Key Insights

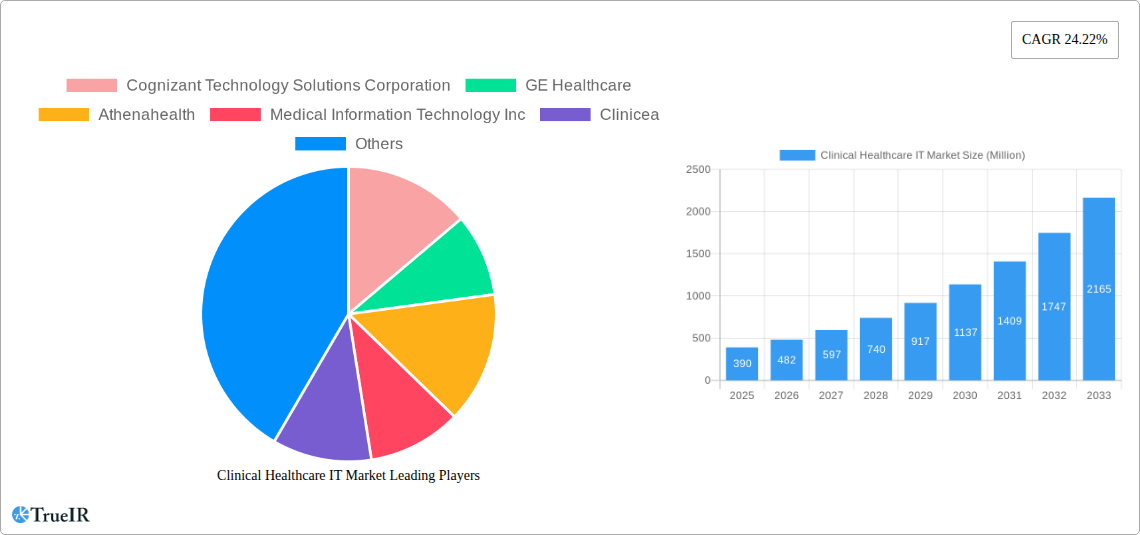

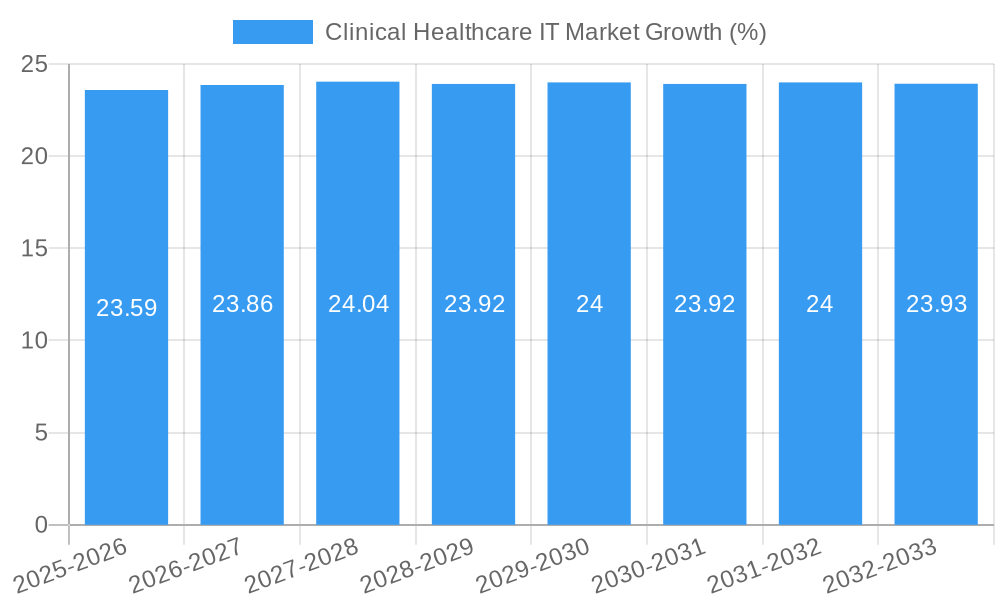

The Clinical Healthcare IT Market is poised for substantial expansion, projected to reach a market size of USD 0.39 billion by 2025. This rapid growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 24.22%, indicating a dynamic and evolving industry. Key drivers propelling this surge include the increasing demand for digitized patient records through Electronic Health Records (EHRs) and Lab Information Management Systems (LIMS), enabling more efficient data management and accessibility. Furthermore, the widespread adoption of Telemedicine and Telehealth platforms is transforming healthcare delivery, making services more accessible and convenient for patients, especially in remote areas. The push for integrated healthcare solutions, exemplified by Computerized Provider Order Entry (CPOE) systems that streamline clinical workflows and reduce medical errors, also contributes significantly to market growth. The growing emphasis on improving diagnostic accuracy through advanced imaging and analysis technologies further bolsters demand for these IT solutions.

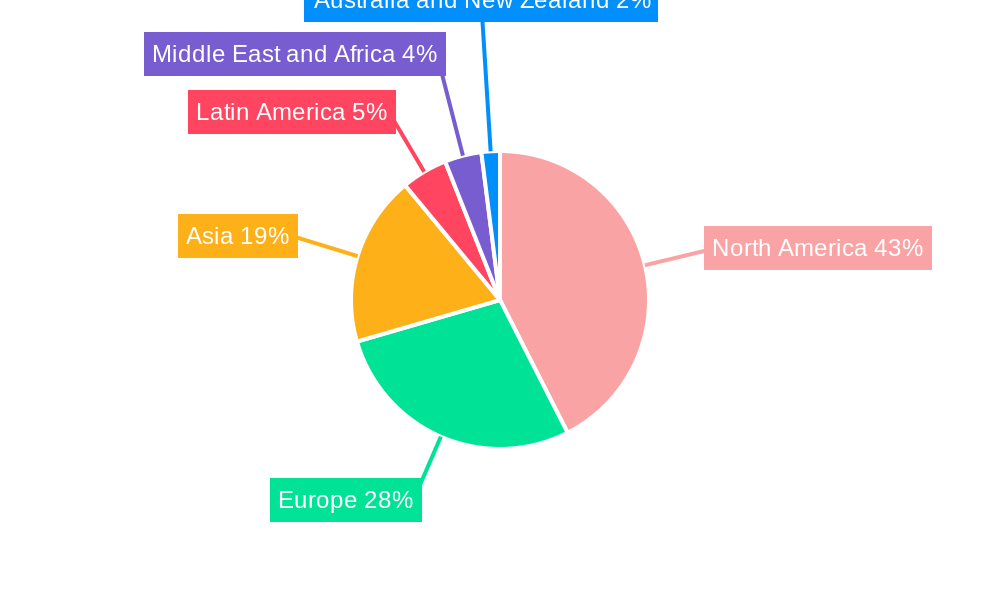

The market’s trajectory is further shaped by significant trends such as the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) in healthcare IT for predictive analytics and personalized medicine. The shift towards value-based care models necessitates robust IT infrastructure to track patient outcomes and manage costs effectively. However, certain restraints, including high implementation costs and data security concerns, need to be strategically addressed by market players. Geographically, North America is expected to lead the market due to early adoption of advanced healthcare technologies and strong government initiatives, followed by Europe. The Asia-Pacific region, driven by growing healthcare expenditure and increasing digital health awareness in countries like China and India, presents a significant growth opportunity. End-users like government and public health organizations, along with private hospitals and diagnostic centers, are actively investing in these technologies to enhance patient care and operational efficiency.

This comprehensive report offers an in-depth analysis of the global Clinical Healthcare IT Market, a rapidly evolving sector critical for modern healthcare delivery. With a Study Period spanning from 2019 to 2033, and a Base Year of 2025, this research meticulously examines market dynamics, trends, opportunities, and challenges. The Forecast Period of 2025–2033 projects significant growth, building upon the insights from the Historical Period of 2019–2024.

This report leverages high-volume keywords such as Electronic Health Records (EHR), Telemedicine, Healthcare IT Solutions, Digital Health, E-health, Clinical Software, Healthcare Management Systems, Patient Data Management, Hospital Information Systems (HIS), and Medical Informatics to ensure optimal SEO performance and reach key industry stakeholders.

Clinical Healthcare IT Market Market Structure & Competitive Landscape

The Clinical Healthcare IT Market is characterized by a moderate to high concentration, driven by the substantial investments required for research, development, and regulatory compliance. Innovation is a primary driver, fueled by the relentless pursuit of enhanced patient outcomes, operational efficiencies, and cost reductions within healthcare systems. The market's competitive landscape is shaped by a mix of established giants and agile innovators. Regulatory impacts, including HIPAA, GDPR, and evolving data privacy laws, significantly influence product development and market entry strategies. Product substitutes exist, particularly in the form of legacy systems or manual processes, but the clear benefits of integrated IT solutions are driving adoption. End-user segmentation highlights a growing demand from both government and public health initiatives seeking to standardize care and private hospitals and diagnostic centers aiming to optimize patient management and revenue cycles. Mergers and Acquisitions (M&A) are prevalent as larger players seek to expand their portfolios, acquire new technologies, and gain market share. Over the historical period (2019-2024), an estimated 25-35 major M&A deals have occurred, with concentration ratios for the top five vendors ranging between 45-55% in specific sub-segments. Key players include Epic Systems Corporation, Oracle Corporation, GE Healthcare, Athenahealth, and Cognizant Technology Solutions Corporation.

Clinical Healthcare IT Market Market Trends & Opportunities

The Clinical Healthcare IT Market is poised for exceptional growth, projected to reach a valuation of over $100 Billion by the end of the forecast period in 2033, expanding at a Compound Annual Growth Rate (CAGR) of approximately 12%. This robust expansion is underpinned by several transformative trends and emerging opportunities. The accelerating adoption of Electronic Health Records (EHR) systems remains a cornerstone, driven by government mandates, the need for interoperability, and the desire for comprehensive patient data access. This trend is further amplified by the increasing integration of AI and machine learning within EHR platforms, enabling predictive analytics, early disease detection, and personalized treatment plans.

Telemedicine and Telehealth services have witnessed an unprecedented surge, a trend that is expected to persist and evolve. The convenience, accessibility, and cost-effectiveness of remote patient monitoring and virtual consultations are reshaping healthcare delivery models, especially in rural and underserved areas. This expansion creates significant opportunities for vendors offering integrated telemedicine platforms, remote monitoring devices, and secure communication tools.

The growing emphasis on data analytics and population health management is another key trend. Healthcare organizations are increasingly leveraging clinical IT solutions to collect, analyze, and interpret vast amounts of patient data. This enables them to identify health trends, manage chronic diseases more effectively, optimize resource allocation, and improve public health outcomes. The demand for Business Intelligence (BI) and Analytics tools within healthcare is consequently skyrocketing.

Furthermore, the digital transformation of hospitals and healthcare systems is creating a significant market for comprehensive Healthcare Management Systems (HMS). These systems encompass a wide range of functionalities, including patient scheduling, billing, inventory management, and staff management, all aimed at streamlining operations and enhancing efficiency. The increasing digitization of medical imaging and the adoption of Picture Archiving and Communication Systems (PACS) further contribute to the market's expansion.

Opportunities abound for vendors focusing on interoperability solutions, ensuring seamless data exchange between disparate systems and providers. The growing demand for cybersecurity in healthcare also presents a substantial opportunity, as the protection of sensitive patient data becomes paramount. The increasing prevalence of chronic diseases globally necessitates proactive management, driving the demand for advanced clinical IT solutions that facilitate continuous patient monitoring and personalized care pathways.

The market penetration rate of advanced clinical IT solutions is still relatively low in emerging economies, indicating a vast untapped potential for growth and expansion. As healthcare infrastructure develops in these regions, the adoption of modern IT systems will become a critical component. The shift towards value-based care models also incentivizes healthcare providers to invest in technologies that can demonstrate improved patient outcomes and cost efficiencies.

Dominant Markets & Segments in Clinical Healthcare IT Market

The Clinical Healthcare IT Market exhibits distinct dominance across various regions and segments, driven by a confluence of robust healthcare infrastructure, favorable government policies, and a high degree of technological adoption.

Dominant Regions: North America, particularly the United States, currently leads the market due to its advanced healthcare ecosystem, significant investments in healthcare IT research and development, and proactive regulatory framework that encourages digital health adoption. Europe follows closely, with countries like Germany, the UK, and France actively promoting the digitalization of healthcare services. The Asia-Pacific region is emerging as a high-growth market, fueled by increasing healthcare expenditure, government initiatives to improve healthcare access, and a rapidly expanding IT infrastructure.

Dominant Software Segment: Electronic Health Records (EHR)

- Key Growth Drivers: Government mandates for EHR adoption, the push for interoperability across healthcare systems, the need for comprehensive patient data management, and the increasing demand for data analytics for population health management.

- Detailed Analysis: EHR systems are the backbone of modern clinical IT, providing a centralized repository for patient medical histories, diagnoses, treatments, and medications. Their dominance is cemented by their ability to improve clinical decision-making, reduce medical errors, enhance patient safety, and streamline administrative workflows. The continuous evolution of EHRs to incorporate AI-powered insights and personalized patient engagement tools further solidifies their leading position.

Dominant End-User: Private Hospitals and Diagnostic Centers

- Key Growth Drivers: The strong financial capacity of private healthcare providers to invest in advanced IT solutions, the competitive pressure to offer superior patient experiences and outcomes, and the need to optimize operational efficiency for profitability.

- Detailed Analysis: Private hospitals and diagnostic centers are early adopters of cutting-edge clinical IT solutions. They invest heavily in integrated systems that can manage patient flow, optimize resource utilization, enhance billing and revenue cycle management, and improve the overall quality of care. Their focus on patient satisfaction and competitive differentiation drives the demand for innovative and user-friendly healthcare IT platforms.

Significant Growth in Telemedicine and Telehealth:

- Key Growth Drivers: Increased patient and provider acceptance post-pandemic, the need to extend healthcare access to remote and underserved populations, the growing prevalence of chronic diseases requiring continuous monitoring, and advancements in connected devices and communication technologies.

- Detailed Analysis: While EHRs represent the established dominant segment, Telemedicine and Telehealth are experiencing the most rapid growth trajectory. This segment is revolutionizing healthcare delivery by enabling remote consultations, virtual monitoring, and digital therapeutics. Its expansion is crucial for improving healthcare accessibility, affordability, and convenience.

Picture Archiving and Communication Systems (PACS) also hold a significant position, driven by the increasing volume of medical imaging and the need for efficient storage, retrieval, and analysis of these images by radiologists and other healthcare professionals.

Clinical Healthcare IT Market Product Analysis

Product innovation in the Clinical Healthcare IT Market is characterized by a strong focus on enhancing interoperability, improving user experience, and integrating advanced analytical capabilities. Electronic Health Records (EHR) systems are evolving beyond basic data storage to incorporate AI-driven decision support tools, predictive analytics for patient risk stratification, and seamless integration with wearable devices for real-time health monitoring. Telemedicine and Telehealth platforms are seeing advancements in secure video conferencing, remote patient monitoring devices, and integrated virtual care management solutions. Lab Information Management Systems (LIMS) are becoming more sophisticated with enhanced workflow automation, quality control features, and cloud-based accessibility. Computerized Provider Order Entry (CPOE) systems are focusing on reducing medication errors through intelligent order sets and real-time drug interaction checks. The competitive advantage lies in the ability of these products to deliver tangible improvements in patient care, operational efficiency, and cost reduction, coupled with robust data security and regulatory compliance.

Key Drivers, Barriers & Challenges in Clinical Healthcare IT Market

Key Drivers:

- Technological Advancements: The rapid evolution of AI, machine learning, cloud computing, and IoT technologies is enabling more sophisticated and integrated healthcare IT solutions.

- Government Initiatives and Regulations: Mandates for EHR adoption, incentives for digital health, and evolving data privacy regulations are propelling market growth.

- Increasing Healthcare Expenditure: Growing global spending on healthcare, particularly in emerging economies, fuels demand for advanced IT infrastructure.

- Focus on Patient-Centric Care: The shift towards personalized medicine and improved patient experiences drives the adoption of patient portals and remote monitoring solutions.

Barriers & Challenges:

- High Implementation Costs: The initial investment in hardware, software, training, and integration can be substantial, posing a barrier for smaller healthcare providers.

- Interoperability Issues: The lack of seamless data exchange between disparate IT systems remains a significant challenge, hindering efficient information flow.

- Data Security and Privacy Concerns: Protecting sensitive patient data from cyber threats and ensuring compliance with stringent privacy regulations is a continuous challenge.

- Resistance to Change: Overcoming clinician and administrative resistance to adopting new technologies and workflows can slow down implementation.

- Regulatory Complexities: Navigating the intricate and evolving regulatory landscape across different regions adds to the complexity and cost of market entry and compliance. Supply chain disruptions for hardware components have also impacted deployment timelines in the past, although this is a less persistent challenge now.

Growth Drivers in the Clinical Healthcare IT Market Market

The Clinical Healthcare IT Market is propelled by a combination of factors. Technological innovation, particularly in AI and cloud computing, is enabling the development of smarter, more accessible healthcare IT solutions. Government initiatives promoting digital health adoption and patient data security, such as the push for interoperable EHRs, are significant growth catalysts. The increasing prevalence of chronic diseases worldwide necessitates advanced patient monitoring and management tools, driving demand for specialized clinical IT. Economic growth in developing regions translates to increased healthcare spending and a greater capacity to invest in modern IT infrastructure. The growing emphasis on value-based care models incentivizes providers to adopt technologies that demonstrably improve patient outcomes and reduce costs.

Challenges Impacting Clinical Healthcare IT Market Growth

Several challenges continue to impact the growth of the Clinical Healthcare IT Market. The significant upfront investment required for implementing sophisticated IT systems can be a major hurdle, especially for smaller healthcare facilities. Ensuring robust data security and patient privacy in the face of escalating cyber threats remains a paramount concern, necessitating continuous investment in cybersecurity measures. Achieving true interoperability across diverse healthcare IT systems from various vendors continues to be an elusive goal, impeding seamless data exchange. Furthermore, navigating the complex and ever-changing landscape of healthcare regulations across different jurisdictions adds to implementation costs and timeframes. Resistance to change from healthcare professionals accustomed to traditional workflows can also slow down the adoption of new technologies.

Key Players Shaping the Clinical Healthcare IT Market Market

- Cognizant Technology Solutions Corporation

- GE Healthcare

- Athenahealth

- Medical Information Technology Inc.

- Clinicea

- NextGen Healthcare

- Veradigm LLC

- eClinicalWorks

- Epic Systems Corporation

- Oracle Corporation

Significant Clinical Healthcare IT Market Industry Milestones

- April 2024: The Union Health Ministry launched the innovative myCGHS app for iOS devices, aiming to boost access to EHR, information, and resources for the beneficiaries of the Central Government Health Scheme (CGHS).

- March 2024: Emory Healthcare led the way in transforming how clinicians access patient health records with its deployment of the 15-inch MacBook Air and the launch of the new native Epic Hyperspace app. This marked the first time Epic was made available to clinicians on the Mac App Store.

Future Outlook for Clinical Healthcare IT Market Market

- April 2024: The Union Health Ministry launched the innovative myCGHS app for iOS devices, aiming to boost access to EHR, information, and resources for the beneficiaries of the Central Government Health Scheme (CGHS).

- March 2024: Emory Healthcare led the way in transforming how clinicians access patient health records with its deployment of the 15-inch MacBook Air and the launch of the new native Epic Hyperspace app. This marked the first time Epic was made available to clinicians on the Mac App Store.

Future Outlook for Clinical Healthcare IT Market Market

The future outlook for the Clinical Healthcare IT Market is exceptionally bright, driven by sustained innovation and increasing global demand for efficient and accessible healthcare. The convergence of technologies like AI, IoT, and blockchain will unlock new possibilities in personalized medicine, predictive analytics, and secure data management. The continued expansion of telemedicine and remote patient monitoring will revolutionize care delivery, particularly in bridging geographical gaps. Strategic opportunities lie in developing solutions that address the growing burden of chronic diseases, enhance cybersecurity, and facilitate true interoperability. As healthcare systems worldwide strive for greater efficiency, improved patient outcomes, and cost-effectiveness, investment in advanced clinical IT solutions will remain a top priority, ensuring robust market growth and transformative impact on global health.

Clinical Healthcare IT Market Segmentation

-

1. Software

- 1.1. Electronic Health Records

- 1.2. Lab Information Management System (LIMS)

- 1.3. Telemedicine and Telehealth

- 1.4. Picture

- 1.5. Computerized Provider Order Entry (CPOE)

- 1.6. Others (

-

2. End-user

- 2.1. Government and Public Health

- 2.2. Private Hospitals and Diagnostic Centers

Clinical Healthcare IT Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

Clinical Healthcare IT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment

- 3.3. Market Restrains

- 3.3.1. Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment

- 3.4. Market Trends

- 3.4.1. Electronic Health Record (EHR) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Software

- 5.1.1. Electronic Health Records

- 5.1.2. Lab Information Management System (LIMS)

- 5.1.3. Telemedicine and Telehealth

- 5.1.4. Picture

- 5.1.5. Computerized Provider Order Entry (CPOE)

- 5.1.6. Others (

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Government and Public Health

- 5.2.2. Private Hospitals and Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Software

- 6. North America Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Software

- 6.1.1. Electronic Health Records

- 6.1.2. Lab Information Management System (LIMS)

- 6.1.3. Telemedicine and Telehealth

- 6.1.4. Picture

- 6.1.5. Computerized Provider Order Entry (CPOE)

- 6.1.6. Others (

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Government and Public Health

- 6.2.2. Private Hospitals and Diagnostic Centers

- 6.1. Market Analysis, Insights and Forecast - by Software

- 7. Europe Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Software

- 7.1.1. Electronic Health Records

- 7.1.2. Lab Information Management System (LIMS)

- 7.1.3. Telemedicine and Telehealth

- 7.1.4. Picture

- 7.1.5. Computerized Provider Order Entry (CPOE)

- 7.1.6. Others (

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Government and Public Health

- 7.2.2. Private Hospitals and Diagnostic Centers

- 7.1. Market Analysis, Insights and Forecast - by Software

- 8. Asia Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Software

- 8.1.1. Electronic Health Records

- 8.1.2. Lab Information Management System (LIMS)

- 8.1.3. Telemedicine and Telehealth

- 8.1.4. Picture

- 8.1.5. Computerized Provider Order Entry (CPOE)

- 8.1.6. Others (

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Government and Public Health

- 8.2.2. Private Hospitals and Diagnostic Centers

- 8.1. Market Analysis, Insights and Forecast - by Software

- 9. Australia and New Zealand Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Software

- 9.1.1. Electronic Health Records

- 9.1.2. Lab Information Management System (LIMS)

- 9.1.3. Telemedicine and Telehealth

- 9.1.4. Picture

- 9.1.5. Computerized Provider Order Entry (CPOE)

- 9.1.6. Others (

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Government and Public Health

- 9.2.2. Private Hospitals and Diagnostic Centers

- 9.1. Market Analysis, Insights and Forecast - by Software

- 10. Latin America Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Software

- 10.1.1. Electronic Health Records

- 10.1.2. Lab Information Management System (LIMS)

- 10.1.3. Telemedicine and Telehealth

- 10.1.4. Picture

- 10.1.5. Computerized Provider Order Entry (CPOE)

- 10.1.6. Others (

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Government and Public Health

- 10.2.2. Private Hospitals and Diagnostic Centers

- 10.1. Market Analysis, Insights and Forecast - by Software

- 11. Middle East and Africa Clinical Healthcare IT Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Software

- 11.1.1. Electronic Health Records

- 11.1.2. Lab Information Management System (LIMS)

- 11.1.3. Telemedicine and Telehealth

- 11.1.4. Picture

- 11.1.5. Computerized Provider Order Entry (CPOE)

- 11.1.6. Others (

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Government and Public Health

- 11.2.2. Private Hospitals and Diagnostic Centers

- 11.1. Market Analysis, Insights and Forecast - by Software

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cognizant Technology Solutions Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 GE Healthcare

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Athenahealth

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Medical Information Technology Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Clinicea

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 NextGen Healthcare

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Veradigm LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 eClinicalWorks

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Epic Systems Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Oracle Corporatio

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Cognizant Technology Solutions Corporation

List of Figures

- Figure 1: Global Clinical Healthcare IT Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Clinical Healthcare IT Market Volume Breakdown (Trillion, %) by Region 2024 & 2032

- Figure 3: North America Clinical Healthcare IT Market Revenue (Million), by Software 2024 & 2032

- Figure 4: North America Clinical Healthcare IT Market Volume (Trillion), by Software 2024 & 2032

- Figure 5: North America Clinical Healthcare IT Market Revenue Share (%), by Software 2024 & 2032

- Figure 6: North America Clinical Healthcare IT Market Volume Share (%), by Software 2024 & 2032

- Figure 7: North America Clinical Healthcare IT Market Revenue (Million), by End-user 2024 & 2032

- Figure 8: North America Clinical Healthcare IT Market Volume (Trillion), by End-user 2024 & 2032

- Figure 9: North America Clinical Healthcare IT Market Revenue Share (%), by End-user 2024 & 2032

- Figure 10: North America Clinical Healthcare IT Market Volume Share (%), by End-user 2024 & 2032

- Figure 11: North America Clinical Healthcare IT Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Clinical Healthcare IT Market Volume (Trillion), by Country 2024 & 2032

- Figure 13: North America Clinical Healthcare IT Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Clinical Healthcare IT Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Clinical Healthcare IT Market Revenue (Million), by Software 2024 & 2032

- Figure 16: Europe Clinical Healthcare IT Market Volume (Trillion), by Software 2024 & 2032

- Figure 17: Europe Clinical Healthcare IT Market Revenue Share (%), by Software 2024 & 2032

- Figure 18: Europe Clinical Healthcare IT Market Volume Share (%), by Software 2024 & 2032

- Figure 19: Europe Clinical Healthcare IT Market Revenue (Million), by End-user 2024 & 2032

- Figure 20: Europe Clinical Healthcare IT Market Volume (Trillion), by End-user 2024 & 2032

- Figure 21: Europe Clinical Healthcare IT Market Revenue Share (%), by End-user 2024 & 2032

- Figure 22: Europe Clinical Healthcare IT Market Volume Share (%), by End-user 2024 & 2032

- Figure 23: Europe Clinical Healthcare IT Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Clinical Healthcare IT Market Volume (Trillion), by Country 2024 & 2032

- Figure 25: Europe Clinical Healthcare IT Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Clinical Healthcare IT Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Clinical Healthcare IT Market Revenue (Million), by Software 2024 & 2032

- Figure 28: Asia Clinical Healthcare IT Market Volume (Trillion), by Software 2024 & 2032

- Figure 29: Asia Clinical Healthcare IT Market Revenue Share (%), by Software 2024 & 2032

- Figure 30: Asia Clinical Healthcare IT Market Volume Share (%), by Software 2024 & 2032

- Figure 31: Asia Clinical Healthcare IT Market Revenue (Million), by End-user 2024 & 2032

- Figure 32: Asia Clinical Healthcare IT Market Volume (Trillion), by End-user 2024 & 2032

- Figure 33: Asia Clinical Healthcare IT Market Revenue Share (%), by End-user 2024 & 2032

- Figure 34: Asia Clinical Healthcare IT Market Volume Share (%), by End-user 2024 & 2032

- Figure 35: Asia Clinical Healthcare IT Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Clinical Healthcare IT Market Volume (Trillion), by Country 2024 & 2032

- Figure 37: Asia Clinical Healthcare IT Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Clinical Healthcare IT Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Clinical Healthcare IT Market Revenue (Million), by Software 2024 & 2032

- Figure 40: Australia and New Zealand Clinical Healthcare IT Market Volume (Trillion), by Software 2024 & 2032

- Figure 41: Australia and New Zealand Clinical Healthcare IT Market Revenue Share (%), by Software 2024 & 2032

- Figure 42: Australia and New Zealand Clinical Healthcare IT Market Volume Share (%), by Software 2024 & 2032

- Figure 43: Australia and New Zealand Clinical Healthcare IT Market Revenue (Million), by End-user 2024 & 2032

- Figure 44: Australia and New Zealand Clinical Healthcare IT Market Volume (Trillion), by End-user 2024 & 2032

- Figure 45: Australia and New Zealand Clinical Healthcare IT Market Revenue Share (%), by End-user 2024 & 2032

- Figure 46: Australia and New Zealand Clinical Healthcare IT Market Volume Share (%), by End-user 2024 & 2032

- Figure 47: Australia and New Zealand Clinical Healthcare IT Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Clinical Healthcare IT Market Volume (Trillion), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Clinical Healthcare IT Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Clinical Healthcare IT Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Clinical Healthcare IT Market Revenue (Million), by Software 2024 & 2032

- Figure 52: Latin America Clinical Healthcare IT Market Volume (Trillion), by Software 2024 & 2032

- Figure 53: Latin America Clinical Healthcare IT Market Revenue Share (%), by Software 2024 & 2032

- Figure 54: Latin America Clinical Healthcare IT Market Volume Share (%), by Software 2024 & 2032

- Figure 55: Latin America Clinical Healthcare IT Market Revenue (Million), by End-user 2024 & 2032

- Figure 56: Latin America Clinical Healthcare IT Market Volume (Trillion), by End-user 2024 & 2032

- Figure 57: Latin America Clinical Healthcare IT Market Revenue Share (%), by End-user 2024 & 2032

- Figure 58: Latin America Clinical Healthcare IT Market Volume Share (%), by End-user 2024 & 2032

- Figure 59: Latin America Clinical Healthcare IT Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Latin America Clinical Healthcare IT Market Volume (Trillion), by Country 2024 & 2032

- Figure 61: Latin America Clinical Healthcare IT Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Latin America Clinical Healthcare IT Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East and Africa Clinical Healthcare IT Market Revenue (Million), by Software 2024 & 2032

- Figure 64: Middle East and Africa Clinical Healthcare IT Market Volume (Trillion), by Software 2024 & 2032

- Figure 65: Middle East and Africa Clinical Healthcare IT Market Revenue Share (%), by Software 2024 & 2032

- Figure 66: Middle East and Africa Clinical Healthcare IT Market Volume Share (%), by Software 2024 & 2032

- Figure 67: Middle East and Africa Clinical Healthcare IT Market Revenue (Million), by End-user 2024 & 2032

- Figure 68: Middle East and Africa Clinical Healthcare IT Market Volume (Trillion), by End-user 2024 & 2032

- Figure 69: Middle East and Africa Clinical Healthcare IT Market Revenue Share (%), by End-user 2024 & 2032

- Figure 70: Middle East and Africa Clinical Healthcare IT Market Volume Share (%), by End-user 2024 & 2032

- Figure 71: Middle East and Africa Clinical Healthcare IT Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Clinical Healthcare IT Market Volume (Trillion), by Country 2024 & 2032

- Figure 73: Middle East and Africa Clinical Healthcare IT Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Clinical Healthcare IT Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Clinical Healthcare IT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 3: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 4: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 5: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 6: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 7: Global Clinical Healthcare IT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Region 2019 & 2032

- Table 9: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 10: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 11: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 12: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 13: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 15: United States Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 17: Canada Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 19: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 20: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 21: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 22: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 23: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 25: Germany Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 27: United Kingdom Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: United Kingdom Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 29: France Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 31: Italy Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 33: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 34: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 35: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 36: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 37: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 39: China Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: China Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 41: Japan Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 43: India Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: India Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 45: South Korea Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 47: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 48: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 49: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 50: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 51: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 53: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 54: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 55: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 56: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 57: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 59: Brazil Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Brazil Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 61: Argentina Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Argentina Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 63: Mexico Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Mexico Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 65: Global Clinical Healthcare IT Market Revenue Million Forecast, by Software 2019 & 2032

- Table 66: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Software 2019 & 2032

- Table 67: Global Clinical Healthcare IT Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 68: Global Clinical Healthcare IT Market Volume Trillion Forecast, by End-user 2019 & 2032

- Table 69: Global Clinical Healthcare IT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Global Clinical Healthcare IT Market Volume Trillion Forecast, by Country 2019 & 2032

- Table 71: United Arab Emirates Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: United Arab Emirates Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 73: Saudi Arabia Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Saudi Arabia Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

- Table 75: South Africa Clinical Healthcare IT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: South Africa Clinical Healthcare IT Market Volume (Trillion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Clinical Healthcare IT Market?

The projected CAGR is approximately 24.22%.

2. Which companies are prominent players in the Clinical Healthcare IT Market?

Key companies in the market include Cognizant Technology Solutions Corporation, GE Healthcare, Athenahealth, Medical Information Technology Inc, Clinicea, NextGen Healthcare, Veradigm LLC, eClinicalWorks, Epic Systems Corporation, Oracle Corporatio.

3. What are the main segments of the Clinical Healthcare IT Market?

The market segments include Software, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment.

6. What are the notable trends driving market growth?

Electronic Health Record (EHR) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Complex Healthcare Datasets and Implementation of AI and ML; Increase in Cloud-based Deployment.

8. Can you provide examples of recent developments in the market?

April 2024: The Union Health Ministry launched the innovative myCGHS app for iOS devices, aiming to boost access to EHR, information, and resources for the beneficiaries of the Central Government Health Scheme (CGHS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Clinical Healthcare IT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Clinical Healthcare IT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Clinical Healthcare IT Market?

To stay informed about further developments, trends, and reports in the Clinical Healthcare IT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence