Key Insights

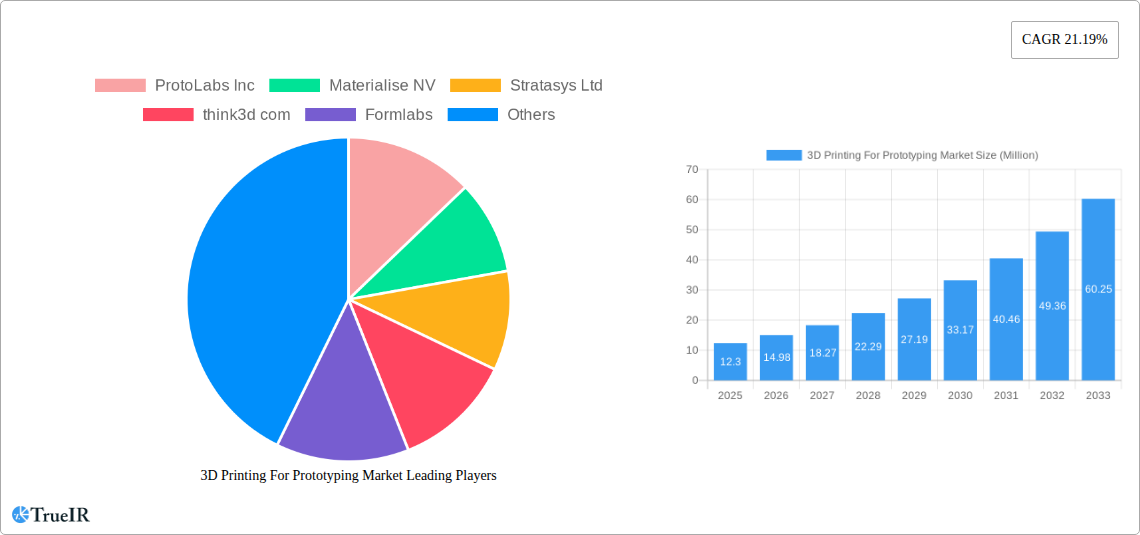

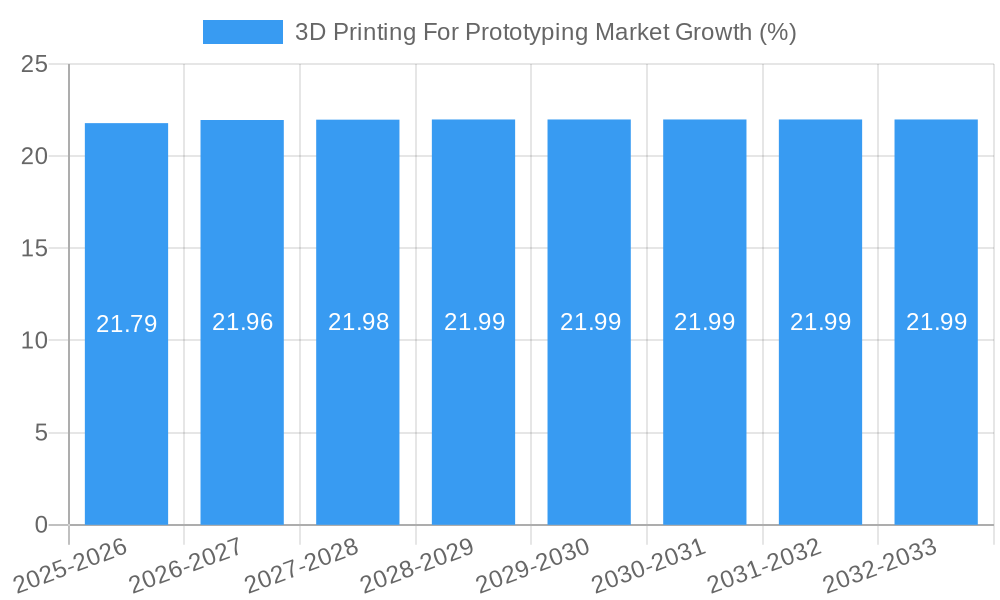

The 3D printing for prototyping market is poised for remarkable expansion, projected to reach $12.30 million with an impressive Compound Annual Growth Rate (CAGR) of 21.19%. This robust growth is fueled by several compelling drivers, primarily the accelerating demand for rapid iteration in product development across diverse industries. The inherent ability of 3D printing to produce complex geometries quickly and cost-effectively makes it indispensable for accelerating design cycles and reducing time-to-market. Emerging trends, such as the increasing adoption of advanced materials like high-performance polymers and metals, alongside the continuous innovation in printing technologies, including Stereolithography (SLA), Selective Laser Sintering (SLS), and Fused Deposition Modeling (FDM), are further propelling this market forward. These advancements allow for the creation of more functional and durable prototypes, bridging the gap between conceptualization and final production.

While the market exhibits strong upward momentum, certain restraints need to be navigated. These include the initial capital investment for high-end 3D printing equipment, the need for specialized skills in design and operation, and ongoing material cost fluctuations. However, the widespread integration of 3D printing in key end-user industries like Aerospace and Defense, Automotive, and Healthcare is a significant growth catalyst. The demand for lightweight, customized components in aerospace, intricate internal structures in automotive parts, and patient-specific medical devices in healthcare are all areas where 3D printing excels. This strategic importance ensures sustained market interest and investment, paving the way for continued innovation and market penetration in the coming years.

Unlock critical insights into the burgeoning 3D Printing For Prototyping market with this in-depth report. Covering the historical period of 2019–2024 and projecting growth through 2033, this analysis leverages high-volume SEO keywords to deliver unparalleled market intelligence for industry stakeholders. Explore technological advancements, dominant market segments, key players, and future growth catalysts shaping the rapid evolution of rapid prototyping.

3D Printing For Prototyping Market Market Structure & Competitive Landscape

The 3D Printing for Prototyping market is characterized by a dynamic and evolving competitive landscape, marked by increasing market concentration driven by strategic mergers and acquisitions alongside organic growth. Innovation remains a paramount driver, with significant investment in research and development by leading entities to enhance material capabilities, print speeds, and resolution. Regulatory frameworks are gradually adapting to accommodate the rapid advancements in additive manufacturing, fostering greater adoption across diverse industries. Product substitutes, while present in traditional manufacturing methods, are increasingly being displaced by the agility and cost-effectiveness of 3D printing for early-stage development. The end-user segmentation showcases a broad spectrum of industries relying on rapid prototyping, with automotive and healthcare emerging as significant adoption hubs. M&A trends indicate a consolidation phase, with larger players acquiring innovative startups to expand their technological portfolios and market reach. For instance, in the historical period (2019-2024), approximately 35-45 significant M&A deals have been observed. Concentration ratios, while varying by specific technology and material segment, are trending towards moderate to high in established segments, reflecting the dominance of key players. Key innovation drivers include the demand for faster product development cycles, customization, and the ability to create complex geometries previously unattainable.

3D Printing For Prototyping Market Market Trends & Opportunities

The 3D Printing for Prototyping market is poised for robust expansion, driven by an insatiable demand for accelerated product development cycles and increased design freedom. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18-22% during the forecast period of 2025–2033. This significant growth is fueled by ongoing technological shifts, with advancements in material science enabling the printing of functional prototypes with properties closely mimicking end-use parts. Consumer preferences are increasingly leaning towards highly customized and innovative products, a demand that 3D printing is uniquely positioned to meet. The competitive dynamics are intensifying, with both established manufacturing giants and agile startups vying for market share. Opportunities abound for companies that can offer integrated solutions encompassing design, material selection, printing services, and post-processing. The penetration rate of 3D printing in prototyping applications is steadily increasing, moving from niche use cases to mainstream adoption across virtually every industrial sector. The inherent scalability of 3D printing, from single-unit prototypes to small-batch production, further amplifies its appeal. The ability to iterate designs rapidly and cost-effectively reduces the overall time-to-market and minimizes development risks. The exploration of novel materials, such as advanced composites and biocompatible polymers, opens up new avenues for application in specialized fields. Furthermore, the integration of artificial intelligence and machine learning in optimizing print parameters and design workflows presents a significant opportunity for enhanced efficiency and performance. The growing awareness and accessibility of 3D printing technologies are democratizing innovation, empowering smaller businesses and research institutions to leverage its benefits. The market is also witnessing a trend towards distributed manufacturing, where prototyping can be performed closer to the point of design or assembly, further streamlining the product development process. The increasing adoption of digital twins and simulation tools in conjunction with 3D printing allows for virtual testing and validation of prototypes, leading to further time and cost savings.

Dominant Markets & Segments in 3D Printing For Prototyping Market

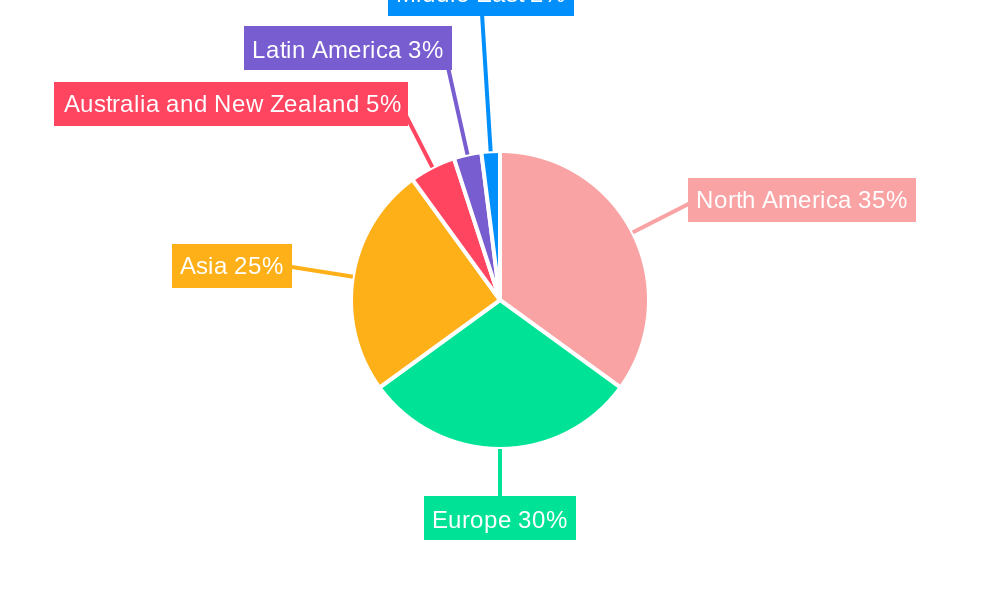

The 3D Printing for Prototyping market exhibits distinct dominance across various regions and segments, driven by unique industrial needs and technological advancements.

Technology Dominance:

- Fused Deposition Modeling (FDM): Continues to hold a significant market share due to its affordability, ease of use, and wide availability of materials, making it a go-to for general-purpose prototyping.

- Stereolithography (SLA) and Digital Light Processing (DLP): These resin-based technologies lead in applications requiring high accuracy, intricate details, and smooth surface finishes, particularly in healthcare and consumer electronics prototyping.

- Selective Laser Sintering (SLS): Holds a strong position for functional prototypes in demanding industries like automotive and aerospace, offering excellent mechanical properties and the ability to print complex geometries without support structures.

- Binder Jetting: Emerges as a key technology for rapid, cost-effective prototyping of metal and ceramic parts, especially in early design validation stages.

Material Type Dominance:

- Polymer: Remains the dominant material type, encompassing a vast range of thermoplastics and thermosets suitable for diverse prototyping needs, from basic visual models to functional end-use part simulations. The availability of diverse polymer grades, including high-performance engineering plastics, fuels its widespread adoption.

- Metal: Demonstrates rapid growth, driven by the increasing demand for functional metal prototypes in aerospace, automotive, and medical device industries. Advancements in metal powder metallurgy and binder jetting are key enablers.

- Ceramic: While a smaller segment, ceramic prototyping is gaining traction in specialized applications within the aerospace, medical, and electronics sectors due to its unique properties like high-temperature resistance and biocompatibility.

End-user Industry Dominance:

- Automotive: This sector represents a leading market for 3D printing in prototyping. The ability to rapidly iterate on complex part designs, jigs, fixtures, and even functional components significantly reduces development timelines and costs for new vehicle models. The demand for lightweighting and customization further propels adoption.

- Aerospace and Defense: Critical applications demanding high precision, material strength, and complex geometries make 3D printing indispensable for prototyping aircraft components, satellite parts, and defense equipment. The need for rapid deployment and customization is a key driver.

- Healthcare: From anatomical models for surgical planning to prototyping of medical devices and prosthetics, the healthcare industry is a significant adopter. Biocompatible materials and high accuracy are paramount.

- Consumer Goods and Electronics: Rapid prototyping enables designers and engineers to quickly visualize and test new product concepts, iterate on form factors, and develop functional prototypes for electronic enclosures and consumer products, accelerating time-to-market.

- Polymer: Remains the dominant material type, encompassing a vast range of thermoplastics and thermosets suitable for diverse prototyping needs, from basic visual models to functional end-use part simulations. The availability of diverse polymer grades, including high-performance engineering plastics, fuels its widespread adoption.

- Metal: Demonstrates rapid growth, driven by the increasing demand for functional metal prototypes in aerospace, automotive, and medical device industries. Advancements in metal powder metallurgy and binder jetting are key enablers.

- Ceramic: While a smaller segment, ceramic prototyping is gaining traction in specialized applications within the aerospace, medical, and electronics sectors due to its unique properties like high-temperature resistance and biocompatibility.

End-user Industry Dominance:

- Automotive: This sector represents a leading market for 3D printing in prototyping. The ability to rapidly iterate on complex part designs, jigs, fixtures, and even functional components significantly reduces development timelines and costs for new vehicle models. The demand for lightweighting and customization further propels adoption.

- Aerospace and Defense: Critical applications demanding high precision, material strength, and complex geometries make 3D printing indispensable for prototyping aircraft components, satellite parts, and defense equipment. The need for rapid deployment and customization is a key driver.

- Healthcare: From anatomical models for surgical planning to prototyping of medical devices and prosthetics, the healthcare industry is a significant adopter. Biocompatible materials and high accuracy are paramount.

- Consumer Goods and Electronics: Rapid prototyping enables designers and engineers to quickly visualize and test new product concepts, iterate on form factors, and develop functional prototypes for electronic enclosures and consumer products, accelerating time-to-market.

Key Growth Drivers: The dominance in these segments is propelled by several factors including:

- Technological Advancements: Continuous innovation in printing technologies, materials, and software.

- Cost-Effectiveness: Reduced prototyping costs compared to traditional methods, especially for low-volume production and design iterations.

- Speed and Agility: Significantly shorter lead times for prototype creation, enabling faster product development cycles.

- Design Freedom: The ability to create complex geometries and customized designs previously impossible with traditional manufacturing.

- Industry-Specific Demands: Tailored requirements within sectors like automotive (lightweighting, performance) and healthcare (biocompatibility, precision) driving specific technological adoptions.

- Favorable Government Policies: Initiatives supporting advanced manufacturing and innovation in key regions.

3D Printing For Prototyping Market Product Analysis

The 3D Printing for Prototyping market is defined by continuous product innovation, enabling the creation of highly accurate, functional, and complex prototypes. Advancements in printer hardware, such as faster print speeds and higher resolutions, are coupled with the development of novel materials that mimic the mechanical and thermal properties of end-use parts. Applications range from rapid visualization models and ergonomic studies to functional testing of components, thereby significantly reducing development cycles and costs. The competitive advantage lies in the ability to offer a holistic prototyping solution, integrating advanced software for design optimization and material selection with high-performance printing capabilities, ultimately accelerating time-to-market for new products.

Key Drivers, Barriers & Challenges in 3D Printing For Prototyping Market

Key Drivers:

The 3D Printing for Prototyping market is propelled by a confluence of technological, economic, and policy-driven factors. Technological advancements, such as increased print speeds, enhanced material diversity (including high-performance polymers and metals), and improved resolution, are fundamental. Economically, the reduction in prototyping costs and faster time-to-market offered by additive manufacturing directly impact product development budgets and competitiveness. Policy-wise, government initiatives promoting advanced manufacturing, innovation, and reshoring are creating a supportive ecosystem for 3D printing adoption. For instance, specific grants for R&D in additive manufacturing and tax incentives for adopting advanced technologies play a crucial role.

Barriers & Challenges:

Despite significant growth, the market faces several barriers and challenges. Supply chain issues, particularly concerning the availability and cost of specialized printing materials and components, can create bottlenecks. Regulatory hurdles, especially in highly regulated industries like aerospace and healthcare, require extensive validation and certification processes for 3D printed parts, which can be time-consuming and costly. Competitive pressures from established manufacturing methods, although diminishing, still exist for certain high-volume applications. Furthermore, the need for skilled workforce to operate and maintain advanced 3D printing equipment and software presents a challenge. The initial capital investment for high-end industrial 3D printers can also be a barrier for small and medium-sized enterprises (SMEs).

Growth Drivers in the 3D Printing For Prototyping Market Market

The growth of the 3D Printing for Prototyping market is primarily driven by several key factors. Technologically, continuous innovation in additive manufacturing processes, leading to faster print speeds, enhanced precision, and the development of a wider array of advanced materials, including composites and biocompatible polymers, is crucial. Economically, the significant reduction in prototyping costs and lead times compared to traditional manufacturing methods empowers companies to accelerate their product development cycles and bring innovative products to market more swiftly. Policy-wise, supportive government initiatives, such as grants for research and development in additive manufacturing and tax incentives for adopting advanced technologies, are fostering a conducive environment for market expansion. The increasing demand for customization and mass personalization across industries further fuels the adoption of 3D printing for rapid prototyping.

Challenges Impacting 3D Printing For Prototyping Market Growth

Several challenges continue to impact the growth trajectory of the 3D Printing for Prototyping market. Regulatory complexities, particularly in highly sensitive sectors like aerospace and medical devices, demand rigorous validation and certification processes for 3D printed components, which can extend development timelines. Supply chain disruptions, affecting the availability and consistent quality of specialized printing materials and equipment, pose a significant risk to production continuity. Intense competitive pressures, both from established traditional manufacturing methods for certain applications and from emerging additive manufacturing technologies, necessitate continuous innovation and cost optimization. Furthermore, the ongoing need for a skilled workforce proficient in operating and maintaining advanced 3D printing systems and associated software presents a persistent challenge in scaling operations effectively.

Key Players Shaping the 3D Printing For Prototyping Market Market

- ProtoLabs Inc

- Materialise NV

- Stratasys Ltd

- think3d com

- Formlabs

- HLH Prototypes Co Ltd

- Sopan Infotech

- PLM Group

- Sculpteo

- Fathom Digital Manufacturing

Significant 3D Printing For Prototyping Market Industry Milestones

- July 2024: Cubicure partnered with HARTING AG, a specialist in 3D Mechatronic Integrated Device (MID) solutions, to pioneer the 3D printing of Laser Direct Structuring (LDS) materials. This collaboration addresses previous challenges in MID prototype printing related to resolution and material compatibility, promising direct 3D printing of LDS materials with superior resolution and smooth surfaces, seamlessly integrated into HARTING's LDS process for reduced prototype and small series run times.

- April 2024: Formlabs unveiled Form 4, setting a new benchmark in professional resin 3D printing with its proprietary Low Force Display (LFD) print engine. Boasting print speeds up to five times faster than previous models, Form 4 significantly enhances productivity, enabling professionals to take design risks and accelerate their market entry.

Future Outlook for 3D Printing For Prototyping Market Market

The future outlook for the 3D Printing for Prototyping market is exceptionally bright, propelled by sustained technological advancements and an increasing appetite for innovation across industries. Strategic opportunities lie in the further development of advanced materials with enhanced functional properties, the integration of AI and machine learning for optimizing design and print processes, and the expansion of services catering to distributed manufacturing models. The market potential is vast, with increasing adoption anticipated in emerging sectors and a continued shift towards functional prototyping and bridge manufacturing. The ability of 3D printing to facilitate rapid design iteration, cost-effective customization, and on-demand production positions it as a cornerstone of future product development strategies, driving efficiency and accelerating the realization of novel ideas.

3D Printing For Prototyping Market Segmentation

-

1. Technology

- 1.1. Stereolithography

- 1.2. Selective Laser Sintering (SLS)

- 1.3. Fused Deposition Modeling (FDM)

- 1.4. Digital Light Processing (DLP)

- 1.5. Binder Jetting

- 1.6. Other Technologies

-

2. Material Type

- 2.1. Metal

- 2.2. Polymer

- 2.3. Ceramic

- 2.4. Other Material Types

-

3. End-user Industry

- 3.1. Aerospace and Defense

- 3.2. Automotive

- 3.3. Healthcare

- 3.4. Consumer Good and Electronics

- 3.5. Other End-user Industries

3D Printing For Prototyping Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East

3D Printing For Prototyping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations

- 3.3. Market Restrains

- 3.3.1. Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Segment is Expected to Observe Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereolithography

- 5.1.2. Selective Laser Sintering (SLS)

- 5.1.3. Fused Deposition Modeling (FDM)

- 5.1.4. Digital Light Processing (DLP)

- 5.1.5. Binder Jetting

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Metal

- 5.2.2. Polymer

- 5.2.3. Ceramic

- 5.2.4. Other Material Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace and Defense

- 5.3.2. Automotive

- 5.3.3. Healthcare

- 5.3.4. Consumer Good and Electronics

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereolithography

- 6.1.2. Selective Laser Sintering (SLS)

- 6.1.3. Fused Deposition Modeling (FDM)

- 6.1.4. Digital Light Processing (DLP)

- 6.1.5. Binder Jetting

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Metal

- 6.2.2. Polymer

- 6.2.3. Ceramic

- 6.2.4. Other Material Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace and Defense

- 6.3.2. Automotive

- 6.3.3. Healthcare

- 6.3.4. Consumer Good and Electronics

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereolithography

- 7.1.2. Selective Laser Sintering (SLS)

- 7.1.3. Fused Deposition Modeling (FDM)

- 7.1.4. Digital Light Processing (DLP)

- 7.1.5. Binder Jetting

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Metal

- 7.2.2. Polymer

- 7.2.3. Ceramic

- 7.2.4. Other Material Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace and Defense

- 7.3.2. Automotive

- 7.3.3. Healthcare

- 7.3.4. Consumer Good and Electronics

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereolithography

- 8.1.2. Selective Laser Sintering (SLS)

- 8.1.3. Fused Deposition Modeling (FDM)

- 8.1.4. Digital Light Processing (DLP)

- 8.1.5. Binder Jetting

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Metal

- 8.2.2. Polymer

- 8.2.3. Ceramic

- 8.2.4. Other Material Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace and Defense

- 8.3.2. Automotive

- 8.3.3. Healthcare

- 8.3.4. Consumer Good and Electronics

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereolithography

- 9.1.2. Selective Laser Sintering (SLS)

- 9.1.3. Fused Deposition Modeling (FDM)

- 9.1.4. Digital Light Processing (DLP)

- 9.1.5. Binder Jetting

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Metal

- 9.2.2. Polymer

- 9.2.3. Ceramic

- 9.2.4. Other Material Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace and Defense

- 9.3.2. Automotive

- 9.3.3. Healthcare

- 9.3.4. Consumer Good and Electronics

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stereolithography

- 10.1.2. Selective Laser Sintering (SLS)

- 10.1.3. Fused Deposition Modeling (FDM)

- 10.1.4. Digital Light Processing (DLP)

- 10.1.5. Binder Jetting

- 10.1.6. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Material Type

- 10.2.1. Metal

- 10.2.2. Polymer

- 10.2.3. Ceramic

- 10.2.4. Other Material Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Aerospace and Defense

- 10.3.2. Automotive

- 10.3.3. Healthcare

- 10.3.4. Consumer Good and Electronics

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East 3D Printing For Prototyping Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Stereolithography

- 11.1.2. Selective Laser Sintering (SLS)

- 11.1.3. Fused Deposition Modeling (FDM)

- 11.1.4. Digital Light Processing (DLP)

- 11.1.5. Binder Jetting

- 11.1.6. Other Technologies

- 11.2. Market Analysis, Insights and Forecast - by Material Type

- 11.2.1. Metal

- 11.2.2. Polymer

- 11.2.3. Ceramic

- 11.2.4. Other Material Types

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Aerospace and Defense

- 11.3.2. Automotive

- 11.3.3. Healthcare

- 11.3.4. Consumer Good and Electronics

- 11.3.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 ProtoLabs Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Materialise NV

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Stratasys Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 think3d com

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Formlabs

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 HLH Prototypes Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sopan Infotech

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 PLM Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sculpteo

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Fathom Digital Manufacturing*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 ProtoLabs Inc

List of Figures

- Figure 1: Global 3D Printing For Prototyping Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global 3D Printing For Prototyping Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America 3D Printing For Prototyping Market Revenue (Million), by Technology 2024 & 2032

- Figure 4: North America 3D Printing For Prototyping Market Volume (Billion), by Technology 2024 & 2032

- Figure 5: North America 3D Printing For Prototyping Market Revenue Share (%), by Technology 2024 & 2032

- Figure 6: North America 3D Printing For Prototyping Market Volume Share (%), by Technology 2024 & 2032

- Figure 7: North America 3D Printing For Prototyping Market Revenue (Million), by Material Type 2024 & 2032

- Figure 8: North America 3D Printing For Prototyping Market Volume (Billion), by Material Type 2024 & 2032

- Figure 9: North America 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 10: North America 3D Printing For Prototyping Market Volume Share (%), by Material Type 2024 & 2032

- Figure 11: North America 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 12: North America 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 13: North America 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 15: North America 3D Printing For Prototyping Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America 3D Printing For Prototyping Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America 3D Printing For Prototyping Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America 3D Printing For Prototyping Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe 3D Printing For Prototyping Market Revenue (Million), by Technology 2024 & 2032

- Figure 20: Europe 3D Printing For Prototyping Market Volume (Billion), by Technology 2024 & 2032

- Figure 21: Europe 3D Printing For Prototyping Market Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Europe 3D Printing For Prototyping Market Volume Share (%), by Technology 2024 & 2032

- Figure 23: Europe 3D Printing For Prototyping Market Revenue (Million), by Material Type 2024 & 2032

- Figure 24: Europe 3D Printing For Prototyping Market Volume (Billion), by Material Type 2024 & 2032

- Figure 25: Europe 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 26: Europe 3D Printing For Prototyping Market Volume Share (%), by Material Type 2024 & 2032

- Figure 27: Europe 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 28: Europe 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 29: Europe 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Europe 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 31: Europe 3D Printing For Prototyping Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe 3D Printing For Prototyping Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe 3D Printing For Prototyping Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe 3D Printing For Prototyping Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia 3D Printing For Prototyping Market Revenue (Million), by Technology 2024 & 2032

- Figure 36: Asia 3D Printing For Prototyping Market Volume (Billion), by Technology 2024 & 2032

- Figure 37: Asia 3D Printing For Prototyping Market Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Asia 3D Printing For Prototyping Market Volume Share (%), by Technology 2024 & 2032

- Figure 39: Asia 3D Printing For Prototyping Market Revenue (Million), by Material Type 2024 & 2032

- Figure 40: Asia 3D Printing For Prototyping Market Volume (Billion), by Material Type 2024 & 2032

- Figure 41: Asia 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 42: Asia 3D Printing For Prototyping Market Volume Share (%), by Material Type 2024 & 2032

- Figure 43: Asia 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 44: Asia 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 45: Asia 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 46: Asia 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 47: Asia 3D Printing For Prototyping Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia 3D Printing For Prototyping Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia 3D Printing For Prototyping Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia 3D Printing For Prototyping Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by Technology 2024 & 2032

- Figure 52: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by Technology 2024 & 2032

- Figure 53: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by Technology 2024 & 2032

- Figure 54: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by Technology 2024 & 2032

- Figure 55: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by Material Type 2024 & 2032

- Figure 56: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by Material Type 2024 & 2032

- Figure 57: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 58: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by Material Type 2024 & 2032

- Figure 59: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 60: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 61: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 62: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 63: Australia and New Zealand 3D Printing For Prototyping Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Australia and New Zealand 3D Printing For Prototyping Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Australia and New Zealand 3D Printing For Prototyping Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Australia and New Zealand 3D Printing For Prototyping Market Volume Share (%), by Country 2024 & 2032

- Figure 67: Latin America 3D Printing For Prototyping Market Revenue (Million), by Technology 2024 & 2032

- Figure 68: Latin America 3D Printing For Prototyping Market Volume (Billion), by Technology 2024 & 2032

- Figure 69: Latin America 3D Printing For Prototyping Market Revenue Share (%), by Technology 2024 & 2032

- Figure 70: Latin America 3D Printing For Prototyping Market Volume Share (%), by Technology 2024 & 2032

- Figure 71: Latin America 3D Printing For Prototyping Market Revenue (Million), by Material Type 2024 & 2032

- Figure 72: Latin America 3D Printing For Prototyping Market Volume (Billion), by Material Type 2024 & 2032

- Figure 73: Latin America 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 74: Latin America 3D Printing For Prototyping Market Volume Share (%), by Material Type 2024 & 2032

- Figure 75: Latin America 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 76: Latin America 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 77: Latin America 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 78: Latin America 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 79: Latin America 3D Printing For Prototyping Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Latin America 3D Printing For Prototyping Market Volume (Billion), by Country 2024 & 2032

- Figure 81: Latin America 3D Printing For Prototyping Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Latin America 3D Printing For Prototyping Market Volume Share (%), by Country 2024 & 2032

- Figure 83: Middle East 3D Printing For Prototyping Market Revenue (Million), by Technology 2024 & 2032

- Figure 84: Middle East 3D Printing For Prototyping Market Volume (Billion), by Technology 2024 & 2032

- Figure 85: Middle East 3D Printing For Prototyping Market Revenue Share (%), by Technology 2024 & 2032

- Figure 86: Middle East 3D Printing For Prototyping Market Volume Share (%), by Technology 2024 & 2032

- Figure 87: Middle East 3D Printing For Prototyping Market Revenue (Million), by Material Type 2024 & 2032

- Figure 88: Middle East 3D Printing For Prototyping Market Volume (Billion), by Material Type 2024 & 2032

- Figure 89: Middle East 3D Printing For Prototyping Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 90: Middle East 3D Printing For Prototyping Market Volume Share (%), by Material Type 2024 & 2032

- Figure 91: Middle East 3D Printing For Prototyping Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 92: Middle East 3D Printing For Prototyping Market Volume (Billion), by End-user Industry 2024 & 2032

- Figure 93: Middle East 3D Printing For Prototyping Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 94: Middle East 3D Printing For Prototyping Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 95: Middle East 3D Printing For Prototyping Market Revenue (Million), by Country 2024 & 2032

- Figure 96: Middle East 3D Printing For Prototyping Market Volume (Billion), by Country 2024 & 2032

- Figure 97: Middle East 3D Printing For Prototyping Market Revenue Share (%), by Country 2024 & 2032

- Figure 98: Middle East 3D Printing For Prototyping Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 5: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 6: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 7: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 12: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 13: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 14: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 15: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 20: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 21: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 22: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 23: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 25: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 29: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 30: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 31: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 33: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 36: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 37: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 38: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 39: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 40: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 41: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 44: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 45: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 46: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 47: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 49: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2019 & 2032

- Table 51: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 52: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Technology 2019 & 2032

- Table 53: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 54: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 55: Global 3D Printing For Prototyping Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 56: Global 3D Printing For Prototyping Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 57: Global 3D Printing For Prototyping Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global 3D Printing For Prototyping Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 3D Printing For Prototyping Market?

The projected CAGR is approximately 21.19%.

2. Which companies are prominent players in the 3D Printing For Prototyping Market?

Key companies in the market include ProtoLabs Inc, Materialise NV, Stratasys Ltd, think3d com, Formlabs, HLH Prototypes Co Ltd, Sopan Infotech, PLM Group, Sculpteo, Fathom Digital Manufacturing*List Not Exhaustive.

3. What are the main segments of the 3D Printing For Prototyping Market?

The market segments include Technology, Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations.

6. What are the notable trends driving market growth?

Aerospace and Defense Segment is Expected to Observe Significant Growth.

7. Are there any restraints impacting market growth?

Growing Investments Toward Research and Development; Growing Shift Toward Sustainable Innovations.

8. Can you provide examples of recent developments in the market?

July 2024: Cubicure partnered with HARTING AG, a specialist in 3D Mechatronic Integrated Device (MID) solutions, to pioneer the 3D printing of Laser Direct Structuring (LDS) materials. The companies noted that previous attempts at 3D printing MID prototypes faced challenges related to resolution and material compatibility. However, this new technology promises direct 3D printing of LDS materials, boasting superior resolution and smooth surfaces. Furthermore, the printed materials can be effortlessly integrated into HARTING's existing LDS process, leading to notable time savings in producing prototypes and small series runs.April 2024: Formlabs unveiled Form 4, the pinnacle of speed and reliability in 3D printing. With its proprietary Low Force Display (LFD) print engine, Formlabs set a new standard in professional resin 3D printing. Boasting print speeds up to five times faster, the Form 4 enhances productivity, empowering professionals to embrace design risks and expedite their market entry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "3D Printing For Prototyping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 3D Printing For Prototyping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 3D Printing For Prototyping Market?

To stay informed about further developments, trends, and reports in the 3D Printing For Prototyping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence