Key Insights

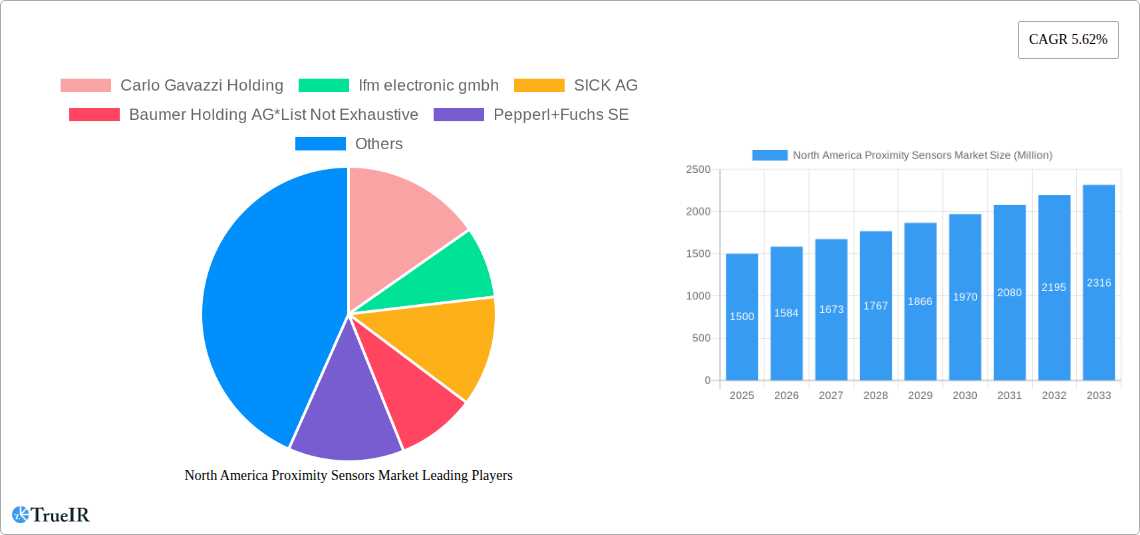

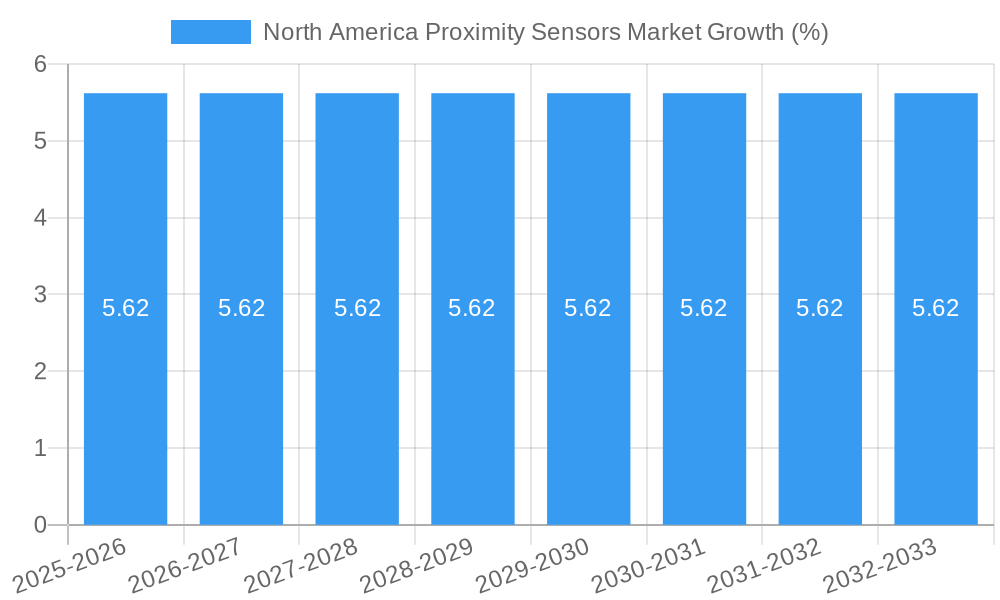

The North America proximity sensors market is poised for significant expansion, projected to reach an estimated market size of approximately $1,500 million by 2025. Driven by a robust compound annual growth rate (CAGR) of 5.62%, this market is expected to witness sustained momentum through 2033. Key growth drivers include the accelerating adoption of industrial automation across manufacturing sectors, the increasing demand for sophisticated safety systems in automotive applications, and the burgeoning electronics and semiconductor manufacturing industries. Furthermore, the aerospace and defense sector's continuous need for advanced sensing technologies and the growing sophistication of packaging automation are contributing substantially to market uplift. The proliferation of IoT devices and smart factory initiatives further bolsters the demand for reliable and precise proximity sensing solutions, underpinning the market's healthy growth trajectory.

The market landscape for proximity sensors in North America is characterized by diverse technological applications and a dynamic competitive environment. Inductive sensors, renowned for their durability and suitability for metal detection in harsh industrial settings, continue to hold a prominent share. Capacitive sensors are increasingly finding application in non-metallic object detection, while photoelectric and magnetic sensors cater to specialized requirements in automation and control systems. Leading players such as SICK AG, OMRON Corporation, and Pepperl+Fuchs SE are actively innovating and expanding their product portfolios to meet evolving industry needs. The region's strong industrial base, coupled with significant investments in technological advancements, positions North America as a critical hub for proximity sensor innovation and deployment. Challenges such as the initial cost of advanced sensor integration and the need for skilled personnel for implementation are being addressed through ongoing research and development and industry-wide training initiatives.

North America Proximity Sensors Market: Comprehensive Analysis and Forecast (2019-2033)

This report offers an in-depth analysis of the North America proximity sensors market, providing critical insights into market dynamics, trends, opportunities, and competitive strategies. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025 and an estimated year also in 2025, this research delves into the historical performance (2019-2024) and forecasts future growth through 2033. The proximity sensors market in North America is a vital component of industrial automation, automotive advancements, and electronics manufacturing, driven by increasing demand for smart and connected systems.

North America Proximity Sensors Market Market Structure & Competitive Landscape

The North America proximity sensors market exhibits a moderately concentrated structure, with key players like Pepperl+Fuchs SE, OMRON Corporation, and SICK AG holding significant market shares. Innovation is a primary driver, fueled by the continuous development of advanced sensing technologies and the integration of smart features. Regulatory impacts, while not overly burdensome, influence product design and safety standards, particularly in automotive and aerospace applications. Product substitutes, such as vision sensors and machine vision systems, are emerging but proximity sensors retain their cost-effectiveness and simplicity for many core automation tasks. End-user segmentation reveals the industrial sector as the dominant consumer, followed closely by automotive and electronics manufacturing. Merger and acquisition (M&A) trends are present, with smaller innovators being absorbed by larger players to expand technological portfolios and market reach. For instance, the market has witnessed approximately 5-10 significant M&A activities annually during the historical period, indicative of consolidation efforts. The concentration ratio among the top five players is estimated to be around 40-50%, highlighting a competitive yet consolidated landscape.

North America Proximity Sensors Market Market Trends & Opportunities

The North America proximity sensors market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. This expansion is fueled by the escalating adoption of Industrial Internet of Things (IIoT) across various manufacturing sectors, driving demand for reliable and intelligent sensing solutions for real-time data acquisition and process optimization. The automotive industry's relentless pursuit of advanced driver-assistance systems (ADAS) and autonomous driving technologies is a significant catalyst, necessitating highly accurate and responsive proximity sensors for object detection, parking assistance, and safety functions. Furthermore, the burgeoning electronics and semiconductor manufacturing industries are witnessing increased automation, requiring precision sensing for intricate assembly processes and quality control.

Technological advancements are at the forefront, with a notable shift towards smaller form factors, enhanced environmental resistance (e.g., IP67/IP69K ratings), and improved sensing capabilities, including extended detection ranges and specialized functionalities like IO-Link communication for seamless integration into Industry 4.0 frameworks. The growing preference for non-contact sensing technologies over traditional mechanical switches is also a key trend, enhancing operational efficiency and reducing wear and tear.

Opportunities abound for manufacturers who can offer cost-effective, highly reliable, and application-specific proximity sensor solutions. The increasing demand for sensors capable of detecting a wider range of materials, including challenging substrates like plastics and liquids, presents a fertile ground for innovation. Moreover, the growing emphasis on predictive maintenance in industrial settings creates opportunities for sensors that can monitor their own operational status and provide early warnings of potential failures. The market penetration rate for proximity sensors in core industrial automation applications is already high, exceeding 70%, but segments like automotive ADAS and specialized electronics manufacturing are still experiencing rapid growth in adoption, offering substantial untapped potential. The increasing adoption of Industry 5.0 concepts, focusing on human-robot collaboration, will further necessitate advanced and safe sensing capabilities.

Dominant Markets & Segments in North America Proximity Sensors Market

The Industrial end-user segment currently dominates the North America proximity sensors market, driven by the extensive application of automation in manufacturing, warehousing, and logistics. Within this segment, Inductive proximity sensors are particularly prevalent due to their robustness and cost-effectiveness in detecting metallic objects in harsh environments, a staple in factory automation. The Automotive sector is rapidly emerging as a close second and is projected to witness the highest growth rate over the forecast period. This surge is attributed to the increasing integration of proximity sensors in ADAS, infotainment systems, and electric vehicle (EV) charging infrastructure.

The Electronics and Semiconductor Manufacturing segment also plays a crucial role, demanding high-precision, miniature proximity sensors for intricate assembly and inspection processes. The Packaging industry utilizes proximity sensors for object detection, sorting, and quality control in high-speed production lines. The Aerospace and Defense sector, while a smaller segment, requires highly specialized and robust proximity sensors for critical applications where reliability and extreme environmental resistance are paramount.

Key growth drivers in the industrial sector include the continuous push for operational efficiency, reduced downtime, and enhanced safety through automation. Government initiatives promoting advanced manufacturing and reshoring efforts are further stimulating demand. In the automotive sector, stringent safety regulations and the accelerating transition to electric and autonomous vehicles are major catalysts. The electronics industry benefits from the ongoing miniaturization of devices and the demand for higher throughput in production. Policies supporting digital transformation and Industry 4.0 adoption across all these sectors are indirectly boosting the proximity sensors market by fostering an environment conducive to automation and smart sensing. The estimated market size for the Industrial segment alone is expected to reach over $1,500 Million by 2025.

North America Proximity Sensors Market Product Analysis

Product innovations in the North America proximity sensors market are characterized by advancements in sensing technology, miniaturization, and enhanced connectivity. Manufacturers are focusing on developing sensors with extended detection ranges, improved accuracy, and greater resistance to environmental factors like dust, moisture, and vibration. The integration of IO-Link communication is a significant trend, enabling bidirectional data exchange and remote configuration, thereby simplifying integration and diagnostics in automated systems. Specialized sensors for detecting non-metallic objects and harsh media are also gaining traction, expanding the application scope of proximity sensing beyond traditional metallic detection. These technological leaps enhance the competitive advantage of proximity sensors by offering greater versatility and smarter functionality within automation ecosystems.

Key Drivers, Barriers & Challenges in North America Proximity Sensors Market

Key Drivers:

- Growing Adoption of Automation and IIoT: The relentless drive for efficiency, productivity, and data-driven decision-making across industries is a primary growth engine for proximity sensors.

- Advancements in Automotive Technology: The increasing demand for ADAS, autonomous driving, and EV technologies directly fuels the need for sophisticated proximity sensing solutions.

- Technological Innovations: Development of smaller, more robust, and feature-rich sensors (e.g., IO-Link compatibility, improved detection capabilities) expands application possibilities.

- Government Support and Initiatives: Policies promoting advanced manufacturing, digitalization, and smart infrastructure indirectly boost sensor demand.

Barriers & Challenges:

- Intense Competition and Price Sensitivity: A mature market with numerous players leads to price pressures, especially for standard sensor types.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of raw materials and components, leading to production delays and increased costs.

- Emergence of Advanced Alternatives: Sophisticated vision systems and other sensing technologies can offer higher levels of detail and functionality, posing a competitive threat in certain niche applications.

- Skilled Workforce Shortage: The need for skilled personnel to design, implement, and maintain automated systems can indirectly limit the pace of adoption.

Growth Drivers in the North America Proximity Sensors Market Market

Key growth drivers for the North America proximity sensors market are multifaceted, stemming from technological advancements, economic imperatives, and supportive policy frameworks. Economically, the pursuit of operational excellence and cost reduction in manufacturing industries necessitates advanced automation, where proximity sensors play a foundational role in detecting product presence, position, and movement. Technological evolution, particularly in areas like IIoT and Industry 4.0, is creating a demand for smarter sensors capable of providing richer data and seamless integration into networked systems. Regulatory drivers, such as stringent automotive safety standards and mandates for energy efficiency in industrial processes, also push for the adoption of more advanced and reliable sensing solutions.

Challenges Impacting North America Proximity Sensors Market Growth

Several challenges are poised to impact the growth trajectory of the North America proximity sensors market. Regulatory complexities, while generally supportive of innovation, can introduce compliance hurdles and certification requirements that vary across industries and geographies, potentially slowing down product deployment. Supply chain issues, ranging from component shortages to logistical bottlenecks, remain a significant concern, impacting production lead times and cost management for manufacturers. Competitive pressures are intense, with a crowded market landscape and the constant threat of substitute technologies offering more advanced capabilities, particularly in high-end applications. These factors necessitate a strategic focus on innovation, supply chain resilience, and differentiated product offerings to navigate the evolving market dynamics.

Key Players Shaping the North America Proximity Sensors Market Market

- Carlo Gavazzi Holding

- Ifm electronic gmbh

- SICK AG

- Baumer Holding AG

- Pepperl+Fuchs SE

- Hans Turck GmbH & Co KG

- Banner Engineering Corp

- OMRON Corporation

- Rockwell Automation Inc

Significant North America Proximity Sensors Market Industry Milestones

- 2019: Introduction of advanced IO-Link enabled inductive sensors offering enhanced diagnostics and integration capabilities.

- 2020: Increased adoption of photoelectric sensors in e-commerce fulfillment centers for automated sorting and logistics.

- 2021: Development of miniature, high-performance magnetic sensors for compact automotive applications and consumer electronics.

- 2022: Significant investment by key players in R&D for AI-integrated sensors capable of adaptive learning and predictive maintenance.

- 2023: Emergence of novel capacitive sensors capable of detecting a wider range of materials, including challenging liquids and powders.

- 2024: Growing trend towards sustainable sensor manufacturing and recyclable materials in product design.

Future Outlook for North America Proximity Sensors Market Market

The future outlook for the North America proximity sensors market is exceptionally bright, driven by the relentless march of automation, the proliferation of smart technologies, and the evolving demands of key end-use industries. The continued growth of IIoT, AI, and Industry 4.0 principles will necessitate increasingly sophisticated and interconnected sensing solutions. The automotive sector's transformation towards autonomous driving and electrification will remain a dominant growth catalyst. Opportunities lie in developing ultra-reliable, multi-functional sensors with advanced diagnostic capabilities and seamless integration into edge computing architectures. Manufacturers that can offer innovative, application-specific solutions with a focus on sustainability and data intelligence are best positioned to capitalize on the significant market potential in the coming years, with projected market size exceeding $4,000 Million by 2033.

North America Proximity Sensors Market Segmentation

-

1. Technology

- 1.1. Inductive

- 1.2. Capacitive

- 1.3. Photoelectric

- 1.4. Magnetic

-

2. End-User

- 2.1. Industrial

- 2.2. Automotive

- 2.3. Electronics and Semiconductor Manufacturing

- 2.4. Aerospace and Defense

- 2.5. Packaging

- 2.6. Other End-use Applications

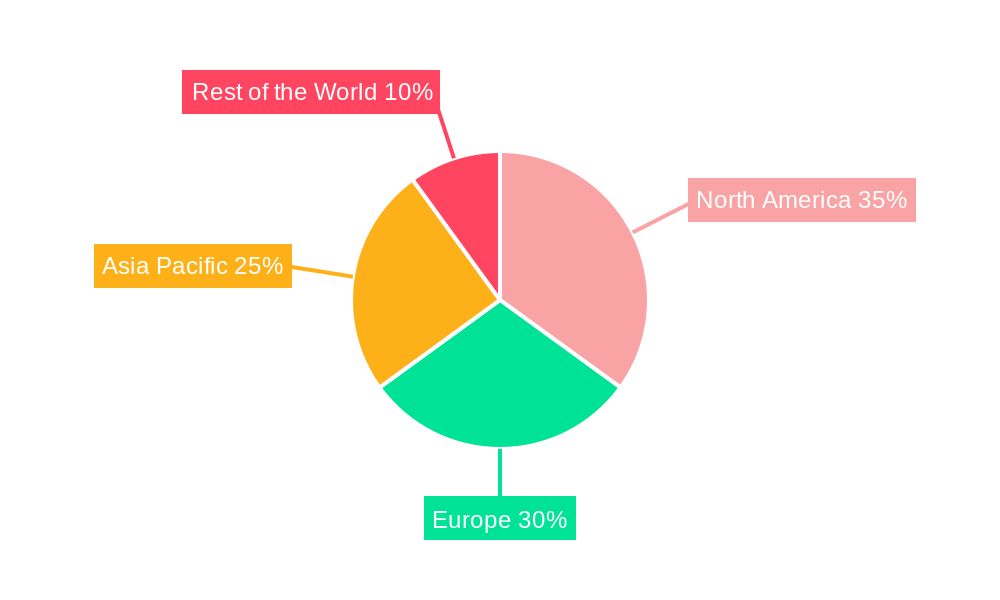

North America Proximity Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Proximity Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Industrial Automation; Increase in Demand for Non-contact Sensing Technology

- 3.3. Market Restrains

- 3.3.1. ; Limitations in Sensing Capabilities

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Consumer Electronics Devices is North America is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Proximity Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Inductive

- 5.1.2. Capacitive

- 5.1.3. Photoelectric

- 5.1.4. Magnetic

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Industrial

- 5.2.2. Automotive

- 5.2.3. Electronics and Semiconductor Manufacturing

- 5.2.4. Aerospace and Defense

- 5.2.5. Packaging

- 5.2.6. Other End-use Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America Proximity Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Proximity Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Proximity Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Proximity Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Carlo Gavazzi Holding

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ifm electronic gmbh

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SICK AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Baumer Holding AG*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Pepperl+Fuchs SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hans Turck GmbH & Co KG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Banner Engineering Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 OMRON Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rockwell Automation Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Carlo Gavazzi Holding

List of Figures

- Figure 1: North America Proximity Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Proximity Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: North America Proximity Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Proximity Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: North America Proximity Sensors Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: North America Proximity Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Proximity Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Proximity Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 11: North America Proximity Sensors Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: North America Proximity Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Proximity Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Proximity Sensors Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the North America Proximity Sensors Market?

Key companies in the market include Carlo Gavazzi Holding, Ifm electronic gmbh, SICK AG, Baumer Holding AG*List Not Exhaustive, Pepperl+Fuchs SE, Hans Turck GmbH & Co KG, Banner Engineering Corp, OMRON Corporation, Rockwell Automation Inc.

3. What are the main segments of the North America Proximity Sensors Market?

The market segments include Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Industrial Automation; Increase in Demand for Non-contact Sensing Technology.

6. What are the notable trends driving market growth?

Growing Adoption of Consumer Electronics Devices is North America is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

; Limitations in Sensing Capabilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Proximity Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Proximity Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Proximity Sensors Market?

To stay informed about further developments, trends, and reports in the North America Proximity Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence