Key Insights

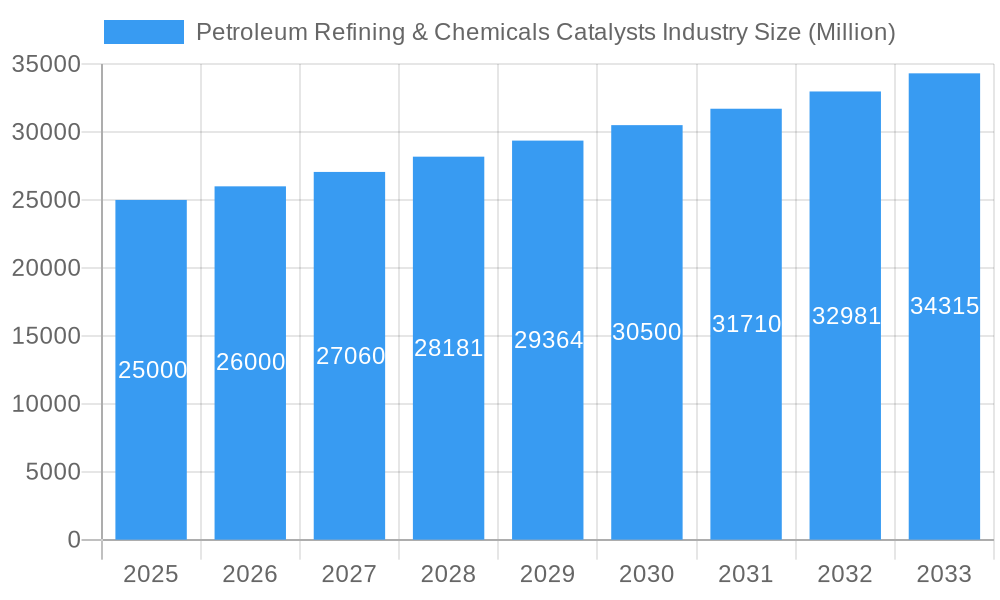

The Petroleum Refining & Chemicals Catalysts market, valued at approximately $10096.57 million in 2025, is projected for significant expansion. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 4.3% from 2025 to 2033. Key growth drivers include escalating demand for refined petroleum products, particularly within the burgeoning Asia-Pacific economies, and the chemical synthesis sector's focus on enhancing yields and process efficiencies across applications like isomerization and polymerization. Advancements in catalyst technologies, including more selective and durable materials such as metals, organometallic catalysts, and molecular sieves, are further bolstering market growth. The broad spectrum of applications, spanning petroleum refining, chemical synthesis, and synthesis gas processes, ensures market resilience. Intense competition among established entities such as Chevron Phillips Chemical Company, Honeywell International Inc., and BASF SE, alongside emerging innovators, stimulates continuous improvement and technological breakthroughs.

Petroleum Refining & Chemicals Catalysts Industry Market Size (In Billion)

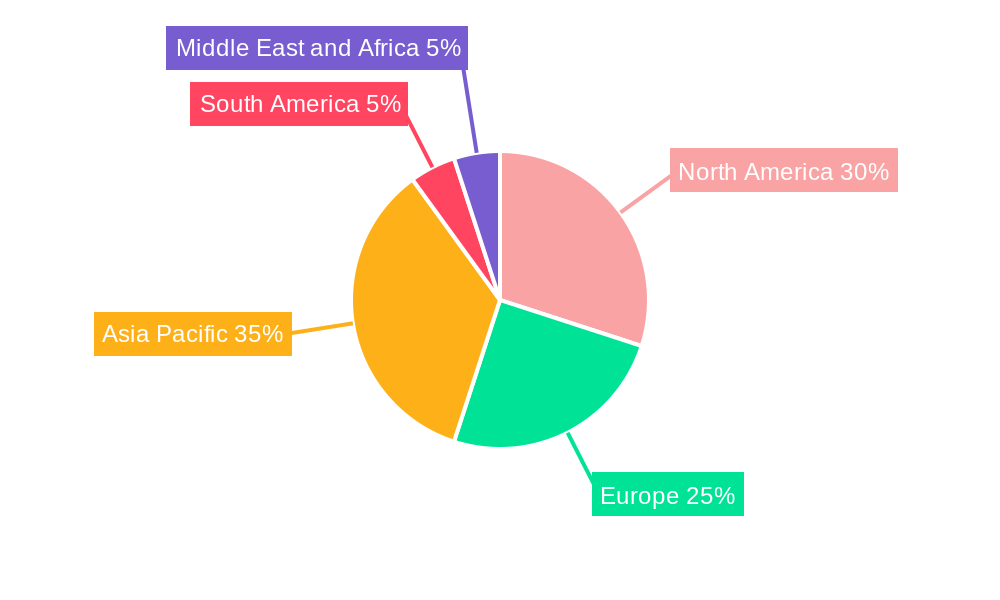

However, the market contends with several challenges. Volatility in crude oil prices directly influences refining profitability and, consequently, catalyst demand. Stringent global environmental regulations necessitate cleaner production methods, driving the development and adoption of eco-friendly catalysts, which introduces increased costs and complexity. Substantial research and development investments required for new catalyst technologies can pose a barrier to entry for some participants. Geographic demand distribution is varied, with Asia-Pacific anticipated to lead growth due to rapid industrialization and infrastructure development. While North America and Europe retain significant market shares, competitive pressures and regulatory landscapes will continue to shape their market dynamics. Strategic alliances, mergers, acquisitions, and sustained R&D initiatives are vital for market players aiming to maintain a competitive advantage in this evolving landscape.

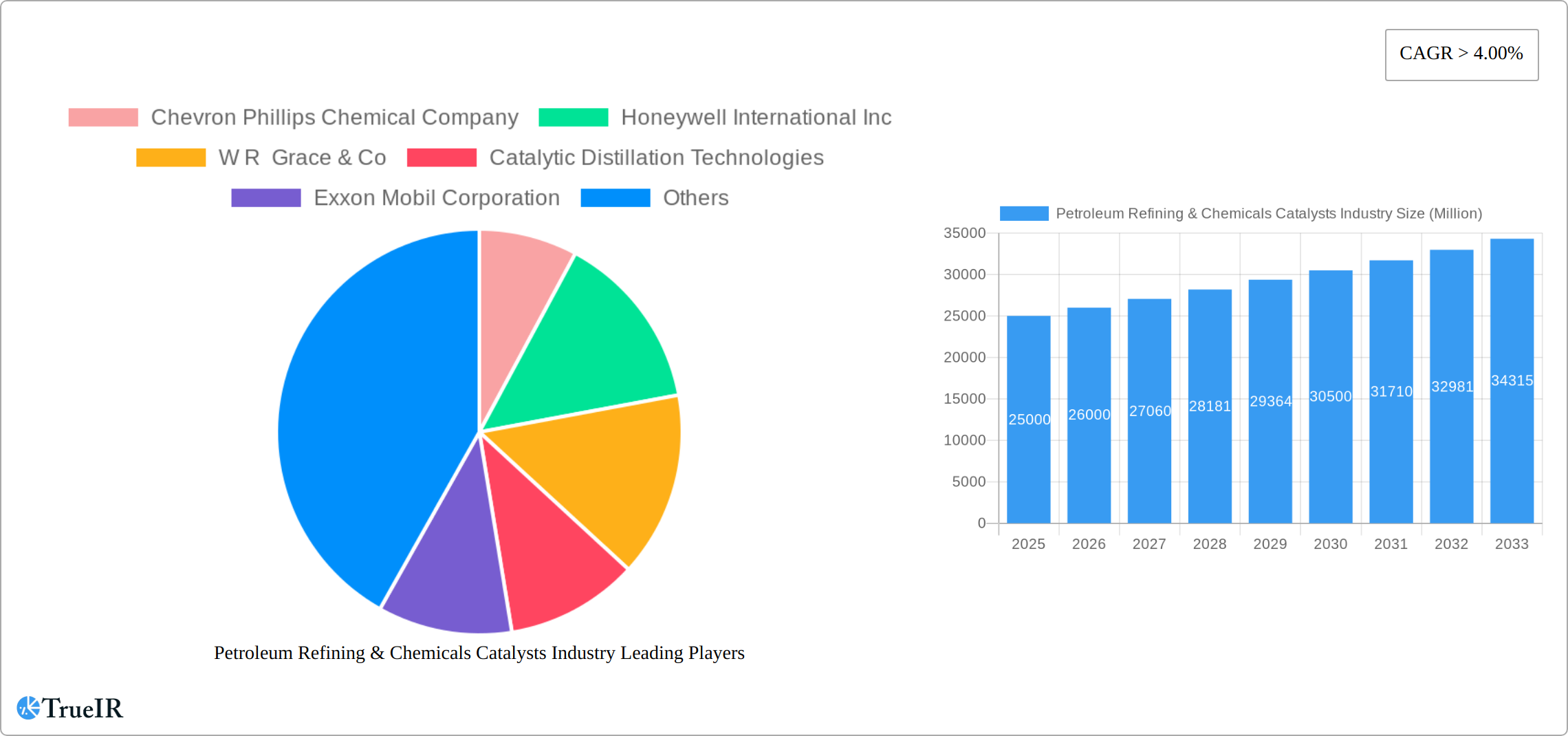

Petroleum Refining & Chemicals Catalysts Industry Company Market Share

Petroleum Refining & Chemicals Catalysts Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Petroleum Refining & Chemicals Catalysts industry, offering valuable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth opportunities. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report leverages extensive research and data analysis to present a clear and actionable overview of this critical sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Petroleum Refining & Chemicals Catalysts Industry Market Structure & Competitive Landscape

The Petroleum Refining & Chemicals Catalysts market is characterized by a moderately concentrated structure, with several influential global players holding a substantial market share. In 2025, the market concentration was estimated at approximately 65%, largely driven by established multinational corporations boasting robust research and development capabilities. Prominent industry leaders such as Chevron Phillips Chemical Company, Honeywell International Inc, and W R Grace & Co command significant market influence, leveraging their advanced technological expertise, extensive intellectual property, and well-established global distribution networks. Innovation remains a pivotal growth engine, with companies consistently investing in cutting-edge catalyst technologies designed to optimize efficiency, enhance selectivity, and extend catalyst lifespan. The industry is also under the significant influence of stringent environmental regulations, particularly concerning emissions reduction and sustainable waste management practices. Furthermore, the market experiences competitive pressures from the emergence of novel catalyst technologies and the potential for product substitution in niche applications. End-user segmentation is predominantly driven by the petroleum refining, chemical synthesis, and polymerization sectors, each presenting distinct demand profiles and application-specific requirements. Merger and acquisition (M&A) activity has been observed at a moderate pace, with strategic acquisitions frequently aimed at broadening product portfolios, accessing new geographical markets, and consolidating market presence. Over the past five years, the total M&A volume in the sector approximated \$1.5 billion.

- Market Concentration: Approximately 65% in 2025

- Key Market Players: Chevron Phillips Chemical Company, Honeywell International Inc, W R Grace & Co, Exxon Mobil Corporation, BASF SE, Johnson Matthey Inc, Evonik Industries AG, Clariant International Ltd, and Dow.

- Innovation Drivers: Substantial R&D investments in novel catalyst formulations, advanced material science, nanotechnology, and a strong focus on enhancing process efficiency, selectivity, and overall sustainability.

- Regulatory Impacts: Stringent global environmental regulations are a primary driver for innovation, fostering the development of catalysts that minimize emissions, improve energy efficiency, and support circular economy principles.

- Product Substitutes: While direct substitution is limited, emerging catalyst technologies and alternative chemical processes present potential long-term threats in specific applications.

- End-User Segmentation: Dominated by Petroleum Refining, Chemical Synthesis (including petrochemicals and specialty chemicals), and Polymerization industries.

- M&A Trends: Moderate activity focused on strategic acquisitions for portfolio diversification, geographical expansion, technology integration, and market share consolidation.

Petroleum Refining & Chemicals Catalysts Industry Market Trends & Opportunities

The Petroleum Refining & Chemicals Catalysts market is experiencing robust and sustained growth, propelled by escalating demand from downstream industries and continuous technological advancements. The market size is projected to reach approximately \$25 billion by 2033, reflecting a significant expansion from the \$12 billion recorded in 2024. This impressive growth trajectory is underpinned by several key factors, including the persistent rise in global energy consumption, the expanding capacity of petrochemical production worldwide, and the increasing demand for high-performance, cleaner fuels and advanced chemical products. Technological innovation, particularly in the realms of nanotechnology, advanced materials science, and computational chemistry, is fundamentally transforming catalyst design and performance. This evolution is leading to catalysts with enhanced activity, superior selectivity, improved durability, and a reduced environmental footprint. Furthermore, evolving consumer preferences for sustainable and eco-friendly products are directly influencing the market, spurring the demand for catalysts that actively contribute to waste minimization, pollution reduction, and energy conservation. The competitive landscape is marked by intense rivalry among established global players and dynamic emerging companies, fostering an environment of continuous innovation and competitive pricing strategies.

The Compound Annual Growth Rate (CAGR) of the market during the forecast period is anticipated to be around 7.5%. Market penetration rates demonstrate variability across different geographical regions and specific applications, with mature markets exhibiting more moderate growth compared to rapidly expanding emerging economies, which present significant untapped potential.

Dominant Markets & Segments in Petroleum Refining & Chemicals Catalysts Industry

The Asia-Pacific region dominates the Petroleum Refining & Chemicals Catalysts market, driven by rapid industrialization, increasing energy demand, and significant investments in refinery expansion and petrochemical projects. Within the segments:

- Application: Petroleum Refining remains the largest segment, fueled by consistent global demand for refined petroleum products.

- Isomerization: Chemical Synthesis showcases significant growth potential, underpinned by the expanding chemical industry.

- Synthesis Gas Processes: Polymerization is experiencing steady growth due to the rising demand for polymers in various applications.

- Material: Metals and Organometallic Catalysts dominate the market owing to their versatile applications and high performance.

- Metallic Compounds: Aluminosilicates are widely used due to their cost-effectiveness and stability.

- Molecular Sieves: Chemical Compounds are gaining traction due to their superior selectivity and performance in specific applications.

- Other Chemical Compounds: Other Materials represent a niche but growing market segment catering to specialized requirements.

Key Growth Drivers:

- Asia-Pacific: Rapid industrialization, increasing energy consumption, and significant infrastructure development.

- North America: Technological advancements, strong R&D investment, and government support for clean energy technologies.

- Europe: Emphasis on sustainable practices, increasing adoption of advanced catalyst technologies, and regulatory framework promoting environmental responsibility.

Petroleum Refining & Chemicals Catalysts Industry Product Analysis

Significant technological advancements are profoundly shaping the Petroleum Refining & Chemicals Catalysts industry. The core focus of innovation lies in developing more efficient, highly selective, and exceptionally durable catalysts that actively minimize waste generation and reduce environmental impact. These advancements encompass the strategic utilization of nanotechnology to dramatically increase catalyst surface area and intrinsic activity, the pioneering development of novel catalyst support materials with tailored properties, and the sophisticated application of advanced characterization techniques for precise catalyst design and performance prediction. The market is witnessing a pronounced trend towards the development and adoption of multi-functional catalysts capable of orchestrating multiple chemical reactions in a single step, thereby enhancing overall process efficiency and significantly reducing production costs. The primary determinant of competitive advantage in this sector lies in the ability to engineer unique catalyst formulations, deliver superior performance characteristics, and achieve cost-effective, scalable production methods.

Key Drivers, Barriers & Challenges in Petroleum Refining & Chemicals Catalysts Industry

Key Drivers: Rising global energy consumption, expanding petrochemical production, stricter environmental regulations driving demand for cleaner technologies, and continuous innovation in catalyst design and manufacturing.

Key Challenges: Fluctuating raw material prices, stringent environmental regulations imposing significant compliance costs, intense competition among industry players, and potential supply chain disruptions due to geopolitical instability. For example, supply chain issues in 2022 resulted in a xx% increase in catalyst prices.

Growth Drivers in the Petroleum Refining & Chemicals Catalysts Industry Market

The market is driven by increasing demand for refined petroleum products and petrochemicals, stringent environmental regulations pushing for cleaner technologies, and ongoing innovation in catalyst design and synthesis. Government incentives for clean energy technologies and investments in refinery modernization further stimulate growth.

Challenges Impacting Petroleum Refining & Chemicals Catalysts Industry Growth

The industry faces several significant challenges that could impede its growth trajectory. Fluctuations in crude oil prices directly impact the feedstock costs for many refining and petrochemical processes, creating price volatility and affecting investment decisions. Increasingly stringent environmental regulations, while driving innovation, also impose higher compliance costs and can necessitate significant capital expenditure for process upgrades. Competition from alternative technologies, including bio-based feedstocks and new chemical synthesis routes, poses a potential long-term threat. Furthermore, global supply chain disruptions, coupled with geopolitical instability, can lead to critical raw material shortages, further exacerbating price volatility and impacting production timelines.

Key Players Shaping the Petroleum Refining & Chemicals Catalysts Industry Market

- Chevron Phillips Chemical Company

- Honeywell International Inc

- W R Grace & Co

- Catalytic Distillation Technologies

- Exxon Mobil Corporation

- INEOS Technologies

- Johnson Matthey Inc

- Evonik Industries AG

- Wako Chemicals USA Inc

- KBR Inc

- BASF SE

- Eka Chemicals AB

- Zeochem LLC

- Zeolyst International

- Chicago Bridge & Iron Company

- Dow

- Bayer Technology Services

- Nova Chemicals Corp

- Clariant International Ltd

- Eastman Chemical Co

Significant Petroleum Refining & Chemicals Catalysts Industry Industry Milestones

- 2020: Introduction of a new generation of zeolite catalysts with enhanced selectivity and stability by W R Grace & Co.

- 2021: Acquisition of a smaller catalyst manufacturer by Honeywell International Inc, expanding their product portfolio.

- 2022: Launch of a novel metal-organic framework (MOF) based catalyst by BASF SE for improved CO2 capture.

- 2023: Significant investment in R&D by Chevron Phillips Chemical Company for developing sustainable catalyst technologies.

Future Outlook for Petroleum Refining & Chemicals Catalysts Industry Market

The Petroleum Refining & Chemicals Catalysts market is poised for continued growth, driven by rising global energy demand, advancements in catalyst technology, and stricter environmental regulations. Strategic investments in R&D, collaborations between industry players and research institutions, and the focus on developing sustainable catalysts will shape the industry's future. The market presents significant opportunities for companies that can innovate, adapt to changing regulations, and meet the evolving needs of their customers.

Petroleum Refining & Chemicals Catalysts Industry Segmentation

-

1. Material

-

1.1. Metals and Organometallic Catalysts

- 1.1.1. Inexpensive Metals

- 1.1.2. Precious Metals

- 1.1.3. Metallic Compounds

-

1.2. Aluminosilicates

- 1.2.1. Zeolites

- 1.2.2. Molecular Sieves

-

1.3. Chemical Compounds

- 1.3.1. Peroxides

- 1.3.2. Acids

- 1.3.3. Amines

- 1.3.4. Other Chemical Compounds

- 1.4. Other Materials

-

1.1. Metals and Organometallic Catalysts

-

2. Application

-

2.1. Petroleum Refining

- 2.1.1. Fluid Catalytic Cracking (FCC)

- 2.1.2. Hydrocracking

- 2.1.3. Hydrotreating

- 2.1.4. Alkylation

- 2.1.5. Reforming

- 2.1.6. Isomerization

-

2.2. Chemical Synthesis

- 2.2.1. Organic Synthesis

- 2.2.2. Oxidation

- 2.2.3. Hydrogenation

- 2.2.4. Dehydrogenation

- 2.2.5. Synthesis Gas Processes

-

2.3. Polymerization

- 2.3.1. Polyolefins

- 2.3.2. Condensation Polymers

- 2.3.3. Thermosetting Polymers

- 2.3.4. Additional Polymers

-

2.1. Petroleum Refining

Petroleum Refining & Chemicals Catalysts Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Petroleum Refining & Chemicals Catalysts Industry Regional Market Share

Geographic Coverage of Petroleum Refining & Chemicals Catalysts Industry

Petroleum Refining & Chemicals Catalysts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Refinery Market Output in Africa; Middle East; and Asia-Pacific; Rising Demand for Maintaining High Octane Figures

- 3.3. Market Restrains

- 3.3.1. High Manufacturing Costs; Other Restraints

- 3.4. Market Trends

- 3.4.1. Petroleum Refining Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Petroleum Refining & Chemicals Catalysts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Metals and Organometallic Catalysts

- 5.1.1.1. Inexpensive Metals

- 5.1.1.2. Precious Metals

- 5.1.1.3. Metallic Compounds

- 5.1.2. Aluminosilicates

- 5.1.2.1. Zeolites

- 5.1.2.2. Molecular Sieves

- 5.1.3. Chemical Compounds

- 5.1.3.1. Peroxides

- 5.1.3.2. Acids

- 5.1.3.3. Amines

- 5.1.3.4. Other Chemical Compounds

- 5.1.4. Other Materials

- 5.1.1. Metals and Organometallic Catalysts

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Petroleum Refining

- 5.2.1.1. Fluid Catalytic Cracking (FCC)

- 5.2.1.2. Hydrocracking

- 5.2.1.3. Hydrotreating

- 5.2.1.4. Alkylation

- 5.2.1.5. Reforming

- 5.2.1.6. Isomerization

- 5.2.2. Chemical Synthesis

- 5.2.2.1. Organic Synthesis

- 5.2.2.2. Oxidation

- 5.2.2.3. Hydrogenation

- 5.2.2.4. Dehydrogenation

- 5.2.2.5. Synthesis Gas Processes

- 5.2.3. Polymerization

- 5.2.3.1. Polyolefins

- 5.2.3.2. Condensation Polymers

- 5.2.3.3. Thermosetting Polymers

- 5.2.3.4. Additional Polymers

- 5.2.1. Petroleum Refining

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Metals and Organometallic Catalysts

- 6.1.1.1. Inexpensive Metals

- 6.1.1.2. Precious Metals

- 6.1.1.3. Metallic Compounds

- 6.1.2. Aluminosilicates

- 6.1.2.1. Zeolites

- 6.1.2.2. Molecular Sieves

- 6.1.3. Chemical Compounds

- 6.1.3.1. Peroxides

- 6.1.3.2. Acids

- 6.1.3.3. Amines

- 6.1.3.4. Other Chemical Compounds

- 6.1.4. Other Materials

- 6.1.1. Metals and Organometallic Catalysts

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Petroleum Refining

- 6.2.1.1. Fluid Catalytic Cracking (FCC)

- 6.2.1.2. Hydrocracking

- 6.2.1.3. Hydrotreating

- 6.2.1.4. Alkylation

- 6.2.1.5. Reforming

- 6.2.1.6. Isomerization

- 6.2.2. Chemical Synthesis

- 6.2.2.1. Organic Synthesis

- 6.2.2.2. Oxidation

- 6.2.2.3. Hydrogenation

- 6.2.2.4. Dehydrogenation

- 6.2.2.5. Synthesis Gas Processes

- 6.2.3. Polymerization

- 6.2.3.1. Polyolefins

- 6.2.3.2. Condensation Polymers

- 6.2.3.3. Thermosetting Polymers

- 6.2.3.4. Additional Polymers

- 6.2.1. Petroleum Refining

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Petroleum Refining & Chemicals Catalysts Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Metals and Organometallic Catalysts

- 7.1.1.1. Inexpensive Metals

- 7.1.1.2. Precious Metals

- 7.1.1.3. Metallic Compounds

- 7.1.2. Aluminosilicates

- 7.1.2.1. Zeolites

- 7.1.2.2. Molecular Sieves

- 7.1.3. Chemical Compounds

- 7.1.3.1. Peroxides

- 7.1.3.2. Acids

- 7.1.3.3. Amines

- 7.1.3.4. Other Chemical Compounds

- 7.1.4. Other Materials

- 7.1.1. Metals and Organometallic Catalysts

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Petroleum Refining

- 7.2.1.1. Fluid Catalytic Cracking (FCC)

- 7.2.1.2. Hydrocracking

- 7.2.1.3. Hydrotreating

- 7.2.1.4. Alkylation

- 7.2.1.5. Reforming

- 7.2.1.6. Isomerization

- 7.2.2. Chemical Synthesis

- 7.2.2.1. Organic Synthesis

- 7.2.2.2. Oxidation

- 7.2.2.3. Hydrogenation

- 7.2.2.4. Dehydrogenation

- 7.2.2.5. Synthesis Gas Processes

- 7.2.3. Polymerization

- 7.2.3.1. Polyolefins

- 7.2.3.2. Condensation Polymers

- 7.2.3.3. Thermosetting Polymers

- 7.2.3.4. Additional Polymers

- 7.2.1. Petroleum Refining

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Petroleum Refining & Chemicals Catalysts Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Metals and Organometallic Catalysts

- 8.1.1.1. Inexpensive Metals

- 8.1.1.2. Precious Metals

- 8.1.1.3. Metallic Compounds

- 8.1.2. Aluminosilicates

- 8.1.2.1. Zeolites

- 8.1.2.2. Molecular Sieves

- 8.1.3. Chemical Compounds

- 8.1.3.1. Peroxides

- 8.1.3.2. Acids

- 8.1.3.3. Amines

- 8.1.3.4. Other Chemical Compounds

- 8.1.4. Other Materials

- 8.1.1. Metals and Organometallic Catalysts

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Petroleum Refining

- 8.2.1.1. Fluid Catalytic Cracking (FCC)

- 8.2.1.2. Hydrocracking

- 8.2.1.3. Hydrotreating

- 8.2.1.4. Alkylation

- 8.2.1.5. Reforming

- 8.2.1.6. Isomerization

- 8.2.2. Chemical Synthesis

- 8.2.2.1. Organic Synthesis

- 8.2.2.2. Oxidation

- 8.2.2.3. Hydrogenation

- 8.2.2.4. Dehydrogenation

- 8.2.2.5. Synthesis Gas Processes

- 8.2.3. Polymerization

- 8.2.3.1. Polyolefins

- 8.2.3.2. Condensation Polymers

- 8.2.3.3. Thermosetting Polymers

- 8.2.3.4. Additional Polymers

- 8.2.1. Petroleum Refining

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Petroleum Refining & Chemicals Catalysts Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Metals and Organometallic Catalysts

- 9.1.1.1. Inexpensive Metals

- 9.1.1.2. Precious Metals

- 9.1.1.3. Metallic Compounds

- 9.1.2. Aluminosilicates

- 9.1.2.1. Zeolites

- 9.1.2.2. Molecular Sieves

- 9.1.3. Chemical Compounds

- 9.1.3.1. Peroxides

- 9.1.3.2. Acids

- 9.1.3.3. Amines

- 9.1.3.4. Other Chemical Compounds

- 9.1.4. Other Materials

- 9.1.1. Metals and Organometallic Catalysts

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Petroleum Refining

- 9.2.1.1. Fluid Catalytic Cracking (FCC)

- 9.2.1.2. Hydrocracking

- 9.2.1.3. Hydrotreating

- 9.2.1.4. Alkylation

- 9.2.1.5. Reforming

- 9.2.1.6. Isomerization

- 9.2.2. Chemical Synthesis

- 9.2.2.1. Organic Synthesis

- 9.2.2.2. Oxidation

- 9.2.2.3. Hydrogenation

- 9.2.2.4. Dehydrogenation

- 9.2.2.5. Synthesis Gas Processes

- 9.2.3. Polymerization

- 9.2.3.1. Polyolefins

- 9.2.3.2. Condensation Polymers

- 9.2.3.3. Thermosetting Polymers

- 9.2.3.4. Additional Polymers

- 9.2.1. Petroleum Refining

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Metals and Organometallic Catalysts

- 10.1.1.1. Inexpensive Metals

- 10.1.1.2. Precious Metals

- 10.1.1.3. Metallic Compounds

- 10.1.2. Aluminosilicates

- 10.1.2.1. Zeolites

- 10.1.2.2. Molecular Sieves

- 10.1.3. Chemical Compounds

- 10.1.3.1. Peroxides

- 10.1.3.2. Acids

- 10.1.3.3. Amines

- 10.1.3.4. Other Chemical Compounds

- 10.1.4. Other Materials

- 10.1.1. Metals and Organometallic Catalysts

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Petroleum Refining

- 10.2.1.1. Fluid Catalytic Cracking (FCC)

- 10.2.1.2. Hydrocracking

- 10.2.1.3. Hydrotreating

- 10.2.1.4. Alkylation

- 10.2.1.5. Reforming

- 10.2.1.6. Isomerization

- 10.2.2. Chemical Synthesis

- 10.2.2.1. Organic Synthesis

- 10.2.2.2. Oxidation

- 10.2.2.3. Hydrogenation

- 10.2.2.4. Dehydrogenation

- 10.2.2.5. Synthesis Gas Processes

- 10.2.3. Polymerization

- 10.2.3.1. Polyolefins

- 10.2.3.2. Condensation Polymers

- 10.2.3.3. Thermosetting Polymers

- 10.2.3.4. Additional Polymers

- 10.2.1. Petroleum Refining

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chevron Phillips Chemical Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 W R Grace & Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Catalytic Distillation Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Exxon Mobil Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 INEOS Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson Matthey Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wako Chemicals USA Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KBR Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eka Chemicals AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zeochem LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Zeolyst International*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Chicago Bridge & Iron Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dow

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Bayer Technology Services

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Nova Chemicals Corp

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Clariant International Ltd

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Eastman Chemical Co

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Chevron Phillips Chemical Company

List of Figures

- Figure 1: Global Petroleum Refining & Chemicals Catalysts Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Material 2025 & 2033

- Figure 3: Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Material 2025 & 2033

- Figure 9: North America Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: North America Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Application 2025 & 2033

- Figure 11: North America Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Country 2025 & 2033

- Figure 13: North America Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Material 2025 & 2033

- Figure 15: Europe Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Application 2025 & 2033

- Figure 17: Europe Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Material 2025 & 2033

- Figure 21: South America Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: South America Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Application 2025 & 2033

- Figure 23: South America Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Country 2025 & 2033

- Figure 25: South America Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Material 2025 & 2033

- Figure 27: Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Material 2020 & 2033

- Table 2: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Material 2020 & 2033

- Table 5: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Material 2020 & 2033

- Table 14: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Application 2020 & 2033

- Table 15: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: United States Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Canada Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Material 2020 & 2033

- Table 20: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Country 2020 & 2033

- Table 22: Germany Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Italy Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Material 2020 & 2033

- Table 28: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: Brazil Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Material 2020 & 2033

- Table 34: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Application 2020 & 2033

- Table 35: Global Petroleum Refining & Chemicals Catalysts Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Petroleum Refining & Chemicals Catalysts Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Petroleum Refining & Chemicals Catalysts Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Petroleum Refining & Chemicals Catalysts Industry?

Key companies in the market include Chevron Phillips Chemical Company, Honeywell International Inc, W R Grace & Co, Catalytic Distillation Technologies, Exxon Mobil Corporation, INEOS Technologies, Johnson Matthey Inc, Evonik Industries AG, Wako Chemicals USA Inc, KBR Inc, BASF SE, Eka Chemicals AB, Zeochem LLC, Zeolyst International*List Not Exhaustive, Chicago Bridge & Iron Company, Dow, Bayer Technology Services, Nova Chemicals Corp, Clariant International Ltd, Eastman Chemical Co.

3. What are the main segments of the Petroleum Refining & Chemicals Catalysts Industry?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10096.57 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Refinery Market Output in Africa; Middle East; and Asia-Pacific; Rising Demand for Maintaining High Octane Figures.

6. What are the notable trends driving market growth?

Petroleum Refining Application to Dominate the Market.

7. Are there any restraints impacting market growth?

High Manufacturing Costs; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Petroleum Refining & Chemicals Catalysts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Petroleum Refining & Chemicals Catalysts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Petroleum Refining & Chemicals Catalysts Industry?

To stay informed about further developments, trends, and reports in the Petroleum Refining & Chemicals Catalysts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence