Key Insights

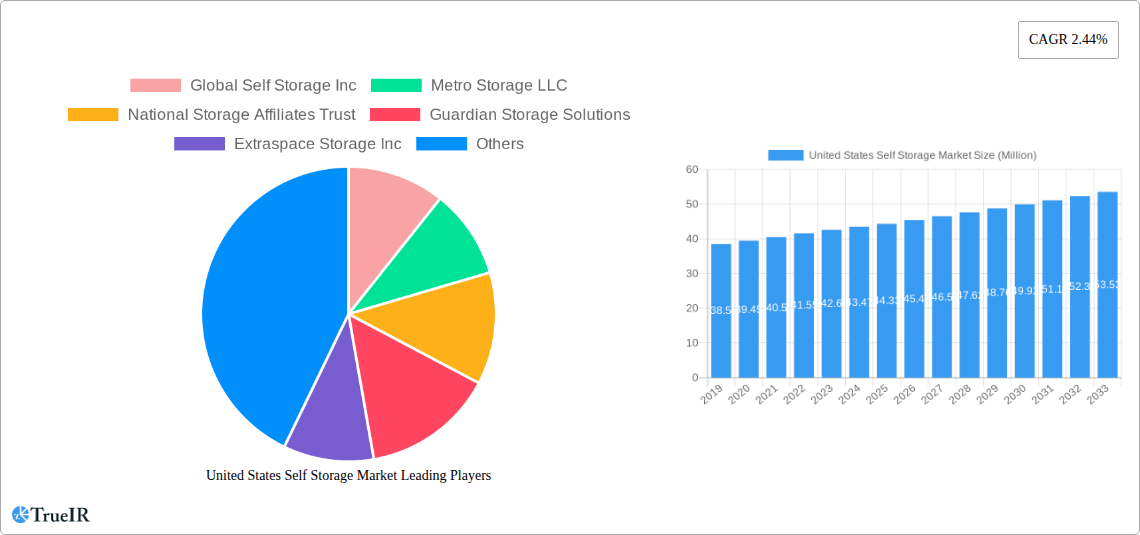

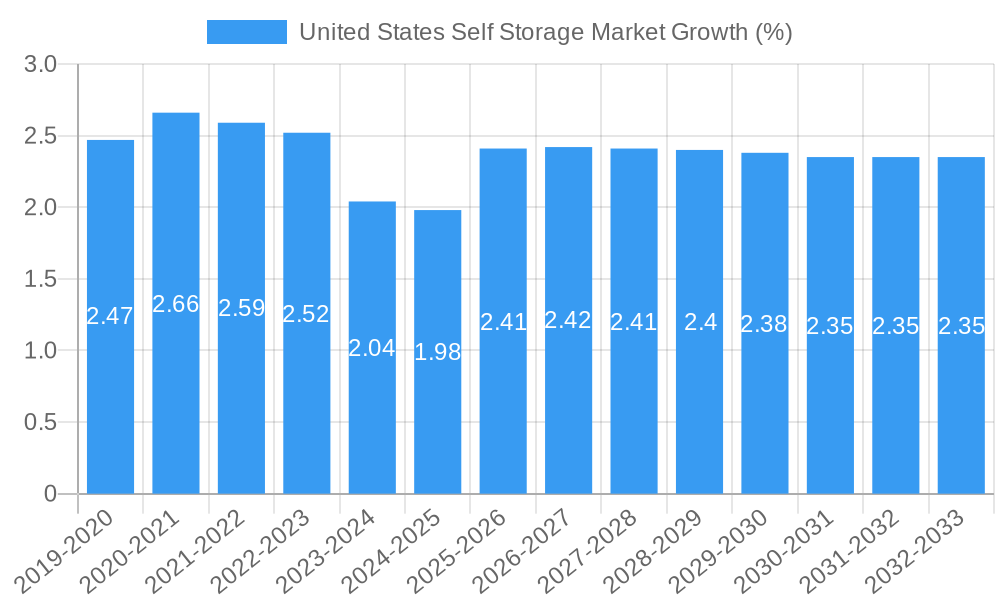

The United States self-storage market is poised for steady growth, projected to reach approximately \$44.33 billion by 2025. This expansion is driven by a confluence of factors, including an increasing demand for flexible living and working spaces, a rising trend in downsizing among households, and a growing emphasis on decluttering and organization. The market's compound annual growth rate (CAGR) of 2.44% over the forecast period (2025-2033) indicates sustained, albeit moderate, expansion. Key drivers such as an aging population requiring storage solutions for accumulated possessions, a robust rental market necessitating temporary storage during moves, and the burgeoning e-commerce sector's need for inventory management are all contributing to this upward trajectory. Furthermore, the increasing acceptance of self-storage as a viable solution for both personal and business needs, from storing seasonal items and furniture to managing business inventory and archives, underpins its market resilience.

The competitive landscape is dominated by established players like Public Storage, ExtraSpace Storage Inc., and CubeSmart LP, alongside emerging companies like Ko Self Storage. These companies are actively investing in technology for enhanced customer experience, including online booking, digital access, and climate-controlled units. The market segmentation into Personal and Business users highlights distinct demand patterns, with personal users often seeking storage for life transitions like moving, renovations, or managing excess belongings, while businesses utilize self-storage for inventory, equipment, and document archiving. Geographically, the United States remains the dominant region for self-storage services. Future growth is anticipated through strategic expansions, acquisitions, and the development of specialized storage solutions catering to niche market demands.

This in-depth report delivers a dynamic, SEO-optimized analysis of the United States Self Storage Market, leveraging high-volume keywords for optimal search rankings and engaging industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025, this report provides crucial insights into market structure, trends, dominant segments, product innovations, key players, and future outlook.

United States Self Storage Market Market Structure & Competitive Landscape

The United States Self Storage Market exhibits a moderately concentrated structure, with key players like Public Storage, Extra Space Storage Inc., and National Storage Affiliates Trust holding significant market share. Innovation drivers are predominantly focused on technology integration, such as advanced security systems, online booking platforms, and smart access solutions, enhancing customer convenience and operational efficiency. Regulatory impacts, while generally favorable, include zoning laws, environmental regulations, and local permitting processes that can influence development and expansion strategies. Product substitutes are limited, primarily revolving around alternative storage solutions like portable storage units or self-storage facilities in adjacent regions, though dedicated self-storage remains the preferred choice for secure, accessible, and flexible storage needs. End-user segmentation reveals a strong demand from both Personal and Business users, each with distinct requirements and usage patterns. Mergers and Acquisitions (M&A) trends are a significant feature, with major players actively pursuing consolidation to expand their geographic footprint and service offerings. For instance, the acquisition of Simply Self Storage by Public Storage for USD 2.2 billion in September 2023 underscores the ongoing M&A activity aimed at market consolidation and strategic growth. Concentration ratios are estimated to be around 55-60%, indicating a competitive yet consolidated landscape.

United States Self Storage Market Market Trends & Opportunities

The United States Self Storage Market is experiencing robust growth, driven by evolving consumer lifestyles, increasing urbanization, and a growing demand for flexible storage solutions. The market size is projected to reach over USD 65,000 Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). Technological advancements are reshaping the industry, with the adoption of AI-powered pricing models, contactless rentals, and integrated mobile applications enhancing customer experience and operational efficiency. Consumer preferences are shifting towards convenience, security, and affordability, with a rising demand for climate-controlled units and specialized storage options for items like RVs and boats. The competitive landscape is characterized by both established national brands and a growing number of independent operators, fostering a dynamic environment for innovation and customer acquisition. Opportunities abound in emerging urban and suburban markets, the expansion of ancillary services like tenant insurance, and the integration of sustainability practices in facility management. The increasing trend of downsizing homes and the rise of e-commerce businesses requiring inventory storage further fuel market expansion.

Dominant Markets & Segments in United States Self Storage Market

The Personal user segment stands as a dominant force in the United States Self Storage Market, consistently driving demand through various life events and evolving living arrangements. Factors contributing to this dominance include increasing urbanization, where smaller living spaces necessitate external storage solutions, and a growing population characterized by a desire for decluttering and organized living. The mobility of the workforce and the trend towards temporary housing or relocation further bolster demand from individuals. Infrastructure development, particularly in suburban areas surrounding major metropolitan hubs, has made self-storage facilities more accessible, catering to the needs of families and individuals seeking to store household goods, seasonal items, and recreational equipment.

- Key Growth Drivers for Personal Segment:

- Urbanization and Smaller Living Spaces: As cities grow, apartments and homes tend to become smaller, creating a pressing need for off-site storage.

- Life Events: Relocations, downsizing, marriage, divorce, and the accumulation of possessions are significant triggers for self-storage rental.

- Consumerism and Hobbies: The continued purchase of goods and the pursuit of hobbies requiring specialized equipment (e.g., camping gear, sports equipment) drive demand.

- Digitalization of Services: Online booking, payment, and unit management have made self-storage more accessible and convenient for individuals.

The Business user segment, while often a secondary focus, represents a significant and growing contributor to the United States Self Storage Market. Businesses utilize self-storage for a variety of purposes, including inventory management for e-commerce operations, document archiving and record retention, storing equipment and tools, and providing temporary storage during renovations or relocations. The flexibility and cost-effectiveness of self-storage solutions compared to dedicated commercial warehouse space make them an attractive option for small to medium-sized enterprises (SMEs) and even larger corporations with specific storage needs. Government policies that encourage small business growth and the rise of the gig economy indirectly support this segment by increasing the number of independent entrepreneurs requiring flexible storage solutions.

- Key Growth Drivers for Business Segment:

- E-commerce Growth: Online retailers require storage for inventory, often opting for self-storage due to its scalability and cost-effectiveness.

- Document Management: Businesses across all sectors need secure and accessible storage for important records and archives.

- Small Business Expansion: SMEs often use self-storage as a cost-effective solution for expansion without committing to long-term leases on larger commercial properties.

- Seasonal Businesses: Industries with seasonal demands (e.g., retail during holidays) benefit from flexible storage options.

United States Self Storage Market Product Analysis

The United States Self Storage Market is characterized by a range of product innovations aimed at enhancing security, convenience, and customer experience. These include advancements in climate-controlled units, offering precise temperature and humidity regulation for sensitive items like electronics, artwork, and documents. Smart lock technology and mobile-based access control are increasingly being implemented, allowing for seamless entry and exit without physical keys. Furthermore, the market is seeing the development of specialized storage units tailored for specific needs, such as vehicle storage (RVs, boats, cars) and wine storage. Competitive advantages are derived from strategic locations, competitive pricing, 24/7 access options, robust security measures, and the integration of digital platforms for booking and management. The introduction of tenant insurance programs, like Extra Space Storage Inc.'s Savvy Storage Insurance Program, also enhances product offerings by providing peace of mind and an additional revenue stream.

Key Drivers, Barriers & Challenges in United States Self Storage Market

Key Drivers: The United States Self Storage Market is propelled by several critical drivers. Economic stability and consumer spending power directly influence the demand for storage solutions. The growing trend of urbanization and smaller living spaces necessitates off-site storage. The proliferation of e-commerce fuels demand for inventory storage by businesses. Technological advancements in management systems and security enhance operational efficiency and customer appeal. Furthermore, demographic shifts, such as an aging population and increased mobility, contribute to the demand for flexible storage options.

Barriers & Challenges: Despite its robust growth, the market faces several challenges. Regulatory hurdles, including zoning restrictions and local permitting processes, can impede new development and expansion. Intense competition from both established players and new entrants can lead to price wars and affect profit margins. Rising operational costs, including utilities, labor, and property taxes, can impact profitability. Supply chain issues can occasionally affect the availability and cost of construction materials for facility development. Additionally, economic downturns or shifts in consumer spending habits could temporarily dampen demand.

Growth Drivers in the United States Self Storage Market Market

The United States Self Storage Market is significantly driven by evolving consumer behaviors and economic factors. The persistent trend of urbanization leads to smaller dwelling sizes, creating a substantial need for external storage solutions. Economic stability and rising disposable incomes allow more households to afford self-storage services for various needs, from decluttering to storing seasonal items. The exponential growth of e-commerce directly fuels demand from businesses seeking flexible and cost-effective inventory management solutions. Technological advancements, such as online booking, contactless rentals, and integrated property management software, enhance operational efficiency and customer convenience, further stimulating market growth.

Challenges Impacting United States Self Storage Market Growth

Despite its positive trajectory, the United States Self Storage Market grapples with several impediments. Stringent zoning regulations and local permitting processes in many municipalities can significantly slow down or even halt new development, limiting supply expansion. The highly competitive nature of the market, with numerous national brands and independent operators, can lead to pricing pressures and necessitate increased marketing expenditure. Rising operational costs, encompassing utilities, property taxes, and labor expenses, can erode profit margins. Furthermore, the availability and cost of construction materials can impact the pace of new facility development. Economic downturns or periods of reduced consumer spending can also pose a challenge, temporarily affecting rental demand.

Key Players Shaping the United States Self Storage Market Market

- Global Self Storage Inc

- Metro Storage LLC

- National Storage Affiliates Trust

- Guardian Storage Solutions

- Extraspace Storage Inc

- Ko Self Storage

- Public Storage

- CubeSmart LP

- StorageMart

- Simply Self Storage Management LLC

- U-Haul International Inc (U-Haul Holding company)

Significant United States Self Storage Market Industry Milestones

- September 2023: Extra Space Storage Inc. introduced the Savvy Storage Insurance Program (Savvy) to the self-storage industry, aimed at boosting ancillary revenues and enhancing customer experience for property owners.

- September 2023: Public Storage completed the acquisition of Simply Self Storage from Blackstone Real Estate Income Trust Inc. for USD 2.2 billion, reinforcing its opportunistic growth strategy and market consolidation efforts.

Future Outlook for United States Self Storage Market Market

- September 2023: Extra Space Storage Inc. introduced the Savvy Storage Insurance Program (Savvy) to the self-storage industry, aimed at boosting ancillary revenues and enhancing customer experience for property owners.

- September 2023: Public Storage completed the acquisition of Simply Self Storage from Blackstone Real Estate Income Trust Inc. for USD 2.2 billion, reinforcing its opportunistic growth strategy and market consolidation efforts.

Future Outlook for United States Self Storage Market Market

The future outlook for the United States Self Storage Market remains exceptionally positive, driven by several converging factors. Continued urbanization and the trend towards smaller living spaces will sustain the demand for personal storage. The ongoing expansion of e-commerce will solidify the need for business storage solutions. Technological integration, including AI-driven operations, enhanced security features, and seamless digital customer journeys, will further differentiate providers and attract new users. Opportunities for strategic M&A will persist as larger players seek to expand their portfolios and market share. The development of specialized storage solutions and the focus on sustainable practices are also expected to shape future market dynamics, ensuring continued growth and innovation in the coming years.

United States Self Storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

United States Self Storage Market Segmentation By Geography

- 1. United States

United States Self Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Urbanization and Smaller Living Spaces; Improved Economic Outlook and Innovative Trends

- 3.3. Market Restrains

- 3.3.1. Government Regulations

- 3.4. Market Trends

- 3.4.1. Increased Urbanization and Smaller Living Spaces to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. North America United States Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Rest of The World United States Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Global Self Storage Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Metro Storage LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 National Storage Affiliates Trust

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Guardian Storage Solutions

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Extraspace Storage Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ko Self Storage

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Public Storage

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 CubeSmart LP

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 StorageMart

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Simply Self Storage Management LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 U-Haul International Inc (U-Haul Holding company)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Global Self Storage Inc

List of Figures

- Figure 1: United States Self Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Self Storage Market Share (%) by Company 2024

List of Tables

- Table 1: United States Self Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 3: United States Self Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: United States Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United States Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 13: United States Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Self Storage Market?

The projected CAGR is approximately 2.44%.

2. Which companies are prominent players in the United States Self Storage Market?

Key companies in the market include Global Self Storage Inc, Metro Storage LLC, National Storage Affiliates Trust, Guardian Storage Solutions, Extraspace Storage Inc, Ko Self Storage, Public Storage, CubeSmart LP, StorageMart, Simply Self Storage Management LLC, U-Haul International Inc (U-Haul Holding company).

3. What are the main segments of the United States Self Storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 44.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Urbanization and Smaller Living Spaces; Improved Economic Outlook and Innovative Trends.

6. What are the notable trends driving market growth?

Increased Urbanization and Smaller Living Spaces to Drive the Market.

7. Are there any restraints impacting market growth?

Government Regulations.

8. Can you provide examples of recent developments in the market?

September 2023: Extra Space Storage Inc. introduced a tenant insurance offering, the Savvy Storage Insurance Program (Savvy), to serve the self-storage industry. The program is expected to help property owners increase ancillary revenues and improve customer experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Self Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Self Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Self Storage Market?

To stay informed about further developments, trends, and reports in the United States Self Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence