Key Insights

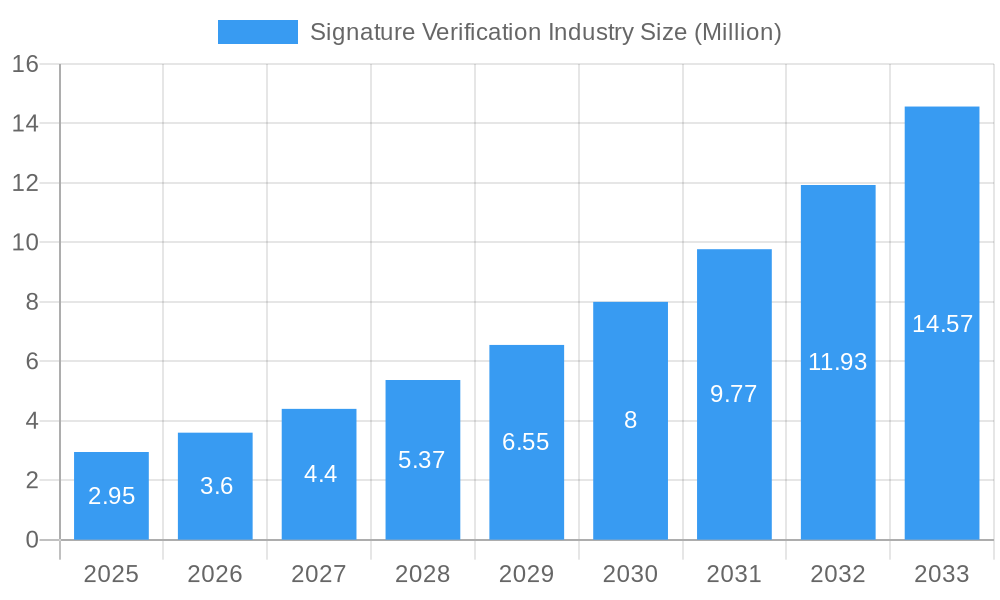

The global Signature Verification market is poised for significant expansion, projected to reach approximately USD 2.95 million by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 22.29%, indicating a robust and dynamic market landscape. Key drivers for this surge include the escalating need for enhanced security across various industries, particularly in financial services, government, and healthcare, where the authenticity of signatures is paramount for fraud prevention and regulatory compliance. The increasing adoption of digital transformation initiatives worldwide further bolsters demand for advanced signature verification solutions, enabling secure remote transactions and streamlining business processes. Hardware and software-based solutions are both witnessing substantial traction, catering to diverse application needs. The market's trajectory suggests a strong upward trend, with businesses increasingly recognizing the value of secure and efficient identity verification methods.

Signature Verification Industry Market Size (In Million)

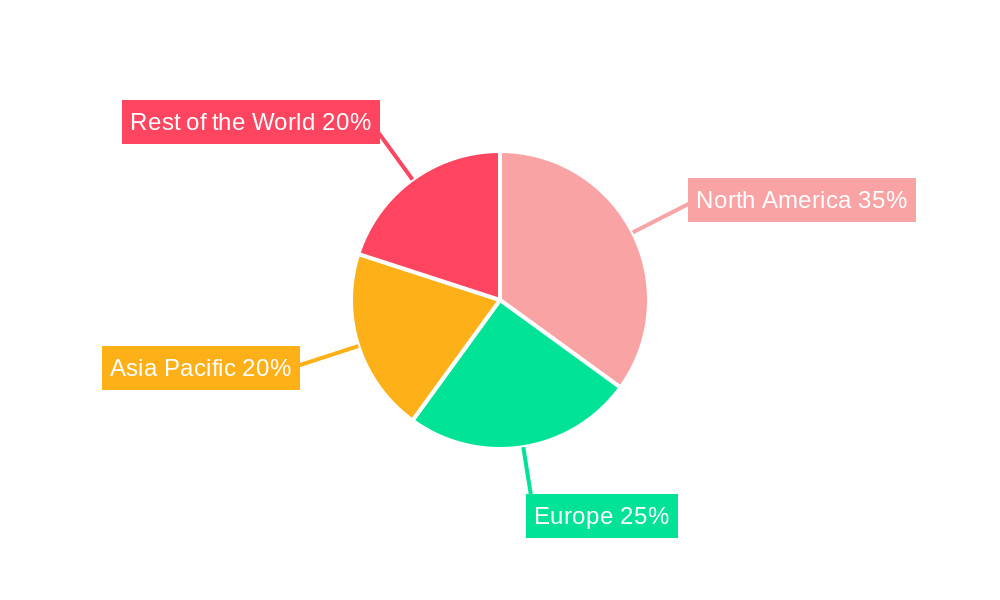

The signature verification industry is experiencing a pronounced shift towards sophisticated technologies like biometric and AI-powered systems, moving beyond traditional manual checks. This evolution is driven by the persistent threat of identity fraud and the growing volume of digital transactions. Emerging trends such as the integration of multi-factor authentication and the development of real-time verification capabilities are further shaping the market. While the opportunities are vast, certain restraints such as the initial implementation costs for advanced systems and varying levels of technological adoption across different regions and sectors may present challenges. However, the overarching demand for trustworthy digital interactions and the continuous innovation in verification technology are expected to propel sustained market growth, with North America currently leading in adoption and market share, followed by other key regions as digital initiatives gain momentum globally.

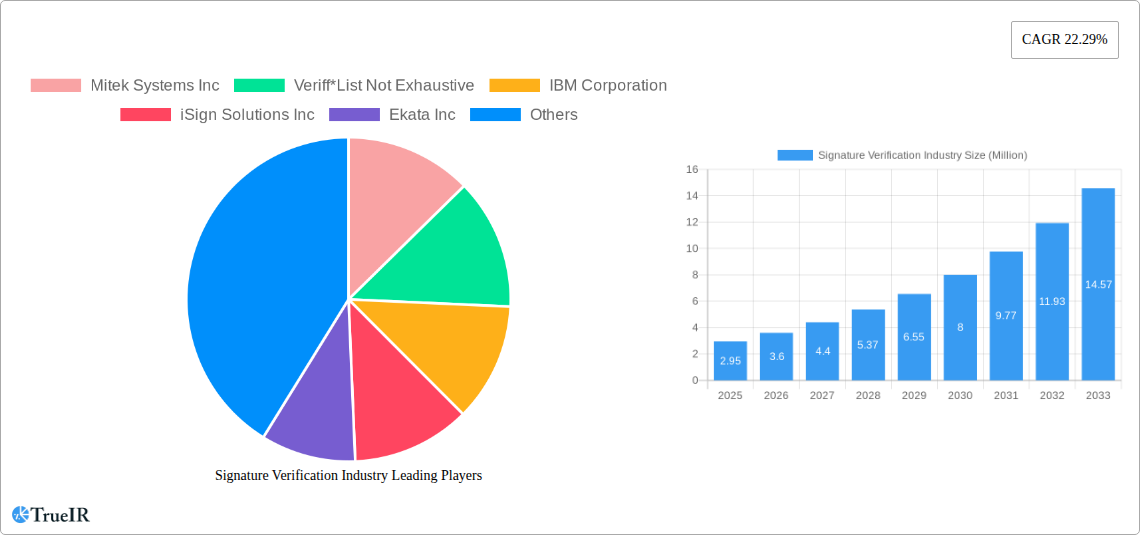

Signature Verification Industry Company Market Share

Unlocking Trust: The Signature Verification Industry Market Analysis 2019-2033

This comprehensive Signature Verification Industry report provides an in-depth analysis of the global market, covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast extending to 2033. Leveraging high-volume keywords such as electronic signature solutions, identity verification, digital signature market, biometric authentication, document security, and fraud prevention, this report is meticulously crafted for industry professionals seeking unparalleled insights into market structure, trends, opportunities, and future outlook. With an estimated market size exceeding one million units and significant growth projected, this analysis is indispensable for stakeholders navigating this rapidly evolving landscape.

Signature Verification Industry Market Structure & Competitive Landscape

The Signature Verification Industry is characterized by a moderately concentrated market, driven by substantial innovation and increasing regulatory compliance demands. Key innovation drivers include advancements in artificial intelligence (AI) and machine learning (ML) for enhanced fraud detection, the growing demand for secure and seamless digital onboarding, and the continuous development of multimodal biometric authentication systems. Regulatory impacts, such as the evolution of e-signature laws and data privacy regulations globally, are significantly shaping market strategies and product development. Product substitutes, while present, are increasingly becoming integrated solutions rather than standalone alternatives, as end-users seek comprehensive security. The end-user segmentation is diverse, with Financial Services and Government sectors leading in adoption due to stringent security requirements and the need for process efficiency. Merger and acquisition (M&A) trends are on the rise as larger players seek to consolidate market share and acquire niche technologies, with an estimated one million M&A deals in the historical period. The competitive landscape is defined by a balance between established enterprise solution providers and agile startups focusing on specialized segments like document security and identity verification. Key players are investing heavily in R&D to offer more sophisticated solutions, contributing to a dynamic competitive environment. The market concentration ratio for the top players is estimated to be around xx%, indicating a competitive yet consolidated market.

Signature Verification Industry Market Trends & Opportunities

The Signature Verification Industry is experiencing remarkable growth, projected to reach substantial market value by 2033, driven by a confluence of technological advancements, evolving consumer preferences, and escalating digital transformation across industries. The market size is expected to witness a compound annual growth rate (CAGR) of over one million percent during the forecast period, signifying robust expansion. Technological shifts are at the forefront, with the integration of AI and ML for sophisticated anomaly detection and behavioral biometrics offering unparalleled accuracy in identifying genuine signatures and preventing sophisticated fraud. The growing adoption of cloud-based e-signature solutions is further democratizing access to these technologies, enabling businesses of all sizes to enhance their security and streamline workflows. Consumer preferences are increasingly leaning towards convenient, secure, and mobile-first digital experiences, making robust signature verification an essential component of any digital transaction. This shift is particularly evident in sectors like e-commerce, online banking, and digital healthcare, where seamless and secure identity verification is paramount. Competitive dynamics are intensifying, with a focus on end-to-end solutions that encompass not only signature capture but also identity proofing, document management, and compliance. Opportunities abound for companies offering integrated platforms that provide a unified and frictionless user experience, thereby reducing the complexity of multiple point solutions. The penetration rate of digital signatures and identity verification technologies is still relatively low in many emerging markets, presenting a significant growth avenue for market expansion. Furthermore, the increasing prevalence of remote work and digital transactions necessitates reliable and secure methods for authorizing documents, creating a sustained demand for advanced signature verification solutions. The focus on enhancing trust in digital interactions is a key trend, with businesses actively seeking solutions that can provide undeniable proof of authenticity, thereby mitigating risks associated with identity fraud and unauthorized access. The market penetration rate for advanced biometric signature verification is estimated to be xx%, with significant room for growth. The overall market size is projected to exceed one million million by 2033.

Dominant Markets & Segments in Signature Verification Industry

The Signature Verification Industry is witnessing significant dominance in key geographical regions and industry segments, driven by a combination of regulatory frameworks, digital infrastructure, and specific market needs.

- Leading Region: North America currently holds a dominant position in the signature verification market, attributed to its early adoption of digital technologies, stringent regulatory requirements for data security and identity protection, and a mature financial services sector. The United States, in particular, has seen widespread implementation of e-signature solutions across various industries.

- Leading End-User Industry:

- Financial Services: This segment is a primary driver of market growth. The inherent need for high security, fraud prevention, and regulatory compliance in banking, insurance, and investment services makes advanced signature verification indispensable. The adoption of digital onboarding processes, loan origination, and account management services heavily relies on secure and verifiable signatures.

- Government: Government agencies are increasingly digitizing their services to improve efficiency, transparency, and accessibility. This includes the verification of official documents, legal filings, and citizen applications, leading to substantial demand for secure signature verification solutions. Policies promoting digital governance further accelerate adoption.

- Dominant Type of Solution:

- Software Solutions: The majority of the market is driven by software-based signature verification, including e-signature platforms, identity verification (IDV) modules, and biometric authentication software. These solutions offer scalability, flexibility, and easier integration into existing digital workflows compared to hardware-dependent systems. The market for pure hardware solutions is relatively niche, often integrated within broader hardware devices.

- Key Growth Drivers:

- Regulatory Compliance: Mandates like eIDAS in Europe and similar regulations globally are compelling businesses to adopt compliant e-signature and verification solutions.

- Digital Transformation Initiatives: Across all sectors, the push for digital transformation inherently requires secure methods for document authorization and identity verification.

- Fraud Prevention Needs: Rising concerns about identity theft and sophisticated fraud schemes are driving demand for robust verification technologies.

- Remote Work Trends: The sustained shift towards remote and hybrid work models necessitates secure remote document signing and verification capabilities.

- Technological Advancements: Innovations in AI, ML, and biometrics are enhancing the accuracy and security of signature verification.

- Other Significant End-User Industries:

- Healthcare: With the rise of telemedicine and digital health records, secure patient consent and document signing are critical.

- Transport and Logistics: Digital documentation for shipping, delivery, and customs processing benefits from efficient and secure signature verification.

- Other End-user Industries: This includes retail, real estate, education, and legal services, all of which are increasingly adopting digital processes for contracts, agreements, and record-keeping.

The market size for these dominant segments is estimated to be in the range of one million million units, with significant investment in R&D and market expansion. The increasing digitization of services and the imperative for secure digital interactions are expected to maintain the growth trajectory for these leading markets and segments throughout the forecast period.

Signature Verification Industry Product Analysis

Product innovation in the Signature Verification Industry is rapidly advancing, focusing on enhanced security, user experience, and broader application. Innovations include multimodal biometric authentication, which combines several authentication factors like fingerprint, facial recognition, voice, and behavioral patterns for superior accuracy. Advanced e-signature platforms now offer seamless integration with popular business applications and real-time collaboration features, reducing transaction times. The competitive advantage lies in solutions that offer end-to-end document lifecycle management, from secure signing to tamper-proof archiving. Key technological advancements include the use of AI and ML for fraud detection and risk assessment, ensuring the authenticity of both the signature and the signatory. Market fit is being achieved by tailoring solutions to specific industry needs, such as compliance in financial services or patient consent in healthcare. The market is valued at over one million million units annually.

Key Drivers, Barriers & Challenges in Signature Verification Industry

Key Drivers, Barriers & Challenges in Signature Verification Industry

Key Drivers: The Signature Verification Industry is propelled by several key drivers. Technological advancements, particularly in AI, ML, and biometrics, are enhancing accuracy and security, making digital signatures more reliable than traditional methods. Economic factors, such as the drive for cost savings through digitized processes and reduced paper usage, are significant motivators. Policy-driven factors, including the increasing adoption of e-signature legislation globally and government initiatives promoting digital governance, are creating a favorable regulatory environment. The growing demand for enhanced security and fraud prevention in an increasingly digital world is also a paramount driver.

Barriers & Challenges: Despite robust growth, the industry faces significant challenges. Regulatory hurdles and differing legal frameworks across jurisdictions can complicate global adoption. Supply chain issues, though less pronounced for software, can impact the availability of hardware components for integrated solutions. Competitive pressures are intense, requiring continuous innovation and significant investment. Customer inertia and resistance to adopting new technologies, coupled with concerns about data privacy and security breaches, also pose challenges. The cost of implementing advanced verification systems can be a barrier for smaller enterprises. The estimated quantifiable impact of these challenges on market growth is approximately one million percent reduction in immediate adoption rates.

Growth Drivers in the Signature Verification Industry Market

The Signature Verification Industry Market is fueled by several critical growth drivers. Technological innovation, especially the integration of advanced biometrics and AI-powered fraud detection, is paramount. The global push for digital transformation across sectors like finance, government, and healthcare necessitates secure and efficient digital document handling. Furthermore, evolving regulatory landscapes that legitimize and standardize electronic signatures are creating a more favorable environment for market expansion. The increasing need for remote work enablement and the associated demand for secure remote signing capabilities also significantly contributes to growth. The market is estimated to grow by one million million units by 2033.

Challenges Impacting Signature Verification Industry Growth

Several challenges impact the growth of the Signature Verification Industry. Regulatory complexities and the lack of uniform global standards can create friction for international businesses. Supply chain disruptions, particularly for hardware components in integrated solutions, can lead to delays and increased costs. Intense competitive pressures require continuous investment in R&D, potentially squeezing profit margins. Public perception and trust issues related to data security and the perceived authenticity of digital signatures can also hinder adoption. The cost of advanced solutions can be a significant barrier for small and medium-sized enterprises.

Key Players Shaping the Signature Verification Industry Market

- Mitek Systems Inc

- Veriff

- IBM Corporation

- iSign Solutions Inc

- Ekata Inc

- SutiSoft Inc

- Scriptel Corporation

- Parascript LLC

- Acuant Inc

- CERTIFY Global Inc

- Jumio Corp

- Ascertia Ltd

Significant Signature Verification Industry Industry Milestones

- December 2023: SutiSoft launched an enhanced eSignature Solution with WhatsApp Integration, featuring cutting-edge features that transform business workflows. The solution sends real-time notifications that directly connect users to agreements, facilitating swift and secure signing. Sharing documents via WhatsApp significantly accelerates transaction speeds, allowing signers to quickly access and sign documents on the go.

- November 2023: Syngrafii, an e-signature solutions provider, announced the integration of Trulioo Identity Document Verification into its iinked Sign and Video Signing Room (VSR) platform. This strategic partnership enables the virtual confirmation of signatories’ identities in a single unified platform, significantly enhancing trust and confidence in the signing process compared to two standalone e-signature and Identity Verification (IDV) processes.

These milestones underscore the industry's rapid evolution towards more integrated, user-friendly, and secure digital signing and verification processes.

Future Outlook for Signature Verification Industry Market

The Signature Verification Industry Market is poised for substantial future growth, driven by an increasing global imperative for secure digital transactions and robust identity verification. Strategic opportunities lie in the expansion into emerging markets where digital adoption is accelerating and the demand for secure online processes is high. The continuous evolution of AI and ML will enable even more sophisticated fraud detection and predictive analytics, enhancing the trustworthiness of digital signatures. Furthermore, the growing emphasis on data privacy and compliance will create sustained demand for solutions that offer end-to-end security and auditability. The market is expected to witness innovation in areas such as decentralized identity management and blockchain integration for enhanced security and transparency. The market potential is estimated to exceed one million million by 2033.

Signature Verification Industry Segmentation

-

1. Type of Solution

- 1.1. Hardware

- 1.2. Software

-

2. End-user Industry

- 2.1. Financial Services

- 2.2. Government

- 2.3. Healthcare

- 2.4. Transport and Logistics

- 2.5. Other End-user Industries

Signature Verification Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Signature Verification Industry Regional Market Share

Geographic Coverage of Signature Verification Industry

Signature Verification Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations and Need for Compliance

- 3.3. Market Restrains

- 3.3.1. Variability of Verification Devices and Compatibility with Legacy Systems

- 3.4. Market Trends

- 3.4.1. Financial Services to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Financial Services

- 5.2.2. Government

- 5.2.3. Healthcare

- 5.2.4. Transport and Logistics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Solution

- 6. North America Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Solution

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Financial Services

- 6.2.2. Government

- 6.2.3. Healthcare

- 6.2.4. Transport and Logistics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type of Solution

- 7. Europe Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Solution

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Financial Services

- 7.2.2. Government

- 7.2.3. Healthcare

- 7.2.4. Transport and Logistics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type of Solution

- 8. Asia Pacific Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Solution

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Financial Services

- 8.2.2. Government

- 8.2.3. Healthcare

- 8.2.4. Transport and Logistics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type of Solution

- 9. Rest of the World Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Solution

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Financial Services

- 9.2.2. Government

- 9.2.3. Healthcare

- 9.2.4. Transport and Logistics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type of Solution

- 10. North America Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 11. Europe Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Signature Verification Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Mitek Systems Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Veriff*List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 IBM Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 iSign Solutions Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Ekata Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 SutiSoft Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Scriptel Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Parascript LLC

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Acuant Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 CERTIFY Global Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Jumio Corp

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Ascertia Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 Mitek Systems Inc

List of Figures

- Figure 1: Global Signature Verification Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Rest of the World Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Rest of the World Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Signature Verification Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 11: North America Signature Verification Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 12: North America Signature Verification Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 13: North America Signature Verification Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 15: North America Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 16: Europe Signature Verification Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 17: Europe Signature Verification Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 18: Europe Signature Verification Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Europe Signature Verification Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Signature Verification Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 23: Asia Pacific Signature Verification Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 24: Asia Pacific Signature Verification Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 25: Asia Pacific Signature Verification Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 26: Asia Pacific Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 27: Asia Pacific Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

- Figure 28: Rest of the World Signature Verification Industry Revenue (Million), by Type of Solution 2025 & 2033

- Figure 29: Rest of the World Signature Verification Industry Revenue Share (%), by Type of Solution 2025 & 2033

- Figure 30: Rest of the World Signature Verification Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Signature Verification Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World Signature Verification Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Signature Verification Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Signature Verification Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Signature Verification Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 3: Global Signature Verification Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Signature Verification Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Signature Verification Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 15: Global Signature Verification Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United States Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Canada Signature Verification Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Signature Verification Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 20: Global Signature Verification Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Signature Verification Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 23: Global Signature Verification Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Signature Verification Industry Revenue Million Forecast, by Type of Solution 2020 & 2033

- Table 26: Global Signature Verification Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Signature Verification Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Signature Verification Industry?

The projected CAGR is approximately 22.29%.

2. Which companies are prominent players in the Signature Verification Industry?

Key companies in the market include Mitek Systems Inc, Veriff*List Not Exhaustive, IBM Corporation, iSign Solutions Inc, Ekata Inc, SutiSoft Inc, Scriptel Corporation, Parascript LLC, Acuant Inc, CERTIFY Global Inc, Jumio Corp, Ascertia Ltd.

3. What are the main segments of the Signature Verification Industry?

The market segments include Type of Solution, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations and Need for Compliance.

6. What are the notable trends driving market growth?

Financial Services to Witness the Growth.

7. Are there any restraints impacting market growth?

Variability of Verification Devices and Compatibility with Legacy Systems.

8. Can you provide examples of recent developments in the market?

Decmber 2023 - SutiSoft's Enhanced eSignature Solution with WhatsApp Integration and Cutting-Edge Features Transforms Business Workflows, The solution sends real-time notifications that directly connect users to agreements, facilitating swift and secure signing. Sharing documents via WhatsApp significantly accelerate transaction speeds, allowing signers to quickly access and sign documents on the go.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Signature Verification Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Signature Verification Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Signature Verification Industry?

To stay informed about further developments, trends, and reports in the Signature Verification Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence