Key Insights

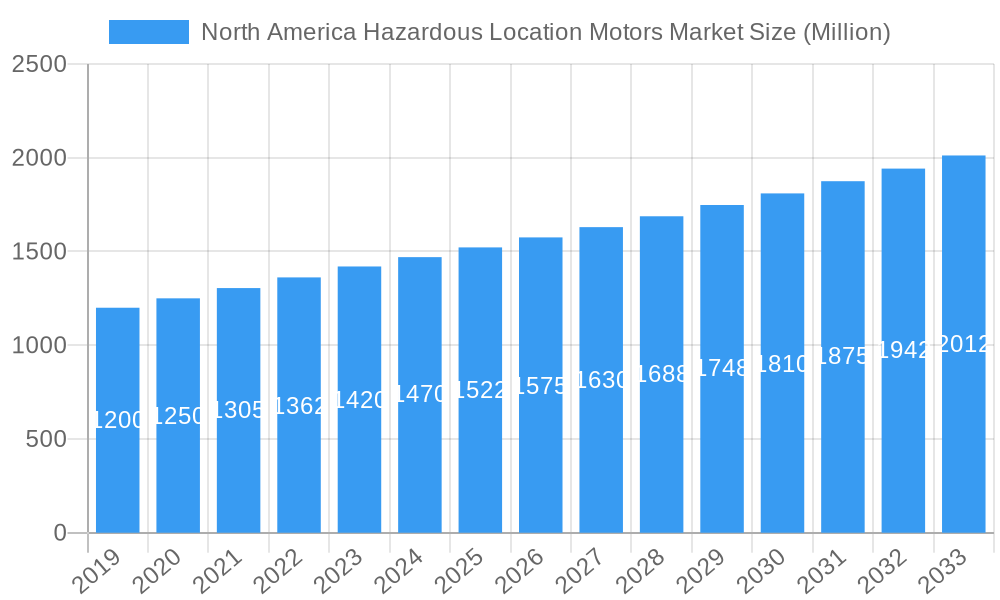

The North America Hazardous Location Motors Market is poised for robust expansion, projected to reach a significant market size of approximately $1,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 5.10% through 2033. This upward trajectory is primarily propelled by the escalating demand for enhanced safety and reliability in industries operating within volatile environments. Key drivers include stringent regulatory mandates for explosion-proof equipment, particularly in sectors like petroleum refining, chemical processing, and grain handling, where the risk of ignition from electrical sparks is a critical concern. The increasing adoption of advanced manufacturing processes and automation further fuels the need for specialized motors capable of withstanding hazardous conditions, thereby minimizing operational risks and ensuring worker safety. The market's growth is also supported by ongoing technological advancements in motor design, leading to more energy-efficient, durable, and intelligent hazardous location motors.

North America Hazardous Location Motors Market Market Size (In Billion)

The market's segmentation by type reveals a strong demand for Explosion-Proof General Purpose Motors, Explosion-Proof Pump Motors, and Explosion-Proof Inverter Duty Motors, reflecting their widespread application across various hazardous industries. The classification by Class, Division, and Zone underscores the market's segmentation into highly specialized sub-segments, catering to distinct hazardous environments and risk levels. In North America, the United States leads in market share due to its extensive industrial base, particularly in oil and gas, chemical manufacturing, and mining. Canada and Mexico also contribute significantly, driven by their own industrial activities and cross-border trade. Key restraints, such as the high initial cost of explosion-proof motors and the need for specialized installation and maintenance, are being addressed by manufacturers through innovations that improve cost-effectiveness and ease of use, along with offering comprehensive service packages. Emerging trends like the integration of IoT for predictive maintenance and the development of intrinsically safe motor technologies are expected to further shape the market's future.

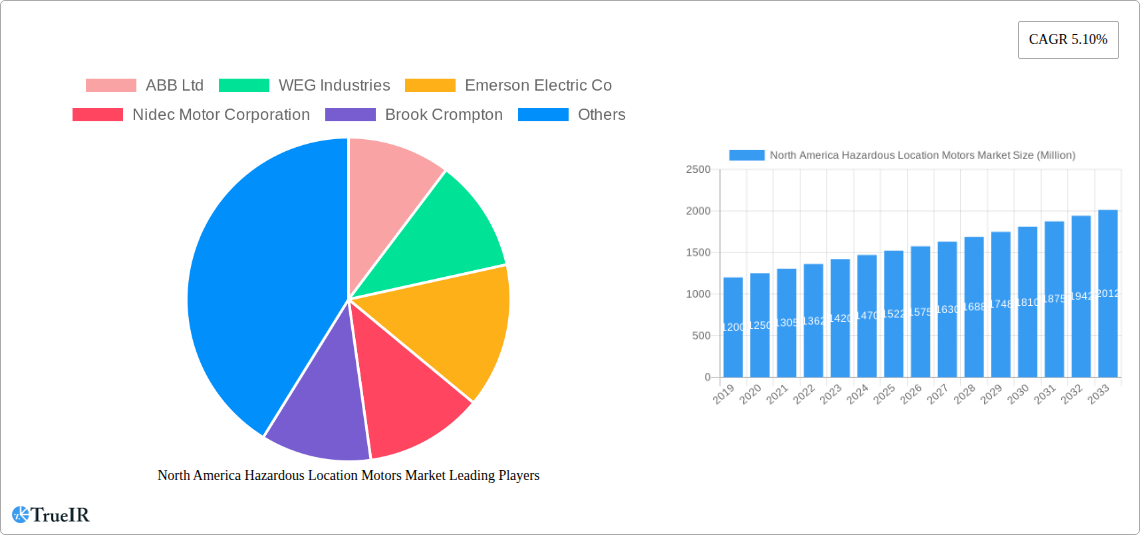

North America Hazardous Location Motors Market Company Market Share

Here is the dynamic, SEO-optimized report description for the North America Hazardous Location Motors Market, designed for immediate use without modification.

North America Hazardous Location Motors Market: Comprehensive Market Insights & Future Projections (2019–2033)

This in-depth report provides a definitive analysis of the North America Hazardous Location Motors Market, covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and an estimated year also in 2025. The forecast period extends from 2025 to 2033, building upon historical data from 2019 to 2024. Delve into market size, growth trends, competitive strategies, and emerging opportunities that define the landscape of hazardous location motors across North America. Our research leverages high-volume SEO keywords to ensure maximum visibility and provides actionable intelligence for industry stakeholders, including manufacturers, suppliers, distributors, and end-users.

North America Hazardous Location Motors Market Market Structure & Competitive Landscape

The North America Hazardous Location Motors Market exhibits a moderately concentrated structure, characterized by the presence of several established global players and a growing number of niche manufacturers. Innovation drivers are primarily fueled by stringent safety regulations, the demand for energy-efficient solutions, and the need for motors capable of withstanding extreme environmental conditions prevalent in industries like oil & gas and chemical processing. Regulatory impacts, such as evolving ATEX and NEC standards, necessitate continuous product development and compliance efforts. Product substitutes, while limited in highly specialized applications, include intrinsically safe equipment and pneumatic systems. End-user segmentation reveals a strong reliance on the industrial sector, with significant demand from petroleum refining, chemical manufacturing, and mining operations. Mergers & Acquisitions (M&A) trends are observed as key players seek to expand their product portfolios, geographic reach, and technological capabilities, leading to market consolidation. For instance, a notable M&A volume of approximately 15 transactions was recorded during the historical period, aimed at enhancing market share and integrating advanced technologies. Concentration ratios indicate that the top five players collectively hold an estimated 55% of the market share.

North America Hazardous Location Motors Market Market Trends & Opportunities

The North America Hazardous Location Motors Market is poised for robust growth, driven by an increasing emphasis on industrial safety, evolving regulatory frameworks, and the persistent need for reliable power solutions in volatile environments. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period (2025–2033). Technological shifts are central to this growth, with a rising adoption of variable frequency drives (VFDs) integrated into explosion-proof motors to enhance energy efficiency and operational control. This trend is further supported by the growing demand for smart motor technologies, incorporating IoT capabilities for predictive maintenance and remote monitoring, thereby reducing downtime in critical industrial processes. Consumer preferences are increasingly leaning towards motors that offer superior protection against ignition sources, enhanced durability, and reduced carbon footprint. The competitive dynamics are intensifying, with companies investing heavily in R&D to develop advanced materials, robust sealing mechanisms, and improved cooling systems to meet the demanding specifications of hazardous locations. Market penetration rates for specialized hazardous location motors are expected to rise as industries across North America upgrade their infrastructure and prioritize safety compliance. For example, the adoption of explosion-proof inverter duty motors is accelerating in sectors requiring precise speed control and high energy efficiency in potentially explosive atmospheres. Furthermore, the growing investments in renewable energy infrastructure, particularly in offshore wind farms and solar installations in remote, potentially hazardous areas, are opening new avenues for growth in specialized hazardous location motor applications.

Dominant Markets & Segments in North America Hazardous Location Motors Market

The North America Hazardous Location Motors Market is dominated by the Explosion-Proof General Purpose Motors segment, driven by its widespread application across a multitude of industrial settings requiring reliable protection against explosions. Within this dominant segment, Class I and Class II hazard classifications, coupled with Division 1 and Zone 1 environments, represent the most substantial market share due to the prevalence of flammable gases, vapors, and combustible dusts in key North American industries. The Petroleum Refining Plants application stands out as a primary growth driver, with significant investments in infrastructure upgrades and stringent safety protocols mandating the use of certified hazardous location motors. This is closely followed by Utility Gas Plants and Aluminum Manufacturing and Storage Areas, both of which necessitate robust motor solutions to mitigate ignition risks.

- Key Growth Drivers in Dominant Segments:

- Stringent Regulatory Compliance: Mandates from bodies like OSHA and API necessitate the use of explosion-proof equipment, driving demand for certified motors.

- Infrastructure Modernization: Aging industrial facilities across North America are undergoing upgrades, leading to the replacement of non-compliant equipment with advanced hazardous location motors.

- Increasing Oil & Gas Exploration and Production: Continued activity in the oil and gas sector, particularly in regions with challenging environments, fuels the demand for specialized drill rig duty and explosion-proof pump motors.

- Growth in Renewable Energy Infrastructure: The expansion of offshore wind farms and associated substations creates demand for explosion-proof motors in marine and potentially hazardous offshore environments.

- Advancements in Motor Technology: Development of more energy-efficient and robust explosion-proof inverter duty motors enhances their appeal in demanding applications.

Geographically, the United States holds the largest market share, owing to its extensive industrial base, significant oil and gas reserves, and robust regulatory enforcement. Canada also contributes a substantial portion, driven by its own energy sector and manufacturing industries. Mexico, while currently smaller, shows promising growth potential as its industrial sector expands and safety standards align with those of its North American counterparts. The dominance of explosion-proof general purpose motors is further amplified by their versatility and essential role in ensuring operational continuity and safety in diverse hazardous settings, from chemical processing plants to grain elevators and fireworks manufacturing.

North America Hazardous Location Motors Market Product Analysis

The North America Hazardous Location Motors Market is characterized by continuous product innovation focused on enhancing safety, efficiency, and reliability in hazardous environments. Key product innovations include the development of advanced explosion-proof inverter duty motors offering superior speed control and energy savings, and severe duty motors engineered for extreme operational conditions. Competitive advantages are derived from robust design, advanced sealing technologies to prevent ingress of flammable substances, and compliance with stringent international safety standards such as ATEX and NEC. Technological advancements are central to market competitiveness, with manufacturers investing in research for materials resistant to corrosion and extreme temperatures, and integrated smart features for monitoring and diagnostics.

Key Drivers, Barriers & Challenges in North America Hazardous Location Motors Market

The North America Hazardous Location Motors Market is propelled by several key drivers, including increasingly stringent safety regulations that mandate the use of certified explosion-proof equipment, driving continuous demand. Economic factors such as ongoing infrastructure development in the oil & gas, chemical, and manufacturing sectors, coupled with investments in renewable energy projects, further stimulate market growth. Technological advancements in motor design, leading to improved energy efficiency and enhanced protection against ignition sources, also play a crucial role.

Key challenges and restraints impacting the market include significant upfront costs associated with purchasing and installing certified hazardous location motors, which can be a deterrent for some businesses. Supply chain disruptions, exacerbated by geopolitical events and raw material availability, can lead to increased lead times and production delays. Furthermore, the complexity of regulatory compliance across different jurisdictions and the need for specialized expertise for installation and maintenance present ongoing hurdles. Competitive pressures from both established giants and emerging players can also lead to price erosion in certain segments.

Growth Drivers in the North America Hazardous Location Motors Market Market

Growth in the North America Hazardous Location Motors Market is significantly fueled by rigorous safety regulations and standards, such as those set by the National Electrical Code (NEC) and other regional bodies, mandating explosion-proof equipment in hazardous zones. Economic expansion and continued investments in critical industries like oil and gas, chemical manufacturing, and utilities necessitate the deployment of reliable and safe motor solutions. Technological advancements, including the development of more energy-efficient explosion-proof inverter duty motors and the integration of IoT for predictive maintenance, are creating new opportunities. Furthermore, the expanding renewable energy sector, particularly in offshore wind and solar installations located in potentially hazardous environments, is a notable growth catalyst.

Challenges Impacting North America Hazardous Location Motors Market Growth

Challenges impacting North America Hazardous Location Motors Market growth primarily revolve around the substantial capital expenditure required for explosion-proof motor systems, which can be a barrier for smaller enterprises. Regulatory complexities and the need to comply with diverse and evolving standards across different states and provinces add to the operational burden. Supply chain vulnerabilities, including the availability of specialized components and raw materials, can lead to production delays and increased costs. Intense competition among manufacturers, leading to price pressures, also presents a significant challenge. Moreover, the technical expertise required for the installation, maintenance, and repair of these specialized motors can limit widespread adoption in certain regions.

Key Players Shaping the North America Hazardous Location Motors Market Market

- ABB Ltd

- WEG Industries

- Emerson Electric Co

- Nidec Motor Corporation

- Brook Crompton

- Rockwell Automation Inc

- Kollmorgen Corporation

- Stainless Motors Inc

- Heatrex Inc

- Dietz Electric Co Inc

Significant North America Hazardous Location Motors Market Industry Milestones

- 2022/Q3: Emerson Electric Co. acquires a prominent hazardous location motor manufacturer to expand its industrial automation portfolio.

- 2023/Q1: ABB Ltd launches a new series of energy-efficient explosion-proof inverter duty motors with enhanced digital monitoring capabilities.

- 2023/Q2: WEG Industries announces significant expansion of its manufacturing capacity for hazardous location motors to meet rising demand.

- 2024/Q1: Rockwell Automation Inc. integrates advanced safety features and AI-driven diagnostics into its line of hazardous location motor control solutions.

- 2024/Q3: Brook Crompton introduces a new range of explosion-proof severe duty motors designed for the most challenging industrial applications.

Future Outlook for North America Hazardous Location Motors Market Market

The future outlook for the North America Hazardous Location Motors Market is exceptionally promising, driven by a confluence of safety imperatives, technological advancements, and sustained industrial investment. The increasing stringency of environmental and safety regulations globally, particularly in North America, will continue to be a primary growth catalyst, compelling industries to adopt certified hazardous location motors. Technological innovation, especially in areas like smart motor technology, predictive maintenance, and energy efficiency, will unlock new market segments and enhance the value proposition of existing products. The ongoing energy transition, with its significant infrastructure projects in both traditional and renewable energy sectors, will create sustained demand for specialized motor solutions. Strategic opportunities lie in the development of customized solutions for emerging applications, further integration of digital technologies, and expansion into underserved industrial niches within the North American region.

North America Hazardous Location Motors Market Segmentation

-

1. Type

- 1.1. Explosion-Proof General Purpose Motors

- 1.2. Drill Rig Duty Motors

- 1.3. Explosion-Proof Pump Motors

- 1.4. Explosion-Proof Inverter Duty Motors

- 1.5. Explosion-Proof Severe Duty Motors

-

2. Class

- 2.1. Class I

- 2.2. Class II

- 2.3. Class III

-

3. Division

- 3.1. Division 1

- 3.2. Division 2

-

4. Zone

- 4.1. Zone 0

- 4.2. Zone 1

- 4.3. Zone 21

- 4.4. Zone 22

-

5. Applications

- 5.1. Spray Painting and Finishing Areas

- 5.2. Petroleum Refining Plants

- 5.3. Dry Cleaning Facilities

- 5.4. Utility Gas Plants

- 5.5. Grain Elevators and Grain Handling Facilities

- 5.6. Flour Mills

- 5.7. Aluminum Manufacturing and Storage Areas

- 5.8. Fire Work Plants and Storage Areas

- 5.9. Confectionary Plants

- 5.10. Other Applications

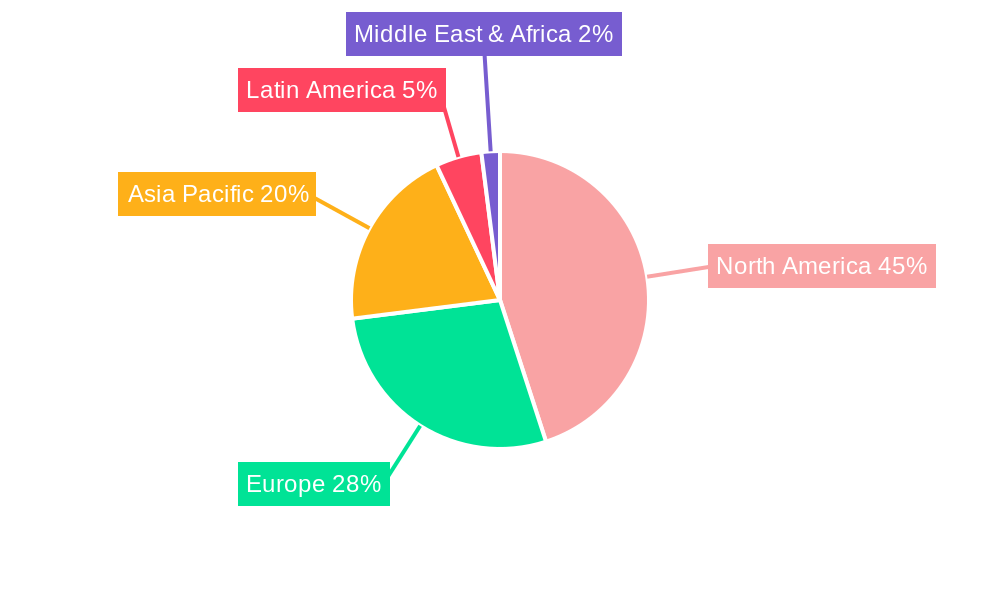

North America Hazardous Location Motors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Hazardous Location Motors Market Regional Market Share

Geographic Coverage of North America Hazardous Location Motors Market

North America Hazardous Location Motors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Safety Measures; Increasing Demand for Energy Efficient Motors

- 3.3. Market Restrains

- 3.3.1. ; Regulations & Compliance; High Installation Cost for Material and Labor in Comparison to Non-Explosion Proof Motors

- 3.4. Market Trends

- 3.4.1. The Increasing demand for Oil and Gas is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hazardous Location Motors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosion-Proof General Purpose Motors

- 5.1.2. Drill Rig Duty Motors

- 5.1.3. Explosion-Proof Pump Motors

- 5.1.4. Explosion-Proof Inverter Duty Motors

- 5.1.5. Explosion-Proof Severe Duty Motors

- 5.2. Market Analysis, Insights and Forecast - by Class

- 5.2.1. Class I

- 5.2.2. Class II

- 5.2.3. Class III

- 5.3. Market Analysis, Insights and Forecast - by Division

- 5.3.1. Division 1

- 5.3.2. Division 2

- 5.4. Market Analysis, Insights and Forecast - by Zone

- 5.4.1. Zone 0

- 5.4.2. Zone 1

- 5.4.3. Zone 21

- 5.4.4. Zone 22

- 5.5. Market Analysis, Insights and Forecast - by Applications

- 5.5.1. Spray Painting and Finishing Areas

- 5.5.2. Petroleum Refining Plants

- 5.5.3. Dry Cleaning Facilities

- 5.5.4. Utility Gas Plants

- 5.5.5. Grain Elevators and Grain Handling Facilities

- 5.5.6. Flour Mills

- 5.5.7. Aluminum Manufacturing and Storage Areas

- 5.5.8. Fire Work Plants and Storage Areas

- 5.5.9. Confectionary Plants

- 5.5.10. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Hazardous Location Motors Market Analysis, Insights and Forecast, 2020-2032

- 7. Canada North America Hazardous Location Motors Market Analysis, Insights and Forecast, 2020-2032

- 8. Mexico North America Hazardous Location Motors Market Analysis, Insights and Forecast, 2020-2032

- 9. Rest of North America North America Hazardous Location Motors Market Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 WEG Industries

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Emerson Electric Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nidec Motor Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Brook Crompton

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Rockwell Automation Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kollmorgen Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Stainless Motors Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Heatrex Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dietz Electric Co Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: North America Hazardous Location Motors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Hazardous Location Motors Market Share (%) by Company 2025

List of Tables

- Table 1: North America Hazardous Location Motors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: North America Hazardous Location Motors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: North America Hazardous Location Motors Market Revenue Million Forecast, by Class 2020 & 2033

- Table 4: North America Hazardous Location Motors Market Revenue Million Forecast, by Division 2020 & 2033

- Table 5: North America Hazardous Location Motors Market Revenue Million Forecast, by Zone 2020 & 2033

- Table 6: North America Hazardous Location Motors Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 7: North America Hazardous Location Motors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Hazardous Location Motors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: North America Hazardous Location Motors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: North America Hazardous Location Motors Market Revenue Million Forecast, by Class 2020 & 2033

- Table 15: North America Hazardous Location Motors Market Revenue Million Forecast, by Division 2020 & 2033

- Table 16: North America Hazardous Location Motors Market Revenue Million Forecast, by Zone 2020 & 2033

- Table 17: North America Hazardous Location Motors Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 18: North America Hazardous Location Motors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Hazardous Location Motors Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hazardous Location Motors Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the North America Hazardous Location Motors Market?

Key companies in the market include ABB Ltd, WEG Industries, Emerson Electric Co, Nidec Motor Corporation, Brook Crompton, Rockwell Automation Inc, Kollmorgen Corporation, Stainless Motors Inc, Heatrex Inc, Dietz Electric Co Inc.

3. What are the main segments of the North America Hazardous Location Motors Market?

The market segments include Type, Class, Division, Zone, Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Safety Measures; Increasing Demand for Energy Efficient Motors.

6. What are the notable trends driving market growth?

The Increasing demand for Oil and Gas is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Regulations & Compliance; High Installation Cost for Material and Labor in Comparison to Non-Explosion Proof Motors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hazardous Location Motors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hazardous Location Motors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hazardous Location Motors Market?

To stay informed about further developments, trends, and reports in the North America Hazardous Location Motors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence