Key Insights

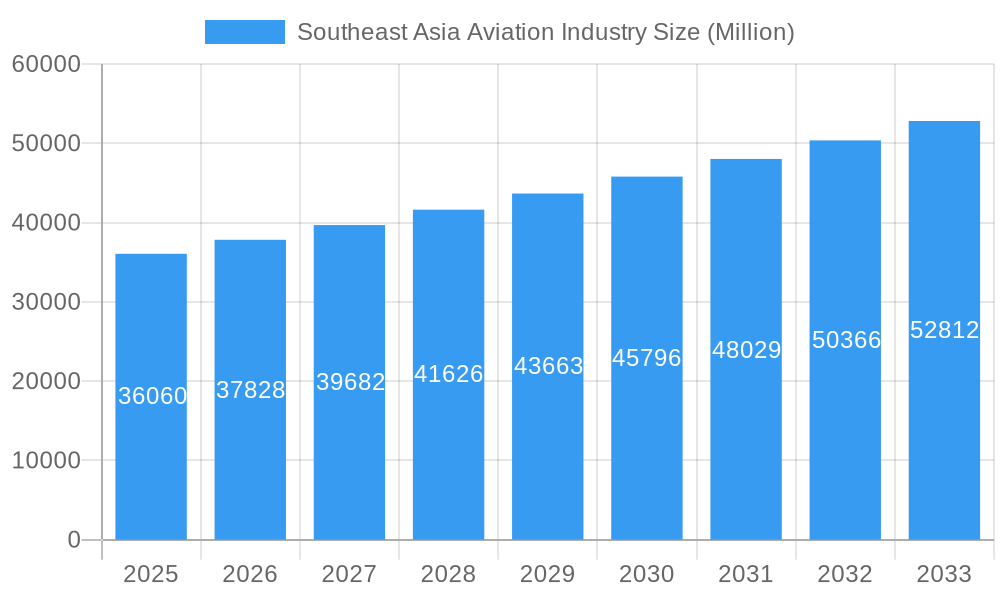

The Southeast Asia aviation industry, valued at $36.06 billion in 2025, is projected to experience robust growth, driven by increasing air travel demand fueled by a burgeoning middle class, rising tourism, and expanding regional trade. Key growth drivers include significant investments in airport infrastructure upgrades across the region, the expansion of low-cost carriers, and the increasing adoption of advanced technologies like improved air traffic management systems. The market is segmented by aircraft type (commercial, freighter, military, general aviation) and country (Singapore, Indonesia, Thailand, Philippines, Malaysia, and Rest of Southeast Asia). While the region faces challenges such as airspace limitations in certain countries and potential disruptions from geopolitical instability, the overall outlook remains positive. The projected CAGR of 4.84% indicates a substantial increase in market value over the forecast period (2025-2033). Strong economic growth in several Southeast Asian nations, particularly Indonesia and Vietnam (implied through "Rest of Southeast Asia" segment), further supports this optimistic projection. The presence of both established international players (Boeing, Airbus) and regional manufacturers (PT Dirgantara Indonesia) signifies a dynamic and competitive landscape. This competition fosters innovation and keeps prices competitive, benefiting both airlines and consumers. The increasing demand for both passenger and cargo transportation underpins the projected growth across all aircraft segments.

Southeast Asia Aviation Industry Market Size (In Billion)

The competitive landscape includes a mix of global giants like Boeing and Airbus, alongside regional manufacturers and smaller aviation companies. This blend contributes to the market's diversity and resilience. The focus on sustainable aviation practices and the adoption of fuel-efficient aircraft will become increasingly important, influencing both regulatory frameworks and industry investment strategies. Government initiatives promoting aviation infrastructure development and regional connectivity are pivotal in shaping the industry's trajectory. The continued expansion of air travel in Southeast Asia is likely to attract further foreign investment, boosting overall market growth and competitiveness. The growth trajectory indicates a significant opportunity for companies involved in aircraft manufacturing, maintenance, repair, and overhaul (MRO), and related services.

Southeast Asia Aviation Industry Company Market Share

Southeast Asia Aviation Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Southeast Asia aviation industry, encompassing market size, growth forecasts, competitive landscape, key players, and future outlook. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and policymakers. The report leverages extensive data analysis to provide actionable insights into this rapidly evolving market. Expect detailed analysis of commercial aircraft, freighter aircraft, military aircraft, non-combat aircraft, and general aviation segments across key Southeast Asian nations: Singapore, Indonesia, Thailand, Philippines, Malaysia, and the Rest of Southeast Asia.

Southeast Asia Aviation Industry Market Structure & Competitive Landscape

The Southeast Asia aviation industry exhibits a moderately concentrated market structure, with key players like Boeing and Airbus holding significant market share in the commercial aircraft segment. The concentration ratio (CR4) for commercial aircraft is estimated at 70% in 2025, indicating the dominance of a few large players. However, the general aviation and military segments show higher fragmentation, with numerous smaller companies competing.

Innovation is a key driver, with companies continually investing in new technologies to improve fuel efficiency, safety, and passenger experience. Regulatory frameworks, particularly those concerning safety and environmental standards, play a significant role in shaping the industry landscape. The emergence of electric and hybrid-electric aircraft presents a potential substitute to traditional fuel-powered aircraft, although this technology is still in its early stages.

End-user segmentation is driven by diverse needs, including passenger airlines, cargo carriers, military forces, and private owners. M&A activity has been relatively moderate in recent years, with a total transaction value of approximately $xx Million in 2024, primarily focused on consolidation within specific segments.

- Market Concentration: CR4 (Commercial Aircraft) - 70% (2025 est.)

- Innovation Drivers: Fuel efficiency, safety advancements, electric/hybrid-electric aircraft technology

- Regulatory Impacts: Stringent safety and environmental regulations

- Product Substitutes: Electric and hybrid-electric aircraft

- End-User Segmentation: Passenger airlines, cargo carriers, military, private owners

- M&A Trends: Moderate activity, focused on segment consolidation, total value approximately $xx Million in 2024

Southeast Asia Aviation Industry Market Trends & Opportunities

The Southeast Asia aviation industry is projected to experience robust growth over the forecast period (2025-2033), driven by increasing air travel demand, economic growth, and infrastructure development. The market size is estimated to reach $xx Million in 2025 and is forecast to achieve a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is being fueled by rising disposable incomes, increasing tourism, and the expansion of low-cost carriers.

Technological shifts, such as the adoption of advanced avionics and data analytics, are enhancing operational efficiency and safety. Consumer preferences are leaning towards enhanced comfort, connectivity, and sustainability. The competitive landscape is dynamic, with existing players expanding their offerings and new entrants seeking to capture market share. Market penetration rates for various aircraft types will increase significantly, particularly in the commercial and general aviation segments. Specific challenges, such as maintaining consistent growth in the face of geopolitical instability and economic slowdowns, must be considered.

Dominant Markets & Segments in Southeast Asia Aviation Industry

Indonesia and Singapore emerge as the leading markets in the Southeast Asia aviation industry, driven by robust economic growth and expanding air travel demand. The commercial aircraft segment dominates in terms of market size and growth potential.

Key Growth Drivers (Indonesia & Singapore):

- Strong Economic Growth: Fuels demand for air travel and related services.

- Government Support: Investments in airport infrastructure and aviation-related initiatives.

- Tourism Growth: Attracts significant numbers of international and domestic travelers.

- Expansion of Low-Cost Carriers: Provides affordable travel options.

Dominant Segments:

- Commercial Aircraft: High growth fueled by increasing passenger traffic and airline expansion.

- General Aviation: Growing demand driven by increased private ownership and business travel.

Other countries like Thailand, Malaysia, and the Philippines are also experiencing significant growth, albeit at a slower pace compared to Indonesia and Singapore. The Rest of Southeast Asia represents a considerable market with potential for future expansion. Detailed analysis will be provided for each country within the full report to illustrate variances and future projections.

Southeast Asia Aviation Industry Product Analysis

The aviation industry is witnessing significant product innovation, focusing on improved fuel efficiency, advanced avionics, enhanced passenger comfort, and increased safety features. The market is increasingly demanding eco-friendly aircraft, leading to significant investment in electric and hybrid-electric aircraft technologies. These innovations are enhancing the competitive landscape, with manufacturers striving to offer superior performance, cost-effectiveness, and technological advancements to gain a market advantage. Analysis in the full report will cover specific product launches, their market fit, and competitive impact.

Key Drivers, Barriers & Challenges in Southeast Asia Aviation Industry

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels demand for air travel.

- Economic Growth: Expansion of tourism and business activities increases air travel demand.

- Government Initiatives: Infrastructure investments and supportive policies boost the industry.

Challenges:

- Supply Chain Disruptions: Impacts the timely delivery of aircraft and parts, with estimated cost increases of $xx Million annually.

- Regulatory Complexity: Navigating varying regulations across countries adds complexity and cost.

- Competitive Pressures: Intense rivalry among manufacturers and airlines necessitates constant innovation.

Growth Drivers in the Southeast Asia Aviation Industry Market

The Southeast Asia aviation industry is propelled by rising disposable incomes, stimulating demand for air travel, and robust economic growth in several key countries. Government support for infrastructure development, including airport expansions and upgrades, plays a crucial role. The burgeoning tourism sector also significantly fuels demand.

Challenges Impacting Southeast Asia Aviation Industry Growth

Supply chain disruptions, exacerbated by global events, pose a major challenge, increasing costs by $xx Million annually. Regulatory inconsistencies across Southeast Asian nations add complexity, potentially impacting investments and expansion. Intense competition among manufacturers and airlines creates pressure for cost optimization and innovation.

Key Players Shaping the Southeast Asia Aviation Industry Market

- Textron Inc

- Dassault Aviation

- PT Dirgantara Indonesia

- General Dynamics Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Rostec

- Airbus SE

- Honda Aircraft Company LL

- United Aircraft Corporation

- ATR

- The Boeing Company

Significant Southeast Asia Aviation Industry Industry Milestones

- 2021 (Q3): Airbus secured a major order for A320neo aircraft from a Southeast Asian airline.

- 2022 (Q1): Significant investment announced in airport infrastructure development in Indonesia.

- 2023 (Q2): New regulations implemented to improve aviation safety standards across the region.

- 2024 (Q4): Launch of a new low-cost carrier in the Philippines. (Further milestones will be detailed in the full report.)

Future Outlook for Southeast Asia Aviation Industry Market

The Southeast Asia aviation industry is poised for sustained growth, driven by continued economic expansion, rising disposable incomes, and increasing tourism. Strategic investments in airport infrastructure, coupled with supportive government policies, will further enhance the industry's potential. The emergence of new technologies, such as electric and hybrid-electric aircraft, promises to shape future industry developments, creating both opportunities and challenges for established and emerging players. The detailed outlook with specific market projections will be provided in the full report.

Southeast Asia Aviation Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Southeast Asia Aviation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Southeast Asia Aviation Industry Regional Market Share

Geographic Coverage of Southeast Asia Aviation Industry

Southeast Asia Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. China Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 12. Japan Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 13. India Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 14. South Korea Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 15. Taiwan Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 16. Australia Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 17. Rest of Asia-Pacific Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2025

- 18.2. Company Profiles

- 18.2.1 Textron Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Dassault Aviation

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 PT Dirgantara Indonesia

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 General Dynamics Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Leonardo SpA

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Lockheed Martin Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Rostec

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Airbus SE

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Honda Aircraft Company LL

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 United Aircraft Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 ATR

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 The Boeing Company

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Textron Inc

List of Figures

- Figure 1: Global Southeast Asia Aviation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: North America Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 5: North America Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 6: North America Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 7: North America Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 8: North America Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 11: North America Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 12: North America Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 13: North America Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 14: North America Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 15: North America Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 17: South America Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 18: South America Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 19: South America Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 20: South America Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 23: South America Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 24: South America Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 25: South America Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 26: South America Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 27: South America Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 28: Europe Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 29: Europe Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 30: Europe Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 31: Europe Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 32: Europe Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 35: Europe Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 36: Europe Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 37: Europe Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 38: Europe Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 39: Europe Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 40: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 41: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 42: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 43: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 44: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 47: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 48: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 49: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 50: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 52: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 53: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 54: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 55: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 56: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 59: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 60: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 61: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 62: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 63: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 3: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 7: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: India Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Taiwan Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Australia Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia-Pacific Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United States Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Canada Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Mexico Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Argentina Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 35: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 36: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 37: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 38: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 39: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: United Kingdom Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Germany Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Italy Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Spain Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Russia Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Benelux Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Nordics Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 51: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 52: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 53: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 54: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 55: Turkey Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Israel Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: GCC Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: North Africa Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: South Africa Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Rest of Middle East & Africa Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 63: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 64: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 65: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 66: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 67: China Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: India Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 69: Japan Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Korea Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 71: ASEAN Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Oceania Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 73: Rest of Asia Pacific Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Aviation Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Southeast Asia Aviation Industry?

Key companies in the market include Textron Inc, Dassault Aviation, PT Dirgantara Indonesia, General Dynamics Corporation, Leonardo SpA, Lockheed Martin Corporation, Rostec, Airbus SE, Honda Aircraft Company LL, United Aircraft Corporation, ATR, The Boeing Company.

3. What are the main segments of the Southeast Asia Aviation Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Aviation Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence