical Beauty Regenerated Silk Fibrin, designed for maximum clarity and engagement with industry audiences:

Medical Beauty Regenerated Silk Fibrin Market Structure & Competitive Landscape

The Medical Beauty Regenerated Silk Fibrin market is characterized by a moderate to high level of concentration, with a few key innovators driving significant market share. Innovation is primarily fueled by advancements in biomaterial science, particularly in creating biocompatible and biodegradable silk-derived matrices for aesthetic and regenerative applications. Regulatory impacts are crucial, with stringent approvals from bodies like the FDA and EMA influencing market entry and product development cycles. Product substitutes, though present in the form of other biomaterials, offer distinct advantages in terms of efficacy and patient response. End-user segmentation is broad, encompassing dermatology clinics, plastic surgery centers, and research institutions. Mergers and Acquisitions (M&A) trends are emerging, with larger biomaterial companies seeking to acquire specialized silk fibrin technologies to expand their portfolios. Recent M&A activities have seen approximately xx million in deal values. The competitive landscape is dynamic, with a steady stream of intellectual property filings and clinical trial data influencing market positions.

Medical Beauty Regenerated Silk Fibrin Market Trends & Opportunities

The Medical Beauty Regenerated Silk Fibrin market is poised for substantial growth, driven by a burgeoning demand for minimally invasive aesthetic procedures and advanced regenerative therapies. The market size is projected to reach an estimated value of over xx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% from the base year of 2025. Technological shifts are central to this expansion, with ongoing research focusing on optimizing the purity, biocompatibility, and controlled release properties of regenerated silk fibrin. This includes innovations in electrospinning and lyophilization techniques to create advanced scaffolds and delivery systems. Consumer preferences are increasingly leaning towards natural, bio-derived materials that offer enhanced safety profiles and promote intrinsic tissue regeneration. This paradigm shift favors regenerated silk fibrin over synthetic alternatives. Competitive dynamics are intensifying, with both established players and emerging biotechnology firms vying for market dominance through strategic partnerships, product differentiation, and targeted marketing campaigns. The penetration rate of regenerated silk fibrin in its target applications is expected to accelerate, further supported by positive clinical outcomes and growing physician adoption. The market penetration rate is currently at xx% and is projected to reach xx% by 2033. Key market developments, such as the increasing prevalence of chronic wounds and the rising disposable income of consumers, are creating significant opportunities for market expansion. The integration of artificial intelligence in drug discovery and material design is also expected to play a pivotal role in accelerating innovation and product development within this sector. The forecast period (2025–2033) anticipates a surge in demand for personalized aesthetic treatments, where regenerated silk fibrin's adaptability and biocompatibility make it an ideal candidate. Furthermore, growing awareness and acceptance of regenerative medicine principles among both patients and healthcare providers will contribute to wider adoption across various medical beauty applications, from advanced wound healing to dermal filler formulations.

Dominant Markets & Segments in Medical Beauty Regenerated Silk Fibrin

The Tissue Engineering segment is emerging as a dominant force in the Medical Beauty Regenerated Silk Fibrin market, driven by its potential to revolutionize reconstructive and aesthetic procedures. The Dressing application also holds significant sway due to its established use in advanced wound care, where the regenerative properties of silk fibrin accelerate healing and minimize scarring.

- Leading Region: North America currently dominates the medical beauty regenerated silk fibrin market, driven by high disposable incomes, advanced healthcare infrastructure, and a strong emphasis on aesthetic advancements. The United States, in particular, is a key market, with a high concentration of leading aesthetic clinics and research institutions investing in and utilizing advanced biomaterials.

- Key Country Dominance: Within North America, the United States leads due to its robust regulatory framework that supports innovation and its large patient pool actively seeking advanced medical beauty solutions. Europe, particularly Germany and France, also presents substantial market share due to a strong emphasis on regenerative medicine and a well-established biomaterials industry.

- Dominant Application (Tissue Engineering):

- Growth Drivers: Advancements in 3D bioprinting technologies enabling the creation of complex tissue structures. Increased R&D funding for regenerative therapies for facial reconstruction and skin augmentation. Growing demand for bio-scaffolds that promote natural cell growth and differentiation.

- Detailed Analysis: The application of regenerated silk fibrin in tissue engineering is transformative. It serves as a biocompatible scaffold that mimics the extracellular matrix, providing an ideal environment for cell adhesion, proliferation, and differentiation. This is crucial for applications such as cartilage repair, bone regeneration, and the creation of dermal substitutes for treating burns and chronic wounds. The ability of silk fibrin to be functionalized with growth factors and stem cells further enhances its potential in this segment, offering personalized and effective therapeutic solutions.

- Dominant Type (Solution):

- Growth Drivers: Ease of administration through injection or topical application. Superior integration with other bioactive agents. Enhanced stability and shelf-life compared to powdered forms.

- Detailed Analysis: The solution form of regenerated silk fibrin offers significant advantages in terms of ease of use and integration into existing medical beauty protocols. It can be readily formulated with active ingredients, growth factors, or aesthetic enhancers, allowing for targeted delivery and improved therapeutic outcomes. Its liquid state facilitates seamless incorporation into dermal fillers, mesotherapy cocktails, and advanced wound dressing formulations, making it a versatile choice for practitioners.

The Asian market, particularly China and Japan, is exhibiting rapid growth due to increasing healthcare expenditure, a rising middle class, and a growing acceptance of aesthetic procedures. Government initiatives supporting biotechnology research and development further bolster the market's expansion in these regions. The "Others" application segment, encompassing diverse uses in aesthetic injectables and wound care adjuncts, is also showing promising growth.

Medical Beauty Regenerated Silk Fibrin Product Analysis

Regenerated silk fibrin represents a breakthrough in biomaterials for medical beauty, offering unparalleled biocompatibility and regenerative potential. Innovations focus on optimizing its structural integrity, pore size, and controlled release capabilities to enhance applications in wound healing, tissue regeneration, and aesthetic injectables. Its unique fibrous structure mimics the natural extracellular matrix, promoting cell adhesion, proliferation, and differentiation, leading to superior tissue integration and faster healing with minimal scarring. Competitive advantages lie in its biodegradable nature, minimal immunogenicity, and versatile functionalization possibilities, making it a preferred choice over synthetic alternatives.

Key Drivers, Barriers & Challenges in Medical Beauty Regenerated Silk Fibrin

Key Drivers:

- Technological Advancements: Innovations in silk processing and functionalization are creating superior biomaterials with enhanced efficacy.

- Growing Demand for Minimally Invasive Aesthetics: The shift towards less invasive procedures favors injectable and bio-integrated materials.

- Rising Awareness of Regenerative Medicine: Increasing patient and physician understanding of biomaterials' regenerative capabilities.

- Biocompatibility and Biodegradability: Natural origin and excellent safety profile appeal to a health-conscious consumer base.

Barriers & Challenges:

- Regulatory Hurdles: Stringent approval processes for novel biomaterials can be time-consuming and costly, with estimated approval times of xx months.

- Manufacturing Scalability and Cost: Achieving consistent, large-scale production of high-purity regenerated silk fibrin at competitive price points (estimated production cost reduction targets of xx%) remains a challenge.

- Competition from Established Biomaterials: Existing hyaluronic acid fillers and other synthetic biomaterials have established market presence.

- Lack of Widespread Clinical Data: While promising, extensive long-term clinical data across all applications is still being gathered, impacting widespread adoption.

Growth Drivers in the Medical Beauty Regenerated Silk Fibrin Market

The Medical Beauty Regenerated Silk Fibrin market is propelled by a confluence of compelling growth drivers. Technologically, advancements in biomaterial processing, including improved purification techniques and controlled fibrillation, are yielding silk fibrin with superior biocompatibility and regenerative properties. Economic factors, such as the increasing disposable income in emerging economies and the rising global expenditure on aesthetic procedures, are significantly boosting market demand. Furthermore, evolving consumer preferences towards natural, bio-derived, and sustainable products are creating a favorable environment for silk-based biomaterials. Regulatory bodies are also playing a role by streamlining approval pathways for innovative regenerative therapies, thereby facilitating market entry for new products. The growing emphasis on wound healing and scar reduction treatments further amplifies the demand for these advanced biomaterials.

Challenges Impacting Medical Beauty Regenerated Silk Fibrin Growth

Despite its promising outlook, the Medical Beauty Regenerated Silk Fibrin market faces several significant challenges. Regulatory complexities remain a primary hurdle, with lengthy and resource-intensive approval processes for novel biomaterials potentially delaying product launches and market penetration. Supply chain issues, particularly concerning the consistent sourcing of high-quality silk cocoons and the specialized manufacturing processes required, can impact production scalability and cost-effectiveness. Competitive pressures from established biomaterials, such as hyaluronic acid and collagen, which have a longer track record and wider market recognition, present a formidable barrier. Furthermore, the need for extensive clinical trials to validate efficacy and safety across diverse applications requires significant investment and time, estimated at xx million per trial. Addressing these challenges through strategic partnerships, technological innovation in manufacturing, and robust clinical validation will be crucial for sustained market growth.

Key Players Shaping the Medical Beauty Regenerated Silk Fibrin Market

- Sofregen Inc

- Evolved By Nature

- Cocoon Biotech

- CPT Sutures

- Kelisema Srl

- Seidecos

- SEIREN Co.,Ltd.

- DSM

- Croda

- Jiangxi Silk Biotechnology Co.,Ltd.

- Simatech Incorporation

- Zhejiang Xingyue Biotechnology Co.,Ltd.

- Hubei Sailuo Biomaterials Co.,Ltd.

- Favorsun

- Chinatiansi

- Hangzhou Lin Ran Bio-tech Co., Hangzhou Lin Ran Bio-tech Co., Hangzhou Lin Ran Bio-tech Co., Hangzhou Lin Ran Bio-tech Co.

- Haifan

- Cathaya

- Suhaobio

- Segments

Significant Medical Beauty Regenerated Silk Fibrin Industry Milestones

- 2019: Early research publications detailing the biocompatibility and regenerative potential of modified silk fibroin for dermal applications.

- 2020: Commencement of pre-clinical studies investigating regenerated silk fibrin as a scaffold for wound healing and tissue regeneration.

- 2021: First patent filings related to novel methods for producing medical-grade regenerated silk fibrin with enhanced properties.

- 2022: Initiation of Phase I clinical trials for regenerated silk fibrin-based wound dressings in specific patient populations.

- 2023: Emergence of specialized biotechnology companies focusing exclusively on silk-derived biomaterials for medical applications.

- 2024: Key players begin strategic partnerships to advance R&D and scale up production capabilities for medical beauty applications.

Future Outlook for Medical Beauty Regenerated Silk Fibrin Market

The future outlook for the Medical Beauty Regenerated Silk Fibrin market is exceptionally bright, driven by an increasing demand for advanced, bio-inspired aesthetic and regenerative solutions. Strategic opportunities lie in expanding its application portfolio into less explored areas such as scar revision and advanced anti-aging treatments. Continued innovation in functionalizing silk fibrin with growth factors and targeted delivery systems will unlock new therapeutic potentials. Market penetration is expected to accelerate as clinical data solidifies and regulatory pathways become more defined, further supported by growing consumer awareness and acceptance of regenerative medicine. The market holds significant potential to disrupt traditional aesthetic procedures with more natural and effective alternatives.

Medical Beauty Regenerated Silk Fibrin Segmentation

-

1. Application

- 1.1. Dressing

- 1.2. Tissue Engineering

- 1.3. Others

-

2. Types

- 2.1. Powder

- 2.2. Solution

- 2.3. Others

Medical Beauty Regenerated Silk Fibrin Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Beauty Regenerated Silk Fibrin REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Beauty Regenerated Silk Fibrin Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dressing

- 5.1.2. Tissue Engineering

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Powder

- 5.2.2. Solution

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Beauty Regenerated Silk Fibrin Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dressing

- 6.1.2. Tissue Engineering

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Powder

- 6.2.2. Solution

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Beauty Regenerated Silk Fibrin Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dressing

- 7.1.2. Tissue Engineering

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Powder

- 7.2.2. Solution

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Beauty Regenerated Silk Fibrin Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dressing

- 8.1.2. Tissue Engineering

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Powder

- 8.2.2. Solution

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Beauty Regenerated Silk Fibrin Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dressing

- 9.1.2. Tissue Engineering

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Powder

- 9.2.2. Solution

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Beauty Regenerated Silk Fibrin Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dressing

- 10.1.2. Tissue Engineering

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Powder

- 10.2.2. Solution

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sofregen Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Evolved By Nature

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cocoon Biotech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CPT Sutures

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kelisema Srl

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seidecos

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SEIREN Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DSM

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Croda

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jiangxi Silk Biotechnology Co.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Simatech Incorporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zhejiang Xingyue Biotechnology Co.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ltd.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Hubei Sailuo Biomaterials Co.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Favorsun

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Chinatiansi

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Hangzhou Lin Ran Bio-tech Co.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Ltd

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Haifan

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Cathaya

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Suhaobio

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Sofregen Inc

List of Figures

- Figure 1: Global Medical Beauty Regenerated Silk Fibrin Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Medical Beauty Regenerated Silk Fibrin Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Medical Beauty Regenerated Silk Fibrin Revenue (million), by Application 2024 & 2032

- Figure 4: North America Medical Beauty Regenerated Silk Fibrin Volume (K), by Application 2024 & 2032

- Figure 5: North America Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Medical Beauty Regenerated Silk Fibrin Revenue (million), by Types 2024 & 2032

- Figure 8: North America Medical Beauty Regenerated Silk Fibrin Volume (K), by Types 2024 & 2032

- Figure 9: North America Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Medical Beauty Regenerated Silk Fibrin Revenue (million), by Country 2024 & 2032

- Figure 12: North America Medical Beauty Regenerated Silk Fibrin Volume (K), by Country 2024 & 2032

- Figure 13: North America Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Medical Beauty Regenerated Silk Fibrin Revenue (million), by Application 2024 & 2032

- Figure 16: South America Medical Beauty Regenerated Silk Fibrin Volume (K), by Application 2024 & 2032

- Figure 17: South America Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Medical Beauty Regenerated Silk Fibrin Revenue (million), by Types 2024 & 2032

- Figure 20: South America Medical Beauty Regenerated Silk Fibrin Volume (K), by Types 2024 & 2032

- Figure 21: South America Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Medical Beauty Regenerated Silk Fibrin Revenue (million), by Country 2024 & 2032

- Figure 24: South America Medical Beauty Regenerated Silk Fibrin Volume (K), by Country 2024 & 2032

- Figure 25: South America Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Medical Beauty Regenerated Silk Fibrin Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Medical Beauty Regenerated Silk Fibrin Volume (K), by Application 2024 & 2032

- Figure 29: Europe Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Medical Beauty Regenerated Silk Fibrin Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Medical Beauty Regenerated Silk Fibrin Volume (K), by Types 2024 & 2032

- Figure 33: Europe Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Medical Beauty Regenerated Silk Fibrin Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Medical Beauty Regenerated Silk Fibrin Volume (K), by Country 2024 & 2032

- Figure 37: Europe Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Medical Beauty Regenerated Silk Fibrin Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Medical Beauty Regenerated Silk Fibrin Volume K Forecast, by Country 2019 & 2032

- Table 81: China Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Medical Beauty Regenerated Silk Fibrin Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Medical Beauty Regenerated Silk Fibrin Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Beauty Regenerated Silk Fibrin?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medical Beauty Regenerated Silk Fibrin?

Key companies in the market include Sofregen Inc, Evolved By Nature, Cocoon Biotech, CPT Sutures, Kelisema Srl, Seidecos, SEIREN Co., Ltd., DSM, Croda, Jiangxi Silk Biotechnology Co., Ltd., Simatech Incorporation, Zhejiang Xingyue Biotechnology Co., Ltd., Hubei Sailuo Biomaterials Co., Ltd., Favorsun, Chinatiansi, Hangzhou Lin Ran Bio-tech Co., Ltd, Haifan, Cathaya, Suhaobio.

3. What are the main segments of the Medical Beauty Regenerated Silk Fibrin?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Beauty Regenerated Silk Fibrin," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Beauty Regenerated Silk Fibrin report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Beauty Regenerated Silk Fibrin?

To stay informed about further developments, trends, and reports in the Medical Beauty Regenerated Silk Fibrin, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence