Key Insights

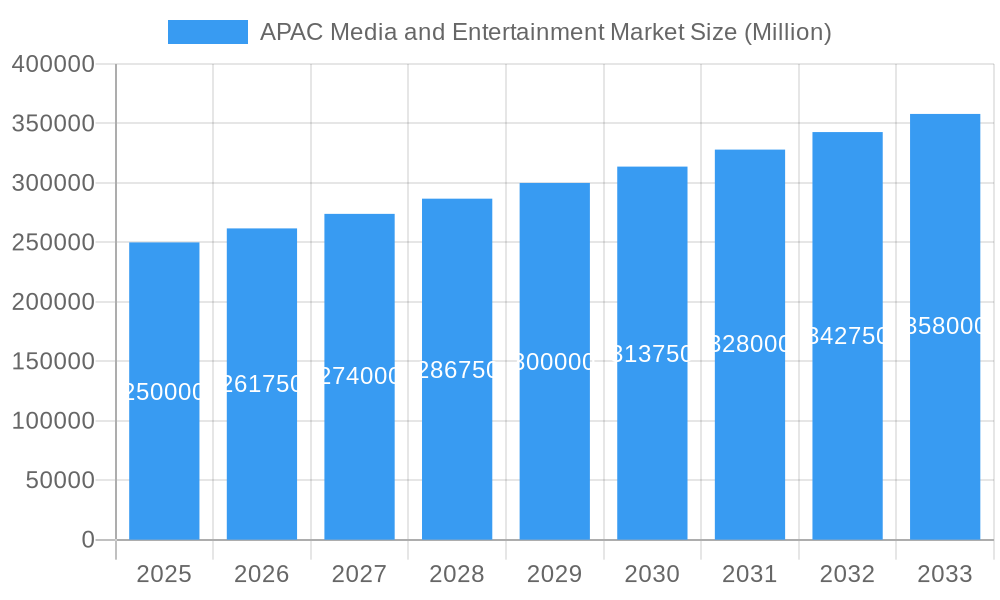

The APAC Media and Entertainment market is poised for robust expansion, projected to reach an estimated $250,000 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 4.77% through 2033. This dynamic growth is primarily fueled by a confluence of factors, including the accelerating digital transformation across the region, increasing internet penetration, and a burgeoning young, tech-savvy population with a growing appetite for diverse entertainment content. The rise of mobile-first consumption, the proliferation of streaming services, and the significant investments in content creation and distribution are further propelling the market forward. Notably, emerging economies within APAC are leading this surge, driven by a rising disposable income and a greater access to digital platforms. The increasing adoption of high-speed internet, particularly 5G, is unlocking new avenues for immersive entertainment experiences, such as augmented reality (AR) and virtual reality (VR), further cementing the region's position as a global media powerhouse.

APAC Media and Entertainment Market Market Size (In Billion)

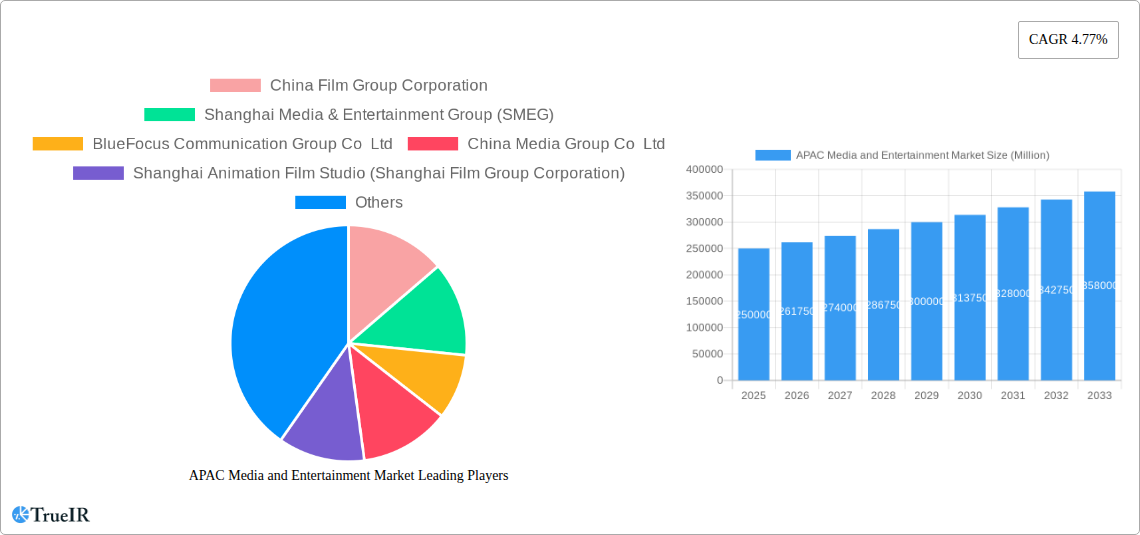

Key segments such as Filmed Entertainment, Internet Advertising, Music, and Video Games and e-sports are exhibiting exceptional growth trajectories, reflecting evolving consumer preferences and technological advancements. The Business-to-business (B2B) segment, encompassing advertising and content licensing, also presents substantial opportunities. Despite the overall optimistic outlook, certain restraints like evolving regulatory landscapes in some countries and intense competition among a vast array of players could pose challenges. However, the innovative strategies adopted by leading companies like China Film Group Corporation, Shanghai Media & Entertainment Group, and Zee Entertainment Enterprises Limited, coupled with strategic expansions into untapped markets and the development of localized content, are expected to navigate these hurdles effectively. The Asia Pacific region, with China and India at its forefront, is set to dominate this market, followed by significant contributions from Japan and South Korea, underscoring the region's pivotal role in shaping the future of global media and entertainment.

APAC Media and Entertainment Market Company Market Share

This in-depth report offers a definitive analysis of the dynamic APAC Media and Entertainment Market, covering market structure, competitive landscape, trends, opportunities, dominant segments, and future outlook. Leveraging high-volume SEO keywords such as "APAC media market," "Asia Pacific entertainment industry," "filmed entertainment growth," "digital media trends," "internet advertising APAC," and "video games market Asia," this report is designed for industry leaders, investors, and strategists seeking unparalleled insights. The study encompasses a comprehensive period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019 to 2024.

APAC Media and Entertainment Market Market Structure & Competitive Landscape

The APAC Media and Entertainment Market is characterized by a diverse and evolving structure, with market concentration varying significantly across its numerous sub-segments. Innovation is a key driver, fueled by rapid technological adoption and a burgeoning digital infrastructure. Regulatory landscapes play a crucial role, influencing content distribution, advertising practices, and market entry strategies. Substitute products are increasingly prevalent, with digital streaming services challenging traditional broadcast models and mobile gaming competing for consumer attention. End-user segmentation spans a wide demographic, from B2B enterprises seeking advertising solutions to individual consumers engaging with entertainment content. Mergers and acquisitions (M&A) trends indicate a strategic consolidation, with companies aiming to expand their portfolios, enhance technological capabilities, and achieve economies of scale. For instance, M&A activities in the filmed entertainment sector often focus on acquiring intellectual property and expanding distribution networks. Regulatory impacts, such as content localization policies, can shape market entry barriers and competitive dynamics. The competitive landscape is robust, with both established media giants and agile digital-native players vying for market share. Understanding these structural elements is critical for navigating the complexities of this vast and rapidly growing market.

APAC Media and Entertainment Market Market Trends & Opportunities

The APAC Media and Entertainment Market is poised for substantial growth, driven by a confluence of factors including an expanding middle class, increasing disposable incomes, and a highly digitally-connected population. The market size is projected to reach over US$ 3,500 Million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of XX% projected for the forecast period (2025–2033). Technological shifts are at the forefront, with the pervasive adoption of 5G networks, advancements in Artificial Intelligence (AI) for content creation and personalization, and the rise of immersive technologies like Augmented Reality (AR) and Virtual Reality (VR) transforming content delivery and consumption. Consumer preferences are rapidly evolving, with a strong inclination towards on-demand streaming services, short-form video content, and interactive entertainment experiences such as video games and e-sports. The demand for localized and culturally relevant content is also surging, presenting significant opportunities for regional content creators. Competitive dynamics are intensifying, leading to strategic partnerships, content licensing agreements, and a focus on user engagement metrics. The burgeoning digital advertising sector, driven by sophisticated data analytics and targeted campaigns, is another significant growth avenue. Furthermore, the increasing penetration of smart devices and the accessibility of affordable internet plans are expanding the reach of digital media and entertainment offerings to previously untapped markets. Opportunities abound in areas such as personalized content recommendations, interactive advertising formats, and the monetization of user-generated content.

Dominant Markets & Segments in APAC Media and Entertainment Market

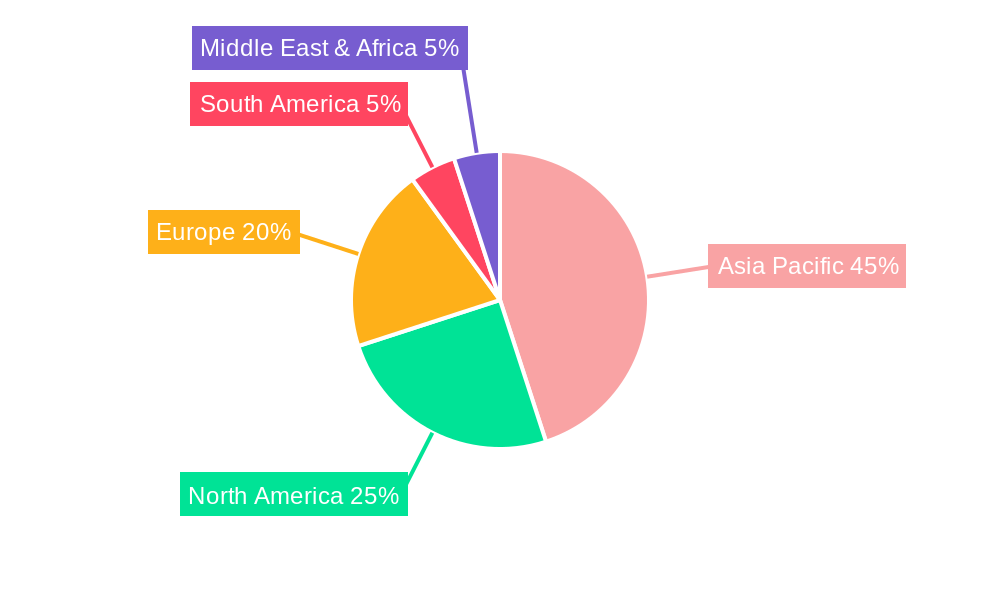

The APAC Media and Entertainment Market is dominated by a few key regions and segments, with China and India leading in terms of market size and growth potential. The Filmed Entertainment segment continues to be a powerhouse, driven by robust box office revenues and the exponential growth of streaming platforms. Internet Advertising is another colossal segment, fueled by the massive online user base and sophisticated digital marketing strategies. TV Subscription and Licence Fees remain a significant revenue stream, though its dominance is gradually being challenged by over-the-top (OTT) services.

- China: Leads in terms of overall market value, with strong performance in filmed entertainment, internet advertising, and video games. Government support for the digital economy and a vast consumer base contribute to its dominance.

- India: A rapidly growing market, particularly in television broadcasting, music streaming, and the burgeoning digital content space. Favorable demographics and increasing digital penetration are key growth drivers.

- Filmed Entertainment: This segment's dominance is underpinned by major studio productions, an expanding network of cinemas, and the rapid rise of domestic streaming services offering a diverse range of content.

- Internet Advertising: The sheer volume of internet users in APAC, coupled with the increasing sophistication of programmatic advertising and influencer marketing, makes this a highly lucrative segment.

- Video Games and e-sports: This segment is experiencing explosive growth, driven by mobile gaming's accessibility and the professionalization of e-sports tournaments, attracting significant viewership and investment.

The growth in these dominant segments is propelled by several key factors:

- Infrastructure Development: Widespread internet penetration, including the rollout of 5G networks, provides a robust foundation for digital media consumption.

- Favorable Policies: Government initiatives aimed at promoting digital content creation, e-commerce, and technological innovation are fostering a conducive market environment.

- Consumer Spending Power: Rising disposable incomes and a growing middle-class population are driving increased expenditure on entertainment and media products.

- Content Localization: The ability to produce and distribute content that resonates with local cultural nuances is a significant driver of engagement and revenue.

APAC Media and Entertainment Market Product Analysis

The APAC Media and Entertainment Market is characterized by a constant stream of product innovations designed to capture audience attention and monetize diverse content formats. Key product developments include the proliferation of high-definition and ultra-high-definition streaming content, the integration of interactive features within digital platforms, and the advancement of AI-powered recommendation engines for personalized user experiences. The competitive advantage lies in the ability to offer seamless cross-platform accessibility, curated content libraries, and engaging user interfaces. Technological advancements in cloud computing and data analytics are enabling more efficient content delivery and targeted advertising strategies. The market fit for these products is strong, catering to an ever-increasing demand for on-demand, personalized, and immersive entertainment experiences across the Asia Pacific region.

Key Drivers, Barriers & Challenges in APAC Media and Entertainment Market

Key Drivers: The APAC Media and Entertainment Market is propelled by several interconnected forces. Technological advancements, particularly the widespread adoption of smartphones and high-speed internet, are fundamental enablers. The growing middle class with increasing disposable income fuels consumer spending on entertainment. Government initiatives promoting digital transformation and content creation provide a supportive policy environment. The massive and young demographic, eager for diverse entertainment options, represents a significant market opportunity.

Barriers & Challenges: Despite robust growth, the market faces significant hurdles. Regulatory complexities and differing content censorship laws across various countries can hinder market expansion. Piracy and intellectual property infringement remain persistent challenges, impacting revenue streams. Fierce competition from both global giants and local players leads to price wars and increased marketing costs. Supply chain issues, particularly for hardware and infrastructure components, can also pose constraints. The high cost of content production and distribution requires substantial investment.

Growth Drivers in the APAC Media and Entertainment Market Market

Several key drivers are fueling the impressive growth of the APAC Media and Entertainment Market. Technologically, the rapid expansion of 5G networks and improved mobile internet penetration are facilitating seamless streaming and interactive experiences, significantly boosting digital content consumption. Economically, rising disposable incomes and a growing middle-class population across the region translate into increased consumer spending on entertainment and media. Regulatory factors, such as government support for local content creation and investment in digital infrastructure, are creating a more favorable ecosystem for market players. For example, initiatives to promote digital advertising and streaming services in countries like South Korea and Singapore are creating new avenues for growth and innovation.

Challenges Impacting APAC Media and Entertainment Market Growth

Challenges impacting APAC Media and Entertainment Market growth are multifaceted. Regulatory complexities and varying censorship laws across different countries present significant hurdles for market expansion and content distribution. Piracy and intellectual property infringement remain persistent concerns, eroding potential revenue streams for content creators and distributors. The competitive landscape is intensely fierce, with both global media conglomerates and agile local players vying for market share, often leading to price wars and increased marketing expenditures. Furthermore, supply chain issues related to hardware and technological infrastructure can disrupt service delivery and development timelines, especially in emerging economies within the region.

Key Players Shaping the APAC Media and Entertainment Market Market

- China Film Group Corporation

- Shanghai Media & Entertainment Group (SMEG)

- BlueFocus Communication Group Co Ltd

- China Media Group Co Ltd

- Shanghai Animation Film Studio (Shanghai Film Group Corporation)

- DB Corp Ltd

- Sun TV Network Limited

- Dish TV India Limited

- HT Media Limited

- Eros International PLC

- Zee Entertainment Enterprises Limited

Significant APAC Media and Entertainment Market Industry Milestones

- November 2022: The Telecom Regulatory Authority of India (TRAI) announced amendments to the new tariff order (NTO 2.0) in the broadcasting sector. The regulator set a ceiling of INR 19 per MRP for TV channels that can be part of a bouquet, limiting channel bundling discounts to 45%, while continuing its restraint of MRPs for TV channels. This significantly impacts TV channel pricing and bouquet formation strategies.

- October 2022: Taiwan developed its first English-language news, lifestyle, and entertainment television channel. This initiative aims to enhance Taiwan's international presence and global profile by fostering deeper relationships with like-minded democratic nations.

Future Outlook for APAC Media and Entertainment Market Market

The future outlook for the APAC Media and Entertainment Market is exceptionally promising, driven by sustained digital transformation and evolving consumer behavior. Strategic opportunities lie in the continued expansion of streaming services, the development of immersive entertainment experiences powered by AR/VR, and the monetization of the rapidly growing e-sports ecosystem. The increasing demand for localized content across diverse languages and cultures will present significant growth catalysts for regional players. Furthermore, advancements in AI and data analytics will enable hyper-personalized content delivery and highly effective advertising campaigns, driving revenue growth and enhancing user engagement. The market is expected to witness further consolidation and strategic partnerships as companies seek to capitalize on these burgeoning opportunities and solidify their positions in this dynamic landscape.

APAC Media and Entertainment Market Segmentation

-

1. Type

- 1.1. Business-to-business (B2B)

- 1.2. Book Publishing

- 1.3. Filmed Entertainment

- 1.4. Internet Access

- 1.5. Internet Advertising

- 1.6. Magazine Publishing

- 1.7. Music

- 1.8. Newspaper Publishing

- 1.9. Out-of-Home (OOH) Advertising

- 1.10. Radio

- 1.11. TV Advertising

- 1.12. TV Subscription and Licence Fees

- 1.13. Video Games and e-sports

APAC Media and Entertainment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Media and Entertainment Market Regional Market Share

Geographic Coverage of APAC Media and Entertainment Market

APAC Media and Entertainment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming

- 3.2.2 OTT

- 3.2.3 and Internet Advertising; Smart Utilization of Data Algorithms and AI Leading to Enhanced Digital Products and Services

- 3.3. Market Restrains

- 3.3.1. Significant Increase in Piracy Leading to Loss of Revenue

- 3.4. Market Trends

- 3.4.1. Increasing Trends Around Personalization and Increased Digitalization is expected to Drive the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Business-to-business (B2B)

- 5.1.2. Book Publishing

- 5.1.3. Filmed Entertainment

- 5.1.4. Internet Access

- 5.1.5. Internet Advertising

- 5.1.6. Magazine Publishing

- 5.1.7. Music

- 5.1.8. Newspaper Publishing

- 5.1.9. Out-of-Home (OOH) Advertising

- 5.1.10. Radio

- 5.1.11. TV Advertising

- 5.1.12. TV Subscription and Licence Fees

- 5.1.13. Video Games and e-sports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Business-to-business (B2B)

- 6.1.2. Book Publishing

- 6.1.3. Filmed Entertainment

- 6.1.4. Internet Access

- 6.1.5. Internet Advertising

- 6.1.6. Magazine Publishing

- 6.1.7. Music

- 6.1.8. Newspaper Publishing

- 6.1.9. Out-of-Home (OOH) Advertising

- 6.1.10. Radio

- 6.1.11. TV Advertising

- 6.1.12. TV Subscription and Licence Fees

- 6.1.13. Video Games and e-sports

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Business-to-business (B2B)

- 7.1.2. Book Publishing

- 7.1.3. Filmed Entertainment

- 7.1.4. Internet Access

- 7.1.5. Internet Advertising

- 7.1.6. Magazine Publishing

- 7.1.7. Music

- 7.1.8. Newspaper Publishing

- 7.1.9. Out-of-Home (OOH) Advertising

- 7.1.10. Radio

- 7.1.11. TV Advertising

- 7.1.12. TV Subscription and Licence Fees

- 7.1.13. Video Games and e-sports

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Business-to-business (B2B)

- 8.1.2. Book Publishing

- 8.1.3. Filmed Entertainment

- 8.1.4. Internet Access

- 8.1.5. Internet Advertising

- 8.1.6. Magazine Publishing

- 8.1.7. Music

- 8.1.8. Newspaper Publishing

- 8.1.9. Out-of-Home (OOH) Advertising

- 8.1.10. Radio

- 8.1.11. TV Advertising

- 8.1.12. TV Subscription and Licence Fees

- 8.1.13. Video Games and e-sports

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Business-to-business (B2B)

- 9.1.2. Book Publishing

- 9.1.3. Filmed Entertainment

- 9.1.4. Internet Access

- 9.1.5. Internet Advertising

- 9.1.6. Magazine Publishing

- 9.1.7. Music

- 9.1.8. Newspaper Publishing

- 9.1.9. Out-of-Home (OOH) Advertising

- 9.1.10. Radio

- 9.1.11. TV Advertising

- 9.1.12. TV Subscription and Licence Fees

- 9.1.13. Video Games and e-sports

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Media and Entertainment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Business-to-business (B2B)

- 10.1.2. Book Publishing

- 10.1.3. Filmed Entertainment

- 10.1.4. Internet Access

- 10.1.5. Internet Advertising

- 10.1.6. Magazine Publishing

- 10.1.7. Music

- 10.1.8. Newspaper Publishing

- 10.1.9. Out-of-Home (OOH) Advertising

- 10.1.10. Radio

- 10.1.11. TV Advertising

- 10.1.12. TV Subscription and Licence Fees

- 10.1.13. Video Games and e-sports

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China Film Group Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shanghai Media & Entertainment Group (SMEG)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BlueFocus Communication Group Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Media Group Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shanghai Animation Film Studio (Shanghai Film Group Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DB Corp Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sun TV Network Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dish TV India Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HT Media Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eros International PLC*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zee Entertainment Enterprises Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 China Film Group Corporation

List of Figures

- Figure 1: Global APAC Media and Entertainment Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 7: South America APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: South America APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Middle East & Africa APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Media and Entertainment Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific APAC Media and Entertainment Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific APAC Media and Entertainment Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Media and Entertainment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 25: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global APAC Media and Entertainment Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: China APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: India APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Media and Entertainment Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Media and Entertainment Market?

The projected CAGR is approximately 26.7%.

2. Which companies are prominent players in the APAC Media and Entertainment Market?

Key companies in the market include China Film Group Corporation, Shanghai Media & Entertainment Group (SMEG), BlueFocus Communication Group Co Ltd, China Media Group Co Ltd, Shanghai Animation Film Studio (Shanghai Film Group Corporation), DB Corp Ltd, Sun TV Network Limited, Dish TV India Limited, HT Media Limited, Eros International PLC*List Not Exhaustive, Zee Entertainment Enterprises Limited.

3. What are the main segments of the APAC Media and Entertainment Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trends Around Personalization and Increased Digitalization; Significant Growth in Online Gaming. OTT. and Internet Advertising; Smart Utilization of Data Algorithms and AI Leading to Enhanced Digital Products and Services.

6. What are the notable trends driving market growth?

Increasing Trends Around Personalization and Increased Digitalization is expected to Drive the Growth of the Market.

7. Are there any restraints impacting market growth?

Significant Increase in Piracy Leading to Loss of Revenue.

8. Can you provide examples of recent developments in the market?

November 2022: The Telecom Regulatory Authority of India (TRAI) announced amendments to the new tariff order (NTO 2.0) in the broadcasting sector. The regulator has set a ceiling of INR 19 per MRP for TV channels that can be part of the bouquet. It is now limiting channel bundling discounts to 45%, while at the same time, it continues its restraint of MRPs for TV channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Media and Entertainment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Media and Entertainment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Media and Entertainment Market?

To stay informed about further developments, trends, and reports in the APAC Media and Entertainment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence