Key Insights

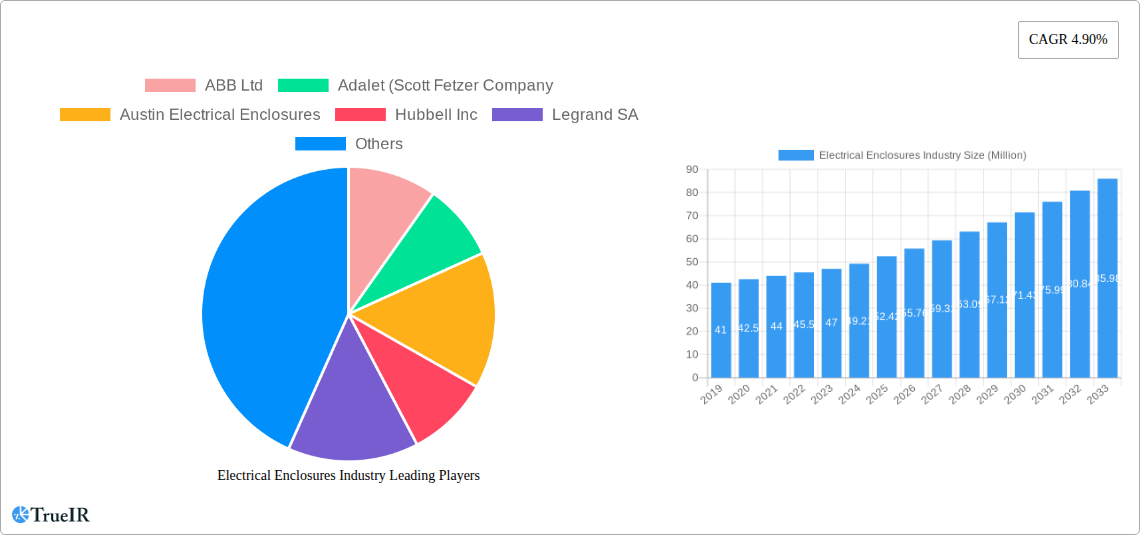

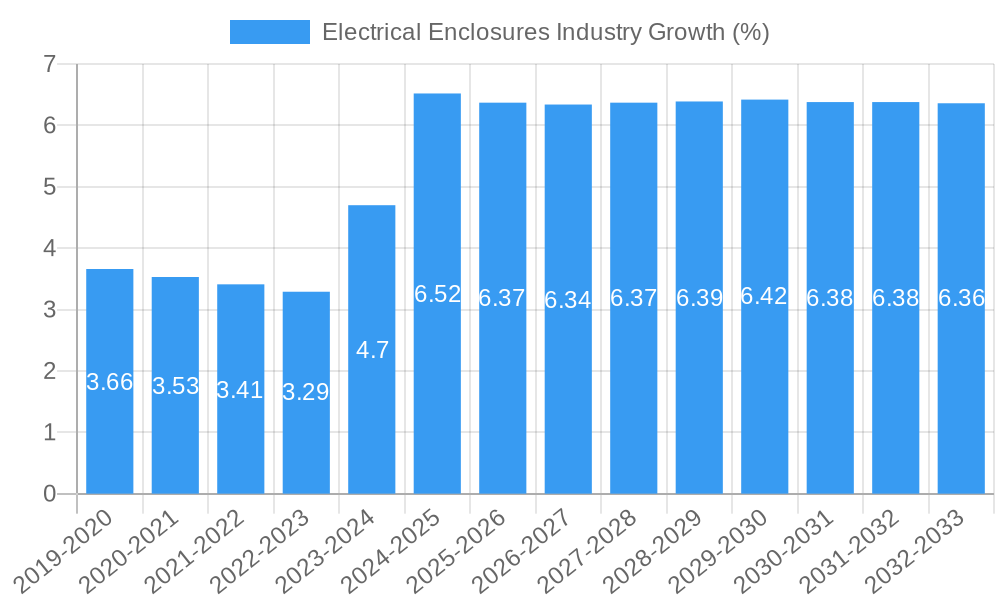

The global Electrical Enclosures market is poised for robust growth, projected to reach a substantial market size of USD 52.42 billion by 2025. Driven by an anticipated Compound Annual Growth Rate (CAGR) of 4.90% from 2019 to 2033, this expansion signifies a dynamic and evolving industry. Key growth drivers include the escalating demand for reliable and secure housing for electrical and electronic components across various sectors, particularly the rapidly expanding energy and power industry and the continuously innovating industrial sector, encompassing automotive and manufacturing. The increasing adoption of smart grid technologies, renewable energy installations, and the relentless pursuit of automation in manufacturing processes are all contributing to a heightened need for sophisticated and durable electrical enclosures. Furthermore, stringent safety regulations and the growing emphasis on preventing equipment failure and ensuring operational continuity are bolstering market demand.

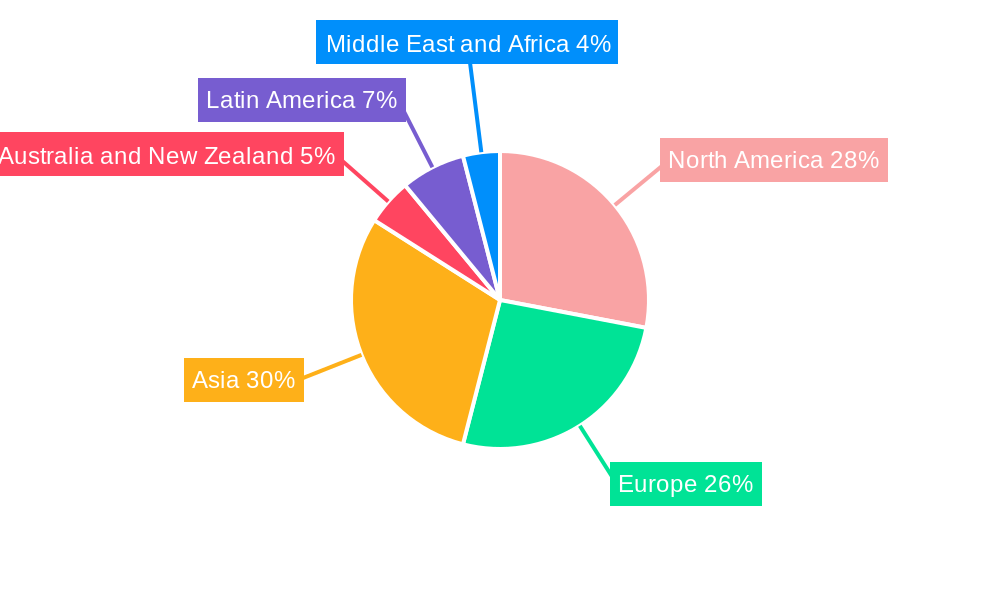

The market segmentation reveals a diverse landscape, with metallic enclosures likely holding a significant share due to their inherent strength, durability, and shielding properties, while non-metallic enclosures are gaining traction due to their cost-effectiveness, corrosion resistance, and lighter weight, especially in specific environmental conditions. The process industries are also a crucial segment, requiring specialized enclosures for harsh environments. Geographically, North America and Europe are expected to remain dominant markets, supported by established industrial infrastructures and significant investments in smart city initiatives and grid modernization. However, the Asia-Pacific region, particularly China and India, is anticipated to witness the fastest growth due to rapid industrialization, urbanization, and increasing foreign direct investment in manufacturing and infrastructure. Emerging trends such as the development of integrated smart enclosures with advanced monitoring capabilities and the increasing use of sustainable materials in enclosure manufacturing will further shape the market trajectory.

This in-depth report provides a detailed examination of the global Electrical Enclosures Market, a critical sector supporting the reliable operation and safety of electrical equipment across diverse industries. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this analysis leverages extensive market data and expert insights to deliver actionable intelligence for stakeholders. We delve into the market structure, key trends, dominant segments, product innovations, growth drivers, challenges, and competitive landscape, offering a complete picture of this dynamic industry.

Electrical Enclosures Industry Market Structure & Competitive Landscape

The Electrical Enclosures market is characterized by a moderate to high level of concentration, with several multinational corporations and a substantial number of regional players competing for market share. Innovation is a key differentiator, driven by the increasing demand for enhanced safety, durability, and advanced features like smart connectivity and environmental resistance. Regulatory impacts are significant, with stringent safety standards and certifications shaping product design and manufacturing processes. The market experiences ongoing pressure from product substitutes, particularly in niche applications, necessitating continuous product development. End-user segmentation reveals a diverse demand base, with the Energy and Power and Industrial (Automotive and Manufacturing) sectors being major consumers. Mergers and acquisitions (M&A) play a vital role in market consolidation and expansion, with an estimated volume of xx billion USD in M&A activities recorded during the historical period.

- Market Concentration: Moderate to High, with leading players holding significant shares.

- Innovation Drivers: Enhanced safety, durability, smart functionalities, miniaturization, and sustainability.

- Regulatory Impacts: Strict adherence to international safety standards (e.g., IEC, NEMA, UL) and environmental regulations.

- Product Substitutes: Advancements in alternative material solutions and integrated systems.

- End-User Segmentation: Dominance of Energy & Power, Industrial, and Process Industries.

- M&A Trends: Strategic acquisitions for market expansion, technology integration, and portfolio diversification.

Electrical Enclosures Industry Market Trends & Opportunities

The Electrical Enclosures market is poised for robust growth, with an estimated CAGR of xx% during the forecast period. This expansion is fueled by increasing global electrification, infrastructure development projects, and the growing adoption of renewable energy sources. Technological shifts are paramount, with a rising demand for intelligent enclosures that offer real-time monitoring, remote diagnostics, and enhanced protection against environmental factors. Consumer preferences are leaning towards lightweight, corrosion-resistant, and sustainable enclosure solutions, driving innovation in material science. Competitive dynamics are intensifying, prompting companies to focus on product differentiation, cost optimization, and strategic partnerships. The market penetration rate for advanced and smart enclosures is expected to witness significant growth as industries embrace Industry 4.0 principles. The projected global market size for electrical enclosures is expected to reach xx trillion USD by 2033, an impressive increase from its historical valuation.

The surge in demand for electrical enclosures is intrinsically linked to the global push towards enhanced electrical infrastructure. Governments worldwide are investing heavily in modernizing power grids, expanding electricity access, and integrating smart grid technologies. This necessitates a commensurate increase in the deployment of reliable and robust electrical enclosures to house and protect critical components. Furthermore, the rapid growth of data centers, driven by the proliferation of digital services and cloud computing, presents a substantial opportunity for enclosure manufacturers. These facilities require highly sophisticated and secure enclosures to protect sensitive IT equipment from environmental hazards and unauthorized access.

The ongoing transition to renewable energy sources, such as solar and wind power, also plays a pivotal role. The infrastructure supporting these intermittent energy sources, including inverters, transformers, and control systems, requires specialized enclosures designed to withstand harsh outdoor environments and ensure operational integrity. The increasing adoption of electric vehicles (EVs) and the subsequent expansion of charging infrastructure further amplify the demand for electrical enclosures. These enclosures are crucial for housing the complex power electronics and safety mechanisms within EV charging stations, ensuring their reliable and safe operation.

Moreover, the industrial sector, encompassing automotive manufacturing, general manufacturing, and heavy industries, continues to be a significant end-user. Automation and the increasing sophistication of industrial machinery necessitate advanced enclosure solutions to protect control systems, sensors, and other electrical components from dust, moisture, vibration, and extreme temperatures. The growing emphasis on predictive maintenance and the Industrial Internet of Things (IIoT) is driving the demand for enclosures equipped with integrated sensors and communication capabilities, enabling remote monitoring and data analysis.

The process industries, including oil and gas, chemicals, and pharmaceuticals, also contribute substantially to the market. These sectors often operate in hazardous or corrosive environments, requiring enclosures that meet stringent safety and material specifications. The demand for explosion-proof and chemical-resistant enclosures is particularly high in these segments. Opportunities also exist in specialized applications such as marine, rail, and aerospace, where unique environmental and performance requirements demand tailored enclosure solutions. The ongoing focus on energy efficiency and sustainability is encouraging the development of enclosures made from recyclable materials and designed for optimal thermal management, further expanding market potential.

Dominant Markets & Segments in Electrical Enclosures Industry

The Energy and Power segment is the dominant end-user industry in the Electrical Enclosures market, driven by substantial investments in grid modernization, renewable energy infrastructure, and the expansion of power generation and distribution networks. Countries like the United States, China, and India are leading the charge due to their large energy demands and ongoing infrastructure development initiatives. Within materials, Metallic enclosures, particularly those made from steel and aluminum, continue to hold a significant market share due to their superior strength, durability, and fire resistance, making them ideal for demanding applications in power substations and industrial facilities.

- Leading Region: North America and Asia Pacific exhibit the highest market dominance due to significant infrastructure investments and industrial growth.

- Leading Country: The United States and China are projected to be the largest markets owing to their extensive energy grids, burgeoning manufacturing sectors, and rapid adoption of new technologies.

- Dominant End-User Industry: Energy and Power, driven by grid expansion, renewable energy projects, and critical infrastructure protection.

- Dominant Material Segment: Metallic enclosures (steel, aluminum) remain dominant due to their inherent strength, durability, and fire resistance, essential for critical infrastructure.

The growth in the Energy and Power sector is directly attributable to the global shift towards decarbonization and the need to support an increasingly complex and decentralized energy landscape. The installation of new solar farms, wind turbines, and hydroelectric power plants requires a vast number of enclosures to protect the associated electrical equipment, including inverters, transformers, and control systems. Similarly, the upgrade and expansion of existing transmission and distribution networks to handle increased load and improve reliability necessitate the deployment of advanced enclosures.

Industrial applications, including Automotive and Manufacturing, represent another crucial segment. The trend towards automation, smart factories, and the electrification of vehicle production lines fuels the demand for specialized enclosures that can protect sensitive control systems and robotics from harsh manufacturing environments. The increasing complexity of automotive electrical systems also requires more sophisticated and compact enclosure solutions.

The Process Industries, such as oil and gas, chemicals, and pharmaceuticals, present a continuous demand for high-performance enclosures. These sectors operate under stringent safety and environmental regulations, requiring enclosures that can withstand corrosive atmospheres, extreme temperatures, and potentially explosive environments. The development of explosion-proof and intrinsically safe enclosures is a key growth driver in this segment.

The Other En segment, encompassing sectors like telecommunications, transportation, and commercial buildings, is also witnessing steady growth. The expansion of 5G networks, the modernization of railway infrastructure, and the construction of smart buildings all contribute to the demand for various types of electrical enclosures. The growing adoption of Building Management Systems (BMS) and the need for robust cybersecurity for electrical infrastructure further drive this demand.

Electrical Enclosures Industry Product Analysis

Product innovation in the Electrical Enclosures market is focused on enhancing durability, safety, and functionality. Manufacturers are developing advanced materials like composite plastics and high-grade stainless steel for improved corrosion resistance and lightweight properties. Smart enclosures with integrated sensors for temperature, humidity, and vibration monitoring, along with IoT connectivity, are gaining traction. Applications span from housing critical components in power substations and industrial machinery to protecting sensitive electronics in data centers and telecommunication infrastructure. Competitive advantages are derived from superior material quality, customized design solutions, adherence to international standards, and the seamless integration of smart technologies, ensuring reliability and operational efficiency.

Key Drivers, Barriers & Challenges in Electrical Enclosures Industry

Key Drivers: The Electrical Enclosures industry is propelled by several key drivers. The global expansion of electrification and the increasing demand for reliable power infrastructure are paramount. Government initiatives supporting renewable energy integration and grid modernization initiatives are significant catalysts. The rise of Industry 4.0, automation, and the Industrial Internet of Things (IIoT) fuels the need for intelligent and connected enclosures. Technological advancements in materials science, leading to more durable, lightweight, and corrosion-resistant solutions, also contribute significantly. The growing adoption of electric vehicles and the corresponding infrastructure development present a substantial growth opportunity.

Barriers & Challenges: Despite robust growth, the industry faces several barriers and challenges. Intense price competition among manufacturers can impact profit margins. Stringent and evolving regulatory landscapes and certification requirements add complexity and cost to product development. Supply chain disruptions, particularly concerning raw material availability and price volatility, pose significant risks. The skilled labor shortage in manufacturing can hinder production capacity. Furthermore, the adoption of alternative solutions and the need for continuous innovation to stay ahead of technological advancements present ongoing challenges. The global supply chain disruptions have impacted material costs, estimated to have increased by xx% over the historical period.

Growth Drivers in the Electrical Enclosures Industry Market

Key growth drivers in the Electrical Enclosures industry are multifaceted. The pervasive trend of global electrification, coupled with extensive investments in smart grid technologies and renewable energy infrastructure, forms a foundational growth catalyst. Government policies promoting energy efficiency and carbon footprint reduction further incentivize the demand for advanced enclosure solutions. The accelerating adoption of automation and Industry 4.0 principles across manufacturing and industrial sectors necessitates the deployment of sophisticated enclosures for critical control systems. Furthermore, the burgeoning electric vehicle market and its expanding charging infrastructure represent a significant and growing avenue for market expansion, demanding specialized and robust enclosure designs.

Challenges Impacting Electrical Enclosures Industry Growth

Several challenges impact the growth of the Electrical Enclosures industry. Navigating complex and often disparate international regulatory standards and certification processes can be a significant hurdle, increasing compliance costs and time-to-market. Volatility in raw material prices, particularly for metals and specialty plastics, coupled with persistent global supply chain disruptions, can lead to unpredictable production costs and lead times. Intense competitive pressure from both established global players and emerging regional manufacturers drives down pricing and necessitates continuous innovation to maintain market differentiation. The increasing demand for customized solutions also adds complexity to manufacturing processes and inventory management, posing operational challenges.

Key Players Shaping the Electrical Enclosures Industry Market

- ABB Ltd

- Adalet (Scott Fetzer Company)

- Austin Electrical Enclosures

- Hubbell Inc

- Legrand SA

- Emerson Electric Co

- Eldon Holding AB

- Siemens AG

- Schneider Electric SE

- Rittal GmbH & Co Kg

- AZZ Inc

- Pentair PLC

- Eaton Corporation

Significant Electrical Enclosures Industry Industry Milestones

- Oct 2022: Tri-Mack Plastics Manufacturing Corp announced the development of a lightweight, high-strength enclosure made from unidirectional (UD) carbon fiber-reinforced thermoplastic (CFRTP) tape and only forty-thousandths of an inch (0.40-inch) thick, showcasing advancements in material science for enclosure applications.

- Feb 2022: Siemens, in partnership with Nexii Building Solutions, announced a new sustainable EV charging concept structure designed for electrifying fleets and high-demand charging applications at scale. The new VersiCharge XL concept was created to electrify new or existing parking lots and building structures quickly and efficiently using a modular, scalable design, highlighting innovation in EV infrastructure solutions.

Future Outlook for Electrical Enclosures Industry Market

- Oct 2022: Tri-Mack Plastics Manufacturing Corp announced the development of a lightweight, high-strength enclosure made from unidirectional (UD) carbon fiber-reinforced thermoplastic (CFRTP) tape and only forty-thousandths of an inch (0.40-inch) thick, showcasing advancements in material science for enclosure applications.

- Feb 2022: Siemens, in partnership with Nexii Building Solutions, announced a new sustainable EV charging concept structure designed for electrifying fleets and high-demand charging applications at scale. The new VersiCharge XL concept was created to electrify new or existing parking lots and building structures quickly and efficiently using a modular, scalable design, highlighting innovation in EV infrastructure solutions.

Future Outlook for Electrical Enclosures Industry Market

The future outlook for the Electrical Enclosures industry is exceptionally bright, driven by sustained global demand for reliable electrical infrastructure and the relentless pace of technological advancement. Strategic opportunities lie in the continued expansion of renewable energy integration, smart city initiatives, and the digitalization of industries. The growing emphasis on sustainability will drive the demand for eco-friendly materials and energy-efficient enclosure designs. Manufacturers that focus on developing intelligent, connected enclosures with enhanced cybersecurity features and customizable solutions will be well-positioned to capitalize on future market potential, estimated to grow by xx% in the forecast period.

Electrical Enclosures Industry Segmentation

-

1. Material

- 1.1. Metallic

- 1.2. Non-metallic

-

2. End-user Industry

- 2.1. Energy and Power

- 2.2. Industrial (Automotive and Manufacturing)

- 2.3. Process Industries

- 2.4. Other En

Electrical Enclosures Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Electrical Enclosures Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Power Infrastructure Developments; Rising Adoption of Industrial Automation

- 3.3. Market Restrains

- 3.3.1. Quality and Safety Concerns

- 3.4. Market Trends

- 3.4.1. Energy and Power End-User Industry to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Metallic

- 5.1.2. Non-metallic

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Energy and Power

- 5.2.2. Industrial (Automotive and Manufacturing)

- 5.2.3. Process Industries

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Metallic

- 6.1.2. Non-metallic

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Energy and Power

- 6.2.2. Industrial (Automotive and Manufacturing)

- 6.2.3. Process Industries

- 6.2.4. Other En

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Metallic

- 7.1.2. Non-metallic

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Energy and Power

- 7.2.2. Industrial (Automotive and Manufacturing)

- 7.2.3. Process Industries

- 7.2.4. Other En

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Metallic

- 8.1.2. Non-metallic

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Energy and Power

- 8.2.2. Industrial (Automotive and Manufacturing)

- 8.2.3. Process Industries

- 8.2.4. Other En

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Australia and New Zealand Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Metallic

- 9.1.2. Non-metallic

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Energy and Power

- 9.2.2. Industrial (Automotive and Manufacturing)

- 9.2.3. Process Industries

- 9.2.4. Other En

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Latin America Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Metallic

- 10.1.2. Non-metallic

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Energy and Power

- 10.2.2. Industrial (Automotive and Manufacturing)

- 10.2.3. Process Industries

- 10.2.4. Other En

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Middle East and Africa Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Material

- 11.1.1. Metallic

- 11.1.2. Non-metallic

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Energy and Power

- 11.2.2. Industrial (Automotive and Manufacturing)

- 11.2.3. Process Industries

- 11.2.4. Other En

- 11.1. Market Analysis, Insights and Forecast - by Material

- 12. North America Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 14. Asia Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 India

- 14.1.3 Japan

- 15. Australia and New Zealand Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Electrical Enclosures Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 ABB Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Adalet (Scott Fetzer Company

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Austin Electrical Enclosures

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Hubbell Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Legrand SA

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Emerson Electric Co

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Eldon Holding AB

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Siemens AG

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Schneider Electric SE

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Rittal GmbH & Co Kg

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 AZZ Inc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Pentair PLC

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Eaton Corporation

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.1 ABB Ltd

List of Figures

- Figure 1: Global Electrical Enclosures Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Electrical Enclosures Industry Revenue (Million), by Material 2024 & 2032

- Figure 15: North America Electrical Enclosures Industry Revenue Share (%), by Material 2024 & 2032

- Figure 16: North America Electrical Enclosures Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Electrical Enclosures Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Electrical Enclosures Industry Revenue (Million), by Material 2024 & 2032

- Figure 21: Europe Electrical Enclosures Industry Revenue Share (%), by Material 2024 & 2032

- Figure 22: Europe Electrical Enclosures Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: Europe Electrical Enclosures Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: Europe Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Electrical Enclosures Industry Revenue (Million), by Material 2024 & 2032

- Figure 27: Asia Electrical Enclosures Industry Revenue Share (%), by Material 2024 & 2032

- Figure 28: Asia Electrical Enclosures Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Asia Electrical Enclosures Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Asia Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Electrical Enclosures Industry Revenue (Million), by Material 2024 & 2032

- Figure 33: Australia and New Zealand Electrical Enclosures Industry Revenue Share (%), by Material 2024 & 2032

- Figure 34: Australia and New Zealand Electrical Enclosures Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Australia and New Zealand Electrical Enclosures Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Australia and New Zealand Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Electrical Enclosures Industry Revenue (Million), by Material 2024 & 2032

- Figure 39: Latin America Electrical Enclosures Industry Revenue Share (%), by Material 2024 & 2032

- Figure 40: Latin America Electrical Enclosures Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America Electrical Enclosures Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Electrical Enclosures Industry Revenue (Million), by Material 2024 & 2032

- Figure 45: Middle East and Africa Electrical Enclosures Industry Revenue Share (%), by Material 2024 & 2032

- Figure 46: Middle East and Africa Electrical Enclosures Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 47: Middle East and Africa Electrical Enclosures Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 48: Middle East and Africa Electrical Enclosures Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Electrical Enclosures Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electrical Enclosures Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Electrical Enclosures Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 22: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Canada Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 27: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 32: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 33: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: China Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: India Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Electrical Enclosures Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 38: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 39: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 41: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 42: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Global Electrical Enclosures Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 44: Global Electrical Enclosures Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 45: Global Electrical Enclosures Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electrical Enclosures Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Electrical Enclosures Industry?

Key companies in the market include ABB Ltd, Adalet (Scott Fetzer Company, Austin Electrical Enclosures, Hubbell Inc, Legrand SA, Emerson Electric Co, Eldon Holding AB, Siemens AG, Schneider Electric SE, Rittal GmbH & Co Kg, AZZ Inc, Pentair PLC, Eaton Corporation.

3. What are the main segments of the Electrical Enclosures Industry?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Power Infrastructure Developments; Rising Adoption of Industrial Automation.

6. What are the notable trends driving market growth?

Energy and Power End-User Industry to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Quality and Safety Concerns.

8. Can you provide examples of recent developments in the market?

Oct 2022 - Tri-Mack Plastics Manufacturing Corp, a high-performance thermoplastic parts manufacturer, announced the development of a lightweight, high-strength enclosure made from unidirectional (UD) carbon fiber-reinforced thermoplastic (CFRTP) tape and only forty-thousandths of an inch (0.40-inch) thick.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electrical Enclosures Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electrical Enclosures Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electrical Enclosures Industry?

To stay informed about further developments, trends, and reports in the Electrical Enclosures Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence