Key Insights

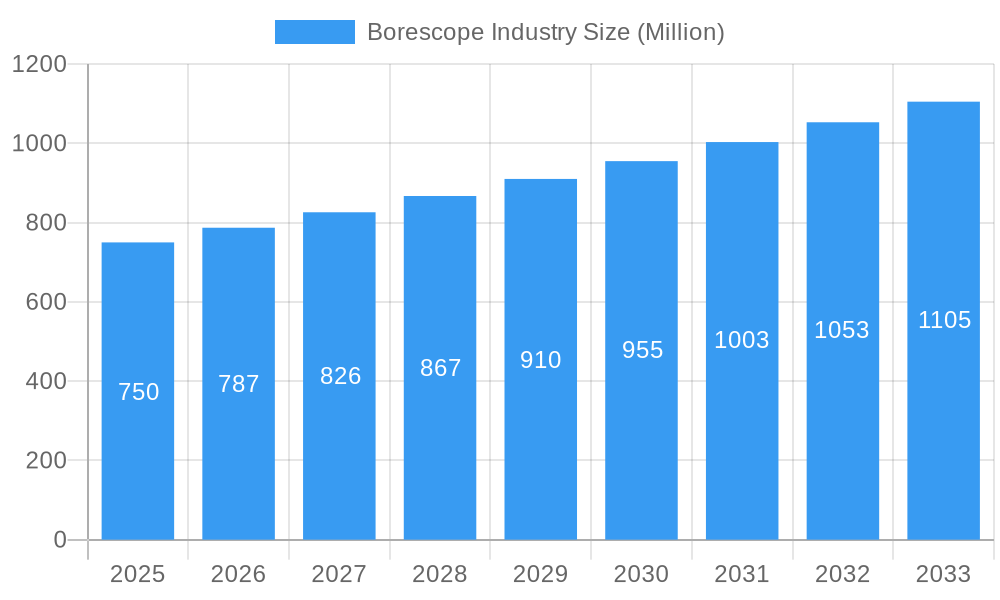

The global borescope market is projected for substantial growth, with an estimated market size of $0.85 billion in the base year 2025, forecast to expand at a Compound Annual Growth Rate (CAGR) of 5.53% through 2033. This expansion is driven by the increasing demand for advanced inspection solutions across critical industries. Key factors include the rising need for proactive maintenance and stringent quality control in sectors like automotive, aviation, and power generation, where early defect detection is vital for safety and operational efficiency. The expanding oil and gas sector and evolving manufacturing processes further bolster market momentum. Continuous advancements in imaging technology, resulting in more versatile and high-resolution borescopes, are accelerating adoption for intricate inspections in confined spaces. The pharmaceutical industry's strict regulatory demands for sterile environments and equipment integrity also present significant growth opportunities.

Borescope Industry Market Size (In Million)

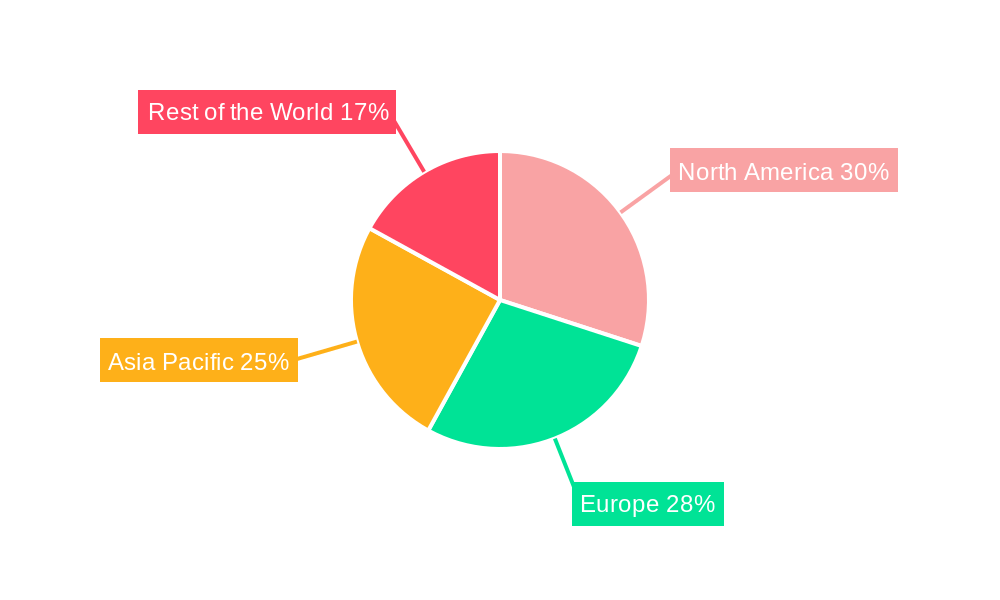

Market segmentation indicates that Video borescopes command a leading position due to their superior imaging and data recording capabilities. Flexible and semi-rigid endoscopes serve specialized applications requiring maneuverability, while rigid borescopes are indispensable for straightforward visual inspections. Within diameter segments, 3 mm to 6 mm and 6 mm to 10 mm are expected to experience considerable growth, aligning with the trend towards smaller, more accessible inspection tools. The 0 mm to 3 mm segment is also gaining traction due to ongoing miniaturization efforts. Geographically, North America and Europe are anticipated to dominate, supported by their established industrial bases and early adoption of advanced inspection technologies. The Asia Pacific region, however, is projected to demonstrate the highest growth rate, fueled by rapid industrialization, substantial infrastructure investment, and an increasing focus on quality and safety standards in manufacturing, mining, and construction. Market expansion may be moderately influenced by the initial investment in sophisticated equipment and the requirement for skilled operators, though technological progress is progressively addressing these challenges.

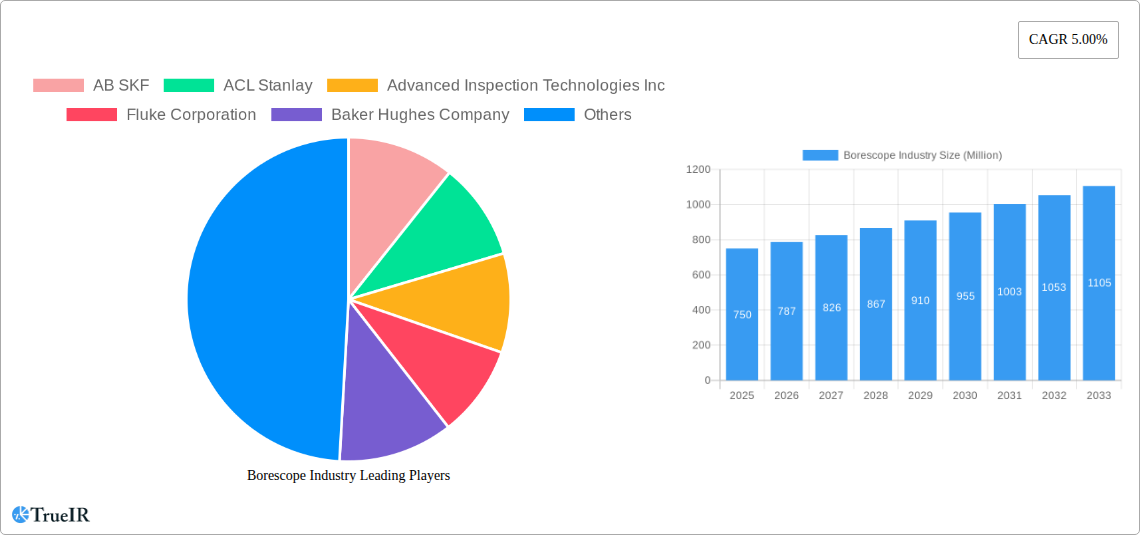

Borescope Industry Company Market Share

Borescope Industry Market: Comprehensive Analysis and Future Projections (2019–2033)

Gain unparalleled insights into the dynamic Borescope Industry with this in-depth market report, covering the historical period of 2019–2024 and projecting growth through 2033, with a detailed forecast for 2025–2033. This report leverages high-volume keywords and a data-driven approach to provide actionable intelligence for industry stakeholders, investors, and decision-makers. Explore market structure, key trends, dominant segments, product innovations, growth drivers, challenges, and the competitive landscape, including major players and significant industry milestones.

Borescope Industry Market Structure & Competitive Landscape

The borescope industry exhibits a moderately concentrated market structure, characterized by the presence of both established multinational corporations and specialized regional players. Key innovation drivers include advancements in miniaturization, high-resolution imaging, artificial intelligence integration for automated defect detection, and wireless connectivity. Regulatory impacts, particularly in sectors like aerospace and pharmaceuticals, drive the demand for highly certified and traceable inspection equipment. Product substitutes, such as portable ultrasonic testing devices and direct visual inspection methods in less critical applications, pose a degree of competition. End-user segmentation reveals distinct adoption patterns across various industries, with oil and gas, power generation, and aviation consistently being major consumers of advanced borescope technology. Merger and acquisition (M&A) trends indicate a strategic consolidation phase, with larger entities acquiring innovative startups or niche players to expand their product portfolios and market reach. Over the historical period (2019-2024), an estimated 15-20 M&A deals were recorded, indicating active strategic maneuvering. Concentration ratios for the top 5 players are estimated to be around 40-45%, showcasing significant but not monopolistic market control.

Borescope Industry Market Trends & Opportunities

The global borescope market is poised for substantial growth, driven by an increasing demand for remote visual inspection (RVI) solutions across diverse industrial sectors. The market size is projected to reach an estimated $3.5 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period of 2025–2033. Technological shifts are central to this expansion, with a prominent trend towards the development of AI-powered borescopes that offer enhanced defect recognition and data analysis capabilities. The integration of high-definition cameras, advanced illumination systems, and interchangeable tip configurations are further enhancing the performance and versatility of these inspection tools. Consumer preferences are increasingly leaning towards user-friendly interfaces, portability, and real-time data streaming for immediate decision-making. The competitive dynamics are intensifying, with companies focusing on differentiating through superior imaging quality, specialized application solutions, and comprehensive after-sales support. Opportunities abound in emerging economies, driven by expanding industrial infrastructure and a growing emphasis on asset integrity management. The penetration rate of advanced borescope technology in critical infrastructure sectors is expected to rise significantly, creating substantial market penetration opportunities. Furthermore, the growing adoption of borescopes in minimally invasive medical procedures, a niche segment, is also contributing to market expansion, albeit at a slower pace compared to industrial applications. The rising need for predictive maintenance and asset lifecycle management in sectors like oil & gas, power generation, and aviation are major growth catalysts, creating recurring revenue streams from service and maintenance contracts.

Dominant Markets & Segments in Borescope Industry

The Asia-Pacific region is emerging as a dominant market for borescopes, driven by rapid industrialization, significant infrastructure development, and increasing adoption of advanced inspection technologies in countries like China and India. Within this region, the oil and gas sector represents a cornerstone of demand, followed closely by manufacturing and power generation.

Key Growth Drivers in Dominant Markets:

- Infrastructure Development: Massive government investments in new power plants, refining facilities, and manufacturing hubs necessitate robust inspection solutions.

- Stringent Safety Regulations: Increasingly rigorous safety and environmental regulations in these regions mandate thorough inspections to prevent failures and ensure compliance.

- Technological Adoption: A growing awareness and willingness to invest in advanced technologies to improve operational efficiency and reduce downtime.

Dominant Segments Analysis:

- Type:

- Video Borescopes: This segment holds the largest market share due to their superior imaging capabilities, recording features, and ease of use, estimated to account for over 60% of the market revenue.

- Flexible Borescopes: Essential for inspecting complex internal geometries, this segment also exhibits strong growth.

- Diameter:

- 3 mm to 6 mm: This diameter range is highly sought after across various industries, offering a balance of maneuverability and inspection capability, estimated to capture 35-40% of the market.

- 6 mm to 10 mm: Crucial for inspecting larger pipelines and engine components.

- Angle:

- 0° to 90°: The most common viewing angle, essential for straightforward inspections.

- 90° to 180° and 180° to 360°: Specialized articulation for inspecting intricate or hidden areas, driving innovation in steerable and multi-directional borescopes.

- End-user Industry:

- Oil and Gas: Dominates due to the critical need for inspecting pipelines, storage tanks, and drilling equipment for integrity and safety, contributing an estimated $1.5 Million in market value.

- Power Generation: Essential for inspecting turbines, boilers, and transmission lines.

- Aviation: Critical for engine inspections, airframe integrity checks, and maintenance, ensuring flight safety.

- Manufacturing: Widely used for quality control and inspection of intricate components.

Borescope Industry Product Analysis

The borescope industry is characterized by continuous product innovation aimed at enhancing inspection accuracy, efficiency, and accessibility. Key advancements include the development of ultra-miniature borescopes with diameters as small as 0.5 mm for highly confined spaces, and articulated video borescopes offering 360-degree articulation for comprehensive coverage of complex internal structures. The integration of artificial intelligence (AI) for automated defect detection and analysis is a significant competitive advantage, reducing human error and speeding up inspection processes. High-resolution 4K cameras, advanced LED illumination, and longer working distances are becoming standard features, improving image clarity in challenging environments. Furthermore, the development of wireless connectivity and cloud-based data management solutions allows for real-time collaboration and efficient data archiving, further solidifying the market fit of these sophisticated inspection tools.

Key Drivers, Barriers & Challenges in Borescope Industry

Key Drivers, Barriers & Challenges in Borescope Industry

Key Drivers:

- Technological Advancements: Continuous innovation in imaging, miniaturization, and AI integration is expanding the capabilities and applications of borescopes.

- Increasing Demand for Asset Integrity Management: Industries like oil & gas, power generation, and aviation prioritize safety and operational efficiency, driving the need for regular inspections.

- Stringent Regulatory Standards: Growing emphasis on safety and environmental compliance in various sectors mandates the use of advanced inspection tools.

- Growth in Emerging Economies: Rapid industrialization and infrastructure development in regions like Asia-Pacific are creating significant demand.

Barriers & Challenges:

- High Initial Investment Cost: Advanced borescope systems can be expensive, posing a barrier for smaller businesses or less critical applications.

- Skilled Workforce Requirement: Operating and interpreting results from sophisticated borescope systems requires trained and skilled personnel, leading to potential talent shortages.

- Technological Obsolescence: The rapid pace of technological advancement can lead to concerns about the longevity and future compatibility of purchased equipment.

- Competitive Pressures: An increasingly competitive market landscape can put pressure on pricing and profit margins.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of components and finished products, potentially delaying deliveries and increasing costs. Estimated impact on project timelines: 5-10%.

Growth Drivers in the Borescope Industry Market

The borescope industry is propelled by a confluence of robust growth drivers. Technological innovation remains paramount, with ongoing advancements in sensor technology, optics, and artificial intelligence leading to borescopes that are more precise, portable, and capable of complex analysis. The increasing global emphasis on asset integrity management across critical sectors such as oil and gas, power generation, and aviation is a significant economic driver, as companies invest in preventative maintenance and safety protocols to avoid costly failures and downtime. Stricter regulatory frameworks worldwide, aimed at enhancing safety and environmental protection, further compel industries to adopt advanced remote visual inspection (RVI) solutions. The burgeoning industrial sectors in emerging economies, particularly in Asia-Pacific, are creating substantial new markets for borescope technology, driven by infrastructure expansion and a growing awareness of the benefits of industrial automation and inspection.

Challenges Impacting Borescope Industry Growth

Despite the positive growth trajectory, the borescope industry faces several challenges. The high initial cost of sophisticated borescope systems can act as a restraint, particularly for small and medium-sized enterprises (SMEs) or in sectors with tighter budget constraints. A significant barrier is the need for a skilled workforce to operate these advanced instruments and interpret the data effectively; a shortage of trained technicians can limit adoption. Rapid technological obsolescence is another concern, as the swift evolution of the technology can make existing equipment outdated, prompting frequent upgrade cycles. Furthermore, intense competition among manufacturers, both established players and emerging companies, can lead to price erosion and pressure on profit margins. Global supply chain disruptions, as experienced in recent years, can impact the availability of critical components and finished goods, potentially leading to extended lead times and increased production costs.

Key Players Shaping the Borescope Industry Market

- AB SKF

- ACL Stanlay

- Advanced Inspection Technologies Inc

- Fluke Corporation

- Baker Hughes Company

- ViZaar Industrial Imaging AG

- Gradient Lens Corporation

- Olympus Corporation

- JME Technologies Inc

- FLIR Systems

Significant Borescope Industry Industry Milestones

- February 2022: Waygate Technologies announced the upgrade of its high-end Everest Mentor Visual iQ (MViQ) VideoProbe. This software upgrade enables the provision of advanced video borescopes with integrated artificial intelligence (AI) for the aerospace, energy, and petrochemical industries.

- February 2021: Olympus Corporation introduced the SIF-H190 single balloon enteroscope in Japan and Europe. This device is designed for deeper access into the small intestine with smoother passage, facilitating the diagnosis and treatment of conditions such as obscure gastrointestinal bleeding by allowing precise navigation and control.

Future Outlook for Borescope Industry Market

The future outlook for the borescope industry remains exceptionally bright, driven by an intensifying global focus on safety, efficiency, and preventative maintenance across key industrial sectors. The market is poised for continued expansion as technological innovations, particularly in artificial intelligence and miniaturization, unlock new application possibilities and enhance existing capabilities. The increasing adoption of Industry 4.0 principles will further integrate borescopes into broader digital inspection and data management ecosystems, creating opportunities for enhanced predictive analytics and remote diagnostics. Emerging economies, with their rapid industrial growth, represent a significant untapped potential. Strategic collaborations and ongoing R&D investments by leading players will continue to shape the competitive landscape, with a focus on developing highly specialized solutions for niche applications in sectors like medical devices and renewable energy infrastructure. The market is expected to witness sustained growth, driven by the inherent value borescopes provide in ensuring operational integrity and minimizing risks.

Borescope Industry Segmentation

-

1. Type

- 1.1. Video

- 1.2. Flexible

- 1.3. Endoscopes

- 1.4. Semi-rigid

- 1.5. Rigid

-

2. Diameter

- 2.1. 0 mm to 3 mm

- 2.2. 3 mm to 6 mm

- 2.3. 6 mm to 10 mm

- 2.4. Above 10 mm

-

3. Angle

- 3.1. 0° to 90°

- 3.2. 90° to 180°

- 3.3. 180° to 360°

-

4. End-user Industry

- 4.1. Automotive

- 4.2. Aviation

- 4.3. Power Generation

- 4.4. Oil and Gas

- 4.5. Manufacturing

- 4.6. Chemicals

- 4.7. Food and Beverages

- 4.8. Pharmaceuticals

- 4.9. Mining and Construction

- 4.10. Other End-user Industries

Borescope Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Borescope Industry Regional Market Share

Geographic Coverage of Borescope Industry

Borescope Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Requirement for High Operational Productivity

- 3.3. Market Restrains

- 3.3.1. Lack of Good Lighting Conditions

- 3.4. Market Trends

- 3.4.1. Automotive Industry to Exhibit High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Flexible

- 5.1.3. Endoscopes

- 5.1.4. Semi-rigid

- 5.1.5. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Diameter

- 5.2.1. 0 mm to 3 mm

- 5.2.2. 3 mm to 6 mm

- 5.2.3. 6 mm to 10 mm

- 5.2.4. Above 10 mm

- 5.3. Market Analysis, Insights and Forecast - by Angle

- 5.3.1. 0° to 90°

- 5.3.2. 90° to 180°

- 5.3.3. 180° to 360°

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Automotive

- 5.4.2. Aviation

- 5.4.3. Power Generation

- 5.4.4. Oil and Gas

- 5.4.5. Manufacturing

- 5.4.6. Chemicals

- 5.4.7. Food and Beverages

- 5.4.8. Pharmaceuticals

- 5.4.9. Mining and Construction

- 5.4.10. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Video

- 6.1.2. Flexible

- 6.1.3. Endoscopes

- 6.1.4. Semi-rigid

- 6.1.5. Rigid

- 6.2. Market Analysis, Insights and Forecast - by Diameter

- 6.2.1. 0 mm to 3 mm

- 6.2.2. 3 mm to 6 mm

- 6.2.3. 6 mm to 10 mm

- 6.2.4. Above 10 mm

- 6.3. Market Analysis, Insights and Forecast - by Angle

- 6.3.1. 0° to 90°

- 6.3.2. 90° to 180°

- 6.3.3. 180° to 360°

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Automotive

- 6.4.2. Aviation

- 6.4.3. Power Generation

- 6.4.4. Oil and Gas

- 6.4.5. Manufacturing

- 6.4.6. Chemicals

- 6.4.7. Food and Beverages

- 6.4.8. Pharmaceuticals

- 6.4.9. Mining and Construction

- 6.4.10. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Video

- 7.1.2. Flexible

- 7.1.3. Endoscopes

- 7.1.4. Semi-rigid

- 7.1.5. Rigid

- 7.2. Market Analysis, Insights and Forecast - by Diameter

- 7.2.1. 0 mm to 3 mm

- 7.2.2. 3 mm to 6 mm

- 7.2.3. 6 mm to 10 mm

- 7.2.4. Above 10 mm

- 7.3. Market Analysis, Insights and Forecast - by Angle

- 7.3.1. 0° to 90°

- 7.3.2. 90° to 180°

- 7.3.3. 180° to 360°

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Automotive

- 7.4.2. Aviation

- 7.4.3. Power Generation

- 7.4.4. Oil and Gas

- 7.4.5. Manufacturing

- 7.4.6. Chemicals

- 7.4.7. Food and Beverages

- 7.4.8. Pharmaceuticals

- 7.4.9. Mining and Construction

- 7.4.10. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Video

- 8.1.2. Flexible

- 8.1.3. Endoscopes

- 8.1.4. Semi-rigid

- 8.1.5. Rigid

- 8.2. Market Analysis, Insights and Forecast - by Diameter

- 8.2.1. 0 mm to 3 mm

- 8.2.2. 3 mm to 6 mm

- 8.2.3. 6 mm to 10 mm

- 8.2.4. Above 10 mm

- 8.3. Market Analysis, Insights and Forecast - by Angle

- 8.3.1. 0° to 90°

- 8.3.2. 90° to 180°

- 8.3.3. 180° to 360°

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Automotive

- 8.4.2. Aviation

- 8.4.3. Power Generation

- 8.4.4. Oil and Gas

- 8.4.5. Manufacturing

- 8.4.6. Chemicals

- 8.4.7. Food and Beverages

- 8.4.8. Pharmaceuticals

- 8.4.9. Mining and Construction

- 8.4.10. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Borescope Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Video

- 9.1.2. Flexible

- 9.1.3. Endoscopes

- 9.1.4. Semi-rigid

- 9.1.5. Rigid

- 9.2. Market Analysis, Insights and Forecast - by Diameter

- 9.2.1. 0 mm to 3 mm

- 9.2.2. 3 mm to 6 mm

- 9.2.3. 6 mm to 10 mm

- 9.2.4. Above 10 mm

- 9.3. Market Analysis, Insights and Forecast - by Angle

- 9.3.1. 0° to 90°

- 9.3.2. 90° to 180°

- 9.3.3. 180° to 360°

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Automotive

- 9.4.2. Aviation

- 9.4.3. Power Generation

- 9.4.4. Oil and Gas

- 9.4.5. Manufacturing

- 9.4.6. Chemicals

- 9.4.7. Food and Beverages

- 9.4.8. Pharmaceuticals

- 9.4.9. Mining and Construction

- 9.4.10. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 AB SKF

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ACL Stanlay

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Advanced Inspection Technologies Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fluke Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baker Hughes Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ViZaar Industrial Imaging AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gradient Lens Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Olympus Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 JME Technologies Inc *List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 FLIR Systems

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 AB SKF

List of Figures

- Figure 1: Global Borescope Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 5: North America Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 6: North America Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 7: North America Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 8: North America Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 9: North America Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Borescope Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 15: Europe Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 16: Europe Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 17: Europe Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 18: Europe Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 19: Europe Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Europe Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Borescope Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 25: Asia Pacific Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 26: Asia Pacific Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 27: Asia Pacific Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 28: Asia Pacific Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Borescope Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Borescope Industry Revenue (billion), by Type 2025 & 2033

- Figure 33: Rest of the World Borescope Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of the World Borescope Industry Revenue (billion), by Diameter 2025 & 2033

- Figure 35: Rest of the World Borescope Industry Revenue Share (%), by Diameter 2025 & 2033

- Figure 36: Rest of the World Borescope Industry Revenue (billion), by Angle 2025 & 2033

- Figure 37: Rest of the World Borescope Industry Revenue Share (%), by Angle 2025 & 2033

- Figure 38: Rest of the World Borescope Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Rest of the World Borescope Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Rest of the World Borescope Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Borescope Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 3: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 4: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Borescope Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 8: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 9: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 13: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 14: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 18: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 19: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Borescope Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Borescope Industry Revenue billion Forecast, by Diameter 2020 & 2033

- Table 23: Global Borescope Industry Revenue billion Forecast, by Angle 2020 & 2033

- Table 24: Global Borescope Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Borescope Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Borescope Industry?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Borescope Industry?

Key companies in the market include AB SKF, ACL Stanlay, Advanced Inspection Technologies Inc, Fluke Corporation, Baker Hughes Company, ViZaar Industrial Imaging AG, Gradient Lens Corporation, Olympus Corporation, JME Technologies Inc *List Not Exhaustive, FLIR Systems.

3. What are the main segments of the Borescope Industry?

The market segments include Type, Diameter, Angle, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.85 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Requirement for High Operational Productivity.

6. What are the notable trends driving market growth?

Automotive Industry to Exhibit High Growth.

7. Are there any restraints impacting market growth?

Lack of Good Lighting Conditions.

8. Can you provide examples of recent developments in the market?

February 2022: Waygate Technologies announced the upgrade of its high-end Everest Mentor Visual iQ (MViQ) VideoProbe for remote visual inspection. The software upgrade enables Waygate Technologies to provide the most advanced video borescopes with built-in artificial intelligence (AI) to aerospace, energy, and petrochemical industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Borescope Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Borescope Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Borescope Industry?

To stay informed about further developments, trends, and reports in the Borescope Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence