Key Insights

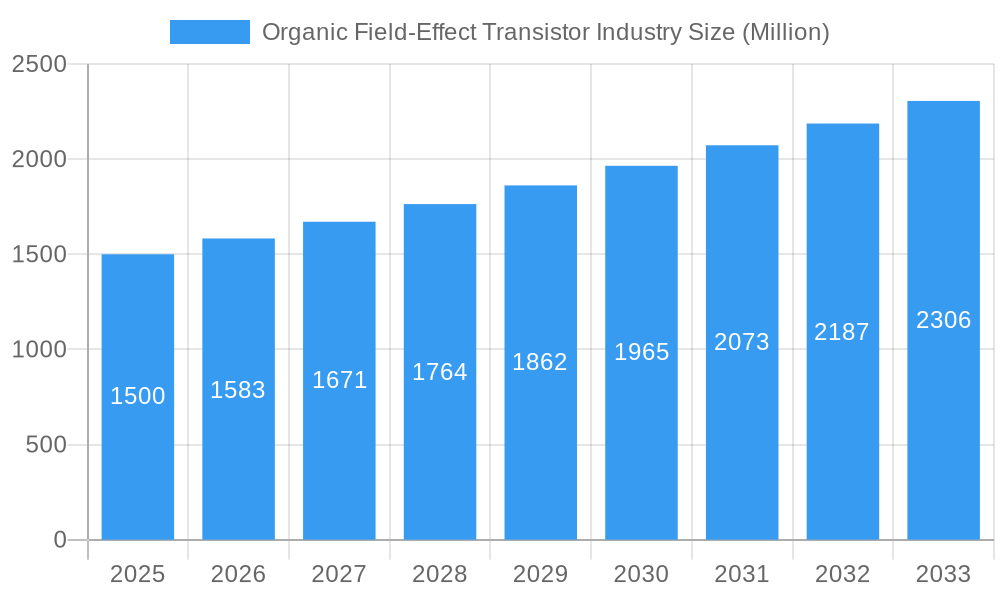

The Organic Field-Effect Transistor (OFET) market is poised for significant expansion, projected to reach approximately $1,500 million by 2025 and demonstrating a robust Compound Annual Growth Rate (CAGR) of 5.50% through 2033. This impressive growth trajectory is fueled by an increasing demand for flexible and low-cost electronic solutions across various industries. Key market drivers include the burgeoning adoption of OFETs in next-generation display technologies like flexible OLEDs and e-paper, as well as their integration into wearable electronics and the Internet of Things (IoT) devices. The inherent advantages of OFETs, such as their adaptability to large-area, roll-to-roll manufacturing processes and their ability to function on non-silicon substrates, position them as a compelling alternative to traditional silicon-based transistors for specific applications. Furthermore, ongoing advancements in organic semiconductor materials, enhancing their performance, stability, and processing efficiency, are continually expanding the potential use cases and market appeal of OFETs.

Organic Field-Effect Transistor Industry Market Size (In Billion)

The market is segmented by Type, with Junction Field-Effect Transistors (JFETs) encompassing P-type and N-type variations, and Metal-Oxide-Semiconductor Field-Effect Transistors (MOSFETs) playing crucial roles. Application diversity is a significant strength, with OFETs finding utility as Analog Switches, Amplifiers, Phase Shift Oscillators, Current Limiters, Digital Circuits, and other specialized applications. The end-user landscape is equally broad, spanning the Automotive sector for advanced dashboard displays and sensor integration, Consumer Electronics for flexible displays and smart packaging, IT/Telecom for advanced networking components, and Power Generating Industries for specific control and monitoring systems. While market growth is strong, potential restraints include challenges related to long-term device stability and the need for further optimization in charge carrier mobility compared to their inorganic counterparts for high-performance computing. However, the continuous innovation from leading companies such as Vishay Intertechnology Inc., Infineon Technologies AG, Texas Instruments, and Taiwan Semiconductor Manufacturing Company Ltd. is actively addressing these limitations and driving the market forward.

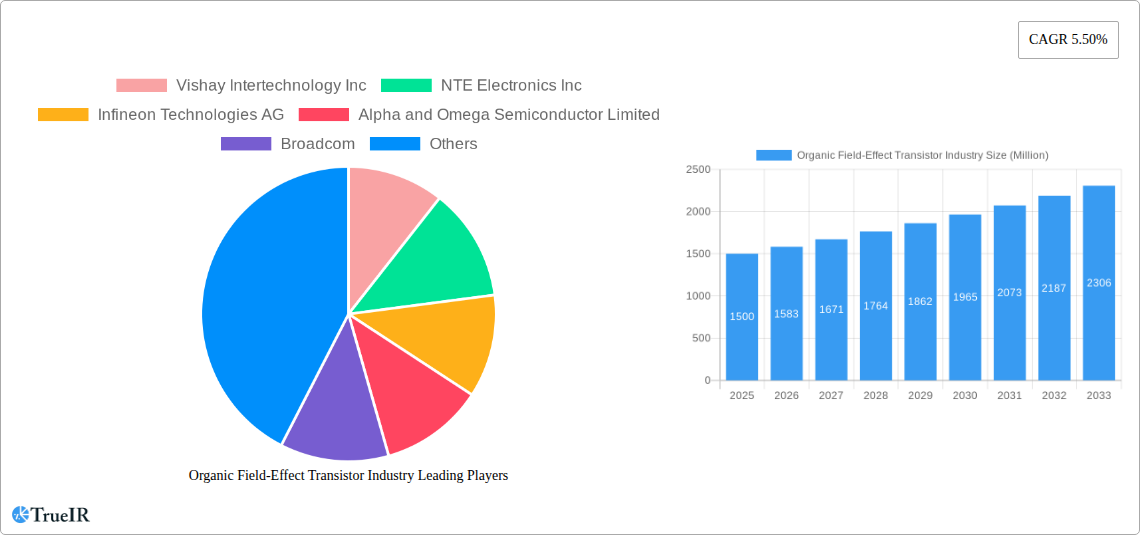

Organic Field-Effect Transistor Industry Company Market Share

Here is a dynamic, SEO-optimized report description for the Organic Field-Effect Transistor Industry, tailored for high search rankings and industry engagement.

Organic Field-Effect Transistor Industry Market Structure & Competitive Landscape

The Organic Field-Effect Transistor (OFET) industry exhibits a moderately concentrated market structure, driven by significant investments in research and development and the increasing demand for flexible and low-cost electronic components. Innovation remains a pivotal driver, with advancements in material science and fabrication techniques continuously pushing the boundaries of device performance. Regulatory impacts, while evolving, are generally favorable, encouraging the adoption of OFETs in emerging applications that prioritize sustainability and reduced environmental footprint. Product substitutes, primarily traditional inorganic semiconductors, face increasing competition from OFETs in niche areas where flexibility, transparency, and cost-effectiveness are paramount.

End-user segmentation highlights a burgeoning adoption across various sectors, with consumer electronics and IT/Telecom leading the charge. Mergers and acquisitions (M&A) trends are gradually shaping the competitive landscape as larger players seek to integrate OFET technologies into their product portfolios. While specific M&A volumes for OFETs are still developing, the overall semiconductor M&A activity indicates a consolidation phase aimed at acquiring specialized expertise and intellectual property. Key players are strategically investing in R&D to enhance device mobility, stability, and lifespan, crucial for broader market penetration. The market's future growth is intrinsically linked to the successful commercialization of these innovations and the establishment of robust supply chains for organic semiconductor materials.

- Market Concentration: Moderate, with key players investing heavily in R&D.

- Innovation Drivers: Material science advancements, improved fabrication techniques, demand for flexible electronics.

- Regulatory Impacts: Generally favorable, encouraging sustainable electronics adoption.

- Product Substitutes: Traditional inorganic semiconductors, facing competition in specific niches.

- End-User Segmentation: Consumer electronics and IT/Telecom are prominent early adopters.

- M&A Trends: Growing interest in acquiring OFET expertise and intellectual property.

Organic Field-Effect Transistor Industry Market Trends & Opportunities

The Organic Field-Effect Transistor (OFET) industry is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 15.2% during the forecast period of 2025–2033. This robust expansion is fueled by a confluence of technological advancements, evolving consumer preferences, and expanding market opportunities across diverse applications. The market size is expected to reach an estimated value of $7.5 Million by 2025 and is projected to grow to $22.5 Million by 2033. Key market trends indicate a significant shift towards flexible, printable, and wearable electronics, where OFETs offer distinct advantages over rigid silicon-based counterparts. The decreasing cost of production, coupled with improvements in device performance metrics such as charge carrier mobility and operational stability, is democratizing access to advanced electronic functionalities.

Consumer preferences are increasingly leaning towards personalized, integrated, and environmentally conscious electronic devices. OFETs, with their inherent compatibility with low-temperature processing and organic materials, align perfectly with these demands, enabling the development of thinner, lighter, and more energy-efficient products. Opportunities abound in areas such as smart packaging, electronic textiles, bio-integrated sensors, and next-generation display technologies, including flexible OLEDs and e-paper. The IT/Telecom sector is witnessing a rising demand for OFETs in applications like flexible displays for mobile devices and advanced sensor arrays for IoT networks. Similarly, the consumer electronics market is exploring OFETs for integration into smart home devices, wearable fitness trackers, and other personalized gadgets.

Technological shifts are characterized by the exploration of novel organic semiconductor materials with enhanced electrical properties and improved environmental stability. The development of solution-processable inks for large-area printing techniques like inkjet and roll-to-roll manufacturing presents a significant opportunity to drastically reduce manufacturing costs and accelerate production cycles. Furthermore, research into hybrid organic-inorganic devices is opening up new avenues for performance optimization. Competitive dynamics are intensifying as both established semiconductor giants and agile startups vie for market share. Strategic partnerships between material suppliers, device manufacturers, and end-product innovators are becoming crucial for navigating the complexities of the supply chain and accelerating product development. The potential for miniaturization and integration into complex systems, coupled with the inherent biocompatibility of many organic materials, also points towards significant growth in the healthcare and medical device sectors. The market penetration rate of OFETs is steadily increasing, particularly in segments where their unique characteristics offer a compelling value proposition.

Dominant Markets & Segments in Organic Field-Effect Transistor Industry

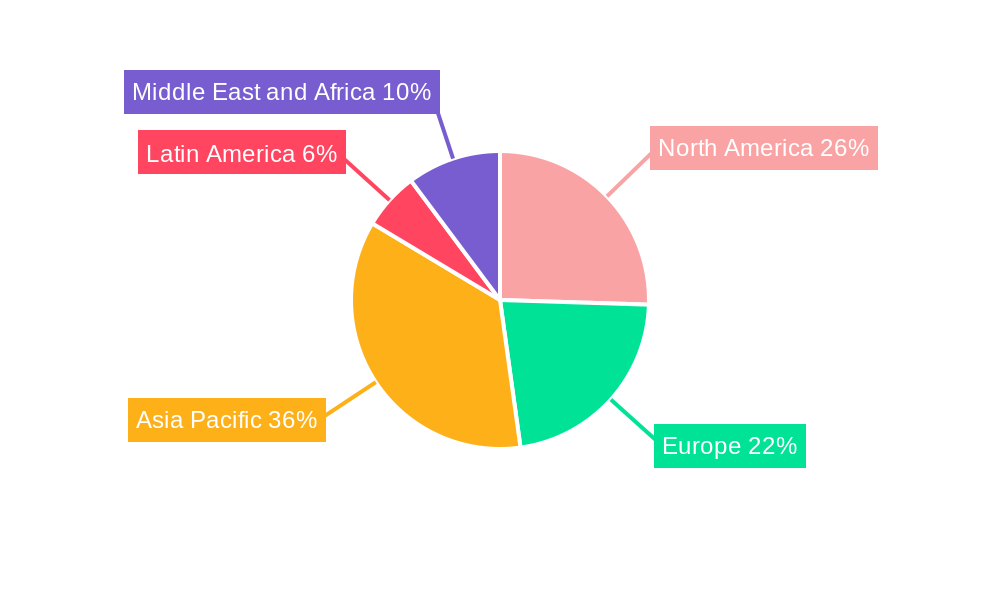

The Organic Field-Effect Transistor (OFET) industry demonstrates significant dominance and growth potential across specific regions, countries, and segments, driven by distinct market dynamics and technological adoption patterns.

Leading Region: Asia-Pacific currently holds a dominant position in the OFET market, largely attributed to its robust manufacturing infrastructure, extensive research and development activities, and a substantial presence of key industry players. Countries like South Korea, Japan, and China are at the forefront of innovation and production, benefiting from government support for advanced manufacturing and a strong demand for consumer electronics.

- Key Growth Drivers in Asia-Pacific:

- Extensive R&D investments in advanced semiconductor materials.

- Strong manufacturing capabilities for flexible and printed electronics.

- High consumer demand for innovative electronic devices.

- Government initiatives promoting digital transformation and sustainable technologies.

Dominant Segment - Type: Within the OFET landscape, JFET - Junction Field Effect Transistors, particularly N-Type variants, are currently experiencing significant traction. This is due to their favorable performance characteristics in terms of switching speed and current handling capabilities, making them suitable for a wide range of applications. While MOSFETs are also a crucial segment, JFETs are carving out a strong niche in areas requiring specific electrical properties.

- Key Growth Drivers for JFET - N-Type:

- Enhanced performance in analog switching and amplification circuits.

- Compatibility with low-voltage operations, crucial for portable devices.

- Advancements in material engineering leading to improved stability and reliability.

Dominant Segment - Application: The Analog Switches application segment is a primary driver of OFET market growth. OFETs excel in providing efficient and low-power switching solutions, essential for signal routing and control in various electronic systems. Following closely are Amplifiers, where the unique properties of organic semiconductors allow for novel designs in audio, RF, and sensor amplification.

- Key Growth Drivers for Analog Switches:

- Demand for low-power, high-performance switching in IoT devices.

- Integration into smart sensors and flexible display backplanes.

- Cost-effectiveness for mass-produced electronic components.

Dominant Segment - End-User: The Consumer electronics sector is a major end-user driving the adoption of OFETs. The increasing demand for flexible displays, wearable devices, smart cards, and interactive packaging directly benefits from the unique capabilities of OFETs. The IT/Telecom sector is also a significant growth area, with OFETs finding applications in flexible antennas, RFID tags, and advanced sensor networks.

- Key Growth Drivers for Consumer Electronics:

- Demand for thin, lightweight, and bendable electronic devices.

- Integration into smart textiles and wearable health monitors.

- Development of next-generation interfaces and interactive surfaces.

The interplay of these dominant segments and regions creates a dynamic market environment where innovation in materials and manufacturing processes directly translates into competitive advantages. The sustained growth in these areas is indicative of the OFET industry's maturation and its increasing importance in the broader semiconductor ecosystem.

Organic Field-Effect Transistor Industry Product Analysis

The OFET industry is characterized by continuous product innovation focused on enhancing device performance, stability, and manufacturing scalability. Key advancements include the development of novel organic semiconductor materials with higher charge carrier mobilities and improved operational lifetimes, enabling faster switching speeds and greater endurance. Applications are expanding rapidly, with OFETs now integral to flexible displays, printable sensors, smart packaging, and wearable electronics. Their inherent compatibility with low-temperature, solution-based processing provides a significant competitive advantage in terms of reduced manufacturing costs and environmental impact compared to traditional silicon-based transistors. This allows for the creation of lightweight, conformable, and transparent electronic components that are unachievable with conventional methods.

Key Drivers, Barriers & Challenges in Organic Field-Effect Transistor Industry

Key Drivers: The organic field-effect transistor (OFET) industry is propelled by several key drivers. Technologically, advancements in organic semiconductor materials, such as novel polymers and small molecules with enhanced charge carrier mobility and environmental stability, are crucial. Economically, the decreasing cost of production through solution-based printing techniques like inkjet and roll-to-roll processing makes OFETs increasingly competitive for mass-market applications. Policy-driven factors, including a global push for sustainable electronics and reduced energy consumption, also favor OFETs due to their potential for lower manufacturing energy footprints and their use in energy-efficient devices. For example, the growing demand for IoT devices necessitates low-power, flexible electronics, which OFETs are well-suited to provide.

Barriers & Challenges: Significant challenges impede the widespread adoption of OFETs. Supply chain issues related to the consistent quality and availability of specialized organic semiconductor precursors can lead to production bottlenecks. Regulatory hurdles, particularly concerning the long-term environmental impact and recyclability of organic materials, require careful consideration and standardization. Competitive pressures from well-established inorganic semiconductor technologies, which benefit from decades of optimization and proven reliability, remain a formidable barrier. For instance, while OFETs offer flexibility, achieving comparable performance metrics to silicon-based counterparts in high-frequency applications remains a challenge, limiting their penetration in certain high-end markets. The XX Million market for established semiconductor technologies presents a substantial incumbent advantage.

Growth Drivers in the Organic Field-Effect Transistor Industry Market

Growth in the Organic Field-Effect Transistor (OFET) industry is primarily driven by technological advancements in organic semiconductor materials, leading to improved mobility and stability. Economically, the inherent low-cost potential of solution-based printing techniques, such as inkjet and roll-to-roll manufacturing, makes OFETs highly attractive for high-volume applications where cost is a critical factor. Policy-driven initiatives promoting energy-efficient electronics and sustainable manufacturing practices further bolster OFET adoption. For example, the increasing demand for flexible displays in consumer electronics and the proliferation of Internet of Things (IoT) devices are creating significant opportunities for OFETs due to their unique form factor and low power consumption capabilities. The projected market size of XX Million by 2025 underscores this upward trend.

Challenges Impacting Organic Field-Effect Transistor Industry Growth

Several challenges impact the growth of the Organic Field-Effect Transistor (OFET) industry. Supply chain complexities related to the consistent and cost-effective sourcing of high-purity organic semiconductor precursors can lead to production delays and increased costs. Regulatory complexities surrounding material safety, environmental impact, and end-of-life disposal of organic electronic components require standardization and clear guidelines. Competitive pressures from mature silicon-based semiconductor technologies, which benefit from decades of established infrastructure and performance optimization, remain a significant barrier. For example, achieving the same level of reliability and operational lifespan as silicon transistors in demanding industrial applications is still an area of active research for OFETs. The estimated market barrier of XX Million in alternative technologies presents a substantial hurdle.

Key Players Shaping the Organic Field-Effect Transistor Industry Market

- Vishay Intertechnology Inc

- NTE Electronics Inc

- Infineon Technologies AG

- Alpha and Omega Semiconductor Limited

- Broadcom

- Texas Instruments

- Mitsubishi Electric Corporation

- Nexperia

- Sensitron Semiconductor

- Toshiba Corporation

- Solitron Devices Inc

- Shindengen America Inc

- MACOM

- NXP Semiconductors

- STMicroelectronics

- NATIONAL INSTRUMENTS CORP ALL

- Taiwan Semiconductor Manufacturing Company Ltd

- Semiconductor Components Industries LLC

Significant Organic Field-Effect Transistor Industry Industry Milestones

- June 2022: Nanosheets, a form of gate-all-around field-effect transistor (GAAFET) where a gate surrounds floating transistor fins, gained prominence.

- 2025 (Projected Production): TSMC announced plans to deploy nanosheets in their 2nm process technology.

- 2025 (Ongoing Research): TSMC is actively seeking innovative transistor layouts to reduce energy consumption in high-performance computing (HPC) applications, such as data centers, to mitigate contributions to global warming.

Future Outlook for Organic Field-Effect Transistor Industry Market

The future outlook for the Organic Field-Effect Transistor (OFET) industry is exceptionally promising, driven by persistent technological innovation and expanding market applications. Strategic opportunities lie in further enhancing device performance metrics like mobility and stability, alongside scaling up cost-effective manufacturing processes. The growing demand for flexible, wearable, and biodegradable electronics in sectors such as consumer electronics, healthcare, and the Internet of Things (IoT) will act as significant growth catalysts. The projected market size of $22.5 Million by 2033 highlights the substantial market potential. As research into novel organic materials and advanced fabrication techniques continues, OFETs are poised to play an increasingly pivotal role in the next generation of electronic devices, offering unique advantages in terms of form factor, cost, and sustainability.

Organic Field-Effect Transistor Industry Segmentation

-

1. Type

-

1.1. JFET - Junction Field Effect Transistors

- 1.1.1. P - Type

- 1.1.2. N - Type

- 1.2. MOSFET -

-

1.1. JFET - Junction Field Effect Transistors

-

2. Application

- 2.1. Analog Switches

- 2.2. Amplifiers

- 2.3. Phase Shift Oscillator

- 2.4. Current Limiter

- 2.5. Digital Circuits

- 2.6. Others

-

3. End-User

- 3.1. Automotive

- 3.2. Consumer electronics

- 3.3. IT/Telecom

- 3.4. Power Generating Industries

- 3.5. Other End Users

Organic Field-Effect Transistor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Organic Field-Effect Transistor Industry Regional Market Share

Geographic Coverage of Organic Field-Effect Transistor Industry

Organic Field-Effect Transistor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics; Demand for Green Energy Power Generation Drives the Market

- 3.3. Market Restrains

- 3.3.1. Due to the Static Electricity Field Effect Transistors can be Damaged

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Field-Effect Transistor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. JFET - Junction Field Effect Transistors

- 5.1.1.1. P - Type

- 5.1.1.2. N - Type

- 5.1.2. MOSFET -

- 5.1.1. JFET - Junction Field Effect Transistors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Analog Switches

- 5.2.2. Amplifiers

- 5.2.3. Phase Shift Oscillator

- 5.2.4. Current Limiter

- 5.2.5. Digital Circuits

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Automotive

- 5.3.2. Consumer electronics

- 5.3.3. IT/Telecom

- 5.3.4. Power Generating Industries

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Organic Field-Effect Transistor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. JFET - Junction Field Effect Transistors

- 6.1.1.1. P - Type

- 6.1.1.2. N - Type

- 6.1.2. MOSFET -

- 6.1.1. JFET - Junction Field Effect Transistors

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Analog Switches

- 6.2.2. Amplifiers

- 6.2.3. Phase Shift Oscillator

- 6.2.4. Current Limiter

- 6.2.5. Digital Circuits

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Automotive

- 6.3.2. Consumer electronics

- 6.3.3. IT/Telecom

- 6.3.4. Power Generating Industries

- 6.3.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Organic Field-Effect Transistor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. JFET - Junction Field Effect Transistors

- 7.1.1.1. P - Type

- 7.1.1.2. N - Type

- 7.1.2. MOSFET -

- 7.1.1. JFET - Junction Field Effect Transistors

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Analog Switches

- 7.2.2. Amplifiers

- 7.2.3. Phase Shift Oscillator

- 7.2.4. Current Limiter

- 7.2.5. Digital Circuits

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Automotive

- 7.3.2. Consumer electronics

- 7.3.3. IT/Telecom

- 7.3.4. Power Generating Industries

- 7.3.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Organic Field-Effect Transistor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. JFET - Junction Field Effect Transistors

- 8.1.1.1. P - Type

- 8.1.1.2. N - Type

- 8.1.2. MOSFET -

- 8.1.1. JFET - Junction Field Effect Transistors

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Analog Switches

- 8.2.2. Amplifiers

- 8.2.3. Phase Shift Oscillator

- 8.2.4. Current Limiter

- 8.2.5. Digital Circuits

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Automotive

- 8.3.2. Consumer electronics

- 8.3.3. IT/Telecom

- 8.3.4. Power Generating Industries

- 8.3.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Organic Field-Effect Transistor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. JFET - Junction Field Effect Transistors

- 9.1.1.1. P - Type

- 9.1.1.2. N - Type

- 9.1.2. MOSFET -

- 9.1.1. JFET - Junction Field Effect Transistors

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Analog Switches

- 9.2.2. Amplifiers

- 9.2.3. Phase Shift Oscillator

- 9.2.4. Current Limiter

- 9.2.5. Digital Circuits

- 9.2.6. Others

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Automotive

- 9.3.2. Consumer electronics

- 9.3.3. IT/Telecom

- 9.3.4. Power Generating Industries

- 9.3.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Organic Field-Effect Transistor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. JFET - Junction Field Effect Transistors

- 10.1.1.1. P - Type

- 10.1.1.2. N - Type

- 10.1.2. MOSFET -

- 10.1.1. JFET - Junction Field Effect Transistors

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Analog Switches

- 10.2.2. Amplifiers

- 10.2.3. Phase Shift Oscillator

- 10.2.4. Current Limiter

- 10.2.5. Digital Circuits

- 10.2.6. Others

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Automotive

- 10.3.2. Consumer electronics

- 10.3.3. IT/Telecom

- 10.3.4. Power Generating Industries

- 10.3.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vishay Intertechnology Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NTE Electronics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infineon Technologies AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alpha and Omega Semiconductor Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Broadcom

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Texas Instruments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric Corporation*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nexperia

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sensitron Semiconducto

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toshiba Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Solitron Devices Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shindengen America Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MACOM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NXP Semiconductors

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 STMicroelectronics

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 NATIONAL INSTRUMENTS CORP ALL

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Taiwan Semiconductor Manufacturing Company Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Semiconductor Components Industries LLC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: Global Organic Field-Effect Transistor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Organic Field-Effect Transistor Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Organic Field-Effect Transistor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Organic Field-Effect Transistor Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Organic Field-Effect Transistor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Organic Field-Effect Transistor Industry Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Organic Field-Effect Transistor Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Organic Field-Effect Transistor Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Organic Field-Effect Transistor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Organic Field-Effect Transistor Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Organic Field-Effect Transistor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Organic Field-Effect Transistor Industry Revenue (Million), by Application 2025 & 2033

- Figure 13: Europe Organic Field-Effect Transistor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Organic Field-Effect Transistor Industry Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Organic Field-Effect Transistor Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Organic Field-Effect Transistor Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Organic Field-Effect Transistor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Organic Field-Effect Transistor Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Organic Field-Effect Transistor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Organic Field-Effect Transistor Industry Revenue (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Organic Field-Effect Transistor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Organic Field-Effect Transistor Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Organic Field-Effect Transistor Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Organic Field-Effect Transistor Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Organic Field-Effect Transistor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Organic Field-Effect Transistor Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Organic Field-Effect Transistor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Organic Field-Effect Transistor Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Organic Field-Effect Transistor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Organic Field-Effect Transistor Industry Revenue (Million), by End-User 2025 & 2033

- Figure 31: Latin America Organic Field-Effect Transistor Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Latin America Organic Field-Effect Transistor Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Organic Field-Effect Transistor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Organic Field-Effect Transistor Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Organic Field-Effect Transistor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Organic Field-Effect Transistor Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Organic Field-Effect Transistor Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Organic Field-Effect Transistor Industry Revenue (Million), by End-User 2025 & 2033

- Figure 39: Middle East and Africa Organic Field-Effect Transistor Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Middle East and Africa Organic Field-Effect Transistor Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Organic Field-Effect Transistor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 24: Global Organic Field-Effect Transistor Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Field-Effect Transistor Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Organic Field-Effect Transistor Industry?

Key companies in the market include Vishay Intertechnology Inc, NTE Electronics Inc, Infineon Technologies AG, Alpha and Omega Semiconductor Limited, Broadcom, Texas Instruments, Mitsubishi Electric Corporation*List Not Exhaustive, Nexperia, Sensitron Semiconducto, Toshiba Corporation, Solitron Devices Inc, Shindengen America Inc, MACOM, NXP Semiconductors, STMicroelectronics, NATIONAL INSTRUMENTS CORP ALL, Taiwan Semiconductor Manufacturing Company Ltd, Semiconductor Components Industries LLC.

3. What are the main segments of the Organic Field-Effect Transistor Industry?

The market segments include Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics; Demand for Green Energy Power Generation Drives the Market.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Due to the Static Electricity Field Effect Transistors can be Damaged.

8. Can you provide examples of recent developments in the market?

June 2022 - Nanosheets are a sort of gate-all-around field-effect transistor (GAAFET) in which a gate surrounds floating transistor fins. TSMC announced to deploy nanosheets in their 2nm process, which will go into production in 2025. TSMC is looking for innovative transistor layouts that can reduce energy usage in HPC applications such as data centers, which contribute considerably to global warming.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Field-Effect Transistor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Field-Effect Transistor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Field-Effect Transistor Industry?

To stay informed about further developments, trends, and reports in the Organic Field-Effect Transistor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence