Key Insights

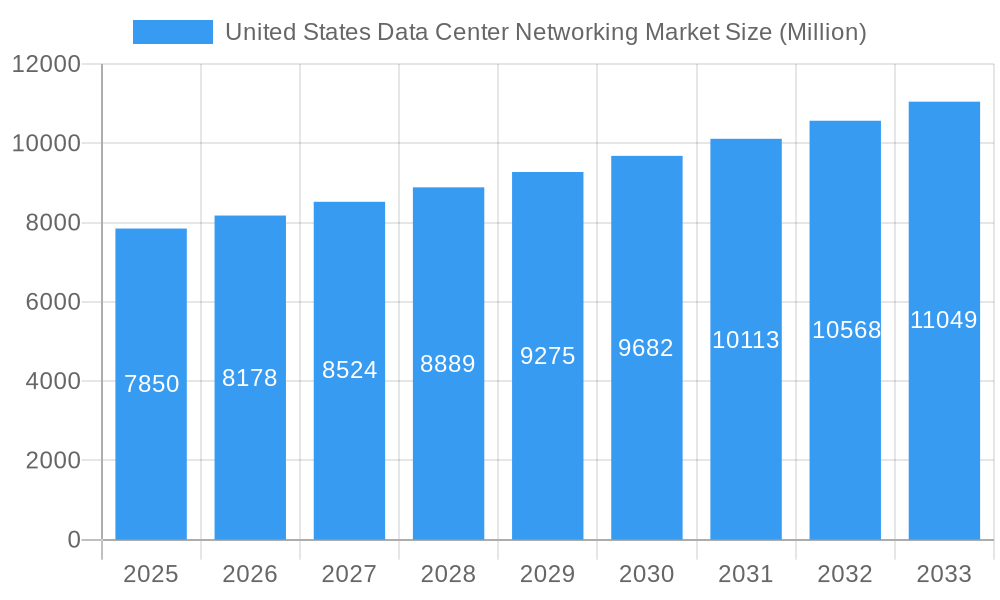

The United States data center networking market is poised for significant expansion, with a current market size of approximately $7.85 billion in 2025. This robust growth is driven by the escalating demand for robust network infrastructure to support the exponential rise in data generation and consumption. Key catalysts include the widespread adoption of cloud computing services, the proliferation of big data analytics, the burgeoning growth of the Internet of Things (IoT) ecosystem, and the increasing complexity of AI and machine learning workloads. These factors necessitate high-performance, scalable, and efficient networking solutions within data centers to ensure seamless data flow and low latency. Furthermore, the ongoing digital transformation initiatives across various industries, coupled with the continuous need for upgraded network equipment to meet evolving technological demands, are also contributing to market expansion. The market is characterized by a steady compound annual growth rate (CAGR) of 4.20%, indicating a sustained upward trajectory in the coming years.

United States Data Center Networking Market Market Size (In Billion)

The market is segmented into various components, with Ethernet Switches and Routers emerging as primary product categories due to their foundational role in data center architecture. Services such as Installation & Integration, Training & Consulting, and Support & Maintenance are crucial for enabling organizations to effectively deploy and manage complex networking environments. Key end-users like the IT & Telecommunication, BFSI, and Government sectors are heavily investing in advanced data center networking solutions to enhance their operational efficiency, security, and service delivery. Emerging trends such as the adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) are transforming traditional network architectures, offering greater flexibility and automation. Conversely, challenges such as escalating costs associated with high-speed network equipment upgrades and the need for specialized skill sets for network management present potential restraints to market growth. However, the overarching trend of digital acceleration and the continuous pursuit of enhanced data processing capabilities are expected to outweigh these limitations, ensuring a dynamic and growing market.

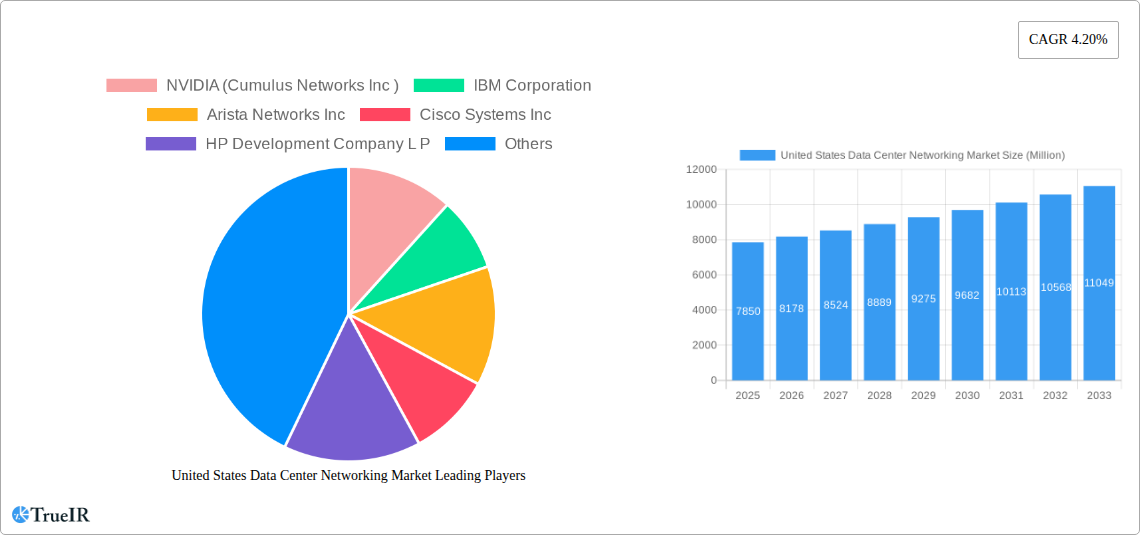

United States Data Center Networking Market Company Market Share

United States Data Center Networking Market: Deep Dive Analysis and Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Data Center Networking Market, offering critical insights into market dynamics, competitive strategies, and future growth trajectories. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to understand and capitalize on this rapidly evolving sector. The market is projected to reach XX Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

United States Data Center Networking Market Market Structure & Competitive Landscape

The United States Data Center Networking Market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Innovation is a primary driver, fueled by the relentless pursuit of higher speeds, lower latency, and enhanced efficiency in data transmission. Key innovation areas include the development of next-generation Ethernet switches, advanced routing protocols, and specialized networking solutions for AI and high-performance computing. Regulatory impacts, while generally supportive of technological advancement, can influence deployment strategies, particularly concerning data privacy and security standards. Product substitutes are limited within core networking functionalities, but integrated solutions and software-defined networking (SDN) offer alternative approaches to traditional hardware deployments. The end-user segmentation reveals a dynamic landscape, with IT & Telecommunication and BFSI sectors consistently leading demand, followed by Government and Media & Entertainment. Mergers & Acquisitions (M&A) are a notable trend, as larger companies seek to consolidate market position, acquire cutting-edge technologies, and expand their service portfolios. Over the historical period (2019-2024), there were approximately XX significant M&A activities recorded, indicating ongoing consolidation. The top 5 players currently hold an estimated XX% market share, highlighting the competitive intensity.

United States Data Center Networking Market Market Trends & Opportunities

The United States Data Center Networking Market is on a robust growth trajectory, driven by the insatiable demand for digital services, the proliferation of cloud computing, and the transformative impact of artificial intelligence. The overall market size is projected to experience significant expansion, with an estimated value of XX Million USD in 2025, growing to XX Million USD by 2033. This sustained growth is underpinned by a CAGR of XX% during the forecast period. Technological shifts are rapidly redefining the market landscape. The increasing adoption of 25G, 100G, 400G, and even 800G Ethernet speeds is paramount, enabling faster data transfer and supporting more complex workloads. The emergence of AI and machine learning applications necessitates specialized networking infrastructure capable of handling massive datasets and complex computations with minimal latency. This trend presents a substantial opportunity for vendors offering high-performance networking solutions.

Consumer preferences are evolving, with organizations increasingly seeking agile, scalable, and cost-effective networking solutions. Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) are gaining traction, offering greater flexibility and centralized control over network operations. Cloud adoption continues to be a major catalyst, driving demand for robust and efficient networking within hyperscale and colocation data centers. The hybrid cloud model further accentuates this need, requiring seamless connectivity between on-premises and cloud environments.

Competitive dynamics are intensifying, with established players continually innovating and new entrants emerging with specialized solutions. The focus is shifting from mere connectivity to intelligent networking that offers advanced analytics, automation, and security features. Opportunities abound for companies that can provide end-to-end solutions, including hardware, software, and comprehensive support services. The growing importance of edge computing, driven by the need for real-time data processing closer to the source, also presents a significant avenue for market expansion, requiring the deployment of smaller, highly efficient data center networking solutions. The demand for energy-efficient networking equipment is also a growing trend, aligning with broader sustainability initiatives.

Dominant Markets & Segments in United States Data Center Networking Market

The United States Data Center Networking Market exhibits dominance across several key segments, reflecting diverse industry needs and technological advancements.

Component: By Product

- Ethernet Switches: This segment holds the largest market share, driven by their fundamental role in data center connectivity. The increasing demand for higher port densities and faster speeds (25G, 100G, 400G) to support cloud computing, AI, and big data analytics is a primary growth driver. The deployment of these advanced switches is crucial for hyperscale and enterprise data centers.

- Routers: Essential for directing traffic and managing network topology, routers remain a critical component. The growth in this segment is fueled by the need for efficient inter-data center connectivity, wide-area network (WAN) aggregation, and the increasing complexity of network architectures in large enterprises and service providers.

- Storage Area Network (SAN): SANs are vital for high-performance storage solutions, particularly in environments demanding rapid data access for applications like databases, virtualization, and high-performance computing. The continuous growth of data volumes and the increasing adoption of flash storage contribute to the sustained demand for SAN technologies.

- Application Delivery Controller (ADC): ADCs are crucial for optimizing application performance, security, and availability. The rise of cloud-native applications, microservices, and the need for robust load balancing and traffic management solutions are driving growth in this segment. The increasing focus on application security and resilience further bolsters demand.

- Other Networking Equipment: This broad category includes network interface cards (NICs), network cables, and other specialized hardware. While individually smaller, their collective importance in building a complete data center network infrastructure contributes to overall market growth.

Component: By Services

- Installation & Integration: As data center networks become more complex, the demand for expert installation and seamless integration services is paramount. This segment is driven by the need for efficient deployment of new hardware, upgrades, and the consolidation of existing infrastructure, ensuring minimal disruption to operations.

- Support & Maintenance: Ongoing support and maintenance services are critical for ensuring the continuous uptime and optimal performance of data center networks. This segment is characterized by long-term contracts and a focus on proactive monitoring, troubleshooting, and hardware replacement, providing a stable revenue stream for service providers.

- Training & Consulting: With the rapid evolution of networking technologies, organizations require specialized training and consulting services to effectively manage and leverage their data center infrastructure. This segment addresses the need for skilled personnel and strategic guidance on network design, optimization, and future-proofing.

End-User

- IT & Telecommunication: This sector is the largest consumer of data center networking solutions, driven by the exponential growth of data traffic, cloud services, and the continuous expansion of network infrastructure to support evolving digital services. The demand for high-bandwidth, low-latency connectivity is a constant.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector relies heavily on secure, reliable, and high-performance networking for critical operations such as trading, transaction processing, and data analytics. The need for low-latency networks for high-frequency trading and robust security measures for sensitive data are key growth drivers.

- Government: Government entities, including defense, intelligence agencies, and public sector organizations, require secure and resilient data center networks to manage sensitive information and provide essential services. The increasing digitalization of government functions and the focus on cybersecurity are significant contributors to this segment's growth.

- Media & Entertainment: This sector demands high-bandwidth networking for content creation, distribution, and streaming services. The increasing adoption of 4K/8K streaming and immersive technologies necessitates robust network infrastructure capable of handling massive data transfers.

- Other End-Users: This category includes sectors like healthcare, retail, manufacturing, and research institutions, all of which have growing data center networking needs driven by digital transformation, IoT adoption, and data analytics initiatives.

United States Data Center Networking Market Product Analysis

The United States Data Center Networking Market is witnessing significant product innovation focused on enhancing speed, efficiency, and intelligence. Ethernet switches are evolving rapidly, with 25G, 100G, 400G, and emerging 800G technologies becoming increasingly prevalent. These advancements are crucial for supporting the massive data throughput required by AI workloads, cloud computing, and high-performance computing. Routers are being optimized for lower latency and greater programmability, enabling more agile network management. Storage Area Networks are integrating advanced features for faster data access and improved reliability. Application Delivery Controllers are incorporating AI-driven analytics for predictive traffic management and enhanced security. The competitive advantage lies in offering solutions that provide not only high performance but also cost-effectiveness, energy efficiency, and seamless integration with existing infrastructure and cloud environments. The focus on specialized networking for AI, exemplified by solutions like NVIDIA's SpectrumXtreme, is a key differentiator, promising significant improvements in AI performance and power efficiency.

Key Drivers, Barriers & Challenges in United States Data Center Networking Market

Key Drivers

The United States Data Center Networking Market is propelled by a confluence of powerful forces:

- Explosive Data Growth: The continuous surge in data generation from IoT devices, AI/ML, cloud services, and digital content creation necessitates robust and scalable networking infrastructure.

- Cloud Computing Expansion: The widespread adoption of public, private, and hybrid cloud models drives demand for high-performance, low-latency networking solutions to connect and manage distributed data centers.

- AI and Machine Learning Adoption: The compute-intensive nature of AI/ML workloads, requiring massive data processing and fast interconnections, is a significant catalyst for advanced networking technologies.

- Digital Transformation Initiatives: Across all industries, organizations are investing in digital transformation, which invariably involves upgrading and expanding their data center networking capabilities.

- Edge Computing Growth: The decentralization of computing power to the edge demands efficient networking solutions for distributed data centers, supporting real-time data processing and reduced latency.

Barriers & Challenges

Despite the strong growth potential, the market faces several significant barriers and challenges:

- Supply Chain Disruptions: Global semiconductor shortages and logistical complexities can impact the availability and lead times of critical networking components, leading to increased costs and project delays.

- Talent Shortage: A scarcity of skilled network engineers and cybersecurity professionals capable of designing, deploying, and managing complex data center networks poses a significant challenge.

- Cybersecurity Threats: The increasing sophistication of cyberattacks necessitates constant vigilance and investment in advanced security features within networking infrastructure, adding to deployment complexities and costs.

- Interoperability and Standardization: Ensuring seamless interoperability between diverse hardware and software from multiple vendors can be a complex undertaking, requiring adherence to evolving industry standards.

- High Capital Expenditure: The significant upfront investment required for high-performance networking equipment and infrastructure can be a deterrent for some organizations, particularly small and medium-sized businesses.

Growth Drivers in the United States Data Center Networking Market Market

The United States Data Center Networking Market is experiencing robust growth driven by several key factors. The relentless expansion of cloud computing, encompassing hyperscale, enterprise, and hybrid deployments, necessitates continuous upgrades to networking infrastructure for enhanced bandwidth and reduced latency. The burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) is a major catalyst, demanding high-performance networking solutions capable of handling massive datasets and complex computations. Furthermore, the increasing proliferation of the Internet of Things (IoT) devices is generating unprecedented volumes of data, requiring sophisticated networking to manage and process this information efficiently. Digital transformation initiatives across various industries, from healthcare to finance, are also fueling the demand for advanced data center networking solutions to support new applications and services. Government investments in secure and resilient infrastructure also contribute significantly to market expansion.

Challenges Impacting United States Data Center Networking Market Growth

The growth trajectory of the United States Data Center Networking Market is not without its hurdles. Persistent global supply chain issues, particularly concerning semiconductors, continue to impact the availability and cost of critical components, leading to extended lead times and potential project delays. The increasing complexity of network architectures and the rapid evolution of technologies create a significant challenge in finding and retaining skilled network engineers and cybersecurity professionals. Regulatory complexities surrounding data privacy and security, while driving demand for secure solutions, can also introduce compliance overheads and influence deployment strategies. Moreover, the highly competitive nature of the market necessitates continuous innovation and significant capital investment, creating pressure on profit margins for vendors. The escalating threat landscape of cyberattacks also demands constant upgrades and robust security measures, adding to the overall cost of ownership and operational challenges.

Key Players Shaping the United States Data Center Networking Market Market

- NVIDIA (Cumulus Networks Inc)

- IBM Corporation

- Arista Networks Inc

- Cisco Systems Inc

- HP Development Company L P

- Emerson Electric Co

- Dell Inc

- Schneider Electric

- Huawei Technologies Co Ltd

- VMware Inc

- Intel Corporation

- Eaton Corporation

Significant United States Data Center Networking Market Industry Milestones

- October 2023: Arista Networks has introduced a portfolio of 25G Ethernet switches to support primarily financial applications that demand high performance and low latency. The new 7130 25G Series boxes are a significant power and features upgrade over the vendor’s current 7130 10G Ethernet line of devices and promise to reduce link latency 2.5-fold for data transmission by reducing queuing, serialization delays and eliminating the need for latency-inducing Forward Error Correction (FEC) typically required by 25G Ethernet.

- May 2023: NVIDIA has announced SpectrumXtreme, an accelerated networking platform manufactured to enhance the performance and efficiency of the cloud-based on Ethernet AI. NVIDIA Spectrum-X is developed on networking developments powered by the firm coupling of the NVIDIA Spectrum-4 Ethernet switch with the NVIDIA BlueField-3 DPU, attaining 1.7x better overall AI performance and power efficiency, along with consistent, predictable performance in multi-tenant environments.

Future Outlook for United States Data Center Networking Market Market

The future outlook for the United States Data Center Networking Market remains exceptionally bright, characterized by sustained innovation and expanding opportunities. The increasing demand for higher bandwidth and lower latency will continue to drive the adoption of advanced networking technologies like 400G, 800G Ethernet, and beyond. The pivotal role of AI and machine learning in enterprise operations will fuel the demand for specialized, high-performance networking solutions, creating significant market potential for vendors offering optimized hardware and software. The continued growth of cloud services, coupled with the rise of edge computing, will necessitate more distributed, intelligent, and agile networking architectures. Strategic opportunities lie in providing integrated solutions that encompass hardware, software, and comprehensive management and security services. Companies that can effectively address the challenges of supply chain stability, talent acquisition, and evolving cybersecurity threats will be well-positioned for substantial growth in this dynamic market. The market is anticipated to reach XX Million USD by 2033, driven by these compelling growth catalysts.

United States Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

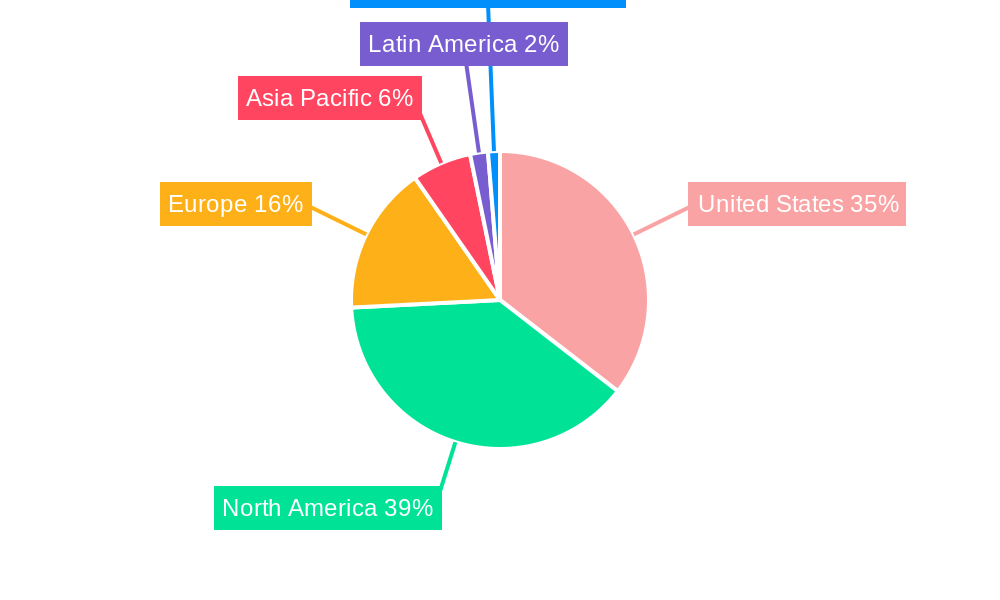

United States Data Center Networking Market Segmentation By Geography

- 1. United States

United States Data Center Networking Market Regional Market Share

Geographic Coverage of United States Data Center Networking Market

United States Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory constraints

- 3.4. Market Trends

- 3.4.1. Ethernet Switches is Anticipated to be the Largest Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America United States Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Unites States

- 6.1.2 Canada

- 7. Europe United States Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United Kingdom

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Rest of Europe

- 8. Asia Pacific United States Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 South Korea

- 8.1.5 Rest of Asia Pacific

- 9. Rest of the World United States Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 NVIDIA (Cumulus Networks Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 IBM Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Arista Networks Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cisco Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 HP Development Company L P

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Emerson Electric Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dell Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Huawei Technologies Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 VMware Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Intel Corporation

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Eaton Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 NVIDIA (Cumulus Networks Inc )

List of Figures

- Figure 1: United States Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: United States Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: United States Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 3: United States Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: United States Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: Unites States United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: United States Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United States Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: China United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Japan United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: South Korea United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Asia Pacific United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United States Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States Data Center Networking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: United States Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 22: United States Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 23: United States Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Data Center Networking Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the United States Data Center Networking Market?

Key companies in the market include NVIDIA (Cumulus Networks Inc ), IBM Corporation, Arista Networks Inc, Cisco Systems Inc, HP Development Company L P, Emerson Electric Co, Dell Inc, Schneider Electric, Huawei Technologies Co Ltd, VMware Inc, Intel Corporation, Eaton Corporation.

3. What are the main segments of the United States Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-Performance Computing across Europe; Growing Investments in IT& Telecom Sector.

6. What are the notable trends driving market growth?

Ethernet Switches is Anticipated to be the Largest Segment.

7. Are there any restraints impacting market growth?

Regulatory constraints.

8. Can you provide examples of recent developments in the market?

October 2023: Arista Networks has introduced a portfolio of 25G Ethernet switches to support primarily financial applications that demand high performance and low latency. The new 7130 25G Series boxes are a significant power and features upgrade over the vendor’s current 7130 10G Ethernet line of devices and promise to reduce link latency 2.5-fold for data transmission by reducing queuing, serialization delays and eliminating the need for latency-inducing Forward Error Correction (FEC) typically required by 25G Ethernet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Data Center Networking Market?

To stay informed about further developments, trends, and reports in the United States Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence