Key Insights

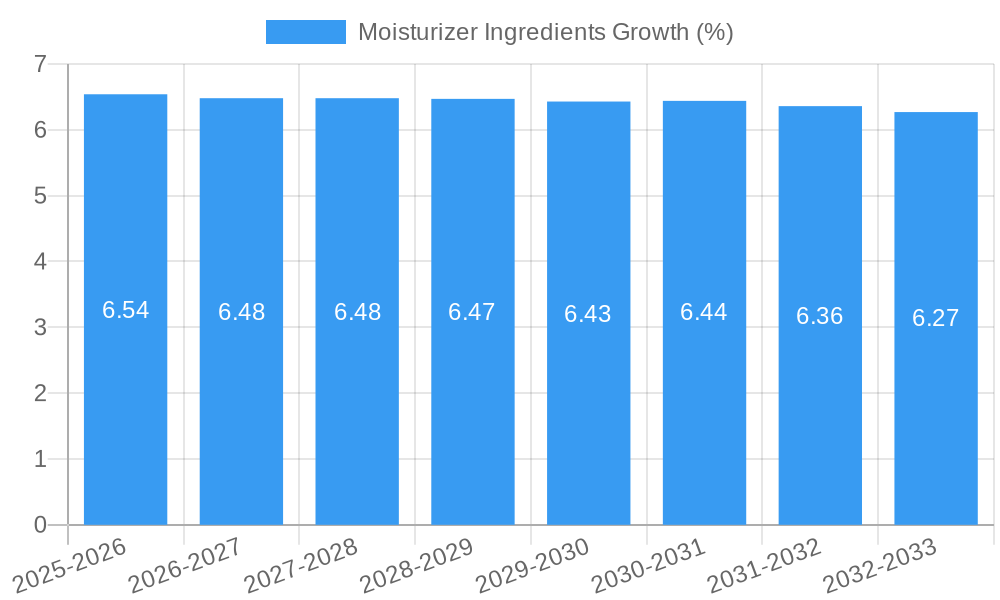

The global moisturizer ingredients market is poised for significant expansion, projected to reach an estimated market size of approximately $5.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 6.5% expected to drive it towards $9.5 billion by 2033. This surge is primarily fueled by a growing consumer demand for effective skincare solutions that address a range of concerns, from hydration and nourishment to anti-aging and repair. The increasing awareness of the benefits of specialized moisturizing ingredients, coupled with advancements in cosmetic science, are major drivers. Furthermore, the booming beauty and personal care industry, particularly in emerging economies, and the rising disposable incomes are contributing to a higher uptake of premium and ingredient-focused skincare products. The market is witnessing a strong trend towards natural and organic ingredients, driven by consumer preference for cleaner formulations and environmental consciousness. Innovations in encapsulation technologies and the development of multi-functional ingredients are also playing a crucial role in enhancing product efficacy and consumer appeal.

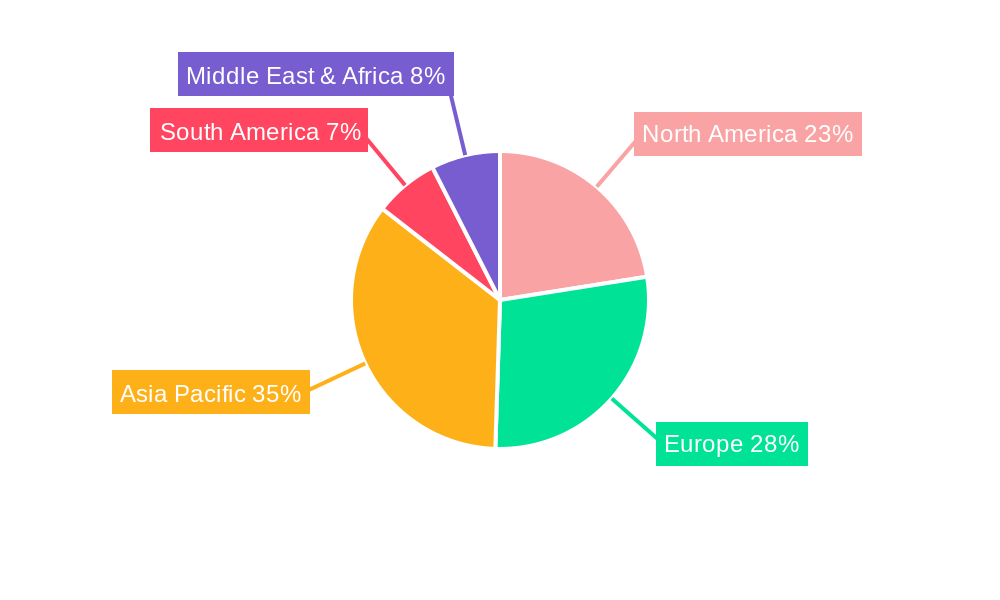

Despite the optimistic growth trajectory, the market faces certain restraints. High raw material costs and fluctuating supply chain dynamics can pose challenges to manufacturers, potentially impacting profit margins. Stringent regulatory frameworks regarding ingredient safety and claims in different regions also necessitate significant investment in research, development, and compliance. The competitive landscape is intense, with a mix of established multinational corporations and agile niche players vying for market share. This necessitates continuous innovation and strategic partnerships. The market is segmented across various applications, including creams, facial masks, and essences, with "Creams" representing the largest segment due to their widespread use. Moisture absorption and hydrating variants are expected to witness substantial growth, aligning with the increasing focus on maintaining optimal skin hydration levels. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the fastest-growing market, owing to its large population, increasing urbanization, and a rapidly expanding middle class with a growing appetite for advanced skincare.

This comprehensive report, "Moisturizer Ingredients Market: Strategic Analysis & Future Projections (2019–2033)," offers an in-depth exploration of the global moisturizer ingredients market. With a study period spanning from 2019 to 2033, a base year of 2025, and an estimated year also of 2025, this analysis meticulously dissects the market dynamics, trends, and future outlook. The forecast period from 2025 to 2033 provides critical insights into anticipated growth and evolving market landscapes. This report is an indispensable resource for industry stakeholders seeking to navigate the complexities of the moisturizer ingredients market, understand key trends in skincare ingredients, and leverage opportunities within the cosmetic ingredients sector. It highlights innovations in natural cosmetic ingredients, the growing demand for hydrating ingredients, and the strategic importance of repair moisturizing ingredients.

Moisturizer Ingredients Market Structure & Competitive Landscape

The global moisturizer ingredients market exhibits a moderately concentrated structure, with a handful of major players accounting for a significant market share, estimated at over 70% in 2025. Innovation is a key driver, fueled by extensive research and development investments exceeding $100 million annually by leading companies. Regulatory impacts, particularly concerning ingredient safety and sustainability, are increasingly shaping product development and market entry strategies. The presence of numerous product substitutes, ranging from DIY formulations to synthetic alternatives, intensifies competitive pressures, estimated to lead to price erosion of up to 10% on commodity ingredients by 2030. End-user segmentation reveals a strong preference for hydrating and repair moisturizing ingredients, driven by an aging global population and rising awareness of skin health. Mergers and acquisitions (M&A) activity has been a notable trend, with an estimated $500 million in M&A deals completed between 2021 and 2024, consolidating market leadership and expanding product portfolios.

Moisturizer Ingredients Market Trends & Opportunities

The global moisturizer ingredients market is poised for substantial growth, projected to reach a market size of over $15 billion by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 6.5% between 2025 and 2033. Technological shifts are continuously redefining ingredient efficacy and sustainability. Advancements in biotechnology are leading to the development of novel, highly potent hydrating ingredients and repair moisturizing ingredients, such as peptides and advanced ceramides, which are gaining significant traction. The market penetration of these advanced ingredients is expected to rise from approximately 20% in 2025 to over 40% by 2033. Consumer preferences are increasingly leaning towards natural and sustainable skincare ingredients, driving demand for plant-derived emollients, humectants, and active botanicals. This trend is creating significant opportunities for ingredient manufacturers focusing on eco-friendly sourcing and production methods. For instance, the demand for ethically sourced shea butter and hyaluronic acid has seen a year-over-year increase of over 15% in recent years. Competitive dynamics are intensifying, with ingredient suppliers differentiating themselves through product performance, cost-effectiveness, and adherence to stringent quality and safety standards. The rise of personalized skincare is also creating niche opportunities for specialized ingredients tailored to specific skin concerns. The market is also witnessing a surge in demand for ingredients that offer multifunctional benefits, such as anti-aging, antioxidant, and anti-inflammatory properties. This has led to greater investment in research and development for multi-tasking ingredients. The increasing disposable income in emerging economies is further fueling the demand for premium skincare products, consequently boosting the market for high-quality moisturizer ingredients. Furthermore, the growing influence of social media and beauty influencers is shaping consumer perceptions and driving demand for innovative and effective skincare solutions. The development of biodegradable and environmentally friendly ingredients is also becoming a crucial differentiator for companies looking to capture a larger market share. The regulatory landscape, while presenting challenges, also fosters innovation as companies strive to meet evolving standards for safety and efficacy.

Dominant Markets & Segments in Moisturizer Ingredients

North America currently holds a dominant position in the global moisturizer ingredients market, projected to account for over 30% of the market share in 2025, with an estimated market value of $4.5 billion. This dominance is driven by a combination of high consumer spending on premium skincare, robust research and development infrastructure, and a strong emphasis on product innovation. Within North America, the United States leads the market, followed by Canada. The Application segment of Cream represents the largest segment, expected to command over 45% of the market revenue in 2025, valued at approximately $6.75 billion. This is attributed to the widespread consumer preference for cream-based moisturizers for daily use, offering efficacy for a wide range of skin types and concerns. Key growth drivers in this segment include the increasing demand for anti-aging creams, sun protection creams, and specialized facial creams.

The Types segment of Hydrating ingredients is the fastest-growing, projected to expand at a CAGR of over 7.0% during the forecast period. The estimated market value for hydrating ingredients in 2025 is around $4 billion. This surge is fueled by a growing consumer awareness of the importance of skin hydration for maintaining skin barrier function, elasticity, and a youthful appearance. Consumers are actively seeking ingredients like hyaluronic acid, glycerin, and ceramides that provide superior and long-lasting moisture. The "Other" application segment, which includes products like serums, toners, and specialized treatments, is also showing promising growth, driven by the trend towards multi-step skincare routines and the demand for targeted solutions. The Facial Mask application segment, while smaller than creams, is anticipated to witness significant growth due to the increasing popularity of at-home spa treatments and the demand for intensive, short-term hydration and repair. The Grease Moisturizing segment, though a mature market, continues to hold a substantial share, catering to individuals with dry and very dry skin, often requiring richer formulations. However, the trend towards lighter, non-greasy textures is influencing formulation development even within this category. The Repair Moisturizing segment is also experiencing robust growth, driven by consumer interest in ingredients that address specific skin concerns like redness, irritation, and damage, often linked to environmental stressors and aging.

Moisturizer Ingredients Product Analysis

Product innovation in the moisturizer ingredients market is characterized by a focus on enhanced efficacy, sustainability, and multi-functional benefits. Leading companies are investing heavily in the research and development of novel actives, such as bio-engineered peptides for anti-aging, fermented botanical extracts for enhanced bioavailability, and advanced ceramide complexes for superior skin barrier repair. These innovations offer competitive advantages by addressing unmet consumer needs for visible results and improved skin health. For instance, the introduction of encapsulated actives allows for controlled release and targeted delivery, maximizing efficacy and minimizing potential irritation. The emphasis on natural and sustainably sourced ingredients, like upcycled plant extracts and lab-grown actives, is also a significant differentiator, appealing to environmentally conscious consumers.

Key Drivers, Barriers & Challenges in Moisturizer Ingredients

Key Drivers:

- Growing consumer awareness of skin health and the demand for effective skincare solutions. This is leading to a substantial increase in the use of high-performance moisturizer ingredients, valued at over $1 billion in R&D investment annually.

- Technological advancements in ingredient synthesis and biotechnology. Innovations in areas like peptide technology and fermentation are creating novel, highly efficacious ingredients.

- Rising disposable incomes and the growing middle class in emerging economies. This fuels demand for premium and specialized skincare products, consequently boosting the moisturizer ingredients market.

- The trend towards natural and clean beauty. Consumers are actively seeking plant-derived, sustainable, and ethically sourced ingredients.

- The increasing aging population globally, driving demand for anti-aging and restorative skincare.

Challenges Impacting Moisturizer Ingredients Growth:

- Stringent regulatory requirements and evolving ingredient safety standards. Compliance with regulations from bodies like the FDA and REACH can add significant costs, estimated at an additional 15% to product development.

- Supply chain disruptions and volatility in raw material prices. Geopolitical factors and climate change can impact the availability and cost of key ingredients.

- Intense competition and price pressures. The presence of numerous players and product substitutes can lead to margin erosion, particularly for commodity ingredients.

- Consumer skepticism towards synthetic ingredients and demand for full ingredient transparency. This requires manufacturers to invest in educating consumers and ensuring clear labeling.

- The high cost of research and development for novel ingredients. Bringing new, effective ingredients to market can cost tens of millions of dollars.

Growth Drivers in the Moisturizer Ingredients Market

The moisturizer ingredients market is propelled by several key drivers. Technologically, advancements in biotechnology and green chemistry are enabling the development of novel, high-performance ingredients with enhanced efficacy and sustainability. For instance, the development of bio-fermented hyaluronic acid offers superior moisturizing capabilities. Economically, the growing disposable income in emerging markets, coupled with an increasing awareness of skincare benefits, is fueling demand for premium and specialized moisturizer formulations. Regulatory drivers are also playing a role, as stricter safety and efficacy standards encourage innovation and investment in high-quality ingredients. The rising global focus on anti-aging and preventative skincare further amplifies the demand for advanced repair moisturizing ingredients.

Challenges Impacting Moisturizer Ingredients Growth

Despite robust growth potential, the moisturizer ingredients market faces several challenges. Regulatory complexities, including varying international standards for ingredient approval and labeling, can create significant hurdles for market entry and expansion, potentially delaying product launches by 12-24 months. Supply chain issues, such as the availability of specific natural raw materials and price volatility due to environmental factors, can impact production costs and lead times. Competitive pressures from a saturated market and the constant need for differentiation through innovation and pricing strategies are also significant restraints. Furthermore, consumer demand for absolute transparency regarding ingredient sourcing and ethical practices adds another layer of complexity for manufacturers.

Key Players Shaping the Moisturizer Ingredients Market

- BASF

- AQIA

- McKinley Resources

- DSM

- SK Bioland

- Max + Jane

- Givaudan Active Beauty

- ROELMI HPC

- Active Concepts

- The Herbarie

Significant Moisturizer Ingredients Industry Milestones

- 2020 January: BASF launches a new line of bio-based emollients, emphasizing sustainability.

- 2021 March: DSM acquires a leading supplier of probiotics for skincare applications, enhancing its active ingredient portfolio.

- 2022 June: Givaudan Active Beauty introduces a novel peptide complex targeting skin elasticity.

- 2023 November: AQIA expands its manufacturing capacity for high-purity hyaluronic acid, responding to growing market demand.

- 2024 February: ROELMI HPC unveils an innovative plant-derived active ingredient with significant anti-inflammatory properties.

Future Outlook for Moisturizer Ingredients Market

The future outlook for the moisturizer ingredients market is exceptionally bright, with continued robust growth projected. Strategic opportunities lie in the increasing consumer demand for sustainable, natural, and scientifically proven ingredients. The market will witness further innovation in personalized skincare solutions, leading to a greater demand for specialized and multifunctional ingredients. The expansion of e-commerce and direct-to-consumer models will also drive the need for ingredient suppliers to be agile and responsive to evolving consumer preferences. Investment in cutting-edge research, particularly in areas like microbiome skincare and advanced delivery systems, will be crucial for capturing future market share and driving long-term value. The market is expected to witness a significant rise in the adoption of bio-engineered and lab-grown ingredients, offering both efficacy and reduced environmental impact.

Moisturizer Ingredients Segmentation

-

1. Application

- 1.1. Cream

- 1.2. Facial Mask

- 1.3. Essence

- 1.4. Other

-

2. Types

- 2.1. Grease Moisturizing

- 2.2. Moisture Absorption

- 2.3. Hydrating

- 2.4. Repair Moisturizing

Moisturizer Ingredients Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Moisturizer Ingredients REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Moisturizer Ingredients Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cream

- 5.1.2. Facial Mask

- 5.1.3. Essence

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Grease Moisturizing

- 5.2.2. Moisture Absorption

- 5.2.3. Hydrating

- 5.2.4. Repair Moisturizing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Moisturizer Ingredients Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cream

- 6.1.2. Facial Mask

- 6.1.3. Essence

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Grease Moisturizing

- 6.2.2. Moisture Absorption

- 6.2.3. Hydrating

- 6.2.4. Repair Moisturizing

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Moisturizer Ingredients Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cream

- 7.1.2. Facial Mask

- 7.1.3. Essence

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Grease Moisturizing

- 7.2.2. Moisture Absorption

- 7.2.3. Hydrating

- 7.2.4. Repair Moisturizing

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Moisturizer Ingredients Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cream

- 8.1.2. Facial Mask

- 8.1.3. Essence

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Grease Moisturizing

- 8.2.2. Moisture Absorption

- 8.2.3. Hydrating

- 8.2.4. Repair Moisturizing

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Moisturizer Ingredients Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cream

- 9.1.2. Facial Mask

- 9.1.3. Essence

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Grease Moisturizing

- 9.2.2. Moisture Absorption

- 9.2.3. Hydrating

- 9.2.4. Repair Moisturizing

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Moisturizer Ingredients Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cream

- 10.1.2. Facial Mask

- 10.1.3. Essence

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Grease Moisturizing

- 10.2.2. Moisture Absorption

- 10.2.3. Hydrating

- 10.2.4. Repair Moisturizing

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AQIA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McKinley Resources

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DSM

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SK Bioland

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Max + Jane

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Givaudan Active Beauty

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ROELMI HPC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Active Concepts

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Herbarie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Moisturizer Ingredients Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Moisturizer Ingredients Revenue (million), by Application 2024 & 2032

- Figure 3: North America Moisturizer Ingredients Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Moisturizer Ingredients Revenue (million), by Types 2024 & 2032

- Figure 5: North America Moisturizer Ingredients Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Moisturizer Ingredients Revenue (million), by Country 2024 & 2032

- Figure 7: North America Moisturizer Ingredients Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Moisturizer Ingredients Revenue (million), by Application 2024 & 2032

- Figure 9: South America Moisturizer Ingredients Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Moisturizer Ingredients Revenue (million), by Types 2024 & 2032

- Figure 11: South America Moisturizer Ingredients Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Moisturizer Ingredients Revenue (million), by Country 2024 & 2032

- Figure 13: South America Moisturizer Ingredients Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Moisturizer Ingredients Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Moisturizer Ingredients Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Moisturizer Ingredients Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Moisturizer Ingredients Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Moisturizer Ingredients Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Moisturizer Ingredients Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Moisturizer Ingredients Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Moisturizer Ingredients Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Moisturizer Ingredients Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Moisturizer Ingredients Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Moisturizer Ingredients Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Moisturizer Ingredients Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Moisturizer Ingredients Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Moisturizer Ingredients Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Moisturizer Ingredients Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Moisturizer Ingredients Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Moisturizer Ingredients Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Moisturizer Ingredients Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Moisturizer Ingredients Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Moisturizer Ingredients Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Moisturizer Ingredients Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Moisturizer Ingredients Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Moisturizer Ingredients Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Moisturizer Ingredients Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Moisturizer Ingredients Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Moisturizer Ingredients Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Moisturizer Ingredients Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Moisturizer Ingredients Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Moisturizer Ingredients Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Moisturizer Ingredients Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Moisturizer Ingredients Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Moisturizer Ingredients Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Moisturizer Ingredients Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Moisturizer Ingredients Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Moisturizer Ingredients Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Moisturizer Ingredients Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Moisturizer Ingredients Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Moisturizer Ingredients Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Moisturizer Ingredients?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Moisturizer Ingredients?

Key companies in the market include BASF, AQIA, McKinley Resources, DSM, SK Bioland, Max + Jane, Givaudan Active Beauty, ROELMI HPC, Active Concepts, The Herbarie.

3. What are the main segments of the Moisturizer Ingredients?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Moisturizer Ingredients," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Moisturizer Ingredients report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Moisturizer Ingredients?

To stay informed about further developments, trends, and reports in the Moisturizer Ingredients, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence