Key Insights

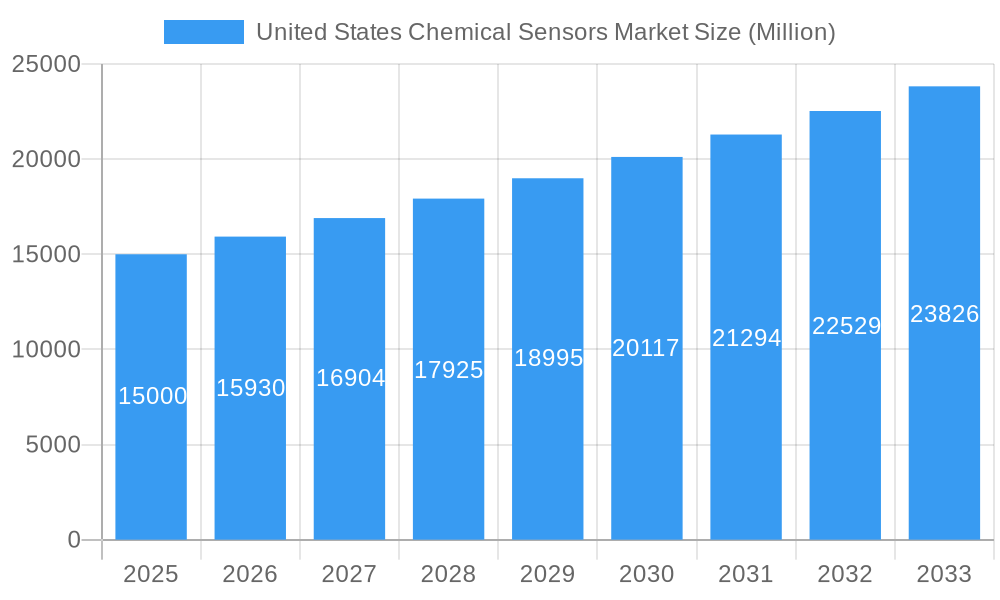

The United States chemical sensors market is poised for robust expansion, driven by escalating demand across a spectrum of critical industries. With a projected market size estimated at $15,000 million in 2025 and a Compound Annual Growth Rate (CAGR) of 6.20%, the market is set to reach approximately $20,000 million by 2033. This significant growth is fueled by increasing safety regulations, a rising focus on environmental protection, and advancements in industrial automation. The Industrial segment, encompassing manufacturing, energy, and petrochemicals, will continue to be a dominant force, leveraging chemical sensors for process optimization, quality control, and hazard detection. Simultaneously, the Medical sector is witnessing accelerated adoption for diagnostics and patient monitoring, while environmental monitoring applications are expanding due to growing awareness and stricter compliance requirements. Defense and Homeland Security also represent a strong growth avenue, with chemical sensors playing a vital role in threat detection and public safety initiatives.

United States Chemical Sensors Market Market Size (In Billion)

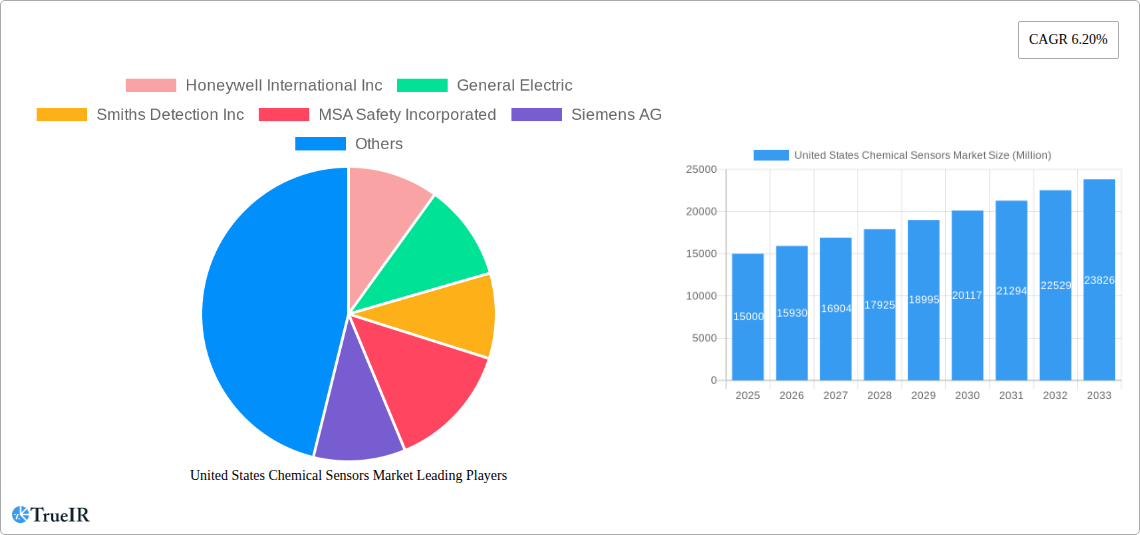

The market's trajectory is further shaped by technological innovations, particularly in the development of more sensitive, accurate, and cost-effective electrochemical and optical sensor technologies. These advancements are enabling broader applications and enhancing the performance of existing ones. However, certain restraints, such as the high initial investment costs for advanced sensor systems and the need for stringent calibration and maintenance, could temper rapid widespread adoption in some smaller-scale applications. Key players like Honeywell International Inc., General Electric, and Smiths Detection Inc. are at the forefront, investing heavily in research and development to introduce novel solutions and expand their market reach. The competitive landscape is characterized by strategic collaborations, mergers, and acquisitions aimed at enhancing product portfolios and gaining a competitive edge in this dynamic market.

United States Chemical Sensors Market Company Market Share

This in-depth report provides a detailed analysis of the United States chemical sensors market, offering insights into its structure, trends, opportunities, and competitive landscape. Covering the study period from 2019 to 2033, with a base year of 2025, the report delves into historical performance, current market dynamics, and future projections. Our analysis leverages high-volume SEO keywords to ensure maximum discoverability and engagement for industry professionals, investors, and stakeholders.

The United States chemical sensors market is poised for substantial growth, driven by increasing demand across industrial, medical, and environmental sectors. With advancements in technology and a growing emphasis on safety and compliance, the market presents significant opportunities for innovation and expansion.

United States Chemical Sensors Market Market Structure & Competitive Landscape

The United States chemical sensors market exhibits a moderately concentrated structure, with several key players dominating the landscape. Innovation serves as a primary driver, fueled by relentless research and development aimed at enhancing sensor accuracy, sensitivity, and miniaturization. Regulatory impacts, particularly concerning environmental protection and workplace safety, significantly influence market dynamics, compelling manufacturers to develop compliant and sophisticated sensor solutions. Product substitutes, while present in certain niche applications, are largely outpaced by the specialized capabilities offered by advanced chemical sensors. End-user segmentation reveals a strong reliance on industrial applications, followed closely by medical and environmental monitoring. Mergers and acquisitions (M&A) play a crucial role in market consolidation and expansion. In the historical period (2019-2024), we observed approximately 15-20 significant M&A activities, with a concentration ratio of the top 5 players estimated to be around 45-50% in terms of market share. Key players actively pursue strategic partnerships and acquisitions to broaden their product portfolios and geographical reach.

United States Chemical Sensors Market Market Trends & Opportunities

The United States chemical sensors market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033. This upward trajectory is underpinned by a confluence of technological advancements, evolving consumer preferences, and dynamic competitive forces. The increasing adoption of the Internet of Things (IoT) and the proliferation of smart devices are creating new avenues for sensor deployment, enabling real-time monitoring and data analytics in diverse applications. For instance, the surge in demand for smart home devices and wearable technology necessitates highly sensitive and compact chemical sensors for air quality monitoring and personal health tracking.

Technological shifts are characterized by the development of novel sensing materials and techniques, leading to enhanced performance metrics such as lower detection limits, faster response times, and greater selectivity. The transition from traditional electrochemical and catalytic bead sensors to more advanced optical and other emerging sensor technologies is a prominent trend. This evolution is driven by the need for more precise measurements in critical sectors like healthcare, where early disease detection and personalized medicine rely on highly accurate biosensors.

Consumer preferences are increasingly leaning towards solutions that offer convenience, safety, and environmental consciousness. This translates into a demand for portable and user-friendly chemical sensors for applications ranging from food safety testing to personal exposure monitoring. In the industrial realm, the focus on predictive maintenance and operational efficiency is driving the adoption of chemical sensors for process optimization, leak detection, and emissions control, thereby reducing operational costs and enhancing safety protocols.

Competitive dynamics are intensifying, with established players and emerging startups vying for market share. Differentiation through technological innovation, cost-effectiveness, and strong customer support are key strategies. The market is witnessing a trend towards specialized sensors tailored for specific industry needs, moving away from one-size-fits-all solutions. Furthermore, the growing awareness and stricter regulations surrounding air and water quality are creating significant market penetration opportunities for environmental monitoring sensors. The industrial safety segment, particularly in petrochemicals, mining, and manufacturing, continues to be a major growth driver due to stringent safety regulations and the inherent risks associated with hazardous environments. The healthcare sector's growing reliance on in-vitro diagnostics and point-of-care testing further fuels the demand for highly sensitive and reliable medical chemical sensors. The defense and homeland security sector is also a significant contributor, with a continuous need for advanced chemical detection systems for threat assessment and public safety.

Dominant Markets & Segments in United States Chemical Sensors Market

The Industrial application segment stands as the dominant force within the United States chemical sensors market, driven by stringent safety regulations, the need for process optimization, and the increasing adoption of automation across various manufacturing sectors. This segment is projected to account for over 35% of the total market revenue in the forecast period. Key growth drivers include the expansion of the petrochemical industry, the automotive manufacturing sector's emphasis on quality control, and the food and beverage industry's focus on product safety and shelf-life monitoring. The robust infrastructure investments in these industries necessitate reliable and precise chemical sensing solutions for monitoring emissions, detecting leaks, and ensuring workplace safety.

Within Product Types, Electrochemical sensors continue to hold a significant market share, estimated at around 30%, due to their cost-effectiveness, versatility, and wide range of applications, particularly in gas sensing. However, Optical sensors are experiencing rapid growth, fueled by their high sensitivity, selectivity, and non-contact measurement capabilities, finding increasing adoption in environmental monitoring and medical diagnostics. The projected CAGR for optical sensors is expected to be higher than the market average.

The Environmental Monitoring application segment is another major contributor, driven by growing public concern over pollution and climate change, coupled with increasing government mandates for air and water quality control. This segment is expected to witness a CAGR of approximately 8.0% during the forecast period. Key drivers include the need for real-time monitoring of greenhouse gases, industrial pollutants, and water contaminants. Government policies promoting sustainable practices and the development of smart city initiatives further propel the demand for advanced environmental sensing technologies.

The Medical application segment is also a significant growth area, spurred by the aging population, the rising prevalence of chronic diseases, and advancements in medical technology. The demand for point-of-care diagnostics, wearable health monitors, and in-vitro diagnostic devices is fueling innovation in biosensors and other medical-grade chemical sensors. This segment is anticipated to grow at a CAGR of around 7.8%.

While Defense and Homeland Security represent a smaller, yet critical, segment, its demand for advanced chemical detection systems for hazardous substances and explosives remains consistent, driven by national security imperatives.

United States Chemical Sensors Market Product Analysis

The United States chemical sensors market is characterized by continuous product innovation aimed at improving sensitivity, selectivity, and response times. Electrochemical sensors remain a staple, offering reliable detection of various gases with cost-effectiveness. Optical sensors are rapidly gaining traction, leveraging advanced photodetectors and novel optical materials for high-precision measurements in applications like medical diagnostics and environmental monitoring. Catalytic bead sensors continue to be crucial for detecting flammable gases in industrial settings. The broader "Other Product Types" category encompasses emerging technologies such as solid-state and microelectromechanical systems (MEMS) sensors, which offer miniaturization and integration capabilities. Competitive advantages are derived from miniaturization, low power consumption, enhanced connectivity (e.g., IoT integration), and the development of multi-analyte detection platforms.

Key Drivers, Barriers & Challenges in United States Chemical Sensors Market

Key Drivers:

- Technological Advancements: Continuous innovation in materials science, microfabrication, and data analytics leads to more accurate, sensitive, and cost-effective chemical sensors. The integration of AI and machine learning for predictive analytics further enhances their value.

- Stringent Regulations: Increasing regulatory mandates for environmental protection, workplace safety, and product quality drive the demand for advanced chemical monitoring solutions across industries.

- Growing Awareness: Heightened public awareness of health and environmental issues fuels demand for sensors in consumer products and environmental monitoring.

- Industrial Automation: The drive for efficiency and safety in industrial processes necessitates the deployment of real-time chemical sensing for process control and anomaly detection.

Key Barriers & Challenges:

- High Development Costs: The research and development of novel sensor technologies can be capital-intensive, posing a barrier for smaller players.

- Calibration and Maintenance: Ensuring the accuracy and longevity of chemical sensors often requires regular calibration and maintenance, which can be a logistical and cost challenge for end-users.

- Interference and False Positives: In complex environments, some sensors can be susceptible to interference from other substances, leading to false positives or inaccurate readings, impacting their reliability.

- Supply Chain Disruptions: The global supply chain for specialized electronic components and raw materials can be susceptible to disruptions, impacting production timelines and costs. For instance, a 10-15% increase in component prices due to supply chain issues was observed during the historical period.

- Market Fragmentation: While dominated by key players, the market also comprises numerous niche players, leading to fragmentation and challenges in standardization.

Growth Drivers in the United States Chemical Sensors Market Market

The United States chemical sensors market is propelled by a confluence of powerful growth drivers. Technological innovation, particularly in nanotechnology and advanced materials, enables the development of smaller, more sensitive, and highly selective sensors. The increasing adoption of IoT and the demand for real-time data analytics across industries, from smart manufacturing to precision agriculture, create a vast market for connected chemical sensors. Economic factors, such as the push for increased operational efficiency and reduced waste in industrial processes, directly correlate with the demand for sophisticated chemical monitoring. Furthermore, evolving regulatory landscapes, with stricter environmental protection laws and enhanced workplace safety standards, act as significant catalysts, compelling businesses to invest in advanced sensing technologies for compliance and risk mitigation. The rising prevalence of personalized healthcare and the demand for point-of-care diagnostics also contribute significantly to market expansion.

Challenges Impacting United States Chemical Sensors Market Growth

Despite the positive outlook, several challenges can impede the growth of the United States chemical sensors market. Regulatory complexities, particularly the evolving standards and certification processes for new sensor technologies, can lead to extended development cycles and market entry delays. Supply chain vulnerabilities, as evidenced by recent global disruptions, can impact the availability and cost of essential components, affecting manufacturing output and pricing strategies. Intense competitive pressures from both established multinational corporations and nimble startups can lead to price erosion and a need for continuous innovation to maintain market share. The initial investment cost for advanced sensing systems can also be a barrier for some smaller enterprises, particularly in sectors with tighter profit margins. Furthermore, ensuring the long-term reliability and accuracy of sensors in harsh industrial or environmental conditions, and mitigating the risk of false positives or negatives, remain ongoing technical challenges that can affect adoption rates.

Key Players Shaping the United States Chemical Sensors Market Market

- Honeywell International Inc

- General Electric

- Smiths Detection Inc

- MSA Safety Incorporated

- Siemens AG

- SICK AG

- Hans Turck GmbH & Co KG

- Pepperl+Fuchs Group

- AirTest Technologies Inc

- SenseAir AB

Significant United States Chemical Sensors Market Industry Milestones

- January 2021: Sensemetrics introduced Strand, a sensor connectivity device, as part of its sensor automation product portfolio, which can be applied in mining amongst other industries. This development enhanced the integration and data management capabilities for various sensor types.

- December 2020: The US-based CTS Corporation acquired Sensor Scientific Inc., a privately held temperature sensing company. Sensor Scientific is a provider of thermistors and temperature sensor assemblies serving OEMs for several applications in the industrial markets, amongst others. This acquisition strengthened CTS Corporation's position in the industrial sensor market by expanding its temperature sensing portfolio.

Future Outlook for United States Chemical Sensors Market Market

The future outlook for the United States chemical sensors market is exceptionally bright, driven by sustained technological advancements and expanding application frontiers. The continued integration of AI and machine learning will enable predictive capabilities and smart decision-making based on sensor data. The growing demand for sustainable solutions will fuel the development of sensors for environmental remediation and resource management. Miniaturization and the rise of wearable and IoT-enabled devices will further democratize access to chemical sensing technology across consumer and industrial sectors. Strategic collaborations between sensor manufacturers, software developers, and end-users will unlock new market opportunities and drive innovation. The market's trajectory points towards increasingly sophisticated, interconnected, and intelligent chemical sensing solutions playing a pivotal role in enhancing safety, efficiency, and well-being across the nation.

United States Chemical Sensors Market Segmentation

-

1. Product Type

- 1.1. Electrochemical

- 1.2. Optical

- 1.3. Pallister/Catalytic Bead

- 1.4. Other Product Types

-

2. Application

- 2.1. Industrial

- 2.2. Medical

- 2.3. Environmental Monitoring

- 2.4. Defense and Homeland Security

- 2.5. Other Applications

United States Chemical Sensors Market Segmentation By Geography

- 1. United States

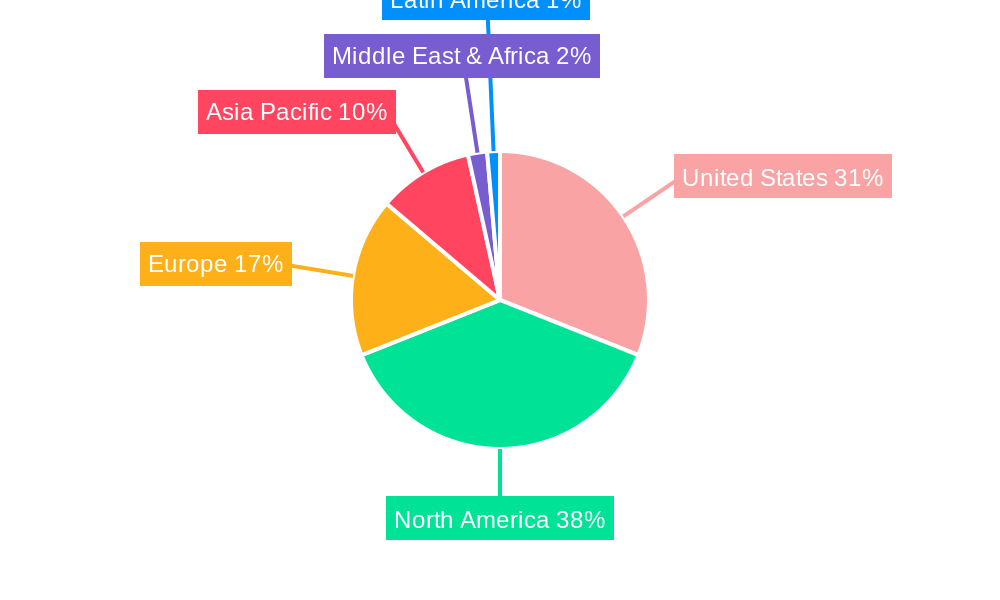

United States Chemical Sensors Market Regional Market Share

Geographic Coverage of United States Chemical Sensors Market

United States Chemical Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Adoption from Automotive and Healthcare Sector

- 3.3. Market Restrains

- 3.3.1. Lower Awareness of Facility Management Services

- 3.4. Market Trends

- 3.4.1. Medical Segment will Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Electrochemical

- 5.1.2. Optical

- 5.1.3. Pallister/Catalytic Bead

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Medical

- 5.2.3. Environmental Monitoring

- 5.2.4. Defense and Homeland Security

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa United States Chemical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 General Electric

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Smiths Detection Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 MSA Safety Incorporated

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Siemens AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SICK AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Hans Turck GmbH & Co KG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Pepperl+Fuchs Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 AirTest Technologies Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SenseAir AB

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: United States Chemical Sensors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Chemical Sensors Market Share (%) by Company 2025

List of Tables

- Table 1: United States Chemical Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: United States Chemical Sensors Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: United States Chemical Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: United States Chemical Sensors Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 5: United States Chemical Sensors Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United States Chemical Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: United States Chemical Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Chemical Sensors Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 11: United States Chemical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United States Chemical Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 15: United States Chemical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United States Chemical Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: United States Chemical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United States Chemical Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United States Chemical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United States Chemical Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 27: United States Chemical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United States Chemical Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: United States Chemical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: United States Chemical Sensors Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United States Chemical Sensors Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: United States Chemical Sensors Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 35: United States Chemical Sensors Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: United States Chemical Sensors Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: United States Chemical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: United States Chemical Sensors Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Chemical Sensors Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the United States Chemical Sensors Market?

Key companies in the market include Honeywell International Inc, General Electric, Smiths Detection Inc, MSA Safety Incorporated, Siemens AG, SICK AG, Hans Turck GmbH & Co KG, Pepperl+Fuchs Group, AirTest Technologies Inc, SenseAir AB.

3. What are the main segments of the United States Chemical Sensors Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Developments in Miniaturised and Portable Electrochemical Sensors; Increased Adoption from Automotive and Healthcare Sector.

6. What are the notable trends driving market growth?

Medical Segment will Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Lower Awareness of Facility Management Services.

8. Can you provide examples of recent developments in the market?

January 2021: Sensemetrics introduced Strand, a sensor connectivity device, as part of its sensor automation product portfolio, which can be applied in mining amongst other industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Chemical Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Chemical Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Chemical Sensors Market?

To stay informed about further developments, trends, and reports in the United States Chemical Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence