Key Insights

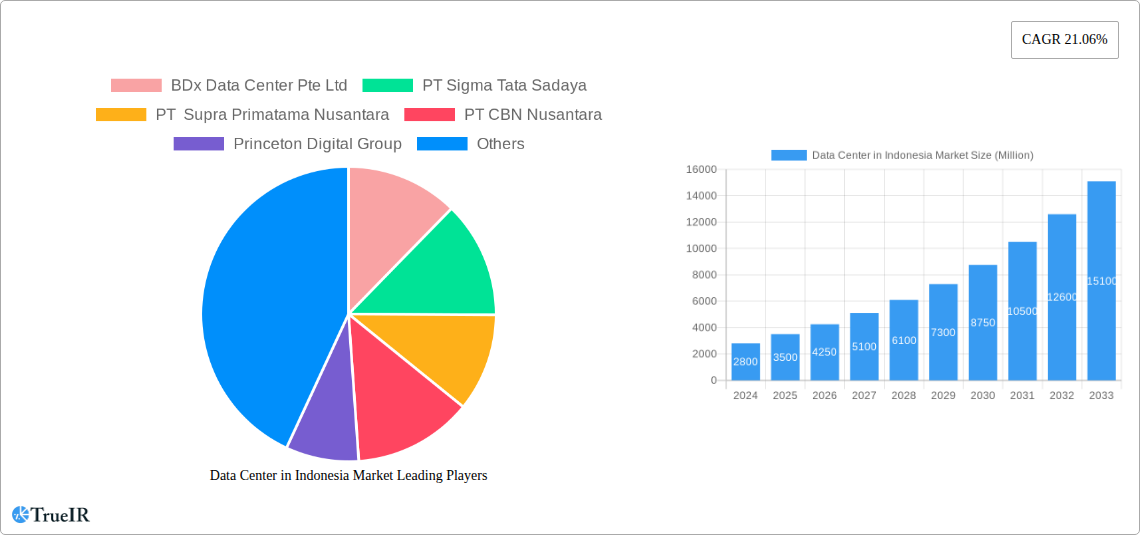

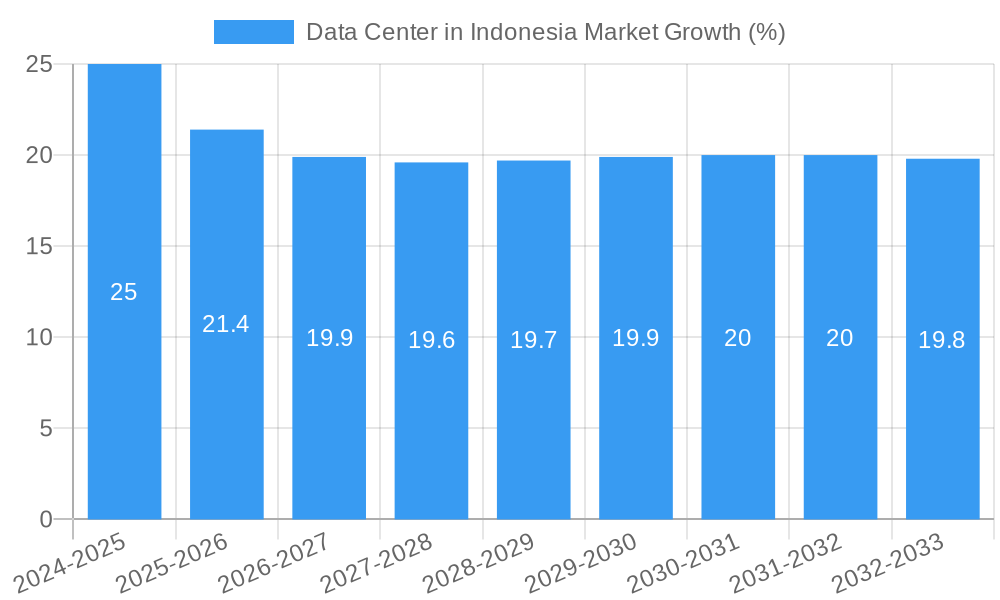

The Indonesian data center market is poised for remarkable expansion, projected to reach a substantial market size of approximately USD 3,500 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 21.06% through 2033. This exceptional growth is fueled by a confluence of powerful drivers, including the escalating demand for digital services, the rapid adoption of cloud computing by enterprises, and the burgeoning e-commerce sector. Government initiatives aimed at fostering digital transformation and attracting foreign investment further bolster this positive trajectory. The market is experiencing a significant surge in demand for colocation services, particularly hyperscale and wholesale deployments, as businesses seek to leverage scalable and reliable infrastructure. The growing proliferation of data generation, coupled with the increasing need for data localization due to evolving regulatory landscapes, is also contributing significantly to market expansion.

Key trends shaping the Indonesian data center landscape include a strong focus on sustainability and energy efficiency, with operators investing in green technologies and renewable energy sources. The development of massive and mega data centers is becoming increasingly prevalent to cater to the growing capacity needs of cloud providers and hyperscalers. Segmentation analysis reveals Greater Jakarta as the dominant hotspot, accounting for a significant portion of current and future demand, while the rest of Indonesia presents substantial untapped potential. The BFSI, Cloud, and E-Commerce sectors are leading the charge in data center adoption, followed closely by Telecom and Media & Entertainment. Despite the optimistic outlook, potential restraints such as the availability of skilled talent, complexities in land acquisition and permits, and the initial capital expenditure required for large-scale deployments need careful consideration. However, the sheer volume of investment and the strategic importance of digital infrastructure for Indonesia’s economic growth suggest that these challenges are being actively addressed by market players and policymakers alike.

Data Center in Indonesia Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Indonesian Data Center market. Leveraging high-volume keywords and detailed segmentation, this report offers critical insights for industry stakeholders, investors, and decision-makers navigating this rapidly expanding sector. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market structure, trends, dominant segments, key players, and future outlook.

Data Center in Indonesia Market Market Structure & Competitive Landscape

The Indonesian data center market is characterized by a dynamic and evolving competitive landscape, marked by increasing foreign investment and strategic partnerships. Market concentration is moderate, with a significant portion of capacity held by a few key players, yet opportunities for new entrants and specialized providers remain. Innovation drivers are primarily fueled by the burgeoning demand for cloud services, hyperscale deployments, and the digital transformation initiatives across various industries. Regulatory frameworks are progressively maturing, aiming to ensure data security, sovereignty, and operational standards, influencing investment decisions and market access. Product substitutes, while not direct for physical data center infrastructure, exist in the form of cloud-based solutions for specific IT workloads. End-user segmentation highlights strong demand from BFSI, Cloud, and E-Commerce sectors, driving the need for robust and scalable data center facilities. Mergers and acquisitions (M&A) are anticipated to play a crucial role in market consolidation and expansion, with recent activities indicating a trend towards strategic alliances to secure market share and enhance service offerings. The market is projected to see a substantial growth in its Large and Mega data center segments, catering to the increasing power density requirements of hyperscale operators.

Data Center in Indonesia Market Market Trends & Opportunities

The Indonesian data center market is experiencing exponential growth, driven by a confluence of factors including rapid digitalization, increasing internet penetration, and the expanding adoption of cloud computing. The market size is projected to grow at a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is underpinned by a significant surge in demand from hyperscale cloud providers, e-commerce giants, and the financial services sector, all seeking to leverage Indonesia's strategic location and burgeoning digital economy. Technological shifts are evident with the increasing deployment of AI, IoT, and big data analytics, which necessitate advanced, high-density data center infrastructure. Consumer preferences are increasingly leaning towards localized data storage and processing to ensure compliance with data sovereignty regulations and to reduce latency for end-users. Competitive dynamics are intensifying, with both established international players and ambitious local companies vying for market share. Opportunities abound for the development of new facilities, particularly in emerging digital hubs outside of Greater Jakarta, and for providers offering specialized services such as colocation, managed hosting, and disaster recovery solutions. The absorption rate for non-utilized capacity is expected to decrease as demand continues to outpace supply, creating a favorable investment climate. The market is poised to witness significant capacity expansion, with a focus on building out Tier 3 and Tier 4 facilities to meet the stringent requirements of modern enterprise and hyperscale clients.

Dominant Markets & Segments in Data Center in Indonesia Market

The Hotspot: Greater Jakarta remains the dominant region within the Indonesian data center market, owing to its established digital infrastructure, concentration of businesses, and accessibility. However, the Rest of Indonesia is rapidly emerging as a significant growth area, driven by government initiatives to decentralize digital infrastructure and reduce reliance on the capital.

Within Data Center Size, the Mega and Large segments are experiencing the most substantial growth. This is directly attributable to the increasing demand from hyperscale cloud providers and large enterprises requiring massive capacity for their digital operations. The Massive category is also gaining traction as hyperscale deployments continue to expand.

In terms of Tier Type, Tier 3 data centers represent the current market standard, offering a balance of redundancy and uptime. However, the demand for Tier 4 facilities is steadily increasing, driven by mission-critical applications and the stringent uptime requirements of financial institutions and major cloud providers. Tier 1 and 2 facilities, while still present, are seeing less investment in new builds compared to higher-tier offerings.

The Absorption: Non-Utilized segment is projected to shrink as market demand accelerates. This indicates a tightening supply-demand balance, making new capacity development a crucial factor for market growth.

Regarding Colocation Type, Hyperscale is the leading segment, driven by global cloud providers establishing a significant presence in Indonesia. Wholesale colocation is also experiencing robust growth, catering to large enterprises and managed service providers. Retail colocation, while still relevant for smaller businesses and specific IT needs, is witnessing a slower growth trajectory compared to its larger counterparts.

The End User landscape is dominated by Cloud providers, followed closely by BFSI and E-Commerce. These sectors are the primary drivers of demand for high-capacity, secure, and reliable data center services. Telecom companies also represent a significant user base, requiring infrastructure to support their expanding network services.

Data Center in Indonesia Market Product Analysis

The Indonesian data center market is characterized by the continuous evolution of its core products, primarily colocation services. Innovations are centered around increasing power density, improving energy efficiency through advanced cooling technologies, and enhancing network connectivity through robust peering capabilities. Competitive advantages are being carved out through the offering of modular designs, scalable infrastructure, and the provision of higher-tier certifications (Tier 3 and Tier 4). Applications are diverse, ranging from hosting critical enterprise IT infrastructure and enabling cloud services to supporting the rapid growth of e-commerce platforms and telecommunications networks. The market is seeing a rise in specialized offerings, such as edge data centers designed for low-latency applications, and facilities equipped to handle the demands of AI and big data processing.

Key Drivers, Barriers & Challenges in Data Center in Indonesia Market

Key Drivers:

- Rapid Digital Transformation: The widespread adoption of digital technologies across all sectors is the primary growth catalyst, fueling demand for data storage and processing.

- Cloud Computing Expansion: The increasing migration of businesses to cloud platforms necessitates substantial data center capacity.

- Growing E-Commerce Market: Indonesia's burgeoning e-commerce sector requires robust infrastructure to support online transactions and logistics.

- Government Initiatives: Supportive policies promoting digital infrastructure development and foreign investment further accelerate market growth.

- Increased Internet Penetration: A growing internet user base translates to higher demand for digital services, requiring underlying data center support.

Barriers & Challenges:

- High Initial Investment Costs: Establishing large-scale, high-tier data centers requires significant capital expenditure.

- Power Availability and Reliability: Securing consistent and reliable power supply, especially in remote areas, can be a challenge.

- Skilled Workforce Shortage: A lack of readily available skilled personnel in data center operations and management can hinder development.

- Land Acquisition and Permitting: Navigating land acquisition processes and obtaining necessary permits can be time-consuming and complex.

- Cybersecurity Threats: The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures.

Growth Drivers in the Data Center in Indonesia Market Market

Key growth drivers in the Indonesian data center market are intrinsically linked to the nation's accelerated digital transformation. The escalating adoption of cloud computing services by enterprises of all sizes is a significant propellant, creating sustained demand for colocation and infrastructure-as-a-service. Furthermore, the booming e-commerce sector, bolstered by a young and digitally active population, necessitates scalable and reliable data center solutions for online retail operations. Government support through digital infrastructure development plans and incentives for foreign investment also plays a crucial role in fostering market expansion. The increasing demand for localized data processing and storage, driven by data sovereignty regulations and the need for reduced latency, further fuels the growth of data center investments across the archipelago.

Challenges Impacting Data Center in Indonesia Market Growth

Several challenges can impact the growth trajectory of the Indonesian data center market. The availability and reliability of power infrastructure, particularly outside major metropolitan areas, remains a critical concern. High initial capital expenditure for constructing state-of-the-art facilities can be a significant barrier to entry. Furthermore, navigating the complex regulatory landscape, including land acquisition processes and environmental permits, can lead to project delays. The availability of a skilled workforce for operating and maintaining advanced data center facilities is another area that requires attention. Finally, intense competition among established and emerging players can exert pressure on pricing and service margins.

Key Players Shaping the Data Center in Indonesia Market Market

- BDx Data Center Pte Ltd

- PT Sigma Tata Sadaya

- PT Supra Primatama Nusantara

- PT CBN Nusantara

- Princeton Digital Group

- EdgeConneX Inc

- PT Faasri Utama Sakti

- Digital Edge (Singapore) Holdings Pte Ltd

- PT DCI Indonesia Tbk

- Space DC Pte Ltd

- NTT Ltd

- Nusantara Data Center

Significant Data Center in Indonesia Market Industry Milestones

- September 2022: A company commenced construction on a 23MW data center in Jakarta, Indonesia, marking its third site in Southeast Asia and capitalizing on the region's rapid digital transformation. The facility will offer 3,430 cabinets and an IT load of 23MW, designed for high power density applications from cloud-driven hyperscale deployments and service providers. Expected completion: Q4 2023.

- August 2022: PT Sigma Cipta Caraka (telkomsigma) transferred its data center business to PT Telkom Data Ekosistem (TDE) for IDR 2.01 trillion, as part of PT Telkom Indonesia's business restructuring program.

- June 2022: BDx Indonesia was launched, following a USD 300 million joint venture agreement between Big Data Exchange (BDx), PT Indosat Tbk (Indosat Ooredoo Hutchison or IOH), and PT Aplikanusa Lintasarta.

Future Outlook for Data Center in Indonesia Market Market

The future outlook for the Indonesian data center market is exceptionally bright, driven by sustained digital transformation and increasing foreign investment. Strategic opportunities lie in the development of hyperscale and edge data centers to meet the growing demand from cloud providers and emerging technologies like AI and IoT. The expansion into tier-two cities and less saturated regions presents significant untapped potential. As the market matures, we anticipate further consolidation through M&A activities and a continued focus on sustainability and energy efficiency in data center design and operations. The market is well-positioned to capitalize on Indonesia's demographic dividend and its ambition to become a leading digital economy in Southeast Asia.

Data Center in Indonesia Market Segmentation

-

1. Hotspot

- 1.1. Greater Jakarta

- 1.2. Rest of Indonesia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

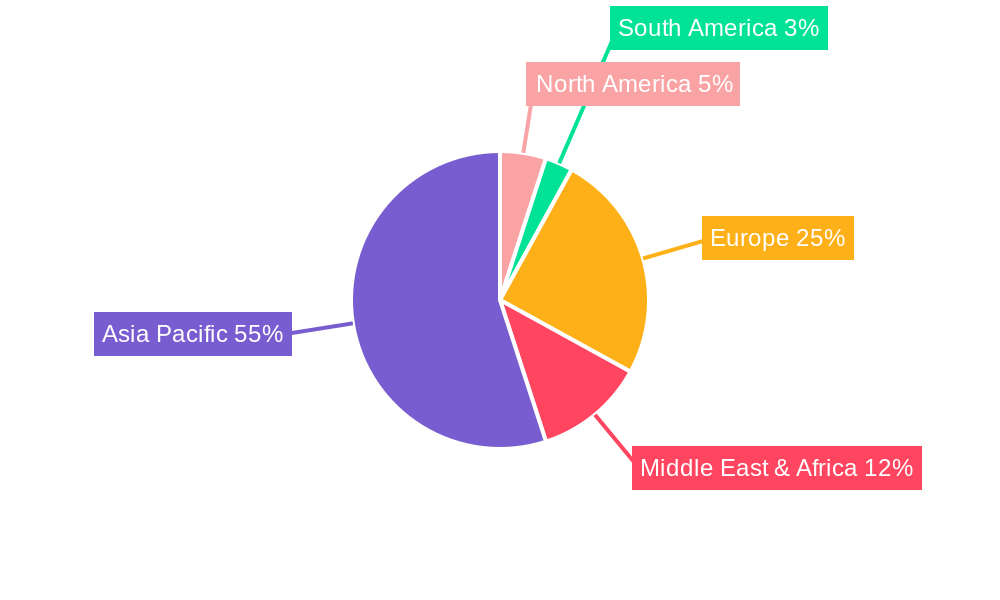

Data Center in Indonesia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Center in Indonesia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Greater Jakarta

- 5.1.2. Rest of Indonesia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North America Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 6.1.1. Greater Jakarta

- 6.1.2. Rest of Indonesia

- 6.2. Market Analysis, Insights and Forecast - by Data Center Size

- 6.2.1. Large

- 6.2.2. Massive

- 6.2.3. Medium

- 6.2.4. Mega

- 6.2.5. Small

- 6.3. Market Analysis, Insights and Forecast - by Tier Type

- 6.3.1. Tier 1 and 2

- 6.3.2. Tier 3

- 6.3.3. Tier 4

- 6.4. Market Analysis, Insights and Forecast - by Absorption

- 6.4.1. Non-Utilized

- 6.5. Market Analysis, Insights and Forecast - by Colocation Type

- 6.5.1. Hyperscale

- 6.5.2. Retail

- 6.5.3. Wholesale

- 6.6. Market Analysis, Insights and Forecast - by End User

- 6.6.1. BFSI

- 6.6.2. Cloud

- 6.6.3. E-Commerce

- 6.6.4. Government

- 6.6.5. Manufacturing

- 6.6.6. Media & Entertainment

- 6.6.7. Telecom

- 6.6.8. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 7. South America Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 7.1.1. Greater Jakarta

- 7.1.2. Rest of Indonesia

- 7.2. Market Analysis, Insights and Forecast - by Data Center Size

- 7.2.1. Large

- 7.2.2. Massive

- 7.2.3. Medium

- 7.2.4. Mega

- 7.2.5. Small

- 7.3. Market Analysis, Insights and Forecast - by Tier Type

- 7.3.1. Tier 1 and 2

- 7.3.2. Tier 3

- 7.3.3. Tier 4

- 7.4. Market Analysis, Insights and Forecast - by Absorption

- 7.4.1. Non-Utilized

- 7.5. Market Analysis, Insights and Forecast - by Colocation Type

- 7.5.1. Hyperscale

- 7.5.2. Retail

- 7.5.3. Wholesale

- 7.6. Market Analysis, Insights and Forecast - by End User

- 7.6.1. BFSI

- 7.6.2. Cloud

- 7.6.3. E-Commerce

- 7.6.4. Government

- 7.6.5. Manufacturing

- 7.6.6. Media & Entertainment

- 7.6.7. Telecom

- 7.6.8. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 8. Europe Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 8.1.1. Greater Jakarta

- 8.1.2. Rest of Indonesia

- 8.2. Market Analysis, Insights and Forecast - by Data Center Size

- 8.2.1. Large

- 8.2.2. Massive

- 8.2.3. Medium

- 8.2.4. Mega

- 8.2.5. Small

- 8.3. Market Analysis, Insights and Forecast - by Tier Type

- 8.3.1. Tier 1 and 2

- 8.3.2. Tier 3

- 8.3.3. Tier 4

- 8.4. Market Analysis, Insights and Forecast - by Absorption

- 8.4.1. Non-Utilized

- 8.5. Market Analysis, Insights and Forecast - by Colocation Type

- 8.5.1. Hyperscale

- 8.5.2. Retail

- 8.5.3. Wholesale

- 8.6. Market Analysis, Insights and Forecast - by End User

- 8.6.1. BFSI

- 8.6.2. Cloud

- 8.6.3. E-Commerce

- 8.6.4. Government

- 8.6.5. Manufacturing

- 8.6.6. Media & Entertainment

- 8.6.7. Telecom

- 8.6.8. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 9. Middle East & Africa Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 9.1.1. Greater Jakarta

- 9.1.2. Rest of Indonesia

- 9.2. Market Analysis, Insights and Forecast - by Data Center Size

- 9.2.1. Large

- 9.2.2. Massive

- 9.2.3. Medium

- 9.2.4. Mega

- 9.2.5. Small

- 9.3. Market Analysis, Insights and Forecast - by Tier Type

- 9.3.1. Tier 1 and 2

- 9.3.2. Tier 3

- 9.3.3. Tier 4

- 9.4. Market Analysis, Insights and Forecast - by Absorption

- 9.4.1. Non-Utilized

- 9.5. Market Analysis, Insights and Forecast - by Colocation Type

- 9.5.1. Hyperscale

- 9.5.2. Retail

- 9.5.3. Wholesale

- 9.6. Market Analysis, Insights and Forecast - by End User

- 9.6.1. BFSI

- 9.6.2. Cloud

- 9.6.3. E-Commerce

- 9.6.4. Government

- 9.6.5. Manufacturing

- 9.6.6. Media & Entertainment

- 9.6.7. Telecom

- 9.6.8. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 10. Asia Pacific Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 10.1.1. Greater Jakarta

- 10.1.2. Rest of Indonesia

- 10.2. Market Analysis, Insights and Forecast - by Data Center Size

- 10.2.1. Large

- 10.2.2. Massive

- 10.2.3. Medium

- 10.2.4. Mega

- 10.2.5. Small

- 10.3. Market Analysis, Insights and Forecast - by Tier Type

- 10.3.1. Tier 1 and 2

- 10.3.2. Tier 3

- 10.3.3. Tier 4

- 10.4. Market Analysis, Insights and Forecast - by Absorption

- 10.4.1. Non-Utilized

- 10.5. Market Analysis, Insights and Forecast - by Colocation Type

- 10.5.1. Hyperscale

- 10.5.2. Retail

- 10.5.3. Wholesale

- 10.6. Market Analysis, Insights and Forecast - by End User

- 10.6.1. BFSI

- 10.6.2. Cloud

- 10.6.3. E-Commerce

- 10.6.4. Government

- 10.6.5. Manufacturing

- 10.6.6. Media & Entertainment

- 10.6.7. Telecom

- 10.6.8. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BDx Data Center Pte Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PT Sigma Tata Sadaya

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Supra Primatama Nusantara

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PT CBN Nusantara

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Princeton Digital Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EdgeConneX Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PT Faasri Utama Sakti

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Digital Edge (Singapore) Holdings Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT DCI Indonesia Tbk

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Space DC Pte Ltd5 4 LIST OF COMPANIES STUDIE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NTT Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nusantara Data Center

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 BDx Data Center Pte Ltd

List of Figures

- Figure 1: Global Data Center in Indonesia Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Indonesia Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Indonesia Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 5: North America Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 6: North America Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 7: North America Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 8: North America Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 9: North America Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 10: North America Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 11: North America Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 12: North America Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 13: North America Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 14: North America Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 19: South America Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 20: South America Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 21: South America Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 22: South America Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 27: South America Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 28: South America Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 29: South America Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: South America Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Europe Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 33: Europe Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 34: Europe Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 35: Europe Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 36: Europe Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 37: Europe Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 38: Europe Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 39: Europe Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 40: Europe Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 41: Europe Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 42: Europe Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 43: Europe Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 44: Europe Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Europe Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 47: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 48: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 49: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 50: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 51: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 52: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 53: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 54: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 55: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 56: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 57: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 58: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 61: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 62: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 63: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 64: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 65: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 66: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 67: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 68: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 69: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 70: Asia Pacific Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 71: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 72: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 73: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center in Indonesia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global Data Center in Indonesia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 11: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 12: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 14: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 15: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 21: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 23: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 24: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 25: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 31: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 32: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 33: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 34: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 35: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Russia Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Benelux Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Nordics Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 47: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 48: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 49: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 50: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 51: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Turkey Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Israel Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: GCC Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: North Africa Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East & Africa Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 60: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 61: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 62: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 63: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 64: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 65: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: China Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: India Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Japan Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Korea Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: ASEAN Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Oceania Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of Asia Pacific Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center in Indonesia Market?

The projected CAGR is approximately 21.06%.

2. Which companies are prominent players in the Data Center in Indonesia Market?

Key companies in the market include BDx Data Center Pte Ltd, PT Sigma Tata Sadaya, PT Supra Primatama Nusantara, PT CBN Nusantara, Princeton Digital Group, EdgeConneX Inc, PT Faasri Utama Sakti, Digital Edge (Singapore) Holdings Pte Ltd, PT DCI Indonesia Tbk, Space DC Pte Ltd5 4 LIST OF COMPANIES STUDIE, NTT Ltd, Nusantara Data Center.

3. What are the main segments of the Data Center in Indonesia Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

September 2022: The company commenced construction on a 23MW data center in Jakarta, Indonesia, marking the company’s third site in South East Asia as it capitalizes on the region’s rapid digital transformation in the wake of the global pandemic.The new facility will offer 3,430 cabinets and an IT load of 23MW and is designed to cater for the growing demand for high power density applications from cloud-driven hyperscale deployments, local and international network and financial service providers. It is expected to complete by Q4 2023.August 2022: PT Sigma Cipta Caraka (SCA), also known as telkomsigma, transfers its data centre business to PT Telkom Data Ekosistem (TDE), which is worth a total of IDR 2.01 trillion. The parent company PT Telkom Indonesia (Persero) Tbk (TLKM), claimed that this transfer of the data centre business line is related to the business restructuring program held by Telkom Group.June 2022: The company announced the launch of BDx Indonesia, following the completion of a USD 300 million joint venture agreement with PT Indosat Tbk (Indosat Ooredoo Hutchison or IOH) and PT Aplikanusa Lintasarta, Big Data Exchange (BDx).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center in Indonesia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center in Indonesia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center in Indonesia Market?

To stay informed about further developments, trends, and reports in the Data Center in Indonesia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence