Key Insights

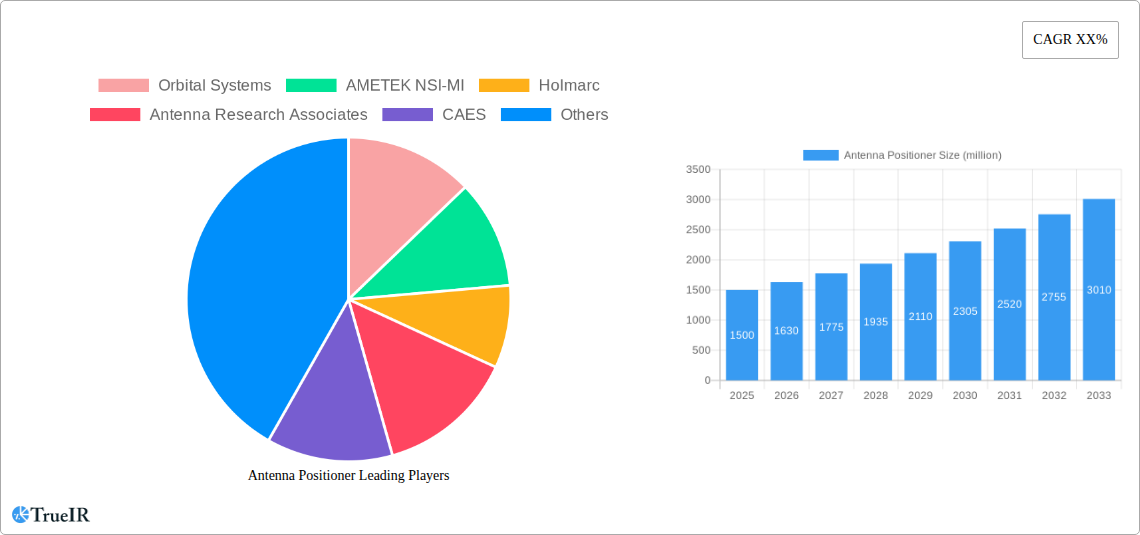

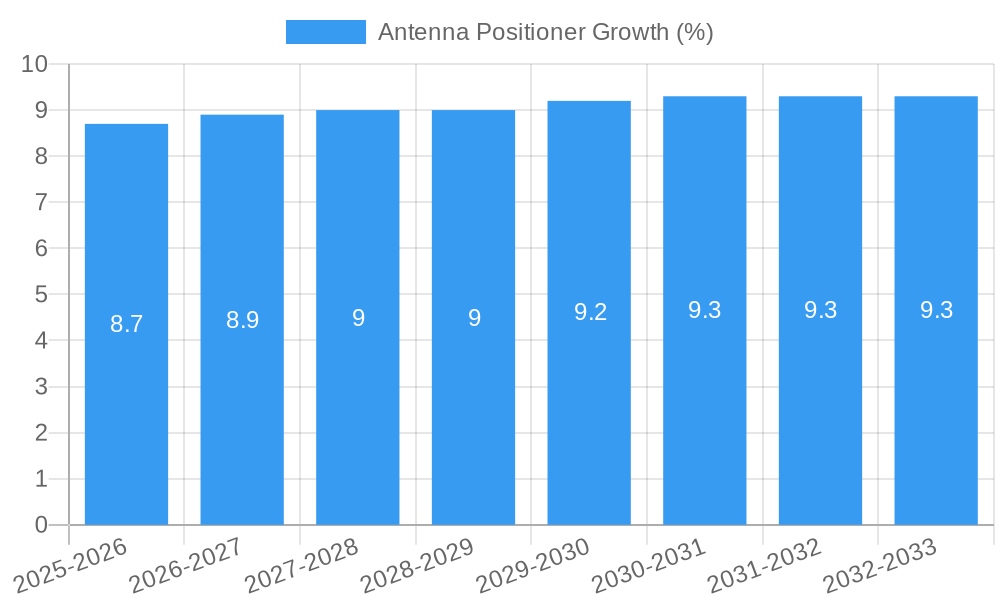

The global Antenna Positioner market is experiencing robust growth, projected to reach approximately $1,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 8.5% between 2025 and 2033. This expansion is primarily driven by the escalating demand for advanced testing and measurement solutions across both military and commercial sectors. The defense industry's continuous investment in sophisticated radar, electronic warfare systems, and communication technologies necessitates precise antenna alignment and calibration, fueling the adoption of sophisticated antenna positioners. Simultaneously, the burgeoning commercial applications, including telecommunications (especially the rollout of 5G networks requiring precise antenna beamforming), satellite communication, and automotive radar, are significant contributors to market expansion. The increasing complexity and performance requirements of modern antenna systems directly translate into a higher demand for accurate and versatile positioning solutions.

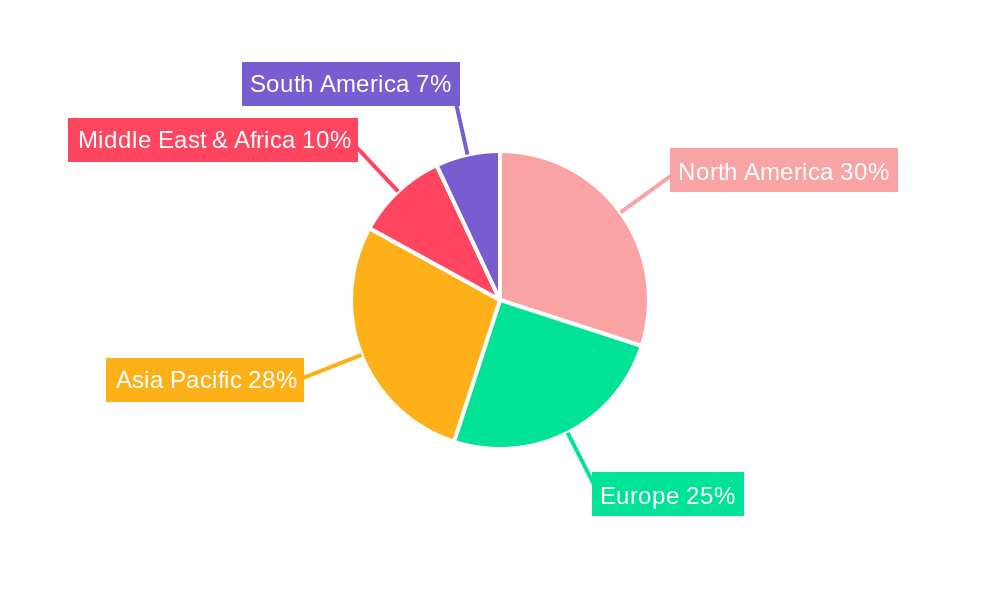

Technological advancements are a key trend shaping the antenna positioner market. Innovations are focusing on enhancing precision, speed, and automation in positioner systems, enabling faster and more reliable antenna testing. The development of highly accurate azimuth and multi-axis positioners (XY, XYZ) is crucial for simulating real-world operating conditions and validating antenna performance under diverse scenarios. However, the market faces certain restraints, including the high initial investment costs associated with advanced antenna positioner systems, which can be a barrier for smaller enterprises. Furthermore, the need for specialized expertise to operate and maintain these sophisticated systems can also present challenges. Despite these hurdles, the overarching trend towards miniaturization, increased connectivity, and the growing importance of efficient spectrum utilization are expected to sustain a positive growth trajectory for the antenna positioner market globally, with significant opportunities in regions like North America and Asia Pacific.

Absolutely! Here's a dynamic, SEO-optimized report description for Antenna Positioner, incorporating your specific requirements and keywords.

This comprehensive report provides an in-depth analysis of the global Antenna Positioner market, offering critical insights into market dynamics, technological advancements, and future growth prospects. Covering the historical period from 2019 to 2024 and extending through a detailed forecast period from 2025 to 2033, with a base and estimated year of 2025, this study is an indispensable resource for stakeholders seeking to understand the evolving landscape of antenna positioning solutions. The report delves into the intricate structure of the market, identifies key trends and opportunities, analyzes dominant segments, and provides a thorough product overview. It also meticulously examines the drivers, barriers, and challenges influencing market growth, alongside significant industry milestones and the future outlook. With an estimated market value of X million in the base year and projected growth to Y million by the end of the forecast period, the Antenna Positioner market presents a significant opportunity for innovation and investment.

Antenna Positioner Market Structure & Competitive Landscape

The global Antenna Positioner market exhibits a moderate to high degree of concentration, with several key players dominating significant market share, estimated to be around XX% held by the top five companies. Innovation remains a primary driver, fueled by increasing demand for advanced antenna tracking systems in military, aerospace, and telecommunications sectors. Regulatory impacts, though not overtly restrictive, influence product development and compliance standards, particularly for defense applications. Product substitutes, such as fixed antenna arrays and advanced signal processing techniques, present a minor competitive threat but are unlikely to displace the need for precision positioning. The end-user segmentation reveals a strong reliance on military and government applications, accounting for approximately XX% of the market revenue, followed by the commercial sector at XX%. Mergers and acquisitions (M&A) activity has been moderate, with an estimated XX deals recorded during the historical period, often aimed at expanding product portfolios or gaining access to new technologies.

- Innovation Drivers: Miniaturization, increased accuracy, higher load capacities, and integration with advanced control systems.

- Regulatory Impacts: Compliance with defense specifications (e.g., MIL-STD) and evolving telecommunications standards.

- Product Substitutes: Advanced beamforming antennas, software-defined radio (SDR) solutions.

- End-User Segmentation: Military & Government (XX%), Commercial (XX%).

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

Antenna Positioner Market Trends & Opportunities

The global Antenna Positioner market is poised for substantial growth, driven by escalating demand for precise and reliable antenna tracking across diverse applications. The market size, estimated at XX million in the base year of 2025, is projected to expand significantly by 2033, exhibiting a compound annual growth rate (CAGR) of XX%. Technological shifts are a cornerstone of this growth, with a notable emphasis on developing high-precision, high-speed, and robust positioners capable of handling increasingly complex antenna systems and demanding operational environments. The miniaturization trend is also prominent, enabling the integration of sophisticated positioning systems into smaller, more agile platforms. Consumer preferences are evolving towards integrated solutions offering seamless operation, advanced diagnostics, and remote control capabilities. The competitive dynamics are characterized by continuous innovation in precision, payload capacity, and environmental resilience, with companies investing heavily in research and development to gain a competitive edge. Market penetration rates for advanced positioners are steadily increasing, particularly in emerging economies and in sectors like satellite communications, ground-based radar, and advanced research facilities. Opportunities abound for manufacturers offering customized solutions, robust performance in harsh conditions, and adherence to stringent quality and performance standards. The ongoing expansion of 5G networks, the proliferation of satellite constellations, and the increasing sophistication of defense systems are all significant catalysts for future market expansion, creating a robust demand for antenna positioners that can meet these evolving technological frontiers. The adoption of AI and machine learning for predictive maintenance and optimized control algorithms is another burgeoning trend that presents significant opportunities for market players to differentiate their offerings.

Dominant Markets & Segments in Antenna Positioner

The Military & Government application segment is the dominant force in the global Antenna Positioner market, representing approximately XX% of the total market revenue. This dominance is driven by the extensive and continuous need for advanced tracking and pointing systems in defense applications, including radar systems, satellite communication terminals for reconnaissance and surveillance, electronic warfare, and missile guidance. The robust investments in national security and defense modernization programs worldwide are primary growth drivers within this segment. Countries with significant defense expenditures, such as the United States, China, and various European nations, represent leading markets.

Among the types of antenna positioners, the Azimuth Positioner segment holds a substantial market share, estimated at XX%, due to its fundamental role in directional antenna systems. This type of positioner is critical for applications requiring rotation around a vertical axis to acquire and track targets or signals. The Vertical XY Positioner segment follows, accounting for approximately XX%, offering two-axis movement crucial for a wider range of tracking scenarios, particularly in radar and satellite dish applications. The Horizontal XY Positioner segment, with an estimated XX% market share, provides three-axis movement, offering the highest degree of maneuverability and is essential for complex tracking requirements in advanced scientific research and specialized military applications. The Others segment, including specialized gimbals and multi-axis positioners, comprises the remaining XX% and caters to niche, high-performance requirements.

- Leading Region: North America, driven by substantial defense spending and a strong presence of aerospace and defense companies.

- Leading Country: United States, due to its extensive military research, development, and procurement activities.

- Dominant Application Segment: Military & Government (XX% market share), fueled by global defense modernization and surveillance needs.

- Key Growth Drivers for Military & Government:

- Increased geopolitical tensions leading to enhanced defense spending.

- Development and deployment of advanced radar and satellite communication systems.

- Need for sophisticated electronic warfare capabilities.

- Dominant Type Segment: Azimuth Positioner (XX% market share), essential for basic directional antenna pointing.

- Key Growth Drivers for Azimuth Positioners:

- Widespread use in communication and surveillance systems.

- Cost-effectiveness for numerous applications.

- Emerging Trends: Growing demand for integrated, highly precise XY and XYZ positioners for complex tracking scenarios.

Antenna Positioner Product Analysis

Antenna positioner product innovations are primarily focused on enhancing precision, speed, and payload capacity while reducing size and weight. Advanced materials and sophisticated servo-control systems are being integrated to achieve sub-arcsecond accuracy and high dynamic performance, crucial for advanced radar, satellite tracking, and scientific research. Applications range from terrestrial and satellite communication ground stations to military surveillance, electronic warfare, and radio astronomy. Competitive advantages are derived from superior accuracy, reliability in harsh environments, resistance to vibration and shock, and seamless integration with advanced control software, offering users optimized tracking algorithms and real-time diagnostic capabilities.

Key Drivers, Barriers & Challenges in Antenna Positioner

Key Drivers:

- Technological Advancements: Development of high-precision, high-speed servo motors and advanced control algorithms.

- Increasing Demand in Defense: Growing need for advanced radar, surveillance, and satellite communication systems.

- Expansion of Satellite Communication: Proliferation of satellite constellations for global internet coverage and specialized services.

- 5G Network Rollout: Demand for precise antenna alignment for base stations and advanced testing.

- Growth in IoT and Connected Devices: Requires sophisticated tracking for sensor networks and data acquisition.

Barriers & Challenges:

- High Development Costs: R&D for high-precision systems is capital-intensive.

- Supply Chain Disruptions: Reliance on specialized components can lead to delays and cost increases.

- Stringent Performance Requirements: Meeting demanding specifications for military and aerospace applications can be challenging.

- Competition from Alternative Technologies: Advanced signal processing and software-defined solutions.

- Skilled Workforce Shortage: Requirement for specialized engineers in design, manufacturing, and maintenance.

Growth Drivers in the Antenna Positioner Market

The Antenna Positioner market is propelled by several key drivers, primarily technological advancements leading to enhanced precision and speed, catering to the evolving needs of critical industries. The increasing global defense spending and the continuous modernization of military infrastructure, including radar systems and satellite communications for intelligence, surveillance, and reconnaissance (ISR), represent a significant growth catalyst. Furthermore, the rapid expansion of the satellite communication sector, driven by the deployment of mega-constellations for global internet access and the growing demand for broadband connectivity in remote areas, fuels the requirement for reliable ground station antenna positioning. The ongoing rollout of 5G networks necessitates precise antenna alignment and testing, creating opportunities for high-accuracy positioners. The proliferation of IoT devices and the expansion of smart cities also indirectly contribute by increasing the complexity of wireless communication networks that rely on accurate antenna placement for optimal performance.

Challenges Impacting Antenna Positioner Growth

The growth of the Antenna Positioner market faces several significant challenges. Regulatory complexities, particularly those related to export controls for advanced defense-related equipment, can hinder international sales and technology transfer. Supply chain issues, including the availability of specialized electronic components and high-precision mechanical parts, can lead to production delays and increased costs. Competitive pressures from both established players and emerging companies offering potentially lower-cost solutions can impact market share and profitability. Furthermore, the high upfront investment required for research and development of cutting-edge positioning technology acts as a barrier to entry for smaller companies. The cyclical nature of defense spending in some regions can also lead to fluctuations in demand.

Key Players Shaping the Antenna Positioner Market

- Orbital Systems

- AMETEK NSI-MI

- Holmarc

- Antenna Research Associates

- CAES

- Maturo

- ETS Lindgren

- Microwave Vision Group

- Milliwave Silicon Solution

- mmWave Test Solutions

- Smitek

Significant Antenna Positioner Industry Milestones

- 2019: Launch of next-generation high-precision azimuth positioners with improved load capacities.

- 2020: Introduction of advanced servo control systems for XYZ positioners offering enhanced tracking accuracy in dynamic environments.

- 2021: Major defense contractor integrates advanced antenna positioner solutions into new radar system development, showcasing enhanced target acquisition capabilities.

- 2022: Significant investment in R&D by leading players for miniaturized and ruggedized positioners for drone and unmanned aerial vehicle (UAV) applications.

- 2023: Emergence of new players focusing on cost-effective, high-performance positioners for commercial satellite ground stations.

- 2024: Development of AI-powered predictive maintenance features for antenna positioner systems, improving uptime and reducing operational costs.

Future Outlook for Antenna Positioner Market

- 2019: Launch of next-generation high-precision azimuth positioners with improved load capacities.

- 2020: Introduction of advanced servo control systems for XYZ positioners offering enhanced tracking accuracy in dynamic environments.

- 2021: Major defense contractor integrates advanced antenna positioner solutions into new radar system development, showcasing enhanced target acquisition capabilities.

- 2022: Significant investment in R&D by leading players for miniaturized and ruggedized positioners for drone and unmanned aerial vehicle (UAV) applications.

- 2023: Emergence of new players focusing on cost-effective, high-performance positioners for commercial satellite ground stations.

- 2024: Development of AI-powered predictive maintenance features for antenna positioner systems, improving uptime and reducing operational costs.

Future Outlook for Antenna Positioner Market

The future outlook for the Antenna Positioner market is exceptionally bright, driven by an confluence of technological advancements and escalating demand across key sectors. The continued growth of satellite communications, particularly low Earth orbit (LEO) constellations, will necessitate a surge in the deployment of ground stations equipped with highly accurate and responsive positioners. The defense sector's ongoing modernization efforts, coupled with the increasing sophistication of electronic warfare and ISR capabilities, will sustain robust demand. Furthermore, the expansion of 6G research and development, along with the evolving needs of advanced scientific research and atmospheric monitoring, presents novel opportunities for specialized antenna positioning solutions. The integration of artificial intelligence and machine learning for enhanced autonomy and predictive maintenance will further elevate the performance and value proposition of these systems, positioning the market for sustained, significant growth.

Antenna Positioner Segmentation

-

1. Application

- 1.1. Military & Government

- 1.2. Commercial

-

2. Types

- 2.1. Azimuth Positioner

- 2.2. Vertical XY Positioner

- 2.3. Horizontal XY Positioner

- 2.4. Others

Antenna Positioner Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Antenna Positioner REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antenna Positioner Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military & Government

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Azimuth Positioner

- 5.2.2. Vertical XY Positioner

- 5.2.3. Horizontal XY Positioner

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Antenna Positioner Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military & Government

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Azimuth Positioner

- 6.2.2. Vertical XY Positioner

- 6.2.3. Horizontal XY Positioner

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Antenna Positioner Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military & Government

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Azimuth Positioner

- 7.2.2. Vertical XY Positioner

- 7.2.3. Horizontal XY Positioner

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Antenna Positioner Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military & Government

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Azimuth Positioner

- 8.2.2. Vertical XY Positioner

- 8.2.3. Horizontal XY Positioner

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Antenna Positioner Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military & Government

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Azimuth Positioner

- 9.2.2. Vertical XY Positioner

- 9.2.3. Horizontal XY Positioner

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Antenna Positioner Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military & Government

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Azimuth Positioner

- 10.2.2. Vertical XY Positioner

- 10.2.3. Horizontal XY Positioner

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Orbital Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AMETEK NSI-MI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Holmarc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Antenna Research Associates

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CAES

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Maturo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ETS Lindgren

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microwave Vision Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Milliwave Silicon Solution

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 mmWave Test Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Smitek

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Orbital Systems

List of Figures

- Figure 1: Global Antenna Positioner Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Antenna Positioner Revenue (million), by Application 2024 & 2032

- Figure 3: North America Antenna Positioner Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Antenna Positioner Revenue (million), by Types 2024 & 2032

- Figure 5: North America Antenna Positioner Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Antenna Positioner Revenue (million), by Country 2024 & 2032

- Figure 7: North America Antenna Positioner Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Antenna Positioner Revenue (million), by Application 2024 & 2032

- Figure 9: South America Antenna Positioner Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Antenna Positioner Revenue (million), by Types 2024 & 2032

- Figure 11: South America Antenna Positioner Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Antenna Positioner Revenue (million), by Country 2024 & 2032

- Figure 13: South America Antenna Positioner Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Antenna Positioner Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Antenna Positioner Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Antenna Positioner Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Antenna Positioner Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Antenna Positioner Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Antenna Positioner Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Antenna Positioner Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Antenna Positioner Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Antenna Positioner Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Antenna Positioner Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Antenna Positioner Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Antenna Positioner Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Antenna Positioner Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Antenna Positioner Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Antenna Positioner Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Antenna Positioner Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Antenna Positioner Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Antenna Positioner Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Antenna Positioner Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Antenna Positioner Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Antenna Positioner Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Antenna Positioner Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Antenna Positioner Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Antenna Positioner Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Antenna Positioner Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Antenna Positioner Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Antenna Positioner Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Antenna Positioner Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Antenna Positioner Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Antenna Positioner Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Antenna Positioner Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Antenna Positioner Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Antenna Positioner Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Antenna Positioner Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Antenna Positioner Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Antenna Positioner Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Antenna Positioner Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Antenna Positioner Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antenna Positioner?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Antenna Positioner?

Key companies in the market include Orbital Systems, AMETEK NSI-MI, Holmarc, Antenna Research Associates, CAES, Maturo, ETS Lindgren, Microwave Vision Group, Milliwave Silicon Solution, mmWave Test Solutions, Smitek.

3. What are the main segments of the Antenna Positioner?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antenna Positioner," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antenna Positioner report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antenna Positioner?

To stay informed about further developments, trends, and reports in the Antenna Positioner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence