Key Insights

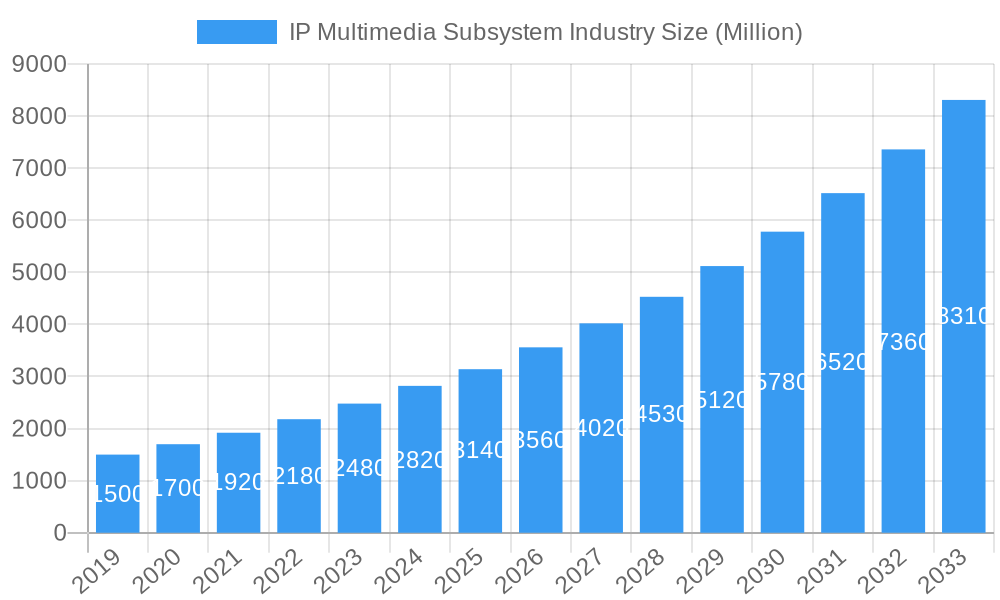

The IP Multimedia Subsystem (IMS) market is poised for significant expansion, projected to reach a substantial size of USD 3.14 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 13.38%. This dynamic growth is fueled by the escalating demand for advanced communication services, particularly instant messaging, Voice over IP (VoIP), Voice over LTE (VoLTE), and Voice over Wi-Fi (VoWiFi). The proliferation of smartphones and the increasing adoption of converged communication solutions by enterprises are key catalysts, enabling seamless integration of voice, video, and data services. The ongoing evolution of telecommunications infrastructure towards 5G and beyond further amplifies the need for sophisticated IMS platforms that can efficiently manage these complex service offerings.

IP Multimedia Subsystem Industry Market Size (In Billion)

The market's growth trajectory is further supported by several underlying trends. The increasing deployment of Over-The-Top (OTT) services, coupled with the growing emphasis on unified communications and collaborations (UCC) solutions within businesses, presents significant opportunities. Furthermore, the continuous innovation in IMS architecture, leading to enhanced scalability, reliability, and cost-effectiveness, is attracting wider adoption. While the market is predominantly driven by service innovation, potential restraints such as the complexity of integration with legacy systems and evolving regulatory landscapes require careful navigation. However, the strong performance of major players like Huawei, Ericsson, and Nokia, alongside emerging contenders, indicates a healthy competitive environment that will foster further market development and technological advancements.

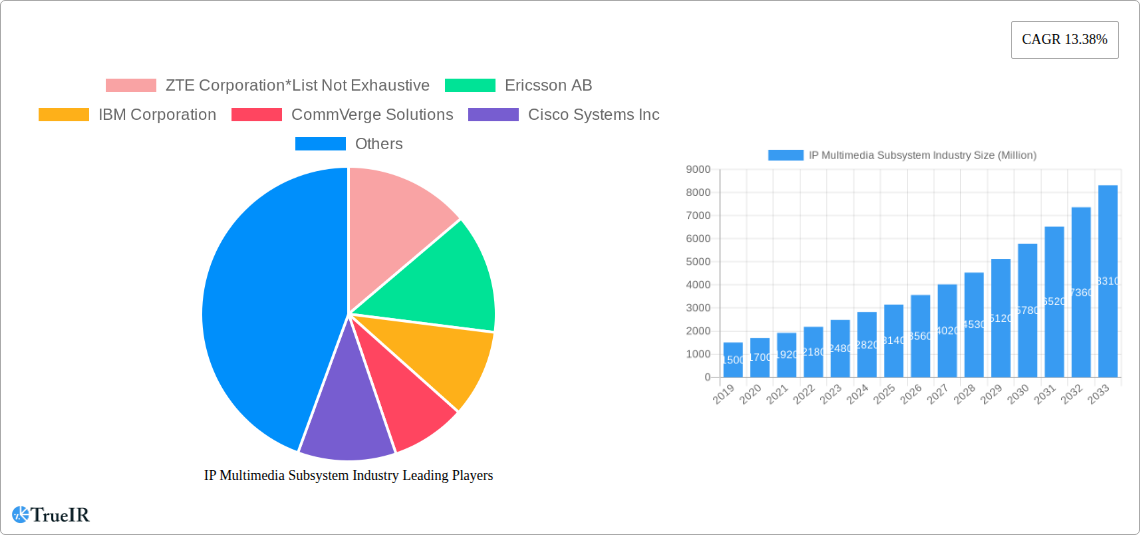

IP Multimedia Subsystem Industry Company Market Share

This in-depth report provides a dynamic, SEO-optimized analysis of the global IP Multimedia Subsystem (IMS) industry. Leveraging high-volume keywords and extensive market data, we offer critical insights into market structure, trends, dominant segments, and future opportunities. The study covers the historical period from 2019–2024, the base year of 2025, and a comprehensive forecast period from 2025–2033.

IP Multimedia Subsystem Industry Market Structure & Competitive Landscape

The IP Multimedia Subsystem (IMS) industry exhibits a moderately consolidated market structure, with a significant presence of large telecommunications equipment manufacturers and software providers. Key innovation drivers include the increasing demand for unified communications, the ongoing transition to 5G networks, and the growing adoption of cloud-native IMS solutions. Regulatory impacts, while varied across regions, generally favor interoperability and the establishment of clear technical standards to ensure seamless service delivery. Product substitutes, such as Over-The-Top (OTT) communication applications, present a continuous competitive pressure, necessitating ongoing advancements in IMS capabilities and integration. End-user segmentation is driven by service provider needs for enhanced voice, video, and messaging capabilities, alongside enterprise demand for integrated collaboration tools. Merger and acquisition (M&A) trends in the IMS market have focused on consolidating technology portfolios, expanding service offerings, and acquiring specialized expertise. Recent M&A activities have seen key players acquiring innovative startups in areas like AI-powered communication enhancement and network function virtualization (NFV). The market concentration ratio is estimated to be around 0.65, indicating a balance between a few dominant players and a competitive fringe. M&A volumes have averaged 15-20 transactions annually over the past three years, with an average deal size of approximately $50 Million to $200 Million.

- Innovation Drivers:

- Ubiquitous adoption of smartphones and mobile data.

- Growing demand for high-definition voice and video communication.

- Integration of AI and machine learning for enhanced communication services.

- Evolution towards cloud-native and virtualized IMS architectures.

- Regulatory Impacts:

- Net neutrality policies influencing service provisioning.

- Data privacy regulations (e.g., GDPR) impacting user data handling.

- Spectrum allocation and licensing for mobile broadband services.

- Product Substitutes:

- Over-The-Top (OTT) messaging and voice applications (e.g., WhatsApp, Skype).

- Standalone video conferencing solutions.

- End-User Segmentation:

- Mobile Network Operators (MNOs) seeking to enhance subscriber services.

- Enterprise businesses for unified communications and collaboration.

- Fixed-line operators looking to modernize their service portfolios.

- M&A Trends:

- Acquisition of niche technology providers specializing in AI, NFV, and cybersecurity.

- Consolidation to achieve economies of scale and broaden service portfolios.

- Strategic partnerships for joint R&D and market expansion.

IP Multimedia Subsystem Industry Market Trends & Opportunities

The global IP Multimedia Subsystem (IMS) market is poised for substantial growth, driven by the insatiable demand for robust, integrated, and next-generation communication services. The market size is projected to expand from an estimated $15 Billion in 2025 to over $25 Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6.5%. This growth trajectory is underpinned by significant technological shifts, most notably the widespread deployment of 5G networks, which are fundamentally enhancing the capabilities and applications of IMS. 5G's inherent low latency, high bandwidth, and massive connectivity enable richer, more immersive communication experiences, including enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (mMTC), all of which are directly facilitated and managed by advanced IMS architectures.

Consumer preferences are rapidly evolving towards seamless, multi-device communication experiences. Users expect to transition effortlessly between voice calls, video conferences, instant messaging, and file sharing across various platforms and devices. IMS plays a crucial role in enabling this convergence by providing a unified control plane for these diverse services. The increasing adoption of VoLTE (Voice over LTE) and VoWiFi (Voice over Wi-Fi) services has already established a strong foundation for IMS, and the expansion into richer communication services (RCS) and integrated contact center solutions further fuels market penetration. The competitive dynamics are characterized by intense innovation, with players vying to offer more intelligent, scalable, and cost-effective IMS solutions. Cloud-native IMS architectures are gaining significant traction, allowing for greater agility, faster deployment of new services, and improved operational efficiency through network function virtualization (NFV) and software-defined networking (SDN).

Opportunities abound for vendors that can offer end-to-end IMS solutions, including robust security features, advanced analytics for service optimization, and seamless integration with existing IT infrastructure. The growing enterprise demand for unified communications as a service (UCaaS) presents a significant avenue for growth, as businesses seek to consolidate their communication platforms for improved productivity and collaboration. Furthermore, the expansion of IoT services, which require efficient and scalable communication protocols, will also drive IMS adoption. The market penetration rate for advanced IMS-enabled services is expected to rise from approximately 60% in 2025 to over 85% by 2033, as operators increasingly leverage IMS for their core service delivery. The focus on digital transformation across industries is creating fertile ground for IMS providers to deliver tailored solutions that enhance business processes and customer engagement. The ongoing refinement of IMS functionalities to support emerging technologies like augmented reality (AR) and virtual reality (VR) in communication further broadens its application scope and market appeal, ensuring sustained growth and innovation. The total addressable market is estimated to reach $30 Billion by 2033.

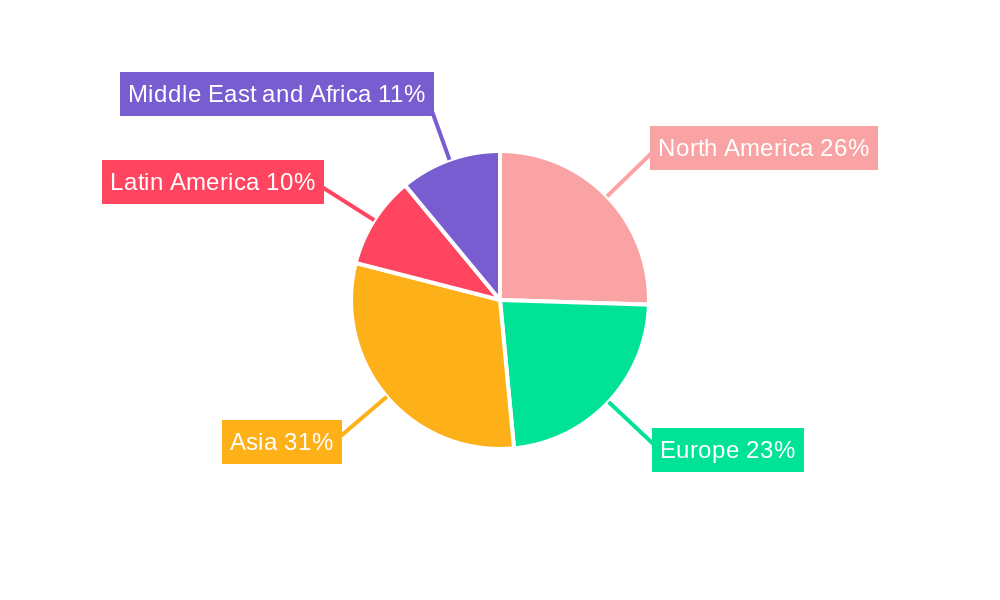

Dominant Markets & Segments in IP Multimedia Subsystem Industry

The IP Multimedia Subsystem (IMS) industry is characterized by dynamic regional growth and a diverse service segment landscape, with North America and Europe currently holding dominant market shares due to their advanced telecommunications infrastructure and high adoption rates of next-generation communication services. Asia-Pacific, however, is emerging as a crucial growth engine, driven by rapid 5G deployments, a burgeoning smartphone user base, and significant investments in digital transformation initiatives by both governments and private enterprises. Countries like China, India, and South Korea are at the forefront of this expansion, leveraging IMS to support a wide array of innovative services.

Within the service segments, VoLTE (Voice over LTE) and VoWiFi (Voice over Wi-Fi) are currently the most prevalent and foundational IMS services, forming the backbone of mobile voice communication for billions of users globally. Their dominance is a testament to the enhanced call quality, faster call setup times, and seamless handover capabilities they offer. The continued growth of these services is driven by the ongoing global rollout of 4G LTE networks and the increasing availability of VoLTE and VoWiFi-enabled devices.

However, the future growth and innovation will largely be propelled by VoIP (Voice over IP) and Instant Messaging. VoIP services, beyond traditional telephony, are seeing a surge in enterprise adoption for unified communications platforms, contact centers, and business-to-business (B2B) communication solutions. This segment is expanding to include advanced features like video conferencing, screen sharing, and presence information, all managed through IMS. Instant Messaging, while already popular, is evolving into rich communication services (RCS) that integrate more advanced features, including group chats, file sharing, high-resolution media exchange, and even transactional capabilities. The integration of AI-powered chatbots and virtual assistants within messaging platforms further amplifies their utility and market penetration.

The "Other Services" segment is a critical and rapidly expanding category that encompasses a broad spectrum of emerging applications powered by IMS. This includes:

- Rich Communication Services (RCS): Offering an enhanced messaging experience that goes beyond SMS and MMS. Key growth drivers include the desire for more interactive and feature-rich messaging.

- Unified Communications and Collaboration (UC&C) solutions: Integrating voice, video, messaging, and conferencing into a single platform for enterprise productivity. Growth is fueled by remote work trends and the need for seamless collaboration.

- Contact Center as a Service (CCaaS): IMS enables advanced features like intelligent routing, omnichannel support, and AI-powered analytics for customer service operations.

- Internet of Things (IoT) Communication: IMS provides a scalable and efficient platform for device-to-device and device-to-application communication in IoT ecosystems.

- Emergency Services (e.g., E911): Leveraging IMS for enhanced location services and reliable communication during emergencies.

- Video Conferencing and Streaming Services: IMS infrastructure supports high-quality video communication and broadcast applications.

The market dominance in these segments is increasingly shifting towards solutions that offer greater personalization, AI integration, and seamless cross-platform compatibility. As 5G infrastructure matures, the "Other Services" segment, particularly those leveraging advanced capabilities like low latency and high bandwidth, is expected to witness the most accelerated growth, driven by innovation in areas like augmented reality (AR) and virtual reality (VR) communication. Regulatory support for open standards and interoperability will be crucial for sustained growth across all segments.

IP Multimedia Subsystem Industry Product Analysis

The IP Multimedia Subsystem (IMS) industry is characterized by continuous product innovation focused on enhancing communication experiences and enabling new service offerings. Core product advancements revolve around the development of more flexible, scalable, and cloud-native IMS platforms, often leveraging Network Function Virtualization (NFV) and Software-Defined Networking (SDN) architectures. These innovations allow for greater agility in service deployment and management, reducing operational costs and time-to-market for new features. Key applications include the seamless delivery of VoLTE, VoWiFi, and the burgeoning Rich Communication Services (RCS), alongside integrated Unified Communications and Collaboration (UC&C) solutions for enterprises. Competitive advantages are being gained through superior interoperability, robust security features, AI-driven service optimization, and seamless integration with existing network infrastructures. Emerging products are exploring capabilities for AR/VR communication and advanced IoT connectivity, solidifying IMS's role as a foundational technology for the future of communication.

Key Drivers, Barriers & Challenges in IP Multimedia Subsystem Industry

Key Drivers:

- 5G Network Expansion: The widespread deployment of 5G networks is a primary growth catalyst, enabling enhanced mobile broadband, lower latency, and new service possibilities that IMS is designed to support.

- Growing Demand for Unified Communications: Enterprises are increasingly seeking integrated communication solutions that combine voice, video, messaging, and collaboration tools for improved productivity.

- Technological Advancements: Innovations in cloud-native architectures, NFV, and SDN are making IMS platforms more flexible, scalable, and cost-effective to deploy and manage.

- Increasing Smartphone Penetration: A larger base of internet-connected mobile devices directly fuels the demand for IMS-enabled services like VoLTE and RCS.

- Digital Transformation Initiatives: Businesses across various sectors are investing in digital transformation, which often includes upgrading their communication infrastructure to more modern, IP-based solutions.

Barriers & Challenges:

- Legacy Infrastructure Integration: Integrating new IMS solutions with existing, older telecommunications infrastructure can be complex and costly for service providers.

- Interoperability Standards: Ensuring seamless interoperability between different vendors' IMS components and with third-party applications remains a challenge.

- Regulatory Hurdles: Evolving regulations regarding data privacy, security, and net neutrality can create complexities in service design and deployment.

- Intense Competition from OTT Players: Over-The-Top (OTT) communication services offer alternative, often free or low-cost, communication channels, posing significant competition to traditional IMS-based services.

- Security Concerns: As IMS handles sensitive communication data, ensuring robust security against cyber threats and data breaches is paramount and requires continuous investment.

- Skilled Workforce Shortage: The need for specialized skills in IP networking, cloud computing, and IMS management can be a limiting factor for some organizations.

Growth Drivers in the IP Multimedia Subsystem Industry Market

The IP Multimedia Subsystem (IMS) industry is propelled by several interconnected growth drivers. The exponential global rollout of 5G networks is a paramount catalyst, unlocking the potential for advanced services requiring high bandwidth and low latency, which IMS is intrinsically designed to manage. Concurrently, the surging demand for unified communications and collaboration (UC&C) solutions across enterprises, amplified by remote work trends, is a significant driver for IMS adoption. Technological advancements, particularly the shift towards cloud-native IMS architectures, NFV, and SDN, are enhancing flexibility, scalability, and cost-efficiency, making IMS more attractive to service providers. Furthermore, the ever-increasing smartphone penetration globally directly translates to a larger user base for IMS-enabled services like VoLTE and richer communication experiences. Finally, ongoing digital transformation initiatives across industries necessitate modern, IP-based communication infrastructures, further bolstering IMS market growth.

Challenges Impacting IP Multimedia Subsystem Industry Growth

Despite robust growth drivers, the IP Multimedia Subsystem (IMS) industry faces several impactful challenges. The integration of IMS with existing legacy telecommunications infrastructure presents significant technical complexities and substantial investment requirements for many service providers. Ensuring interoperability across diverse vendor ecosystems and with third-party applications remains a critical hurdle for seamless service delivery. Navigating evolving regulatory landscapes, particularly concerning data privacy, security, and net neutrality, can create compliance burdens and slow down innovation. The fierce competition from Over-The-Top (OTT) communication service providers, offering often freemium models, continues to put pressure on the profitability of traditional IMS-based services. Moreover, escalating security threats necessitate continuous investment in robust cybersecurity measures to protect sensitive communication data. Lastly, a persistent shortage of skilled personnel with expertise in IP networking, cloud computing, and IMS management can impede the effective deployment and operation of these advanced systems.

Key Players Shaping the IP Multimedia Subsystem Industry Market

- ZTE Corporation

- Ericsson AB

- IBM Corporation

- CommVerge Solutions

- Cisco Systems Inc

- Ribbon Communications

- Huawei Technologies Co Ltd

- Oracle Corporation

- Nokia Corporation

- Samsung Networks

Significant IP Multimedia Subsystem Industry Industry Milestones

- March 2023: Ericsson and AXIAN Telecom intensified their partnership at Mobile World Congress 2023. The collaboration focuses on modernizing AXIAN Telecom's operations in Madagascar, including Telma Madagascar's radio access network (RAN), microwave transport infrastructure, and core networks. Ericsson will deliver cost-efficient solutions, particularly for the mobile transport network, and upgrade existing IP Multimedia Subsystem, virtual charging, virtual User Data Consolidation, and virtual mediation systems. This highlights the integration of IMS modernization with broader network transformation initiatives.

- September 2022: L Hiya, a provider of call performance management cloud, announced a new partnership with Ericsson. This collaboration aims to deliver network-based call protection services to wireless carriers globally. The offering, Call Qualification, powered by Hiya Protect, is available to all wireless carriers utilizing the Ericsson IP Multimedia Subsystem, demonstrating the increasing role of IMS in enhancing subscriber security and trust in communication.

Future Outlook for IP Multimedia Subsystem Industry Market

The future outlook for the IP Multimedia Subsystem (IMS) industry is exceptionally promising, driven by its foundational role in enabling the next wave of digital communication. Strategic opportunities lie in the continued integration of IMS with emerging technologies such as artificial intelligence (AI) for intelligent call routing and analysis, and augmented reality (VR) for immersive communication experiences. The ongoing global transition to 5G and the subsequent expansion of 5G Advanced will further unlock new use cases for IMS, particularly in areas like massive IoT connectivity and ultra-reliable low-latency communication services. Service providers that can offer agile, cloud-native, and secure IMS solutions with a focus on delivering enhanced user experiences and enabling seamless communication across all devices and platforms will be well-positioned for significant market penetration and sustained growth. The market is projected to see continued innovation in services like Rich Communication Services (RCS) and advanced Unified Communications as a Service (UCaaS) offerings, solidifying IMS's critical position in the telecommunications ecosystem for the foreseeable future.

IP Multimedia Subsystem Industry Segmentation

-

1. Service

- 1.1. Instant Messaging

- 1.2. VoIP

- 1.3. VoLTE

- 1.4. VoWiFi

- 1.5. Other Services

IP Multimedia Subsystem Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

IP Multimedia Subsystem Industry Regional Market Share

Geographic Coverage of IP Multimedia Subsystem Industry

IP Multimedia Subsystem Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of LTE and VoLTE and Emergence of 5G; Increasing Use of Multimedia Services

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Emergence of 5G Offers Potential Opportunities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IP Multimedia Subsystem Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Instant Messaging

- 5.1.2. VoIP

- 5.1.3. VoLTE

- 5.1.4. VoWiFi

- 5.1.5. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America IP Multimedia Subsystem Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Instant Messaging

- 6.1.2. VoIP

- 6.1.3. VoLTE

- 6.1.4. VoWiFi

- 6.1.5. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe IP Multimedia Subsystem Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Instant Messaging

- 7.1.2. VoIP

- 7.1.3. VoLTE

- 7.1.4. VoWiFi

- 7.1.5. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia IP Multimedia Subsystem Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Instant Messaging

- 8.1.2. VoIP

- 8.1.3. VoLTE

- 8.1.4. VoWiFi

- 8.1.5. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America IP Multimedia Subsystem Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Instant Messaging

- 9.1.2. VoIP

- 9.1.3. VoLTE

- 9.1.4. VoWiFi

- 9.1.5. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa IP Multimedia Subsystem Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Instant Messaging

- 10.1.2. VoIP

- 10.1.3. VoLTE

- 10.1.4. VoWiFi

- 10.1.5. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 ZTE Corporation*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ericsson AB

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CommVerge Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ribbon Communications

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Huawei Technologies Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oracle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nokia Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samsung Networks

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 ZTE Corporation*List Not Exhaustive

List of Figures

- Figure 1: Global IP Multimedia Subsystem Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America IP Multimedia Subsystem Industry Revenue (Million), by Service 2025 & 2033

- Figure 3: North America IP Multimedia Subsystem Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America IP Multimedia Subsystem Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America IP Multimedia Subsystem Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe IP Multimedia Subsystem Industry Revenue (Million), by Service 2025 & 2033

- Figure 7: Europe IP Multimedia Subsystem Industry Revenue Share (%), by Service 2025 & 2033

- Figure 8: Europe IP Multimedia Subsystem Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe IP Multimedia Subsystem Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia IP Multimedia Subsystem Industry Revenue (Million), by Service 2025 & 2033

- Figure 11: Asia IP Multimedia Subsystem Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Asia IP Multimedia Subsystem Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia IP Multimedia Subsystem Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America IP Multimedia Subsystem Industry Revenue (Million), by Service 2025 & 2033

- Figure 15: Latin America IP Multimedia Subsystem Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Latin America IP Multimedia Subsystem Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America IP Multimedia Subsystem Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa IP Multimedia Subsystem Industry Revenue (Million), by Service 2025 & 2033

- Figure 19: Middle East and Africa IP Multimedia Subsystem Industry Revenue Share (%), by Service 2025 & 2033

- Figure 20: Middle East and Africa IP Multimedia Subsystem Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa IP Multimedia Subsystem Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 13: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: China IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Japan IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Australia and New Zealand IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 19: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Mexico IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Brazil IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Service 2020 & 2033

- Table 23: Global IP Multimedia Subsystem Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: United Arab Emirates IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: South Africa IP Multimedia Subsystem Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Multimedia Subsystem Industry?

The projected CAGR is approximately 13.38%.

2. Which companies are prominent players in the IP Multimedia Subsystem Industry?

Key companies in the market include ZTE Corporation*List Not Exhaustive, Ericsson AB, IBM Corporation, CommVerge Solutions, Cisco Systems Inc, Ribbon Communications, Huawei Technologies Co Ltd, Oracle Corporation, Nokia Corporation, Samsung Networks.

3. What are the main segments of the IP Multimedia Subsystem Industry?

The market segments include Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of LTE and VoLTE and Emergence of 5G; Increasing Use of Multimedia Services.

6. What are the notable trends driving market growth?

Emergence of 5G Offers Potential Opportunities.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce.

8. Can you provide examples of recent developments in the market?

March 2023: Ericsson and AXIAN Telecom have intensified their partnership at Mobile World Congress 2023, Barcelona, Spain. The two companies declared a collaboration for the modernization of AXIAN Telecom's operations in Madagascar, Telma Madagascar's radio access network (RAN), microwave transport infrastructure, and core networks. Ericsson would deliver a cost-efficient and versatile solution, especially for the mobile transport network. The modernization also involves upgrading and expanding the existing IP Multimedia Subsystem, virtual charging, virtual User Data Consolidation, and virtual mediation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IP Multimedia Subsystem Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IP Multimedia Subsystem Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IP Multimedia Subsystem Industry?

To stay informed about further developments, trends, and reports in the IP Multimedia Subsystem Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence