Key Insights

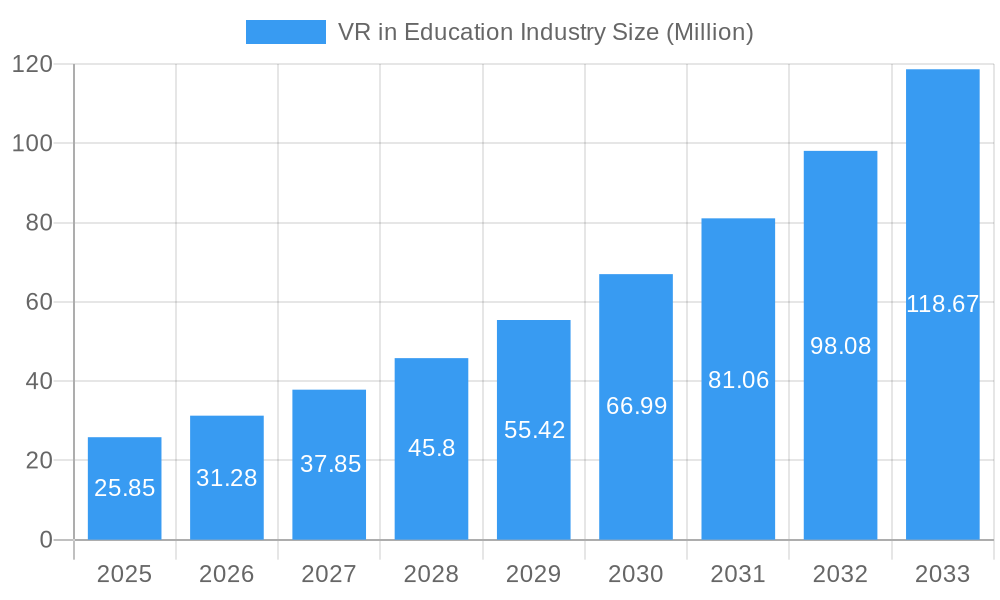

The Virtual Reality (VR) in Education market is experiencing robust expansion, projected to reach an impressive \$25.85 million with a Compound Annual Growth Rate (CAGR) of 21.00% during the forecast period of 2025-2033. This remarkable growth is primarily propelled by a confluence of factors, including the increasing adoption of immersive learning technologies in academic institutions and corporate training programs. The demand for more engaging and effective educational experiences, coupled with advancements in VR hardware and software capabilities, are significant market drivers. Furthermore, the growing accessibility of affordable VR solutions and the development of specialized educational content are further fueling this upward trajectory. The integration of VR in K-12 learning, higher education, and vocational training, particularly in sectors like IT and Telecom, Healthcare, and Retail, is creating a dynamic ecosystem where innovative teaching methodologies are becoming the norm.

VR in Education Industry Market Size (In Million)

The market is segmented across Hardware, Software, and Services, with End Users encompassing Academic Institutions and Corporate Training sectors. Hardware innovations, such as lighter and more powerful VR headsets, are making the technology more practical for classroom and training environments. Simultaneously, the development of sophisticated educational VR software, offering interactive simulations and virtual field trips, is enhancing learning outcomes. The services segment, including installation, training, and content creation, is also growing in importance to support the widespread adoption of VR solutions. Key players like EON Reality, VR Education Holdings, Lenovo Group Limited, Samsung Electronics Co. Ltd., and Microsoft Corporation are at the forefront of driving these advancements and expanding the market's reach. While the market is set for substantial growth, potential restraints might include the initial cost of implementation for some institutions and the ongoing need for professional development to effectively integrate VR into curricula.

VR in Education Industry Company Market Share

This definitive report offers an in-depth exploration of the burgeoning Virtual Reality (VR) in Education Industry. Covering the historical period from 2019–2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this analysis provides actionable insights for stakeholders seeking to navigate and capitalize on this transformative market. With a focus on high-volume keywords like "VR education," "immersive learning," "virtual reality in schools," "corporate training VR," and "educational technology market," this report is optimized for maximum visibility and engagement. Gain a comprehensive understanding of market dynamics, key players, technological advancements, and future growth trajectories that are reshaping the educational landscape.

VR in Education Industry Market Structure & Competitive Landscape

The VR in Education Industry is characterized by a moderately concentrated market structure, driven by substantial investments in hardware and software innovation. Key innovation drivers include the increasing demand for engaging and experiential learning, advancements in VR display technology, and the growing accessibility of high-fidelity VR content. Regulatory impacts, while still evolving, are primarily focused on data privacy and accessibility standards, with a growing emphasis on ensuring equitable access to VR educational tools. Product substitutes, such as traditional e-learning platforms and augmented reality (AR), present a competitive challenge, yet VR's unparalleled immersive capabilities provide a distinct advantage in specific learning scenarios.

The end-user segmentation reveals a strong penetration in Academic Institutions, encompassing both K-12 Learning and Higher Education. Corporate Training is also emerging as a significant segment, with particular traction in IT and Telecom, Healthcare, and Retail and E-commerce sectors seeking to enhance employee skill development and onboarding processes. Mergers and Acquisitions (M&A) trends indicate a consolidation phase, with larger technology firms acquiring specialized VR education startups to bolster their portfolios and expand market reach. Anticipated M&A volumes are projected to exceed 500 Million in the coming years, signaling intensified competitive activity. Concentration ratios are estimated to be around 45% among the top five players, highlighting a dynamic yet competitive environment.

VR in Education Industry Market Trends & Opportunities

The VR in Education Industry is experiencing exponential growth, projected to reach a market size exceeding $50,000 Million by 2033. This significant expansion is fueled by a convergence of technological advancements, evolving pedagogical approaches, and increasing institutional adoption. The Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is estimated at an impressive 22%, underscoring the rapid pace of market penetration and adoption.

Technological shifts are at the forefront of this growth. The development of more affordable, user-friendly, and higher-resolution VR headsets, coupled with advancements in haptic feedback and spatial audio, is enhancing the immersive experience, making it more conducive to effective learning. Furthermore, the evolution of VR content creation tools and platforms is democratizing the development of educational VR applications, enabling educators and institutions to create bespoke learning modules tailored to specific curricula and learning objectives.

Consumer preferences are increasingly leaning towards experiential and interactive learning methodologies. Students, having grown up in a digitally saturated environment, are demonstrating a strong affinity for engaging, gamified learning experiences that VR uniquely offers. This shift is compelling educational institutions to integrate VR solutions to meet student expectations and improve learning outcomes. The demand for personalized learning pathways, where students can explore complex concepts at their own pace and in a safe, simulated environment, is also a significant trend driving VR adoption.

Competitive dynamics are intensifying as more established technology companies and dedicated VR education providers vie for market share. Strategic partnerships between VR hardware manufacturers, software developers, and content creators are becoming crucial for delivering comprehensive VR education solutions. The opportunities are vast, ranging from developing specialized VR modules for STEM subjects, historical simulations, medical training, and vocational skill development, to creating virtual field trips and collaborative learning environments. The potential for VR to bridge geographical barriers and provide equitable access to high-quality education, particularly in underserved regions, represents a significant, albeit challenging, market opportunity. The market penetration rate for VR in education, currently estimated at 15%, is expected to surge in the coming years, driven by these trends and the proven efficacy of immersive learning.

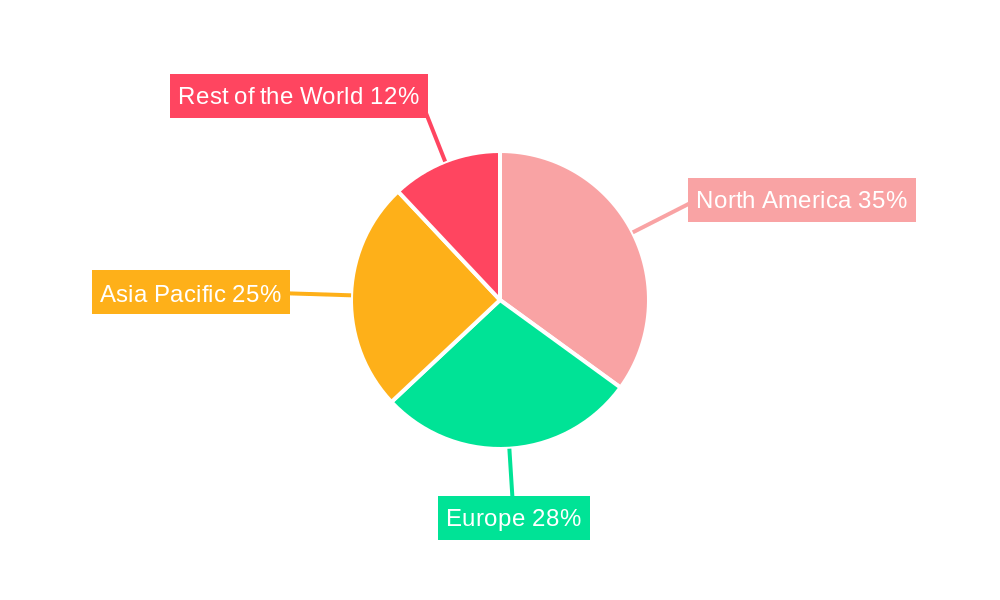

Dominant Markets & Segments in VR in Education Industry

The VR in Education Industry exhibits clear regional and segmental dominance, driven by technological infrastructure, supportive government policies, and early adoption rates. North America currently leads as the dominant region, owing to significant investments in educational technology, robust R&D initiatives, and a strong presence of key market players. The United States, in particular, plays a pivotal role due to its advanced technological ecosystem and widespread adoption of innovative learning tools in both K-12 and higher education.

Within the Type segmentation, Software holds a significant share, driven by the increasing demand for educational VR applications, content libraries, and learning management systems designed for immersive environments. The development of intuitive VR content creation tools also bolsters the software segment. Hardware, including VR headsets and peripherals, remains a crucial enabler, with its market share closely tied to the adoption of software solutions. Services, encompassing installation, training, content development, and technical support, are gaining traction as institutions seek end-to-end solutions.

In terms of End User segmentation, Academic Institutions represent the largest and most rapidly growing segment. K-12 Learning is a key growth driver, with VR offering unparalleled opportunities for engaging young learners in subjects like science, history, and geography through interactive simulations and virtual field trips. Higher Education is also a substantial market, with VR being utilized for advanced scientific research simulations, complex medical training, architectural design visualization, and historical reconstructions.

Corporate Training is an emerging yet rapidly expanding segment, demonstrating substantial potential. Within this, IT and Telecom sectors are leveraging VR for complex system simulations and troubleshooting training. The Healthcare industry is a prime adopter, using VR for surgical training, patient education, and rehabilitation programs. Retail and E-commerce are exploring VR for product visualization, customer service training, and immersive shopping experiences. The "Other End Users" category, including vocational training centers and specialized skill development institutions, also contributes to the overall market growth. Key growth drivers within these dominant segments include increasing government funding for educational technology, the development of standardized VR curriculum frameworks, and the growing realization of VR's efficacy in improving learning retention and practical skill acquisition.

VR in Education Industry Product Analysis

Product innovation in the VR in Education Industry is centered on enhancing realism, interactivity, and accessibility. Key advancements include the development of standalone VR headsets offering greater mobility and ease of use, coupled with higher resolution displays and wider fields of view for a more immersive experience. Software innovations are focused on intuitive content creation platforms that empower educators to build custom VR learning modules without extensive technical expertise. Applications span across virtual labs for science experiments, historical reconstructions for social studies, surgical simulations for medical students, and interactive language learning environments. Competitive advantages lie in the ability to offer adaptive learning paths, real-time performance analytics, and collaborative VR spaces that foster teamwork and engagement, ultimately leading to improved learning outcomes and knowledge retention.

Key Drivers, Barriers & Challenges in VR in Education Industry

The VR in Education Industry is propelled by several key drivers. Technologically, advancements in headset affordability, processing power, and display resolution are making VR more accessible. Economically, the increasing recognition of VR's potential to improve learning outcomes and reduce training costs is driving investment. Policy-driven factors, such as government initiatives promoting digital literacy and STEM education, further catalyze adoption. For example, national educational technology plans often include provisions for immersive learning technologies.

However, significant barriers and challenges impede widespread adoption. High initial hardware costs, while decreasing, remain a hurdle for budget-constrained institutions. The lack of standardized VR content and curriculum integration poses a challenge for educators seeking to seamlessly incorporate VR into existing teaching frameworks. Supply chain issues for VR hardware components can lead to price volatility and availability constraints, impacting deployment timelines. Regulatory hurdles, particularly concerning student data privacy and online safety in virtual environments, require careful navigation. Competitive pressures from established e-learning providers and the need for ongoing teacher training and professional development to effectively utilize VR tools also present considerable challenges. The estimated impact of these challenges on market growth could translate to a delay in full market penetration by approximately 2-3 years, impacting projected market sizes.

Growth Drivers in the VR in Education Industry Market

The VR in Education Industry is experiencing robust growth fueled by several key factors. Technological advancements, particularly the increasing affordability and improved performance of VR hardware, are making immersive learning solutions more accessible to educational institutions worldwide. Economic incentives, such as government grants and institutional funding allocated towards innovative educational technologies, are playing a crucial role in driving adoption. Furthermore, the growing body of research demonstrating the effectiveness of VR in enhancing student engagement, knowledge retention, and skill development is a significant catalyst. Policy-driven factors, including national strategies to promote digital transformation in education and a focus on preparing students for the future workforce, are creating a favorable environment for VR integration. The increasing demand for personalized and experiential learning experiences among students is also pushing educators to explore and adopt VR technologies.

Challenges Impacting VR in Education Industry Growth

Despite its immense potential, the VR in Education Industry faces several significant challenges that impact its growth trajectory. A primary concern is the substantial initial investment required for VR hardware, software, and infrastructure, which can be prohibitive for many educational institutions, particularly those with limited budgets. The development and accessibility of high-quality, curriculum-aligned VR educational content remain a bottleneck; creating compelling and pedagogically sound VR experiences is complex and resource-intensive. Teacher training and professional development are crucial yet often insufficient, leading to underutilization or improper implementation of VR tools. Regulatory complexities, including data privacy concerns for students and the need for clear guidelines on online safety within virtual learning environments, add another layer of challenge. Furthermore, ongoing supply chain issues for VR components can lead to unpredictable pricing and availability, impacting deployment plans and creating uncertainty for institutions. The competitive pressure from established educational technology providers also necessitates continuous innovation and demonstration of tangible return on investment for VR solutions.

Key Players Shaping the VR in Education Industry Market

- EON Reality

- VR Education Holdings

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Avantis Systems Limited

- Virtalis Holdings Limited

- Unity Teach

- Microsoft Corporation

- zSpace Inc

- Nearpod Inc

- Veative Labs

- Alchemy VR Limited

- Meta Platforms Inc

- HTC Corporation

Significant VR in Education Industry Industry Milestones

- October 2022: Japanese startup Jolly Good Inc., in partnership with Juntendo University, commenced a demonstration project to introduce medical education with virtual reality (VR) and develop human medical resources through VR at Royal Mahidol University and throughout Thailand. The company provided Mahidol University with VR teaching material production facilities and VR experience equipment to create an environment enabling the self-production of VR teaching materials for infectious disease treatment education. This milestone signifies a growing global interest in VR for specialized medical training and inter-institutional collaboration.

- May 2022: XR Immersive Tech Inc., a provider of immersive virtual reality (VR) experiences, announced that its subsidiary, Synthesis VR Inc., partnered with VictoryXR in bringing the company's educational content to LBVR operators worldwide, accessible through the Synthesis VR content marketplace. VictoryXR provides virtual reality (VR) educational content for levels starting in kindergarten up to grade 12. This collaboration highlights the expansion of VR educational content accessibility and its integration into broader immersive entertainment and learning ecosystems.

Future Outlook for VR in Education Industry Market

The future outlook for the VR in Education Industry is exceptionally promising, driven by continued technological innovation and increasing global recognition of its transformative potential. Strategic opportunities lie in the development of more affordable and versatile VR hardware, coupled with the creation of AI-powered adaptive learning platforms that personalize the educational experience. The market is poised for significant growth as institutions increasingly invest in immersive technologies to enhance student engagement, improve learning outcomes, and equip learners with future-ready skills. Expansion into new geographical markets and diverse educational segments, including vocational training and lifelong learning, will further fuel growth. The integration of VR with other emerging technologies like artificial intelligence and 5G connectivity will unlock even greater possibilities for collaborative, interactive, and deeply engaging educational experiences, solidifying VR's position as a cornerstone of modern learning. The market potential for widespread adoption, particularly in bridging educational disparities and providing access to specialized training, is estimated to exceed $100,000 Million by 2033.

VR in Education Industry Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. End User

-

2.1. Academic Institutions

- 2.1.1. K-12 Learning

- 2.1.2. Higher Education

-

2.2. Corporate Training

- 2.2.1. IT and Telecom

- 2.2.2. Healthcare

- 2.2.3. Retail and E-commerce

- 2.2.4. Other End users

-

2.1. Academic Institutions

VR in Education Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

VR in Education Industry Regional Market Share

Geographic Coverage of VR in Education Industry

VR in Education Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for interactive and personalized learning experience; Higher acceptance among stakeholders owing to higher engagement and scope for blended learning technology; VR-based technology benefits from being the first entrant in the education & corporate category; The role of education and training among corporates has transformed with the growth in digital engagement and compelling content

- 3.3. Market Restrains

- 3.3.1 Limited content and cost efficiency of consumer-grade applications; Dependence on external factors

- 3.3.2 such as bandwidth and network

- 3.3.3 for ensuring optimal experience

- 3.4. Market Trends

- 3.4.1. Increasing Demand For Interactive and Personalized Learning Experience

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global VR in Education Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Academic Institutions

- 5.2.1.1. K-12 Learning

- 5.2.1.2. Higher Education

- 5.2.2. Corporate Training

- 5.2.2.1. IT and Telecom

- 5.2.2.2. Healthcare

- 5.2.2.3. Retail and E-commerce

- 5.2.2.4. Other End users

- 5.2.1. Academic Institutions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America VR in Education Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Academic Institutions

- 6.2.1.1. K-12 Learning

- 6.2.1.2. Higher Education

- 6.2.2. Corporate Training

- 6.2.2.1. IT and Telecom

- 6.2.2.2. Healthcare

- 6.2.2.3. Retail and E-commerce

- 6.2.2.4. Other End users

- 6.2.1. Academic Institutions

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe VR in Education Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Academic Institutions

- 7.2.1.1. K-12 Learning

- 7.2.1.2. Higher Education

- 7.2.2. Corporate Training

- 7.2.2.1. IT and Telecom

- 7.2.2.2. Healthcare

- 7.2.2.3. Retail and E-commerce

- 7.2.2.4. Other End users

- 7.2.1. Academic Institutions

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific VR in Education Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Academic Institutions

- 8.2.1.1. K-12 Learning

- 8.2.1.2. Higher Education

- 8.2.2. Corporate Training

- 8.2.2.1. IT and Telecom

- 8.2.2.2. Healthcare

- 8.2.2.3. Retail and E-commerce

- 8.2.2.4. Other End users

- 8.2.1. Academic Institutions

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World VR in Education Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Academic Institutions

- 9.2.1.1. K-12 Learning

- 9.2.1.2. Higher Education

- 9.2.2. Corporate Training

- 9.2.2.1. IT and Telecom

- 9.2.2.2. Healthcare

- 9.2.2.3. Retail and E-commerce

- 9.2.2.4. Other End users

- 9.2.1. Academic Institutions

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 EON Reality

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 VR Education Holdings*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lenovo Group Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Samsung Electronics Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Avantis Systems Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Virtalis Holdings Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Unity Teach

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Microsoft Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 zSpace Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nearpod Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Veative Labs

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Alchemy VR Limited

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Meta Platforms Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 HTC Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 EON Reality

List of Figures

- Figure 1: Global VR in Education Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America VR in Education Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America VR in Education Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America VR in Education Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America VR in Education Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America VR in Education Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America VR in Education Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe VR in Education Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe VR in Education Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe VR in Education Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe VR in Education Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe VR in Education Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe VR in Education Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific VR in Education Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific VR in Education Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific VR in Education Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific VR in Education Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific VR in Education Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific VR in Education Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World VR in Education Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World VR in Education Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World VR in Education Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World VR in Education Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World VR in Education Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World VR in Education Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global VR in Education Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global VR in Education Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global VR in Education Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global VR in Education Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global VR in Education Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global VR in Education Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global VR in Education Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global VR in Education Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global VR in Education Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global VR in Education Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global VR in Education Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global VR in Education Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global VR in Education Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global VR in Education Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global VR in Education Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the VR in Education Industry?

The projected CAGR is approximately 21.00%.

2. Which companies are prominent players in the VR in Education Industry?

Key companies in the market include EON Reality, VR Education Holdings*List Not Exhaustive, Lenovo Group Limited, Samsung Electronics Co Ltd, Avantis Systems Limited, Virtalis Holdings Limited, Unity Teach, Microsoft Corporation, zSpace Inc, Nearpod Inc, Veative Labs, Alchemy VR Limited, Meta Platforms Inc, HTC Corporation.

3. What are the main segments of the VR in Education Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for interactive and personalized learning experience; Higher acceptance among stakeholders owing to higher engagement and scope for blended learning technology; VR-based technology benefits from being the first entrant in the education & corporate category; The role of education and training among corporates has transformed with the growth in digital engagement and compelling content.

6. What are the notable trends driving market growth?

Increasing Demand For Interactive and Personalized Learning Experience.

7. Are there any restraints impacting market growth?

Limited content and cost efficiency of consumer-grade applications; Dependence on external factors. such as bandwidth and network. for ensuring optimal experience.

8. Can you provide examples of recent developments in the market?

October 2022: Japanese startup Jolly Good Inc., in partnership with Juntendo University, will commence a demonstration project to introduce medical education with virtual reality (VR) and develop human medical resources through VR at Royal Mahidol University and throughout Thailand. The company will provide Mahidol University with VR teaching material production facilities and VR experience equipment to create an environment that enables the self-production of VR teaching materials for infectious disease treatment education at the university.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "VR in Education Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the VR in Education Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the VR in Education Industry?

To stay informed about further developments, trends, and reports in the VR in Education Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence