Key Insights

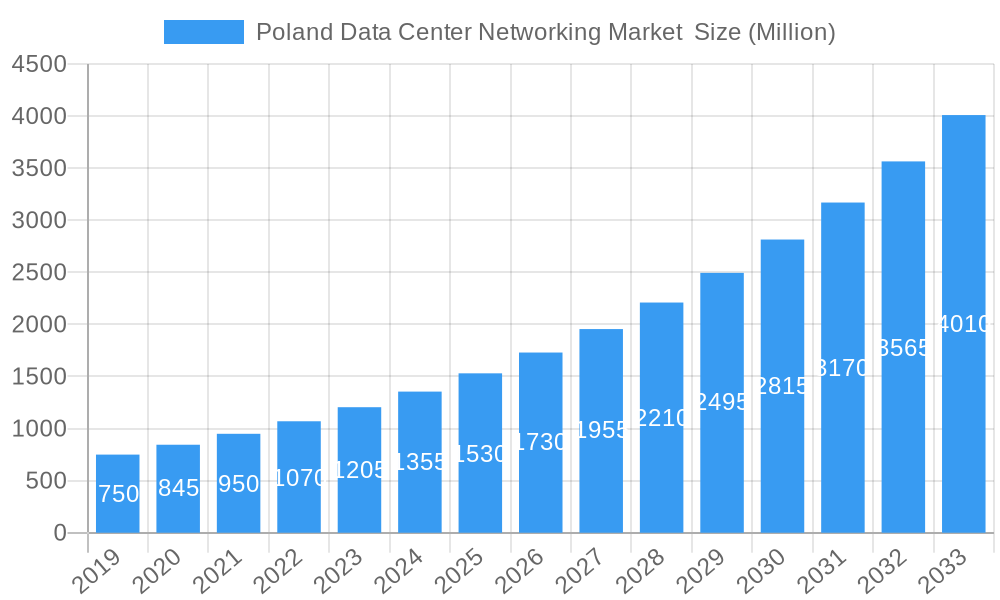

The Poland Data Center Networking Market is projected to achieve a market size of 150.23 million by 2025, exhibiting a robust CAGR of 13.09% from the base year 2025. This significant expansion is propelled by widespread digital transformation across IT & Telecommunication, BFSI, and Government sectors. Key drivers include the escalating demand for high-speed data processing, increased cloud computing adoption, and the necessity for advanced network infrastructure to support data-intensive applications. Strategic investments in data center modernization and the development of new, state-of-the-art facilities further contribute to this growth. Government digitalization initiatives and the expanding presence of hyperscale cloud providers in Poland are also fueling the demand for sophisticated networking solutions.

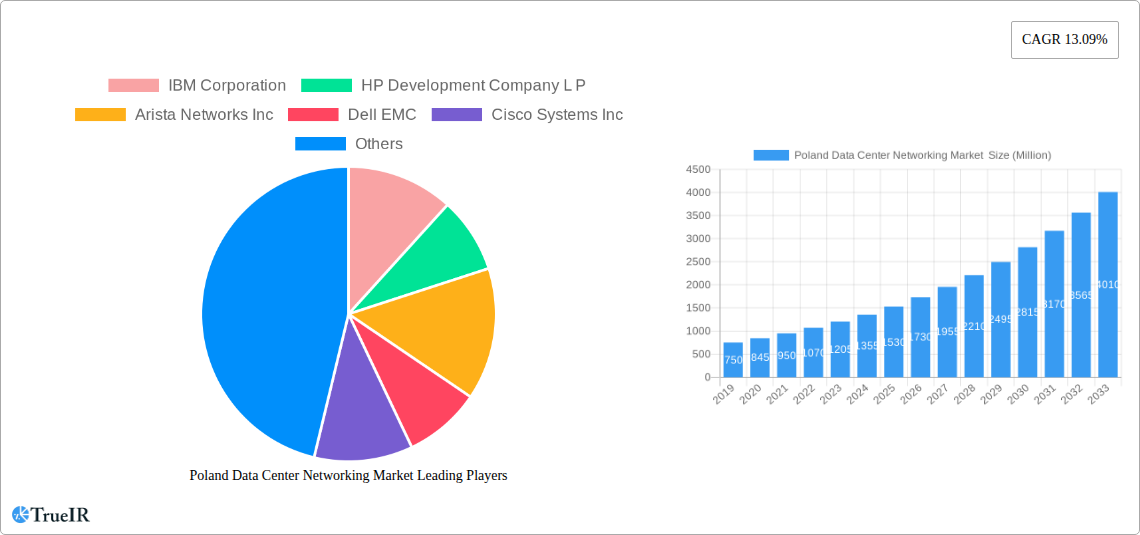

Poland Data Center Networking Market Market Size (In Million)

Market segmentation highlights strong demand for core networking components, including Ethernet Switches and Routers. Essential services such as Installation & Integration and Support & Maintenance are critical for ensuring seamless network operations. Leading companies like Cisco Systems Inc., Arista Networks Inc., and Huawei Technologies Co. Ltd. are instrumental in shaping the market through innovative products and strategic alliances. Potential challenges include high initial investment costs for advanced networking equipment and the requirement for skilled professionals. However, the growing data consumption and the strategic importance of robust data center networks for Poland's economic development are expected to drive sustained and dynamic market growth.

Poland Data Center Networking Market Company Market Share

This comprehensive report offers a dynamic, SEO-optimized analysis of the Poland Data Center Networking Market. It provides critical insights into market size, trends, key players, and future projections, utilizing high-volume keywords for maximum visibility.

Poland Data Center Networking Market Market Structure & Competitive Landscape

The Poland Data Center Networking Market exhibits a moderately concentrated structure, with established global players dominating the landscape alongside emerging domestic providers. Innovation is a key driver, fueled by constant advancements in network speeds, latency reduction, and software-defined networking (SDN) solutions. Regulatory impacts, while evolving, are generally supportive of data center infrastructure development, encouraging investment and technological adoption. Product substitutes are limited, primarily revolving around different networking equipment manufacturers and their proprietary technologies.

The end-user segmentation reveals a strong reliance on the IT & Telecommunication sector, followed by BFSI, Government, and Media & Entertainment. Mergers and acquisitions (M&A) trends are gradually shaping the market, as larger entities seek to consolidate their market share and expand their service portfolios. For instance, recent M&A activities in the broader European data center networking space indicate a trend towards integration and enhanced service offerings, though specific Poland Data Center Networking Market M&A volumes for the historical period (2019-2024) are estimated at xx Million. Concentration ratios are estimated to be around xx% for the top 5 players in 2025.

Poland Data Center Networking Market Market Trends & Opportunities

The Poland Data Center Networking Market is poised for significant expansion, driven by a confluence of technological advancements, increasing digitalization, and a growing demand for robust IT infrastructure. The market size for Poland Data Center Networking is projected to witness substantial growth, with an estimated CAGR of xx% during the forecast period (2025-2033). This growth is underpinned by the increasing adoption of cloud computing services, the proliferation of big data analytics, and the burgeoning Internet of Things (IoT) ecosystem, all of which necessitate high-performance, scalable, and secure networking solutions within data centers.

Technological shifts are profoundly impacting the market, with a pronounced trend towards higher bandwidth speeds, including 100GbE and 400GbE Ethernet switches, and the adoption of advanced routing technologies to optimize data flow and reduce latency. Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) are gaining traction, offering greater agility, automation, and centralized control over network operations, which is crucial for dynamic data center environments.

Consumer preferences are evolving towards more integrated and managed networking solutions. End-users are increasingly seeking vendors that can provide end-to-end services, from installation and integration to ongoing support and maintenance, alongside cutting-edge hardware. This has led to a greater emphasis on comprehensive service offerings within the Poland Data Center Networking Market.

Competitive dynamics are intensifying, with established global players like Cisco Systems Inc., Arista Networks Inc., and Juniper Networks Inc. fiercely competing with increasingly capable regional and specialized vendors. This competition fosters innovation and drives down costs, benefiting end-users. The market penetration rate for advanced networking solutions is expected to increase significantly as more businesses recognize the strategic importance of a resilient and high-performing data center network. The market is also witnessing opportunities arising from the increasing demand for edge computing solutions, requiring localized and low-latency networking capabilities. The growth of artificial intelligence (AI) and machine learning (ML) workloads further accentuates the need for advanced networking infrastructure capable of handling massive data volumes and complex computations.

Dominant Markets & Segments in Poland Data Center Networking Market

Within the Poland Data Center Networking Market, the Component: By Product segment is prominently led by Ethernet Switches. These devices are fundamental to the operation of any data center, facilitating high-speed communication between servers, storage, and other network components. The increasing density of servers and the growing demand for bandwidth-intensive applications directly contribute to the dominance of Ethernet switches. The market for routers also remains significant, crucial for directing traffic within and between networks, especially as data centers become more interconnected. Storage Area Network (SAN) solutions are also vital, ensuring efficient and high-performance data access for critical applications, with their demand closely tied to the growth of data storage needs. Application Delivery Controllers (ADCs) are experiencing growing importance as organizations prioritize application performance, availability, and security in their data center operations.

The Component: By Services segment sees Installation & Integration and Support & Maintenance as the most dominant. As data centers become more complex, the expertise required for seamless installation and ongoing upkeep is paramount. Businesses often lack the in-house technical capabilities or bandwidth to manage these intricate networks effectively, leading to a strong preference for specialized service providers. Training & Consulting also plays a crucial role, empowering IT staff with the knowledge to manage and optimize advanced networking infrastructure.

In terms of End-User, the IT & Telecommunication sector is the largest and most influential segment in the Poland Data Center Networking Market. This is due to the inherent nature of this industry, which is a major consumer and provider of data center services. The BFSI (Banking, Financial Services, and Insurance) sector follows closely, driven by stringent security requirements, the need for high transaction speeds, and increasing regulatory compliance mandates for data handling and storage. The Government sector, with its growing emphasis on e-governance and national digital infrastructure, also represents a significant and expanding market. The Media & Entertainment industry's increasing reliance on streaming services and large-scale content delivery further fuels the demand for robust data center networking.

Key growth drivers for the dominance of these segments include:

- Infrastructure Development: Ongoing investments in modern data center facilities across Poland.

- Digital Transformation Initiatives: Widespread adoption of digital technologies across all sectors.

- Data Growth: Exponential increase in data generation and the need for efficient management.

- Cloud Adoption: Shifting workloads to private, public, and hybrid cloud environments.

- Regulatory Compliance: Stricter data residency and security regulations necessitating on-premise or co-located data center solutions.

Poland Data Center Networking Market Product Analysis

The Poland Data Center Networking Market is characterized by continuous product innovation focused on enhancing speed, reducing latency, and improving network intelligence. Ethernet switches are evolving to support higher port densities and speeds like 200GbE and 400GbE, enabling faster data transfer crucial for AI and big data workloads. Routers are becoming more sophisticated with advanced traffic management capabilities and support for emerging protocols. Storage Area Network (SAN) solutions are increasingly integrating flash storage and higher throughput interfaces for demanding applications. Application Delivery Controllers (ADCs) are incorporating advanced security features and AI-driven traffic optimization. Other networking equipment, such as load balancers and firewalls, are also seeing advancements in performance and integration. These innovations provide competitive advantages by enabling data centers to handle increased traffic, improve application performance, and enhance overall network resilience.

Key Drivers, Barriers & Challenges in Poland Data Center Networking Market

Key Drivers:

- Digital Transformation: The widespread adoption of digital technologies across all industries is a primary catalyst, necessitating robust data center infrastructure.

- Cloud Computing Growth: Increasing reliance on cloud services, both public and private, fuels the demand for high-performance networking within data centers.

- Data Growth and Analytics: The exponential rise in data generation and the growing importance of big data analytics require sophisticated networking capabilities.

- Government Initiatives: National digital strategies and investments in e-governance infrastructure are driving demand.

- Technological Advancements: Continuous innovation in networking hardware and software, such as higher speeds and SDN, enhances efficiency.

Barriers & Challenges:

- High Initial Investment Costs: The significant capital expenditure required for advanced networking equipment can be a barrier for some organizations.

- Skilled Workforce Shortage: A lack of adequately trained IT professionals to manage and maintain complex data center networks poses a challenge.

- Cybersecurity Threats: The ever-evolving landscape of cyber threats necessitates continuous investment in advanced security measures, adding to costs and complexity.

- Interoperability Issues: Ensuring seamless interoperability between different vendors' equipment can sometimes be a challenge.

- Regulatory Compliance: Navigating evolving data privacy and security regulations adds complexity to network design and implementation.

Growth Drivers in the Poland Data Center Networking Market Market

The Poland Data Center Networking Market is propelled by significant growth drivers. The ongoing digital transformation across various sectors, from e-commerce to industrial automation, is a fundamental force, demanding more powerful and responsive data center infrastructure. The burgeoning adoption of cloud computing models, encompassing public, private, and hybrid cloud solutions, directly translates into increased requirements for sophisticated networking within and between data centers. Furthermore, the exponential growth in data generation, driven by IoT devices, social media, and business analytics, necessitates advanced networking to handle the sheer volume and velocity of information. Government initiatives aimed at enhancing digital infrastructure and promoting e-governance also contribute significantly to market expansion. Finally, continuous technological advancements in networking hardware, such as higher bandwidth capabilities and the increasing adoption of Software-Defined Networking (SDN), are key enablers of growth.

Challenges Impacting Poland Data Center Networking Market Growth

Several challenges can impact the growth of the Poland Data Center Networking Market. The substantial upfront investment required for cutting-edge networking hardware and infrastructure can be a significant barrier, particularly for small and medium-sized enterprises. A persistent shortage of skilled IT professionals with expertise in advanced data center networking and cybersecurity can hinder deployment and operational efficiency. The escalating threat landscape of cyberattacks necessitates continuous investment in robust security solutions, adding complexity and cost. Ensuring interoperability between diverse networking equipment from different vendors can also present integration challenges. Moreover, the evolving landscape of data privacy regulations and compliance requirements demands constant vigilance and adaptation in network design and management, potentially slowing down deployment timelines.

Key Players Shaping the Poland Data Center Networking Market Market

- IBM Corporation

- HP Development Company L P

- Arista Networks Inc

- Dell EMC

- Cisco Systems Inc

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- Huawei Technologies Co Ltd

- VMware Inc

Significant Poland Data Center Networking Market Industry Milestones

- October 2022: Kyndryl, in partnership with Dell Technologies and Microsoft Corporation, unveiled an innovative integrated hybrid cloud solution. This offering empowers clients operating in diverse environments, including data centers, remote locations, and mainframes, to accelerate their cloud transformation endeavors. Leveraging Dell infrastructure, Kyndryl's managed services, and the extensive capabilities of Microsoft Azure, clients can significantly bolster their cloud transformation efforts.

- August 2022: NVIDIA, in collaboration with Dell Technologies, introduced a cutting-edge data center solution tailored for the AI era. This solution brings advanced AI training, AI inference, data processing, data science, and robust zero-trust security capabilities to enterprises on a global scale.

Future Outlook for Poland Data Center Networking Market Market

The future outlook for the Poland Data Center Networking Market remains exceptionally strong, driven by sustained digitalization and the increasing demand for data-intensive applications. Strategic opportunities lie in the continued expansion of hyperscale data centers, the growing adoption of edge computing architectures, and the integration of AI and machine learning workloads. The market will likely witness further consolidation and strategic partnerships as vendors aim to offer more comprehensive solutions. Investments in higher bandwidth technologies, network automation, and advanced security protocols will be crucial for market participants. The increasing focus on sustainability and energy efficiency in data center operations will also shape future product development and deployment strategies, presenting opportunities for innovative and eco-friendly networking solutions.

Poland Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Router

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Poland Data Center Networking Market Segmentation By Geography

- 1. Poland

Poland Data Center Networking Market Regional Market Share

Geographic Coverage of Poland Data Center Networking Market

Poland Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals is Hindering the Market Demand

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Router

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HP Development Company L P

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Poland Data Center Networking Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Poland Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Data Center Networking Market Revenue million Forecast, by Region 2020 & 2033

- Table 2: Poland Data Center Networking Market Revenue million Forecast, by Component 2020 & 2033

- Table 3: Poland Data Center Networking Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Poland Data Center Networking Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Poland Data Center Networking Market Revenue million Forecast, by Country 2020 & 2033

- Table 6: Poland Data Center Networking Market Revenue million Forecast, by Component 2020 & 2033

- Table 7: Poland Data Center Networking Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Poland Data Center Networking Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Data Center Networking Market ?

The projected CAGR is approximately 13.09%.

2. Which companies are prominent players in the Poland Data Center Networking Market ?

Key companies in the market include IBM Corporation, HP Development Company L P , Arista Networks Inc, Dell EMC, Cisco Systems Inc, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, Huawei Technologies Co Ltd, VMware Inc.

3. What are the main segments of the Poland Data Center Networking Market ?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.23 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals is Hindering the Market Demand.

8. Can you provide examples of recent developments in the market?

October 2022: Kyndryl, in partnership with Dell Technologies and Microsoft Corporation, unveiled an innovative integrated hybrid cloud solution. This offering empowers clients operating in diverse environments, including data centers, remote locations, and mainframes, to accelerate their cloud transformation endeavors. Leveraging Dell infrastructure, Kyndryl's managed services, and the extensive capabilities of Microsoft Azure, clients can significantly bolster their cloud transformation efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Data Center Networking Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Data Center Networking Market ?

To stay informed about further developments, trends, and reports in the Poland Data Center Networking Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence