Key Insights

The Africa Low-Voltage Electric Motors Market is projected for significant expansion, anticipated to reach 844.4 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.8%. This growth is propelled by extensive industrialization across Africa, particularly in the Oil & Gas, Chemicals & Petrochemicals, and Power Generation sectors. Increasing demand for dependable, energy-efficient electric motors for industrial machinery and equipment in these growing sectors is the primary market driver. Concurrent infrastructure development and the modernization of existing industrial facilities further fuel demand for these essential components. The adoption of more energy-efficient motors to reduce operational expenses and meet environmental mandates also significantly influences market trends.

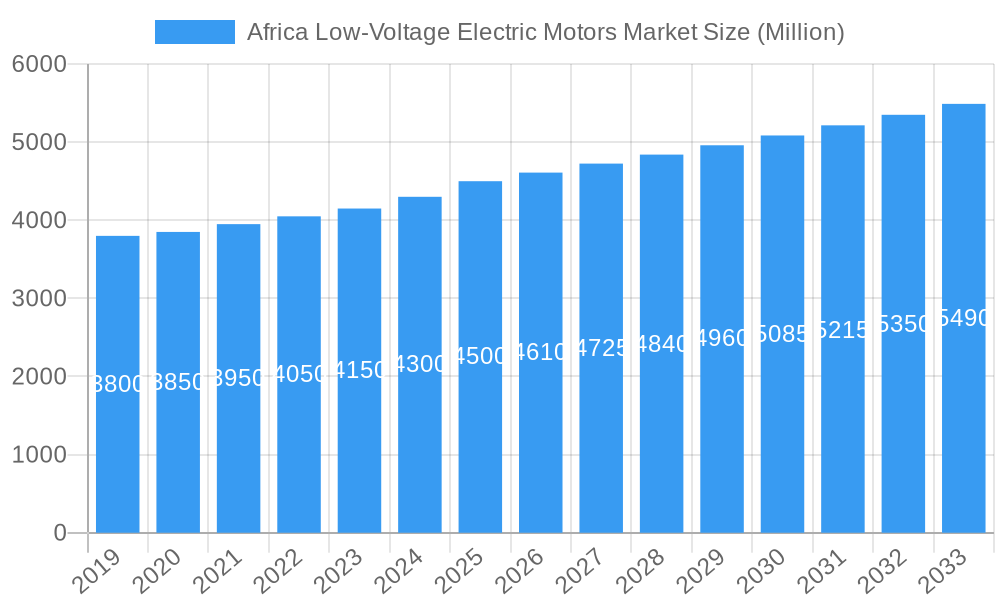

Africa Low-Voltage Electric Motors Market Market Size (In Million)

Despite a positive outlook, market growth may be constrained by fluctuating raw material costs and availability, competition from lower-cost, less advanced alternatives in the informal sector, and the substantial capital investment required for advanced manufacturing technologies. However, considerable untapped potential within African economies, combined with strategic investments from major players like Siemens AG, ABB Ltd, and WEG, is expected to offset these challenges. The market features a dynamic competitive environment with global manufacturers and emerging regional players. The forecast period (2025-2033) will likely see increased adoption of smart, connected electric motors enhancing efficiency and predictive maintenance, with Nigeria and South Africa expected to lead market expansion.

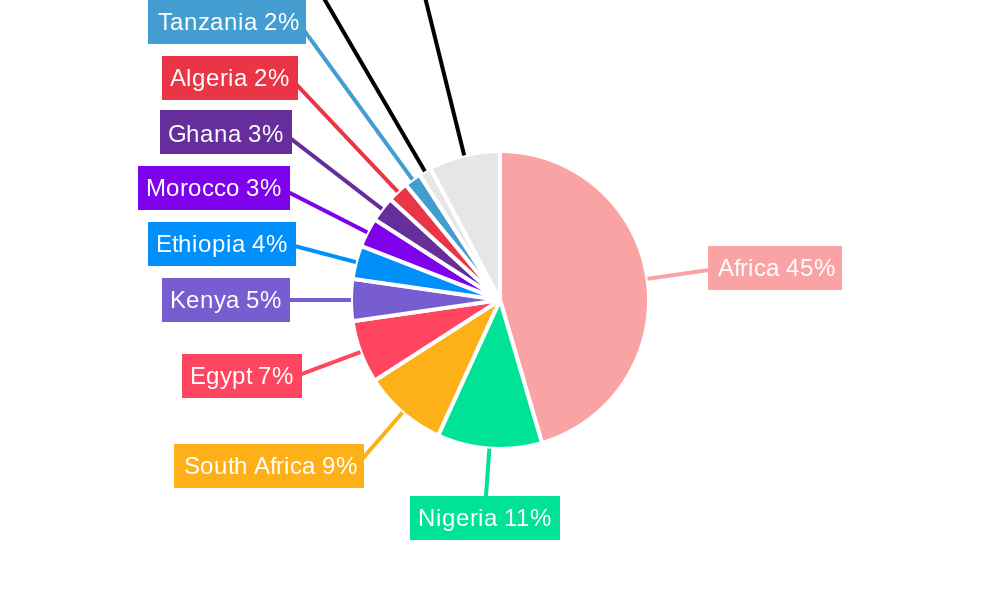

Africa Low-Voltage Electric Motors Market Company Market Share

This comprehensive report analyzes the Africa Low-Voltage Electric Motors Market, a vital element in the continent's industrialization and energy transition. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report offers deep insights into market dynamics, trends, opportunities, and challenges. Optimized for search engines with high-volume keywords such as "Africa electric motors," "low voltage motors Africa," "industrial automation Africa," and "energy efficiency motors," this description targets key industry stakeholders, investors, and researchers. Explore the evolving landscape of electric motors critical for diverse applications across Africa, including manufacturing, mining, power generation, and water management.

Africa Low-Voltage Electric Motors Market Market Structure & Competitive Landscape

The Africa Low-Voltage Electric Motors Market exhibits a moderately concentrated structure, with a few dominant global players alongside a growing number of regional and specialized manufacturers. Innovation drivers are primarily focused on energy efficiency, enhanced durability for harsh environmental conditions, and integration with smart grid technologies. Regulatory impacts, while still developing across various African nations, are increasingly pushing for higher efficiency standards to reduce energy consumption. Product substitutes are limited in core applications, with the primary competition arising from variations in motor technology (e.g., AC vs. DC, induction vs. synchronous) and performance specifications. End-user segmentation reveals a strong reliance on the industrial sector, with Oil and Gas, Power Generation, Metal & Mining, and Automotive and Manufacturing being significant consumers. Mergers and Acquisitions (M&A) trends are nascent but are expected to accelerate as larger international players seek to expand their footprint and gain local market access. Current M&A volumes are in the range of USD 50-100 Million annually, focusing on acquiring distribution networks and local manufacturing capabilities. The concentration ratio for the top 5 players is approximately 45-55%, indicating room for new entrants and niche players.

Africa Low-Voltage Electric Motors Market Market Trends & Opportunities

The Africa Low-Voltage Electric Motors Market is poised for significant growth, driven by robust industrial expansion and a growing emphasis on energy efficiency across the continent. The market size is projected to expand from an estimated USD 3,500 Million in 2025 to over USD 5,500 Million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. Technological shifts are characterized by the increasing adoption of IE3 and IE4 efficiency class motors, driven by both economic incentives and environmental regulations. The demand for Variable Frequency Drives (VFDs) to optimize motor performance and reduce energy consumption is also escalating, further boosting the market. Consumer preferences are evolving towards motors that offer higher reliability, longer operational lifespans, and lower maintenance requirements, particularly in sectors like Oil and Gas and Mining where downtime is extremely costly.

Competitive dynamics are intensifying, with global leaders leveraging their technological prowess and economies of scale to capture market share. However, there is a growing opportunity for local manufacturers and distributors to cater to specific regional needs and provide tailored solutions. The increasing penetration of renewable energy projects, such as solar and wind farms, also presents a significant opportunity for low-voltage electric motors used in associated infrastructure like pumps, fans, and auxiliary systems. Furthermore, the ongoing urbanization and infrastructure development projects across Africa are creating sustained demand for electric motors in water treatment, transportation, and building automation. The market penetration rate for high-efficiency motors is still relatively low, offering substantial growth potential as awareness and adoption increase. The transition towards electric vehicles, though in its early stages in many African countries, will also contribute to the demand for specialized low-voltage electric motors in the future. The potential for smart motor technologies, incorporating IoT capabilities for predictive maintenance and remote monitoring, is an emerging trend that will shape market opportunities in the coming years.

Dominant Markets & Segments in Africa Low-Voltage Electric Motors Market

The Africa Low-Voltage Electric Motors Market is heavily influenced by the industrial backbone of the continent, with key segments driving demand.

Oil and Gas: This sector consistently emerges as a dominant end-user industry. The extraction, processing, and transportation of oil and gas rely heavily on electric motors for pumps, compressors, conveyors, and drilling equipment. The ongoing exploration and production activities, especially in regions like Nigeria, Angola, and Algeria, fuel a substantial demand for robust and reliable low-voltage electric motors capable of operating in demanding environments. Infrastructure development in this sector, including refineries and pipelines, further amplifies this demand.

Power Generation: With the increasing need for electricity across Africa, the power generation sector, including thermal, hydro, and increasingly renewable energy sources, is a significant consumer. Motors are crucial for turbines, generators, cooling systems, and auxiliary equipment. Government initiatives to expand power generation capacity across countries like Egypt, South Africa, and Ethiopia are directly translating into substantial motor procurements.

Metal & Mining: The rich mineral resources of Africa make the metal and mining industry a prime driver for electric motor sales. From excavators and crushers to conveyor belts and ventilation systems, electric motors are indispensable. Countries such as South Africa, Democratic Republic of Congo, and Zambia are major contributors to demand due to their extensive mining operations. The focus on increasing output and improving operational efficiency in this sector necessitates the deployment of advanced and high-performance motors.

Water and Wastewater: As urbanization accelerates, the demand for efficient water supply and wastewater treatment infrastructure is surging. Low-voltage electric motors are critical for pumps used in water distribution networks, treatment plants, and irrigation systems. Investments in water management projects across the continent, driven by population growth and agricultural needs, are key growth catalysts.

Automotive and Manufacturing: While still developing compared to other regions, the automotive assembly plants and various manufacturing industries (textiles, food processing, cement) are increasingly adopting electric motors for production lines, material handling, and machinery. Government efforts to diversify economies and promote local manufacturing are spurring growth in this segment.

Food and Beverages: The growing population and rising disposable incomes are boosting the food and beverage industry. Electric motors are essential for processing machinery, packaging equipment, refrigeration, and conveyor systems, making this segment a steady contributor to market growth.

Chemicals and Petrochemicals: This sector's demand is driven by processing plants requiring motors for pumps, mixers, and compressors, especially in countries with established petrochemical industries.

Other Discrete Industries: This broad category encompasses sectors like construction, agriculture, and logistics, all of which utilize electric motors for various applications, contributing to the overall market expansion.

Africa Low-Voltage Electric Motors Market Product Analysis

The Africa Low-Voltage Electric Motors Market is characterized by a range of product innovations focused on enhancing energy efficiency, durability, and smart capabilities. Key product types include induction motors (squirrel cage and wound rotor), synchronous motors, and specialized motors for specific applications. Advancements in insulation materials and cooling technologies are leading to motors that can withstand higher operating temperatures and humidity levels common in many African regions. The integration of IoT sensors for real-time monitoring and predictive maintenance is a growing trend, offering competitive advantages through reduced downtime and optimized performance. Application areas span across all industrial sectors, with a particular emphasis on pumps, fans, compressors, conveyors, and processing machinery. The competitive advantage lies in offering motors with higher power density, lower noise levels, and improved torque characteristics suitable for the diverse operational demands of the African industrial landscape.

Key Drivers, Barriers & Challenges in Africa Low-Voltage Electric Motors Market

Key Drivers: The Africa Low-Voltage Electric Motors Market is propelled by several key factors. Technologically, the increasing demand for energy-efficient motors (IE3 and IE4 standards) driven by rising electricity costs and environmental consciousness is a primary growth catalyst. Economic factors, including significant investments in infrastructure development across mining, oil & gas, and power generation sectors, directly translate into higher motor demand. Policy-driven factors, such as government initiatives to promote industrialization, attract foreign direct investment, and improve energy access, further bolster the market. For example, the African Union's Agenda 2063 aims to transform the continent through industrial development, necessitating widespread adoption of electric motors.

Barriers & Challenges: Despite the positive outlook, the market faces significant challenges. Supply chain issues, including logistical complexities, import duties, and the availability of spare parts, can hinder timely project execution and increase operational costs. Regulatory hurdles, such as inconsistent standards and lengthy approval processes across different countries, can create complexities for manufacturers and end-users. Competitive pressures from both established global players and emerging local manufacturers, alongside the prevalence of lower-cost, less efficient alternatives, can impact market dynamics. The lack of widespread skilled labor for installation, maintenance, and repair of advanced motor systems also poses a challenge, potentially limiting the adoption of more sophisticated technologies. The estimated impact of these challenges can lead to project delays of 10-15% and increased operational expenses by 5-10% in affected regions.

Growth Drivers in the Africa Low-Voltage Electric Motors Market Market

The growth trajectory of the Africa Low-Voltage Electric Motors Market is significantly influenced by a confluence of factors. Technologically, the relentless pursuit of higher energy efficiency standards (IE3, IE4, and beyond) is a primary driver, fueled by the need to reduce operational costs and comply with evolving environmental regulations. Economically, substantial investments pouring into infrastructure development across the continent, particularly in the mining, oil and gas, and power generation sectors, create a robust demand for electric motors used in critical industrial machinery. Government policies promoting industrialization, attracting foreign direct investment, and focusing on renewable energy integration are also crucial growth catalysts. For instance, national industrial development plans and initiatives aimed at boosting manufacturing output directly translate into increased demand for electric motors.

Challenges Impacting Africa Low-Voltage Electric Motors Market Growth

Several barriers and restraints are impacting the expansion of the Africa Low-Voltage Electric Motors Market. Regulatory complexities, including diverse and sometimes inconsistent standards across different African nations, can create hurdles for market entry and product compliance. Supply chain disruptions, exacerbated by underdeveloped logistics infrastructure and potential political instability in certain regions, can lead to increased lead times and higher costs for both manufacturers and end-users. Competitive pressures are significant, with a fragmented market featuring a mix of global giants and local players, leading to price sensitivity and a potential for lower-quality products to gain traction. Furthermore, the availability of skilled labor for the installation, maintenance, and repair of sophisticated electric motor systems remains a concern, potentially limiting the adoption of advanced technologies and impacting overall operational efficiency.

Key Players Shaping the Africa Low-Voltage Electric Motors Market Market

- ZCL Electric Motor Technology Co Ltd

- ABB Ltd

- Wolong Electric Group Co Ltd

- TECO Corporation

- Toshiba International Corporation

- Nidec Corporation

- WEG

- Siemens AG

- Kirloskar Oil Engines Limited

- VEM Group

- Bonfigliol

Significant Africa Low-Voltage Electric Motors Market Industry Milestones

- October 2023: Nidec and Embraer obtained approval for a collaborative endeavor to develop an Electric Propulsion System for the aerospace industry. Embraer will contribute its extensive knowledge, expertise, and resources about the controller, while Nidec will provide its technological know-how, expertise, and resources about electric motors. According to the company, Nidec Aerospace is anticipated to invest over USD 77.7 million by 2026 and commence mass production in the same year. This development signifies a push towards electrification in related industries, potentially influencing component suppliers.

- November 2022: Siemens announced its intention to separate out its motor and drive business into an independent entity. The new motor and drives business would be an amalgamation of five current Siemens businesses/divisions: Large drives, Sykatec, Weiss Spindel technologies, low voltage motors, and geared motors divisions from Siemens Digital Industries. This strategic move aims to enhance focus and agility within the motor and drive segment, potentially leading to more targeted innovation and market strategies.

Future Outlook for Africa Low-Voltage Electric Motors Market Market

The future outlook for the Africa Low-Voltage Electric Motors Market is exceptionally promising, driven by sustained industrial growth, increasing energy efficiency mandates, and a burgeoning focus on sustainable development. Key growth catalysts include the ongoing large-scale infrastructure projects in power generation, water management, and transportation, which will continue to fuel demand for reliable electric motors. The accelerating adoption of renewable energy sources, such as solar and wind, will also create a consistent demand for motors in associated infrastructure. Furthermore, the push towards localization and value addition within African economies will encourage the establishment of new manufacturing facilities, thereby expanding the market for industrial automation and electric motors. The increasing awareness and implementation of energy-efficient technologies present a significant opportunity for market expansion as industries seek to reduce their operational costs and environmental footprint. Strategic opportunities lie in developing solutions tailored to Africa's unique environmental conditions and offering comprehensive after-sales support and training services.

Africa Low-Voltage Electric Motors Market Segmentation

-

1. End-user Industry

- 1.1. Oil and Gas

- 1.2. Chemicals and Petrochemicals

- 1.3. Power Generation

- 1.4. Metal & Mining

- 1.5. Water and Wastewater

- 1.6. Food and Beverages

- 1.7. Automotive and Manufacturing

- 1.8. Other Discrete Industries

Africa Low-Voltage Electric Motors Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Low-Voltage Electric Motors Market Regional Market Share

Geographic Coverage of Africa Low-Voltage Electric Motors Market

Africa Low-Voltage Electric Motors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Investment in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. Fluctuating Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Oil and Gas to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Oil and Gas

- 5.1.2. Chemicals and Petrochemicals

- 5.1.3. Power Generation

- 5.1.4. Metal & Mining

- 5.1.5. Water and Wastewater

- 5.1.6. Food and Beverages

- 5.1.7. Automotive and Manufacturing

- 5.1.8. Other Discrete Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. South Africa Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 7. Sudan Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 8. Uganda Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 10. Kenya Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa Africa Low-Voltage Electric Motors Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ZCL Electric Motor Technology Co Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 ABB Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Wolong Electric Group Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 TECO Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Toshiba International Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nidec Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 WEG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Siemens AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kirloskar Oil Engines Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 VEM Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bonfigliol

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 ZCL Electric Motor Technology Co Ltd

List of Figures

- Figure 1: Africa Low-Voltage Electric Motors Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Africa Low-Voltage Electric Motors Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Low-Voltage Electric Motors Market Revenue million Forecast, by Region 2020 & 2033

- Table 2: Africa Low-Voltage Electric Motors Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Africa Low-Voltage Electric Motors Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Africa Low-Voltage Electric Motors Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: South Africa Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Sudan Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Uganda Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Tanzania Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Kenya Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Rest of Africa Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Africa Low-Voltage Electric Motors Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 12: Africa Low-Voltage Electric Motors Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: South Africa Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Egypt Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Morocco Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Ghana Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Algeria Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Tanzania Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Ivory Coast Africa Low-Voltage Electric Motors Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Low-Voltage Electric Motors Market?

The projected CAGR is approximately 3.8%.

2. Which companies are prominent players in the Africa Low-Voltage Electric Motors Market?

Key companies in the market include ZCL Electric Motor Technology Co Ltd, ABB Ltd, Wolong Electric Group Co Ltd, TECO Corporation, Toshiba International Corporation, Nidec Corporation, WEG, Siemens AG, Kirloskar Oil Engines Limited, VEM Group, Bonfigliol.

3. What are the main segments of the Africa Low-Voltage Electric Motors Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 844.4 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Investment in Manufacturing Sector.

6. What are the notable trends driving market growth?

Oil and Gas to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Fluctuating Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2023 - Nidec and Embraer obtained approval for a collaborative endeavor to develop an Electric Propulsion System for the aerospace industry. Embraer will contribute its extensive knowledge, expertise, and resources about the controller, while Nidec will provide its technological know-how, expertise, and resources about electric motors. According to the company, Nidec Aerospace is anticipated to invest over USD 77.7 million by 2026 and commence mass production in the same year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Low-Voltage Electric Motors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Low-Voltage Electric Motors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Low-Voltage Electric Motors Market?

To stay informed about further developments, trends, and reports in the Africa Low-Voltage Electric Motors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence