Key Insights

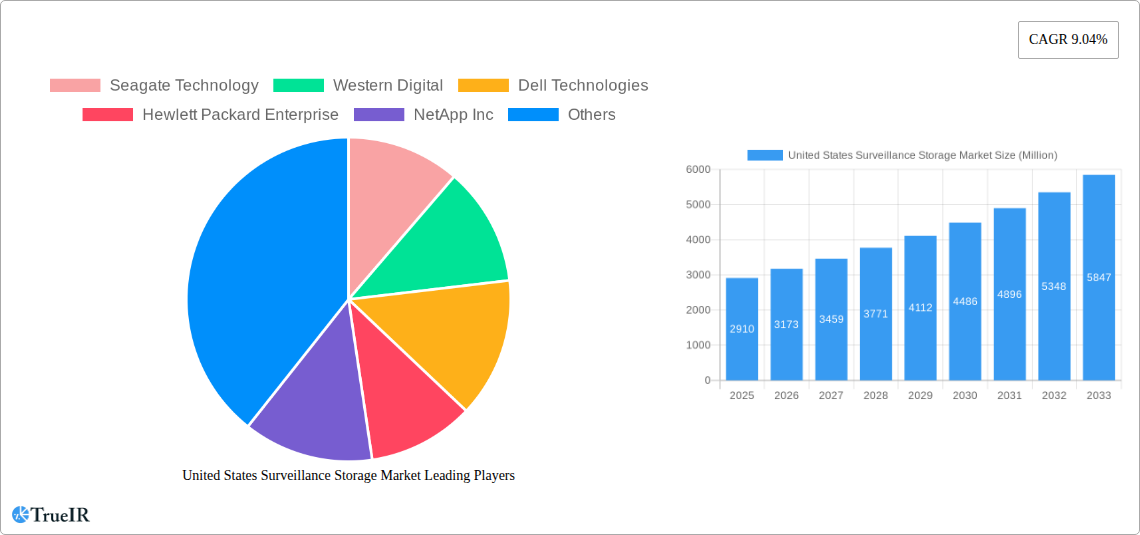

The United States surveillance storage market is poised for robust expansion, projected to reach a substantial value of approximately \$2.91 billion. This growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 9.04% between 2025 and 2033, indicating a dynamic and increasingly vital sector. Key drivers propelling this surge include the escalating demand for high-resolution video surveillance systems, the proliferation of smart cities initiatives, and the continuous advancements in data analytics and AI integration within security infrastructure. Furthermore, regulatory mandates and an increasing awareness of the need for secure data retention for compliance and evidence purposes are significantly contributing to market momentum. The market is witnessing a pronounced shift towards Network Attached Storage (NAS) and Storage Area Network (SAN) solutions, offering scalability and centralized management essential for complex surveillance deployments.

United States Surveillance Storage Market Market Size (In Billion)

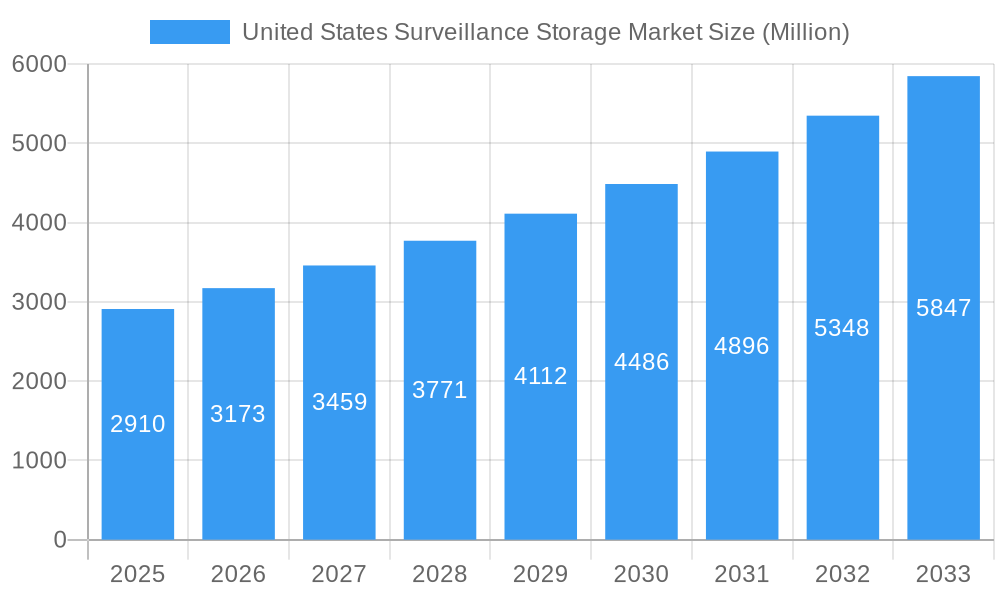

The competitive landscape is characterized by a diverse array of players, from established technology giants like Dell Technologies and IBM to specialized surveillance storage providers such as NetApp Inc. and Seagate Technology. Innovations in storage technologies, including the adoption of Solid State Drives (SSDs) for faster access and advancements in data compression techniques, are crucial for handling the ever-increasing volumes of video data generated by modern surveillance systems. While the market benefits from strong demand across various end-user industries like banking, transportation, and healthcare, potential restraints include the high initial cost of advanced storage solutions and concerns surrounding data privacy and cybersecurity. The shift towards cloud-based surveillance storage also presents both opportunities and challenges, with organizations weighing the benefits of scalability and accessibility against potential data sovereignty and security considerations.

United States Surveillance Storage Market Company Market Share

Here is a dynamic, SEO-optimized report description for the United States Surveillance Storage Market, designed for immediate use:

Gain unparalleled insights into the rapidly evolving United States Surveillance Storage Market with our in-depth report. This comprehensive analysis covers the period from 2019 to 2033, with a deep dive into the base year 2025 and a robust forecast period of 2025–2033, building upon historical data from 2019–2024. We dissect market dynamics, competitive strategies, and emerging opportunities across key segments including NAS, SAN, DAS, Cloud, On-Premise, and diverse end-user industries such as Banking and Financial Institutions, Transportation and Infrastructure, Government and Defense, Healthcare, Industrial, Retail, Enterprises, and Residential sectors.

Our report leverages high-volume keywords such as surveillance storage solutions, video surveillance storage, data storage for security, cloud storage for CCTV, enterprise video storage, NAS for surveillance, SAN for security cameras, on-premise surveillance storage, and long-term video retention to ensure maximum searchability and engagement for industry professionals, IT decision-makers, security professionals, and market analysts.

United States Surveillance Storage Market Market Structure & Competitive Landscape

The United States surveillance storage market is characterized by a moderately concentrated landscape, with key players like Seagate Technology, Western Digital, Dell Technologies, Hewlett Packard Enterprise, NetApp Inc, IBM, Quantum Corporation, and Cisco Systems driving innovation and market share. The market's concentration is influenced by significant R&D investments in high-density storage solutions and advanced analytics capabilities for video data. Innovation drivers are primarily fueled by the escalating demand for high-definition video, the proliferation of IoT devices, and stringent regulatory requirements for data retention in sectors like government and finance. Product substitutes, while present in general data storage, are less impactful in the specialized surveillance segment due to specific performance and reliability demands. End-user segmentation reveals a strong reliance on enterprise and government sectors for volume, though growth is accelerating in retail and transportation. Merger and acquisition (M&A) activity, estimated at approximately 5-10 significant transactions annually in the broader IT infrastructure space impacting storage, indicates a trend towards consolidation to achieve economies of scale and expand service offerings. Regulatory impacts, such as data privacy laws and compliance mandates, shape product development and deployment strategies, emphasizing secure and compliant storage solutions.

United States Surveillance Storage Market Market Trends & Opportunities

The United States surveillance storage market is poised for substantial growth, driven by an increasing volume of video data generated from security cameras, the adoption of AI-powered video analytics, and the necessity for long-term data retention. Market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period. Technological shifts are leaning towards more intelligent and scalable storage solutions. This includes the rise of object storage for its cost-effectiveness and scalability in handling massive unstructured video data, the integration of NVMe technology for faster video retrieval and real-time analytics, and the increasing adoption of hybrid cloud storage models that offer flexibility and cost optimization. Consumer preferences are increasingly favoring solutions that offer seamless integration with existing security infrastructure, ease of management, and robust data security features.

The competitive dynamics are intensifying, with established players investing heavily in cloud-native solutions and AI capabilities. New entrants, particularly in the software-defined storage and specialized surveillance solutions space, are challenging incumbents with agile and cost-effective offerings. Opportunities abound in the development of specialized edge computing storage solutions that can process and store video data closer to the source, reducing latency and bandwidth requirements. Furthermore, the growing demand for advanced video analytics, such as facial recognition and anomaly detection, necessitates storage solutions that can support these computationally intensive workloads. The increasing adoption of surveillance systems in smart cities, intelligent transportation systems, and critical infrastructure projects presents significant growth avenues. The market penetration rate for advanced surveillance storage solutions in the enterprise sector is estimated to be around 60-70%, with considerable room for expansion in the small and medium-sized business (SMB) segment and traditionally underserved industries. The transition towards subscription-based models for storage and analytics services is another key trend offering recurring revenue opportunities for providers.

Dominant Markets & Segments in United States Surveillance Storage Market

Within the United States Surveillance Storage Market, the Enterprise end-user industry segment holds significant dominance, driven by the extensive deployment of surveillance systems for asset protection, operational efficiency, and compliance across various verticals. This sector's dominance is further bolstered by its capacity for large-scale investments in advanced storage infrastructure.

Key Growth Drivers for Dominant Segments:

- Product Type - NAS (Network Attached Storage): Continues to be a dominant segment due to its cost-effectiveness, ease of deployment, and suitability for medium to large-scale surveillance deployments. Its ability to offer centralized storage for multiple cameras makes it a popular choice.

- Deployment - On-Premise: While cloud adoption is rising, on-premise solutions remain dominant, particularly for government, defense, and organizations with strict data sovereignty and control requirements. The demand for direct control over sensitive video data fuels this segment.

- End User Industry - Enterprises: As mentioned, enterprises across manufacturing, retail, and logistics invest heavily in surveillance for loss prevention, safety, and operational monitoring. The sheer volume of cameras and the need for continuous recording are key drivers.

- End User Industry - Government and Defense: This sector is a massive consumer of surveillance storage, driven by national security imperatives, border surveillance, public safety initiatives, and stringent data retention policies. Their requirements for high-capacity, secure, and long-term storage are paramount.

- End User Industry - Banking and Financial Institutions: These institutions require robust surveillance for fraud prevention, compliance, and physical security, leading to significant demand for reliable and high-performance storage solutions.

The dominance of these segments is underpinned by factors such as the escalating need for advanced security measures, the increasing resolution and frame rates of surveillance cameras necessitating greater storage capacity, and evolving regulatory landscapes demanding extended video retention periods. The infrastructure in place within these sectors, coupled with their financial capacity to upgrade and maintain advanced storage systems, further solidifies their leading positions.

United States Surveillance Storage Market Product Analysis

Product innovation in the United States surveillance storage market is characterized by the development of high-density, high-performance storage solutions designed to handle the ever-increasing volume of video data. Key advancements include the integration of AI and machine learning capabilities directly into storage devices for intelligent data management, anomaly detection, and faster video search. Technologies like NVMe SSDs are being incorporated for ultra-fast video access and real-time analytics processing, while object storage and tiered storage solutions offer cost-effective scalability for long-term video retention. Competitive advantages are derived from offering solutions with enhanced data durability, cybersecurity features, simplified management interfaces, and seamless integration with Video Management Systems (VMS).

Key Drivers, Barriers & Challenges in United States Surveillance Storage Market

Key Drivers:

- Technological Advancements: The proliferation of high-resolution cameras, AI-powered analytics, and edge computing drives the demand for more sophisticated and capacious storage.

- Increasing Security Concerns: Rising crime rates and the need for enhanced public safety globally necessitate comprehensive surveillance systems and, consequently, robust storage solutions.

- Regulatory Compliance: Stringent data retention policies in sectors like finance, healthcare, and government mandate long-term storage of video footage, boosting market growth.

- IoT Expansion: The growing number of connected devices, including smart city infrastructure and industrial IoT, generates massive amounts of video data requiring scalable storage.

Barriers & Challenges:

- Data Management Complexity: Handling petabytes of unstructured video data poses significant challenges in terms of organization, retrieval, and cost-effective management.

- Cybersecurity Threats: Surveillance storage systems are attractive targets for cyberattacks, requiring robust security measures and continuous vigilance. Estimated impact of data breaches on organizations can range from millions to tens of millions of dollars annually.

- Scalability and Cost: While demand for storage is high, managing escalating costs associated with capacity expansion and the total cost of ownership remains a critical challenge for many organizations.

- Interoperability Issues: Ensuring seamless integration between diverse surveillance hardware, VMS software, and storage solutions can be complex and time-consuming.

Growth Drivers in the United States Surveillance Storage Market Market

The growth of the United States surveillance storage market is propelled by several key factors. Technologically, the relentless advancement in camera resolution and frame rates mandates higher storage capacities and faster data throughput. The integration of Artificial Intelligence (AI) and machine learning within surveillance systems for advanced analytics, such as facial recognition and behavioral analysis, further amplifies data generation and the need for intelligent storage. Economically, the decreasing cost per terabyte, coupled with the increasing affordability of surveillance solutions, makes them accessible to a wider range of businesses and organizations. Regulatory drivers, including stringent data retention mandates for sectors like finance and healthcare, and government initiatives for public safety and smart city development, create consistent demand for long-term, reliable video storage.

Challenges Impacting United States Surveillance Storage Market Growth

Despite robust growth prospects, the United States surveillance storage market faces several challenges. Regulatory complexities, particularly around data privacy and cross-border data transfer, can create compliance hurdles and influence storage deployment strategies, potentially increasing operational costs by 5-10%. Supply chain issues, exacerbated by global component shortages and geopolitical uncertainties, can lead to extended lead times and increased hardware costs, impacting project timelines and budgets. Competitive pressures from both established vendors and agile new entrants drive price erosion in certain market segments, challenging profit margins. The sheer volume and unstructured nature of video data also present significant management and analytics challenges, requiring sophisticated software solutions and considerable IT resources.

Key Players Shaping the United States Surveillance Storage Market Market

- Seagate Technology

- Western Digital

- Dell Technologies

- Hewlett Packard Enterprise

- NetApp Inc

- IBM

- Quantum Corporation

- Cisco Systems

- Genetec

- Axis Communication

- Tiger Technology

- Wasabi Technologies

- Cloudian

- Milestone Systems

- Verkada Inc

- Broadberry Data Systems LLC

- Synology Inc

Significant United States Surveillance Storage Market Industry Milestones

- March 2024: Wasabi Technologies extended its cloud storage services to SaaS providers and technology vendors through its White Label OEM program. This initiative empowers partners to integrate Wasabi's predictable, scalable, and reliable cloud storage into their offerings for services including backup, disaster recovery, physical security video surveillance storage, and media archiving, enhancing partner capabilities and end-user value.

- January 2024: Tiger Technology innovatively integrated file-tiering-to-the-cloud technology into surveillance video systems. This development allows for seamless playback directly from public cloud platforms, significantly enhancing disaster recovery capabilities and providing software-only data management tailored specifically for the video surveillance industry's evolving needs.

Future Outlook for United States Surveillance Storage Market Market

The future outlook for the United States surveillance storage market is exceptionally bright, fueled by ongoing technological advancements and an ever-increasing demand for comprehensive security and data retention. Strategic opportunities lie in the continued integration of AI and machine learning for intelligent video analytics, the growth of edge computing solutions for localized data processing, and the expansion of cloud-based storage services offering enhanced scalability and flexibility. The market is expected to witness further innovation in areas like cybersecurity for storage systems, more efficient data compression techniques, and the development of specialized storage architectures for emerging applications like smart cities and autonomous systems. The increasing adoption of subscription models and managed services will also shape future growth, providing recurring revenue streams and making advanced storage solutions more accessible to a broader market.

United States Surveillance Storage Market Segmentation

-

1. Product Type

- 1.1. NAS

- 1.2. SAN

- 1.3. DAS

- 1.4. Other Product Types

-

2. Deployment

- 2.1. Cloud

- 2.2. On Premise

-

3. End User Industry

- 3.1. Banking and Financial Institutions

- 3.2. Transportation and Infrastructure

- 3.3. Government and Defense

- 3.4. Healthcare

- 3.5. Industrial

- 3.6. Retail

- 3.7. Enterprises

- 3.8. Residential

- 3.9. Others

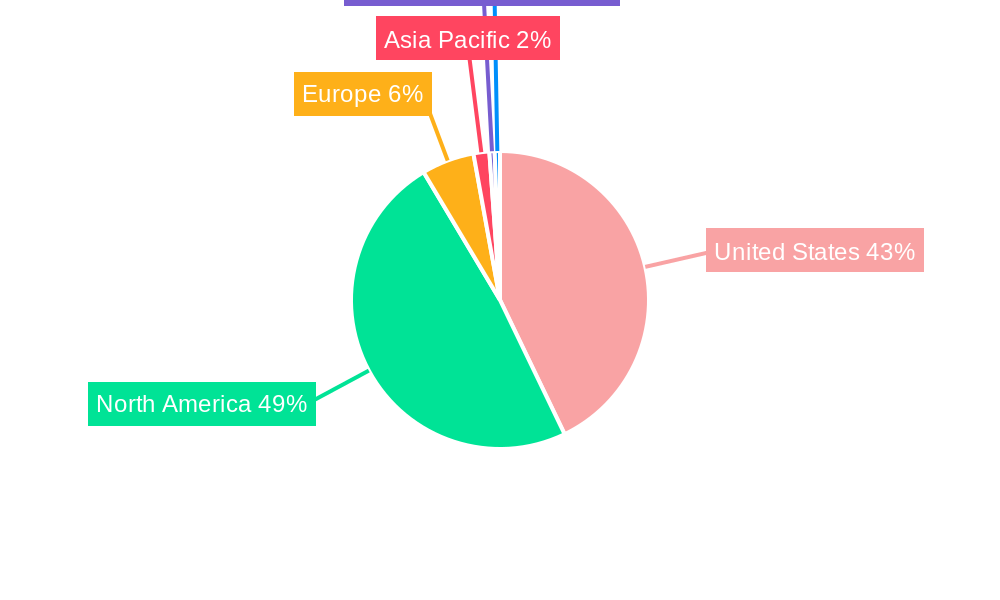

United States Surveillance Storage Market Segmentation By Geography

- 1. United States

United States Surveillance Storage Market Regional Market Share

Geographic Coverage of United States Surveillance Storage Market

United States Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country

- 3.4. Market Trends

- 3.4.1. Cloud Storage Segment to Witness Substantial Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. NAS

- 5.1.2. SAN

- 5.1.3. DAS

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On Premise

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Banking and Financial Institutions

- 5.3.2. Transportation and Infrastructure

- 5.3.3. Government and Defense

- 5.3.4. Healthcare

- 5.3.5. Industrial

- 5.3.6. Retail

- 5.3.7. Enterprises

- 5.3.8. Residential

- 5.3.9. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Seagate Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Western Digital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dell Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hewlett Packard Enterprise

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NetApp Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IBM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quantum Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Genetec

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Axis Communication

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tiger Technology

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wasabi Technologies

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cloudian

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Milestone Systems

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Verkada Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Broadberry Data Systems LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Synology In

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Seagate Technology

List of Figures

- Figure 1: United States Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Surveillance Storage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States Surveillance Storage Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: United States Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: United States Surveillance Storage Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 5: United States Surveillance Storage Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: United States Surveillance Storage Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 7: United States Surveillance Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Surveillance Storage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: United States Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: United States Surveillance Storage Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 11: United States Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: United States Surveillance Storage Market Volume Billion Forecast, by Deployment 2020 & 2033

- Table 13: United States Surveillance Storage Market Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 14: United States Surveillance Storage Market Volume Billion Forecast, by End User Industry 2020 & 2033

- Table 15: United States Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Surveillance Storage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Surveillance Storage Market?

The projected CAGR is approximately 9.04%.

2. Which companies are prominent players in the United States Surveillance Storage Market?

Key companies in the market include Seagate Technology, Western Digital, Dell Technologies, Hewlett Packard Enterprise, NetApp Inc, IBM, Quantum Corporation, Cisco Systems, Genetec, Axis Communication, Tiger Technology, Wasabi Technologies, Cloudian, Milestone Systems, Verkada Inc, Broadberry Data Systems LLC, Synology In.

3. What are the main segments of the United States Surveillance Storage Market?

The market segments include Product Type, Deployment, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country.

6. What are the notable trends driving market growth?

Cloud Storage Segment to Witness Substantial Growth.

7. Are there any restraints impacting market growth?

Growing Adoption of Advanced Surveillance Systems; Expanding Cloud Infrastructure in the Country.

8. Can you provide examples of recent developments in the market?

March 2024: Wasabi Technologies, known for its innovative cloud storage solutions, has extended its acclaimed services to SaaS, Cloud Service Providers, and technology vendors. These entities can now leverage Wasabi's White Label OEM program to incorporate its cloud storage into their offerings. This integration empowers them to provide their end-users with various services, including backup, disaster recovery, physical security video surveillance storage, and media archiving. Wasabi's program ensures that partners can deliver cloud storage that is predictably priced, scalable, and renowned for its reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the United States Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence