Key Insights

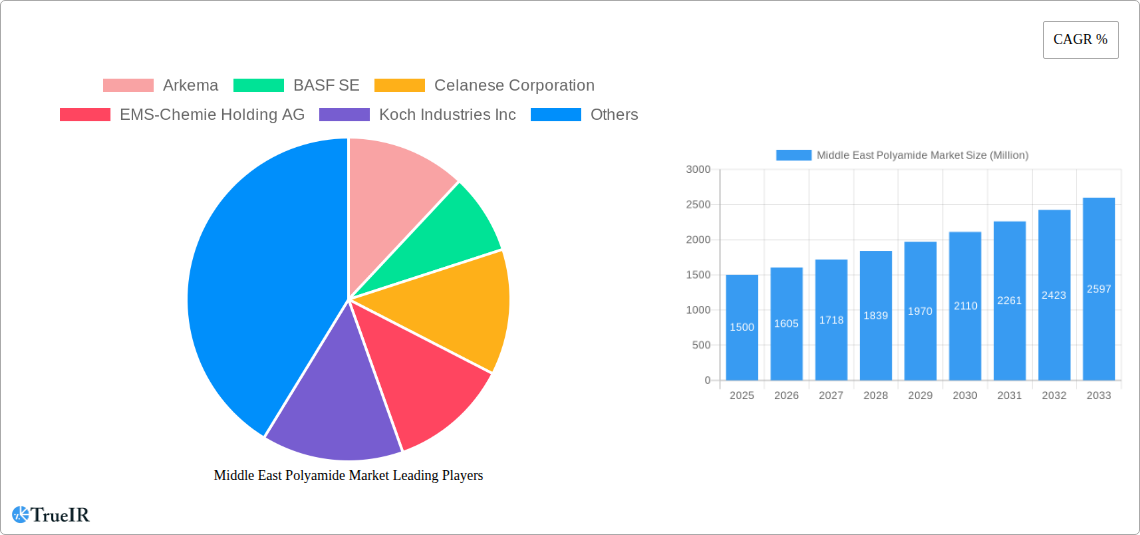

The Middle East Polyamide Market is poised for significant expansion, projected to reach a substantial market size of approximately USD 1,500 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of around 7.2% anticipated throughout the forecast period of 2025-2033. This robust growth is primarily fueled by the burgeoning demand across key end-user industries, notably automotive and electrical & electronics, which are experiencing rapid development within the region. The increasing adoption of lightweight and high-performance materials in automotive manufacturing, driven by fuel efficiency mandates and advancements in electric vehicle technology, is a major catalyst. Similarly, the expanding electronics sector, supported by government initiatives aimed at diversifying economies and fostering technological innovation, is creating sustained demand for advanced polyamide resins.

Middle East Polyamide Market Market Size (In Billion)

Further driving market expansion are critical trends such as the growing emphasis on sustainable and recyclable materials, pushing for the development and adoption of bio-based and recycled polyamides. Advancements in polymer processing technologies are also contributing to the market's upward trajectory by enabling the creation of customized polyamide grades for specific applications. However, the market faces certain restraints, including the volatility in raw material prices, particularly those linked to petrochemical feedstocks, which can impact production costs and profit margins. Fluctuations in global economic conditions and geopolitical uncertainties in the Middle East region could also pose challenges. Despite these headwinds, the strategic focus on industrial diversification and infrastructure development across Middle Eastern nations, coupled with significant investments in advanced manufacturing capabilities, provides a strong foundation for sustained growth in the polyamide market.

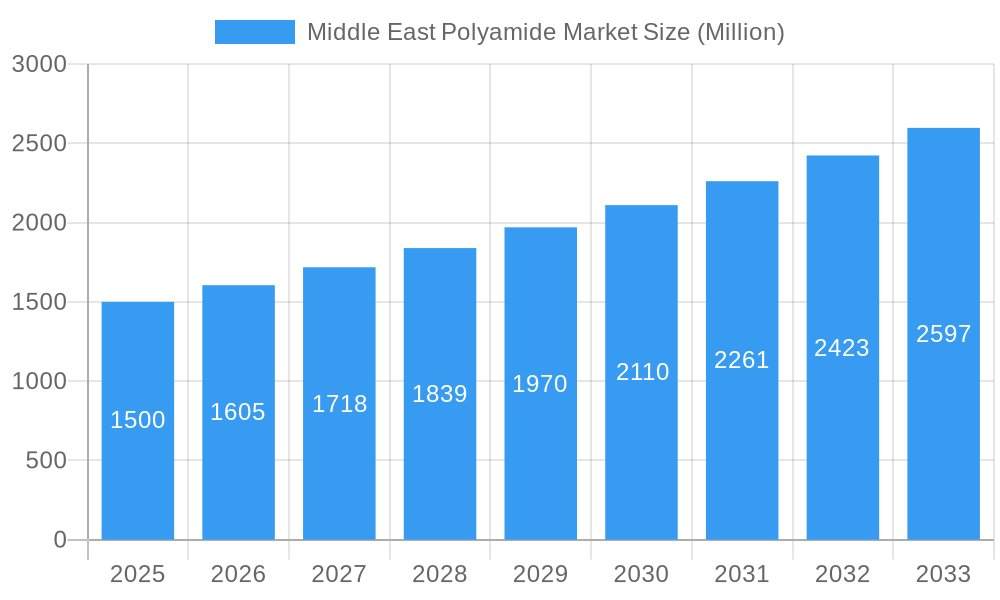

Middle East Polyamide Market Company Market Share

Middle East Polyamide Market: Comprehensive Analysis and Future Projections (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the Middle East Polyamide Market. Leveraging high-volume keywords such as "polyamide market Middle East," "PA 6," "PA 66," "aramid fiber," "polyphthalamide," "automotive plastics," "aerospace polymers," "construction materials," "electrical components," "packaging solutions," and "industrial machinery," this report offers unparalleled insights for industry stakeholders. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this comprehensive document is your definitive guide to understanding market dynamics, key players, and future opportunities.

Middle East Polyamide Market Market Structure & Competitive Landscape

The Middle East Polyamide Market exhibits a moderately concentrated structure, with key global players and emerging regional manufacturers vying for market share. Innovation drivers are primarily fueled by the demand for lightweight, durable, and high-performance materials across critical end-user industries like automotive and aerospace. Regulatory impacts, while evolving, are increasingly focusing on sustainability and material safety, influencing product development and manufacturing processes. Product substitutes, such as other engineering plastics and composite materials, present a competitive challenge, necessitating continuous improvement in polyamide properties and cost-effectiveness. The end-user segmentation reveals a significant reliance on the automotive sector, followed by building and construction and electrical and electronics. Mergers and acquisitions (M&A) trends are noteworthy, with strategic acquisitions aimed at expanding product portfolios and geographic reach. For instance, in November 2022, Celanese Corporation's acquisition of DuPont's M&M business underscored a trend towards consolidation and enhanced capabilities in engineered thermoplastics. The market concentration ratio is estimated to be around 60-70% for the top five players. M&A volumes have seen a steady increase, reflecting a strategic push for market consolidation and synergistic growth.

Middle East Polyamide Market Market Trends & Opportunities

The Middle East Polyamide Market is poised for robust growth, driven by a confluence of factors including escalating demand for high-performance materials, significant infrastructure development, and a burgeoning automotive sector. Market size is projected to reach an estimated USD 4,500 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025-2033. Technological shifts are paramount, with a strong emphasis on developing sustainable and recycled polyamide grades. Companies are actively investing in R&D to enhance properties such as thermal resistance, mechanical strength, and chemical inertness, directly responding to evolving consumer preferences for eco-friendly and durable products. The competitive dynamics are intensifying, characterized by strategic partnerships, product differentiation, and a focus on specialized applications. Market penetration rates for advanced polyamide grades are steadily increasing across key sectors. For example, the automotive industry's shift towards electric vehicles necessitates lighter and stronger materials for battery casings and structural components, creating a significant opportunity for specialized polyamide resins. Similarly, the growing emphasis on energy-efficient buildings in the Middle East is driving demand for advanced insulation and structural materials derived from polyamides. The packaging sector is also witnessing a surge in demand for high-barrier polyamide films for food and pharmaceutical applications, further expanding the market's reach. The increasing adoption of advanced manufacturing techniques, such as additive manufacturing (3D printing), is also opening new avenues for polyamide applications, allowing for the creation of complex geometries and customized parts. The development of bio-based polyamides is another significant trend, aligning with global sustainability initiatives and catering to the growing consumer consciousness regarding environmental impact. This trend presents a substantial opportunity for market players to differentiate themselves and capture a larger market share by offering greener alternatives. The robust growth in the construction sector, particularly in smart cities and mega-projects across the region, is a key driver for the demand for durable and fire-resistant polyamide-based materials in building components and infrastructure. The increasing digitalization across various industries is also driving demand for reliable and high-performance materials for electrical and electronic components, such as connectors, casings, and insulation.

Dominant Markets & Segments in Middle East Polyamide Market

The Automotive segment is identified as the dominant market within the Middle East Polyamide Market, driven by substantial growth in vehicle production and a strong push towards lightweighting and electrification. Within this sector, Polyamide (PA) 66 and Polyamide (PA) 6 are the most widely utilized sub-resin types, owing to their excellent mechanical properties, thermal stability, and cost-effectiveness.

Key Growth Drivers in the Automotive Segment:

- Lightweighting Initiatives: Increasing regulations and consumer demand for fuel efficiency and electric vehicle range are propelling the use of polyamides for replacing heavier metal components in engines, chassis, and interiors.

- Electric Vehicle (EV) Adoption: The growing EV market necessitates advanced materials for battery components, charging infrastructure, and specialized thermal management systems, where polyamides excel.

- Safety and Durability Standards: Polyamides contribute to enhanced vehicle safety through their impact resistance and ability to withstand high temperatures and harsh chemical environments.

- Manufacturing Advancements: The adoption of injection molding and other advanced manufacturing techniques allows for the cost-effective production of complex automotive parts using polyamides.

The Building and Construction segment also holds significant importance, fueled by large-scale infrastructure projects and the growing demand for sustainable and energy-efficient building materials. Polyamides are increasingly used in window profiles, insulation materials, pipes, and coatings, offering superior durability, weather resistance, and fire retardancy.

Key Growth Drivers in the Building and Construction Segment:

- Mega-Projects and Urban Development: Ambitious infrastructure development plans across the Middle East are creating substantial demand for durable construction materials.

- Energy Efficiency Mandates: Growing focus on sustainable construction practices and energy conservation drives the adoption of advanced insulation and building envelope solutions.

- Durability and Longevity: Polyamides offer excellent resistance to corrosion and weathering, ensuring the long-term performance of building components.

- Fire Safety Regulations: Enhanced fire safety standards in buildings are increasing the demand for flame-retardant materials, a property that polyamides can effectively deliver.

The Electrical and Electronics segment is another key contributor, with polyamides finding applications in connectors, switches, housings, and insulation due to their excellent dielectric properties, high heat resistance, and mechanical strength. The Aerospace sector, while smaller in volume, represents a high-value segment with polyamides being utilized for interior components, lightweight structural parts, and specialized applications demanding high performance and flame retardancy. The Industrial and Machinery segment benefits from polyamides' robustness and wear resistance for components like gears, bearings, and housings. The Packaging sector utilizes polyamides for high-barrier films, particularly for food and medical applications, ensuring extended shelf life and product integrity.

The sub-resin type Polyamide (PA) 66 dominates many of these applications due to its superior mechanical properties and higher melting point compared to PA 6, making it ideal for demanding environments. However, Polyamide (PA) 6 remains a strong contender due to its cost-effectiveness and versatility. Aramid fibers, known for their exceptional strength-to-weight ratio, are finding niche applications in high-performance composites for aerospace and protective gear. Polyphthalamide (PPA), with its enhanced thermal and chemical resistance, is increasingly used in under-the-hood automotive applications and high-temperature electrical connectors.

Middle East Polyamide Market Product Analysis

The Middle East Polyamide Market is characterized by continuous product innovation focused on enhancing material performance and sustainability. Key advancements include the development of higher-strength and temperature-resistant polyamide grades, such as specialized PA 66 and PPA variants, for demanding automotive and industrial applications. Furthermore, there is a significant trend towards bio-based and recycled polyamides, addressing environmental concerns and catering to the growing demand for sustainable materials. These innovations offer competitive advantages by enabling manufacturers to meet stringent performance requirements, reduce product weight, and improve overall efficiency. The market fit for these advanced polyamides is strong across sectors like automotive (lightweighting, EV components), aerospace (interior parts, composites), and electrical & electronics (high-temperature connectors).

Key Drivers, Barriers & Challenges in Middle East Polyamide Market

Key Drivers:

- Automotive Industry Growth: The expanding automotive sector, particularly the shift towards electric vehicles, is a primary driver for high-performance polyamides used in lightweighting and component manufacturing.

- Infrastructure Development: Large-scale construction projects across the Middle East necessitate durable and sustainable materials like polyamides for building components and infrastructure.

- Technological Advancements: Innovations in polyamide formulations, including reinforced grades and bio-based alternatives, are expanding application possibilities and market reach.

- Sustainability Initiatives: Growing environmental awareness and regulatory pressures are propelling the demand for recycled and bio-based polyamides.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials, such as crude oil and its derivatives, can impact production costs and profitability.

- Competition from Substitutes: Other engineering plastics and advanced composite materials pose a competitive threat, requiring continuous product development to maintain market share.

- Stringent Regulations: Evolving environmental and safety regulations, particularly concerning chemical usage and end-of-life product management, can present compliance challenges.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as highlighted by recent events, can affect the availability and cost of raw materials and finished products. The estimated impact of these disruptions can lead to a 5-10% increase in production costs.

Growth Drivers in the Middle East Polyamide Market Market

The Middle East Polyamide Market is propelled by several key growth drivers. Technologically, advancements in polymer science are leading to the development of enhanced polyamide grades with superior thermal resistance, mechanical strength, and chemical inertness, making them suitable for more demanding applications. Economically, the robust growth of the automotive industry, driven by increasing vehicle production and a rapid transition towards electric vehicles, is a significant catalyst. Government initiatives promoting industrial diversification and manufacturing excellence also play a crucial role. Regulatory factors, such as tightening emissions standards and a growing emphasis on sustainable materials, are creating a favorable environment for bio-based and recycled polyamides.

Challenges Impacting Middle East Polyamide Market Growth

Several challenges impact the growth of the Middle East Polyamide Market. Regulatory complexities, particularly concerning import/export policies and evolving environmental standards, can create uncertainty for market players. Supply chain issues, including the availability and cost of feedstock materials, can lead to production bottlenecks and increased operational expenses. Competitive pressures from alternative materials and other established polyamide producers necessitate continuous innovation and cost optimization. Quantifiable impacts of these challenges can include delayed project timelines and a potential 5-15% increase in manufacturing costs due to supply chain disruptions.

Key Players Shaping the Middle East Polyamide Market Market

- Arkema

- BASF SE

- Celanese Corporation

- EMS-Chemie Holding AG

- Koch Industries Inc

- LANXESS

- PCC

- Rabigh Refining and Petrochemical Company (Petro Rabigh)

Significant Middle East Polyamide Market Industry Milestones

- November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont, significantly strengthening its market position.

- September 2022: LANXESS introduced Durethan ECO, a sustainable polyamide resin incorporating recycled fibers derived from waste glass. This development underscores the industry's commitment to reducing its carbon footprint and promoting circular economy principles.

- May 2022: Arkema acquired Agiplast, marking a significant step towards becoming the first fully integrated high-performance polymer manufacturer offering both bio-based and recycled materials. This acquisition directly addresses the challenges of resource scarcity and end-of-life product management.

Future Outlook for Middle East Polyamide Market Market

The future outlook for the Middle East Polyamide Market is exceptionally promising, driven by sustained demand from key end-user industries and an accelerating focus on innovation and sustainability. Strategic opportunities lie in the continued growth of the automotive sector, particularly with the burgeoning electric vehicle market, and the ongoing large-scale infrastructure development across the region. The increasing adoption of advanced polyamides, including bio-based and recycled grades, will be a critical differentiator. Furthermore, the market's potential is being unlocked by advancements in material science and manufacturing technologies, enabling polyamides to meet increasingly stringent performance requirements and environmental standards. The estimated market potential for advanced polyamides is projected to increase by 20-25% by 2030.

Middle East Polyamide Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Aramid

- 2.2. Polyamide (PA) 6

- 2.3. Polyamide (PA) 66

- 2.4. Polyphthalamide

Middle East Polyamide Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Polyamide Market Regional Market Share

Geographic Coverage of Middle East Polyamide Market

Middle East Polyamide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Polyamide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Aramid

- 5.2.2. Polyamide (PA) 6

- 5.2.3. Polyamide (PA) 66

- 5.2.4. Polyphthalamide

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Celanese Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EMS-Chemie Holding AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koch Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LANXESS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PCC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rabigh Refining and Petrochemical Company (Petro Rabigh

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Middle East Polyamide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Polyamide Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Polyamide Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: Middle East Polyamide Market Revenue undefined Forecast, by Sub Resin Type 2020 & 2033

- Table 3: Middle East Polyamide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Middle East Polyamide Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 5: Middle East Polyamide Market Revenue undefined Forecast, by Sub Resin Type 2020 & 2033

- Table 6: Middle East Polyamide Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East Polyamide Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Polyamide Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Middle East Polyamide Market?

Key companies in the market include Arkema, BASF SE, Celanese Corporation, EMS-Chemie Holding AG, Koch Industries Inc, LANXESS, PCC, Rabigh Refining and Petrochemical Company (Petro Rabigh.

3. What are the main segments of the Middle East Polyamide Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.September 2022: LANXESS introduced a sustainable polyamide resin, Durethan ECO, which consists of recycled fibers made from waste glass to reduce its carbon footprint.May 2022: Arkema acquired Agiplast to become the first fully integrated high-performance polymer manufacturer offering both bio-based and recycled materials. The acquisition was aimed at addressing the challenges of resource scarcity and end-of-life products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Polyamide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Polyamide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Polyamide Market?

To stay informed about further developments, trends, and reports in the Middle East Polyamide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence