Key Insights

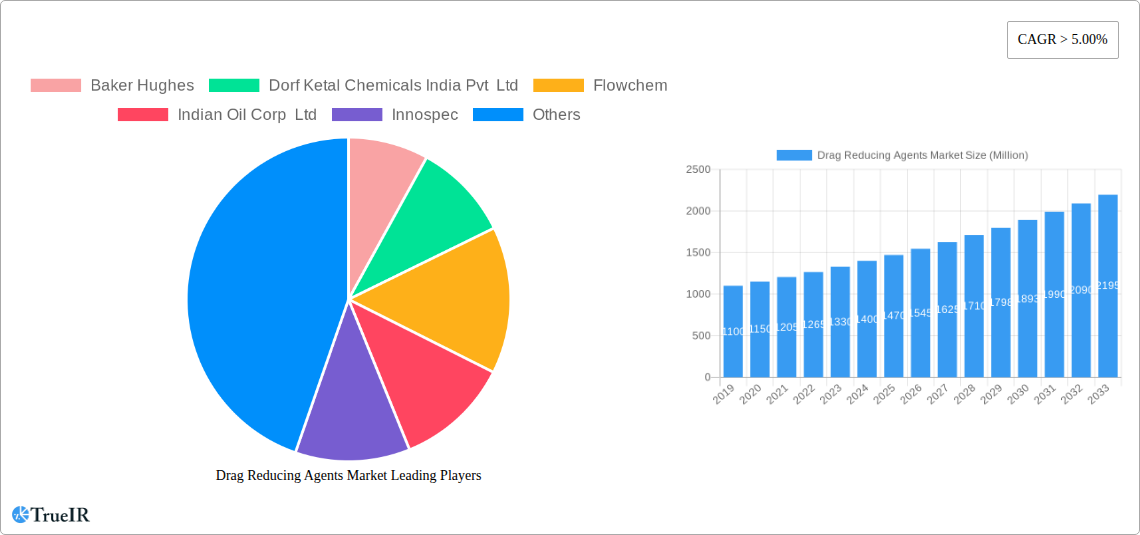

Drag Reducing Agents Market Market Size (In Million)

Drag Reducing Agents Market Market Structure & Competitive Landscape

The global Drag Reducing Agents market exhibits a moderately concentrated structure, characterized by the presence of both established multinational corporations and a growing number of regional players. Innovation drivers are primarily centered around enhancing DRA efficacy, developing environmentally friendly formulations, and improving injection and delivery systems for diverse operational conditions. Regulatory impacts, while evolving, are increasingly focused on environmental sustainability and worker safety, influencing product development and market entry strategies. Product substitutes for DRAs are limited, particularly for high-performance applications in crude oil and refined product transportation, thereby reinforcing the market's reliance on specialized chemical solutions. End-user segmentation reveals significant demand from the oil and gas industry, followed by refining and petrochemical sectors. Merger and acquisition (M&A) trends are indicative of a maturing market, with key players seeking to expand their technological capabilities, geographical reach, and product portfolios. For instance, the market has witnessed strategic acquisitions aimed at consolidating market share and integrating advanced application technologies. The overall volume of M&A activities in the DRA space is estimated to be in the range of several hundred million dollars annually, reflecting strategic consolidations and vertical integration efforts.

- Market Concentration: Moderate, with leading players holding significant market share.

- Innovation Drivers: Enhanced efficacy, eco-friendly formulations, improved delivery systems.

- Regulatory Impacts: Focus on environmental sustainability, worker safety, and emissions reduction.

- Product Substitutes: Limited for critical applications, enhancing DRA market stability.

- End-User Segmentation: Oil & Gas, Refining, Petrochemicals dominate demand.

- M&A Trends: Strategic acquisitions for technology integration, market expansion, and portfolio enhancement. Estimated M&A volume: XX Million USD annually.

Drag Reducing Agents Market Market Trends & Opportunities

The Drag Reducing Agents market is poised for significant expansion, driven by the continuous need for enhanced operational efficiency and cost reduction in fluid transportation. The global market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period, reaching an estimated value of $2,500 Million by 2033. Technological shifts are a major catalyst, with ongoing advancements in polymer science leading to the development of more potent and durable DRAs capable of withstanding extreme temperatures and pressures. These innovations are crucial for optimizing flow rates in complex pipelines, subsea operations, and heavy crude oil transport. Consumer preferences are increasingly leaning towards sustainable and biodegradable DRA solutions, prompting manufacturers to invest heavily in research and development of green alternatives. This trend also presents a significant opportunity for companies that can offer products with a reduced environmental footprint. Competitive dynamics are intensifying, with companies differentiating themselves through customized formulations, superior technical support, and integrated service offerings that encompass application engineering and performance monitoring. Market penetration rates are expected to rise, particularly in emerging economies with expanding energy infrastructure and a growing demand for efficient resource extraction and distribution. The strategic implementation of advanced DRA technology can unlock substantial economic benefits by reducing energy consumption, increasing throughput, and extending the lifespan of existing infrastructure. The global market for drag reducing agents is projected to grow from an estimated $1,500 Million in 2025 to over $2,500 Million by 2033. The CAGR is estimated to be approximately 6.5% during the forecast period.

Dominant Markets & Segments in Drag Reducing Agents Market

The Low- and Medium-phase Crude Oil application segment is projected to remain the dominant force within the global Drag Reducing Agents market, accounting for an estimated 45% of the total market share by 2033. This dominance is attributed to the sheer volume of crude oil transportation globally and the critical need to optimize flow rates, reduce pumping energy, and enhance pipeline throughput for these conventional crude grades. Infrastructure development, particularly the expansion of oil and gas pipelines in North America, the Middle East, and parts of Asia, directly fuels the demand for DRAs in this segment. Favorable government policies promoting energy security and efficient resource utilization further bolster this trend.

- Key Growth Drivers for Low- and Medium-phase Crude Oil:

- Extensive Pipeline Networks: Global reliance on existing and expanding crude oil pipeline infrastructure.

- Energy Security Policies: Government initiatives to ensure stable and efficient energy supply.

- Cost Optimization: Reduced energy consumption for pumping, leading to significant operational savings.

- Increased Throughput: Enhancing the capacity of existing pipelines without costly infrastructure upgrades.

The Heavy/Asphaltic Crude segment is also exhibiting robust growth, driven by the increasing exploitation of these challenging but abundant reserves. The high viscosity and density of heavy crude oil necessitate the use of high-performance DRAs to achieve commercially viable flow rates. Investments in advanced extraction and transportation technologies for heavy oil are directly translating into higher demand for specialized drag reducing agents.

- Key Growth Drivers for Heavy/Asphaltic Crude:

- Abundant Reserves: Increasing focus on tapping into heavy oil resources globally.

- Technological Advancements: Development of specialized DRAs capable of handling high viscosity fluids.

- Economic Viability: Enabling cost-effective transportation of heavy crude through pipelines.

The Multiphase Fluid segment, particularly in offshore oil and gas production, represents another significant growth area. The ability of DRAs to improve flow assurance in subsea pipelines carrying a mixture of oil, gas, and water is crucial for maximizing production from challenging offshore fields. The increasing complexity and depth of offshore operations further underscore the importance of this segment.

- Key Growth Drivers for Multiphase Fluid:

- Offshore Exploration & Production: Growing investments in deepwater and ultra-deepwater projects.

- Flow Assurance: Preventing slugging and ensuring continuous flow of mixed-phase fluids.

- Subsea Infrastructure: Optimization of flow in subsea collection and trunk lines.

The Refined Products segment, while smaller than crude oil transportation, presents steady growth opportunities, especially in regions with high refining capacities and extensive distribution networks. Ensuring efficient and cost-effective delivery of gasoline, diesel, and other refined fuels is paramount for meeting consumer demand.

- Key Growth Drivers for Refined Products:

- Growing Demand for Fuels: Increasing consumption of refined products globally.

- Efficient Distribution Networks: Optimizing the logistics of fuel transportation.

The Other Applications segment, encompassing areas like industrial water, wastewater, and slurries, is expected to witness niche growth driven by specific industrial needs for improved fluid handling and reduced pumping energy.

Drag Reducing Agents Market Product Analysis

Drag Reducing Agents (DRAs) are specialized polymers designed to reduce turbulent friction within pipelines, thereby increasing flow rates and reducing pumping energy requirements. Key product innovations focus on enhancing molecular weight, improving solubility in various fluid types, and developing formulations that maintain efficacy across a wide range of temperatures and pressures. Competitive advantages stem from the ability to offer customized solutions tailored to specific fluid compositions and pipeline conditions, leading to significant operational cost savings and increased throughput. The market is witnessing a trend towards more environmentally benign and biodegradable DRAs, aligning with increasing regulatory and industry demands for sustainability.

Key Drivers, Barriers & Challenges in Drag Reducing Agents Market

Key Drivers:

The Drag Reducing Agents market is propelled by the imperative for enhanced pipeline efficiency and cost reduction in the energy sector. Technological advancements in polymer science are yielding more potent and durable DRAs. The growing global demand for crude oil and refined products necessitates optimized transportation infrastructure. Favorable government policies supporting energy security and efficient resource management also act as significant growth catalysts. The increasing complexity of oil and gas extraction, particularly in challenging environments, further drives the adoption of DRAs for improved flow assurance.

Barriers & Challenges:

Challenges include the high initial cost of certain advanced DRA formulations. Stringent environmental regulations regarding chemical use and disposal can pose a barrier, demanding the development of eco-friendly alternatives. Supply chain disruptions, particularly for specialized raw materials, can impact production and availability. Intense competition among established players and new entrants can lead to price pressures. Furthermore, the need for specialized injection and monitoring equipment can present an adoption hurdle for some smaller operators. The estimated annual cost of supply chain disruptions impacting the DRA market can range from $50 Million to $100 Million.

Growth Drivers in the Drag Reducing Agents Market Market

The Drag Reducing Agents market is primarily driven by the fundamental need to optimize fluid transportation efficiency and minimize operational costs across the energy sector. Technological innovation in polymer chemistry is at the forefront, leading to the development of advanced DRAs with superior performance characteristics, including enhanced thermal stability and broader compatibility with different crude oil and refined product types. The ever-increasing global demand for oil and gas, coupled with the exploitation of more challenging reserves like heavy crude oil and deepwater offshore resources, directly fuels the need for effective flow assurance solutions. Favorable regulatory frameworks that encourage energy efficiency and pipeline integrity further support market growth. The economic imperative to maximize throughput and reduce energy consumption in existing pipeline infrastructure without significant capital expenditure acts as a substantial growth catalyst.

Challenges Impacting Drag Reducing Agents Market Growth

Despite robust growth drivers, the Drag Reducing Agents market faces several challenges. The high cost associated with some advanced DRA formulations can be a barrier to adoption, especially for smaller operators. Evolving environmental regulations concerning the use and disposal of chemicals necessitate continuous innovation towards more sustainable and biodegradable DRA products, which can involve significant R&D investment. Supply chain volatility for key raw materials can lead to production delays and increased costs, impacting overall market stability. Intense competition within the market can exert downward pressure on pricing, affecting profit margins. Additionally, the requirement for specialized injection and monitoring equipment can pose an upfront investment challenge for some end-users. Regulatory hurdles related to product approvals and environmental impact assessments can also prolong market entry for new products and companies. The overall impact of these challenges can lead to an estimated annual revenue loss of $XX Million to $XX Million due to delayed projects or suboptimal adoption rates.

Key Players Shaping the Drag Reducing Agents Market Market

- Baker Hughes

- Dorf Ketal Chemicals India Pvt Ltd

- Flowchem

- Indian Oil Corp Ltd

- Innospec

- Jiangyin Huaheng Auxiliary Co Ltd

- LiquidPower Specialty Products Inc

- NuGenTec

- Oil Flux Americas

- The Zoranoc Oilfield Chemical

Significant Drag Reducing Agents Market Industry Milestones

- August 2022: Baker Hughes announced an agreement to acquire Quest Integrity, a subsidiary of Team, Inc. This acquisition aims to enhance Baker Hughes' capabilities in technology-enabled asset inspection and reliability management solutions for industries including pipelines, refineries, and petrochemicals. Baker Hughes' pipeline inspection services are crucial for identifying pipeline anomalies that may necessitate the use of drag reducers to mitigate frictional pressure drops.

- October 2021: LiquidPower Specialty Products Inc. (LSPI) formed a strategic partnership with Safe Marine Transfer, LLC (SMT). This collaboration focuses on supplying LSPI's market-leading drag-reducing agents (DRA) for subsea applications using SMT's innovative all-electric dual barrier subsea storage and injection unit. This strategic move has the potential to significantly boost output from underwater well/drill centers by increasing flow rates in existing subsea production, collection, and trunk lines, offering a cost-effective solution.

Future Outlook for Drag Reducing Agents Market Market

The future outlook for the Drag Reducing Agents market is highly promising, driven by sustained global energy demand and the ongoing need for operational efficiency in fluid transportation. Strategic opportunities lie in the development and adoption of next-generation DRAs with enhanced environmental profiles and superior performance in extreme conditions. The increasing trend towards subsea production and the exploitation of unconventional oil reserves will further fuel demand. Companies that can offer integrated solutions, including advanced application technology and data analytics for performance optimization, are well-positioned for growth. Continued investment in research and development, coupled with strategic partnerships and acquisitions, will be crucial for market leaders to maintain their competitive edge and capitalize on the evolving needs of the global energy industry. The market is expected to see continued innovation in biodegradable DRAs and smart injection systems, further solidifying their role in efficient and sustainable fluid management.

Drag Reducing Agents Market Segmentation

-

1. Application

- 1.1. Low- and Medium-phase Crude Oil

- 1.2. Heavy/Asphaltic Crude

- 1.3. Multiphase Fluid

- 1.4. Refined Products

- 1.5. Other Applications

Drag Reducing Agents Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

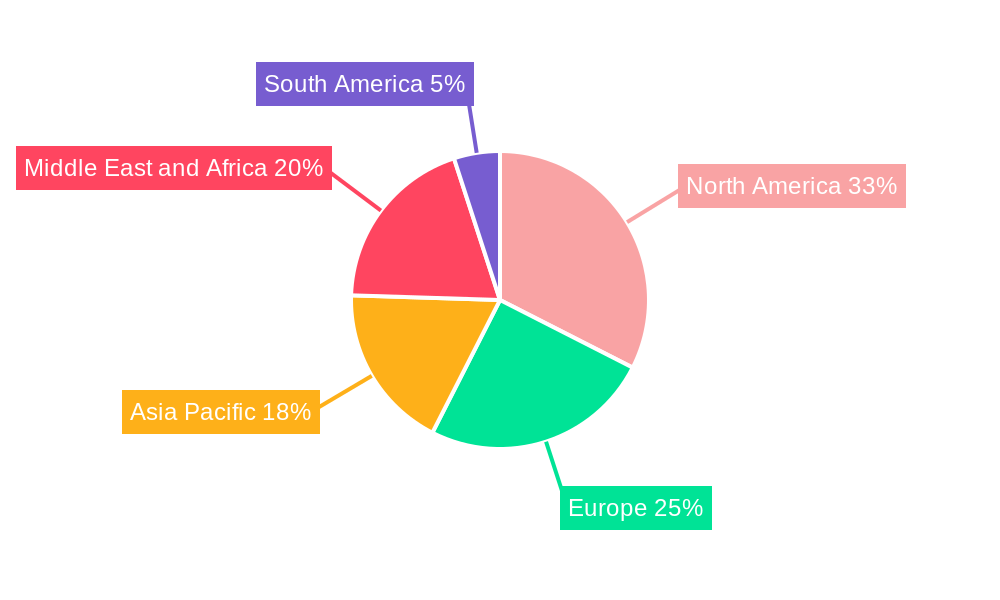

Drag Reducing Agents Market Regional Market Share

Geographic Coverage of Drag Reducing Agents Market

Drag Reducing Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Refineries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from Refineries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Crude Oil has a Substantial Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drag Reducing Agents Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Low- and Medium-phase Crude Oil

- 5.1.2. Heavy/Asphaltic Crude

- 5.1.3. Multiphase Fluid

- 5.1.4. Refined Products

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Drag Reducing Agents Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Low- and Medium-phase Crude Oil

- 6.1.2. Heavy/Asphaltic Crude

- 6.1.3. Multiphase Fluid

- 6.1.4. Refined Products

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Drag Reducing Agents Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Low- and Medium-phase Crude Oil

- 7.1.2. Heavy/Asphaltic Crude

- 7.1.3. Multiphase Fluid

- 7.1.4. Refined Products

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Drag Reducing Agents Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Low- and Medium-phase Crude Oil

- 8.1.2. Heavy/Asphaltic Crude

- 8.1.3. Multiphase Fluid

- 8.1.4. Refined Products

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Drag Reducing Agents Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Low- and Medium-phase Crude Oil

- 9.1.2. Heavy/Asphaltic Crude

- 9.1.3. Multiphase Fluid

- 9.1.4. Refined Products

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Drag Reducing Agents Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Low- and Medium-phase Crude Oil

- 10.1.2. Heavy/Asphaltic Crude

- 10.1.3. Multiphase Fluid

- 10.1.4. Refined Products

- 10.1.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baker Hughes

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dorf Ketal Chemicals India Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Flowchem

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Indian Oil Corp Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Innospec

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jiangyin Huaheng Auxiliary Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LiquidPower Specialty Products Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NuGenTec

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oil Flux Americas

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Zoranoc Oilfield Chemical*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Baker Hughes

List of Figures

- Figure 1: Global Drag Reducing Agents Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Drag Reducing Agents Market Revenue (million), by Application 2025 & 2033

- Figure 3: Asia Pacific Drag Reducing Agents Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific Drag Reducing Agents Market Revenue (million), by Country 2025 & 2033

- Figure 5: Asia Pacific Drag Reducing Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Drag Reducing Agents Market Revenue (million), by Application 2025 & 2033

- Figure 7: North America Drag Reducing Agents Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Drag Reducing Agents Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Drag Reducing Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Drag Reducing Agents Market Revenue (million), by Application 2025 & 2033

- Figure 11: Europe Drag Reducing Agents Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Drag Reducing Agents Market Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Drag Reducing Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Drag Reducing Agents Market Revenue (million), by Application 2025 & 2033

- Figure 15: South America Drag Reducing Agents Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Drag Reducing Agents Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Drag Reducing Agents Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Drag Reducing Agents Market Revenue (million), by Application 2025 & 2033

- Figure 19: Middle East and Africa Drag Reducing Agents Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa Drag Reducing Agents Market Revenue (million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Drag Reducing Agents Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Drag Reducing Agents Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Drag Reducing Agents Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Drag Reducing Agents Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Drag Reducing Agents Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: India Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Japan Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Drag Reducing Agents Market Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Drag Reducing Agents Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: United States Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Canada Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Drag Reducing Agents Market Revenue million Forecast, by Application 2020 & 2033

- Table 16: Global Drag Reducing Agents Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Germany Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: France Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Drag Reducing Agents Market Revenue million Forecast, by Application 2020 & 2033

- Table 23: Global Drag Reducing Agents Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Brazil Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Global Drag Reducing Agents Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Drag Reducing Agents Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: South Africa Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Drag Reducing Agents Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drag Reducing Agents Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Drag Reducing Agents Market?

Key companies in the market include Baker Hughes, Dorf Ketal Chemicals India Pvt Ltd, Flowchem, Indian Oil Corp Ltd, Innospec, Jiangyin Huaheng Auxiliary Co Ltd, LiquidPower Specialty Products Inc, NuGenTec, Oil Flux Americas, The Zoranoc Oilfield Chemical*List Not Exhaustive.

3. What are the main segments of the Drag Reducing Agents Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 749.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Refineries; Other Drivers.

6. What are the notable trends driving market growth?

Crude Oil has a Substantial Market Share.

7. Are there any restraints impacting market growth?

Increasing Demand from Refineries; Other Drivers.

8. Can you provide examples of recent developments in the market?

August 2022 : Baker Hughes announced an agreement to acquire Quest Integrity a subsidiary of Team, Inc, in the development and delivery of technology-enabled asset inspection and reliability management solutions for the pipeline, refinery, petrochemical, and power generation industries. Baker Hughes pipeline inspection services identify, describe, locate, and size abnormalities in a pipeline's wall that may need the use of drag reducers to decrease frictional pressure drops in a pipeline or conduit during fluid flow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drag Reducing Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drag Reducing Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drag Reducing Agents Market?

To stay informed about further developments, trends, and reports in the Drag Reducing Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence