Key Insights

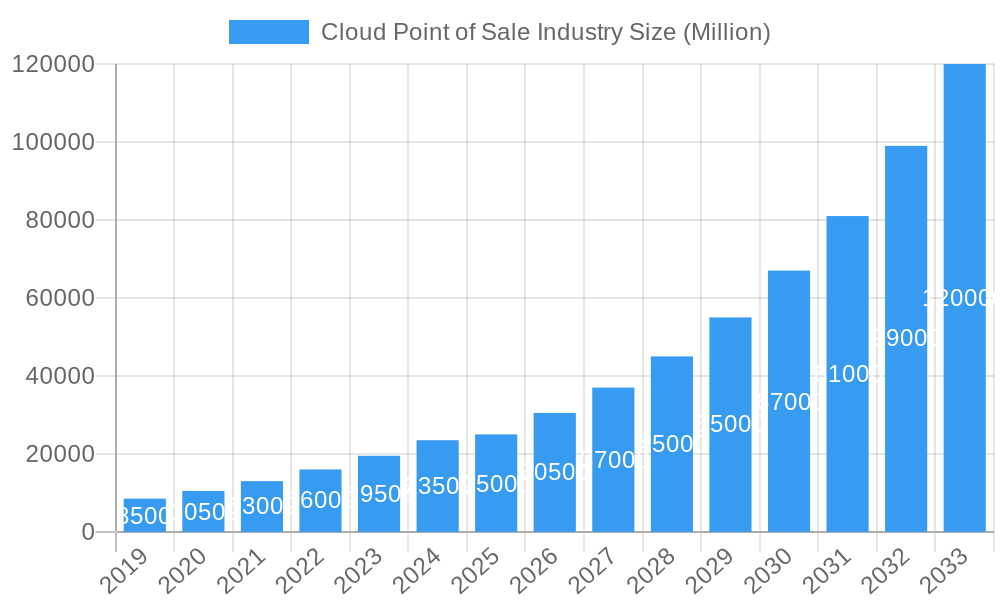

The Cloud Point of Sale (POS) market is projected for substantial growth, reaching an estimated $6.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 18.2% through 2033. This expansion is driven by the widespread adoption of cloud-based solutions across industries, emphasizing operational efficiency, real-time data, and scalability. Key drivers include the demand for mobile POS for on-the-go transactions and personalized customer experiences, particularly in retail and hospitality. The growing importance of data analytics and inventory management, alongside the affordability of cloud POS compared to on-premise systems, significantly fuels growth. Small and medium-sized businesses (SMBs) are increasingly adopting cloud POS due to reduced upfront costs and flexible subscription models. Continuous technological advancements, including AI and machine learning integration for predictive analytics, further enhance the value of cloud POS systems.

Cloud Point of Sale Industry Market Size (In Billion)

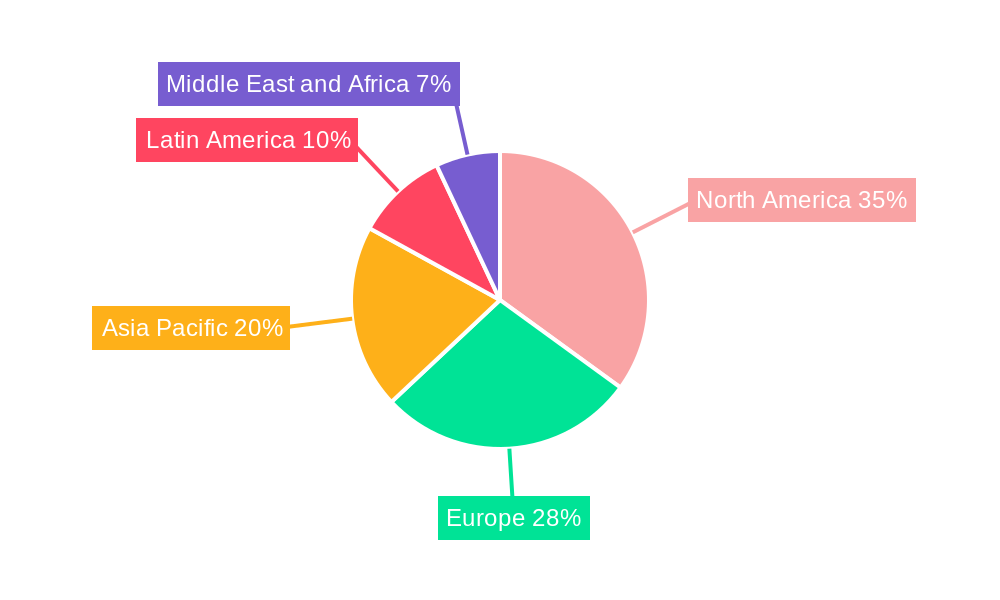

Market segmentation shows the "Software & Services" segment is expected to lead, driven by integrated POS functionalities, analytics, and CRM tools. While "Hardware" remains vital, the focus is on compact, mobile devices. The "Mobile Point of Sale" segment is experiencing rapid growth, surpassing "Fixed Point of Sale" due to its flexibility. Geographically, North America leads due to early adoption, but the Asia Pacific region is anticipated to grow fastest, fueled by digitalization, a growing SMB sector, and increasing disposable incomes. Concerns regarding data security and internet connectivity are being addressed through enhanced security protocols and offline capabilities, ensuring sustained market momentum.

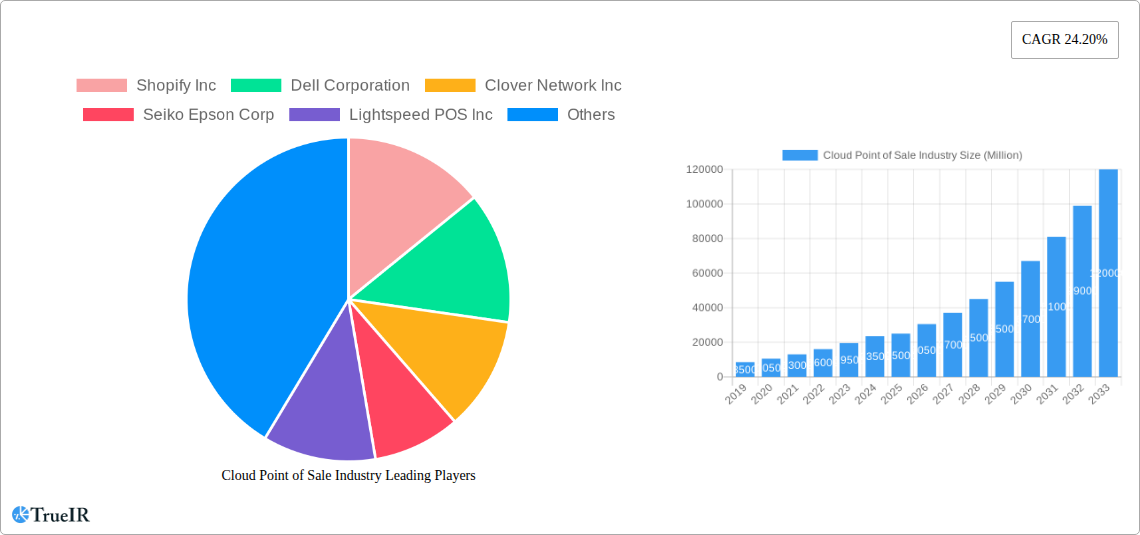

Cloud Point of Sale Industry Company Market Share

Cloud Point of Sale (POS) Market Analysis: Trends, Opportunities, and Competitive Landscape (2019-2033)

This report provides an in-depth analysis of the Cloud Point of Sale (POS) market structure, key trends, dominant segments, and competitive landscape. Covering the period from 2019 to 2033, with a base year of 2025, this report offers critical insights for stakeholders. We utilize high-volume keywords for search engine optimization and to engage industry professionals.

Cloud Point of Sale Industry Market Structure & Competitive Landscape

The Cloud Point of Sale (POS) industry is characterized by a highly fragmented yet increasingly consolidated competitive landscape. While numerous players offer diverse solutions, strategic acquisitions and partnerships are driving market concentration. Innovation remains a key differentiator, fueled by the rapid evolution of mobile POS systems and the integration of advanced software and services. Regulatory frameworks, while sometimes posing challenges, are also evolving to support the transition to cloud-based payment solutions, particularly in sectors like retail and hospitality. The presence of strong product substitutes, such as traditional on-premise POS systems and simpler payment terminals, necessitates continuous innovation and value-added services. End-user segmentation reveals a strong demand across retail, hospitality, and healthcare, with entertainment and other niche sectors also showing significant growth potential. M&A trends indicate a drive towards acquiring market share and technological capabilities, with an estimated tens of acquisitions per year in the recent historical period. This consolidation, alongside a continuous influx of new market entrants, paints a picture of a vibrant and dynamic ecosystem.

- Market Concentration: Moderate to high, with increasing consolidation through M&A.

- Innovation Drivers: Mobile payments, AI-driven analytics, omnichannel integration, enhanced security features.

- Regulatory Impacts: Evolving data privacy laws (e.g., GDPR, CCPA), payment gateway regulations, PCI DSS compliance.

- Product Substitutes: Traditional on-premise POS systems, standalone payment terminals, manual invoicing systems.

- End-user Segmentation: Dominance in retail and hospitality, with strong growth in healthcare and entertainment.

- M&A Trends: Focus on acquiring complementary technologies, expanding market reach, and consolidating market share.

Cloud Point of Sale Industry Market Trends & Opportunities

The Cloud Point of Sale (POS) market is experiencing explosive growth, projected to reach hundreds of billions of dollars by 2033, with a remarkable CAGR of over xx%. This surge is driven by a confluence of technological advancements, evolving consumer preferences, and a strategic shift by businesses towards greater operational efficiency and flexibility. The ubiquity of smartphones and tablets has paved the way for the widespread adoption of mobile POS solutions, enabling businesses of all sizes to process transactions anywhere, anytime. This accessibility is particularly transformative for small and medium-sized businesses (SMBs) that can now compete more effectively with larger enterprises by leveraging cost-effective, cloud-based infrastructure.

The Software & Services segment is outperforming hardware, reflecting the increasing demand for advanced features such as inventory management, customer relationship management (CRM), loyalty programs, and sophisticated analytics. Businesses are no longer looking for just a payment processor; they are seeking an integrated business management solution. This trend creates significant opportunities for companies that can offer comprehensive, customizable software suites delivered as Software-as-a-Service (SaaS). The retail sector remains the largest end-user industry, benefiting from the ability of cloud POS systems to streamline checkout processes, manage inventory across multiple channels, and provide personalized customer experiences. However, the hospitality sector is a rapidly growing segment, with restaurants, hotels, and bars adopting cloud POS for table management, online ordering integrations, and efficient staff communication. The healthcare industry is also increasingly adopting cloud POS for patient billing and streamline administrative tasks.

Technological shifts, such as the rise of contactless payments, NFC technology, and the integration of AI for sales forecasting and personalized marketing, are further accelerating market penetration. The increasing focus on data security and compliance by businesses is also a positive trend, as cloud POS providers are investing heavily in robust security measures, reassuring merchants about the safety of their transactions and customer data. The gig economy and the rise of pop-up shops and mobile vendors are creating new markets for highly portable and affordable cloud POS solutions. The ongoing digital transformation across all industries presents a sustained opportunity for cloud POS providers to offer scalable and adaptable solutions. Furthermore, the increasing adoption of omnichannel strategies by retailers necessitates cloud-based systems that can seamlessly integrate online and in-store sales, inventory, and customer data.

Key Market Trends:

- Dominance of Mobile POS: Increasing adoption due to affordability and flexibility.

- Software & Services Growth: Demand for integrated business management features.

- Omnichannel Integration: Essential for modern retail and e-commerce.

- Contactless Payment Advancements: NFC, QR codes, and tap-to-pay functionalities.

- AI and Data Analytics: Driving personalized customer experiences and business insights.

- Enhanced Security Measures: Critical for building customer trust and regulatory compliance.

Market Opportunities:

- SMBs: Untapped potential for affordable and feature-rich cloud POS solutions.

- Emerging Markets: Rapid adoption driven by digital transformation initiatives.

- Niche Industries: Tailored solutions for specific sector needs (e.g., salons, repair services).

- Integration Partnerships: Collaborations with accounting software, e-commerce platforms, and payment gateways.

- Value-Added Services: Offering advanced analytics, marketing tools, and customer loyalty programs.

Dominant Markets & Segments in Cloud Point of Sale Industry

The Cloud Point of Sale (POS) industry exhibits distinct dominance across various market segments, driven by specific technological enablers, supportive policies, and end-user industry needs. The Software & Services segment stands as the primary growth engine, consistently outpacing hardware sales. This is attributed to the increasing demand for sophisticated functionalities that go beyond basic transaction processing. These include advanced inventory management, customer relationship management (CRM) tools, loyalty program integration, employee scheduling, and robust sales analytics. Businesses are recognizing cloud POS as a central hub for operational efficiency and customer engagement, thus prioritizing software and services that deliver tangible business value.

Within the Type segment, Mobile Point of Sale (MPOS) solutions are experiencing remarkable expansion. This surge is fueled by the inherent flexibility and cost-effectiveness of MPOS, making it accessible to a wide spectrum of businesses, from small startups and pop-up shops to large enterprises seeking to enable on-the-go sales and customer service. The decline in the cost of smartphones and tablets, coupled with the increasing reliability of wireless internet connectivity, has made MPOS a compelling alternative to traditional fixed terminals. However, Fixed Point of Sale (FPOS) systems continue to hold a significant market share, particularly in environments requiring robust, dedicated terminals such as large retail stores, restaurants with fixed counter service, and high-volume transactional environments where stability and a comprehensive user interface are paramount.

The Retail end-user industry remains the largest and most dominant segment for cloud POS solutions. The complex needs of retailers, including multi-channel inventory management, customer loyalty programs, personalized marketing, and efficient checkout processes, are perfectly addressed by the integrated capabilities of cloud POS systems. The ongoing trend towards omnichannel retail further solidifies the importance of cloud-based solutions that can seamlessly connect online and offline sales channels. The Hospitality sector is a rapidly growing segment, with restaurants, cafes, bars, and hotels embracing cloud POS for improved order accuracy, table management, online ordering integrations, and streamlined payment processing. The ability to manage reservations, staff, and customer preferences through a single platform offers significant operational advantages.

Emerging markets and developing countries are also witnessing a surge in cloud POS adoption, driven by government initiatives promoting digitalization and the growing entrepreneurial spirit. Policies supporting cashless transactions and digital payments are acting as powerful catalysts for market penetration in these regions. The infrastructure development, including enhanced internet connectivity and the availability of affordable smart devices, further facilitates this widespread adoption.

Dominant Segments:

- Component: Software & Services

- Key Growth Drivers: Demand for integrated business management, advanced analytics, CRM, inventory management, loyalty programs.

- Type: Mobile Point of Sale (MPOS)

- Key Growth Drivers: Affordability, flexibility, accessibility for SMBs, growth of the gig economy, increased adoption of personal devices for business.

- End-user Industry: Retail

- Key Growth Drivers: Omnichannel retail strategies, need for streamlined inventory management, personalized customer experiences, efficient checkout processes.

- Supporting Policies: Digital payment initiatives, tax reforms encouraging business digitalization.

- Infrastructure: Widespread internet penetration, availability of affordable smart devices.

Cloud Point of Sale Industry Product Analysis

Cloud Point of Sale (POS) products are increasingly sophisticated, blending hardware and software to offer comprehensive business management solutions. Innovations focus on enhancing transaction speed, security, and user experience. Mobile POS devices, often leveraging smartphones or tablets with integrated card readers, offer unparalleled flexibility. Cloud-based software platforms provide advanced features like real-time inventory tracking, customer loyalty programs, and detailed sales analytics, often powered by AI for predictive insights. Competitive advantages stem from seamless integration capabilities with other business systems, intuitive user interfaces, and robust security protocols protecting sensitive financial data.

Key Drivers, Barriers & Challenges in Cloud Point of Sale Industry

Key Drivers:

The Cloud Point of Sale (POS) market is propelled by several key drivers. Technological advancements, particularly in mobile computing and wireless connectivity, have made cloud POS solutions more accessible and affordable than ever. The increasing demand for operational efficiency and cost reduction among businesses of all sizes is a major factor, as cloud solutions often eliminate the need for expensive on-premise hardware and IT maintenance. Evolving consumer preferences for faster, more convenient, and contactless payment options further incentivize adoption. Furthermore, government initiatives promoting digital payments and cashless economies in various regions are creating a favorable regulatory environment. The expansion of omnichannel retail strategies necessitates integrated POS systems that can manage sales across physical and online channels.

Barriers & Challenges:

Despite strong growth, the Cloud Point of Sale (POS) industry faces several challenges. Concerns regarding data security and privacy remain a significant barrier, as businesses entrust sensitive customer and financial information to third-party cloud providers. Reliability of internet connectivity, especially in remote or less developed areas, can hinder the performance of cloud-based systems. High upfront implementation costs and the complexity of integrating with existing legacy systems can also be deterrents for some businesses. Regulatory hurdles and evolving compliance requirements, such as PCI DSS, necessitate continuous adaptation and investment by POS providers. The intense competition within the market can lead to price wars and pressure on profit margins, while supply chain disruptions for hardware components can impact product availability.

Growth Drivers in the Cloud Point of Sale Industry Market

The Cloud Point of Sale (POS) industry is experiencing robust growth driven by several pivotal factors. Technological innovation is at the forefront, with continuous advancements in mobile hardware, secure payment processing, and sophisticated cloud-based software offering enhanced features like AI-powered analytics and personalized marketing. Economic shifts, including the increasing reliance on small and medium-sized businesses (SMBs) and the growth of the gig economy, are creating a demand for flexible, affordable, and scalable POS solutions. Government policies that encourage digital transformation and cashless transactions, alongside initiatives promoting e-commerce and business digitalization, are further accelerating market penetration. The growing adoption of omnichannel retail strategies by businesses necessitates integrated POS systems that can manage sales and inventory seamlessly across online and offline channels.

Challenges Impacting Cloud Point of Sale Industry Growth

Several challenges temper the rapid growth of the Cloud Point of Sale (POS) industry. Data security and privacy concerns remain a paramount issue, as businesses are hesitant to entrust sensitive customer and financial data to cloud-based systems. The reliability of internet connectivity, especially in underserved regions, can lead to transaction failures and operational disruptions. Regulatory complexities and evolving compliance mandates, such as those related to data protection and payment security, necessitate ongoing investment and adaptation by POS providers. Supply chain issues impacting the availability and cost of hardware components, such as semiconductors, can lead to delays and increased expenses. Furthermore, the intense competitive landscape often leads to pricing pressures, impacting profitability.

Key Players Shaping the Cloud Point of Sale Industry Market

- Shopify Inc

- Dell Corporation

- Clover Network Inc

- Seiko Epson Corp

- Lightspeed POS Inc

- Intuit Inc

- Samsung Electronics Co Ltd

- NCR Corporation

- Hewlett Packard Enterprise

- Toshiba Global Commerce Solutions

- Vend Limited

- NEC Corporation

- Micros Retail Systems Inc (Oracle)

- Casio Computer Co Ltd

- Panasonic Corporation

- Block Inc

Significant Cloud Point of Sale Industry Industry Milestones

- September 2022: Square, Inc. (now known as Block, Inc.) introduced millions of vendors across the United States to its Tap to Pay feature on iPhone. This significant development allowed merchants of all sizes to accept contactless payments directly from their iPhones, eliminating the need for additional hardware and incurring no extra costs for the seller, thereby democratizing contactless payment acceptance.

- January 2022: Visa introduced a new cloud-based payment platform, Visa Acceptance Cloud (VAC), which aimed to transform any device into a cloud-connected payment terminal. This innovation allowed acquirers, payment service providers, PoS manufacturers, and IoT players to shift payment processing software from being embedded in individual hardware devices to being universally accessible in the cloud, fostering greater flexibility and scalability in payment acceptance.

Future Outlook for Cloud Point of Sale Industry Market

The future outlook for the Cloud Point of Sale (POS) industry is exceptionally bright, poised for sustained and significant growth. Emerging technologies such as AI-driven personalization, biometric authentication, and advanced data analytics will further enhance the functionality and value proposition of cloud POS systems. The increasing adoption of IoT devices and the expansion of smart retail environments will create new integration opportunities. Strategic partnerships and acquisitions are expected to continue shaping the market, leading to more comprehensive and integrated solutions. The growing demand for seamless omnichannel experiences and the ongoing digital transformation across SMBs and enterprise-level businesses will act as strong growth catalysts. The market is also expected to witness increased innovation in offering highly specialized POS solutions for niche industries, further broadening its reach and impact.

Cloud Point of Sale Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software & Services

-

2. Type

- 2.1. Fixed Point of Sale

- 2.2. Mobile Point of Sale

-

3. End-user Industry

- 3.1. Entertainment

- 3.2. Hospitality

- 3.3. Healthcare

- 3.4. Retail

- 3.5. Other End-user Industries

Cloud Point of Sale Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Cloud Point of Sale Industry Regional Market Share

Geographic Coverage of Cloud Point of Sale Industry

Cloud Point of Sale Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Cashless Transaction; Increased Business Mobility and Flexibility

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure and High Dependence on Legacy Systems

- 3.4. Market Trends

- 3.4.1. Retail Segment is Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Point of Sale Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software & Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed Point of Sale

- 5.2.2. Mobile Point of Sale

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Entertainment

- 5.3.2. Hospitality

- 5.3.3. Healthcare

- 5.3.4. Retail

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Cloud Point of Sale Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software & Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed Point of Sale

- 6.2.2. Mobile Point of Sale

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Entertainment

- 6.3.2. Hospitality

- 6.3.3. Healthcare

- 6.3.4. Retail

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Cloud Point of Sale Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software & Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed Point of Sale

- 7.2.2. Mobile Point of Sale

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Entertainment

- 7.3.2. Hospitality

- 7.3.3. Healthcare

- 7.3.4. Retail

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Cloud Point of Sale Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software & Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed Point of Sale

- 8.2.2. Mobile Point of Sale

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Entertainment

- 8.3.2. Hospitality

- 8.3.3. Healthcare

- 8.3.4. Retail

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Cloud Point of Sale Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software & Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed Point of Sale

- 9.2.2. Mobile Point of Sale

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Entertainment

- 9.3.2. Hospitality

- 9.3.3. Healthcare

- 9.3.4. Retail

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Cloud Point of Sale Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software & Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed Point of Sale

- 10.2.2. Mobile Point of Sale

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Entertainment

- 10.3.2. Hospitality

- 10.3.3. Healthcare

- 10.3.4. Retail

- 10.3.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shopify Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dell Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clover Network Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Seiko Epson Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lightspeed POS Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Intuit Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Electronics Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NCR Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hewlett Packard Enterprise

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toshiba Global Commerce Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Vend Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NEC Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Micros Retail Systems Inc (Oracle)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Casio Computer Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Panasonic Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Block Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Shopify Inc

List of Figures

- Figure 1: Global Cloud Point of Sale Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cloud Point of Sale Industry Revenue (billion), by Component 2025 & 2033

- Figure 3: North America Cloud Point of Sale Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Cloud Point of Sale Industry Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Cloud Point of Sale Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Cloud Point of Sale Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America Cloud Point of Sale Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Cloud Point of Sale Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Cloud Point of Sale Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cloud Point of Sale Industry Revenue (billion), by Component 2025 & 2033

- Figure 11: Europe Cloud Point of Sale Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Cloud Point of Sale Industry Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Cloud Point of Sale Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Cloud Point of Sale Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Cloud Point of Sale Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Cloud Point of Sale Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Cloud Point of Sale Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cloud Point of Sale Industry Revenue (billion), by Component 2025 & 2033

- Figure 19: Asia Pacific Cloud Point of Sale Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Cloud Point of Sale Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Asia Pacific Cloud Point of Sale Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Cloud Point of Sale Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Cloud Point of Sale Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Cloud Point of Sale Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Cloud Point of Sale Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Cloud Point of Sale Industry Revenue (billion), by Component 2025 & 2033

- Figure 27: Latin America Cloud Point of Sale Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Cloud Point of Sale Industry Revenue (billion), by Type 2025 & 2033

- Figure 29: Latin America Cloud Point of Sale Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Cloud Point of Sale Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Latin America Cloud Point of Sale Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Cloud Point of Sale Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Cloud Point of Sale Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Cloud Point of Sale Industry Revenue (billion), by Component 2025 & 2033

- Figure 35: Middle East and Africa Cloud Point of Sale Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East and Africa Cloud Point of Sale Industry Revenue (billion), by Type 2025 & 2033

- Figure 37: Middle East and Africa Cloud Point of Sale Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Cloud Point of Sale Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Cloud Point of Sale Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Cloud Point of Sale Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cloud Point of Sale Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cloud Point of Sale Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 2: Global Cloud Point of Sale Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Cloud Point of Sale Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Cloud Point of Sale Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cloud Point of Sale Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 6: Global Cloud Point of Sale Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Cloud Point of Sale Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Cloud Point of Sale Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cloud Point of Sale Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 10: Global Cloud Point of Sale Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Cloud Point of Sale Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Cloud Point of Sale Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cloud Point of Sale Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 14: Global Cloud Point of Sale Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Cloud Point of Sale Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Cloud Point of Sale Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cloud Point of Sale Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 18: Global Cloud Point of Sale Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 19: Global Cloud Point of Sale Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Cloud Point of Sale Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cloud Point of Sale Industry Revenue billion Forecast, by Component 2020 & 2033

- Table 22: Global Cloud Point of Sale Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Global Cloud Point of Sale Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Cloud Point of Sale Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Point of Sale Industry?

The projected CAGR is approximately 18.2%.

2. Which companies are prominent players in the Cloud Point of Sale Industry?

Key companies in the market include Shopify Inc, Dell Corporation, Clover Network Inc, Seiko Epson Corp, Lightspeed POS Inc, Intuit Inc, Samsung Electronics Co Ltd, NCR Corporation, Hewlett Packard Enterprise, Toshiba Global Commerce Solutions, Vend Limited, NEC Corporation, Micros Retail Systems Inc (Oracle), Casio Computer Co Ltd, Panasonic Corporation, Block Inc.

3. What are the main segments of the Cloud Point of Sale Industry?

The market segments include Component, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Cashless Transaction; Increased Business Mobility and Flexibility.

6. What are the notable trends driving market growth?

Retail Segment is Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

Lack of Infrastructure and High Dependence on Legacy Systems.

8. Can you provide examples of recent developments in the market?

September 2022: Square, Inc. (now known as Block, Inc.) introduced millions of vendors across the United States to its Tap to Pay feature on iPhone. The feature, available within the Square Point of Sale iOS app, allowed merchants of all sizes to accept contactless payments directly from their iPhones, with no additional hardware requirement and at no additional costs to the seller.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Point of Sale Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Point of Sale Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Point of Sale Industry?

To stay informed about further developments, trends, and reports in the Cloud Point of Sale Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence